Market Overview

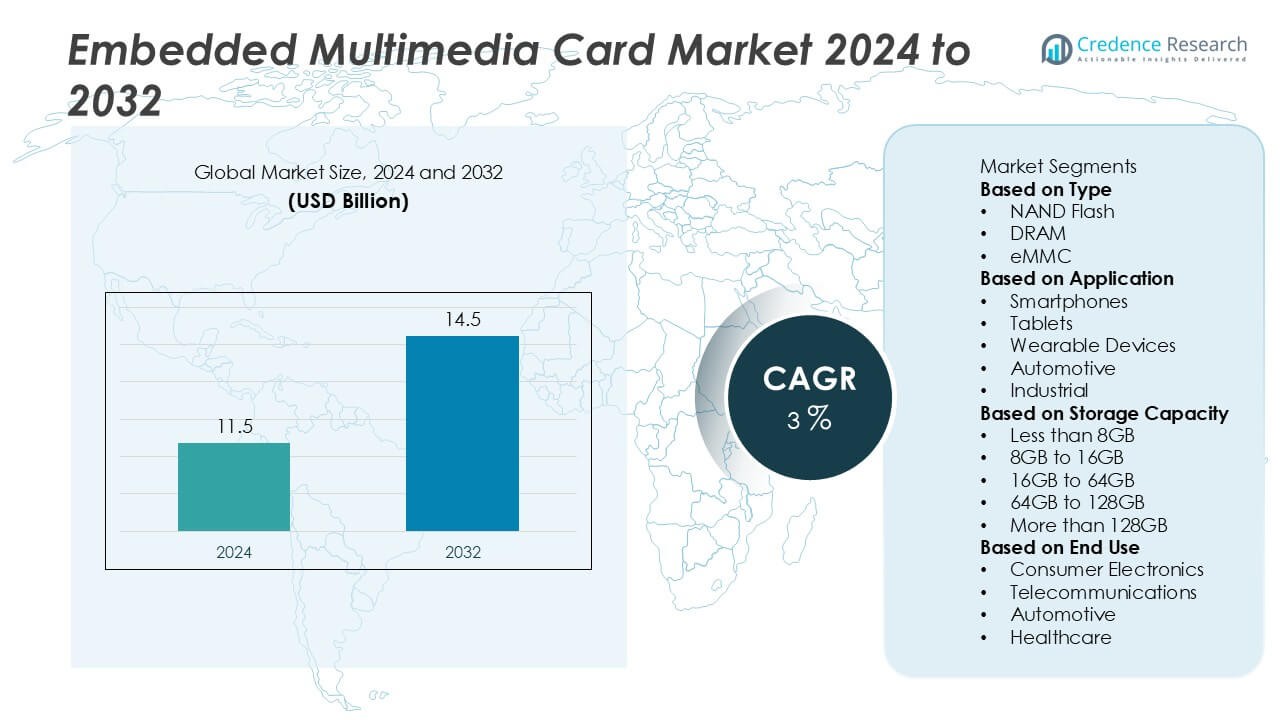

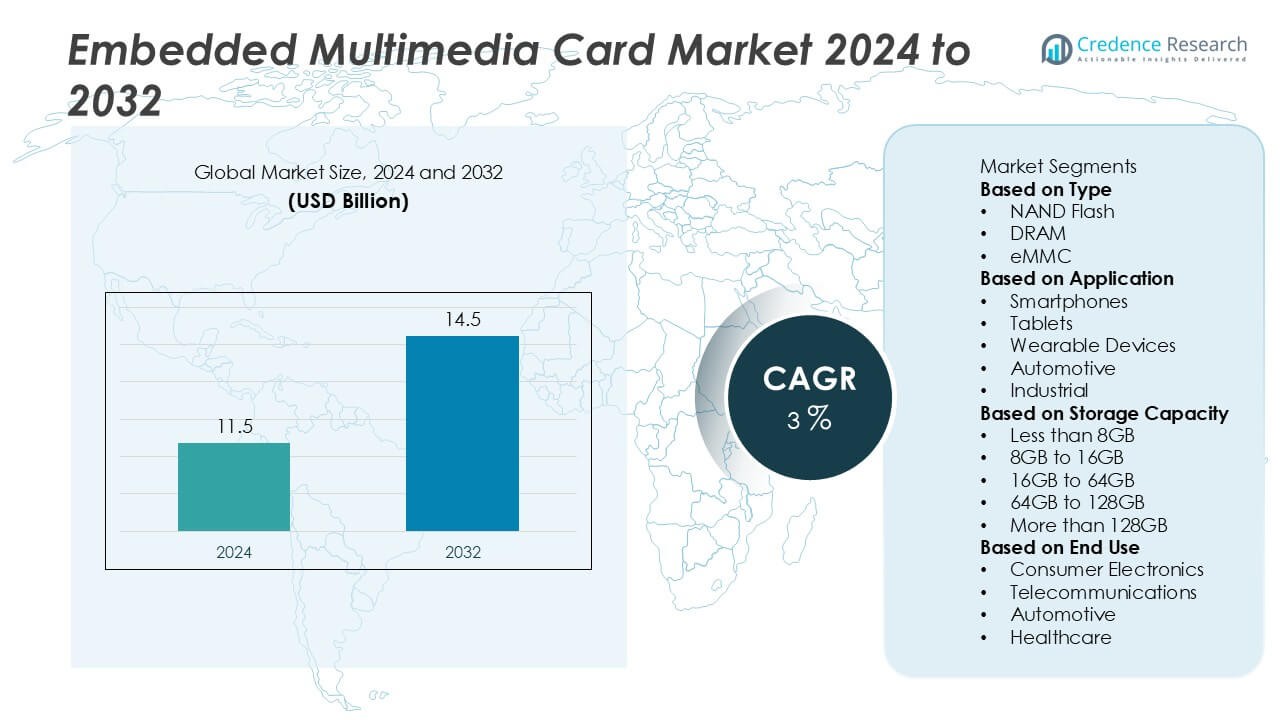

The Embedded Multimedia Card market size was valued at USD 11.5 billion in 2024 and is projected to reach USD 14.5 billion by 2032, growing at a compound annual growth rate (CAGR) of 3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Embedded Multimedia Card Market Size 2024 |

USD 11.5 Billion |

| Embedded Multimedia Card Market, CAGR |

3% |

| Embedded Multimedia Card Market Size 2032 |

USD 14.5 Billion |

The Embedded Multimedia Card Market grows on the back of rising demand for compact, cost-efficient storage solutions across smartphones, IoT devices, and automotive systems. It gains strength from expanding applications in infotainment, navigation, and connected consumer electronics that require reliable memory integration.

The Embedded Multimedia Card Market demonstrates strong regional presence across Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa, each contributing to its expansion through unique industry dynamics. Asia-Pacific leads growth with extensive electronics manufacturing and high consumer demand for smartphones and IoT devices, supported by major hubs in China, South Korea, and Japan. North America and Europe emphasize adoption in automotive and industrial systems, where reliability and durability remain critical. Latin America and the Middle East & Africa show steady growth driven by rising smartphone penetration and digital transformation initiatives. Key players shaping the competitive landscape include Kingston Technology, known for its diversified memory solutions, Western Digital, with strong expertise in storage technologies, and Micron Technology, a leader in semiconductor innovations. Other contributors such as Transcend Information and SK Hynix continue to enhance market competitiveness by focusing on efficiency, performance, and scalable solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Embedded Multimedia Card market was valued at USD 11.5 billion in 2024 and is projected to reach USD 14.5 billion by 2032, registering a CAGR of 3% during the forecast period.

- Rising demand for compact, affordable, and power-efficient storage solutions in smartphones, IoT devices, and automotive systems is driving consistent market growth.

- Increasing integration in infotainment, navigation, and connected consumer electronics highlights expanding applications that rely on reliable memory solutions.

- A steady trend toward higher storage capacities and power-efficient designs positions eMMC as a relevant choice for mainstream devices and smart consumer products.

- Competitive intensity remains high, with key players such as Kingston Technology, Western Digital, Micron Technology, Transcend Information, and SK Hynix focusing on scalability, product optimization, and R&D.

