Market Overview:

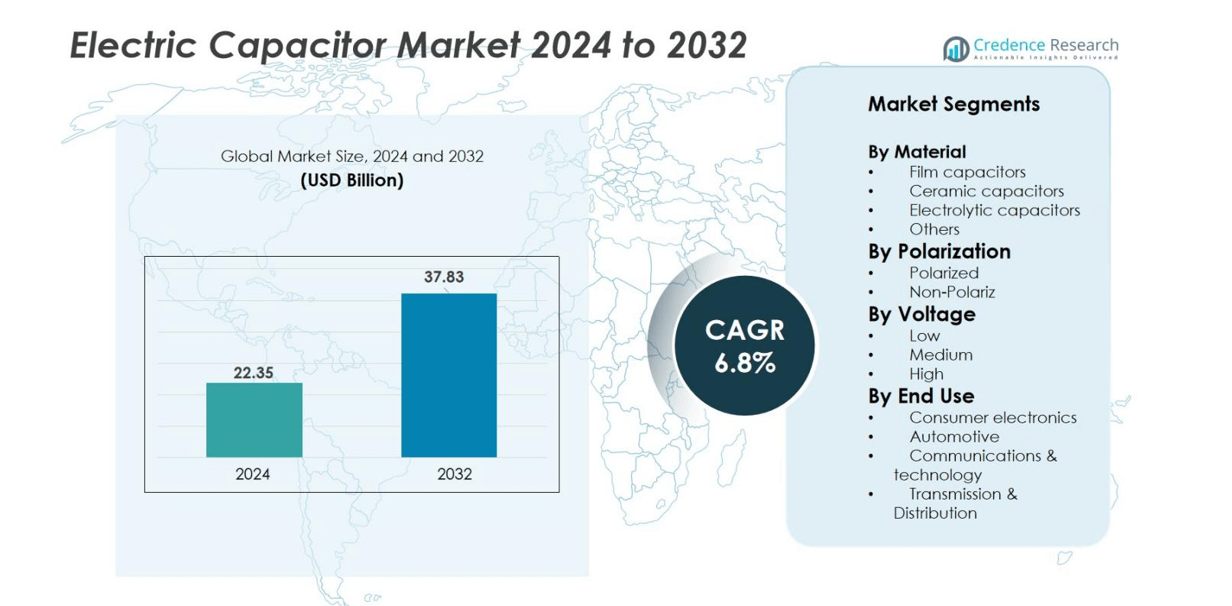

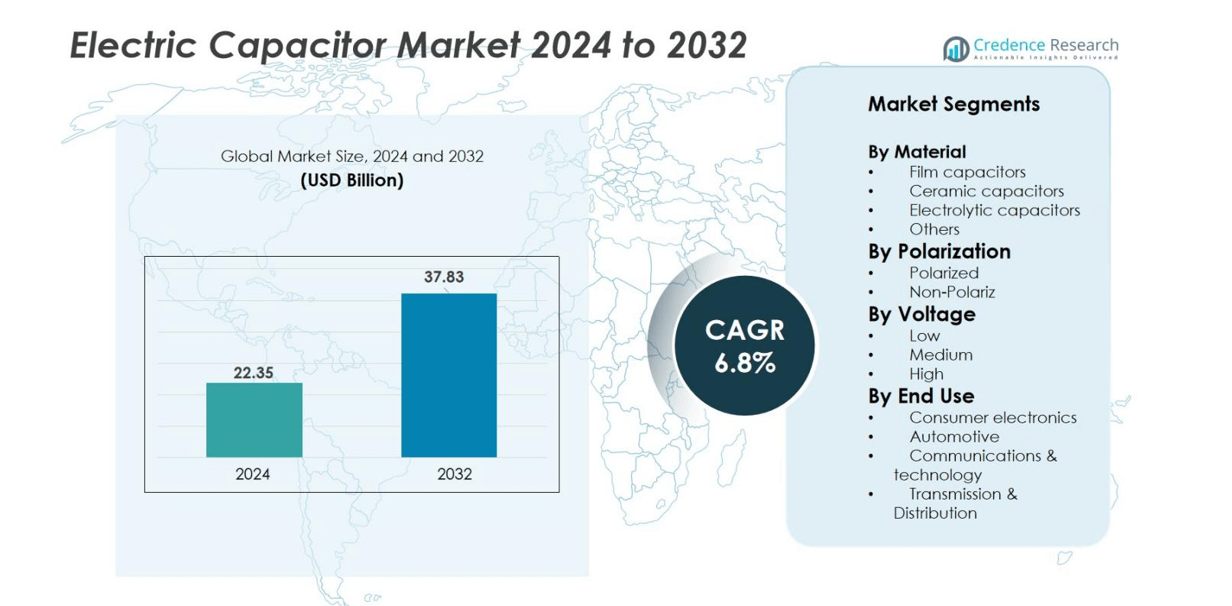

Electric Capacitor market size was valued at USD 22.35 Billion in 2024 and is anticipated to reach USD 37.83 Billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Capacitor Market Size 2024 |

USD 22.35 Billion |

| Electric Capacitor Market, CAGR |

6.8% |

| Electric Capacitor Market Size 2032 |

USD 37.83 Billion |

The Electric Capacitor Market includes leading players such as Murata Manufacturing, Samsung Electro-Mechanics, Panasonic, Kyocera AVX Components, Kemet, Vishay, TDK, and Nichicon, supported by strong production capacity and extensive global customer networks. These companies lead in multilayer ceramic, polymer film, and aluminum electrolytic capacitors, supplying automotive electronics, consumer devices, communication systems, and renewable power equipment. Asia Pacific remained the leading region with a 43% share, driven by large-scale semiconductor manufacturing and high-volume electronics production in China, Japan, South Korea, and Taiwan. North America and Europe followed, benefiting from EV expansion, data centers, industrial automation, and power grid upgrades, strengthening demand for high-performance capacitors in critical applications.

Market Insights

- The Electric Capacitor market was valued at USD 22.35 Billion in 2024 and is projected to reach USD 37.83 Billion by 2032 at a CAGR of 6.8%.

- Rising demand for consumer electronics, EV power systems, and renewable energy equipment continues to drive capacitor adoption across commercial and industrial applications.

- Miniaturization and advanced dielectric materials remain key trends, with MLCCs and polymer film capacitors gaining traction in compact devices, 5G hardware, and high-voltage automotive systems.

