Market Overview

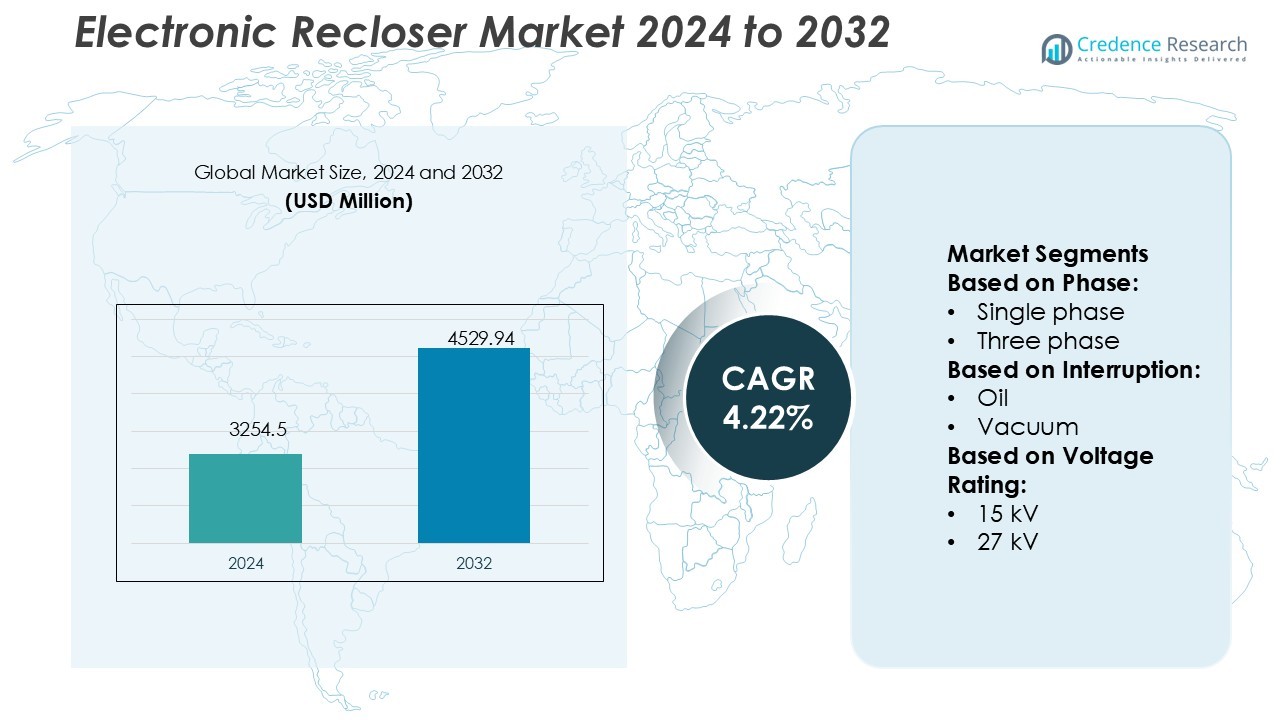

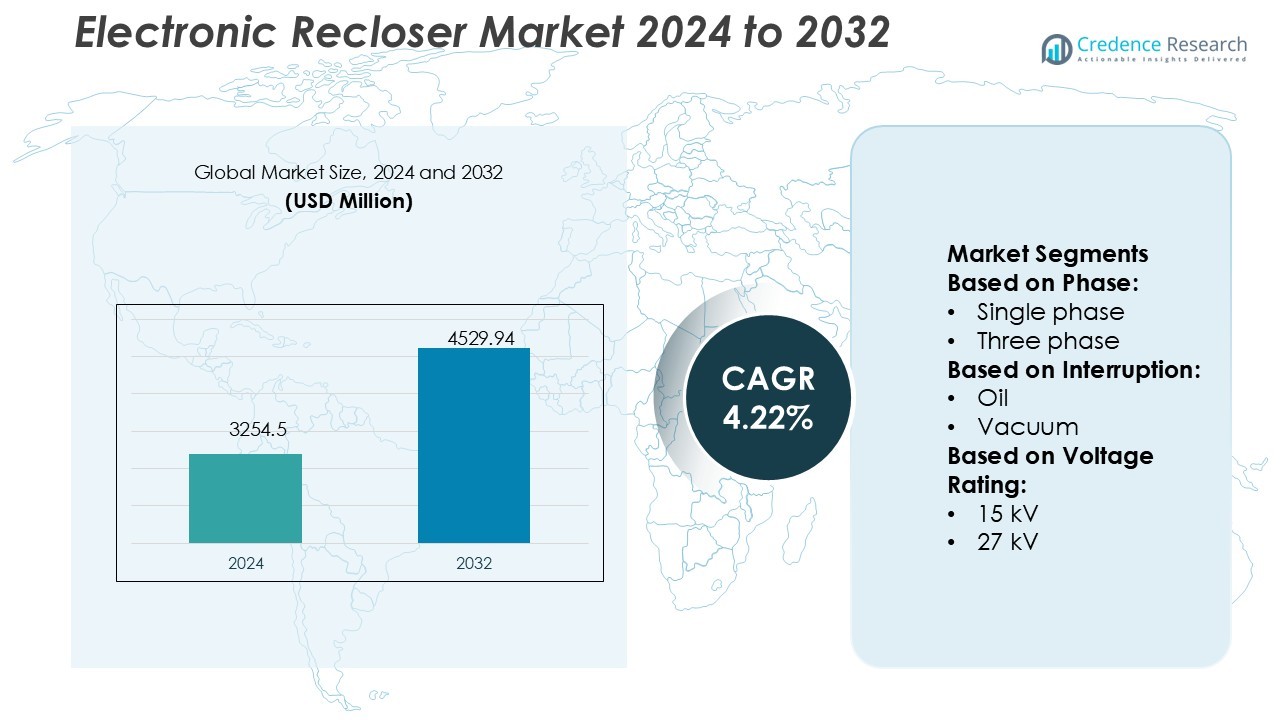

Electronic Recloser Market size was valued USD 3254.5 million in 2024 and is anticipated to reach USD 4529.94 million by 2032, at a CAGR of 4.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Recloser Market Size 2024 |

USD 3254.5 Million |

| Electronic Recloser Market, CAGR |

4.22% |

| Electronic Recloser Market Size 2032 |

USD 4529.94 Million |

The Electronic Recloser Market is highly competitive, with major players including Rockwill, Eaton, Hughes Power System, ENSTO, G&W Electric, NOJA Power Switchgear Pty Ltd, ENTEC Electric & Electronic, ABB, Hubbell, and ARTECHE. These companies lead the market through advanced automation technologies, IoT integration, and grid modernization solutions. Continuous investment in research, innovation, and sustainable product design strengthens their global presence. The focus on digital reclosers and smart control systems enhances fault management and operational reliability. North America dominates the market with a 37% share, driven by widespread adoption of smart grid infrastructure, strong utility investments, and stringent energy reliability standards supporting modernized power distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electronic Recloser Market size was valued at USD 3254.5 million in 2024 and is projected to reach USD 4529.94 million by 2032, registering a CAGR of 4.22% during the forecast period.

- Market growth is driven by rising demand for smart grid automation, improved fault detection systems, and increasing renewable energy integration to enhance grid stability.

- The market is witnessing trends toward IoT-based reclosers, AI-enabled predictive maintenance, and eco-friendly insulation materials, improving efficiency and reliability.

- Leading players focus on innovation, sustainability, and digital recloser designs, while smaller manufacturers face cost and infrastructure restraints that limit large-scale adoption in developing economies.

