Market Overview:

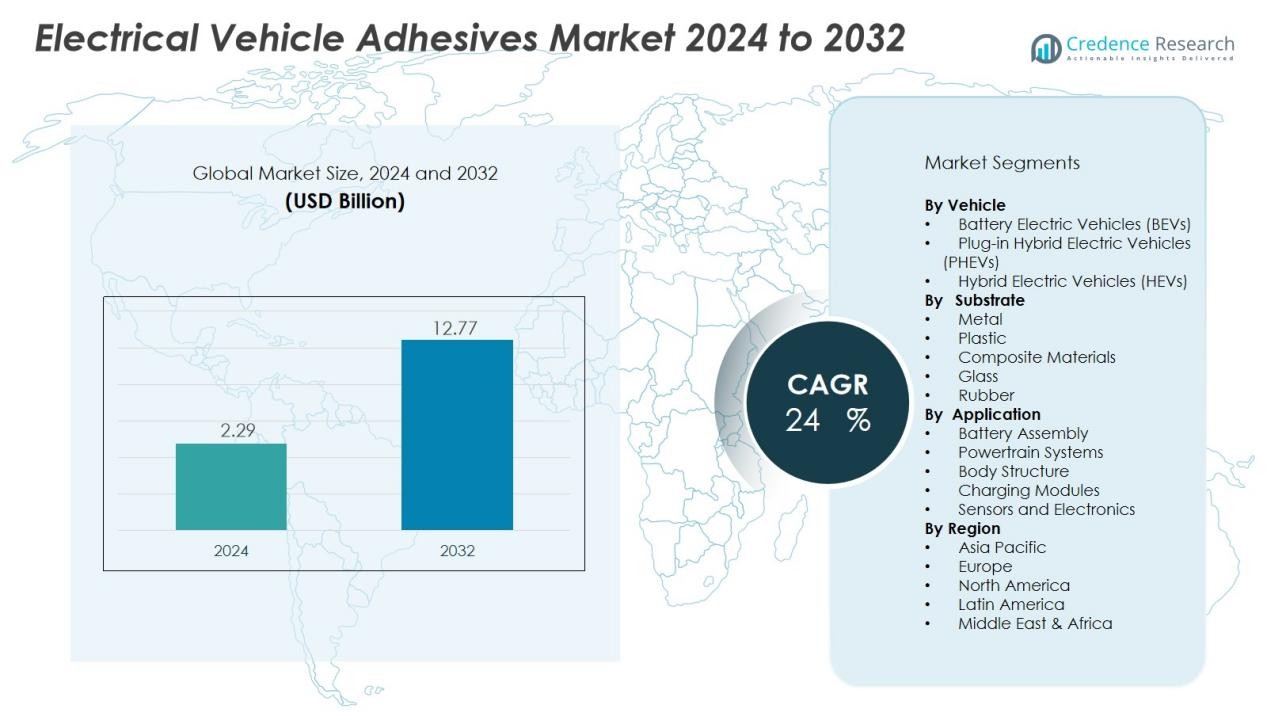

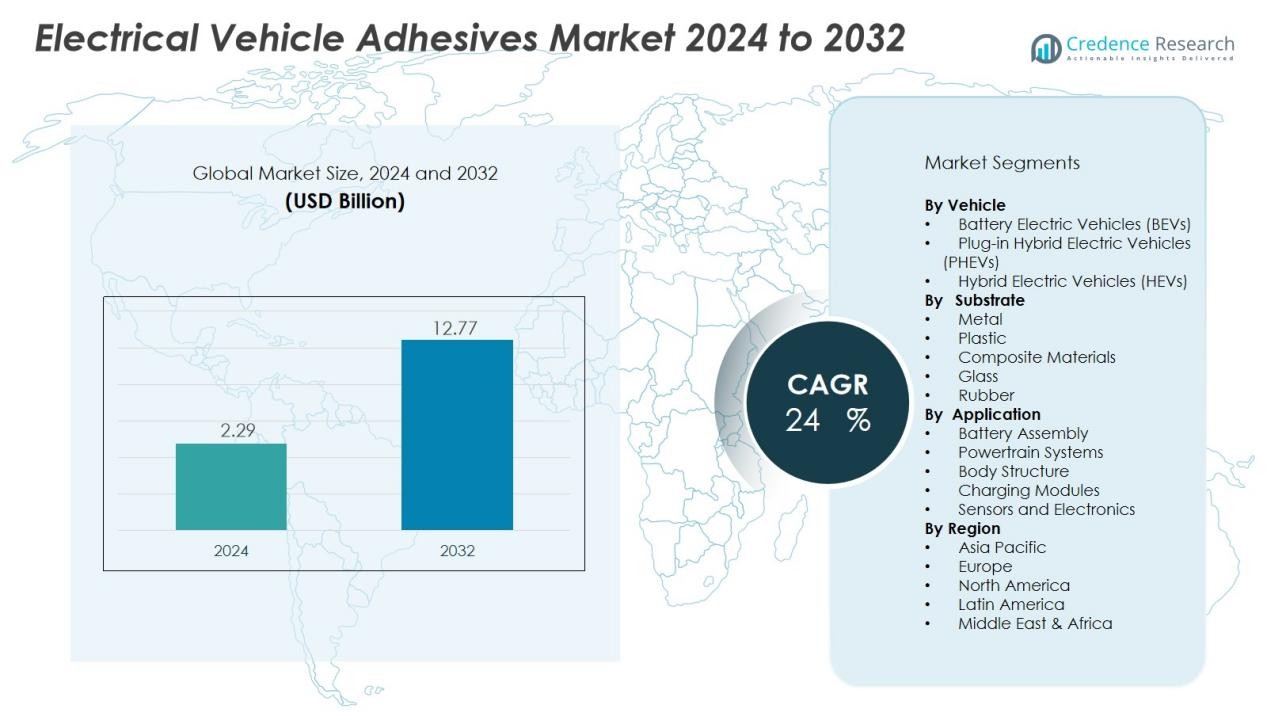

The Electrical Vehicle Adhesives Market size was valued at USD 2.29 billion in 2024 and is anticipated to reach USD 12.77 billion by 2032, at a CAGR of 24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrical Vehicle Adhesives Market Size 2024 |

USD 2.29 Billion |

| Electrical Vehicle Adhesives Market, CAGR |

24% |

| Electrical Vehicle Adhesives Market Size 2032 |

USD 12.77 Billion |

Rising adoption of battery electric and plug-in hybrid vehicles accelerates demand for high-performance adhesives. Manufacturers increasingly use epoxy, polyurethane, and silicone-based formulations for bonding components in batteries, sensors, and charging systems. Growing focus on vehicle range optimization and safety standards further fuels innovation in heat-resistant and conductive adhesives. The surge in EV battery manufacturing facilities and automation in assembly lines strengthens adhesive consumption across OEMs.

Regionally, Asia-Pacific dominates the Electrical Vehicle Adhesives Market with over 45% share, led by China, Japan, and South Korea’s strong EV production ecosystem. Europe follows, driven by stringent emission regulations and the rapid transition to zero-emission mobility. North America experiences steady expansion due to policy incentives, battery plant investments, and rising EV adoption across the United States and Canada.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electrical Vehicle Adhesives Market was valued at USD 0.85 billion in 2018, reached USD 2.29 billion in 2024, and is projected to reach USD 12.77 billion by 2032, registering a CAGR of 24% during the forecast period.

- Asia-Pacific holds 45% share due to its dominant EV production base in China, Japan, and South Korea supported by strong manufacturing ecosystems and government incentives.

- Europe accounts for 30% share, driven by strict emission standards, rapid battery plant development, and rising adoption of sustainable, low-VOC adhesive solutions.

- North America captures 18% share, supported by federal clean energy policies, large-scale EV assembly facilities, and growing investments in domestic battery manufacturing.

- Battery assembly accounts for 42% of total market share, while body structure applications hold 28%, reflecting the growing shift toward lightweight, high-strength bonding across electric vehicle components.