- The market is competitive with major players such as Murata Manufacturing, Samsung Electro-Mechanics, Panasonic, TDK, and Kyocera AVX Components expanding automated production to maintain pricing and quality leadership.

- Asia Pacific leads with a 43% share, followed by North America at 22% and Europe at 20%, while film capacitors hold the largest material segment share due to high reliability and demand in power electronics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Material

Film capacitors held the dominant share of 42% in the Electric Capacitor market, driven by high reliability, low loss rate, and strong dielectric stability. Their adoption remains high in power electronics, solar inverters, motors, and industrial drives, supporting stable growth. Ceramic capacitors followed due to rising use in compact consumer devices and communication hardware, while electrolytic capacitors stayed important for automotive and high-voltage systems. Other materials served niche specialty applications. Increasing energy-efficient component demand and higher power conversion needs continue to strengthen film capacitor penetration globally.

- For instance, TDK developed EPCOS film capacitors supporting currents up to 80 A RMS, enhancing lifetime in grid-connected systems.

By Polarization

Non-polarized capacitors accounted for the largest share of 55%, supported by wide use in AC circuits, filtering, and signal coupling across consumer electronics and industrial equipment. Their ability to operate without polarity constraints makes them suitable for compact, high-frequency circuits including audio systems, smartphones, and power supplies. Polarized capacitors maintained steady demand in high-voltage automotive and power distribution systems that require high capacitance. Growth in renewable energy and fast-charging devices further boosts the preference for non-polarized designs due to higher reliability and flexibility in circuit placement.

