Market Overview:

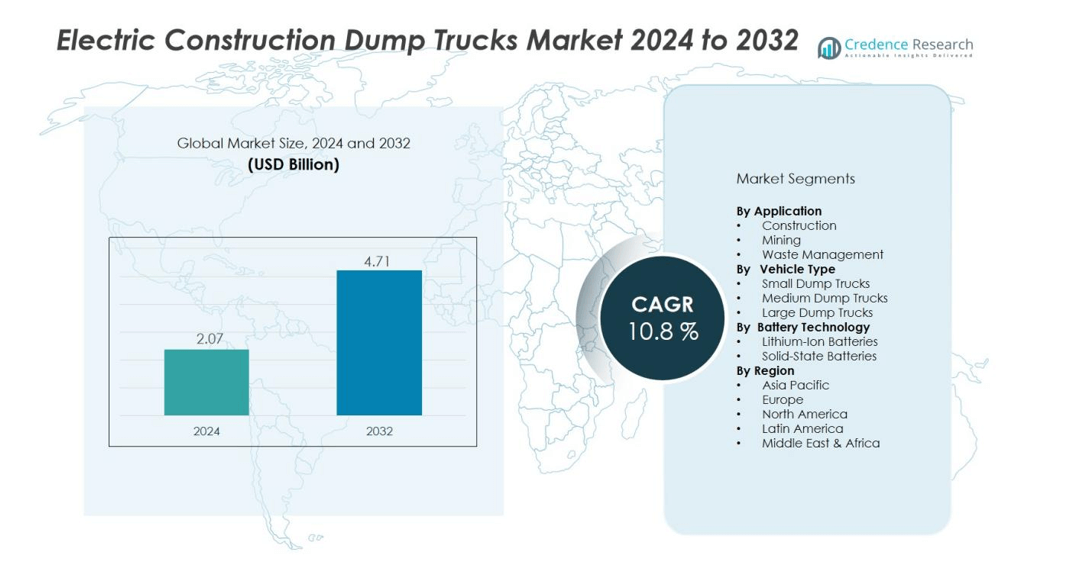

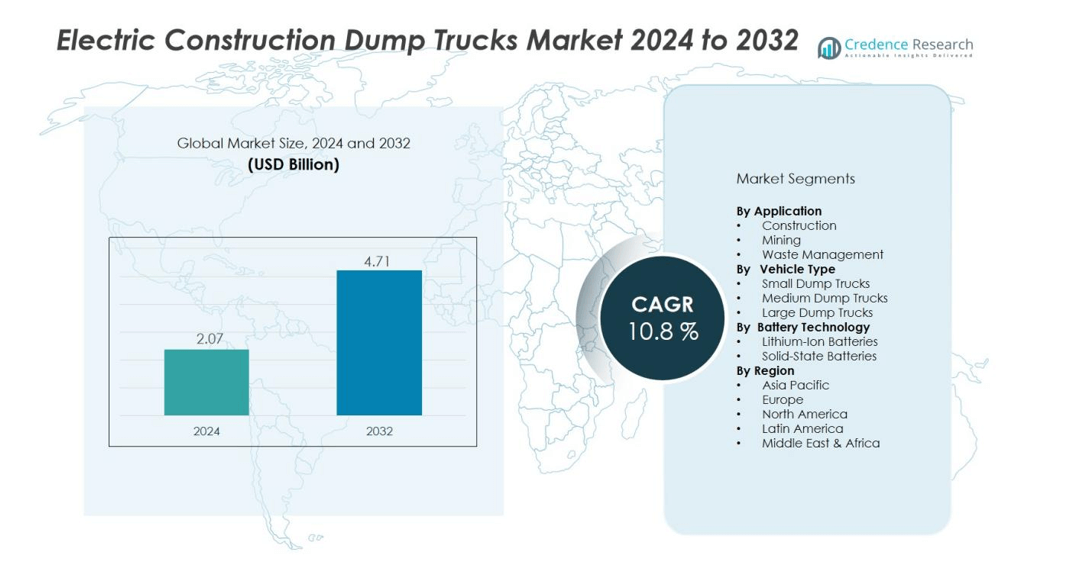

The Electric Construction Dump Trucks Market size was valued at USD 2.07 billion in 2024 and is anticipated to reach USD 4.71 billion by 2032, at a CAGR of 10.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Construction Dump Trucks Market Size 2024 |

USD 2.07 billion |

| Electric Construction Dump Trucks Market, CAGR |

10.8% |

| Electric Construction Dump Trucks Market Size 2032 |

USD 4.71 billion |

The market’s growth is primarily driven by the increasing demand for sustainable construction equipment, as companies strive to reduce their carbon footprints and comply with stringent emission regulations. Advancements in battery technology and electric drivetrain systems are enhancing the efficiency and operational reliability of electric dump trucks. Additionally, government incentives and the rising cost of fossil fuels are further promoting the adoption of electric vehicles in the construction and mining sectors. These factors collectively drive the transition toward electrification in heavy-duty machinery.

