Market Overview

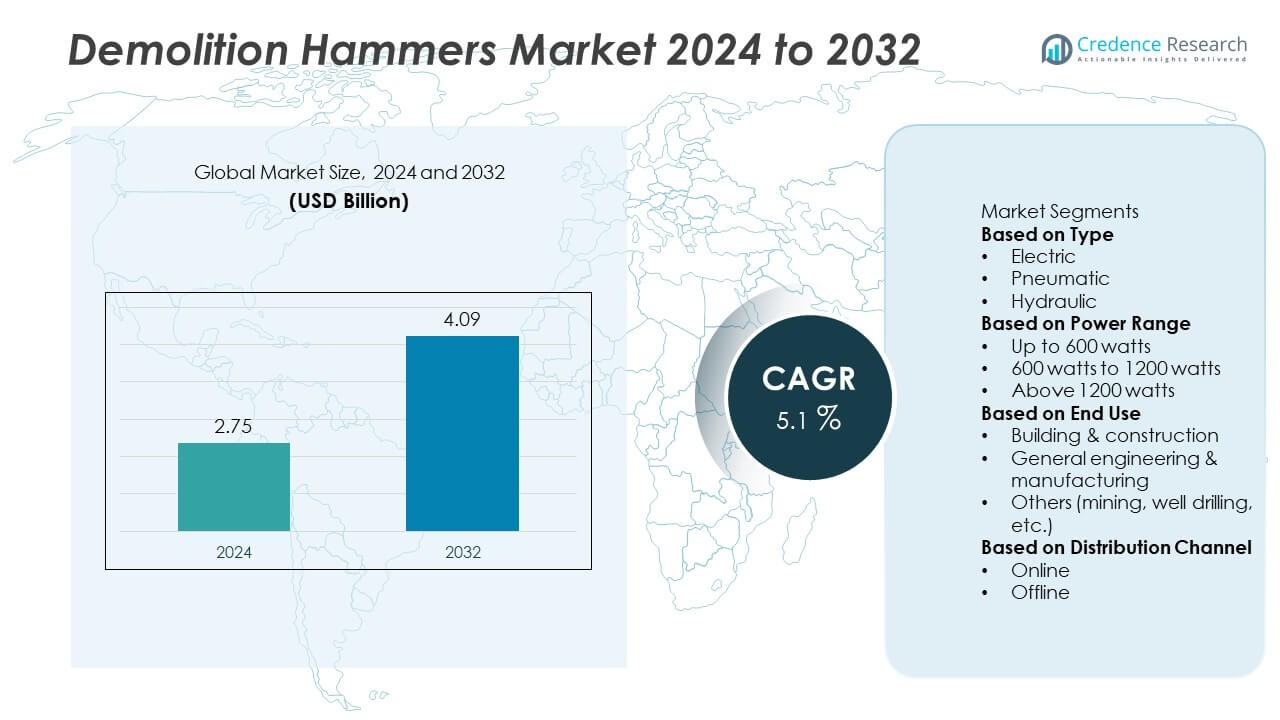

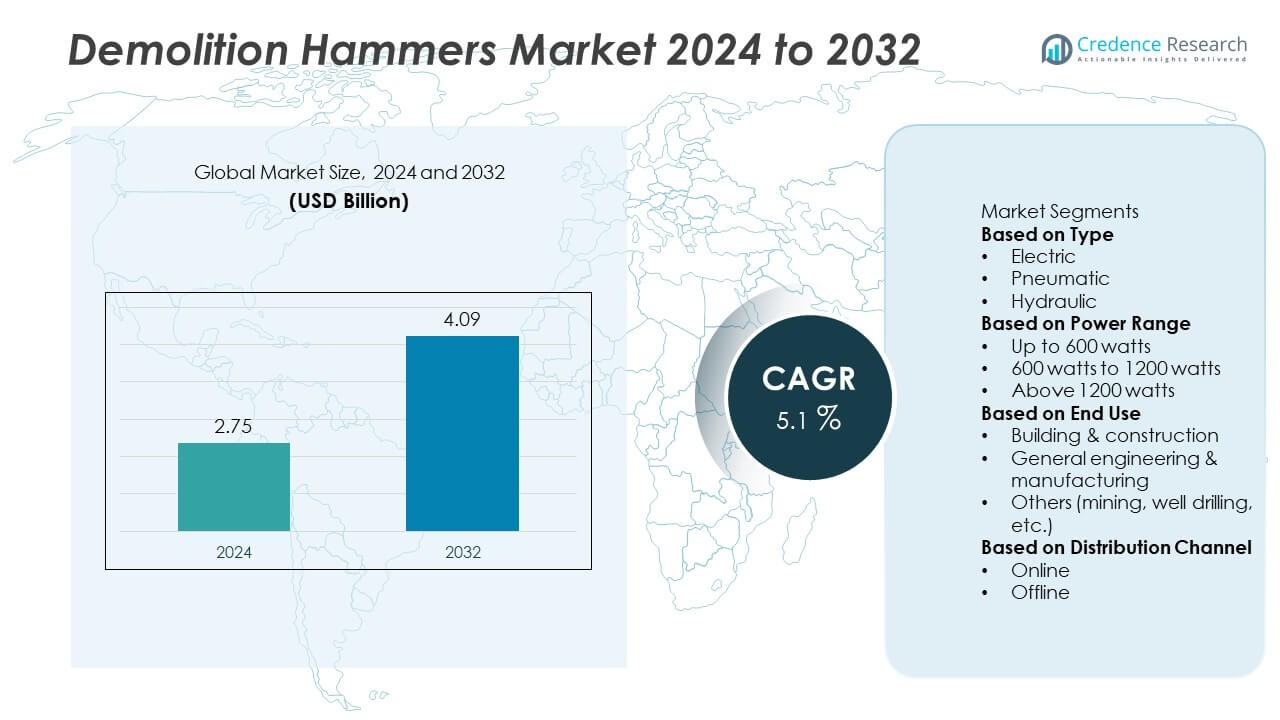

The global demolition hammers market was valued at USD 2.75 billion in 2024 and is projected to reach USD 4.09 billion by 2032, registering a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Demolition Hammers Market Size 2024 |

USD 2.75 Billion |

| Demolition Hammers Market, CAGR |

5.1% |

| Demolition Hammers Market Size 2032 |

USD 4.09 Billion |

The demolition hammers market is dominated by key players such as Hilti, Bauer, Makita, Einhell, Milwaukee, Robert Bosch Tool Corporation, Koki Holdings, Dewalt, Ferm International, and Hitachi. These companies lead through innovation in tool performance, durability, and ergonomic design, focusing on advanced electric and cordless technologies. Asia Pacific emerged as the leading region with a 33% market share in 2024, driven by rapid urbanization and infrastructure expansion. North America followed with a 29% share, supported by strong renovation activity and adoption of efficient electric models. Europe held a 26% share, propelled by stringent safety and energy-efficiency regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global demolition hammers market was valued at USD 2.75 billion in 2024 and is projected to reach USD 4.09 billion by 2032, growing at a CAGR of 5.1% during the forecast period.

- Market growth is driven by expanding construction and renovation activities, particularly in residential and infrastructure projects, boosting demand for efficient, high-impact demolition tools.

- Key trends include the shift toward electric and cordless hammers, integration of brushless motors, and focus on ergonomic, vibration-controlled designs that enhance safety and user comfort.

- The market is competitive with major players such as Hilti, Makita, Dewalt, Milwaukee, and Bosch focusing on innovation, product durability, and expanded service networks to strengthen market presence.

- Asia Pacific led with a 33% share, followed by North America at 29% and Europe at 26%, while the electric type segment dominated with a 53% share, supported by strong adoption in building and construction applications.

Market Segmentation Analysis:

By Type