- For instance, Cornell Dubilier launched its Electrolytic Double Layer Capacitor (EDLC) modules, which provide capacitance up to 3000 farads and support brief power interruptions in industrial automation and renewable energy storage systems, enhancing system resilience and reducing downtime.

By Voltage

Low-voltage capacitors dominated the market with a 48% share, driven by significant use in smartphones, laptops, wearables, home appliances, and other compact consumer electronics. Their small footprint, high efficiency, and low cost support large-scale manufacturing. Medium-voltage capacitors gained traction in automotive electronics and industrial applications, while high-voltage capacitors expanded in power grids, transmission equipment, and renewable energy inverters. Increasing electrification of vehicles and rising need for stable grid infrastructure continue to fuel demand across all voltage ranges, with low-voltage units remaining the preferred choice for mass-produced electronic systems.

Key Growth Drivers

Rising Adoption of Consumer Electronics

Demand for smartphones, laptops, wearables, smart home devices, gaming systems, and IoT hardware continues to expand capacitor consumption worldwide. Electric capacitors play a central role in power management, signal filtering, noise reduction, and fast-charging circuits, making them essential across all compact electronics. Manufacturers are increasing production of multilayer ceramic capacitors and film capacitors to meet miniaturization requirements and high-frequency performance. The shift toward OLED displays, high-speed processors, and 5G-enabled devices requires components that deliver stable power even under high load. Short replacement cycles in consumer devices, combined with surging semiconductor output, provide long-term growth momentum.

- · For instance, Samsung Electro-Mechanics developed ultra-thin MLCCs measuring 0201 size (0.6×0.3 mm) to optimize space in 5G smartphones.

Expansion of Electric and Hybrid Vehicles

Automakers are advancing toward electrified fleets, which rely on capacitors for battery management, regenerative braking, onboard chargers, and ADAS electronics. High-voltage film and aluminum electrolytic capacitors support power conversion and motor control, while MLCCs are used in control modules and infotainment units. EV manufacturers also demand heat-resistant and long-life capacitors for continuous-duty cycles, creating new opportunities for premium-grade components. Rising global EV sales driven by emission norms and government incentives encourage suppliers to expand production capacity. Rapid growth in charging infrastructure, vehicle-to-grid systems, and power electronics platforms strengthens long-term market integration.

- For instance, Nichicon launched aluminum electrolytic capacitors supporting temperatures up to 135°C, tailored for onboard chargers.

Renewable Energy and Grid Modernization

Growth in solar, wind, and energy storage systems has accelerated demand for capacitors used in inverters, converters, and power stabilization units. Grid modernization projects around the world rely on high-voltage film and ceramic capacitors for power factor correction, voltage balancing, and harmonic filtering. Smart grid expansion in industrialized nations, combined with electrification of rural infrastructure, increases procurement of transmission and distribution hardware. Renewable energy developers favor capacitors that offer high efficiency and longer service life under fluctuating loads. As utilities replace aging networks and expand distributed power systems, capacitor suppliers benefit from recurring installations and upgrade cycles.

Key Trend & Opportunity

Miniaturization and High-Performance Material Innovation

Manufacturers are focusing on smaller, lighter, and more energy-efficient capacitor designs to meet the needs of compact electronics and high-frequency communication hardware. MLCCs with stacked dielectric layers deliver higher capacitance in reduced sizes, supporting smartphones, 5G equipment, and wearable technology. Polymer film and ceramic capacitors with improved temperature stability and lower ESR performance are gaining adoption in EVs, aerospace systems, and fast-charging adapters. Companies also invest in lead-free and robust dielectric materials to meet global compliance standards. The trend creates new opportunities for vendors with advanced material science capabilities and automated micro-scale production lines.

- For instance, TDK Corporation introduced CeraLink capacitors capable of operating up to 150°C and 1,000 V, ideal for inverter control units.

