Market Overview:

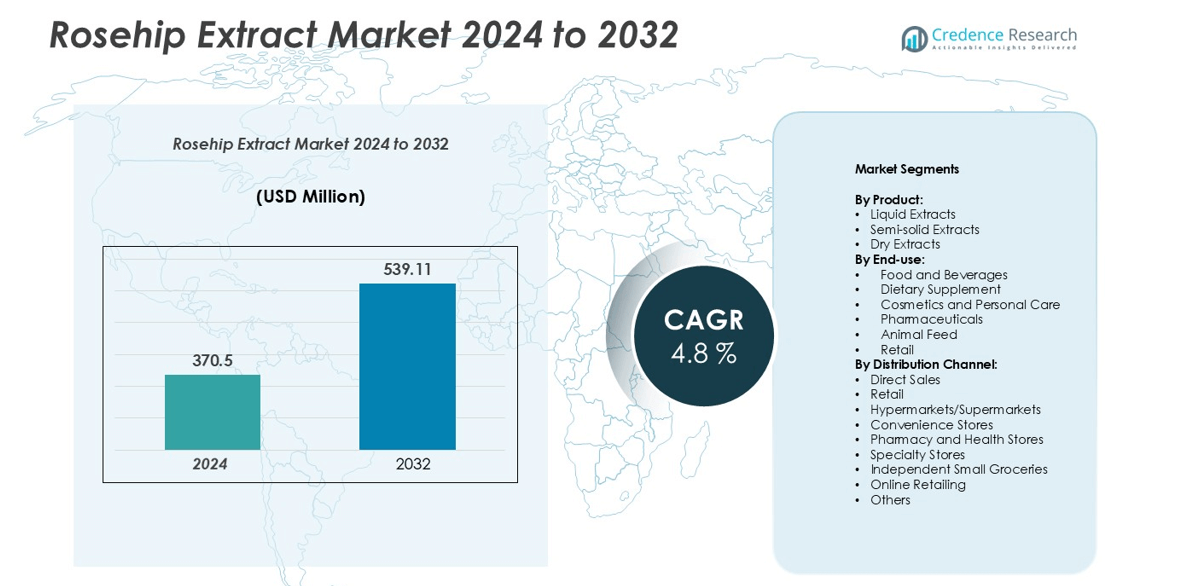

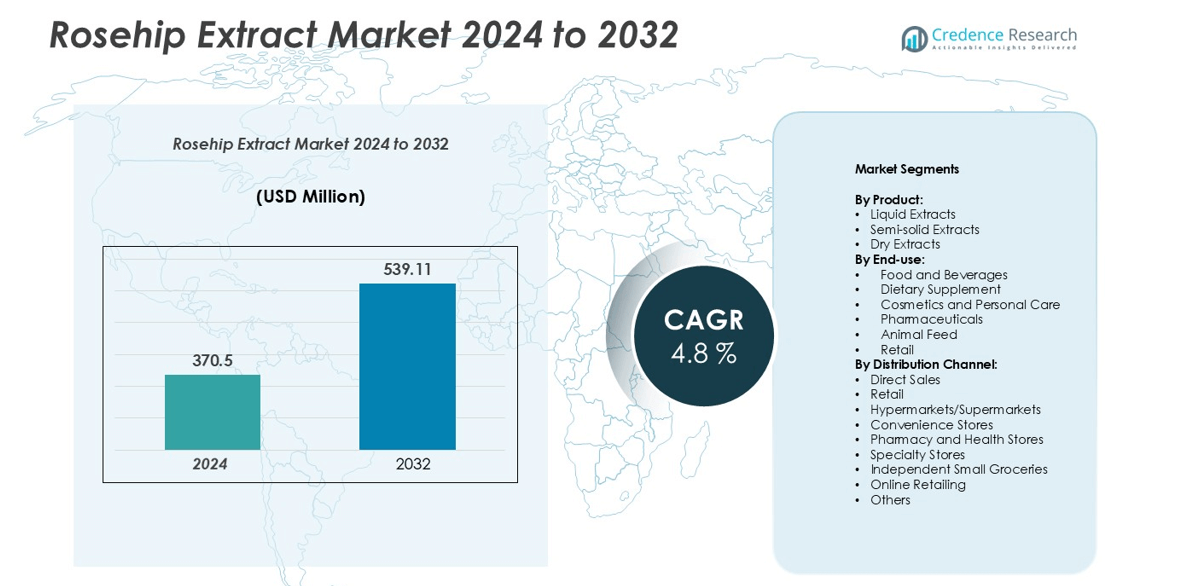

Rosehip extract market size was valued at USD 370.5 million in 2024 and is anticipated to reach USD 539.11 million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rosehip Extract Market Size 2024 |

USD 370.5 million |

| Rosehip Extract Market, CAGR |

4.8% |

| Rosehip Extract Market Size 2032 |

USD 539.11 million |

The rosehip extract market is highly competitive, led by prominent players such as Afriplex, Now Foods, Biossance, FENGCHEN GROUP CO., LTD., Herbal Bioactives LLP, Leven Rose, ParkAcre Enterprises Ltd., and Xi’an Green Spring Technology Co., Ltd. These companies focus on product innovation, high-quality extraction, and expanding distribution through modern retail and e-commerce channels. North America emerges as the largest market, holding 35% share, driven by strong consumer awareness, established nutraceutical companies, and high adoption of dietary supplements and natural personal care products. Europe follows with a 28% share, supported by stringent quality standards and growing demand for clean-label, plant-based products. Asia-Pacific accounts for 22%, reflecting rapid growth from urbanization, rising disposable incomes, and expanding e-commerce. Latin America (10%) and the Middle East & Africa (5%) offer emerging opportunities for market expansion and regional partnerships.

Market Insights

- The rosehip extract market was valued at USD 370.5 million in 2024 and is projected to reach USD 539.11 million by 2032, growing at a CAGR of 4.8%.

- Rising health consciousness and preventive healthcare drive demand, particularly in dietary supplements, functional foods, and personal care products. Liquid extracts dominate the product segment due to high bioavailability, while dietary supplements hold the largest share among end-use applications.

- Key trends include innovation in product formulations such as gummies, functional beverages, and skincare applications, along with increasing consumer preference for natural, clean-label ingredients.

