Market Overview:

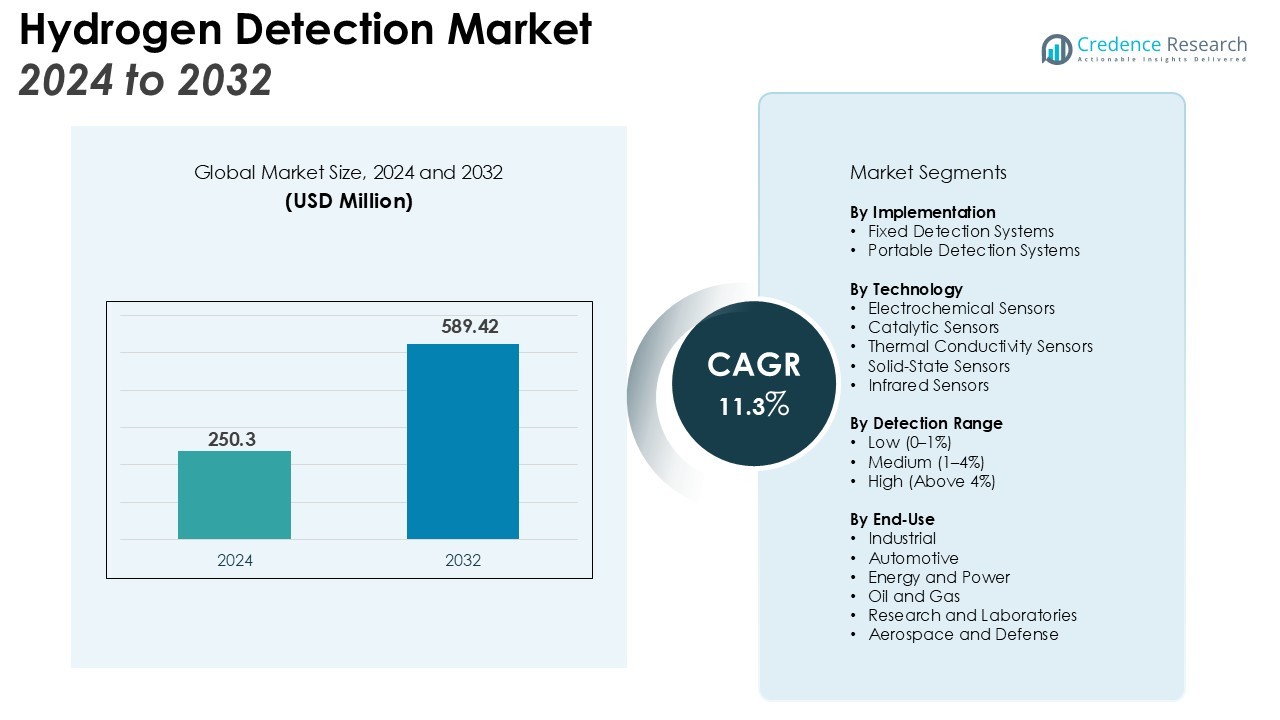

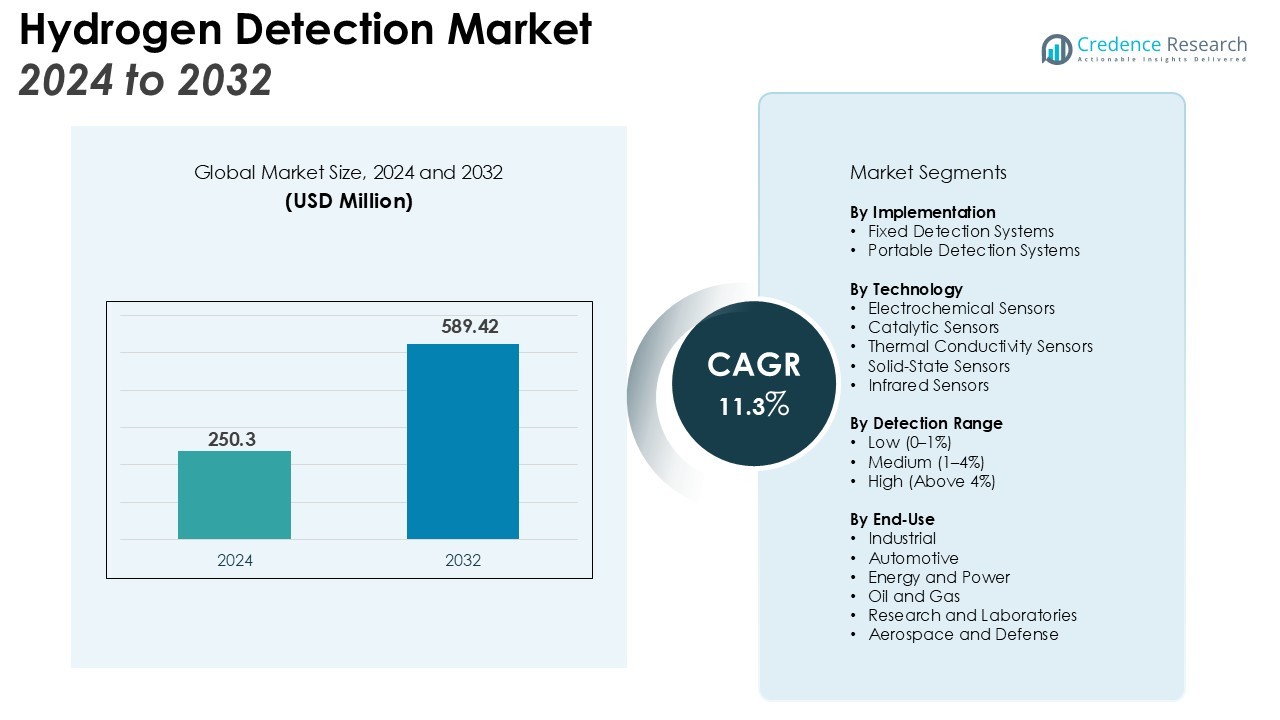

The Hydrogen Detection Market size was valued at USD 250.3 million in 2024 and is anticipated to reach USD 589.42 million by 2032, at a CAGR of 11.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrogen Detection Market Size 2024 |

USD 250.3 Million |

| Hydrogen Detection Market, CAGR |

11.3% |

| Hydrogen Detection Market Size 2032 |

USD 589.42 Million |

The demand for reliable and efficient hydrogen detection systems is driven by strict safety regulations and the global shift toward clean energy. Advancements in sensor technologies, such as miniaturized detectors, IoT-enabled monitoring, and real-time data analytics, are enhancing system precision and reliability. Rising investment in green hydrogen projects and the growing emphasis on safety in hydrogen-powered vehicles are also key contributors to market expansion.

North America leads the hydrogen detection market due to significant government support for hydrogen infrastructure and early adoption across industries. Europe follows closely, supported by its stringent emission standards and hydrogen strategies. The Asia-Pacific region is emerging as a major growth hub, driven by strong clean energy policies and industrial development in countries such as China, Japan, and South Korea, which are advancing hydrogen technology deployment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Hydrogen Detection Market is valued at USD 250.3 million and is expected to reach USD 589.42 million by 2032, driven by rising safety demands across industries.

- Strict government regulations and global clean energy initiatives are accelerating the adoption of certified hydrogen detection systems.

- Advancements in miniaturized sensors, IoT connectivity, and AI-based analytics are improving detection accuracy and operational efficiency.

- Growing investment in green hydrogen projects is creating consistent demand for reliable leak monitoring in production and storage facilities.

- High system cost and complex calibration remain key challenges for small and medium enterprises in adopting advanced detection solutions.

- North America leads the global market with a 38% share, followed by Europe with 31%, both supported by strong regulatory frameworks and infrastructure investments.

- Asia Pacific is emerging as the fastest-growing region, driven by large-scale hydrogen projects in China, Japan, and South Korea supported by government initiatives.

Market Drivers:

Growing Demand for Hydrogen Safety Across Industries

The Hydrogen Detection Market is expanding due to rising hydrogen adoption across transportation, power generation, and manufacturing sectors. The flammable nature of hydrogen creates a critical need for accurate leak detection systems in production, storage, and fuel cell applications. Industrial operators and refueling station developers are integrating advanced detection technologies to meet stringent safety standards. This growing emphasis on workplace safety and infrastructure protection drives continuous investment in detection equipment.

