Market Overviews

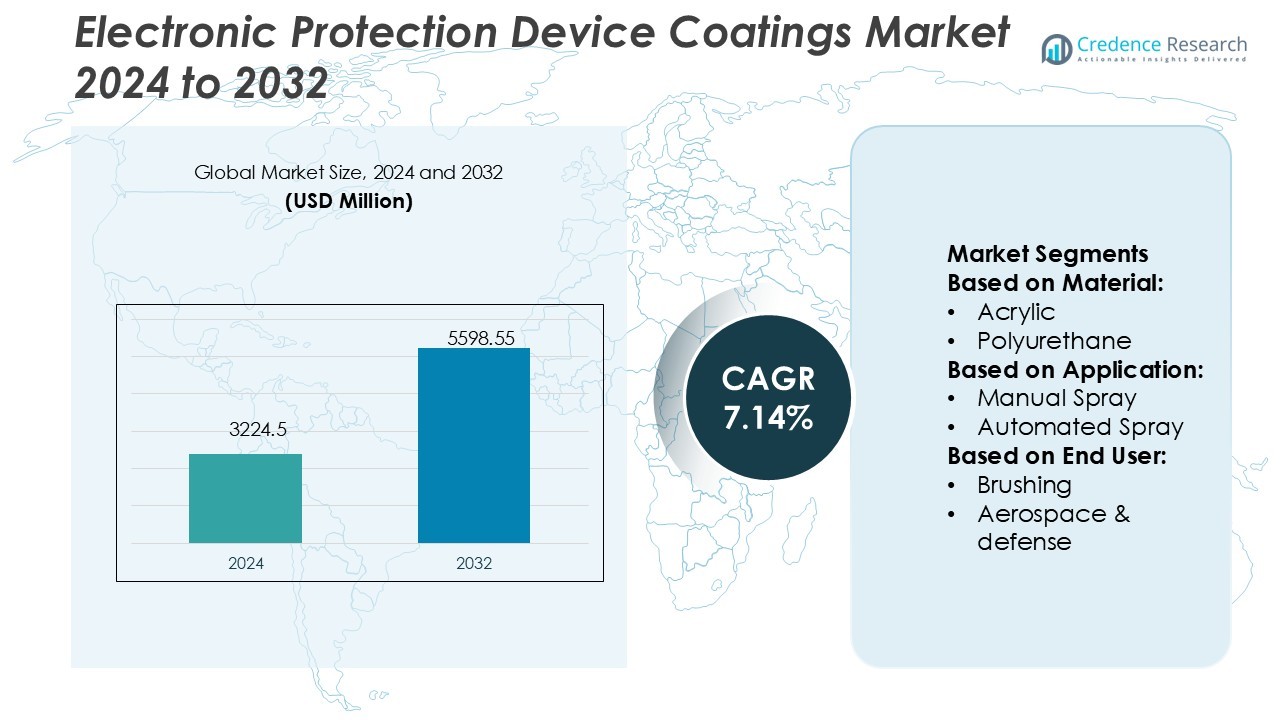

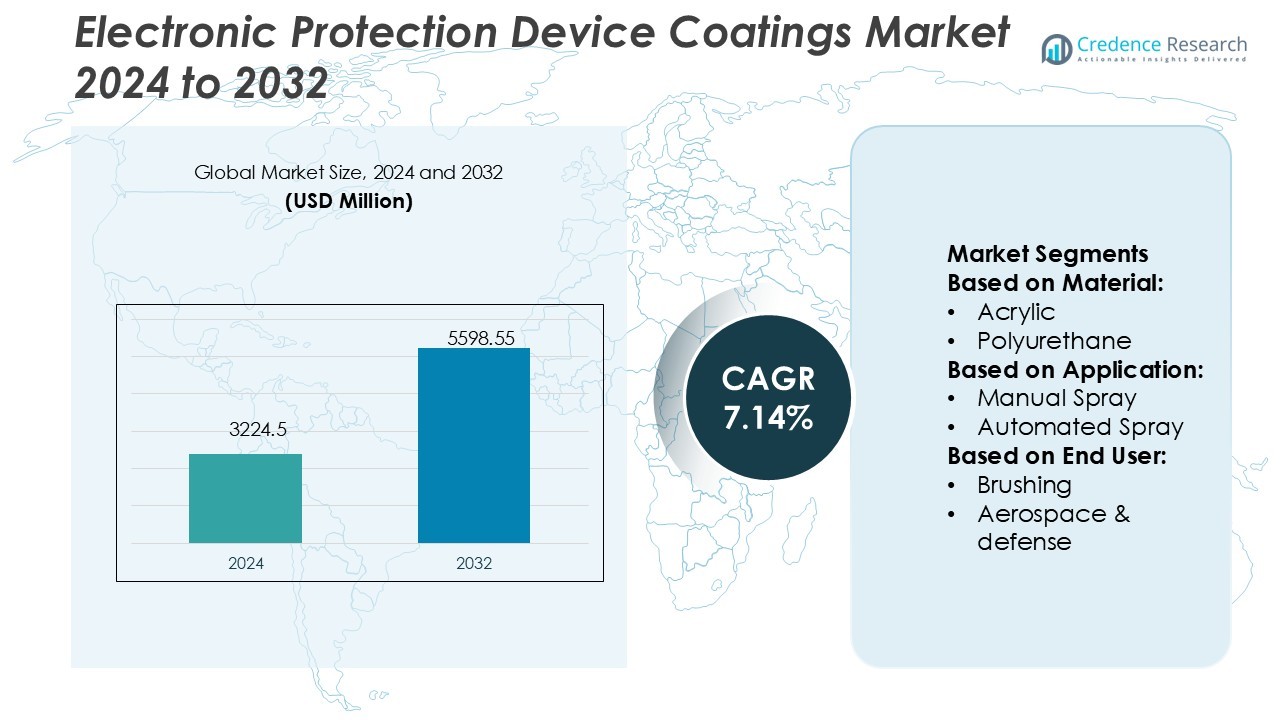

Electronic Protection Device Coatings Market size was valued USD 3224.5 million in 2024 and is anticipated to reach USD 5598.55 million by 2032, at a CAGR of 7.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Protection Device Coatings Market Size 2024 |

USD 3224.5 Million |

| Electronic Protection Device Coatings Market, CAGR |

7.14% |

| Electronic Protection Device Coatings Market Size 2032 |

USD 5598.55 Million |

The Electronic Protection Device Coatings Market features strong competition among major manufacturers focusing on product innovation and advanced material development. Leading companies leverage nanocoating technologies and UV-curable formulations to improve device durability, thermal resistance, and insulation properties. The market shows increasing integration of eco-friendly and high-performance coatings across automotive, consumer electronics, and industrial sectors. North America leads the global market with a 36.7% share, supported by the presence of advanced electronics manufacturing hubs, high R&D investments, and strong demand from aerospace and defense industries emphasizing circuit protection and environmental safety compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electronic Protection Device Coatings Market was valued at USD 3224.5 million in 2024 and is expected to reach USD 5598.55 million by 2032, growing at a CAGR of 7.14%.

- Market growth is driven by rising demand for circuit protection, miniaturized electronic components, and sustainable coating solutions across automotive and consumer electronics sectors.

- Technological advancements, including nanocoatings and UV-curable formulations, are enhancing device reliability, thermal resistance, and insulation efficiency in critical environments.

- High production costs and complex application processes restrain market expansion, particularly for small and mid-sized manufacturers with limited technological capabilities.

- North America holds a 36.7% market share, leading due to its strong electronics and aerospace industries, while the consumer electronics segment accounts for 41.5% of total demand globally, supported by growing device protection requirements and robust manufacturing infrastructure.

