Market Overview

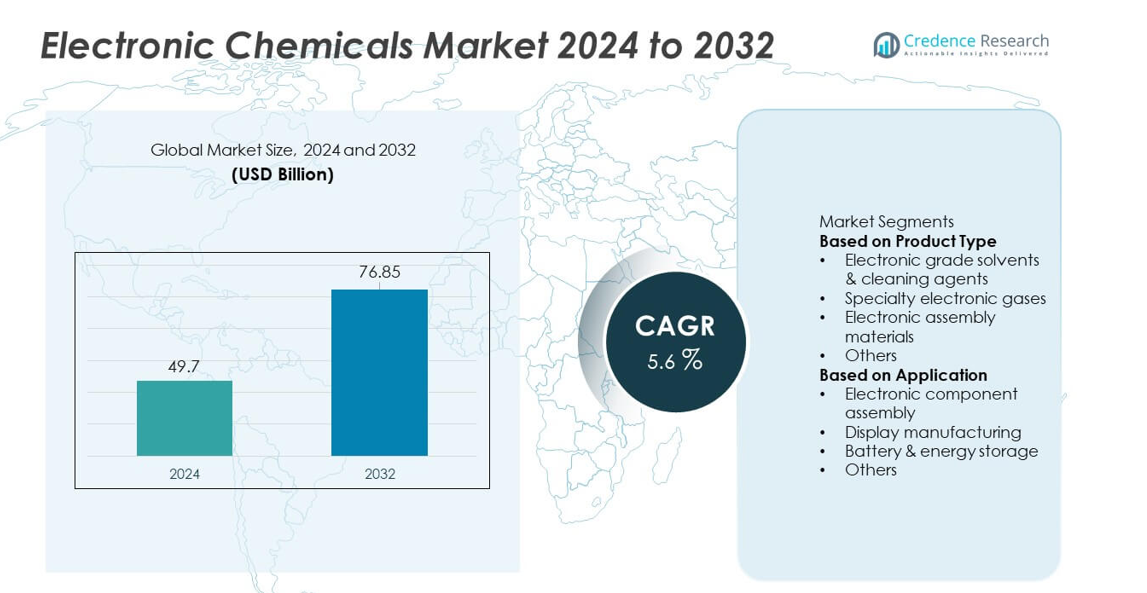

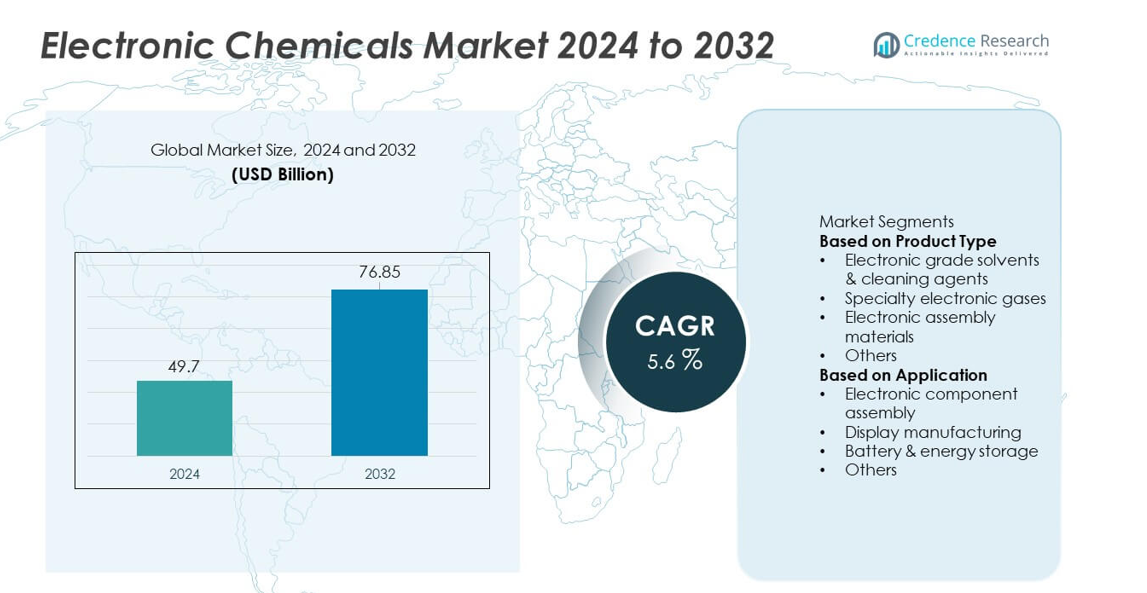

The Electronic Chemicals market size reached USD 49.7 billion in 2024 and is projected to reach USD 76.85 billion by 2032, supported by a 5.6% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Chemicals Market Size 2024 |