- North America holds a 37% share, leading the market, followed by Europe with 28% and Asia-Pacific with 24%, supported by ongoing grid modernization and strong adoption of the three-phase recloser segment, which accounts for the largest share in global installations.

Market Segmentation Analysis:

By Phase

The three-phase segment dominates the Electronic Recloser Market with a 67.4% share in 2024. It is widely adopted in industrial and utility applications due to its superior load management, stability, and capacity to handle high-voltage distribution systems. The increasing integration of three-phase reclosers in smart grids enhances system reliability and minimizes outage durations. Single-phase reclosers, while preferred in rural and residential setups, hold a smaller share due to limited power-handling capability. Rising investments in grid automation and rural electrification further strengthen three-phase recloser demand.

- For instance, Rockwill’s RCW vacuum recloser (a three-phase design) supports current ratings up to 1,250 A and voltage classes up to 38 kV, enabling deployment on heavy feeders in utility networks.

By Interruption

The vacuum interruption segment leads the market, accounting for 73.1% of total revenue in 2024. Vacuum reclosers offer longer operational life, minimal maintenance, and faster arc quenching, making them ideal for medium-voltage distribution networks. Their growing preference over oil-based models stems from environmental benefits and compliance with safety regulations. Oil interruption reclosers are declining in use due to leakage risks and higher maintenance costs. The global trend toward sustainability and increased deployment of eco-efficient switchgear drives vacuum technology adoption across utilities.

- For instance, Eaton’s NOVA three-phase vacuum recloser is rated for continuous current of 630 A and short-circuit interrupting capacity of 12,500 A, with a mechanical life of 10,000 operations before maintenance.

By Voltage Rating

The 27 kV segment holds the largest share of 52.6% in 2024, driven by its suitability for medium-voltage distribution systems. This voltage rating supports urban and semi-urban power grids, offering optimal efficiency and system protection balance. Utilities favor 27 kV reclosers for their adaptability in both overhead and underground networks. The 15 kV and 38 kV segments serve niche applications—15 kV for localized distribution, and 38 kV for high-load industrial environments. Expansion of renewable energy grids and modern substations further boosts demand for the 27 kV category.

Key Growth Drivers

Expansion of Smart Grid Infrastructure

The increasing development of smart grids drives the demand for electronic reclosers. Utilities are adopting automation to improve fault detection and enhance grid reliability. Electronic reclosers enable quick fault isolation and service restoration, reducing downtime. Governments and private operators are investing in grid modernization to support efficient power distribution. Their ability to enable real-time control and communication makes them essential for advanced energy management systems.

- For instance, Hughes’ ACR405 recloser for 33/40 kV networks features vacuum interrupters that can interrupt 20,000 A faults for 3 seconds, enabling utilities to clear high-current faults reliably.

Rising Renewable Energy Integration

The growing shift toward renewable energy sources boosts the use of electronic reclosers. These systems manage fluctuations in power flow from solar and wind generation. They help maintain grid balance and minimize disruptions caused by variable energy supply. As renewable capacity expands, the need for stable and intelligent power management solutions rises. Electronic reclosers play a crucial role in maintaining grid safety and optimizing distributed generation performance.

- For instance, ENSTO offers a range of reclosers—such as the 38 kV / 630 A Smartcloser—for overhead medium-voltage lines. These devices incorporate built-in automation functions for fault detection and automatic reclosing, making them suitable for grids with high renewable energy penetration.

Focus on Power Reliability and Automation

Increasing dependence on continuous power supply across industries is supporting market growth. Electronic reclosers enhance network reliability through automated fault management and quick power restoration. Their integration with remote monitoring and control systems improves operational efficiency. Modern designs support data-driven decision-making and preventive maintenance. The trend toward smart, automated distribution systems continues to accelerate the deployment of reclosers worldwide.