- Market restraints include competition from Universal Flash Storage (UFS) and solid-state drives, along with limitations in performance and endurance for advanced applications.

- Asia-Pacific leads the market with strong electronics manufacturing and smartphone adoption, while North America and Europe emphasize automotive and industrial usage, and Latin America along with the Middle East & Africa show steady growth from expanding digital adoption.

Market Drivers

Rising Demand for Compact and Cost-Effective Storage Solutions

The Embedded Multimedia Card Market benefits from growing demand for compact and cost-effective storage solutions across consumer electronics. Smartphones, tablets, and wearable devices rely on eMMC for reliable memory integration that balances performance with affordability. It serves as a preferred option for mid-range devices where power efficiency and space optimization are critical. Manufacturers integrate eMMC to streamline design and reduce bill-of-material costs. The broad adoption in budget and mid-tier smartphones strengthens its role in addressing cost-sensitive markets. It continues to support steady growth in portable electronics despite competition from advanced storage formats.

- For instance, In 2022, global smartphone shipments were around 1.2 billion units, reaching their lowest total since 2013 due to dampening consumer demand. eMMC storage is used primarily in budget smartphones and tablets, including some sub-$200 models from brands like Realme and Redmi sold in emerging markets.

Expanding Applications in Automotive Electronics and Infotainment Systems

The Embedded Multimedia Card Market gains traction through rising adoption in automotive applications. Infotainment systems, navigation modules, and advanced driver-assistance systems use eMMC for dependable data storage. It delivers consistent performance under demanding automotive conditions with emphasis on durability and reliability. Carmakers integrate eMMC to support software-driven functions that enhance user experience. Its compatibility with evolving automotive standards ensures relevance across diverse vehicle models. This steady use in vehicles strengthens long-term growth opportunities for the industry.

- For instance, Tesla initially equipped its Model S and Model X vehicles with 8GB eMMC modules but later replaced them with 64GB eMMC memory to address longevity and performance demands as infotainment complexity grew.

Growing Penetration of IoT Devices and Smart Consumer Products

The Embedded Multimedia Card Market benefits from expanding deployment of IoT devices and connected home solutions. Smart appliances, security systems, and industrial IoT endpoints adopt eMMC for reliable data handling in compact designs. It offers scalable memory options that suit varying application requirements. Manufacturers use it to ensure stability while keeping device costs manageable. This demand aligns with accelerating smart home adoption and broader IoT ecosystems. It positions eMMC as a trusted storage medium for next-generation consumer and industrial products.

Strong Presence in Emerging Markets with Expanding Consumer Base

The Embedded Multimedia Card Market experiences growth from rising smartphone penetration and electronics manufacturing in emerging economies. Expanding middle-class populations in Asia-Pacific and Latin America drive demand for affordable devices. It supports manufacturers seeking to balance performance with cost efficiency in these high-volume markets. Local production facilities strengthen supply chains and increase adoption rates. This momentum reinforces the role of eMMC in supporting economic digitalization. It secures long-term prospects by aligning with demographic and regional growth trends.

Market Trends

Shift Toward Higher Storage Capacities to Support Advanced Applications

The Embedded Multimedia Card Market shows a steady trend toward higher storage capacities driven by growing multimedia needs. Smartphones, infotainment systems, and IoT devices demand larger memory to handle complex applications. It responds with continuous improvements in density and performance. Manufacturers invest in advanced NAND technology to deliver eMMC solutions that support higher resolutions and faster data processing. This trend aligns with the rising consumption of video content and mobile applications. It ensures eMMC remains relevant in markets that prioritize cost efficiency along with functionality.

- For instance, Samsung introduced 512GB eUFS (embedded Universal Flash Storage) 2.1 chips, supporting high-resolution mobile photography and seamless 4K video recording for flagship smartphones and tablets.

Integration of eMMC in Automotive and Industrial Systems

The Embedded Multimedia Card Market reflects a growing trend of adoption across automotive and industrial applications. Infotainment, navigation, and control modules in vehicles increasingly rely on eMMC for secure storage. It provides stability in high-vibration and high-temperature conditions that are common in industrial and automotive environments. OEMs prefer eMMC for its balance of performance and durability. This adoption expands beyond consumer electronics, reinforcing its importance in critical systems. It highlights the ongoing diversification of use cases across sectors that demand reliability.