USD 49.7 billion |

| Electronic Chemicals Market, CAGR |

5.6% |

| Electronic Chemicals Market Size 2032 |

USD 76.85 billion |

Top players in the Electronic Chemicals market focus on high-purity solvents, specialty gases, photoresists, and advanced cleaning agents that support semiconductor, display, and battery manufacturing. Companies strengthen their presence through global production networks, partnerships with chipmakers, and development of materials compatible with advanced nodes and EUV lithography. Asia Pacific leads the market with a 38% share, driven by strong semiconductor manufacturing in China, Taiwan, South Korea, and Japan. North America follows with a 32% share, supported by expanding fab investments and rising demand for high-performance electronic materials. Europe holds a 25% share, benefiting from advanced electronics, EV battery production, and strict quality standards across precision manufacturing industries.

Market Insights

- The Electronic Chemicals market reached USD 49.7 billion in 2024 and is set to grow at a 5.6% CAGR, supported by rising demand across semiconductor and electronics manufacturing.

- Strong growth comes from expanding chip production, increasing consumption of high-purity solvents, and rapid adoption of specialty gases used in advanced lithography and etching processes.

- Key trends include rising use of ultrapure chemicals, EUV-compatible materials, and sustainable low-emission formulations, with electronic grade solvents leading the product segment with a 37% share.

- Competitive activity accelerates as major suppliers expand global footprints, strengthen supply chains, and invest in R&D to support next-generation semiconductor nodes and high-density packaging technologies.

- Asia Pacific leads with a 38% share, followed by North America at 32% and Europe at 25%, while electronic component assembly dominates the application segment with a 42% share, driven by strong growth in consumer electronics, EVs, and computing devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Electronic grade solvents and cleaning agents lead the segment with a 37% share, driven by strong usage in wafer cleaning, surface preparation, and contamination control across semiconductor fabrication. These chemicals support high-purity processing required for advanced nodes, boosting demand as chipmakers scale production for 5G, AI, and automotive electronics. Specialty electronic gases follow with rising adoption in etching, deposition, and lithography processes. Electronic assembly materials gain traction as device miniaturization increases the need for high-performance adhesives, solders, and encapsulants. Growing production of integrated circuits and high-density packaging continues to reinforce chemical demand across fabrication steps.

- For instance, Samsung Electronics expanded its EUV wafer output at its Hwaseong V line, a facility dedicated to mass-producing chips using advanced process nodes. The company’s V fab has utilized numerous EUV scanners as part of its strategy to meet growing global demand and increase overall capacity.

By Application

Electronic component assembly dominates the application segment with a 42% share, supported by increasing production of semiconductors, PCBs, and microelectronic devices across consumer electronics, EVs, and industrial automation. High-purity chemicals ensure reliability, conductivity, and defect-free assembly in high-density circuitry. Display manufacturing holds significant share as OLED, LCD, and advanced panel production grows across smartphones, televisions, and automotive displays. Battery and energy storage applications expand rapidly due to rising demand for lithium-ion cells, requiring specialized electrolytes and high-purity solvents. Growth in IoT devices, data centers, and electric mobility continues to drive robust chemical consumption across all application areas.

- For instance, TSMC’s extensive wafer processing operations lift the global consumption of various assembly and cleaning chemicals.

Key Growth Drivers

Rising Semiconductor Manufacturing and Advanced Chip Production

Growth in semiconductor fabrication drives strong demand for high-purity electronic chemicals used in cleaning, etching, photolithography, and deposition processes. Chipmakers expand capacity to support 5G, AI, automotive electronics, and high-performance computing, increasing the need for precise and contamination-free chemicals. Shrinking node sizes require more advanced formulations that ensure low defect rates and improved yield. Strong investments in new fabs across Asia, North America, and Europe further accelerate consumption. As semiconductor complexity rises, electronic chemicals remain essential for enabling reliable, high-precision manufacturing.

- For instance, Intel operated manufacturing processes across its global fabs, which increased the consumption of deposition precursors.

Expansion of Consumer Electronics and Smart Devices

Global demand for smartphones, tablets, wearables, gaming devices, and smart home electronics boosts consumption of chemicals used in assembly, display manufacturing, and PCB cleaning. The shift toward miniaturized components and high-density circuits requires more advanced materials and higher chemical purity. OLED and flexible display production also increases chemical usage across coating and patterning steps. With rising adoption of connected devices, manufacturers scale production volumes, driving continuous need for solvents, gases, and assembly materials. Rapid product refresh cycles further amplify demand across consumer electronics supply chains.