Market Drivers:

Rising Production of Electric Vehicles Globally

The Electrical Vehicle Adhesives Market grows rapidly with the surge in electric vehicle manufacturing across major economies. Automakers focus on improving performance, safety, and energy efficiency, driving the demand for high-strength adhesives over traditional fasteners. Adhesives offer superior bonding for dissimilar materials such as aluminum, composites, and plastics. It supports vehicle lightweighting and enhances crash durability, aligning with the industry’s sustainability goals.

- For instance, Tesla’s Model Y incorporates over 400 meters of structural adhesive per vehicle to achieve greater body rigidity and reduce overall vehicle weight, directly boosting its crash safety ratings and energy efficiency.

Growing Need for Lightweight and Energy-Efficient Components

The market benefits from the automotive industry’s emphasis on reducing overall vehicle weight to extend battery range. Adhesives play a key role by replacing heavy mechanical joints and welds, lowering vehicle mass without compromising strength. It enables efficient load distribution and vibration resistance in EV structures. The shift toward lighter materials in chassis, body panels, and battery enclosures continues to expand adhesive applications.

- For instance, BMW’s i3 electric vehicle achieved substantial weight savings, up to 350 kg (770 pounds) compared to a conventional steel body, by utilizing a carbon fiber reinforced plastic (CFRP) ‘Life Module’ (passenger cell) bonded to an aluminum ‘Drive Module’ chassis.

Rising Adoption of Advanced Battery Technologies

The Electrical Vehicle Adhesives Market gains strong momentum from the rising deployment of lithium-ion and solid-state batteries. Adhesives ensure electrical insulation, temperature resistance, and structural stability within battery packs. It also enhances performance by managing heat dissipation and protecting cells from mechanical stress. The trend toward higher energy density batteries fuels innovation in thermally conductive and flame-retardant adhesive formulations.

Government Support and Expansion of Charging Infrastructure

Government initiatives promoting EV adoption and charging infrastructure development strongly drive adhesive consumption. Policies supporting local battery manufacturing and EV assembly increase demand for specialized bonding solutions. It fosters regional investments by leading manufacturers developing advanced adhesive technologies. Continuous expansion of global EV supply chains further boosts market growth across automotive and component sectors.

Market Trends:

Integration of Advanced Adhesive Technologies for Battery Safety and Performance

The Electrical Vehicle Adhesives Market shows a strong trend toward advanced materials engineered for thermal stability and electrical insulation. Manufacturers develop next-generation adhesives with enhanced flame retardancy and conductivity to improve battery safety. It enables efficient heat management, minimizes short-circuit risks, and extends battery lifespan. OEMs increasingly adopt silicone and epoxy-based solutions to bond battery cells, modules, and enclosures under extreme conditions. The shift toward solid-state and high-energy-density batteries further accelerates the use of specialized adhesives. Strategic collaborations between automotive and chemical companies drive material innovation and large-scale production.

- For instance, Henkel launched Loctite TLB 9300 APSi in June 2023, a two-component polyurethane thermally conductive adhesive offering 3 W/mK thermal conductivity.

Shift Toward Sustainable and High-Performance Lightweight Adhesives

The market experiences rising adoption of eco-friendly adhesive formulations to meet sustainability and emission goals. Manufacturers focus on solvent-free, low-VOC, and recyclable products to support green mobility standards. It reduces environmental impact and ensures compliance with global automotive regulations. The trend toward multi-material vehicle structures demands adhesives that provide both strength and flexibility. Growing investments in bio-based and waterborne adhesive systems highlight the industry’s commitment to sustainable manufacturing. Increased automation in EV production also encourages the use of fast-curing adhesives for higher precision and efficiency in assembly lines.

- For example, researchers formulated waterborne polyurethane/acrylic adhesives with over 50% bio-based resin content that maintain a peel strength above 6 N, indicating competitive bonding performance for flexible sustainable applications.

Market Challenges Analysis:

High Material and Production Costs Limiting Widespread Adoption

The Electrical Vehicle Adhesives Market faces challenges due to the high cost of advanced adhesive materials. Premium formulations with heat resistance, conductivity, and flexibility require expensive raw inputs and complex manufacturing processes. It increases production expenses for OEMs compared to traditional fastening methods. Smaller manufacturers struggle to adopt these solutions due to limited budgets and scale. Maintaining consistent performance under varying thermal and mechanical conditions also raises design complexity. Price sensitivity in emerging markets further slows large-scale deployment.