Key Trends & Opportunities

Integration of IoT and Cloud-Based Systems

IoT and cloud technologies are transforming the monitoring and management of electronic reclosers. Utilities use data analytics to predict faults and optimize maintenance schedules. Cloud platforms allow real-time tracking of performance, improving operational transparency. The integration of smart communication systems enhances control and supports predictive management. These digital upgrades open opportunities for manufacturers offering intelligent, connected solutions.

- For instance, G&W’s Viper-ST recloser (rated up to 38 kV, 800 A continuous) supports up to six internal voltage sensors and three dual-ratio current transformers, enabling real-time grid diagnostics over remote networks.

Adoption Across Emerging Economies

Developing regions are investing heavily in power infrastructure expansion. Governments are focusing on reducing energy losses and improving grid efficiency. Electronic reclosers provide cost-effective automation suitable for both urban and rural networks. Local manufacturing and partnerships with regional utilities further support market penetration. The rising demand for reliable energy distribution systems creates strong opportunities for new entrants.

Advancements in Vacuum and Solid-State Designs

- For instance, NOJA Power’s OSM38 recloser is rated for a continuous current of 800 A and an operating voltage class of 38 kV. It has a fault break capacity of 12,500 A and a mechanical life rated up to 30,000 operations.

Continuous innovation in recloser technology is enhancing reliability and safety. Solid-state and vacuum interrupters deliver better performance and require less maintenance than older models. Manufacturers are designing eco-friendly and compact systems suited for modern grid conditions. These technological upgrades help utilities reduce operational risks and extend equipment life. Progress in materials and control systems drives the evolution of smarter and more sustainable reclosers.

Key Challenges

High Implementation and Maintenance Costs

The deployment of electronic reclosers involves significant investment in hardware and communication systems. Smaller utilities often face financial barriers to adopting advanced automation. Maintenance of complex control units also increases long-term operational costs. Limited technical expertise in developing regions adds further constraints. These cost factors remain a major obstacle to widespread adoption.

Cybersecurity and Data Protection Concerns

As reclosers become more connected, cybersecurity risks grow. Unauthorized access to control networks can disrupt operations and compromise safety. Ensuring secure communication between devices requires strong encryption and continuous monitoring. Compliance with global data protection standards increases system complexity. Addressing these security challenges is critical to maintaining trust and operational reliability in digital grid environments.

Regional Analysis

North America

North America holds the leading position in the Electronic Recloser Market with a market share of 37%. The region’s dominance is supported by advanced grid modernization initiatives and the presence of major utility providers. The United States and Canada are investing heavily in smart grid deployment and renewable energy integration. Strong regulatory frameworks encouraging grid reliability and sustainability drive demand for automated protection systems. The adoption of digital technologies, such as IoT and SCADA-based monitoring, further strengthens market growth. Continuous investments in power infrastructure upgrades ensure steady expansion in the coming years.

Europe

Europe accounts for 28% of the Electronic Recloser Market, driven by a strong focus on renewable energy transition and grid stability. Countries such as Germany, France, and the United Kingdom lead installations of intelligent power distribution systems. The European Union’s energy efficiency directives encourage the use of automated protection equipment to minimize power losses. Utilities are upgrading traditional grids with digital reclosers to handle distributed energy resources effectively. Technological advancements, combined with stringent reliability standards, foster market growth. The increasing emphasis on sustainability and energy security continues to shape market expansion across the region.

Asia-Pacific

Asia-Pacific captures 24% of the Electronic Recloser Market, making it one of the fastest-growing regions globally. Rapid urbanization, industrial expansion, and government-led electrification programs drive strong demand. China, India, Japan, and South Korea are key contributors, focusing on enhancing grid reliability and rural power distribution. Growing renewable energy adoption and digital infrastructure investments support the integration of smart reclosers. Local manufacturers are expanding production capabilities to meet the region’s rising demand. The shift toward efficient and resilient power distribution networks positions Asia-Pacific as a key growth hub in the global market.

