Market Overview:

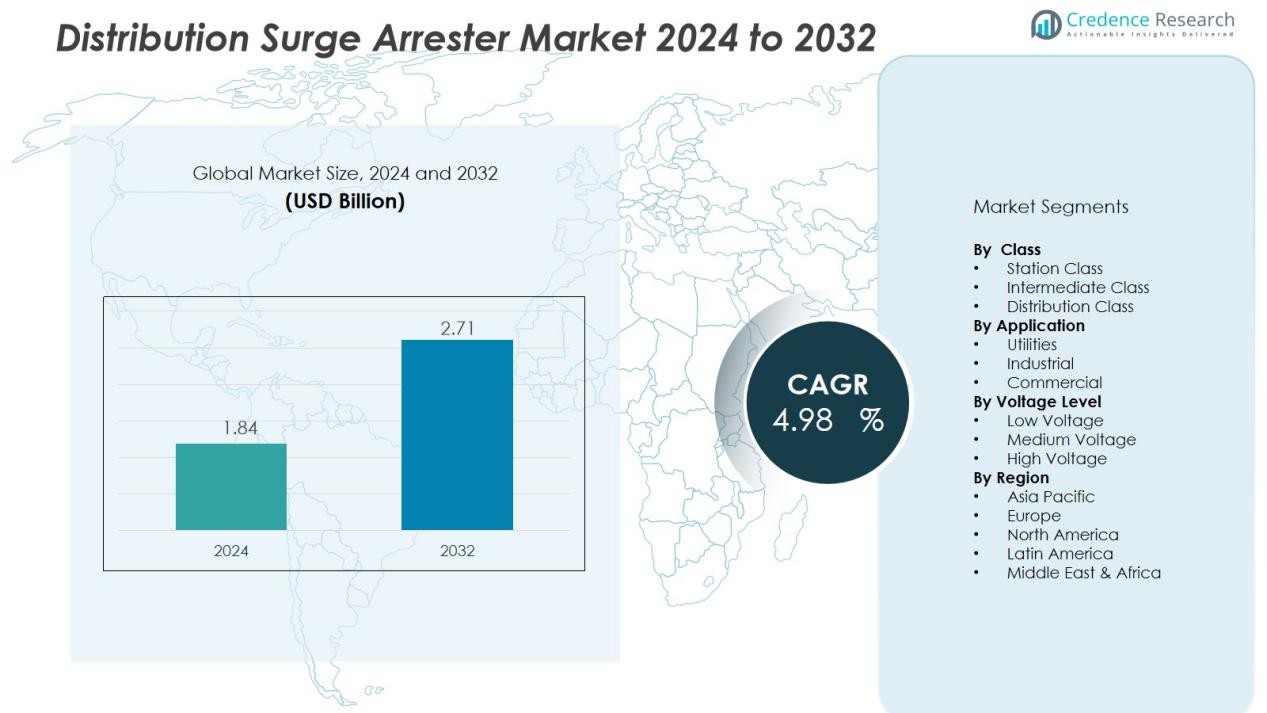

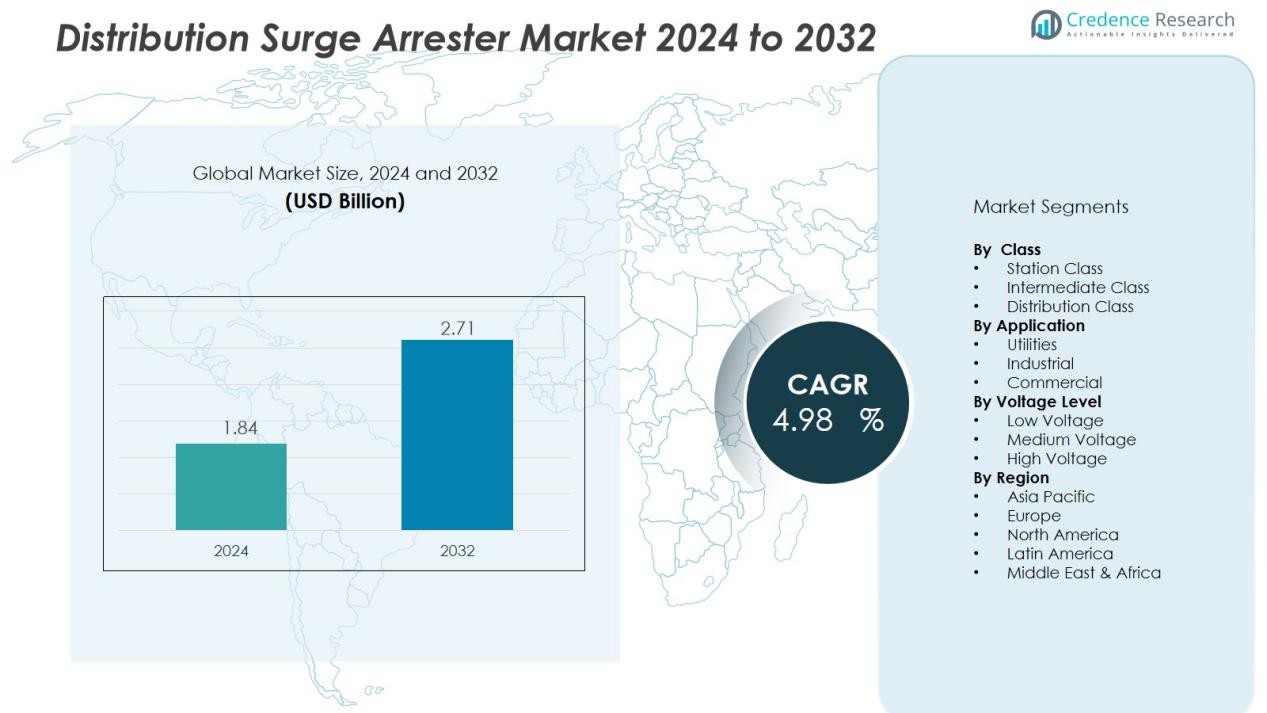

The Distribution Surge Arrester Market size was valued at USD 1.84 billion in 2024 and is anticipated to reach USD 2.71 billion by 2032, at a CAGR of 4.98 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Distribution Surge Arrester Market Size 2024 |

USD 1.84 Billion |

| Distribution Surge Arrester Market, CAGR |

4.98% |

| Distribution Surge Arrester Market Size 2032 |

USD 2.71 Billion |

Growing focus on equipment protection acts as a strong market driver. Utilities deploy surge arresters to prevent outages, improve system reliability, and protect transformers, switchgear, and overhead lines from transient surges. Increased installation of renewable power assets raises the need for suppression devices to handle variable load conditions and lightning exposure. Smart grid projects further accelerate deployment, as utilities prioritize safer and more efficient distribution networks.

Regional demand trends show strong growth across North America, Europe, and Asia-Pacific. North America benefits from aging grid infrastructure replacement, while Europe advances grid hardening and renewable integration. Asia-Pacific leads in deployment volume due to rapid urban expansion, distribution line upgrades, and high lightning density in several countries. Each region contributes steadily, with Asia-Pacific maintaining a dominant share due to its large-scale distribution network expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Distribution Surge Arrester Market was valued at USD 1.84 billion in 2024 and is projected to reach USD 2.71 billion by 2032, growing at a CAGR of 4.98%, driven by the need for equipment protection, stable power delivery, and modernization of distribution networks.

- Asia-Pacific (~45–48%), North America (~28–30%), and Europe (~20–22%) hold the top three regional shares; Asia-Pacific leads due to large-scale network expansion and high lightning density, North America benefits from structured grid replacement programs, and Europe advances grid hardening supported by renewable integration.