- The market is highly competitive, led by players like Afriplex, Now Foods, Biossance, FENGCHEN GROUP, and Herbal Bioactives LLP, focusing on R&D, partnerships, and expanded distribution channels.

- Regionally, North America leads with a 35% share, followed by Europe (28%), Asia-Pacific (22%), Latin America (10%), and MEA (5%), driven by e-commerce growth and rising adoption of natural health products.

Market Segmentation Analysis:

By Product:

The liquid extracts segment dominates the rosehip extract market, accounting for the largest share due to its high bioavailability and ease of incorporation in beverages and dietary supplements. Semi-solid and dry extracts are gaining traction in specialized applications such as cosmetics and pharmaceuticals. The demand for liquid extracts is primarily driven by their superior antioxidant retention and convenience in formulation, enabling manufacturers to deliver functional benefits effectively. Growing consumer preference for ready-to-use natural ingredients and the rising adoption of liquid-based health products continue to support this segment’s leading position.

- For instance, Bloomage Biotech’s Tianjin Factory is planned to have an overall production capacity of 1,000 tons for bioactive materials, including various bio-fermented compounds like hyaluronic acid and γ-aminobutyric acid.

By End-use:

The dietary supplement segment holds a dominant share in the rosehip extract market, fueled by the increasing awareness of preventive healthcare and immunity-boosting solutions. Food and beverages, cosmetics, and pharmaceuticals also represent significant segments, benefiting from rosehip’s antioxidant, anti-inflammatory, and skin-nourishing properties. Retail and animal feed remain smaller contributors but show steady growth. Key drivers include rising health consciousness, demand for natural supplements, and a shift toward plant-based functional ingredients in daily nutrition and personal care products.

