Market Overview:

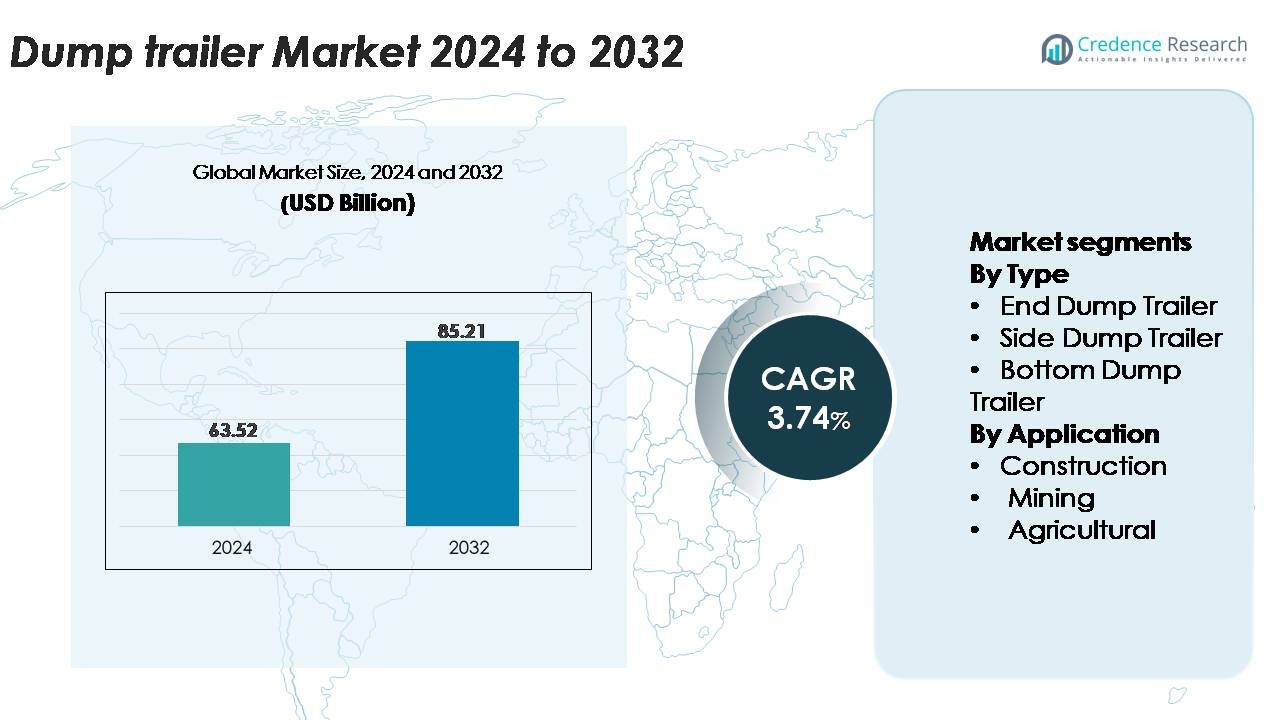

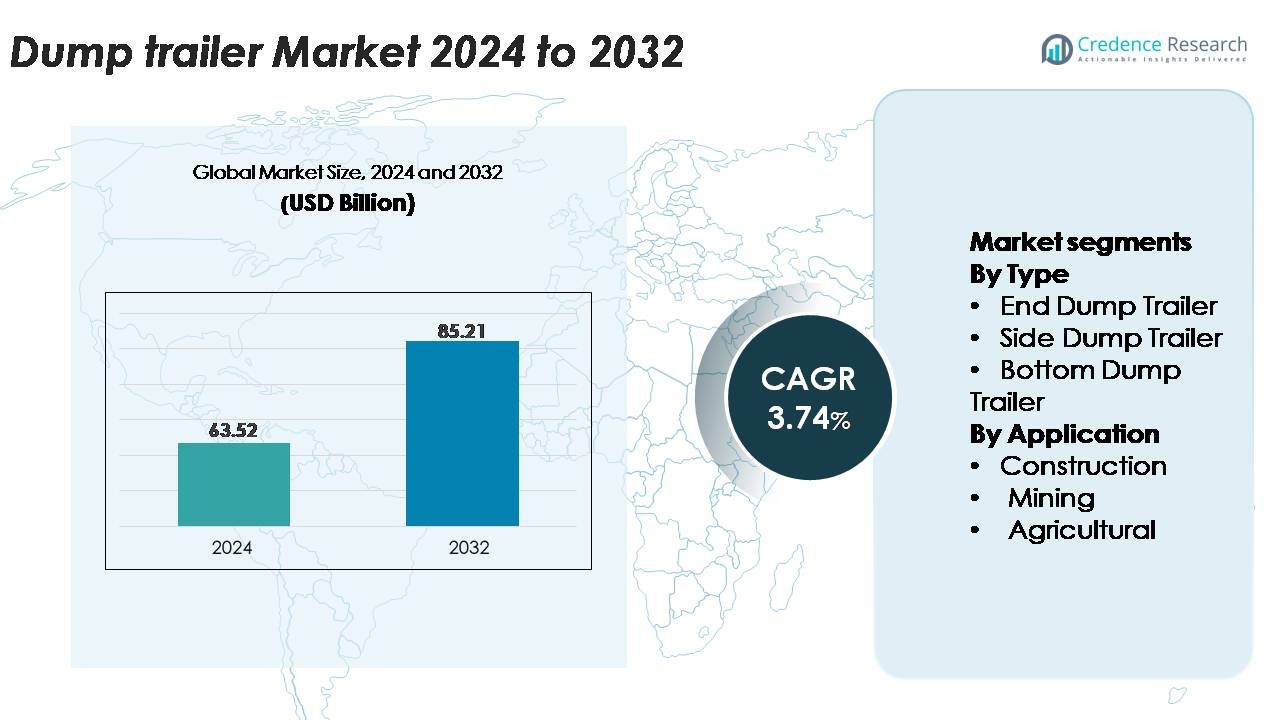

The dump trailer market was valued at USD 63.52 billion in 2024 and is anticipated to reach USD 85.21 billion by 2032, registering a CAGR of 3.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dump Trailer Market Size 2024 |

USD 63.52 Billion |

| Dump Trailer Market, CAGR |

3.74% |

| Dump Trailer Market Size 2032 |

USD 85.21 Billion |

The dump trailer market is shaped by prominent global and regional manufacturers, including Mac Trailer, Schmitz Cargobull, Manac, East Manufacturing, Kögel Trailers, MAXX-D Trailers, Construction Trailer Specialists, JCBL Limited, and Wielton. These companies compete through advancements in lightweight materials, reinforced frames, and high-efficiency hydraulic systems tailored for construction, mining, and agricultural hauling needs. North America remains the leading region, holding approximately 34% of global market share, supported by extensive construction activity, strong demand from aggregate producers, and the presence of major trailer OEMs with large distribution networks. Continuous fleet modernization and adoption of high-capacity models further strengthen the region’s leadership position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The dump trailer market was valued at USD 63.52 billion in 2024 and is projected to reach USD 85.21 billion by 2032, expanding at a CAGR of 3.74%, driven by rising demand across construction, mining, and agricultural operations.

- Growing infrastructure development, large-scale road projects, and expanding quarrying activities significantly accelerate trailer procurement, with end dump trailers holding the dominant share due to their versatility and high-load handling efficiency.

- Market trends emphasize lightweight aluminum designs, advanced hydraulic stability systems, and increased adoption of telematics to improve payload efficiency, safety, and fleet monitoring across diverse applications.

- Competition intensifies as leading players such as Mac Trailer, Schmitz Cargobull, Manac, East Manufacturing, and Wielton focus on product innovation, reinforced trailer frames, and customization to meet sector-specific hauling requirements.

