Market Overview:

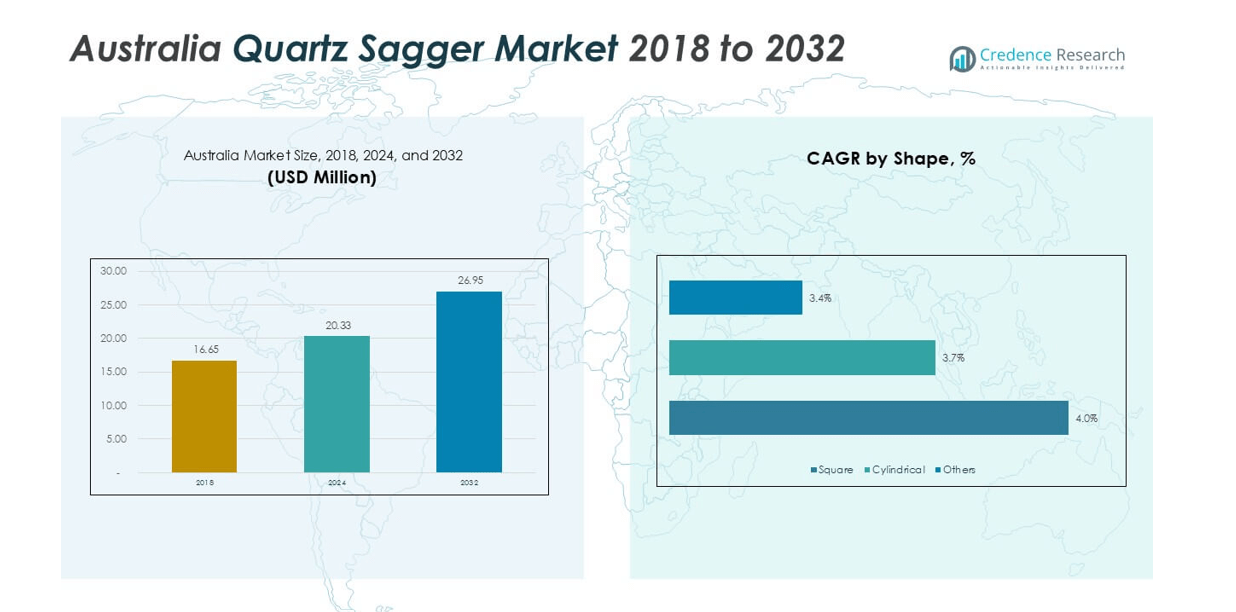

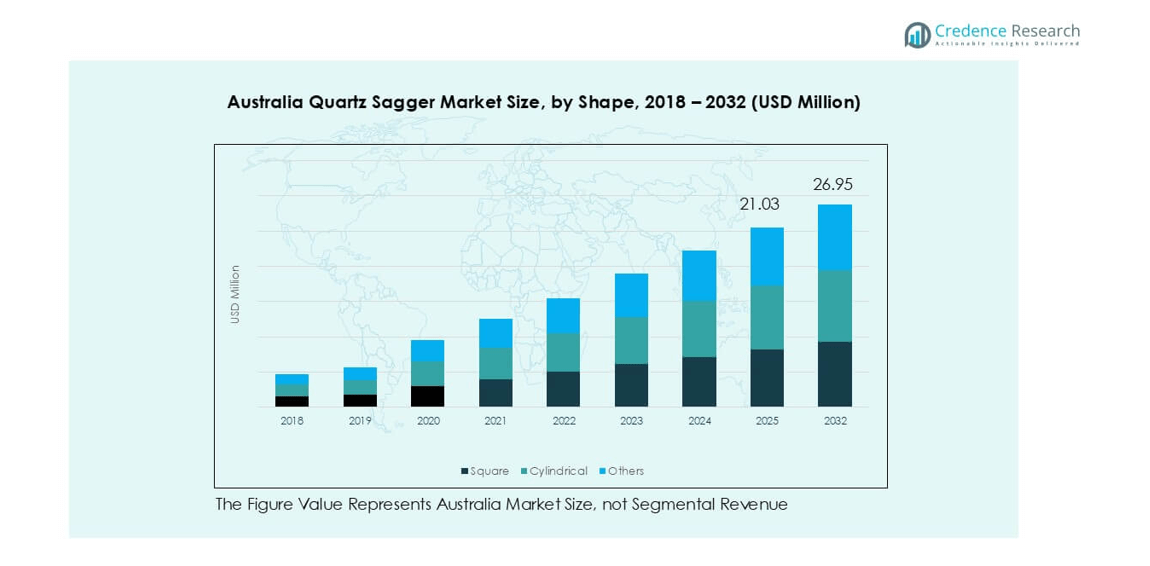

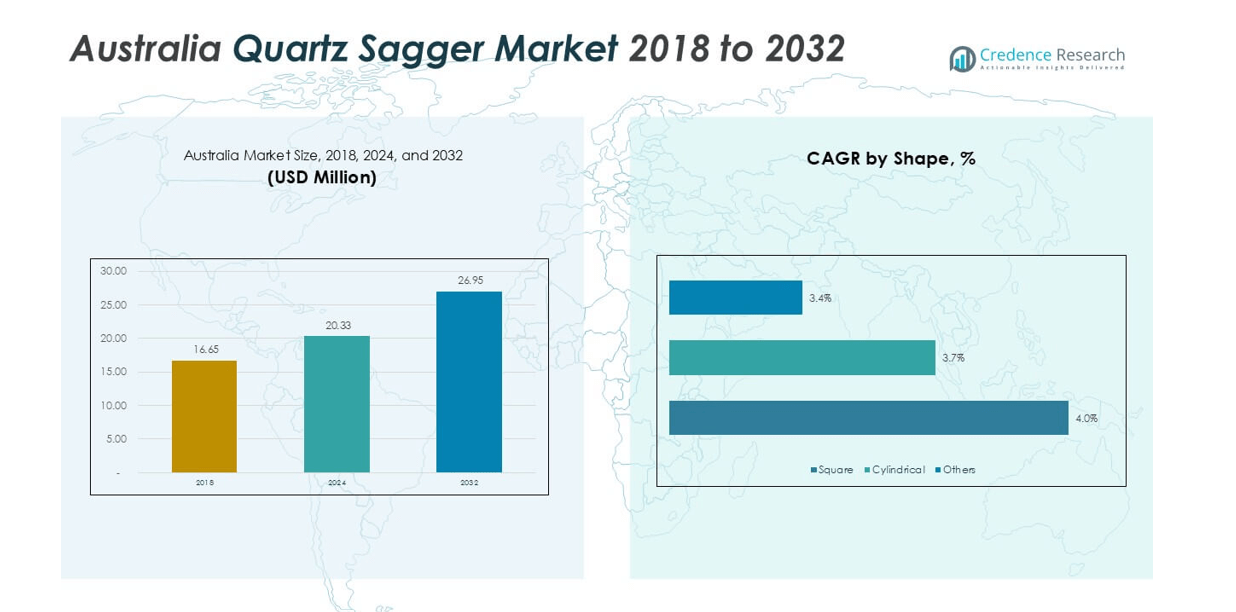

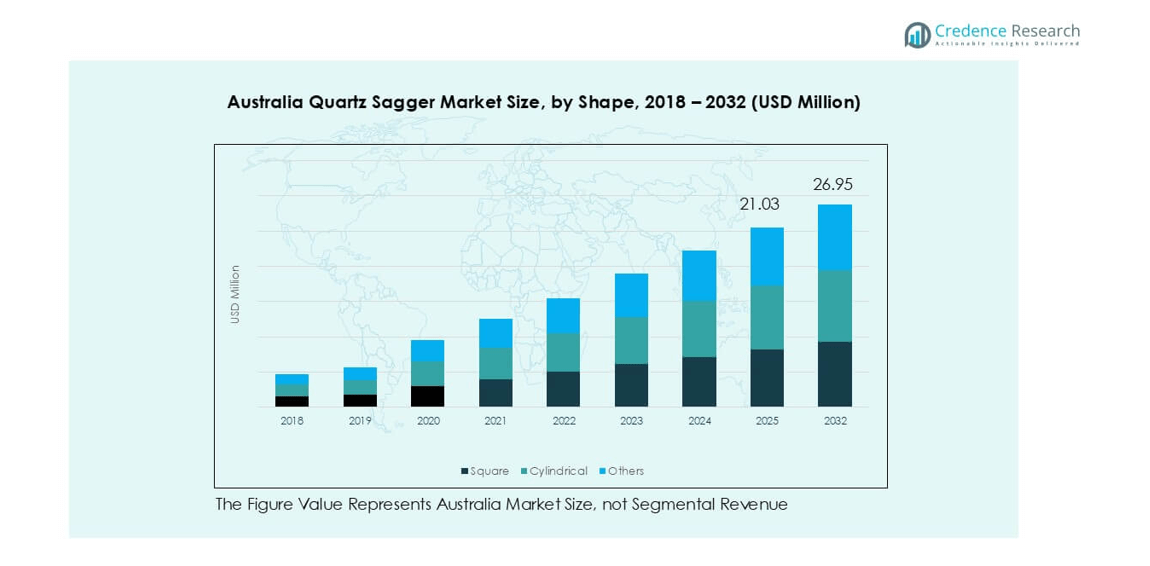

Australia Quartz Sagger market size was valued at USD 16.65 million in 2018, increased to USD 20.33 million in 2024, and is anticipated to reach USD 26.95 million by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Quartz Sagger Market Size 2024 |

USD 20.33 million |

| Australia Quartz Sagger Market, CAGR |

3.6% |

| Australia Quartz Sagger Market Size 2032 |

USD 26.95 million |

The Australia quartz sagger market is shaped by leading players such as Saint-Gobain, NORITAKE CO., LIMITED, Morgan Advanced Materials plc, Zibo Gotrays Industry Co., Ltd., and Liling Zen Ceramic Co., Ltd., which