- For instance, Arjuna Natural Extracts is a Kerala-based company that developed the patented turmeric formulation BCM-95 (also branded as Curcugreen) and manufactures extracts from a variety of botanicals.

By Distribution Channel:

Online retailing leads the distribution channels for rosehip extract, capturing the highest market share due to convenience, wider product variety, and competitive pricing. Direct sales and retail outlets, including hypermarkets and specialty stores, support steady growth by catering to traditional buyers and bulk purchasers. Pharmacy and health stores, along with independent groceries, play a niche role. The surge in e-commerce adoption, coupled with increasing digital marketing of natural health products and consumer preference for doorstep delivery, drives the prominence of online channels in this market.

Key Growth Drivers

Rising Health Consciousness and Preventive Healthcare

Growing awareness of preventive healthcare and immunity-boosting solutions is a major driver for the rosehip extract market. Consumers increasingly seek natural ingredients rich in antioxidants, vitamins, and anti-inflammatory properties to support overall health. Rosehip extracts are widely recognized for their high vitamin C content, joint health benefits, and skin-nourishing properties, making them highly desirable in dietary supplements, functional foods, and personal care products. This trend is amplified by an aging population and lifestyle-related health concerns, leading manufacturers to innovate formulations that integrate rosehip extract. As consumers increasingly prioritize natural alternatives over synthetic ingredients, the demand for rosehip extract across diverse applications continues to rise, bolstering market expansion globally.

- For instance, Rosehip supplements often contain high doses of added vitamin C, in addition to the naturally occurring vitamin C found in the rosehip fruit. While specific product formulations vary by company and are not disclosed here, a single serving of some rosehip supplements can provide as much as 1,200 mg of vitamin C. This is significantly higher than the Recommended Dietary Allowance (RDA) of 75 to 90 mg for adults and is considered a high dosage within the supplement market.

Expanding Applications Across End-Use Industries

The versatility of rosehip extract is driving its adoption across multiple end-use sectors, including dietary supplements, food and beverages, cosmetics, and pharmaceuticals. In the dietary supplement industry, rosehip is used for joint health and immunity support, while in cosmetics, it serves as a natural antioxidant and skin-repair agent. The extract’s incorporation in functional beverages and nutraceuticals further broadens its market potential. Pharmaceutical formulations leverage its anti-inflammatory and analgesic properties. This cross-industry adoption enhances market penetration and fosters innovation, as manufacturers explore new product formats and delivery mechanisms, creating a robust growth ecosystem for the rosehip extract market.

- For instance, Rosehip extract contains high levels of vitamin C, which is an essential nutrient for the immune system. Additionally, rosehip extract is known to have anti-inflammatory properties. Alpspure Lifesciences offers rosehip extract, but these general health benefits are not unique to its product.

Surge in E-commerce and Modern Retail Channels

The growth of online retailing and modern trade channels has significantly boosted the availability and consumption of rosehip extract products. E-commerce platforms enable direct-to-consumer sales, offering a wide variety of liquid, semi-solid, and dry extracts. Consumers benefit from convenience, product variety, and competitive pricing, while manufacturers can reach global markets more efficiently. Additionally, modern retail formats such as hypermarkets, pharmacies, and specialty stores support brand visibility and bulk purchasing. The integration of digital marketing strategies and subscription-based sales models further drives consumer engagement, making distribution channels a key enabler of market growth.

Key Trends & Opportunities

Innovation in Product Formulations

Manufacturers are increasingly developing innovative rosehip extract formulations, such as effervescent tablets, gummies, and functional beverages, to cater to diverse consumer preferences. These innovations not only enhance convenience but also improve bioavailability and taste, driving consumer adoption. Cosmetic and personal care industries are leveraging rosehip extract in anti-aging creams, serums, and moisturizers, highlighting its skin-repairing benefits. The focus on product differentiation and functional enhancement presents significant opportunities for market players to capture niche segments and strengthen brand loyalty.

- For instance, Vitaquest manufactures over 4,000 products for more than 500 brands globally, including custom effervescent tablets that enhance bioavailability and improve taste profiles.