- Regionally, North America leads with around 34% share, followed by Asia Pacific at 29% and Europe at 27%, supported by strong construction pipelines and mining investments that continue to shape segment-level demand dynamics.

Market Segmentation Analysis:

By Type

End dump trailers hold the largest market share in the dump trailer segment due to their versatility, high load-handling efficiency, and widespread use across construction and infrastructure projects. Their ability to unload material quickly through rear-end tipping makes them preferred for aggregates, demolition waste, and bulk materials. Side dump trailers gain traction in applications requiring enhanced stability on uneven terrain, while bottom dump trailers remain essential for roadwork and material spreading. The dominance of end dump trailers is strengthened by ongoing investments in lightweight steel frames and advanced hydraulic systems that improve payload capacity and operational safety.

- For instance, East Manufacturing’s aluminum Genesis end-dump trailer is available in various configurations, with specific models offering a capacity of around 38 cubic yards. The empty weight for a typical frame model is approximately 10,533 lbs (4,777 kg), designed for a high payload capacity.

By Application

The construction sector accounts for the dominant market share, driven by rising infrastructure development, road expansion projects, and urbanization activities that require high-capacity material-hauling solutions. Dump trailers are essential for transporting aggregates, soil, debris, and construction waste, making them central to contractor fleet operations. The mining segment follows, supported by demand for durable trailers capable of handling abrasive materials under harsh conditions, while the agricultural segment benefits from growing mechanization and bulk transport needs. The construction industry’s sustained equipment procurement and fleet modernization efforts reinforce its leadership in overall dump trailer adoption.

