Market Overview

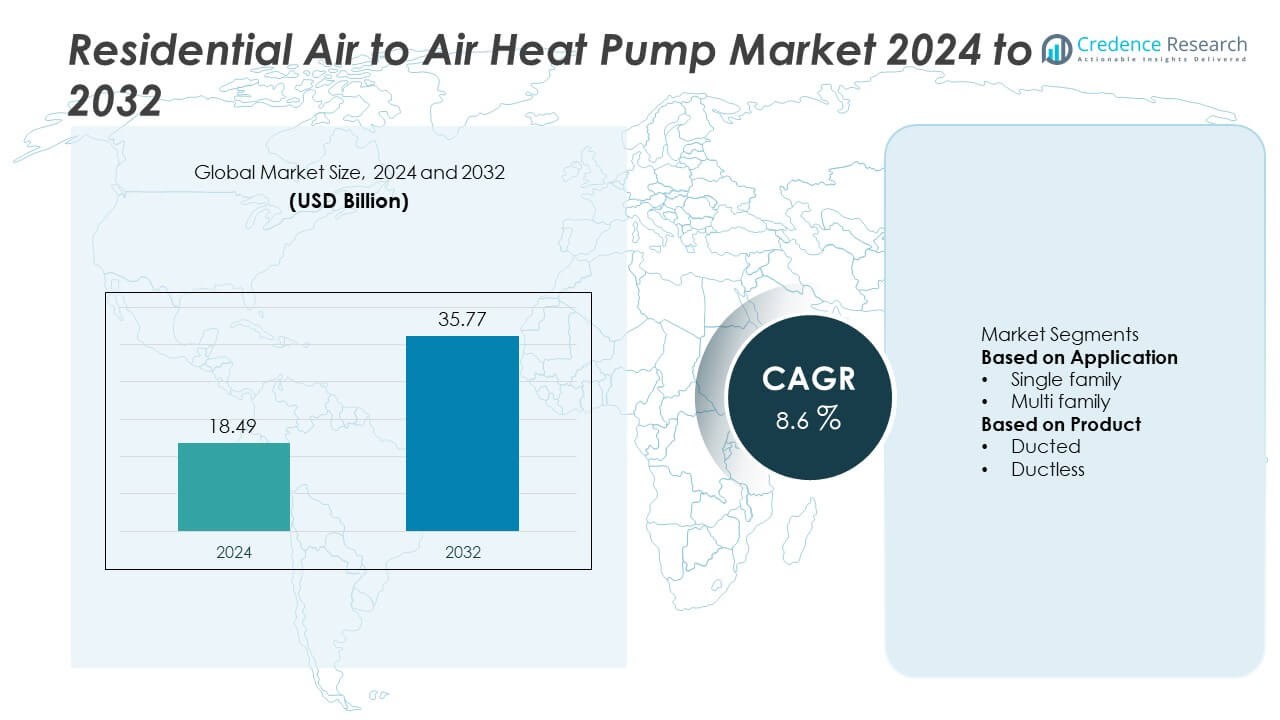

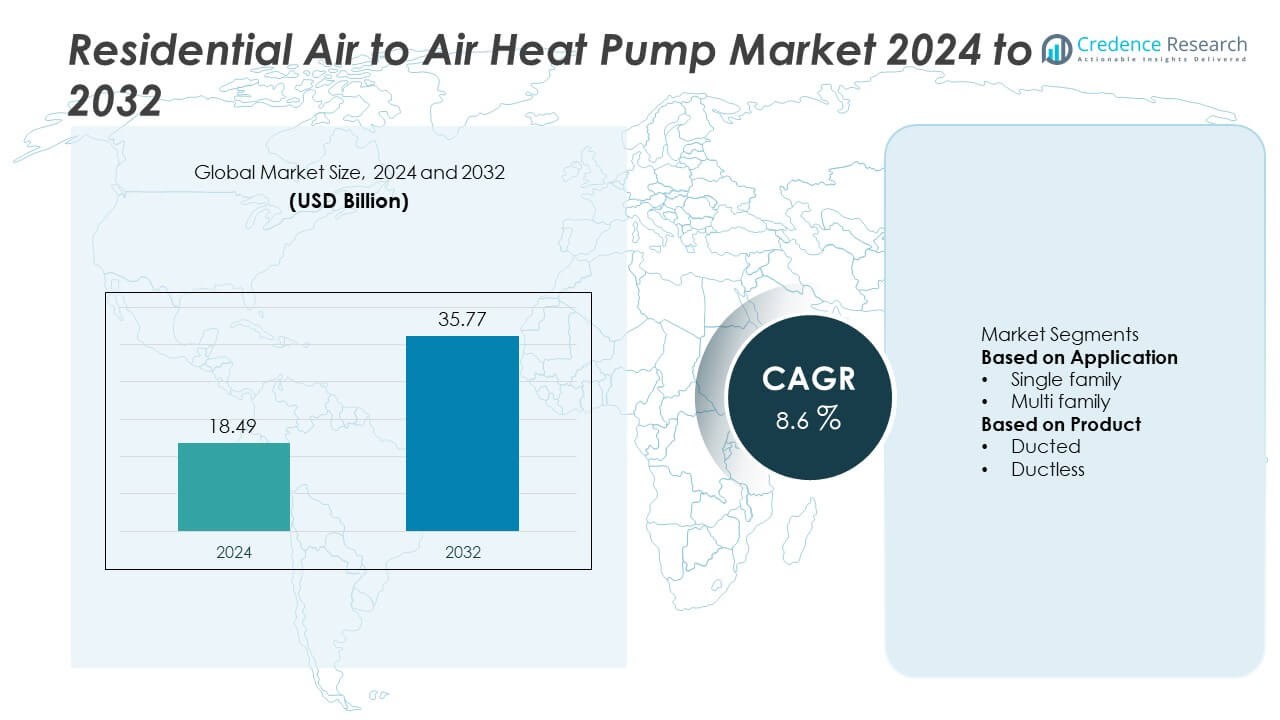

The global residential air-to-air heat pump market was valued at USD 18.49 billion in 2024 and is expected to reach USD 35.77 billion by 2032, growing at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Air-To-Air Heat Pump Market Size 2024 |

USD 18.49 Billion |

| Residential Air-To-Air Heat Pump Market, CAGR |

8.6% |

| Residential Air-To-Air Heat Pump Market Size 2032 |

USD 35.77 Billion |

The residential air-to-air heat pump market is led by key players including Bosch, Daikin, Carrier, LG, Fujitsu, Gree, Blue Star, Bard, Klimaire, and American Standard. These companies dominate through advanced product portfolios, strong regional distribution, and continuous innovation in energy-efficient and smart HVAC technologies. Europe emerged as the leading region in 2024 with a 36% market share, driven by stringent energy-efficiency regulations and government incentives for low-carbon heating. North America followed with a 31% share, supported by electrification initiatives and retrofitting demand, while Asia-Pacific accounted for 25%, fueled by rapid urbanization and smart home adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The residential air-to-air heat pump market was valued at USD 18.49 billion in 2024 and is projected to reach USD 35.77 billion by 2032, growing at a CAGR of 8.6%.

- Rising demand for energy-efficient and low-emission heating systems is driving adoption across single-family homes, which held a 63% share, supported by supportive government incentives and electrification policies.

- Key trends include integration of smart home technologies, inverter-driven compressors, and cold-climate models, improving performance and user convenience.

- Major players such as Bosch, Daikin, Carrier, LG, and Fujitsu focus on sustainable innovation, regional expansion, and partnerships to strengthen competitiveness.

- Europe led the market with a 36% share, followed by North America at 31% and Asia-Pacific at 25%, while the ductless segment dominated by capturing 58% of total product demand due to flexibility and installation ease.

Market Segmentation Analysis:

By Application