The Asia-Pacific region dominates the electric construction dump trucks market, holding over 37% market share in 2023. This is driven by rapid infrastructure development and environmental policies in countries like China and India. North America and Europe also have significant market shares due to the adoption of electric technologies and the availability of government incentives. While Latin America, the Middle East, and Africa have a smaller market presence, these regions are expected to witness growth as construction activities and the demand for electric solutions increase.

Market Insights:

- The Electric Construction Dump Trucks Market was valued at USD 2.07 billion in 2024 and is anticipated to reach USD 4.71 billion by 2032, growing at a CAGR of 10.8% during the forecast period.

- North America holds 32% of the market share, driven by strong regulatory support and government incentives for green technologies, along with a growing emphasis on sustainability within the construction and mining sectors.

- Europe follows with a 27% market share, bolstered by stringent environmental regulations and a strong push towards decarbonizing industrial operations, particularly in countries like Germany, France, and the U.K.

- Asia-Pacific accounts for 25% of the market share, with rapid urbanization, large-scale construction projects, and government incentives for electric vehicles, particularly in China and India, contributing to its dominance.

- The fastest-growing region is Asia-Pacific, expected to expand rapidly due to significant infrastructure development, environmental policies, and the increasing demand for cleaner construction equipment in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Sustainable Construction Equipment

The Electric Construction Dump Trucks Market benefits from the increasing demand for eco-friendly machinery. Construction and mining industries are under pressure to adopt sustainable practices due to stricter environmental regulations and the global push for reducing carbon emissions. Electric dump trucks offer a solution by significantly lowering greenhouse gas emissions compared to their diesel counterparts. This shift toward sustainability is being driven by both regulatory mandates and market demand for greener alternatives in the construction sector.

- For Instance, Electric dump trucks used in mining operations have the potential to reduce carbon emissions by up to 1,300 tons per truck annually compared to diesel models.

Advancements in Battery and Electric Drivetrain Technologies

Technological innovations in battery and electric drivetrain systems are boosting the adoption of electric construction dump trucks. Improvements in battery efficiency, energy storage capacity, and faster charging times are making electric trucks more viable for large-scale construction projects. As these technologies evolve, electric dump trucks can now operate for longer durations and under harsher conditions, expanding their usability in demanding environments. These advancements enhance the overall performance and cost-effectiveness of electric vehicles in the construction industry.

- For Instance, BYD’s electric dump truck, used in urban construction, features advanced battery technology. Existing models reportedly have a battery energy density of up to 160 Wh/kg, with the next-generation blade battery potentially reaching 210 Wh/kg.

Government Incentives and Regulatory Pressures

Government policies and incentives play a crucial role in accelerating the growth of the Electric Construction Dump Trucks Market. Many countries are implementing subsidies, tax credits, and grants to encourage the adoption of electric vehicles, including construction machinery. Simultaneously, stricter environmental regulations on emissions are pushing construction companies to switch to electric alternatives to avoid penalties and comply with new standards. These supportive measures are making electric dump trucks more financially attractive and feasible for large-scale adoption.

Rising Fuel Costs and Operational Efficiency

The rising costs of diesel and other fossil fuels are encouraging construction companies to look for cost-effective alternatives. Electric dump trucks offer lower operational costs over time, especially with the decreasing cost of electricity compared to diesel. The reduced maintenance requirements of electric vehicles further enhance their appeal, as they require fewer repairs and less frequent servicing than traditional internal combustion engine trucks. This cost-saving potential drives the market’s growth by offering a long-term, economically viable solution.

Market Trends:

Integration of Smart Technology and IoT in Electric Dump Trucks

A notable trend in the Electric Construction Dump Trucks Market is the integration of smart technology and Internet of Things (IoT) solutions. Electric dump trucks are becoming increasingly connected, allowing operators to monitor and control various parameters in real-time, such as battery health, fuel efficiency, and load management. These advanced systems enable predictive maintenance, reducing downtime and improving operational efficiency. Automation technologies, such as autonomous driving features, are also being incorporated into electric dump trucks to enhance safety, optimize routes, and reduce labor costs. The growing adoption of smart sensors and data analytics further improves the overall performance and decision-making process, positioning electric dump trucks as highly efficient solutions in modern construction sites.

- For Instance, Komatsu’s HD605-8 dump truck is a conventional diesel-powered vehicle equipped with KOMTRAX Plus telematics solutions, enabling remote monitoring of the engine and operational data.