Growth of IoT, Smart Devices, and Industrial Automation

Smart home appliances, IoT sensors, and connected industrial devices require stable power filtering and fast signal processing, driving demand for compact capacitors. High-density electronic circuits in AI-driven appliances, factory automation systems, and medical wearables increase the need for reliable miniature components. Edge computing and low-power wireless modules rely on capacitors for energy storage and voltage smoothing, especially in battery-based devices. Expansion of smart city projects, robotic systems, and predictive maintenance tools strengthens industry-wide deployment. Vendors offering long-life, low-leakage capacitors optimized for continuous data communication gain a competitive edge.

- For instance, AVX Corporation developed IoT-grade tantalum capacitors with capacitance values up to 470 µF and low leakage for wireless sensor nodes.

Key Challenge

Raw Material Price Volatility and Supply Chain Pressure

Production of aluminum, tantalum, ceramic powders, and specialty polymers faces volatility due to geopolitical disruptions, mining limitations, and trade restrictions. Fluctuating input costs directly affect capacitor pricing and profit margins, especially for mass-volume, low-cost components. Limited availability of high-purity ceramic dielectric materials can slow production lines and increase lead times. Global semiconductor shortages also create competition for shared supply resources, affecting delivery schedules. Companies respond by diversifying procurement, signing long-term contracts, and adopting recycling processes, but smaller suppliers continue to face sourcing challenges that impact output reliability.

Intense Price Competition and Standardization Pressure

Capacitors are available across many standardized formats, creating pricing pressure, especially in low-voltage and consumer electronics segments. Large OEMs demand bulk supply at competitive rates, reducing margins for mid-size manufacturers. While high-performance capacitors for EVs, aerospace, and industrial systems offer stronger profitability, they require extensive testing and certification, raising development costs. Market fragmentation and counterfeit components in certain regions also affect brand credibility and reliability expectations. To stay competitive, leading players invest in automation, patented dielectric formulations, and specialty-grade capacitors where technical performance outweighs price sensitivity.

Regional Analysis

North America

North America held a 22% share of the Electric Capacitor market, driven by strong consumption of consumer electronics, communication equipment, and automotive electronics. The United States led regional demand due to advanced semiconductor manufacturing, adoption of EVs, and heavy investments in renewable energy projects. Power grid modernization and data center expansion further pushed capacitor usage in high-voltage and power conversion systems. Manufacturers benefited from partnerships with aerospace and defense sectors, which require high-reliability capacitors for mission-critical electronics. Increasing demand for fast-charging infrastructure, 5G rollouts, and industrial automation supported steady growth across the region.

Europe

Europe accounted for a 20% share, supported by robust automotive manufacturing, renewable energy deployment, and industrial electronics production. Germany, France, and the U.K. led demand as OEMs invested in electric vehicles, advanced driver-assistance systems, and lithium-ion battery platforms that require high-performance capacitors. The region’s renewable energy transition, including offshore wind and solar farms, increased adoption of power conditioning and grid-stabilizing equipment. European manufacturers also focus on high-reliability ceramic and film capacitors for aerospace and medical devices. Environmental regulations and energy-efficiency standards encouraged the shift to compact, lead-free, and temperature-resistant capacitor designs.

Asia Pacific

Asia Pacific dominated the market with a 43% share, driven by large-scale electronics production and strong manufacturing ecosystems in China, Japan, South Korea, and Taiwan. The region is the global hub for semiconductors, smartphones, wearables, home appliances, and precision communication hardware, all requiring high-volume capacitor deployment. Major players expanded automated production lines to support miniaturized MLCCs and polymer film capacitors for 5G, EVs, and industrial IoT. Increasing automotive electrification in China and Japan, along with grid modernization and renewable power projects, strengthened high-voltage capacitor demand. Competitive pricing and fast technology adoption helped Asia Pacific remain the market leader.