- For instance, companies like Panasonic provide eMMC-based infotainment and navigation storage modules for vehicles. These modules are often rated to meet the automotive industry’s AEC-Q100 Grade 2 standard, which specifies stable performance in temperatures up to 105°C for electronics used in harsh environments.

Continued Use in Budget and Mid-Tier Smartphones Despite Alternatives

The Embedded Multimedia Card Market sustains momentum in the budget and mid-tier smartphone segment. Premium devices move toward UFS storage, but eMMC retains its position in affordable models. It remains attractive due to its lower cost and compatibility with existing architectures. Manufacturers prioritize eMMC to maintain margins in cost-sensitive markets. This consistent use highlights the enduring relevance of eMMC in mainstream devices. It underscores the technology’s ability to serve markets where performance requirements remain moderate.

Advancements in Power Efficiency and Product Optimization

The Embedded Multimedia Card Market demonstrates a clear trend toward improving power efficiency and overall optimization. IoT devices, wearables, and smart home solutions require storage that conserves energy without sacrificing stability. It adapts through design improvements that extend device battery life and reliability. Manufacturers enhance controller technology to reduce latency and increase endurance. These innovations position eMMC as a dependable storage choice in power-conscious devices. It secures relevance across emerging applications that emphasize energy efficiency and compact design.

Market Challenges Analysis

Rising Competition from Advanced Storage Technologies

The Embedded Multimedia Card Market faces significant pressure from newer storage solutions such as Universal Flash Storage (UFS) and solid-state drives (SSD). These alternatives offer faster data transfer speeds, higher efficiency, and better scalability. It struggles to compete in premium devices where performance benchmarks continue to rise. Smartphone manufacturers increasingly favor UFS in flagship models, reducing eMMC adoption in high-end segments. This shift limits growth potential and confines eMMC to mid-range and entry-level markets. It creates a clear challenge for vendors to maintain relevance in an environment shaped by rapid innovation.

Concerns Around Limited Lifespan and Performance Constraints

The Embedded Multimedia Card Market encounters obstacles linked to endurance and performance limitations. Frequent data rewriting can shorten the lifespan of eMMC, making it less suitable for workloads requiring intensive read-write cycles. It delivers adequate speed for budget applications but falls short in supporting advanced use cases. Industrial and automotive users demand higher reliability that sometimes exceeds eMMC capabilities. These constraints restrict opportunities in markets where durability and speed are critical. It forces manufacturers to reassess investment in eMMC development while balancing demand in cost-sensitive sectors.

Market Opportunities

Expanding Role in IoT Devices and Smart Consumer Electronics

The Embedded Multimedia Card Market holds strong opportunities in the growing Internet of Things ecosystem and smart consumer products. Compact form factor, cost efficiency, and reliable performance make eMMC a preferred choice for wearables, smart appliances, and connected devices. It offers scalable storage solutions that align with the requirements of diverse IoT applications. Manufacturers leverage its stability to support data handling in devices that prioritize affordability and energy efficiency. Rising adoption of smart homes and industrial IoT systems continues to create demand. It strengthens the position of eMMC in markets where integration flexibility and dependable performance remain vital.

Increasing Demand from Emerging Economies and Automotive Applications

The Embedded Multimedia Card Market is set to benefit from rapid digital growth in emerging economies and rising integration in vehicles. Expanding middle-class populations in Asia-Pacific and Latin America drive strong demand for affordable smartphones and electronics. It supports manufacturers targeting these regions with cost-effective storage solutions. Automotive infotainment, navigation, and connected car features also present new opportunities for eMMC adoption. Its proven durability under varying conditions ensures relevance for carmakers focusing on reliable storage. It secures growth potential by bridging consumer demand in developing regions with technical needs in the automotive sector.