Growing Demand for Natural and Clean-Label Products

Consumers are shifting towards natural, organic, and clean-label products, creating opportunities for rosehip extract integration across food, beverage, and personal care segments. Its plant-based origin aligns with sustainable and ethical consumption trends, making it attractive for environmentally conscious buyers. Companies are increasingly marketing rosehip extract as a premium, natural ingredient in supplements, beverages, and skincare products. This growing preference for transparency, health-oriented products, and sustainability initiatives continues to fuel market expansion.

- For instance, Arjuna Natural Extracts Ltd. is indeed an Indian company that specializes in manufacturing plant-based active compounds. They produce botanical extracts from ingredients like amla (Indian gooseberry), green tea, pomegranate, and ginger. These products are marketed to meet the increasing demand for natural and “clean-label” food ingredients.

Expansion in Emerging Markets

Emerging regions, particularly in Asia-Pacific and Latin America, present significant growth opportunities due to rising disposable income, urbanization, and increasing health awareness. Consumers in these markets are gradually adopting dietary supplements and functional foods, creating demand for natural extracts like rosehip. Market players are strategically entering these regions through partnerships, local manufacturing, and tailored product offerings, capitalizing on untapped potential and driving global market growth.

Key Challenges

High Production Costs and Raw Material Availability

The rosehip extract market faces challenges related to high production costs and the seasonal availability of raw materials. Extracting bioactive compounds while maintaining potency and quality requires advanced technologies, which can increase manufacturing expenses. Additionally, fluctuations in raw material supply due to climate, crop yield, or geographic limitations can affect production consistency. These factors can impact pricing, margins, and product accessibility, limiting growth potential for smaller players or new entrants in the market.

Regulatory and Quality Compliance Issues

Strict regulations across dietary supplements, food, beverage, and cosmetic industries pose challenges for rosehip extract manufacturers. Compliance with safety, labeling, and efficacy standards is essential to gain market approval and consumer trust. Variations in regulatory frameworks across regions can create barriers to international expansion and increase operational complexity. Additionally, ensuring consistent quality, potency, and purity of extracts is critical, as substandard products can lead to recalls, legal issues, and reputational damage, hindering market growth.

Regional Analysis

North America

North America leads the rosehip extract market, holding approximately 35% market share, driven by strong consumer awareness of health and wellness products. The U.S. is the largest contributor, with high demand for dietary supplements, functional foods, and natural personal care products. Liquid and semi-solid extracts are preferred due to their convenience and bioavailability. Advanced distribution channels, e-commerce penetration, and established nutraceutical companies further support market growth. Rising investments in R&D, innovation in product formulations, and the shift toward clean-label and organic products continue to reinforce North America’s dominant position in the global rosehip extract market.

Europe

Europe accounts for around 28% market share of the global rosehip extract market. Germany, the U.K., and France are key contributors due to strong consumer preference for natural and functional ingredients. The dietary supplement and cosmetics sectors drive demand, supported by stringent quality and safety regulations. Manufacturers focus on advanced extraction technologies and product innovation to meet diverse applications. Increasing awareness of antioxidants and plant-based ingredients, combined with growth in modern retail and online channels, reinforces Europe’s strong position in the rosehip extract market, maintaining steady growth in both mature and emerging segments.

Asia-Pacific

Asia-Pacific holds roughly 22% market share and is the fastest-growing region for rosehip extract. China, Japan, and India are leading markets, fueled by rising disposable incomes, urbanization, and growing health consciousness. Functional beverages, dietary supplements, and skincare applications dominate demand. E-commerce platforms and modern retail channels enhance product accessibility. Consumers increasingly favor plant-based, natural ingredients, while local manufacturers invest in R&D and product diversification. The region’s rapid adoption of natural health products and expanding consumer base position Asia-Pacific as a key driver of global market growth in the coming years.