- Asia-Pacific, holding the highest regional share, is also the fastest-growing region, supported by rapid urbanization, rising power demand, government-led grid-strengthening investments, and widespread renewable integration.

- The utilities segment (~55–60%) dominates due to extensive deployment across feeders, substations, and distribution lines as operators prioritize reliability and insulation coordination.

- The industrial segment (~40–45%) maintains a strong share, driven by the need to protect sensitive equipment in manufacturing, heavy industries, and renewable energy facilities from transient voltage surges.

Market Drivers:

Market Drivers:

Growing Need for Grid Reliability and Equipment Protection

The Distribution Surge Arrester Market grows due to stronger reliability needs. Utilities face rising transient events from faults and lightning. Surge arresters protect transformers and switchgear from severe voltage spikes. This protection reduces outage risks and improves system uptime. The priority on stable power delivery strengthens long-term deployment.

- For instance, CHINT Electric’s NXU-II surge protective device (SPD) is available in models designed for AC440V systems and offers protection for incoming cabinets in residential, commercial, and industrial settings.

Expansion of Renewable Energy and Distributed Generation

Rapid renewable growth increases exposure to voltage fluctuations. Solar and wind assets create variable load conditions on distribution lines. Surge arresters stabilize these networks and protect sensitive assets. The sector values equipment that lowers failure risks. This trend supports steady adoption across utility and industrial sites.

- For Instance, ABB offers Surge Protective Devices (SPDs) like the OVR T2 series, designed to protect sensitive electronic equipment in industrial applications, including wind turbine control panels. These devices use fast-acting metal oxide varistor (MOV) technology and are available with surge current ratings up to 70 kA (8/20 µs) depending on the model.