The electric demolition hammer segment dominated the market with a 53% share in 2024. Its dominance stems from high adoption in construction and renovation due to ease of operation, consistent power delivery, and lower maintenance costs. Electric hammers are preferred for medium-duty demolition tasks in residential and commercial projects. Advancements in brushless motor technology and ergonomic design further support user convenience. The pneumatic and hydraulic types serve industrial and heavy-duty needs but account for smaller shares due to higher equipment and maintenance costs.

- For instance, Hilti launched its TE 2000-22 cordless demolition hammer featuring a 38.2 joules impact energy, enabling professional-grade concrete breaking with lower vibration.

By Power Range

The 600 watts to 1200 watts segment held the largest 46% share in 2024, driven by its balance between power efficiency and versatility. These models are widely used in civil construction, flooring removal, and medium-scale demolition tasks. Their performance suits continuous use while maintaining manageable weight and cost. The up to 600-watt category caters to light-duty domestic and maintenance work, while the above 1200-watt range addresses demanding industrial projects like concrete structure removal and bridge restoration. Rising demand for multi-power control systems supports growth across all power classes.

- For instance, Milwaukee’s MX FUEL Breaker Hammer produces 64 joules impact energy and delivers up to 2 tons of concrete demolition per charge, meeting the requirements of high-power industrial tasks.

By End Use

The building and construction segment accounted for a 62% share in 2024, making it the leading end-use category. The dominance is driven by extensive use in urban infrastructure development, concrete breaking, and road maintenance. Ongoing residential and commercial expansion in Asia-Pacific and Europe fuels demand for portable, high-impact tools. General engineering and manufacturing applications follow, supported by machine dismantling and repair operations. The others category, including mining and well drilling, continues to expand with the need for controlled rock fragmentation and maintenance efficiency in resource extraction sites.