Latin America

Latin America contributes about 10% market share to the global rosehip extract market. Brazil and Mexico are the primary markets, with rising interest in dietary supplements, natural cosmetics, and functional foods. Growing health awareness among urban consumers and the expansion of pharmacies, specialty stores, and online retail channels support market growth. Challenges such as raw material availability and regulatory complexity exist, but strategic local partnerships and investments in manufacturing are helping to strengthen market presence, gradually increasing the region’s contribution to the global rosehip extract market.

Middle East & Africa (MEA)

The MEA region accounts for approximately 5% market share, reflecting a smaller yet growing segment of the global rosehip extract market. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing increasing demand for natural dietary supplements and personal care products. Modern retail expansion and online platforms facilitate consumer access, while reliance on imports poses challenges. Manufacturers are exploring strategic partnerships, local production, and tailored product offerings to capture emerging demand, enhancing the region’s role in the global market and presenting opportunities for incremental growth.

Market Segmentations:

By Product:

- Liquid Extracts

- Semi-solid Extracts

- Dry Extracts

By End-use:

- Food and Beverages

- Dietary Supplement

- Cosmetics and Personal Care

- Pharmaceuticals

- Animal Feed

- Retail

By Distribution Channel:

- Direct Sales

- Retail

- Hypermarkets/Supermarkets

- Convenience Stores

- Pharmacy and Health Stores

- Specialty Stores

- Independent Small Groceries

- Online Retailing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rosehip extract market is highly competitive, characterized by the presence of established global players and emerging regional manufacturers. Leading companies such as Afriplex, Now Foods, Biossance, FENGCHEN GROUP CO., LTD., and Herbal Bioactives LLP focus on product innovation, high-quality extraction technologies, and diversified product portfolios to maintain market leadership. Strategies including strategic partnerships, mergers and acquisitions, and expansion of distribution networks enhance their market reach. Companies are increasingly investing in research and development to improve bioavailability, antioxidant retention, and product stability across liquid, semi-solid, and dry extracts. Additionally, rising demand for clean-label, natural, and functional products encourages competitive pricing and branding initiatives. The market landscape remains dynamic, with players emphasizing sustainability, certifications, and e-commerce adoption to strengthen consumer trust, expand regional penetration, and secure long-term growth in the global rosehip extract market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Afriplex

- Avi Naturals

- Biossance

- FENGCHEN GROUP CO., LTD.

- Herbal Bioactives LLP

- HERBO NUTRA EXTRACT PRIVATE

- Leven Rose

- Now Foods

- ParkAcre Enterprises Ltd.

- A. Herbal Bioactives LLP

- Spectrum Chemical

- Xi’an Green Spring Technology Co., Ltd

Recent Developments

- In 2025, Kulfi Beauty introduced ‘Main Match,’ a concealer, which was new for the brand. The concealer, which uses South Asian-inspired ingredients such as alma fruit, rosehip extracts, and saffron flower extracts, comes in 12 shades called Kulfi flavor.

- In 2025, Lenoir Skin Care™ introduced Rose Facial Cleanser, a science-backed formula to enhance natural beauty.

- In July 2025, Benefit Cosmetics launched a strategic initiative to expand its POREfessional franchise into the complexion category with the development of a 40-shade, skincare-infused foundation, marking its entry into the competitive foundation market.

- In April 2024, Swiss Beauty introduced Dip Tint Lip Oil, designed to customize tint based on individual lip pH. Enriched with marula and rosehip oils, it delivers lasting hydration and soothing care

Report Coverage

The research report offers an in-depth analysis based on Product, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising health consciousness globally.

- Increasing demand for natural dietary supplements and functional foods will drive expansion.

- Liquid extracts will continue to dominate, while dry and semi-solid formats will see steady adoption.

- Dietary supplements and cosmetics are likely to remain the leading end-use segments.

- E-commerce and online retailing will play a larger role in product distribution.

- Innovation in product formulations, such as gummies and functional beverages, will create new opportunities.

- Emerging markets in Asia-Pacific and Latin America will witness rapid growth.

- Companies will invest more in R&D to enhance bioavailability and antioxidant retention.

- Consumer preference for clean-label, plant-based products will influence market strategies.

- Strategic partnerships and regional expansions will strengthen market presence for key players.