focus on high-purity, durable solutions for semiconductor, ceramics, and metallurgical industries. These companies strengthen their presence through innovation, technical expertise, and partnerships with end-use sectors. Regionally, New South Wales leads the market with 35% share in 2024, supported by its strong semiconductor and ceramics industries. Victoria follows with 25%, driven by advanced ceramics and glass applications, while Queensland, Western Australia, and South Australia collectively contribute steady demand from metallurgy and niche manufacturing. The dominance of New South Wales highlights the concentration of advanced technology manufacturing hubs, positioning it as the most influential regional market for quartz saggers in Australia.

Market Insights

- The Australia quartz sagger market was valued at USD 20.33 million in 2024 and is projected to reach USD 26.95 million by 2032, growing at a CAGR of 3.6%.

- Rising demand from the electronics and semiconductor industry, which held nearly 50% share in 2024, is a key driver as high-purity saggers are vital in wafer processing and advanced component production.

- A major trend is the shift toward customized and high-purity saggers, designed for improved thermal resistance and longer service life, meeting the needs of ceramics and metallurgy industries.

- The market is moderately consolidated, with global players like Saint-Gobain, NORITAKE, and Morgan Advanced Materials competing against regional suppliers such as Zibo Gotrays and Liling Zen Ceramic, emphasizing innovation and durability.

