Market Overview

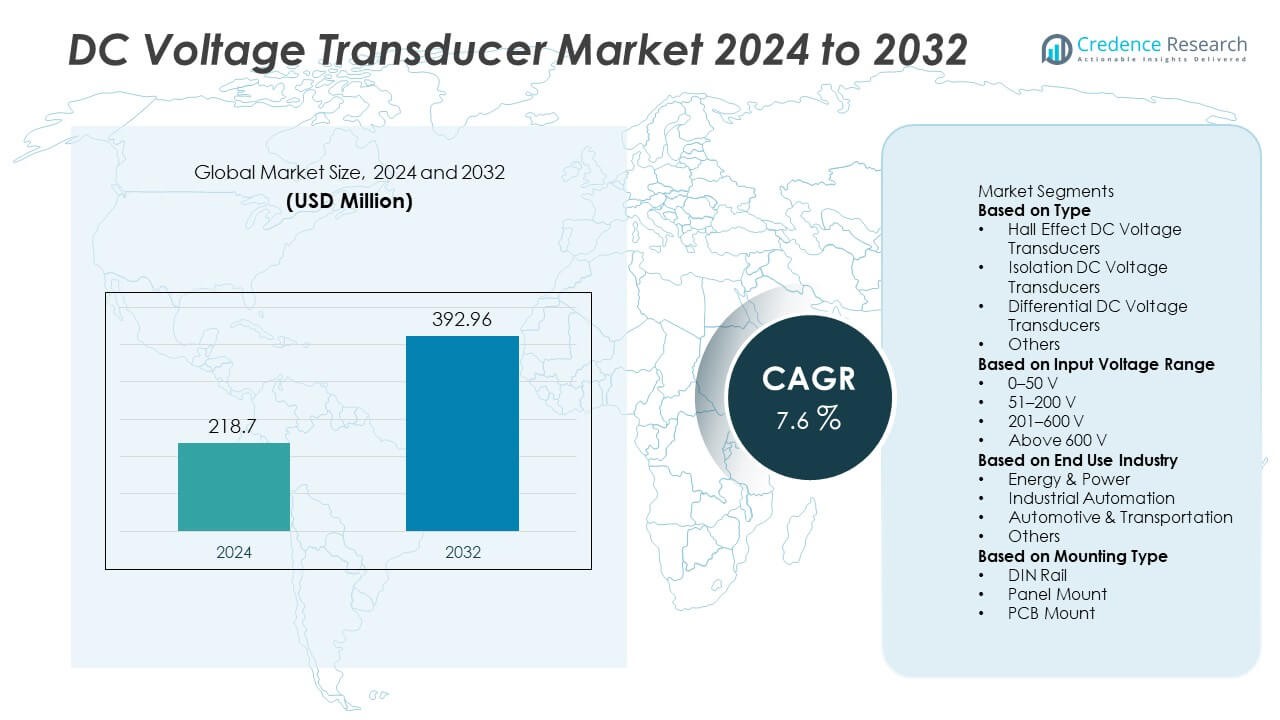

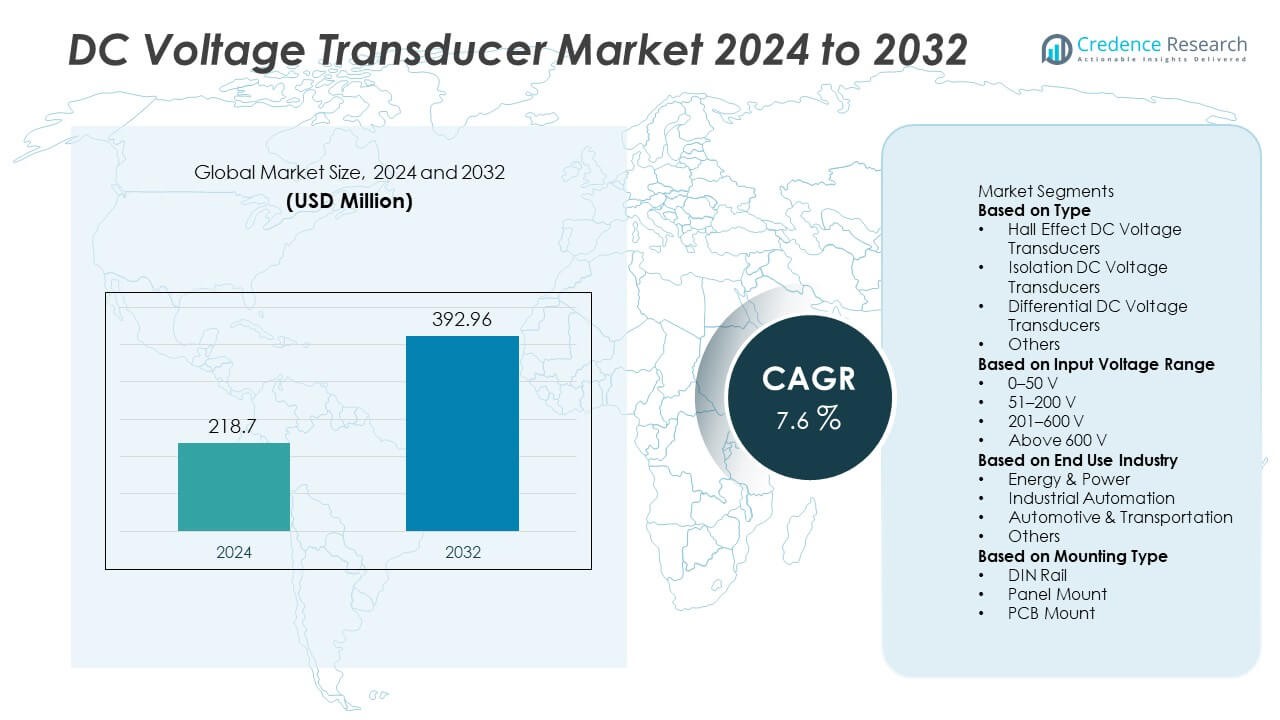

The DC Voltage Transducer Market was valued at USD 218.7 million in 2024 and is projected to reach USD 392.96 million by 2032, registering a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Voltage Transducer Market Size 2024 |

USD 218.7 Million |

| DC Voltage Transducer Market, CAGR |

7.6% |

| DC Voltage Transducer Market Size 2032 |

USD 392.96 Million |

The DC Voltage Transducer market is led by key companies such as ABB Ltd., Siemens AG, Schneider Electric, LEM International SA, Texas Instruments Incorporated, Phoenix Contact, Yokogawa Electric Corporation, Danisense A/S, TE Connectivity, and Omicron Electronics GmbH & Co KG, all competing through high-accuracy sensing technologies and expanded application support in renewable energy, EV charging, automation, and telecom power systems. North America leads the market with a 36% share, supported by strong grid modernization and electric mobility investments. Europe follows with a 30% share, driven by stringent energy efficiency regulations and advanced industrial automation, while Asia-Pacific holds a 25% share, emerging as the fastest-growing region due to rising solar deployments, battery storage programs, and rapid manufacturing expansion.

Market Insights

- The DC Voltage Transducer market was valued at USD 218.7 million in 2024 and is projected to reach USD 392.96 million by 2032, registering a CAGR of 7.6% during the forecast period.

- Growing demand for accurate voltage monitoring in renewable energy and EV charging drives adoption, with the 51–200 V input range segment holding a 41% share due to strong use in solar inverters, telecom power backup, and industrial power supplies.

- Miniaturized, high-precision, and digital output transducers continue to gain traction as industries shift toward IoT-enabled monitoring and predictive maintenance across smart grids, automation systems, and data center power infrastructure.

- Market competition remains strong as companies focus on isolation technology, measurement accuracy, and advanced signal processing, while high product costs and calibration skill requirements restrain adoption among small-scale industrial users.