Stringent Performance Standards and Compatibility Issues

The market encounters technical challenges related to compatibility with diverse substrates used in electric vehicles. Adhesives must bond metals, composites, and polymers while maintaining durability and safety over long cycles. It demands extensive testing and certification to meet automotive and environmental standards. Variations in battery chemistries and component materials complicate adhesive selection. Manufacturers face delays in product validation due to evolving global safety regulations. Ensuring consistent adhesive performance under thermal stress remains a major barrier for mass adoption in the EV sector.

Market Opportunities:

Expansion of EV Manufacturing and Supply Chain Localization

The Electrical Vehicle Adhesives Market presents strong opportunities with the global expansion of EV manufacturing hubs and supply chains. Governments encourage local production through subsidies and clean energy programs, creating demand for region-specific adhesive solutions. It supports domestic manufacturing of batteries, motors, and charging modules. Adhesive producers can partner with automakers to supply customized bonding materials for assembly and safety applications. The growing number of gigafactories worldwide opens new revenue streams for suppliers specializing in thermal, structural, and conductive adhesive systems.

Innovation in Sustainable and Next-Generation Adhesive Materials

The market offers growth potential through development of sustainable, high-performance adhesives tailored for evolving EV technologies. Manufacturers are investing in recyclable, bio-based, and solvent-free materials to align with carbon-neutral goals. It allows companies to meet strict emission norms while maintaining bonding strength and chemical resistance. The shift toward solid-state batteries and modular EV architectures expands the scope for advanced adhesives in energy storage and structural integration. Continuous R&D in smart adhesives with self-healing and sensor-enabled properties positions the industry for long-term innovation-driven growth.

Market Segmentation Analysis:

By Vehicle

The Electrical Vehicle Adhesives Market is segmented into battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs). BEVs dominate due to large-scale adoption and the growing push for zero-emission mobility. Adhesives are used extensively in battery modules, motor assemblies, and structural components to ensure lightweight construction and thermal stability. It helps improve range and crash performance while replacing mechanical fasteners. PHEVs and HEVs also contribute steadily due to ongoing electrification of conventional vehicle platforms.

- For instance, Henkel’s Loctite TLB 9300 APSi adhesive, adopted by one of the world’s largest EV battery manufacturers, delivers a thermal conductivity of 3 W/mK with room-temperature curing capabilities, enabling efficient heat dissipation from battery cells directly to cooling systems in BEV platforms.

By Application

Key applications include battery assembly, powertrain systems, body structures, and charging modules. Adhesives in battery assembly hold the largest share owing to high demand for electrical insulation, vibration resistance, and thermal conductivity. It ensures structural integrity and safety under varying temperature cycles. Powertrain systems use heat-resistant adhesives for electric motors and inverters, while body structures rely on lightweight bonding to enhance durability and corrosion protection.

- For instance, a type of 3M Scotch-Weld Structural Adhesive is used for electric motor assembly in high-performance electric vehicles (EVs), applications where the adhesive is required to withstand continuous operating temperatures up to 150°C (302°F) and higher.

By Substrate

By substrate, the market covers metal, plastic, and composite materials. Metal substrates dominate due to extensive use of aluminum and steel in EV chassis and enclosures. Adhesives provide reliable joining without compromising strength or flexibility. Plastic and composite substrates are gaining traction in interior and exterior parts where weight reduction is a key priority. It drives continuous product innovation for multi-material bonding solutions.

Segmentations:

By Vehicle

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

By Application

- Battery Assembly

- Powertrain Systems

- Body Structure

- Charging Modules

- Sensors and Electronics

By Substrate

- Metal

- Plastic

- Composite Materials

- Glass

- Rubber

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leading the Market with Strong Manufacturing Base

Asia-Pacific holds 45% market share in the Electrical Vehicle Adhesives Market, driven by robust EV production in China, Japan, and South Korea. It benefits from high adoption of battery electric vehicles and strong government support for local manufacturing. China leads with large-scale battery plants and expanding OEM partnerships using advanced adhesive systems for energy storage and assembly applications. Japan focuses on hybrid technologies supported by continuous R&D investment in lightweight bonding materials. India shows rapid growth due to government incentives under FAME and rising EV startups. It strengthens regional supply chains with increasing participation from chemical and automotive companies.