- For instance, Sony has shipped a substantial number of PlayStation 5 units, raising consumption of high-reliability solder pastes and thermal interface materials.

Growth of Electric Vehicles and Energy Storage Technologies

The rapid expansion of electric vehicles and lithium-ion battery production drives strong demand for chemical formulations used in electrode preparation, electrolytes, and cell assembly. High-purity solvents support stable battery performance, while specialty chemicals improve safety, conductivity, and cycle life. Battery gigafactories in Asia Pacific, Europe, and North America fuel large-scale chemical procurement. Energy storage systems for renewable integration also expand usage across advanced materials. As the EV market accelerates, electronic chemicals play a critical role in supporting efficient, high-quality battery manufacturing.

Key Trends & Opportunities

Increasing Use of High-Purity and Ultrapure Chemicals

As semiconductor nodes continue to scale below 5 nm, manufacturers require ultrapure chemicals with low metal content and minimal particle contamination. This trend drives innovation in purification technologies and specialty chemical formulations. Growth in EUV lithography and advanced deposition processes creates new opportunities for material suppliers. Demand for ultrapure water, high-precision etchants, and photoresist chemicals is rising as fabs adopt more complex manufacturing steps. Suppliers offering better purity levels and tighter specifications gain a strong competitive advantage in the market.

- For instance, JSR Corporation produced photoresists optimized for EUV scanners, which are designed to operate at extreme ultraviolet wavelengths, thereby helping enable high-volume manufacturing of advanced semiconductor devices.

Shift Toward Sustainable and Low-Emission Chemical Solutions

Manufacturers adopt eco-friendly solvents, low-GWP specialty gases, and recyclable materials to meet sustainability goals and regulatory expectations. Green chemistry initiatives drive development of safer, low-toxicity formulations for semiconductor cleaning and etching. Companies also explore waste reduction, chemical recycling, and energy-efficient purification technologies. Growing focus on ESG compliance creates opportunities for suppliers offering environmentally optimized products. As the electronics industry works toward carbon reduction, sustainable chemical solutions become integral to long-term production strategies.

- For instance, Air Liquide helps clients in the semiconductor industry reduce emissions by developing innovative and low global warming potential advanced materials such as its enScribe material line, which avoids significant carbon emissions annually when adopted by a major customer.

Key Challenges

High Manufacturing Costs and Need for Extreme Purity

Electronic chemicals require stringent purity levels, precision production, and continuous quality monitoring, leading to high manufacturing costs. Achieving defect-free performance in semiconductor processes demands advanced purification equipment and strict contamination control. Smaller suppliers struggle with capital-intensive production requirements, limiting market entry. As chip nodes shrink, specifications become more demanding, increasing costs for R&D and process validation. These challenges place pressure on producers to maintain quality while controlling expenses.

Supply Chain Vulnerabilities and Raw Material Constraints

The market faces supply disruptions due to dependence on limited raw materials, geopolitical tensions, and concentrated semiconductor manufacturing hubs. Shortages of specialty gases, solvents, and critical precursors affect fab operations and delay production timelines. Logistic challenges and fluctuating chemical prices increase procurement risks for manufacturers. Heavy reliance on Asia Pacific for key chemical inputs also exposes global supply chains to instability. Strengthening regional manufacturing and diversifying supply sources remain essential to mitigating these risks.

Regional Analysis

North America

North America holds a 32% share of the Electronic Chemicals market, driven by strong semiconductor manufacturing activity and rising investments in advanced chip fabrication. The United States leads regional demand through expansions by major foundries and government-backed initiatives to boost domestic chip production. Growth in electric vehicles, data centers, and high-performance computing further increases consumption of high-purity solvents, specialty gases, and assembly chemicals. Strong R&D capabilities and partnerships between chemical suppliers and semiconductor manufacturers support continuous innovation. Canada contributes through growing electronics assembly and clean-energy technology development, reinforcing steady regional demand.

Europe

Europe accounts for a 25% share, supported by advanced electronics manufacturing, strong regulatory standards, and rising investment in semiconductor fabs. Countries such as Germany, France, and the Netherlands drive demand for high-purity cleaning agents, photoresist chemicals, and specialty gases used in precision chipmaking and display technologies. The region’s growing EV sector boosts consumption of battery-related chemicals, while sustainability goals push the adoption of eco-friendly formulations. EU initiatives to strengthen semiconductor sovereignty and expand local production capacity further enhance market growth. Collaboration among chemical suppliers, research institutes, and OEMs supports long-term development.