- New South Wales led with 35% share in 2024, followed by Victoria at 25%, while square saggers accounted for the largest shape segment with 45% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Shape

The square segment dominated the Australia quartz sagger market in 2024, capturing nearly 45% of the share. Its popularity is driven by better stacking efficiency and uniform heat distribution, which are critical in high-volume firing processes. Square saggers also offer cost benefits by maximizing furnace space, making them highly preferred in ceramics and semiconductor applications. Cylindrical saggers follow, particularly used for specialized powder sintering, while other shapes remain limited to custom or research-based uses. Demand for square saggers continues to grow as industries seek higher thermal stability and lower operational costs.

- For instance, Morgan Advanced Materials produces saggers and other ceramic components for semiconductor manufacturing and operates in multiple countries, including Australia.

By Application

Firing ceramics emerged as the leading application, accounting for over 40% of the market share in 2024. The growth is fueled by Australia’s expanding ceramics and advanced materials sector, where precise temperature control is essential. Quartz saggers ensure minimal contamination and high purity, supporting superior ceramic quality. Sintering powders ranks second, driven by applications in electronic components and high-performance materials. Heat treating metals also shows steady demand from metallurgy industries. Increasing investments in ceramics manufacturing capacity further reinforce the leadership of firing ceramics as the dominant segment.

- For instance, Kiln furniture, including saggers made of materials like fused quartz ceramic, is utilized in the production of ceramic tiles and insulators. These components are designed to withstand extremely high temperatures, often exceeding 1,200°C, and provide a stable atmosphere for items during firing.

By End User

The electronics and semiconductors industry held the largest share, representing nearly 50% of the market in 2024. Rising demand for high-purity quartz saggers in wafer processing and advanced semiconductor fabrication drives this dominance. These saggers are valued for their resistance to high temperatures and ability to reduce impurities, aligning with the industry’s stringent quality requirements. Metallurgy industries follow as key users, utilizing quartz saggers for alloy sintering and heat treatments. Glass industries also adopt them for specialized melting processes. The growing semiconductor ecosystem in Australia strengthens this end-user segment’s leadership.

Key Growth Drivers

Rising Semiconductor Manufacturing Demand

The expansion of the semiconductor and electronics industry is a major driver for the Australia quartz sagger market. Quartz saggers are essential in wafer processing, sintering, and high-purity component manufacturing, as they withstand extreme thermal stress while preventing contamination. Australia’s growing focus on semiconductor supply chain resilience, supported by regional investments in advanced electronics, has increased demand for reliable thermal equipment. As global chip shortages highlight the importance of local production, quartz saggers gain traction due to their durability and compatibility with high-precision processes. This trend is reinforced by ongoing technological upgrades in semiconductor fabrication units, ensuring consistent growth.

- For instance, in the manufacturing of silicon wafers, a large quartz crucible can be used for the Czochralski process, where polysilicon is melted at temperatures exceeding 1,400°C for crystal growth. This process requires extremely high purity to ensure contamination-free processing.

Growth in Advanced Ceramics Applications

The demand for advanced ceramics in Australia is another key growth driver. Industries such as energy, aerospace, and healthcare rely on ceramics for their superior mechanical strength and thermal resistance. Quartz saggers play a crucial role in firing ceramics at controlled temperatures, ensuring high structural integrity and purity. With ceramics increasingly replacing metals in applications like medical implants, electronics, and renewable energy components, saggers become indispensable for production quality. Local initiatives to strengthen domestic ceramic production, alongside global export potential, are creating a sustained rise in sagger demand. This driver positions the ceramics sector as a pivotal contributor to market expansion.

Increasing Metallurgical and Heat-Treatment Needs

Australia’s strong presence in metallurgy and mining creates robust demand for quartz saggers in metal heat-treating and sintering applications. Metallurgy industries require saggers for producing specialized alloys and powders that meet performance requirements in aerospace, automotive, and industrial machinery. Quartz saggers are preferred due to their ability to endure high temperatures while minimizing contamination risks, which is critical for premium-grade metal production. The country’s investments in advanced metallurgical processes, combined with global demand for high-quality alloys, fuel the market further. This growth driver underscores the role of quartz saggers in maintaining Australia’s competitiveness in high-value metal processing.