Europe Advancing with Sustainability and Emission Targets

Europe accounts for 30% market share, fueled by stringent emission regulations and early adoption of green mobility initiatives. The region prioritizes sustainable adhesive solutions that meet EU environmental standards and vehicle recyclability goals. Germany, France, and the United Kingdom lead in EV manufacturing supported by strong investments in battery production. Adhesive manufacturers in Europe focus on low-VOC and solvent-free formulations for high safety and performance standards. It benefits from the EU’s zero-emission vehicle targets that encourage innovation across the adhesive supply chain. Ongoing collaborations between chemical producers and automakers enhance technological advancement and product integration.

North America Expanding Through Policy Support and Battery Investments

North America captures 18% market share, driven by the United States and Canada’s efforts to strengthen EV infrastructure and domestic battery production. The region experiences rising adhesive demand from large-scale EV assembly and thermal management applications. Major OEMs invest heavily in advanced adhesive materials to meet safety and energy efficiency standards. It witnesses strong R&D initiatives from leading players focusing on automation-friendly and fast-curing products. Government funding under clean energy acts boosts industry competitiveness and manufacturing localization. Expanding partnerships between automakers and adhesive suppliers reinforce the regional supply network.

Key Player Analysis:

- Henkel (Germany)

- B. Fuller (US)

- Sika AG (Switzerland)

- Ashland (US)

- PPG Industries (US)

- Permabond (UK)

- 3M (US)

- Wacker Chemie AG (Germany)

- Bostik SA – An Arkema company (France)

- L&L Products (US)

- Jowat SE (Germany)

Competitive Analysis:

The Electrical Vehicle Adhesives Market is highly competitive, with key players focusing on innovation, sustainability, and performance optimization. Major companies include Ashland (US), PPG Industries (US), Permabond (UK), 3M (US), Wacker Chemie AG (Germany), and Bostik SA – An Arkema company (France). Each company emphasizes advanced adhesive formulations designed for lightweight construction, heat management, and battery safety. It demonstrates a growing shift toward solvent-free, thermally conductive, and structural bonding materials tailored for electric vehicles. 3M and PPG Industries lead in high-strength epoxy and polyurethane adhesives for EV battery systems, while Ashland and Wacker Chemie focus on silicone-based solutions for thermal stability. Bostik and Permabond expand their product portfolios through partnerships with automakers and component manufacturers. It enhances production efficiency and product customization across regions. Continuous R&D investment and collaboration with OEMs remain central to gaining a competitive edge in this evolving market.

Recent Developments:

- In November 2025, Henkel and Nordmeccanica announced a formal strategic partnership aimed at developing innovative and sustainable packaging solutions at the Giflex conference.

- In December 2024, H.B. Fuller completed the acquisition of Medifill Ltd., a manufacturer of medical-grade cyanoacrylate adhesives based in Ireland.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Vehicle,Application, Substrate and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising adoption of electric vehicles will strengthen demand for high-performance adhesive systems across OEMs.

- Adhesive manufacturers will focus on heat-resistant, flame-retardant, and electrically conductive formulations for battery safety.

- Lightweight bonding materials will gain traction to support range efficiency and structural integrity in vehicle design.

- Sustainable, low-VOC, and recyclable adhesives will become standard to meet global environmental goals.

- Automation in EV assembly lines will drive adoption of fast-curing and precision-dispensing adhesive technologies.

- Integration of smart adhesives with self-healing and sensor-enabled properties will redefine performance monitoring.

- Collaborations between chemical producers and automakers will expand R&D in next-generation bonding materials.

- Increasing regional battery manufacturing hubs will create localized supply opportunities for adhesive suppliers.

- Continuous innovation in solid-state battery designs will open new applications for thermal and structural adhesives.

- Government incentives and emission-reduction policies will sustain long-term market expansion and technological advancement.