- For instance, Schmitz Cargobull’s S.KI tipper trailer, widely used in construction fleets, features a steel rounded body with typical load volumes between 24 and 36 cubic metres, and is equipped with a front-mounted hydraulic cylinder to lift the body and tip its substantial payload capacity of up to 30 tonnes of material per cycle, enabling efficient site-to-site hauling.

Key Growth Drivers

Expansion of Construction, Infrastructure, and Road Development Projects

Rapid expansion of construction and infrastructure projects remains the strongest driver of dump trailer demand, as governments and private developers continue investing in large-scale road building, residential complexes, industrial parks, and public transportation networks. Dump trailers play a vital role in hauling aggregates, cement, soil, demolition debris, and asphalt, making them indispensable across project stages. Their ability to support frequent, heavy-duty cycles enhances productivity for contractors working under tight timelines. Increasing public investments in road rehabilitation, bridge upgrades, and smart city development further accelerates the procurement of high-payload trailers with durable frames and advanced hydraulic systems. As urban expansion intensifies in emerging economies, contractors prioritize fleet expansion to handle rising material volumes, thereby strengthening long-term demand.

- For instance, MANAC’s construction-spec half-round end dump trailer is engineered with a Hardox 450 steel body and offers load capacities ranging from 18 to 26 cubic yards, supported by a 6-stage front hydraulic cylinder delivering lift forces above 80,000 pounds for rapid unloading cycles.

Rising Mining and Quarrying Activities Driving Heavy-Duty Trailer Adoption

The growing scale of mining and quarrying operations significantly boosts demand for robust dump trailers built to withstand abrasive materials and harsh terrain. Mining operators rely on end dump and side dump configurations capable of handling ore, coal, aggregates, and overburden with consistent reliability. The sector’s preference for trailers with reinforced steel frames, high-torque hydraulic cylinders, and improved suspension systems supports operational efficiency and minimizes downtime in remote sites. Increasing mineral exploration activities and the expansion of open-pit mining projects in key regions also stimulate demand for large-capacity dump trailers. As extraction companies modernize fleets to enhance safety and compliance standards, they increasingly adopt trailers engineered for higher payloads, better stability, and reduced maintenance cycles.

· For instance, SmithCo’s SX Series side-dump mining trailer typically offers a tub capacity that can range up to or exceed 26 cubic yards depending on the specific model and configuration. These trailers are designed with a heavy-duty, self-aligning spherical bearing pivot system and 80/100 KSI high-tensile steel frames to manage significant load forces, which enables stable and safe dumping on uneven mine and construction surfaces.

Advancements in Trailer Engineering, Materials, and Fleet Monitoring Technologies

Technological innovation continues to elevate the performance, safety, and longevity of dump trailers, creating a strong growth catalyst. Manufacturers increasingly adopt high-strength, low-alloy steel and aluminum alloys to reduce trailer weight while retaining structural durability, thereby improving payload efficiency. Enhanced hydraulic systems offer smoother tipping cycles and reduced risk of rollover incidents. The integration of telematics and IoT-based fleet monitoring solutions enables operators to track load status, braking patterns, axle usage, and maintenance needs in real time. These capabilities support predictive maintenance, reduce operating costs, and improve equipment utilization. As fleet operators seek improved profitability and regulatory compliance, demand rises for technologically advanced dump trailers designed to maximize material-handling efficiency and lifecycle value.

Key Trends & Opportunities:

Growing Shift Toward Lightweight, Fuel-Efficient, and Sustainable Trailer Designs

A major trend shaping the dump trailer market is the transition toward lightweight and environmentally efficient trailer structures. Manufacturers increasingly use aluminum and composite materials to reduce empty trailer weight, resulting in optimized fuel consumption and higher payload capacity per trip. Lightweight designs also reduce wear on axles, tires, and braking systems, lowering operational costs for fleet owners. The demand for sustainability in logistics and construction operations prompts companies to adopt trailers that minimize emissions and improve haul cycle efficiency. Additionally, opportunities emerge for eco-friendly coatings, corrosion-resistant materials, and improved aerodynamic features. As decarbonization efforts strengthen across transportation and construction value chains, adoption of lightweight, energy-efficient dump trailers continues to grow.

· For instance, East Manufacturing’s aluminum Genesis dump trailer uses a smooth-sided 6061-T6 aluminum body with an unladen weight starting around 4,300 to 5,000 kilograms (9,500 to 11,000 pounds) and offers body capacities typically between 23 and 38 cubic yards depending on configuration, enabling higher payload efficiency per haul cycle.