Market Segmentation Analysis:

By Material

Acrylic coatings hold the largest market share in the Electronic Protection Device Coatings Market due to their strong dielectric properties and cost-effectiveness. Their ease of application, excellent moisture resistance, and compatibility with various substrates make them widely adopted in printed circuit boards and consumer electronics. Polyurethane and silicone coatings follow, driven by demand for flexible, temperature-resistant protection. Increasing use of epoxy for chemical and corrosion resistance in harsh environments also contributes to market expansion, particularly in industrial and automotive applications.

- For instance, Henkel’s Loctite Stycast CC 8555 conformal coating delivers a dielectric strength of 27.5 kV/mm, offering extreme environment protection for high-power PCBs.

By Application

The automated spray segment dominates the market, capturing the largest share due to its high precision, consistency, and efficiency in coating application. It is widely adopted across large-scale electronics manufacturing facilities, where uniform film thickness and reduced material wastage are crucial. Manual spray and dipping methods are preferred for small-batch or prototype production, offering flexibility and lower initial costs. Automation trends and Industry 4.0 integration continue to drive demand for robotic and automated coating systems to improve throughput and quality assurance.

- For instance, PPG’s SPRAYLAT® 599-B3730 conductive coating. The figures cited for sheet resistance, dry film thickness, and the mil-to-micron conversion are confirmed by technical data sheets and product information.

By End User

Consumer electronics represent the leading end-user segment, holding the largest share in the Electronic Protection Device Coatings Market. The growth is fueled by rising production of smartphones, wearables, and smart home devices requiring moisture and dust protection. Automotive and aerospace industries follow, driven by the growing use of electronic control units and advanced sensors. The need for reliable, long-lasting coatings in harsh operating conditions supports market demand, while industrial control systems continue adopting protective coatings to ensure operational stability and extend device lifespan.

Key Growth Drivers

Rising Demand for Consumer Electronics

The increasing production of smartphones, wearables, and smart home devices is driving demand for protective coatings that enhance durability and performance. These coatings safeguard sensitive electronic components against moisture, dust, and chemical exposure. Manufacturers are adopting advanced coating materials such as acrylics and silicones to improve device reliability and lifespan. The growing consumer preference for compact, lightweight devices further accelerates innovation in thin-film protection, supporting steady market growth across Asia-Pacific, particularly in China, Japan, and South Korea.

- For instance, Electrolube’s UVCL coating cures to a dielectric strength of 27 kV/mm and a dielectric constant of 2.5 at 1 MHz. PUC (their modified polyurethane) delivers dielectric strength of 60 kV/mm, operating from –55 °C to 130 °C, with surface insulation resistance of 1×10¹⁵ Ω.

Expansion of Automotive and Aerospace Electronics

The rapid adoption of electronic control systems in vehicles and aircraft is a major growth driver. Components such as sensors, ADAS modules, and control units require durable coatings to ensure stable performance in extreme conditions. Polyurethane and epoxy coatings are gaining traction due to their superior thermal and vibration resistance. The shift toward electric vehicles and autonomous systems also increases the need for long-lasting protection solutions, encouraging suppliers to invest in high-performance coatings that meet stringent safety and reliability standards.

- For instance, Chase’s HumiSeal 2E11 is a two-part epoxy system that cures at room temperature. It is designed for electronic sealing, encapsulating, and potting applications and is known for its strong adhesion and good dielectric properties.

Growing Industrial Automation and IoT Integration

The expansion of industrial automation and Internet of Things (IoT) systems has created a strong demand for reliable coating solutions. Industrial devices, sensors, and control modules require protection against environmental stress, mechanical damage, and corrosion. Manufacturers are integrating smart coatings capable of self-healing and real-time monitoring to ensure uninterrupted system operation. As factories adopt predictive maintenance and digital twin technologies, the importance of protective coatings for electronic devices continues to rise, especially in manufacturing and energy sectors.

Key Trends & Opportunities

Advancement in Nanocoating Technologies

Nanotechnology-based coatings are emerging as a transformative trend in the electronic protection device industry. These coatings offer ultra-thin yet highly durable protection against moisture, corrosion, and contaminants. Their low thermal resistance and strong adhesion make them suitable for compact electronics. Companies are investing in nano-engineered materials to improve conductivity and enhance long-term reliability. The growing demand for miniaturized devices and 5G-compatible components presents significant opportunities for nanocoating adoption in both consumer and industrial electronics.