- North America leads the market with a 36% share, followed by Europe at 30% and Asia-Pacific at 25%, supported by rising renewable deployments and EV infrastructure, while the energy and power sector holds the largest end-use share at 37%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

Hall Effect DC voltage transducers lead the segment with a 48% share, driven by strong adoption in renewable energy systems, industrial motor control, and battery management applications. These transducers offer high accuracy, fast response, and galvanic isolation, making them suitable for modern power electronics. Isolation DC voltage transducers follow due to their growing use in high-voltage environments for grid monitoring and power conversion. Differential DC voltage transducers and other niche types serve specialized measurement needs in laboratory, aerospace, and defense applications, supporting precision monitoring and instrumentation requirements across complex electrical systems.

- For instance, Phoenix Contact’s PTVT series handles input voltages up to 2000 V DC and withstands impulse voltages of 8 kV, improving safety for power conversion units in transmission infrastructure.

By Input Voltage Range:

The 51–200 V range dominates with a 41% share, supported by its widespread use in industrial automation, power supplies, EV charging, and telecom infrastructures. This range meets measurement needs for battery storage, solar inverters, and UPS systems, making it a preferred choice for reliable voltage feedback and protection functions. The 0–50 V range serves low-voltage electronics, while the 201–600 V and above 600 V ranges gain momentum in high-voltage renewable installations and smart grid assets as utilities modernize their energy networks.

- For instance, Texas Instruments’ INA226 monitors bus voltages from 0 V to 36 V and measures current with a 16-bit ADC at 140 μs conversion time, supporting precise diagnostics in compact EV chargers.

By End Use Industry:

Energy and power applications hold the largest 37% share, driven by increasing deployment in solar PV, wind power conversion, energy storage, and smart grid substations. DC voltage transducers support grid stability, system protection, and accurate performance monitoring as utilities scale distributed energy resources. Industrial automation follows with rising use in robotics, drives, and process control equipment. Automotive and transportation applications expand with electric vehicle platforms and charging infrastructure, while other industries adopt transducers for telecom power systems, aerospace platforms, and mission-critical defense equipment.

Key Growth Drivers

Rising Demand for Renewable Energy Systems

Growth in solar PV, wind power, and battery energy storage drives strong adoption of DC voltage transducers. These devices support accurate voltage monitoring, protection, and power conversion efficiency across inverters and grid-tied assets. Utilities use transducers to stabilize distributed energy networks and prevent equipment failures. Expanding investments in microgrids and hybrid power plants further strengthen demand. As countries increase renewable integration targets, transducers become essential for performance optimization and safe power delivery.

- For instance, ABB produces various DC voltage sensors and transducers that support high-voltage measurements, some of which can measure up to 4200 V DC for applications in traction and solar farms.

Expansion of Electric Vehicle and Charging Infrastructure

Electric vehicles depend on precise voltage measurement to manage battery health, safety, and charging efficiency. DC voltage transducers ensure reliable voltage control in charging stations, battery management systems, and onboard power electronics. Government incentives and rapid installation of fast-charging networks boost market growth. Automakers integrate high-accuracy sensors to extend battery life and support energy regeneration. This expansion across charging infrastructure and EV production creates sustainable demand for advanced voltage transducers.

- For instance, LEM’s HAH3DR S07 automotive-grade current transducer measures up to 1200 A DC with a sensitivity around 2 mV/A, providing essential data for efficient power management in 350 kW high-power charging platforms and EV inverters.

Industrial Automation and Smart Manufacturing Growth

Smart factories rely on DC voltage transducers to monitor motor drives, robotics, PLCs, and automated machinery. These devices support predictive maintenance and help maintain stable power conditions in production environments. Adoption increases across industries such as chemicals, food processing, and metal manufacturing. Integration with IoT platforms enhances real-time diagnostics and improves energy efficiency. As companies accelerate automation investments, precise voltage sensing becomes critical for operational safety and equipment reliability.