Asia Pacific

Asia Pacific dominates with a 38% share, driven by large-scale semiconductor manufacturing in China, Taiwan, South Korea, and Japan. The region’s leadership in consumer electronics, displays, and lithium-ion battery production fuels extensive demand for ultrapure solvents, etchants, deposition gases, and assembly materials. Expanding 5G infrastructure and rapid growth in electric mobility further strengthen chemical consumption. Significant investments in new fabs and capacity upgrades by major foundries reinforce Asia Pacific’s position as the global hub for electronic chemicals. Emerging markets in Southeast Asia also contribute through expanding electronics assembly and component manufacturing.

Latin America

Latin America holds a 3% share, supported by rising electronics assembly, growing adoption of renewable energy technologies, and increasing investment in battery manufacturing. Brazil and Mexico lead the region through expanding automotive electronics production and growing demand for consumer devices. The region’s slow semiconductor development limits large-scale chemical consumption, but increasing interest in industrial automation and EV component production offers steady opportunities. Improvements in manufacturing infrastructure and supportive government policies are gradually enhancing the region’s role in the global supply chain, boosting demand for basic solvents, cleaning agents, and assembly materials.

Middle East & Africa

The Middle East & Africa region accounts for a 2% share, driven by emerging electronics assembly operations, increasing adoption of smart devices, and growth of renewable and battery-related industries. Gulf countries such as the UAE and Saudi Arabia invest in advanced manufacturing and high-tech clusters, supporting demand for specialized electronic chemicals. Africa shows gradual growth as telecom expansion and consumer electronics usage rise across major economies. Limited semiconductor manufacturing restricts large-volume consumption, but ongoing digital transformation and technology investments create opportunities for chemical suppliers in select high-growth markets.

Market Segmentations:

By Product Type

- Electronic grade solvents & cleaning agents

- Specialty electronic gases

- Electronic assembly materials

- Others

By Application

- Electronic component assembly

- Display manufacturing

- Battery & energy storage

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Major players in the Electronic Chemicals market include Air Liquide S.A., Arkema S.A., Avantor Inc., BASF SE, Brewer Science Inc., Cabot Microelectronics Corporation, Chemours Company, Covestro AG, Dongjin Semichem Co. Ltd., and Dow Inc. These companies compete by developing high-purity chemicals, specialty gases, advanced photoresists, and precision cleaning agents essential for semiconductor manufacturing. Market leaders strengthen their positions through strategic partnerships with chipmakers, investments in new purification technologies, and expansion of production facilities in key semiconductor hubs. Many players focus on supplying materials that support advanced nodes, EUV lithography, and high-density packaging. Increasing demand for eco-friendly and low-contamination formulations drives innovation across the supply base. Companies also pursue acquisitions and global footprint expansion to ensure stable supply chains and meet rising demand from electronics, display, and battery manufacturers. Continuous R&D investment and technology alignment with leading fabs remain central to competitive differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dow Inc.

- Brewer Science Inc.

- Air Liquide S.A.

- Covestro AG

- Chemours Company

- Dongjin Semichem Co. Ltd.

- BASF SE

- Cabot Microelectronics Corporation

- Arkema S.A.

- Avantor Inc.

Recent Developments

- In November 2025, BASF SE signed a cooperation agreement with Air Liquide S.A. (via its Shanghai subsidiary) and a third party, the Chinese energy company Shenergy, to produce low-carbon MDI using biomethane feedstock.

- In October 2025, BASF SE announced the construction of a new electronic-grade ammonium hydroxide (NH₄OH EG) plant in Ludwigshafen, Germany, to support wafer cleaning, etching, and other precision processes in semiconductor manufacturing.

- In May 2025, Brewer Science, Inc. announced it would showcase advanced material innovations, including BrewerBOND® materials that enable high-yield wafer thinning for advanced compound semiconductors and 3D integration, at the CS MANTECH and ECTC industry conferences

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ultrapure chemicals will rise as semiconductor nodes continue to shrink.

- Investment in EUV-compatible materials will increase to support advanced lithography.

- Growth in EV and battery manufacturing will boost consumption of high-purity solvents and electrolytes.

- OLED, microLED, and flexible display production will expand demand for specialty coating chemicals.

- Chip fabrication capacity additions across Asia, North America, and Europe will strengthen long-term chemical procurement.

- Sustainable, low-toxicity, and low-GWP chemical formulations will gain wider adoption.

- Automation and digital monitoring will enhance chemical handling and purity control in fabs.

- Supply chain diversification will accelerate to reduce dependency on single-source regions.

- High-density packaging and 3D chip architectures will increase demand for advanced assembly materials.

- Collaboration between chemical suppliers and semiconductor manufacturers will deepen to support next-generation process requirements.