Key Trends & Opportunities

Shift Toward High-Purity and Custom Designs

One key trend in the Australia quartz sagger market is the shift toward high-purity and customized sagger designs. As semiconductor and advanced ceramics industries expand, manufacturers demand saggers that minimize impurities and can be tailored for specific furnace geometries. This customization improves efficiency, reduces waste, and aligns with the precision standards required in high-tech industries. Opportunities are rising for local manufacturers to offer advanced saggers with optimized thermal shock resistance and longer lifespans. Companies investing in innovation and digital manufacturing technologies are likely to benefit most from this demand.

- For instance, in Queensland, Australia, a company named High Purity Quartz Limited (UltraHPQ) operates the Sugarbag Hill quartz deposit to produce ultra-high-purity quartz (UHPQ) sand with a target impurity level below 30 ppm.

Sustainability and Energy Efficiency in Production

A growing opportunity lies in the move toward sustainable and energy-efficient processes across Australian industries. Quartz saggers contribute by reducing energy consumption during firing and sintering, thanks to their stability and reusability. Manufacturers are increasingly focused on lifecycle cost reductions, and saggers with extended service life support these goals. The trend is aligned with Australia’s sustainability targets, encouraging companies to adopt materials and equipment that lower carbon footprints. Suppliers who can market eco-friendly saggers with verified performance data will gain a competitive edge, particularly as industries prioritize green certification and compliance.

Key Challenges

High Production Costs and Supply Chain Dependency

One major challenge in the Australia quartz sagger market is the high cost of raw materials and dependence on imports for high-purity quartz. Limited domestic availability makes the market vulnerable to price fluctuations and global supply disruptions. Producing saggers requires precision and advanced manufacturing techniques, which further raises costs. For smaller players, maintaining profitability while ensuring quality remains difficult. This challenge is particularly pressing for local manufacturers competing with global suppliers that operate at larger economies of scale. Addressing supply chain resilience and developing alternative sourcing strategies will be crucial.

Technical Limitations and Lifespan Concerns

Another challenge arises from the technical limitations of quartz saggers in extreme applications. Although highly durable, saggers can still suffer from thermal shock, mechanical stress, or chemical attack in certain metallurgical and ceramic environments. Frequent replacement drives up operational costs for end users and may discourage adoption in price-sensitive industries. Ensuring consistent quality and extending the lifespan of saggers through material innovation remain key challenges for manufacturers. Overcoming these barriers will require investments in R&D and close collaboration with end users to deliver tailored solutions.

Regional Analysis

New South Wales

New South Wales dominated the Australia quartz sagger market in 2024, holding nearly 35% share. The state’s strong electronics and semiconductor base, coupled with well-established ceramics manufacturers, drives this leadership. Advanced research facilities in Sydney and Newcastle further reinforce adoption of high-purity saggers in specialized applications. Growing infrastructure investments in high-tech industries are pushing demand for durable thermal processing materials. With rising government focus on technology-led manufacturing, New South Wales continues to strengthen its position as the largest regional consumer of quartz saggers, supported by both industrial and academic demand for high-performance thermal equipment.

Victoria

Victoria accounted for about 25% of the market share in 2024, ranking second. The state benefits from a strong ceramics industry presence, particularly in advanced ceramics for healthcare, aerospace, and energy applications. Melbourne serves as a hub for research in materials science, which enhances demand for high-quality quartz saggers in laboratories and industrial settings. Additionally, the state’s expanding glass industry contributes to usage in controlled heat treatments. The government’s focus on innovation and sustainable manufacturing is further encouraging adoption. With strong industrial diversity, Victoria represents a key growth region in Australia’s quartz sagger market.