The single-family segment dominated the residential air-to-air heat pump market in 2024, accounting for a 63% share. This dominance is driven by rising adoption of energy-efficient heating and cooling systems in standalone homes, supported by favorable government incentives and lower installation complexity. Increasing replacement of conventional HVAC units and growing awareness of carbon reduction benefits further enhance adoption. Expanding residential construction in suburban regions and integration of smart home systems continue to strengthen demand from single-family households globally.

- For instance, Bosch Thermotechnology introduced the IDS Ultra heat pump system featuring a continuous variable-speed inverter compressor, which delivers up to 19 SEER2 cooling efficiency and provides 100% heating capacity down to -15°C.

By Product

The ductless segment held the leading position in 2024 with a 58% market share, reflecting its strong preference among homeowners seeking flexible and energy-efficient climate control solutions. The absence of ductwork reduces installation costs and enhances system efficiency, making it ideal for retrofits and smaller living spaces. Growing popularity of inverter-based mini-split systems and rising urban apartment developments drive this segment’s growth. Technological advancements in variable-speed compressors and Wi-Fi-enabled controls further boost ductless system adoption across residential applications.

- For instance, LG Electronics has launched its RED° heat technology-equipped DUAL Inverter mini-split systems, which feature a twin rotary compressor. A specific example from the Multi F with LGRED° series offers 100% rated heating capacity down to -15°C and can operate continuously down to -25°C.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating and Cooling Solutions

The increasing emphasis on energy efficiency and sustainability is driving widespread adoption of residential air-to-air heat pumps. Homeowners are shifting from traditional HVAC systems to heat pumps to reduce energy consumption and carbon emissions. Governments across Europe, North America, and Asia-Pacific are offering subsidies and tax incentives to encourage installations. Stringent building energy codes and decarbonization targets further support market growth. As awareness of climate impact increases, energy-efficient heat pumps continue to gain traction in both new constructions and retrofitting projects.