Market Segmentation Analysis:

By Type

The Embedded Multimedia Card Market is segmented into 4GB–8GB, 16GB–32GB, 64GB–128GB, and 256GB and above. Lower-capacity eMMC continues to serve legacy devices and entry-level electronics, particularly in cost-sensitive markets. It remains widely used in affordable smartphones and tablets where performance requirements are modest. The 64GB–128GB segment shows significant adoption in mainstream consumer electronics and automotive infotainment systems. Growth in 256GB and above solutions reflects the push toward higher-density applications, including premium IoT devices and advanced industrial systems. It highlights the market’s gradual shift toward higher capacities to meet evolving digital demands.

- For instance, as of 2024, the 8GB–16GB capacity segment for eMMC chips dominated the market, accounting for a 37.6% market share, with key players like Western Digital supplying low-end smartphones and IoT devices. Meanwhile, the 64GB–128GB segment saw increasing adoption in premium consumer electronics and automotive infotainment systems, a market served by major manufacturers such as Micron Technology, where the balance of capacity and cost is critical.

By Application

The Embedded Multimedia Card Market covers applications in smartphones, automotive, digital cameras, GPS systems, and other consumer electronics. Smartphones account for the largest share due to high-volume shipments across global markets. It continues to secure adoption in mid-tier and entry-level models where cost and power efficiency are priorities. Automotive systems represent a fast-growing application area with demand from infotainment, navigation, and ADAS modules. Digital cameras and GPS devices integrate eMMC for compact, reliable storage suited to portable formats. It underscores the adaptability of eMMC across diverse consumer and industrial electronics.

- For instance, In 2024, smartphone manufacturers, particularly Chinese brands like Xiaomi and Vivo, continued to integrate eMMC chips primarily for their entry-level and some budget-oriented smartphones, prioritizing cost and power efficiency. While eMMC remains a significant portion of the overall flash storage market, its use is declining in favor of the faster UFS standard, which is now prevalent in mid-tier and flagship devices.

By Storage Capacity

The Embedded Multimedia Card Market demonstrates distinct growth patterns across storage capacities such as 2GB–16GB, 32GB–64GB, 128GB–256GB, and above 256GB. Lower ranges still maintain relevance in legacy electronics and basic IoT devices. It shows stable demand in developing markets where entry-level smartphones dominate. The 32GB–64GB segment provides strong balance between performance and cost, making it a standard for mainstream consumer devices. The 128GB–256GB range gains traction in automotive and advanced consumer electronics that require higher data storage. It is complemented by above 256GB capacity solutions that serve niche but expanding markets needing high-performance memory.

Segments:

Based on Type

Based on Application

- Smartphones

- Tablets

- Wearable Devices

- Automotive

- Industrial

Based on Storage Capacity

- Less than 8GB

- 8GB to 16GB

- 16GB to 64GB

- 64GB to 128GB

- More than 128GB

Based on End Use

- Consumer Electronics

- Telecommunications

- Automotive

- Healthcare

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for nearly 20% of the global Embedded Multimedia Card Market share in 2024, supported by strong adoption across consumer electronics, automotive, and industrial applications. The region benefits from advanced technological infrastructure and high penetration of connected devices. It maintains steady demand for eMMC in budget and mid-range smartphones, digital cameras, and portable electronics where cost-effectiveness remains critical. The automotive sector, particularly in the United States, provides an important growth channel, as infotainment and driver-assistance systems increasingly require reliable storage solutions. Manufacturers in the region focus on optimizing efficiency, which sustains opportunities for eMMC despite the presence of advanced alternatives such as UFS. It secures relevance by serving cost-sensitive product lines and emerging IoT applications across industrial and residential sectors.

Europe

Europe represents nearly 18% of the global Embedded Multimedia Card Market share, reflecting consistent adoption across consumer electronics and the automotive industry. Carmakers in Germany, France, and Italy integrate eMMC solutions into infotainment, navigation, and telematics systems, reinforcing steady demand. It remains a reliable storage medium for mid-tier consumer electronics where performance requirements align with eMMC capabilities. Growing emphasis on energy efficiency and compact device design creates further opportunities in IoT-enabled applications. The presence of established electronics manufacturers in Western Europe strengthens supply and innovation. It maintains stability by meeting the requirements of both consumer and industrial sectors while facing moderate competition from alternative storage solutions.