Key Growth Drivers

Rising Construction and Infrastructure Development

Rapid urbanization and expanding infrastructure projects are driving demand for demolition hammers. Growing investments in residential, commercial, and transportation construction across major regions create strong market momentum. Governments are promoting smart city and public infrastructure upgrades, boosting the use of efficient demolition tools. Contractors prefer electric and portable models that offer consistent power, low maintenance, and high precision for concrete and masonry work, supporting continuous growth in both new construction and refurbishment activities.

- For instance, DEWALT’s D25980K electric demolition hammer provides 52 joules of impact energy and 900 bpm, improving productivity on heavy concrete demolition sites.

Technological Advancements in Tool Design

Manufacturers are improving tool performance through innovations like brushless motors, anti-dust systems, and vibration control. These enhancements extend equipment life, reduce fatigue, and ensure safer operation for workers. The shift toward cordless and battery-powered hammers supports flexibility and energy efficiency on job sites. Ergonomically designed tools with improved cooling and noise reduction are gaining preference among professionals seeking durable, high-performance equipment suited for both light and heavy-duty applications.

- For instance, Makita’s HM002GZ03 XGT model operates on a 40 V max battery and delivers 20 joules impact energy with active AVT vibration control, enhancing comfort during long operation.

Growth in Renovation and Remodeling Activities

Rising renovation and refurbishment projects in developed economies continue to strengthen market demand. Older buildings and infrastructure require controlled demolition during structural upgrades, fueling the need for compact and efficient tools. Increased home improvement activities and stricter construction safety regulations further accelerate adoption. Professional contractors and DIY users alike prefer demolition hammers that offer precise control, lower vibration, and reliable performance for interior wall, concrete, and flooring removal tasks.

Key Trends & Opportunities

Shift Toward Electric and Cordless Models

The market is witnessing a shift toward electric and cordless demolition hammers as users seek cleaner, quieter, and maintenance-free tools. Improvements in lithium-ion batteries and power management systems have enhanced runtime and efficiency. Compact and lightweight designs are now capable of handling demanding demolition work with ease. The transition toward electric models aligns with the broader push for sustainable and emission-free construction equipment across global markets.

- For instance, DEWALT introduced the 60V MAX FLEXVOLT 2-inch SDS-Max combination hammer (DCH773Y2) equipped with a brushless motor that delivers 19.4 joules of impact energy.

Increasing Focus on Operator Safety and Ergonomics

Manufacturers are emphasizing operator comfort and safety through ergonomic handle designs and vibration control systems. Enhanced grip materials, shock absorption mechanisms, and automatic shut-off functions are now common in professional-grade models. Compliance with international safety standards has become a key differentiator for leading brands. This growing focus on user well-being and fatigue reduction is fostering demand for premium demolition tools designed for longer working hours.

- For instance, the Metabo MHE 5 SDS-Max breaker integrates VibraTech (MVT) damping technology to significantly reduce vibrations. The tool includes a service display with an LED that indicates when the carbon brushes need to be replaced, allowing for a planned service.

Expansion of Rental and Aftermarket Services

Tool rental services are emerging as a major opportunity for market expansion. Contractors and construction firms increasingly rent demolition hammers to minimize upfront costs and maintenance burdens. Rental providers now offer modern, energy-efficient models equipped with smart diagnostics and service tracking features. This trend benefits both users and manufacturers by promoting recurring tool utilization and expanding access to advanced demolition technologies without high ownership expenses.

Key Challenges

High Equipment Maintenance and Replacement Costs

Demolition hammers are subjected to extreme vibration, dust, and material impact, leading to regular wear and tear. Frequent maintenance and part replacement increase long-term ownership costs for users. Smaller contractors and individual operators often face financial constraints when upgrading to advanced or cordless variants. The need for trained service technicians and spare parts availability further adds to operational challenges in maintaining equipment efficiency.

Stringent Noise and Emission Regulations

Regulatory bodies are imposing strict limits on workplace noise, vibration, and emissions from demolition tools. Compliance with these standards requires costly design modifications and continuous testing. Pneumatic and fuel-driven models face particular challenges in meeting updated safety and environmental requirements. Manufacturers must invest heavily in noise reduction and clean technology innovations, increasing production expenses and slowing time-to-market for new product releases.

Regional Analysis

North America

North America held a 29% share of the demolition hammers market in 2024, driven by strong construction activity in the United States and Canada. Ongoing residential renovation projects and highway maintenance programs are increasing tool demand. The region benefits from widespread adoption of electric and cordless models due to their low maintenance and compliance with noise regulations. Major players focus on ergonomic designs and power efficiency to meet safety standards. The expansion of smart infrastructure projects and steady growth in remodeling activities further support regional market growth.