Queensland

Queensland captured close to 15% market share in 2024, supported by its growing metallurgical and mining sectors. The state’s focus on advanced metal refining and specialty alloys creates strong demand for saggers used in high-temperature processes. Brisbane also hosts research centers developing advanced materials, further supporting adoption. While ceramics and semiconductor industries are relatively smaller compared to New South Wales and Victoria, metallurgy-driven demand provides consistent market growth. The state’s large resource base and ongoing mining investments ensure continued use of quartz saggers in processing technologies, positioning Queensland as a steadily growing regional contributor.

Western Australia

Western Australia held nearly 12% share of the quartz sagger market in 2024, largely driven by its robust mining and metallurgy industries. The region’s dominance in mineral extraction and refining requires advanced thermal processing, where quartz saggers are utilized for their purity and durability. While electronics and ceramics applications are limited, metallurgical end-users sustain steady adoption. Perth’s proximity to global export markets also creates opportunities for supplying high-performance saggers for industrial use. Continued investments in mining innovation and metal refining are expected to keep Western Australia as a significant, though specialized, regional segment in this market.

South Australia and Others (Tasmania, Northern Territory)

South Australia, along with Tasmania and the Northern Territory, collectively represented about 13% market share in 2024. South Australia contributes through its glass manufacturing and ceramics sector, particularly in Adelaide, where innovation in advanced materials supports demand. Tasmania and Northern Territory, though smaller markets, generate niche usage in mining-related applications and specialty industries. These regions are gradually increasing adoption as localized manufacturing initiatives promote greater reliance on advanced thermal processing tools. Together, they form a stable but smaller share of the market, reflecting their specialized industrial bases compared with larger Australian states.

Market Segmentations:

By Shape

- Square

- Cylindrical

- Others

By Application

- Firing Ceramics

- Sintering Powders

- Heat Treating Metals

- Others

By End User

- Electronics and Semiconductors Industry

- Metallurgy Industries

- Glass Industries

- Others

By Geography

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia and Others (Tasmania, Northern Territory)

Competitive Landscape

The competitive landscape of the Australia quartz sagger market is shaped by the presence of both global and regional manufacturers offering specialized products for advanced industrial applications. Leading companies such as Saint-Gobain, NORITAKE CO., LIMITED, and Morgan Advanced Materials plc dominate with strong R&D capabilities, wide product portfolios, and well-established global distribution networks. Domestic and regional players, including Zibo Gotrays Industry Co., Ltd., Liling Zen Ceramic Co., Ltd., and Shandong Topower Pte Ltd., strengthen their positions through cost-competitive offerings and customized solutions. Meanwhile, Magma Group and other niche suppliers focus on metallurgical and ceramics industries with application-specific designs. Competition is largely defined by product quality, lifespan, and technical performance, with companies investing in innovations such as high-purity materials and energy-efficient saggers. Partnerships with semiconductor and ceramics industries, along with a growing emphasis on sustainability, further shape strategies. The market remains moderately consolidated, with global leaders maintaining dominance while regional players capture specialized demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, Sumitomo Refractories announces the development of a sustainable, recyclable quartz sagger.

- In 2022, RHI Magnesita invests in a new manufacturing facility for advanced quartz saggers in China.

Report Coverage

The research report offers an in-depth analysis based on Shape, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, driven by increasing semiconductor manufacturing demand in Australia.

- Advanced ceramics production will continue to strengthen quartz sagger adoption across industries.

- Electronics and semiconductor industries will remain the dominant end users of quartz saggers.

- Square saggers will retain leadership due to efficiency in stacking and uniform heat distribution.

- Metallurgy applications will support stable growth through rising demand for specialized alloys.

- High-purity and customized saggers will gain preference for precision-driven processes.

- Sustainability initiatives will push manufacturers to develop longer-lasting and energy-efficient saggers.

- Global leaders will expand their presence, while regional suppliers will focus on niche applications.

- New South Wales will maintain the largest share, with Victoria emerging as a strong secondary hub.

- Continued R&D investment will improve thermal resistance, durability, and cost efficiency in saggers.