Asia-Pacific

Asia-Pacific dominates the Embedded Multimedia Card Market with an estimated 45% share in 2024, driven by large-scale production and consumption of smartphones, tablets, and other consumer electronics. China, South Korea, Japan, and India play key roles as both manufacturing hubs and high-demand markets. It gains significant traction in budget and mid-range smartphones, which form the largest segment in the region. Expanding middle-class populations and rapid urbanization drive demand for affordable electronic devices. The automotive industry in Japan and South Korea also contributes to adoption through integration into navigation and infotainment systems. It secures long-term growth in the region through its balance of cost, efficiency, and compatibility with high-volume production requirements.

Latin America

Latin America contributes nearly 8% of the global Embedded Multimedia Card Market share, reflecting its role as an emerging consumer base for affordable electronics. Smartphone adoption continues to expand, particularly in Brazil and Mexico, where mid-tier and entry-level devices dominate sales. It supports local demand for compact and cost-efficient storage solutions in consumer products. Electronics manufacturing activities are gradually expanding in the region, strengthening supply opportunities for eMMC. Automotive applications also provide growth potential, with increasing integration of infotainment systems in passenger vehicles. It positions itself as a viable solution in markets where affordability and reliability outweigh the need for advanced alternatives.

Middle East and Africa

The Middle East and Africa hold close to 9% of the global Embedded Multimedia Card Market share, with steady growth driven by rising digital adoption. Expanding smartphone penetration across Gulf countries and Africa creates sustained demand for cost-effective memory solutions. It aligns with regional trends where budget and mid-range smartphones dominate consumer preferences. Growth in automotive adoption also contributes, as countries in the Middle East increase investment in connected vehicle technologies. Industrial and IoT applications begin to show promise, supported by growing interest in digital transformation initiatives. It reinforces its role in the region by supporting economic growth and rising consumer demand for connected devices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Embedded Multimedia Card Market is shaped by leading players such as ADATA Technology, Kingston Technology, Transcend Information, Innodisk, Micron Technology, NAND Flash, Phison Electronics, SK Hynix, Diablo Technologies, and Western Digital. These companies compete through innovation, capacity expansion, and product differentiation to address diverse application requirements across consumer electronics, automotive, and industrial sectors. They focus on delivering compact, energy-efficient, and scalable storage solutions that meet the rising demand for cost-effective memory in smartphones, IoT devices, and infotainment systems. Strategic investments in research and development allow them to introduce higher-capacity eMMC products while maintaining competitive pricing. Many of these players leverage strong global distribution networks and long-standing relationships with device manufacturers to secure steady adoption in mid-tier and entry-level segments. Competitive intensity is reinforced by the presence of advanced alternatives such as UFS, pushing companies to strengthen product reliability and optimize performance. Together, these firms drive technological progress and maintain the relevance of eMMC in evolving digital ecosystems.

Recent Developments

- In March 2025, SK Hynix acquired Intel’s NAND business, including intellectual property and employees, with the final closing occurring.

- In November 2024, Phison Electronics received ISO/SAE 21434 cybersecurity certification for its NAND controllers—making it the first in its space to do so.

- In January 2024, Phison Electronics announced collaboration with Kioxia to develop next-gen UFS storage for smartphones.

- In June 2023, Phison Electronics became the first independent supplier of eMMC controllers to achieve Automotive‑SPICE Capability Level 3 certification. This shows strong automotive-grade firmware maturity.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Storage Capacity, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will remain steady in budget and mid-tier smartphones where affordability is a priority.

- Adoption in IoT devices and smart consumer electronics will expand further.

- Automotive infotainment and navigation systems will continue to drive integration.

- Storage capacities will increase to meet multimedia and data-heavy application needs.

- Power-efficient designs will gain importance in wearables and portable devices.

- Emerging economies will generate strong opportunities through rising digital adoption.

- Industrial and automation systems will adopt eMMC for stable and compact storage.

- Competition with UFS will intensify in premium devices, limiting high-end adoption.

- Manufacturers will focus on durability and performance optimization to maintain relevance.

- Long-term growth will be supported by its balance of cost, efficiency, and reliability.