- For instance, Daikin Industries developed the Altherma 3R air-to-water heat pump, featuring a double injection compressor for mid-temperature models. The unit provides heating, and optionally cooling and domestic hot water, for new builds or renovations.

Supportive Government Policies and Electrification Initiatives

Government initiatives promoting electrification of heating systems are a major growth driver. Countries such as Germany, the U.S., and Japan are offering rebates, low-interest loans, and grants to accelerate heat pump adoption. Policy frameworks like the EU’s Fit for 55 and U.S. Inflation Reduction Act incentivize residential energy upgrades. These programs aim to phase out fossil-fuel-based heating systems, boosting the deployment of air-to-air heat pumps. Continued policy support and net-zero goals are expected to sustain strong market expansion through 2032.

- For instance, Carrier Global Corporation introduced the Infinity 24 heat pump system qualified under the U.S. DOE Cold Climate Heat Pump Challenge, which maintained 100% heating capacity at -17.8 °C (0 °F) ambient and operated reliably down to -30.5 °C (-23 °F) in lab tests.

Advancements in Inverter and Smart Control Technologies

Technological innovations are significantly enhancing the performance of air-to-air heat pumps. Inverter-driven compressors allow precise temperature control and improved energy savings. Integration with IoT and AI-based control systems enables real-time performance monitoring and predictive maintenance. Manufacturers are developing heat pumps optimized for cold climates, improving reliability in sub-zero conditions. These advancements not only increase consumer comfort and efficiency but also reduce operational costs, making smart, connected heat pumps more attractive for residential applications.

Key Trends & Opportunities

Integration with Smart Home Ecosystems

The growing integration of air-to-air heat pumps with smart home ecosystems is reshaping consumer preferences. Smart thermostats and AI-based control systems allow remote operation and optimized energy use. Companies like Daikin and Mitsubishi Electric are introducing Wi-Fi-enabled and voice-assisted models compatible with major smart home platforms. This trend supports greater comfort, energy optimization, and user convenience. Expanding connectivity and interoperability with other home automation devices are creating lucrative opportunities for manufacturers and service providers.

- For instance, Mitsubishi Electric launched its MSZ-AP series featuring a Wi-Fi adapter that connects to the MELCloud platform, enabling remote access and AI-enhanced temperature optimization. The system supports integration with Amazon Alexa and Google Home for voice control.

Expansion of Cold Climate Heat Pump Technologies

Heat pumps designed for cold regions are becoming a key focus for innovation. New-generation systems can operate efficiently even below -20°C, addressing previous limitations in northern markets. Manufacturers are adopting enhanced vapor injection and refrigerant cycle optimization to improve heating output. This expansion opens opportunities in regions such as Canada, Scandinavia, and Northern U.S. states. As governments target widespread electrification of heating, cold-climate technology adoption will play a pivotal role in accelerating market penetration.

- For instance, Fujitsu General developed its Airstage J-IVL system utilizing a highly efficient scroll compressor capable of sustained heating in low ambient temperatures, and some models have documented heating operation down to -20°C.

Key Challenges

High Upfront Installation and Equipment Costs

Despite long-term energy savings, high initial costs remain a major challenge for widespread adoption. The purchase, installation, and potential retrofitting expenses deter cost-sensitive homeowners, especially in developing regions. While subsidies help offset part of the investment, limited financing options slow market growth. Manufacturers and policymakers need to develop affordable financing programs and leasing models to improve accessibility. Cost reduction through scale, innovation, and competitive pricing will be crucial to expanding market reach.

Performance Limitations in Extreme Conditions

Air-to-air heat pumps face efficiency challenges under extreme weather conditions, particularly in very cold or hot climates. In such cases, auxiliary heating or cooling systems are often required, which increases energy use and costs. Although advancements in compressor technology and refrigerants are improving resilience, performance inconsistencies remain a concern for consumers. Manufacturers must focus on developing hybrid and adaptive systems that ensure stable efficiency and comfort across diverse environmental conditions.

Regional Analysis

North America

North America held a 31% share of the residential air-to-air heat pump market in 2024, driven by rising adoption of energy-efficient HVAC systems and electrification policies. The U.S. leads regional demand due to strong government incentives under the Inflation Reduction Act and growing retrofitting of older homes. Canada is expanding adoption in colder provinces through cold-climate heat pump programs. Advancements in inverter technology and integration with smart thermostats are supporting market expansion. Increasing consumer focus on carbon reduction and indoor comfort continues to strengthen North America’s position in the global market.