Latin America

Latin America captured a 7% share, led by Brazil and Mexico, where consumer electronics imports, urbanization, and telecom expansion supported capacitor demand. Growth in automotive assembly plants and renewable energy installations, particularly solar and wind, contributed to the region’s adoption of power-conditioning components. Telecom operators accelerated investment in 4G and 5G networks, increasing the need for compact ceramic capacitors and base-station hardware. Industrial automation in mining and oil sectors opened new opportunities for high-voltage units. However, reliance on imported components and economic fluctuations limited manufacturing capacity, creating growth potential for local assembly and distribution networks.

Middle East & Africa

Middle East & Africa held an 8% share, driven by investments in smart grid projects, telecom expansion, and industrial modernization. Gulf countries focused on solar energy capacity and data center development, boosting demand for high-voltage film and ceramic capacitors used in power control and conversion. Consumer electronics remained a key demand driver across urban markets, while automotive electrification gained early momentum through EV incentives. Infrastructure development in South Africa and the UAE supported adoption of industrial capacitors and power factor correction systems. Limited local manufacturing created opportunities for international suppliers to strengthen regional distribution.

Market Segmentations:

By Material

- Film capacitors

- Ceramic capacitors

- Electrolytic capacitors

- Others

By Polarization

By Voltage

By End Use

- Consumer electronics

- Automotive

- Communications & technology

- Transmission & Distribution

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Capacitor market is highly competitive, with global and regional manufacturers focusing on production scale, innovation, and long-term supply contracts with OEMs. Leading companies such as Murata Manufacturing, Samsung Electro-Mechanics, Panasonic, Kemet, Kyocera AVX Components, and TDK dominate high-volume multilayer ceramic capacitor production, supported by advanced fabrication lines and strong semiconductor partnerships. Film capacitor suppliers, including Vishay, Nichicon, and Eaton, focus on reliability and high-temperature performance for automotive and industrial power systems. Manufacturers are investing in miniaturization, polymer-based dielectrics, and lead-free materials to meet regulatory standards and compact device requirements. Strategic mergers, acquisitions, and capacity expansion in Asia and North America help reduce supply chain risks and capture demand from EVs, renewables, and 5G infrastructure. Competitive pressure remains high due to price sensitivity in consumer electronics, pushing companies to adopt automation and specialized high-reliability segments to improve margins and differentiate from low-cost suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, TDK Corporation unveiled 100 V, 10 µF automotive-grade MLCCs in 3225 sizes, enabling significant component-count reductions in 48-volt subsystems.

- In April 2025, Murata Manufacturing partnered with QuantumScape to mass-produce ceramic films for solid-state batteries, expanding Murata’s footprint beyond conventional MLCCs.

- In April 2025, NICHICON Corporation introduced its PCY Series conductive-polymer aluminum capacitors, designed for industrial and automotive systems requiring ultra-low ESR and high ripple-current endurance.

- In March 2025, Kyocera AVX launched the industry’s first 0402-size MLCC achieving 47 µF capacitance, optimizing board space for AI accelerator and high-density computing cards.

Report Coverage

The research report offers an in-depth analysis based on Material, Polarization, Voltage, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for compact, high-capacitance MLCCs will rise with growth in smartphones, wearables, and IoT devices.

- EV production expansion will increase usage of high-temperature and high-voltage capacitors for battery and power control systems.

- Renewable energy installations will continue to boost capacitor deployment in inverters, converters, and grid stabilization equipment.

- Manufacturers will invest in lead-free and eco-friendly materials to meet global compliance standards.

- 5G rollouts will drive demand for RF capacitors used in base stations and communication hardware.

- Data center growth will increase adoption of capacitors in UPS systems and server power distribution units.

- Miniaturization trends will push innovation toward thinner dielectric layers and higher capacitance density.

- Automation and robotics will create new demand for long-life capacitors in industrial control systems.

- Supply chain localization and automation will become priorities to reduce material price volatility.

- High-reliability capacitors for aerospace and defense will offer premium growth opportunities for specialized manufacturers.