- For instance, Honeywell International Inc.’s HLD Series of hydrogen safety sensors can identify hydrogen leakage at concentrations as low as 50 parts per million (ppm), providing critical early warnings for safety systems.

Government Regulations and Hydrogen Economy Initiatives

Global governments are implementing strict regulations to ensure safety in hydrogen production and distribution. Policies promoting clean hydrogen projects and zero-emission targets push industries to adopt certified detection systems. Regulatory bodies in North America, Europe, and Asia-Pacific are enforcing safety codes that make detection technology mandatory. These initiatives create a supportive environment for companies developing advanced sensors and monitoring systems.

- For instance, Robert Bosch GmbH developed its hydrogen storage control unit to meet the functional safety requirements of ISO 26262, achieving a rating up to Automotive Safety Integrity Level (ASIL) C.

Technological Advancements in Sensing and Monitoring Systems

The market benefits from rapid progress in sensor accuracy, durability, and digital connectivity. Smart hydrogen detectors with IoT integration and AI-based data analytics allow continuous monitoring of hydrogen levels and early leak identification. It improves operational efficiency and reduces maintenance costs by providing predictive insights. The shift toward miniaturized and portable devices also supports wider industrial and mobile applications.

Rising Investment in Green Hydrogen Infrastructure

Large-scale investment in renewable hydrogen projects accelerates the need for advanced detection systems. Green hydrogen plants and storage terminals require continuous monitoring to ensure safety under high-pressure conditions. It strengthens the role of hydrogen sensors in maintaining operational reliability. The development of global hydrogen hubs further boosts demand for scalable detection solutions, enhancing the overall growth outlook of the market.

Market Trends:

Integration of Smart Technologies and Advanced Sensing Solutions

The Hydrogen Detection Market is witnessing a clear shift toward intelligent and connected detection systems. Manufacturers are developing IoT-enabled hydrogen sensors that provide real-time monitoring, remote diagnostics, and predictive maintenance capabilities. It helps facility operators identify potential leaks before they escalate, improving safety and operational efficiency. The adoption of AI and machine learning in gas detection enhances data interpretation and system automation. Miniaturized sensors designed for compact environments, including fuel cell vehicles and portable units, are gaining strong traction. Continuous product innovations, such as optical and solid-state sensors, offer higher accuracy, faster response time, and longer operational lifespan. These advancements reflect the growing alignment between digital technologies and hydrogen infrastructure safety.

- For instance, Siemens Energy’s Silyzer 300 PEM electrolyzer, with a rated power of 17.5 MW, can produce 335 kg of hydrogen per hour.

Focus on Green Energy Infrastructure and Sustainability Goals

Global efforts to decarbonize industrial and transport sectors are reinforcing demand for hydrogen detection solutions. The expansion of green hydrogen projects supported by renewable energy is creating large-scale opportunities for detection system suppliers. It enables safe production, storage, and transportation of hydrogen in clean energy facilities. Governments and private investors are prioritizing projects aligned with net-zero targets, which directly boost sensor adoption. The market is also benefiting from partnerships between technology developers and energy firms to deploy scalable, cost-efficient safety solutions. Rising emphasis on sustainability certifications and compliance standards further increases product demand. These factors establish hydrogen detection technology as an essential component of the evolving clean energy ecosystem.

- For instance, in November 2024, HydrogenPro and J.H.K. formed a partnership to develop green hydrogen projects with capacities ranging from 5 to 50 MW in Germany, Austria, and the Benelux countries.

Market Challenges Analysis:

High Cost and Technical Complexity of Advanced Detection Systems

The Hydrogen Detection Market faces challenges due to the high cost of advanced detection technologies. Sophisticated sensor systems that offer real-time monitoring, IoT integration, and AI-based analytics require significant investment. It limits adoption among small and medium enterprises operating with constrained budgets. Complex calibration processes and the need for skilled technicians further raise operational expenses. The variability of hydrogen concentration in different environments also complicates sensor design and performance. Manufacturers must balance accuracy, durability, and affordability to remain competitive. The cost-pressure dynamic continues to influence large-scale deployment across developing economies.