Modernization of Aging Grid Infrastructure

Many countries operate outdated distribution networks. Replacement programs upgrade vulnerable lines and substations. Surge arresters form a core part of these modernization plans. The technology improves insulation coordination and system resilience. This upgrade cycle fuels broad regional demand.

Rising Focus on Smart Grid Development and Automation

Smart grids require better protection for automated systems. Sensors, controls, and communication units need stable voltage conditions. Surge arresters help protect these devices from transient threats. This protection ensures smooth digital operation and data reliability. The shift toward smarter networks strengthens market penetration.

Market Trends:

Shift Toward Polymer-Housed and Lightweight Designs

The Distribution Surge Arrester Market observes a strong transition toward polymer-housed units. These designs offer better mechanical strength and superior pollution resistance. Utilities choose lightweight arresters to simplify installation on overhead lines and compact substations. The trend supports faster field deployment and improved worker safety. It also reduces maintenance loads due to stronger hydrophobic properties and better durability in harsh climates. Growing adoption of compact designs supports integration with modern distribution layouts.

- For instance, Hubbell Power Systems has highlighted polymer-based arrester modules that integrate with compact outdoor switchgear, with product datasheets illustrating enclosure footprints that are 20–25% smaller than legacy porcelain counterparts in recent ranges.

Integration of Digital Monitoring and Predictive Maintenance Tools

Utilities adopt surge arresters that support digital monitoring features. The trend improves visibility into arrester health and surge activity. It enables data-driven maintenance, which supports better asset planning and reduces unexpected failures. Real-time condition tracking helps operators manage high-load areas more effectively. The shift supports smart grid development by increasing protection accuracy. This trend pushes manufacturers to offer arresters with sensors and communication-ready features for modern utility networks.

- For instance, ImpulseCheck measures the current state of health of surge protective devices with cloud-connected monitoring, and reports protection status changes in real time, enabling proactive servicing actions.

Market Challenges Analysis:

High Installation Costs and Limited Budget Flexibility Among Utilities

The Distribution Surge Arrester Market faces cost-related pressure in many regions. Utilities with restricted budgets delay replacement cycles and new installations. High costs for advanced polymer units and digital monitoring features reduce adoption speed. It also limits upgrades across older substations that require extensive protection improvements. Procurement teams prioritize essential replacements, which slows widespread modernization.

Performance Degradation in Harsh Environments and Testing Constraints

Severe pollution, humidity, and salt exposure reduce arrester performance over time. Utilities in coastal and industrial zones report faster wear, which raises maintenance needs. Limited field-testing capabilities make it difficult to detect early-stage failures. Digital monitoring helps, yet adoption remains uneven across regions. These constraints create operational risks and raise lifecycle management costs.

Market Opportunities:

Rising Investment in Grid Modernization and Renewable Integration

The Distribution Surge Arrester Market gains strong opportunity from global grid upgrade plans. Governments and utilities expand spending to replace outdated equipment in medium-voltage and low-voltage networks. Surge arresters support these upgrades by improving insulation performance and reducing outage risks. Renewable expansion creates further demand due to higher voltage variability on distribution lines. It strengthens the need for advanced protection devices that stabilize system behavior. This creates steady growth potential in both developed and emerging regions.

Expansion of Smart Grid Infrastructure and Digital Monitoring Adoption

Smart grid programs open new avenues for digital surge arrester solutions. Utilities seek monitoring features that support predictive analytics and real-time condition tracking. These tools reduce failure risks and optimize asset planning. Manufacturers gain an opportunity to deliver sensor-enabled units that integrate with utility communication platforms. It increases interest in arrester designs that support automation and enhance operational visibility. Stronger digital integration encourages long-term adoption across utility networks.

Market Segmentation Analysis:

By Class

The Distribution Surge Arrester Market shows strong demand across station, intermediate, and distribution class units. Station class arresters serve high-reliability zones that require strong insulation support and fault endurance. Intermediate class units support medium-voltage networks with balanced performance needs. Distribution class arresters lead deployment due to wide use across overhead lines, pole-mounted transformers, and compact substations. It strengthens protection across rural and urban distribution grids.

- For Instance, silicone rubber housing can have UV resistance rated to 25 years, providing durable performance in exposed outdoor installations. This durability helps reduce maintenance cycles for urban and rural networks.

By Voltage Level

Low-voltage, medium-voltage, and high-voltage segments define the core landscape. Medium-voltage arresters record the highest adoption due to their extensive use across feeders and distribution substations. High-voltage units support long-distance transmission integration and renewable-heavy corridors. Low-voltage arresters gain traction in commercial and industrial sites that operate sensitive equipment. Each voltage level plays a key role in lowering surge impact across coordinated protection layers.