- For instance, H.B. Fuller’s EA6042 adhesive/encapsulant (polyurethane acrylate) has a viscosity of 5,000 cP at 25 °C and achieves a tack-free surface in under 6 seconds when UV cured at 100 mW/cm² (365 nm).

Shift Toward Sustainable and Eco-Friendly Coatings

Environmental regulations and sustainability goals are driving the development of eco-friendly coating solutions. Manufacturers are focusing on low-VOC, solvent-free formulations using waterborne or bio-based materials. This shift not only aligns with global green manufacturing initiatives but also reduces health risks during production. The trend is opening new opportunities for companies offering recyclable and energy-efficient coating products. Increased investment in green chemistry and regulatory compliance is expected to enhance market competitiveness and brand reputation.

- For instance, Kisco’s site operations include installations of RTO (Regenerative Thermal Oxidizer) and HTO (Heat Transfer Oxidizer) units, which cut hydrocarbon emissions by 99.9 %.

Automation in Coating Application Processes

Automation is becoming a key trend in the electronic protection device coatings market. The integration of robotic and automated spray systems ensures precision, uniformity, and reduced material waste. These technologies enhance production speed and consistency, critical in large-scale electronic manufacturing. Automation also minimizes human error and operational downtime. As Industry 4.0 and smart factory concepts expand, automated coating systems present strong opportunities for process optimization and cost efficiency, particularly in high-volume manufacturing environments.

Key Challenges

High Cost of Advanced Coating Materials

The development and application of advanced coatings such as nanocoatings and fluoropolymer-based solutions come with significant costs. High production expenses, complex formulation processes, and specialized equipment limit widespread adoption among small and mid-sized manufacturers. This cost barrier can slow market expansion, especially in emerging economies where price-sensitive customers dominate. Companies must balance performance improvements with affordability to maintain competitiveness and achieve large-scale market penetration across diverse industrial applications.

Technical Limitations in Harsh Environments

Despite advancements, certain coatings still face performance issues under extreme temperature, humidity, or chemical exposure. In aerospace, defense, and heavy industrial environments, coating degradation can compromise device reliability. The challenge lies in developing coatings that provide consistent long-term protection without affecting electrical conductivity or component miniaturization. Manufacturers are focusing on hybrid materials and multilayer coating designs to overcome these technical constraints. Continuous innovation and testing are crucial to meeting the demanding requirements of next-generation electronics.

Regional Analysis

North America

North America holds a market share of 32% in the Electronic Protection Device Coatings Market, driven by the strong presence of consumer electronics, aerospace, and defense sectors. The United States leads regional demand with extensive adoption of conformal coatings in high-performance devices and automotive control systems. Major coating manufacturers are investing in advanced, low-VOC and nanotechnology-based formulations to comply with environmental standards. The growing use of electric vehicles and industrial automation further supports market expansion. Continuous innovation and R&D initiatives by companies enhance North America’s leadership in performance-driven coating technologies.

Europe

Europe accounts for 26% of the market share, fueled by stringent environmental regulations and strong demand from automotive and industrial electronics sectors. Germany, the UK, and France lead the region due to widespread use of protective coatings in automotive control units, aerospace electronics, and renewable energy systems. The European Union’s focus on sustainability encourages the adoption of waterborne and bio-based coatings. Advancements in automation and nanocoating technologies also drive growth. Collaboration between material suppliers and OEMs ensures high-performance protection solutions, maintaining Europe’s position as a key innovation hub for coating technologies.

Asia-Pacific

Asia-Pacific dominates the Electronic Protection Device Coatings Market with a 34% market share, supported by rapid industrialization and large-scale electronics manufacturing. China, Japan, and South Korea are key contributors due to strong production of consumer electronics, semiconductors, and electric vehicles. The growing adoption of IoT devices and smart manufacturing increases coating usage across industries. Local manufacturers are expanding capacity and adopting automated spray systems to meet global demand. Government-backed initiatives for electronic production and foreign investments continue to strengthen the region’s leadership in high-volume, cost-effective protective coating solutions.