Key Trends & Opportunities

Key Trends & Opportunities

Increased Shift Toward Compact and High-Precision Transducers

Industries seek compact sensing devices that deliver high accuracy for space-constrained installations. These transducers reduce system complexity, simplify mounting, and improve cost efficiency. High-precision models support renewable inverters, EV power modules, and sensitive industrial electronics. Vendors focus on innovative core designs and improved signal processing to strengthen product performance. The trend drives continuous upgrades across transducer portfolios and promotes long-term technology adoption.

- For instance, Danisense’s DS50UB-10V offers a compact design with a Ø27.6 mm aperture, measurement capability up to 50 A AC (75 A DC continuous), and a linearity error of less than 5 ppm. This model supports precise control in high-density power electronics and EV converter platforms.

Growing Opportunities in Telecom and Data Centers

Telecom towers and data centers depend on stable DC power systems for critical operations. Voltage transducers enhance energy backup management and reduce risks of system failures. Expansion of 5G networks and cloud computing accelerates deployment in power distribution and battery backup units. Remote monitoring and digital output capabilities improve infrastructure reliability. This creates strong growth opportunities for suppliers serving mission-critical applications.

- For instance, Omicron offers the ability to test and calibrate a wide range of measuring transducers, including those for DC quantities (current, voltage, and power), using high-precision test sets like the CMC 256plus.

Key Challenges

High Cost of Advanced and High-Voltage Transducers

High-insulation materials, precision components, and robust enclosure requirements increase manufacturing costs. This raises purchase prices and limits adoption in smaller facilities and cost-sensitive markets. Some end users consider low-cost alternatives, reducing market penetration for premium devices. Vendors explore design optimization and scale-driven production to lower system costs. Pricing challenges remain a barrier, especially in emerging economies.

Complex Calibration and Technical Skill Requirements

DC voltage transducers require proper calibration and specialized expertise to ensure safe installation and high signal accuracy. Lack of trained technicians delays implementation and reduces system uptime. Workforce skill gaps persist in several developing regions, slowing adoption. Automation-assisted configuration and standardized training programs can reduce complexity. Industry participants emphasize simplified calibration tools to encourage wider deployment.

Regional Analysis

North America

North America holds a 36% share of the DC Voltage Transducer market, driven by strong investment in renewable energy, electric vehicle charging networks, and industrial automation. The United States leads demand with expanding solar and battery storage capacity, while utilities deploy advanced monitoring solutions for grid modernization. Data centers and telecom infrastructure further increase adoption to ensure stable DC power backup. Manufacturers benefit from a well-established electronics ecosystem and higher integration of IoT-enabled sensing technologies. Government energy transition policies, combined with large-scale EV infrastructure programs, reinforce long-term market growth across the region.

Europe

Europe accounts for a 30% share of the DC Voltage Transducer market, supported by strict energy efficiency regulations, growing wind and solar deployment, and investments in smart grid technology. Germany, France, and the United Kingdom lead installations due to rapid electrification across industrial and transportation sectors. The region’s focus on digital substations and hydrogen-ready power systems increases the need for reliable DC voltage monitoring. Telecom 5G rollouts and expanding battery storage facilities also contribute to demand. Ongoing decarbonization goals and high automation adoption in manufacturing continue to create favorable market conditions.

Asia-Pacific

Asia-Pacific holds a 25% share and represents the fastest-growing region, driven by large-scale renewable power expansion, electric mobility programs, and rapid industrial digitalization. China and India increase deployment of DC voltage transducers across solar parks, EV charging networks, and advanced manufacturing hubs. Japan and South Korea adopt precision monitoring technologies for automotive electronics and battery production. Telecom and data center growth also supports strong demand for backup power monitoring. Government support for localized power electronics production and strong investment in energy storage systems position the region for sustained growth.