Increased Adoption of Automation, Telematics, and Connected Fleet Solutions

Manufacturers and fleet operators increasingly embrace digitalization to enhance productivity, creating substantial opportunities for connected dump trailer solutions. Telematics systems provide detailed insights into trailer location, load weight, hydraulic system cycles, fuel consumption, and safety performance, enabling operators to streamline asset utilization. Automated tipping controls, overload detection sensors, and stability monitoring systems reduce accident risks and improve compliance with safety regulations. In large mining and construction fleets, centralized software enables coordinated dispatching, predictive maintenance scheduling, and real-time diagnostics. As digital fleet ecosystems expand, demand rises for intelligent dump trailers that integrate seamlessly with modern fleet management platforms, offering a competitive advantage in operational efficiency and lifecycle optimization.

- For instance, Schmitz Cargobull equips its trailers with the TrailerConnect® telematics module, capable of transmitting GPS position, braking system data, tire pressure readings, and axle-load measurements at intervals as short as 60 seconds, while supporting up to 16 integrated sensors for real-time operational monitoring.

Expansion of Rental Fleets as Contractors Prioritize Flexible Equipment Utilization

The growing preference for rental equipment presents significant opportunities for dump trailer manufacturers and rental service providers. Contractors increasingly choose equipment rentals to avoid high upfront capital expenditures, especially for short-term or seasonal projects. Rental companies are expanding their fleets with versatile end dump and side dump trailers to serve construction, mining, and agricultural clients requiring short-duration hauling support. This trend creates opportunities for manufacturers to collaborate with rental firms by supplying durable, low-maintenance trailer models designed for repeated heavy-duty use. As urban construction cycles fluctuate and budgets tighten, rental adoption is expected to expand further, strengthening a recurring revenue stream for the market.

Key Challenges:

High Maintenance Requirements and Operational Wear in Harsh Working Conditions

Dump trailers operate in demanding environments construction sites, mines, and agricultural fields where heavy loads, abrasive materials, and uneven terrain cause rapid equipment wear. Frequent maintenance of hydraulic cylinders, braking systems, suspension components, and structural frames becomes essential to ensure reliability and safety. Operators face high costs for part replacements, downtime, and periodic inspections. The challenge intensifies for older fleets where reduced structural integrity increases risk of failure or tipping incidents. Extreme temperature conditions, corrosive materials, and continuous load cycles further accelerate wear. These factors raise ownership costs, making it difficult for smaller contractors to sustain long-term operational efficiency without significant investment in proactive maintenance practices.

Volatility in Raw Material Prices and Supply Chain Constraints

Fluctuations in steel, aluminum, hydraulic components, and tire prices create substantial challenges for dump trailer manufacturers and buyers. Price volatility affects production costs, profit margins, and trailer pricing, making procurement planning difficult for contractors and fleet operators. Supply chain disruptions driven by geopolitical tensions, transportation delays, or shortages in critical components can extend delivery timelines and restrict equipment availability during peak project cycles. Manufacturers must balance cost pressures with the need to maintain quality standards and competitive pricing. For end users, unpredictable cost surges may delay fleet expansion or replacement decisions, ultimately affecting market growth and purchase cycles.

Regional Analysis:

North America

North America holds the largest market share at approximately 34%, driven by extensive construction activity, strong demand from aggregate producers, and continuous fleet expansion among logistics and infrastructure contractors. The U.S. leads regional adoption due to large-scale road rehabilitation projects, housing development, and the presence of major trailer manufacturers offering technologically advanced products with telematics and lightweight materials. Canada contributes additional demand through mining, oil sands operations, and agricultural hauling requirements. Strong regulatory standards for trailer safety, load management, and emissions compliance further encourage fleet modernization, supporting steady adoption of high-capacity dump trailer models across industries.

Europe

Europe accounts for nearly 27% of the global dump trailer market, supported by robust construction spending, infrastructure upgrades, and growth in quarrying and recycling operations. Countries such as Germany, the U.K., France, and the Nordic region prioritize durable, high-efficiency trailers engineered for strict EU safety and environmental regulations. Adoption is driven by demand for lightweight aluminum frames, advanced hydraulic systems, and increased focus on reducing haulage emissions. The region’s expanding road maintenance programs and urban redevelopment initiatives further strengthen trailer procurement. Additionally, Europe’s strong rental ecosystem accelerates short-term adoption among contractors seeking flexible equipment utilization options.