- For Instance, For long-distance transmission corridors with integrated coordination to renewable-heavy grids, consider a station-class surge arrester with a rated voltage (\(\mathbf{U}_{\mathbf{r}}\)) of approximately 336 kV (for a 420 kV maximum system voltage) and a maximum continuous operating voltage (\(\mathbf{U}_{\mathbf{c}}\)) in the range of 260-300 kV.

By Application

Utilities, industrial facilities, and commercial sectors drive application-level demand. Utilities dominate due to continuous investment in feeder protection, grid modernization, and renewable integration. Industrial plants adopt arresters to protect motors, drives, and process equipment from transient threats. Commercial buildings deploy compact units to protect HVAC, lighting, and sensitive control systems. The sector maintains broad application diversity, which supports steady growth across multiple end-use environments.

Segmentations:

By Class

- Station Class

- Intermediate Class

- Distribution Class

By Voltage Level

- Low Voltage

- Medium Voltage

- High Voltage

By Application

- Utilities

- Industrial

- Commercial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Demand Across North America Driven by Grid Upgrades

North America holds a market share near the upper range due to steady utility investments and a structured modernization pipeline. The region benefits from large-scale replacement programs focused on aging feeders and substations. The Distribution Surge Arrester Market grows in this region due to high reliability standards and stronger insulation coordination needs. Utilities deploy advanced polymer-housed arresters to improve system durability under harsh weather. Renewable adoption increases surge exposure, which strengthens arrester demand. The region values digital monitoring tools that support predictive maintenance and asset planning.

Rapid Expansion in Asia Pacific Supported by Network Growth

Asia Pacific records a market share at the highest end due to extensive distribution network expansion. The region experiences rising installation levels driven by urban growth and rising power demand. It supports strong arrester deployment across utility and industrial feeders. High lightning density in several countries increases transient surge events, which increases arrester use. Governments invest in grid-strengthening programs that improve fault resilience. Strong renewable integration creates further need for steady network protection.

Steady Growth in Europe Supported by Renewable Integration

Europe records a stable growth pattern supported by wide renewable penetration and strict reliability rules. The region focuses on hardening existing distribution networks to manage fluctuating power flows. Utilities invest in units that support insulation coordination under varying load cycles. It strengthens adoption of polymer-based and compact surge arresters. Digital monitoring aligns with Europe’s smart grid strategy. Ongoing modernization programs sustain consistent demand across utility and industrial users.

Key Player Analysis:

- Hitachi ABB (Switzerland)

- General Electric (U.S.)

- Eaton (Ireland)

- Mitsubishi Electric (Japan)

- Siemens (Germany)

- Schneider Electric (France)

- Toshiba (Japan)

- CG Power (India)

- Meidensha (Japan)

- Hubbell (U.S.)

- Legrand (France)

- Tripp Lite (U.S.)

Competitive Analysis:

The Distribution Surge Arrester Market features strong competition among global manufacturers that focus on reliability, advanced materials, and digital integration. Key companies include Hitachi ABB (Switzerland), Siemens (Germany), Schneider Electric (France), General Electric (U.S.), and Eaton (Ireland), each strengthening product portfolios across utility and industrial segments. Leading players invest in polymer-housed arresters that improve performance under pollution stress and reduce maintenance needs. The sector moves toward sensor-enabled designs that support real-time condition tracking and predictive diagnostics. It encourages firms to expand R&D efforts and deliver arresters suited for smart grid environments. Regional presence, strong channel networks, and project partnerships help major companies secure long-term contracts with utilities. Competitive pressure drives continuous product refinement and wider adoption of compact and high-durability designs.

Recent Developments:

- In October 2025, Hitachi Energy partnered with Blackstone Energy Transition Partners to expand its Service business in North America and invested over $1 billion USD in Service business growth, including new digital service solutions, and acquired a minority stake in Shermco.

- In October 2025, GE Vernova announced the acquisition of the remaining 50% stake of Prolec GE from Xignux, consolidating ownership of this grid equipment company, with the deal expected to close by mid-2026.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Class, Voltage Level, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Stronger investment in grid modernization will lift arrester deployment across utilities.

- Digital monitoring features will gain wider adoption for predictive maintenance and asset control.

- Polymer-housed arresters will replace porcelain units due to better durability and ease of handling.

- Renewable integration will raise demand for arresters that stabilize fluctuating distribution loads.

- Smart grid expansion will push manufacturers to develop compact, communication-ready designs.

- Industrial facilities will increase adoption to protect sensitive motors and electronics from surge events.

- Urban network expansion in developing economies will drive large-scale installation programs.

- High lightning density regions will continue to prioritize advanced surge protection solutions.

- Manufacturers will strengthen material innovation to improve insulation performance and reduce lifecycle costs.

- Global utility partnerships will grow, supporting long-term contracts and tailored arrester solutions.

Market Drivers:

Market Drivers: