Market Overview

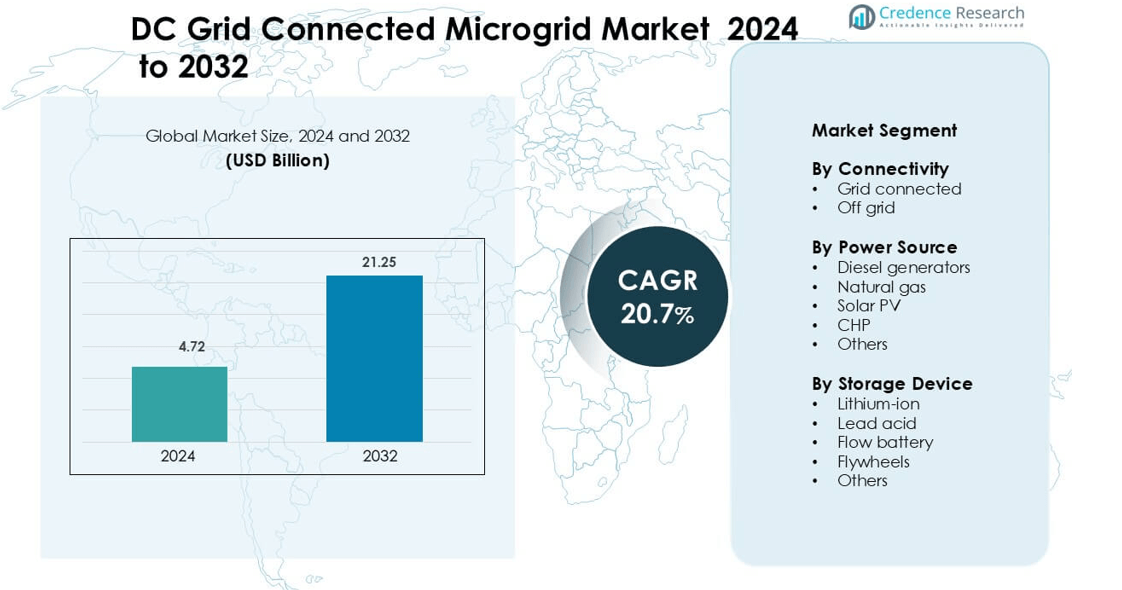

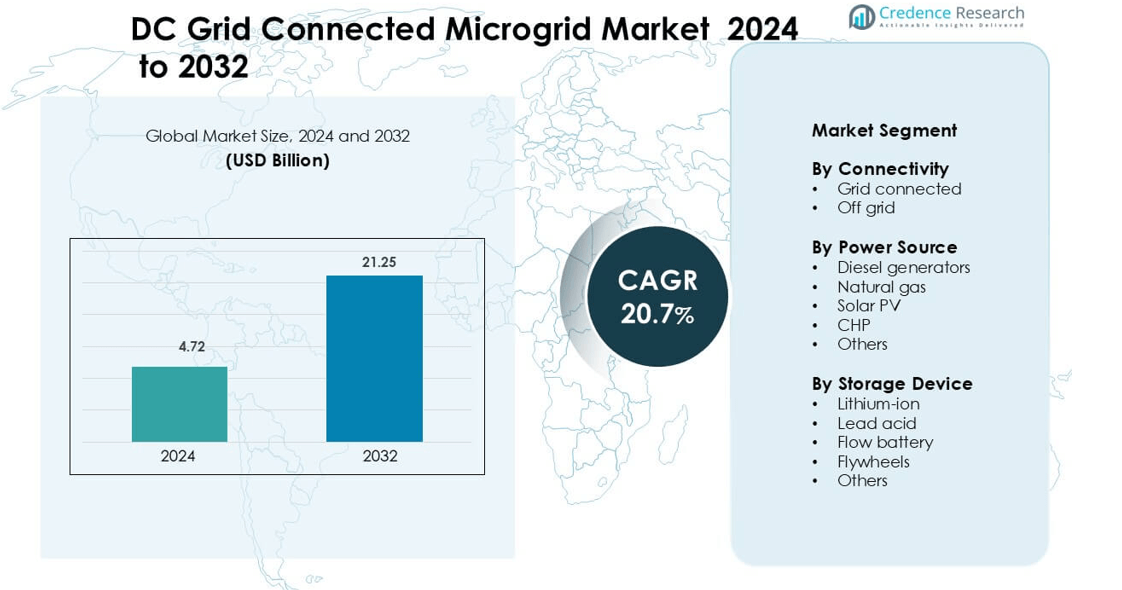

DC Grid Connected Microgrid Market was valued at USD 4.72 billion in 2024 and is anticipated to reach USD 21.25 billion by 2032, growing at a CAGR of 20.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Grid Connected Microgrid Market Size 2024 |

USD 4.72 billion |

| DC Grid Connected Microgrid Market, CAGR |

20.7% |

| DC Grid Connected Microgrid Market Size 2032 |

USD 21.25 billion |

Key players in the DC Grid Connected Microgrid Market include Schneider Electric, ABB, Eaton Corporation, Hitachi Energy, Enel X, PowerSecure, ARDA Power, EnSync Energy Systems, AEG International, and SolarWorX. These companies compete through advanced DC converters, smart controllers, modular microgrid packages, and storage-integrated systems. Many vendors focus on hybrid renewable deployments for commercial, industrial, utility, and remote applications. North America remains the leading region with 34% market share, supported by strong investment in smart grid modernization, energy storage adoption, and EV charging infrastructure. Technology partnerships, microgrid-as-a-service models, and remote monitoring platforms strengthen competitive positioning across key markets.

Market Insights

- The DC Grid Connected Microgrid Market was valued at USD 4.72 billion in 2024 and is projected to reach USD 21.25 billion by 2032, registering a CAGR of 20.7% during the forecast period.

- Rising demand for efficient renewable integration and peak load management drives adoption, with solar PV holding the largest power source share of 41% due to falling module costs and high system efficiency.

- A key trend is the shift toward hybrid microgrids that combine solar, storage, and grid backup, along with rapid deployment across EV charging hubs, data centers, and commercial complexes.

- Competition remains strong, with companies offering modular DC solutions, microgrid-as-a-service models, advanced control software, and lithium-ion-based storage, which holds the largest segment share of 62% in storage devices.

- Regionally, North America leads with 34% market share, followed by Europe at 29% and Asia Pacific at 28%, supported by investment in smart grids, renewable targets, and expansion of commercial microgrid projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Connectivity

Grid-connected systems lead this segment with a market share of 68%. Utilities, campuses, and industrial sites prefer these systems because they support peak shaving, improve power quality, and enable energy trading. Grid-tied platforms allow operators to feed surplus power back to distribution networks, reducing operational cost. Demand rises in regions with advanced smart grid upgrades and renewable integration targets. Off-grid systems hold a smaller share and serve remote locations, island electrification, and defense facilities. This category gains traction where grid expansion is costly or unreliable, but adoption remains limited due to high deployment cost and storage dependence.

- For instance, a smaller 8.4 MW BESS system (initially announced as 6 MW+) was deployed in Wunsiedel, which became operational around February 2018. A later, much larger 100 MW / 200 MWh BESS project was inaugurated in November 2024.

By Power Source

Solar PV dominates this segment with a market share of 41%. Falling module prices, short installation timelines, and zero fuel cost make solar the preferred source in DC microgrid architecture. Commercial buildings, data centers, and community grids use DC-coupled inverters to improve efficiency and reduce conversion losses. Hybrid configurations pair solar with diesel generators or gas turbines to improve reliability during low-irradiance periods. CHP and gas-based systems follow due to stable output and suitability for industrial loads. Diesel retains use in mission-critical applications but faces regulatory pressure over emissions.

- For instance, Schneider Electric was involved in a microgrid project in Montgomery County, Maryland, that uses solar power. The project integrated a 2 MW AC solar project.

By Storage Device

Lithium-ion batteries lead this category with a market share of 62%, driven by high round-trip efficiency, long cycle life, and fast charging capability. Utilities and commercial clients deploy Li-ion banks for peak shaving, load shifting, and renewable smoothing. Cost reduction and growing manufacturing capacity further strengthen adoption. Lead-acid remains in backup and low-duty applications but shows declining preference due to shorter life. Flow batteries gain interest in long-duration storage, while flywheels offer short-burst support for frequency regulation. Emerging chemistries attract investment, yet Li-ion continues to dominate due to proven field performance and scalability.

Key Growth Drivers

Rising Integration of Renewable Energy in Power Networks

The DC grid connected microgrid market gains strong momentum from large-scale renewable integration programs. Solar, wind, and small hydro plants connect more efficiently to DC-based architectures because they avoid multiple conversion steps and reduce transmission losses. Utilities, metro stations, industrial zones, and commercial complexes prefer DC microgrids to stabilize intermittent renewable output and support peak load management. Governments launch incentive schemes for green electrification, including net-metering, feed-in tariffs, and equipment subsidies. With demand for low-emission power growing across data centers, EV charging hubs, and smart buildings, DC microgrids provide improved efficiency, faster response time, and safer load control. This advantage fuels higher adoption and long-term investment.

- For instance, Hitachi Energy has commissioned various microgrid projects globally, which incorporate solar arrays and battery storage systems to support peak load control and reduce conversion losses, and has a presence and collaborations in North Carolina

Increasing Deployment of Smart Grids and Advanced Control Systems

Smart grid modernization acts as a major catalyst for DC microgrid deployment. Real-time monitoring, energy analytics, and remotecontrol platforms help operators maintain power quality and optimize distributed generation assets. DC systems deliver faster fault isolation, improved reliability, and lower conversion losses. Industrial campuses and commercial parks use supervisory control and data acquisition (SCADA) platforms to schedule loads, store surplus energy, and trade power with distribution networks. AI-based controllers handle renewable fluctuations and support automated load balancing. These technologies improve operational stability, reduce downtime, and enhance grid resilience during storms or voltage disturbances. Investments in digital substations and smart meters further accelerate demand.

- For instance, Schneider Electric deployed its EcoStruxure Microgrid controller at a California-based logistics facility integrating a 1,000 kW solar system and a 500 kW battery bank.

Growth of Energy Storage and Demand for Peak Load Management

Energy storage expansion supports rapid growth in the DC grid connected microgrid market. Lithium-ion, flow batteries, and hybrid storage banks help operators manage peak demand, support renewable smoothing, and ensure uninterrupted power supply during outages. Businesses adopt DC microgrids to reduce dependence on diesel generators and lower operational expenses through peak shaving. The rise of EV charging, fast-charging stations, and commercial battery installations strengthens demand for scalable DC storage. Data centers and critical facilities rely on storage-backed DC grids to ensure power continuity and voltage stability. This capability makes DC microgrids a preferred solution in regions with rising power demand and high electricity tariffs.

Key Trend & Opportunity

Development of Hybrid Renewable Microgrids for Commercial and Industrial Use

A major trend is the shift toward hybrid renewable microgrids that integrate solar PV, wind turbines, battery storage, and grid backup. Commercial buildings, healthcare facilities, logistics hubs, and manufacturing units use hybrid DC microgrids to cut power cost, manage peak tariffs, and reduce emissions. Rapid adoption of AI-enabled forecasting tools improves load scheduling and renewable utilization. Vendors offer modular plug-and-play systems that support scalable expansion across campuses and utility-owned microgrid projects. The trend creates new opportunities for EPC firms, inverter manufacturers, and energy management software suppliers. With emphasis on carbon reduction and energy resilience, hybrid microgrids gain strong policy support worldwide.

- For instance, ABB delivered a hybrid microgrid in South Africa combining a 750kW solar plant, a 500 kVA diesel backup, and a lithium-ion storage system of 380 kWh.

Expansion of DC Microgrids in EV Charging and Data Center Infrastructure

Rising EV adoption creates demand for fast-charging infrastructure that benefits from DC architecture. Direct DC coupling between charging stations, solar panels, and battery storage avoids conversion losses and reduces peak load burden on the grid. Data centers also adopt DC microgrids to improve power conversion efficiency and reduce heat loss. Telecom towers, metro rail systems, and port facilities deploy DC microgrids for stable power, faster backup response, and high energy efficiency. Vendors invest in high-voltage DC switchgear, solid-state transformers, and advanced protection systems to support this expansion. These developments provide long-term growth prospects for technology suppliers and integrators.

- For instance, ABB deployed its Terra HP chargers supporting up to 350 kW at Ionity stations across Europe.

Key Challenge

High Upfront Cost and Complex Integration with Existing Grid Infrastructure

Despite strong growth drivers, high capital cost poses a major challenge for several projects. DC microgrids require advanced power electronics, protection equipment, energy management software, and storage systems, increasing initial investment. Retrofitting existing AC infrastructure with DC circuits adds complexity and requires skilled engineering support. Utilities hesitate to adopt large-scale transition strategies without proven long-term return on investment. Financing becomes difficult for smaller commercial users without government subsidy or power purchase agreements. The lack of standardization in DC voltage levels also complicates system design and component interoperability, slowing market penetration.

Scarcity of Standards, Skilled Workforce, and Protection Mechanisms

Protection and safety remain key technical challenges in the DC grid connected microgrid market. Traditional AC breakers and relays do not function effectively in DC environments, requiring specialized fast-response protection devices. Only a limited number of manufacturers supply such components, making procurement costly. The market also suffers from a shortage of engineers trained in DC system design and troubleshooting. Many regions lack regulatory frameworks covering interconnection rules, energy trading policies, and grid synchronization standards. Absence of unified guidelines slows large-scale deployment and adds risk for investors and utilities planning long-term DC infrastructure projects.

Regional Analysis

North America

North America holds a market share of 34%, driven by strong investment in renewable integration, smart grid upgrades, and commercial microgrid projects. Utilities deploy DC-connected systems for peak shaving, energy trading, and improving grid reliability during extreme weather events. Data centers, university campuses, and defense bases adopt DC microgrids to cut conversion losses and maintain uninterrupted power. Supportive regulations, tax incentives, and rising EV charging infrastructure accelerate demand. The United States leads installations, while Canada expands projects in remote and island communities. Growing industrial electrification and energy storage deployment reinforces the region’s long-term growth outlook.

Europe

Europe accounts for a market share of 29%, supported by decarbonization targets and rising dependence on distributed renewable power. Countries invest in DC microgrids for commercial buildings, transportation hubs, industrial parks, and community energy systems. The region leads in regulatory frameworks, smart meters, and grid modernization. Germany, the U.K., and the Netherlands deploy hybrid microgrids integrating solar, wind, and storage to improve energy efficiency. Expansion of EV charging networks creates additional demand for DC architecture. Opportunities also rise in ports, airports, and rail networks that seek low-loss energy distribution and faster backup response.

Asia Pacific

Asia Pacific dominates growth momentum with a market share of 28%, fueled by rising electricity demand, large-scale renewable deployment, and urban electrification. China, Japan, South Korea, and India lead adoption across commercial buildings, industrial clusters, and transportation infrastructure. Remote island and rural electrification programs accelerate microgrid projects in Southeast Asia. Governments promote battery storage, hybrid renewable systems, and green building codes, strengthening long-term adoption. Telecom, data centers, and fast-charging networks also shift toward DC platforms to improve efficiency and cut operational costs. Rapid industrialization and smart city development further expand the market.

Latin America

Latin America holds a market share of 5%, driven by demand for stable power in industrial zones, mining sites, and remote communities. Brazil, Chile, and Mexico invest in renewable-backed microgrids to reduce diesel dependence and enhance grid reliability. Solar-energy abundance makes DC configurations attractive for commercial and agricultural applications. Financial support from multilateral banks strengthens project development, while hybrid systems expand in island territories. Slow regulatory progress limits faster deployment, yet the region shows strong long-term potential with rising clean energy targets and storage adoption.

Middle East & Africa

The Middle East & Africa capture a market share of 4%. Microgrid interest grows in utility, oil and gas, and industrial facilities that demand reliable power and lower fuel costs. GCC countries deploy solar-plus-storage DC systems for commercial sites and data centers, while Africa focuses on rural electrification. Telecom towers, mining operations, and health facilities adopt microgrids to reduce generator usage. The region benefits from strong solar resources and falling storage prices. However, limited financing, technical expertise gaps, and regulatory delays slow broader adoption, though long-term prospects remain positive.

Market Segmentations

By Connectivity

By Power Source

- Diesel generators

- Natural gas

- Solar PV

- CHP

- Others

By Storage Device

- Lithium-ion

- Lead acid

- Flow battery

- Flywheels

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the DC grid connected microgrid market features global power electronics companies, energy management specialists, and renewable integration solution providers. Firms compete on system efficiency, advanced control software, and scalable architecture for commercial, industrial, and utility projects. Major players focus on DC-optimized inverters, solid-state transformers, fast-response protection systems, and high-voltage DC distribution components. Strategic partnerships drive growth as utilities and EPC contractors collaborate on hybrid renewable microgrids backed by lithium-ion storage. Vendors also expand portfolios with modular plug-and-play systems and AI-based energy management platforms. Companies invest in microgrid-as-a-service models to reduce capital barriers and support remote deployments. Continuous product upgrades, cybersecurity features, and compatibility with EV charging networks strengthen their competitiveness. The market remains highly technology-driven, and firms that deliver higher safety, faster response, and lower operating cost secure stronger positioning across commercial, defense, data center, and smart city applications

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, PowerSecure Partnered with Edged to supply resilient power systems for U.S. data centers.

- In April 2023, ARDA Power Named a finalist in the ABB Electrification Startup Challenge (Smart Power)

Report Coverage

The research report offers an in-depth analysis based on Connectivity, Power Source, Storage Device and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption will rise in commercial buildings, campuses, and data centers seeking higher efficiency.

- Hybrid renewable microgrids will expand as solar and storage deployments continue to scale.

- Utilities will deploy more DC systems for peak shaving and faster grid response.

- EV fast-charging networks will increase demand for direct DC coupling and storage.

- Lithium-ion and long-duration batteries will gain deeper integration in microgrid design.

- AI-based control platforms will improve forecasting, load management, and fault isolation.

- Developing regions will use DC microgrids for community electrification and remote sites.

- Modular plug-and-play solutions will shorten project timelines and reduce engineering costs.

- Industrial users will adopt DC microgrids to cut diesel dependence and improve resilience.

- Policy support, energy efficiency rules, and carbon targets will strengthen long-term growth.