Asia Pacific

Asia Pacific holds roughly 29% market share, experiencing the fastest growth due to large-scale infrastructure development, rapid urbanization, and expanding mining operations in China, India, and Southeast Asia. High-volume material movement for metro rail projects, expressways, industrial corridors, and commercial construction drives demand for end dump and side dump trailers. The region’s growing cement, aggregates, and construction materials industries further elevate fleet requirements. Emerging economies emphasize cost-efficient, high-payload trailers to support large public development programs. Increasing mechanization in agriculture and rural infrastructure also contributes significantly to regional expansion, reinforcing Asia Pacific’s role as a critical growth engine.

Latin America

Latin America represents approximately 6% of the dump trailer market, influenced by the region’s mining intensity, agricultural activities, and expanding construction programs. Countries such as Brazil, Chile, and Peru generate strong demand for heavy-duty dump trailers suitable for transporting ore, copper concentrate, aggregates, and crop materials. Infrastructure modernization initiatives including road building, airport expansion, and urban development positively impact trailer procurement. However, economic fluctuations and inconsistent investment cycles affect fleet replacement rates. Despite these challenges, increased reliance on rental fleets and modernization of logistics operations support stable market demand across industrial users.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for nearly 4% of global market share, with demand primarily concentrated in mining, large-scale infrastructure development, and energy-sector construction. Gulf countries invest heavily in new highways, industrial zones, and commercial complexes, driving adoption of high-capacity dump trailers. In Africa, mining operations in South Africa, Namibia, and Botswana generate consistent need for robust trailers capable of handling heavy minerals and overburden. Although procurement can be affected by economic constraints and import dependencies, the region benefits from ongoing government-backed development projects, supporting steady market expansion for durable dump trailer fleets.

Market Segmentations:

By Type

- End Dump Trailer

- Side Dump Trailer

- Bottom Dump Trailer

By Application

- Construction

- Mining

- Agricultural

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The dump trailer market features a mix of global manufacturers and regional players competing on durability, load efficiency, customization capability, and after-sales support. Leading companies focus on engineering high-strength steel and aluminum trailers with advanced hydraulic systems to enhance stability, reduce maintenance cycles, and increase payload efficiency. Many manufacturers are expanding product lines to include end dump, side dump, and bottom dump configurations tailored to construction, mining, and agricultural applications. Strategic partnerships with fleet operators, rental companies, and material-handling contractors strengthen market reach, while investments in telematics integration and IoT-enabled monitoring systems create differentiation through lifecycle value and operational transparency. Companies also emphasize compliance with evolving safety and regulatory standards, supporting adoption in developed markets. As infrastructure and mining activity expand globally, competitive intensity increases, prompting firms to enhance production capacity, improve welding automation, and incorporate corrosion-resistant materials. Overall, innovation-centered manufacturing and service-driven business models define the evolving competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mac Trailer (US)

- Kögel Trailers (Germany)

- JCBL Limited (India)

- East Manufacturing (US)

- Schmitz Cargobull (Germany)

- MAXX-D Trailers (US)

- Manac (Canada)

- Wielton (Poland)

- Construction Trailer Specialists (US)

Recent Developments:

- In April 2025, Kögel unveiled a new lightweight, durable tipper body at the BAUMA 2025 trade show, designed for higher payload efficiency and stability in construction and road-work applications.

- In January 2025, JCBL South (a division of JCBL) delivered its 100th customised trailer to BEML Limited (a Miniratna PSU), highlighting its manufacturing capacity and focus on tailored solutions.

- In April 2024, Mac Trailer introduced the “TipperMax” aluminium drop-centre tipper trailer, which enables higher payloads while maintaining standard ride height, targeting waste-haul applications.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for dump trailers will rise as governments expand infrastructure, road-building, and urban development programs.

- Manufacturers will increasingly adopt lightweight aluminum and high-strength steel to enhance payload efficiency and reduce fuel consumption.

- Telematics, IoT systems, and predictive maintenance tools will become standard features for fleet optimization.

- Adoption of advanced hydraulic stability systems will grow to improve operational safety and reduce rollover risks.

- Rental fleet expansion will accelerate as contractors seek flexible and cost-efficient equipment utilization.

- Mining and quarrying operations will continue driving demand for heavy-duty, high-capacity dump trailer models.

- Automation and digital fleet management platforms will influence procurement decisions across major industries.

- Trailer customization for construction, agriculture, and waste management applications will expand significantly.

- Sustainability initiatives will push manufacturers toward corrosion-resistant coatings and eco-efficient component designs.

- Emerging markets in Asia Pacific, Latin America, and Africa will witness increased fleet modernization due to industrial growth.