Expansion of Electric Infrastructure in Construction Fleets

The growing adoption of electric construction machinery is driving an expansion of charging infrastructure on construction sites and in fleet management systems. As electric dump trucks become more widely used, there is a rising demand for reliable, fast-charging solutions that minimize downtime. Companies are investing in on-site charging stations and upgrading their infrastructure to accommodate electric fleets, thus enhancing the practicality of electric vehicles for large-scale construction projects. This trend is particularly significant in regions with strong environmental policies and sustainability goals. The expansion of charging infrastructure supports the broader adoption of electric dump trucks, making them more viable for daily operations in construction and mining.

- For instance, Volvo Trucks offers electric vehicles like the Volvo FE Electric, which supports DC fast charging up to 150 kW (CCS2 standard) or up to 250 kW for newer heavy-duty models like the FH Electric.

Market Challenges Analysis:

High Initial Cost of Electric Construction Dump Trucks

One of the significant challenges facing the Electric Construction Dump Trucks Market is the high upfront cost. Electric dump trucks typically require larger investments due to the advanced battery technology and electric drivetrains they use. Despite lower operational and maintenance costs in the long run, the initial price remains a barrier for many construction companies. Smaller firms or those with tight budgets may find it difficult to justify the higher initial expense, especially when compared to more affordable diesel-powered alternatives. This cost disparity may slow the adoption of electric dump trucks, particularly in price-sensitive markets.

Limited Battery Range and Charging Infrastructure

Another challenge is the limited battery range and the insufficient charging infrastructure on construction sites. While electric dump trucks are suitable for short to medium-duration tasks, their range may not meet the demands of larger projects that require continuous operation. The lack of widespread, fast-charging stations further complicates the use of electric dump trucks in remote or expansive construction environments. Without an extensive charging network, it is difficult to ensure that electric vehicles can maintain consistent productivity, hindering their viability for long-term or heavy-duty projects.

Market Opportunities:

Increasing Focus on Sustainability and Green Construction

The Electric Construction Dump Trucks Market presents significant opportunities driven by the growing focus on sustainability within the construction industry. As governments and organizations tighten environmental regulations, there is an increasing demand for green technologies. Electric dump trucks provide an effective solution to meet these regulations by reducing carbon emissions and offering a cleaner alternative to traditional diesel trucks. With construction companies prioritizing sustainability and environmentally friendly practices, the shift toward electric vehicles offers a profitable opportunity for both manufacturers and operators to align with global sustainability goals and gain competitive advantages.

Technological Advancements and Battery Improvements

The rapid advancements in battery technology and energy storage solutions open up new opportunities for the Electric Construction Dump Trucks Market. Improvements in battery efficiency, charging speed, and lifespan are making electric dump trucks more viable for large-scale construction projects. These technological enhancements reduce operational downtime, increase productivity, and lower total cost of ownership, making electric trucks more attractive to construction companies. As battery costs continue to decrease and charging infrastructure expands, electric dump trucks will become more accessible to a broader range of industries, further driving market growth.

Market Segmentation Analysis:

By Vehicle Type

The Electric Construction Dump Trucks Market is segmented by vehicle type, which includes small, medium, and large dump trucks. The medium and large vehicle types dominate the market due to their ability to handle heavy-duty tasks such as transporting large quantities of materials in construction sites and mines. Small electric dump trucks, while more affordable, are typically used for lighter applications and smaller-scale projects. As electric vehicle technology continues to improve, the adoption of larger dump trucks is expected to grow, driven by their efficiency and lower operating costs compared to traditional diesel-powered vehicles.

- For instance, Hitachi Construction Machinery developed the EH5000AC-3 electric dump truck, with AC drive technology capable of maintaining speeds up to 56 km/h even with full loads on challenging terrain.

By Application

The Electric Construction Dump Trucks Market is also segmented by application, with key segments including construction, mining, and waste management. The construction sector leads the market due to its high demand for electric trucks capable of transporting building materials efficiently while adhering to sustainability goals. Mining applications are growing as companies seek eco-friendly solutions for large-scale operations. Waste management is another growing segment, with electric dump trucks being adopted to reduce emissions and operational costs in urban waste collection and disposal processes. Each application benefits from the increased efficiency and lower environmental impact of electric vehicles.

- For instance, Anglo American deployed a 210-tonne hydrogen-powered mining haul truck at its Mogalakwena platinum mine, reporting a reduction in annual diesel consumption by approximately 1 million liters with this transition.

By Battery Technology

Battery technology plays a crucial role in the Electric Construction Dump Trucks Market. The primary battery types used include lithium-ion and solid-state batteries. Lithium-ion batteries dominate the market due to their higher energy density and cost-effectiveness. However, solid-state batteries are gaining traction because of their potential to offer better safety features, longer lifespans, and faster charging times. The continued development and improvement of battery technologies will directly impact the performance and adoption rate of electric dump trucks in various industries.