Limited Standardization and Environmental Sensitivity of Sensors

The absence of universal standards for hydrogen detection equipment creates inconsistency in safety practices across regions. It challenges manufacturers in achieving global compliance and interoperability. Environmental factors such as temperature, humidity, and cross-gas interference affect sensor accuracy, reducing reliability in extreme conditions. Maintenance frequency and sensor drift add to operational downtime in industrial applications. Industry stakeholders are focusing on developing stable, multi-environment sensors to address these issues. Delays in setting clear certification frameworks hinder market scalability and technology harmonization. These barriers slow the widespread integration of hydrogen detection systems in high-growth sectors.

Market Opportunities:

Expansion of Global Hydrogen Infrastructure and Energy Projects

The Hydrogen Detection Market is positioned for strong growth with the expansion of global hydrogen infrastructure. Large-scale investments in hydrogen production, transport, and storage facilities are increasing demand for reliable detection systems. It creates opportunities for manufacturers to supply advanced safety and monitoring technologies to new green hydrogen projects. Governments are supporting clean energy transitions through subsidies and public-private partnerships, boosting sensor deployment. The rise of hydrogen refueling networks for fuel cell vehicles also strengthens product demand. Integration of hydrogen pipelines and distribution systems presents long-term prospects for detection system suppliers. These developments reinforce the strategic importance of safety technologies in sustainable energy ecosystems.

Advancement in Sensor Technology and Smart Industrial Applications

Rapid progress in sensor materials, digital integration, and wireless connectivity offers new growth avenues for hydrogen detection providers. It allows companies to deliver compact, cost-effective, and intelligent devices suitable for industrial, automotive, and residential use. Emerging innovations such as nanomaterial-based and optical fiber sensors improve accuracy and lifespan. Collaboration between energy and technology firms supports the development of AI-driven monitoring platforms. The growing focus on predictive safety management encourages adoption of smart sensors. Expanding industrial automation and digital twin systems also create demand for integrated hydrogen detection solutions. These opportunities strengthen market competitiveness and drive continuous technological evolution.

Market Segmentation Analysis:

By Implementation

The Hydrogen Detection Market is segmented into fixed and portable detection systems. Fixed detectors account for the larger share due to their continuous operation in industrial plants, hydrogen refueling stations, and storage facilities. It enables real-time monitoring and rapid leak identification, ensuring compliance with strict safety standards. Portable detectors are gaining traction for on-site inspections, maintenance, and emergency use because of their mobility and ease of operation. The increasing deployment of mobile hydrogen applications supports the growing adoption of compact portable systems.

- For instance, Honeywell’s Hydrogen Leak Detector (HLD) sensor utilizes thermal conductivity technology to identify hydrogen leakage at levels as low as 50 ppm, enhancing safety in hydrogen-powered systems.

By Technology

The market includes electrochemical, catalytic, thermal conductivity, and solid-state sensors. Electrochemical sensors dominate due to their superior sensitivity and fast response at low hydrogen concentrations. It remains a preferred choice in refineries, laboratories, and energy plants. Solid-state sensors are expanding their presence due to long service life, low maintenance, and compatibility with IoT platforms for smart monitoring. Catalytic sensors continue to play a vital role in industrial environments requiring high-temperature durability.

By Detection Range

The market is categorized into low (0–1%), medium (1–4%), and high (above 4%) detection ranges. Low detection range sensors hold the highest share, offering early leak identification and enhanced safety in high-risk areas. It supports preventive maintenance and reduces operational hazards. Medium and high detection range systems are widely used in hydrogen fuel cell and industrial process applications where concentration levels fluctuate frequently. These systems ensure precise monitoring under varying environmental conditions.

- For instance, a recently developed organic semiconductor sensor demonstrated a rapid signal response time of approximately 0.84 seconds when exposed to a low hydrogen concentration of 1%.

Segmentations:

By Implementation

- Fixed Detection Systems

- Portable Detection Systems

By Technology

- Electrochemical Sensors

- Catalytic Sensors

- Thermal Conductivity Sensors

- Solid-State Sensors

- Infrared Sensors

By Detection Range

- Low (0–1%)

- Medium (1–4%)

- High (Above 4%)

By End-Use

- Industrial

- Automotive

- Energy and Power

- Oil and Gas

- Research and Laboratories

- Aerospace and Defense

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leading with Strong Hydrogen Infrastructure and Regulatory Support

North America holds a 38% share of the global Hydrogen Detection Market, maintaining its dominance through advanced safety regulations and infrastructure development. The United States and Canada are leading large-scale hydrogen projects supported by federal incentives and private investment. It drives demand for hydrogen detection systems across production, storage, and transportation sectors. Strong regulatory frameworks such as OSHA and NFPA standards ensure strict safety compliance. Expansion of hydrogen refueling networks and renewable energy facilities supports steady product adoption. Collaboration between technology developers and industrial operators continues to strengthen regional competitiveness and innovation.

Europe Advancing with Clean Energy Transition and Policy Alignment

Europe accounts for 31% of the global Hydrogen Detection Market share, reflecting the region’s strong focus on clean energy and sustainability. It benefits from coordinated hydrogen strategies that promote large-scale infrastructure expansion and safety standardization. Germany, France, and the United Kingdom remain major contributors due to heavy investment in renewable hydrogen production and transportation projects. Ongoing advancements in sensor technology and automation enhance operational safety. The presence of dedicated research centers and favorable regulations strengthens industry innovation. Expanding hydrogen hubs and cross-border collaborations sustain the region’s growing adoption of advanced detection systems.

Asia Pacific Emerging as the Fastest-Growing Market

Asia Pacific captures 24% of the Hydrogen Detection Market share and is projected to experience the highest growth rate ahead. China, Japan, and South Korea are driving strong investment in hydrogen generation and fuel cell networks. It boosts the installation of detection technologies across refueling stations, industrial facilities, and logistics operations. Local manufacturers are focusing on developing IoT-enabled and AI-supported sensors for improved accuracy. Supportive government policies and industrial modernization initiatives enhance market growth. Expanding infrastructure and increasing collaborations with global technology partners reinforce Asia Pacific’s position in hydrogen safety innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Figaro Engineering Inc.

- H2scan

- Teledyne Technologies

- Honeywell International Inc.

- Hydrogen Sense Technology Co., Ltd

- MEMBRAPOR AG

- NevadaNano

Competitive Analysis:

The Hydrogen Detection Market is competitive with strong participation from global and regional manufacturers offering advanced safety and monitoring solutions. Companies focus on developing high-precision sensors with IoT connectivity, AI analytics, and faster response times to enhance performance in industrial and energy applications. It emphasizes continuous product innovation and reliability to meet evolving safety regulations. Firms are expanding production capabilities and forming partnerships with energy providers to strengthen distribution networks. Strategic investments in R&D support the development of compact, durable, and cost-efficient detection systems. Market players are also prioritizing sustainability through energy-efficient designs and integration with green hydrogen facilities. This competition drives steady technological advancement and ensures a diverse range of solutions for different operational environments.

Recent Developments:

- In August 2025, Teledyne Technologies announced an agreement to acquire the TransponderTech business from Saab AB, which includes technologies like the Automatic Identification System (AIS).

- In May 2025, Honeywell International Inc. announced a partnership with Nutanix to modernize the infrastructure for its Integrated Control and Safety System (ICSS), helping industrial clients accelerate digital transformation.

Report Coverage:

The research report offers an in-depth analysis based on Implementation, Technology, Detection Range, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Hydrogen Detection Market will continue expanding with increasing hydrogen infrastructure development across major economies.

- Advancements in AI and IoT-based sensors will enhance accuracy, predictive capability, and real-time safety monitoring.

- Integration of detection systems within hydrogen refueling networks will become a key focus for ensuring operational reliability.

- It will witness rising adoption across transportation, power generation, and industrial manufacturing sectors due to stricter safety norms.

- Companies will invest more in nanomaterial and optical sensing technologies to improve sensitivity and reduce maintenance needs.

- Government-backed clean energy initiatives will accelerate product deployment in green hydrogen production facilities.

- Standardization of safety frameworks will promote global interoperability of detection devices and improve user confidence.

- The demand for compact, wireless, and portable hydrogen detectors will grow in both industrial and residential applications.

- Strategic collaborations between energy corporations and technology providers will foster innovation and regional market penetration.

- Increasing awareness of hydrogen safety and sustainability will strengthen the role of detection technologies in future clean energy ecosystems.