Latin America

Latin America represents 7% of the Electronic Recloser Market, supported by modernization projects in Brazil, Mexico, and Chile. Governments are prioritizing rural electrification and renewable energy integration to improve power accessibility. The region’s utilities are adopting electronic reclosers to reduce outage times and enhance operational efficiency. Favorable regulatory policies and partnerships with global equipment providers accelerate market penetration. Economic development and investment in power reliability infrastructure contribute to steady growth. Despite challenges such as financial constraints and limited technical expertise, the market shows strong long-term potential for expansion.

Middle East & Africa

The Middle East & Africa hold an 4% share of the Electronic Recloser Market, with growth driven by expanding utility networks and smart grid initiatives. Countries like the United Arab Emirates, Saudi Arabia, and South Africa are modernizing power infrastructure to support industrialization. The rising integration of renewable energy sources such as solar and wind increases the need for reliable grid protection systems. Investments in automation and distribution management strengthen regional power stability. Although adoption remains gradual, government-led electrification programs and international collaborations are expected to drive consistent market growth across the region.

Market Segmentations:

By Phase:

By Interruption:

By Voltage Rating:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electronic Recloser Market features strong competition among leading players such as Rockwill, Eaton, Hughes Power System, ENSTO, G&W Electric, NOJA Power Switchgear Pty Ltd, ENTEC Electric & Electronic, ABB, Hubbell, and ARTECHE. The Electronic Recloser Market is characterized by strong competition and continuous technological advancement. Companies are focusing on developing intelligent, automated systems to enhance grid reliability and fault management. The growing adoption of IoT-enabled and cloud-connected reclosers supports real-time monitoring and predictive maintenance. Manufacturers are emphasizing digital control, sustainability, and energy efficiency to meet evolving grid modernization goals. Strategic collaborations with utility operators and renewable energy developers are expanding market reach. Continuous investment in research, innovation, and smart grid integration remains central to maintaining competitiveness and addressing global demand for reliable power distribution solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rockwill

- Eaton

- Hughes Power System

- ENSTO

- G&W Electric

- NOJA Power Switchgear Pty Ltd

- ENTEC Electric & Electronic

- ABB

- Hubbell

- ARTECHE

Recent Developments

- In September 2025, The U.S. Department of Energy (DOE) has announced a significant investment to accelerate the construction of large-scale transmission lines across the country. This funding is aimed at enhancing the nation’s electrical grid infrastructure, ensuring a more reliable and resilient power supply.

- In March 2025, Hubbell introduce its new single phase recloser featuring advanced fault detection, remote ground level resetting via a yellow handle, and visible semaphore/ beacon indicators enhancing both grid reliability and line worker safety through improved operational efficiency.

- In March 2025, Easton unveiled a novel solution integrated into its Form 7 recloser control that uses sensors and machine learning to identify and isolate high impedance faults achieving over 90% detection accuracy. Pilot tests with U.S. utilities supports its deployment.

- In March 2025, S&C Electric Company secured a contract to provide its TripSaver II reclosers for a grid modernization initiative in North America. The project, focused on enhancing grid resilience, achieved a 10% improvement in system reliability and a 12% reduction in maintenance costs.

Report Coverage

The research report offers an in-depth analysis based on Phase, Interruption, Voltage Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increased investment in smart grid modernization projects.

- Rising renewable energy integration will create stronger demand for automated reclosers.

- IoT and AI technologies will enhance monitoring and predictive maintenance capabilities.

- Utilities will adopt eco-friendly designs to meet sustainability and efficiency goals.

- Emerging economies will drive growth through rural electrification and power reliability projects.

- Manufacturers will focus on compact and low-maintenance recloser designs for cost efficiency.

- Digitalization and remote control systems will improve operational transparency and grid safety.

- Strategic partnerships between global and regional players will boost technology deployment.

- Regulatory policies favoring smart infrastructure will accelerate market penetration.

- Advancements in solid-state and vacuum interrupter technology will shape long-term innovation.