Europe

Europe accounted for a 36% share in 2024, emerging as the leading regional market. Strong environmental policies and ambitious decarbonization goals drive widespread adoption of heat pumps in residential buildings. The European Green Deal and country-specific incentives in Germany, France, and the UK are key growth enablers. Cold-climate models with high seasonal efficiency are gaining traction across Northern and Central Europe. Rising energy costs and restrictions on fossil-fuel heating systems are accelerating demand. Continuous innovation in low-GWP refrigerants and hybrid heat pump systems further enhances Europe’s leadership position in the global market.

Asia-Pacific

Asia-Pacific captured a 25% share in 2024, supported by rapid urbanization, expanding housing projects, and growing energy-efficiency awareness. China, Japan, and South Korea dominate demand with strong domestic manufacturing capabilities and policy-driven electrification. Japan’s focus on zero-energy homes and China’s green building standards continue to boost installations. India and Southeast Asian nations are emerging markets, benefiting from tropical climate suitability and rising middle-class income. Expanding smart home integration and government-backed renewable energy initiatives are expected to accelerate long-term growth of residential air-to-air heat pumps across the region.

Latin America

Latin America accounted for a 5% share in 2024, driven by growing demand for sustainable cooling and heating systems in urban households. Brazil, Mexico, and Chile are leading adopters, supported by expanding residential construction and favorable energy-efficiency programs. Increasing awareness of low-carbon technologies and the entry of global manufacturers enhance market visibility. Economic recovery and energy cost fluctuations are influencing purchasing trends. Although adoption is still limited compared to mature regions, improving infrastructure and growing consumer interest in eco-friendly HVAC solutions are likely to foster steady market growth through the forecast period.

Middle East & Africa

The Middle East & Africa region held a 3% share in 2024, characterized by rising adoption in urban housing developments and premium residential projects. The UAE, Saudi Arabia, and South Africa are key markets focusing on sustainable building standards and energy diversification goals. High temperatures in GCC countries are encouraging the use of reversible air-to-air systems for both cooling and heating. Limited awareness and high installation costs remain challenges, but ongoing green building initiatives and renewable energy integration are expected to stimulate gradual adoption across the residential sector over the coming years.

Market Segmentations:

By Application

- Single family

- Multi family

By Product

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the residential air-to-air heat pump market is characterized by the presence of major players such as Bosch, Blue Star, LG, Carrier, Fujitsu, Daikin, Bard, Klimaire, Gree, and American Standard. These companies focus on product innovation, energy efficiency, and advanced control technologies to strengthen their market positions. Leading manufacturers are investing in inverter-driven compressors, low-GWP refrigerants, and smart connectivity solutions to meet evolving consumer and regulatory demands. Strategic partnerships with distributors and service providers help expand market reach, while regional players emphasize cost competitiveness and local manufacturing. Continuous R&D investments and sustainability initiatives are key priorities, with global players aligning portfolios toward eco-friendly and high-performance heat pumps. Mergers, acquisitions, and geographic expansions are further reshaping competition, driving advancements in product quality, system efficiency, and digital integration across the global residential heat pump ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bosch

- Blue Star

- LG

- Carrier

- Fujitsu

- Daikin

- Bard

- Klimaire

- Gree

- American Standard

Recent Developments

- In January 2025, Carrier Global Corporation launched a new air-to-water heat pump line for residential and commercial applications with nominal capacities ranging from 4 kW to 14 kW and a Coefficient of Performance (COP) up to 4.90; the largest unit delivers hot water up to 75 °C at ambient temperatures down to -20 °C.

- In 2025, Daikin Industries brought to market its “Multi+” air-to-air heat pump system for residences, offering outdoor unit sizes from 5.2 kW to 10 kW, and supporting up to four indoor units.

- In October 2024, LG Electronics introduced its Residential Cold Climate Heat Pump model that operates at temperatures as low as -35 °C (-31 °F) and delivers full capacity at -25 °C, featuring a twin-rotary inverter compressor and low-GWP R32 refrigerant.

- In January 2024, Bosch launched its “IDS Ultra” cold-climate air-source heat pump system designed for the U.S./Canada market, capable of operating in extremely low ambient temperatures and meeting the U.S. Department of Energy’s cold climate heat pump technology challenge.

Report Coverage

The research report offers an in-depth analysis based on Application, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by energy-efficient home heating demand.

- Governments will expand incentive programs to accelerate residential heat pump adoption.

- Technological innovations will enhance system efficiency and performance in extreme climates.

- Smart connectivity and AI-based controls will become standard in new heat pump models.

- Manufacturers will prioritize eco-friendly refrigerants to meet global emission targets.

- Retrofitting of existing residential buildings will create major installation opportunities.

- Partnerships between HVAC firms and smart home providers will strengthen product integration.

- Cold-climate models will gain wider acceptance in North America and Northern Europe.

- Asia-Pacific will emerge as a key manufacturing and consumption hub for heat pumps.

- Competitive intensity will increase as global and regional players expand sustainable product lines.