Europe

Europe accounted for a 26% share of the global demolition hammers market in 2024, supported by urban redevelopment and strict energy-efficiency regulations. Countries such as Germany, France, and the United Kingdom are witnessing increased demand for compact, low-emission tools for indoor and heritage restoration projects. Construction equipment manufacturers emphasize noise control and ergonomic features to meet EU safety standards. The growing trend of renovation and retrofitting of old infrastructure drives product replacement cycles, while high labor costs encourage investment in efficient, high-impact electric demolition tools.

Asia Pacific

Asia Pacific dominated the global market with a 33% share in 2024, emerging as the fastest-growing region. Rapid industrialization, infrastructure expansion, and housing construction in China, India, and Southeast Asia are key growth drivers. Rising government investments in smart cities and public infrastructure continue to stimulate demand for electric and hydraulic demolition hammers. Local manufacturers are expanding production capacity and offering competitively priced products. Growing preference for lightweight, high-power tools in urban construction and mining projects strengthens regional demand, supported by an expanding distribution network and robust construction equipment exports.

Latin America

Latin America captured a 7% share of the demolition hammers market in 2024, with growth driven by ongoing urban development in Brazil, Mexico, and Chile. Increased investment in commercial and public infrastructure projects, such as transport corridors and housing developments, is fueling demand for durable demolition tools. The shift toward electric hammers is gaining traction due to lower maintenance and ease of use. However, limited availability of advanced models and economic volatility in some countries constrain rapid adoption. Expansion of local distribution networks and rental services supports market growth across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 5% share in 2024, supported by infrastructure development, oil and gas facility upgrades, and large-scale construction projects. The Gulf Cooperation Council countries lead demand due to ongoing urban expansion and high investment in transport and energy infrastructure. Contractors favor robust hydraulic and electric hammers for high-impact applications. In Africa, growth is supported by industrial expansion and rising government focus on affordable housing. The development of free trade zones and logistics infrastructure is further stimulating demand for durable, high-performance demolition equipment.

Market Segmentations:

By Type

- Electric

- Pneumatic

- Hydraulic

By Power Range

- Up to 600 watts

- 600 watts to 1200 watts

- Above 1200 watts

By End Use

- Building & construction

- General engineering & manufacturing

- Others (mining, well drilling, etc.)

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The demolition hammers market is highly competitive, with major players including Hilti, Bauer, Makita, Einhell, Milwaukee, Robert Bosch Tool Corporation, Koki Holdings, Dewalt, Ferm International, and Hitachi. These companies focus on developing advanced, high-performance tools featuring improved impact energy, reduced vibration, and ergonomic handling to enhance productivity and safety. Continuous investment in R&D drives innovations such as brushless motors, anti-vibration systems, and dust-resistant housing. Leading manufacturers also expand through strategic partnerships, mergers, and regional distribution networks to strengthen market reach. The shift toward electric and cordless models is intensifying competition as players emphasize energy efficiency and portability. Additionally, rising demand for professional-grade tools in construction and industrial maintenance has encouraged manufacturers to broaden product portfolios and introduce smart control technologies. Companies offering durable, low-maintenance, and compliance-ready demolition hammers are expected to sustain strong competitive positioning in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hilti

- Bauer

- Makita

- Einhell

- Milwaukee

- Robert Bosch Tool Corporation

- Koki Holdings

- Dewalt

- Ferm International

- Hitachi

Recent Developments

- In January 2025, DEWALT (a division of Stanley Black & Decker) showcased its POWERSHIFT™ system and total concrete solutions at the World of Concrete trade show, highlighting electrification of demolition and concrete tools.

- In April 2024, Makita released a D-handle rotary hammer (HR2663) with onboard dust extraction for demanding concrete applications.

- In 2024, Makita Corporation released its 70 lb (1-1/8″ Hex) AVT® Breaker Hammer with 72.8 J impact energy and up to 70% faster breaking than corded equivalents.

- In 2023, DEWALT announced its FlexVolt® cordless breaker hammer DCH966 (38 lb) with up to 40 J impact energy and 1,080 bpm, expanding its demolition-hammer offering.

Report Coverage

The research report offers an in-depth analysis based on Type, Power Range, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for demolition hammers will continue to grow with expanding construction and infrastructure projects worldwide.

- Electric and cordless models will gain more preference due to energy efficiency and ease of use.

- Manufacturers will focus on improving ergonomics and reducing vibration to enhance operator safety.

- Integration of smart control and monitoring systems will become more common in advanced models.

- Growth in renovation and refurbishment activities will sustain consistent market demand.

- The Asia Pacific region will remain the leading market, supported by rapid industrialization and urban development.

- Europe will see steady demand driven by strict safety and emission regulations.

- Rental and service-based tool ownership models will expand, offering cost-effective solutions to contractors.

- Companies will increase investments in brushless motor and dust-resistant technologies.

- Market competition will intensify as global brands expand into emerging economies through partnerships and localized production.