Latin America

Latin America holds a 5% market share, with Brazil and Mexico emerging as major contributors. Growth is supported by increasing adoption of automation technologies and expanding automotive and consumer electronics industries. The rising focus on enhancing device reliability and extending product lifespan drives the demand for advanced protective coatings. Manufacturers are gradually investing in modern application technologies such as automated spraying and dipping systems. Although market penetration remains moderate, regional opportunities are expected to rise as infrastructure modernization and industrial digitization gain momentum across Latin American economies.

Middle East & Africa

The Middle East & Africa region captures 3% of the global market share, showing steady growth driven by infrastructure development and expanding industrial sectors. Gulf nations such as the UAE and Saudi Arabia are investing in smart city and automation projects, which require durable electronics protection. The increasing adoption of renewable energy systems and defense technologies further supports demand for protective coatings. Local manufacturers are exploring partnerships to introduce high-performance, moisture-resistant coatings. With growing industrial diversification and digital transformation, the region presents emerging opportunities for market expansion.

Market Segmentations:

By Material:

By Application:

- Manual Spray

- Automated Spray

By End User:

- Brushing

- Aerospace & defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electronic Protection Device Coatings Market features strong competition among leading companies such as Henkel AG, Dymax Corporation, PPG Industries, Electrolube, Chase Corporation, H.B. Fuller, Kisco, 3M Company, MG Chemicals, and Dow Corning. The Electronic Protection Device Coatings Market is highly competitive, driven by continuous innovation and technological advancement. Manufacturers are focusing on developing high-performance coatings that provide superior resistance to moisture, chemicals, and temperature fluctuations. Companies are investing heavily in research and development to create eco-friendly, solvent-free, and nanotechnology-based formulations that meet global environmental standards. Strategic collaborations with electronics and automotive OEMs are helping expand product portfolios and market presence. The shift toward automation, smart manufacturing, and miniaturized electronics is intensifying competition, encouraging firms to enhance product performance, application efficiency, and long-term reliability through advanced coating technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Henkel AG

- Dymax Corporation

- PPG Industries

- Electrolube

- Chase Corporation

- B. Fuller

- Kisco

- 3M Company

- MG Chemicals

- Dow Corning

Recent Developments

- In July 2024, AkzoNobel announced the launch of the new range of Resicoat EV powder coatings to safeguard the electric vehicle’s battery system and electrical components. The new range of products comes with improved heat management capabilities and increased electrical insulating capabilities to help safeguard battery systems, motors, and electrical storage units.

- In March 2024, Hardide Coatings launched JP-5000 4. JP-5000 4 is a tungsten carbide-based coating that finds application in high-velocity oxy-fuel (HVOF) thermal spray coating.

- In December 2023, DuPont launched printed Tedlar PVF coatings. These coatings provide long-lasting aesthetic protection for architectural applications in harsh weather conditions.

- In October 2023, Orion S.A. launched PRINTEX kappa 10. PRINTEX kappa 10 is a high-grade conductive additive that finds applications in energy storage systems, electric vehicles, and consumer applications.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand for advanced electronic protection.

- Manufacturers will focus on developing eco-friendly and low-VOC coating formulations.

- Nanocoating technologies will gain momentum for high-performance and miniaturized electronic components.

- Automation in coating processes will improve precision, efficiency, and production consistency.

- The expansion of electric vehicles will increase the need for durable electronic protection solutions.

- Growing adoption of IoT and smart devices will strengthen demand for conformal coatings.

- Strategic collaborations between coating suppliers and OEMs will enhance innovation and market reach.

- The aerospace and defense sectors will adopt specialized coatings for high-reliability electronics.

- Research in hybrid materials will lead to improved chemical and thermal resistance coatings.

- Asia-Pacific will remain the leading manufacturing hub due to strong electronics production capabilities.