Latin America

Latin America holds a 5% share of the DC Voltage Transducer market, with growth linked to rising grid modernization projects and expanding renewable generation in Brazil, Chile, and Mexico. Utilities adopt DC monitoring solutions to improve distribution network reliability and reduce outages. Data center development and telecom expansion support additional demand for stable DC power systems. Limited industrial automation and higher import costs remain challenges, but partnerships with global sensor providers continue to improve technology availability. Increasing solar investments and public electrification initiatives are expected to support long-term adoption.

Middle East & Africa

The Middle East & Africa region accounts for a 4% share, driven by ongoing investments in utility-scale renewable projects and grid reliability improvements. Gulf countries, including the United Arab Emirates and Saudi Arabia, adopt DC voltage transducers to support smart grid and hydrogen-energy initiatives. Africa’s demand grows gradually, driven by telecom tower expansions and solar-powered rural electrification systems. Limited skilled workforce and higher infrastructure costs affect faster penetration, yet government energy diversification plans offer future opportunities. As microgrids and battery storage projects expand, the region is expected to increase adoption of advanced DC monitoring technologies over time.

Market Segmentations:

By Type

- Hall Effect DC Voltage Transducers

- Isolation DC Voltage Transducers

- Differential DC Voltage Transducers

- Others

By Input Voltage Range

- 0–50 V

- 51–200 V

- 201–600 V

- Above 600 V

By End Use Industry

- Energy & Power

- Industrial Automation

- Automotive & Transportation

- Others

By Mounting Type

- DIN Rail

- Panel Mount

- PCB Mount

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The DC Voltage Transducer market is characterized by strong competition among leading companies including ABB Ltd., Siemens AG, Schneider Electric, LEM International SA, Texas Instruments Incorporated, Phoenix Contact, Yokogawa Electric Corporation, Danisense A/S, TE Connectivity, and Omicron Electronics GmbH & Co KG. These participants focus on precision measurement technologies, compact form factors, and enhanced isolation performance to serve energy, industrial automation, and electric mobility applications. Product strategies emphasize high-accuracy sensing, digital and IoT-enabled outputs, and compatibility with advanced power electronics used in renewable generation, EV charging, and smart grid assets. Strategic initiatives include partnerships with inverter manufacturers, collaborations in battery testing and grid monitoring, and investments in R&D for high-voltage and wide-bandgap semiconductor-based systems. Service offerings such as calibration support, lifecycle maintenance, and cybersecurity-ready monitoring platforms further differentiate vendor capabilities. As industries adopt predictive maintenance and automated control systems, competition is expected to intensify, driving continuous innovation in sensing performance, electrical safety, and integration flexibility.

Key Player Analysis

- ABB Ltd.

- Siemens AG

- Schneider Electric

- LEM International SA

- Texas Instruments Incorporated

- Phoenix Contact

- Yokogawa Electric Corporation

- Danisense A/S

- TE Connectivity

- Omicron Electronics GmbH & Co KG

Recent Developments

- In November 2024, LEM International SA launched the CDT sensor, the first automotive-grade residual current monitoring (RCM) Type B sensor with ASIL B capabilities for bidirectional on-board chargers (OBCs).

- In February 2023, Danisense introduced its DN1000ID large-aperture (41.2 mm) current transducer for high DC currents, aimed at EV test benches and battery evaluation systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Input Voltage Range, End Use Industry, Mounting Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of compact and high-precision DC voltage transducers will increase across renewable energy systems.

- Demand will grow in EV charging networks and battery management platforms.

- IoT-enabled and digital output transducers will support remote monitoring and predictive maintenance.

- Data centers and telecom infrastructure will enhance DC power measurement requirements.

- Smart grid modernization will accelerate integration of advanced voltage sensing technologies.

- Manufacturers will invest in wider input voltage ranges and improved isolation performance.

- Partnerships between sensor makers and power electronics companies will expand product innovation.

- Growing industrial automation will increase usage in robotics, drives, and safety systems.

- Cybersecurity features in monitoring platforms will become essential for critical power networks.

- Adoption in Asia-Pacific and Latin America will rise as electrification and renewable capacity scale.

Key Trends & Opportunities

Key Trends & Opportunities