Segmentations:

By Vehicle Type:

- Small Dump Trucks

- Medium Dump Trucks

- Large Dump Trucks

By Application:

- Construction

- Mining

- Waste Management

By Battery Technology:

- Lithium-Ion Batteries

- Solid-State Batteries

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a significant market share in the Electric Construction Dump Trucks Market, accounting for 32% of global revenue in 2023. The region is leading the adoption of electric vehicles, driven by strong regulatory support and government incentives for green technologies. The growing focus on sustainability within the construction and mining sectors fuels the demand for electric dump trucks. In addition to favorable policies, high fuel prices and rising environmental concerns are pushing companies to adopt electric alternatives. The U.S. remains a key player in the region, with widespread investments in electric infrastructure and commercial fleets. Canada also contributes to the regional growth, emphasizing emissions reduction and technological innovation.

Europe

Europe holds a 27% share in the Electric Construction Dump Trucks Market. The region has seen strong growth due to stringent environmental regulations and a push toward decarbonizing industrial operations. Countries such as Germany, France, and the U.K. are actively transitioning toward electrification of construction fleets, with numerous incentives for businesses to adopt electric dump trucks. Europe’s market is also driven by substantial investments in smart city projects and infrastructure modernization. The growing emphasis on reducing carbon footprints and compliance with the European Union’s sustainability goals further strengthens the region’s position as a leader in electric construction equipment adoption.

Asia-Pacific

Asia-Pacific holds a 25% share in the Electric Construction Dump Trucks Market, with China and India being the dominant players. The rapid urbanization and large-scale construction projects in these countries are key drivers for market growth. Governments in these regions are pushing for cleaner technologies in the construction industry, providing incentives for adopting electric construction vehicles. China’s focus on becoming a leader in electric vehicle production, coupled with its large-scale infrastructure projects, has significantly influenced the market. India, with its expanding construction industry and environmental policies, is also increasingly adopting electric solutions to address growing pollution concerns.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- JCB

- Volvo

- MANITOU

- Komatsu

- XCMG

- Hitachi

- SANY

- Ford

- Kässbohrer

- Caterpillar

- Liebherr

- Wacker Neuson

- Terex

- CASE Construction

- Doosan

Competitive Analysis:

The competitive landscape of the Electric Construction Dump Trucks Market features major players including JCB, Volvo Construction Equipment, Manitou Group, Komatsu Ltd., XCMG Group and Hitachi Construction Machinery. These firms focus on strengthening their offerings of electric dump trucks through product innovation, strategic partnerships and expanded manufacturing. Each competitor invests in battery technology and drivetrain efficiency to gain advantage in this evolving market.

It competes on factors like total cost of ownership, operational reliability and after‑sales support. JCB leverages its strong brand in compact construction equipment to accelerate its electric dump truck segment. Komatsu and Hitachi emphasize high‑capacity mining and construction vehicles with electrified drive systems to meet industrial demand. XCMG targets emerging markets with cost‑effective solutions and aims to scale production of electric‑drive dump trucks. Volvo and Manitou prioritize sustainability certifications and offer fleet‑wide electrification support to large construction clients. These dynamics shape the market and drive competitive differentiation across regions and applications.

Recent Developments:

- In October 2025, JCB launched a new line of Fastrac high-speed tractors, expanding its advanced machinery offerings for the agricultural sector.

- In July 2025, Manitou and Hangsha announced a joint venture aimed at developing lithium battery technology for longer-lasting, battery-powered vehicles.

Report Coverage:

The research report offers an in-depth analysis based on Vehicle Type, Application, Battery Technology and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Government incentives and regulations promoting sustainability will continue to drive demand for electric vehicles in the construction industry.

- Technological advancements in battery efficiency and charging infrastructure will enhance the practicality and affordability of electric dump trucks.

- The expansion of electric infrastructure in construction sites and industrial hubs will make it easier to operate electric dump trucks over long durations.

- Increased focus on reducing operational costs and fuel dependence will make electric dump trucks an attractive choice for construction companies.

- Rising environmental awareness will push construction companies to adopt electric vehicles as part of their sustainability goals.

- The shift towards automation and smart technologies in construction will lead to more widespread integration of electric dump trucks with IoT solutions.

- Ongoing research into solid-state batteries may provide further improvements in safety, performance, and battery life for electric dump trucks.

- The Asia-Pacific region, led by China and India, will experience substantial growth driven by rapid infrastructure development and urbanization.

- Collaborations and partnerships among leading industry players will drive innovation and product diversification, strengthening the competitive landscape.