Market Overview:

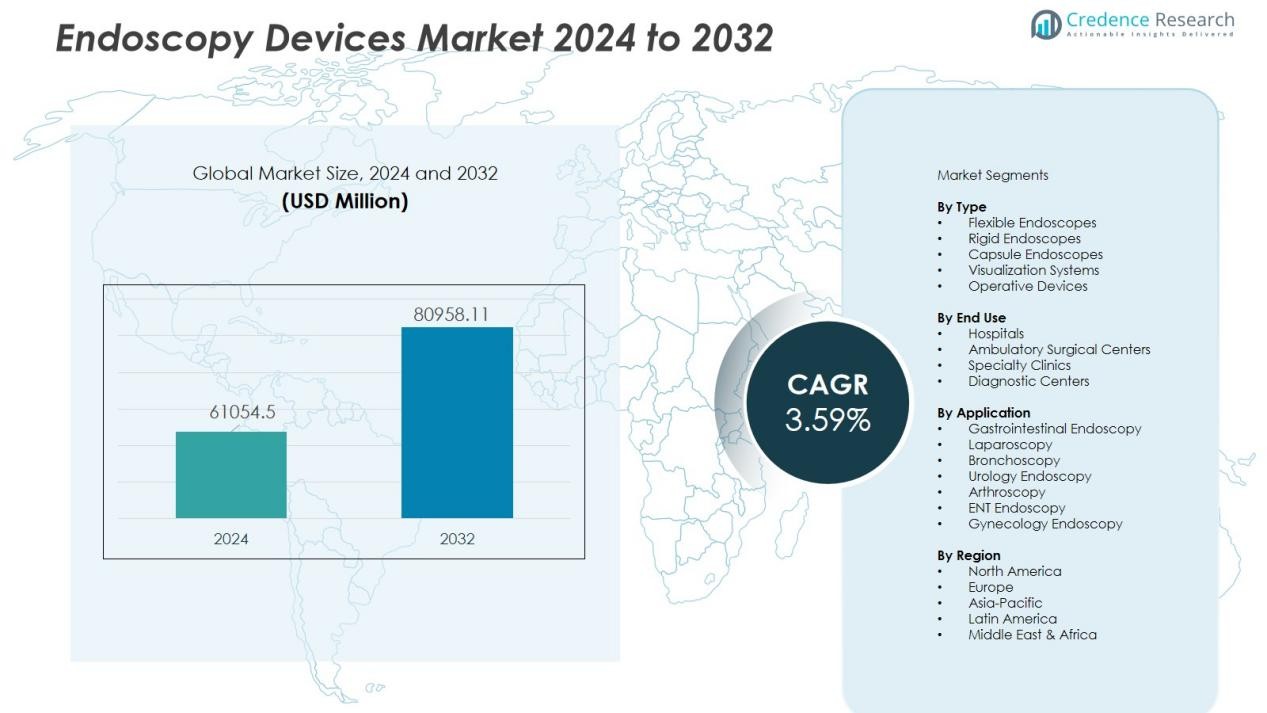

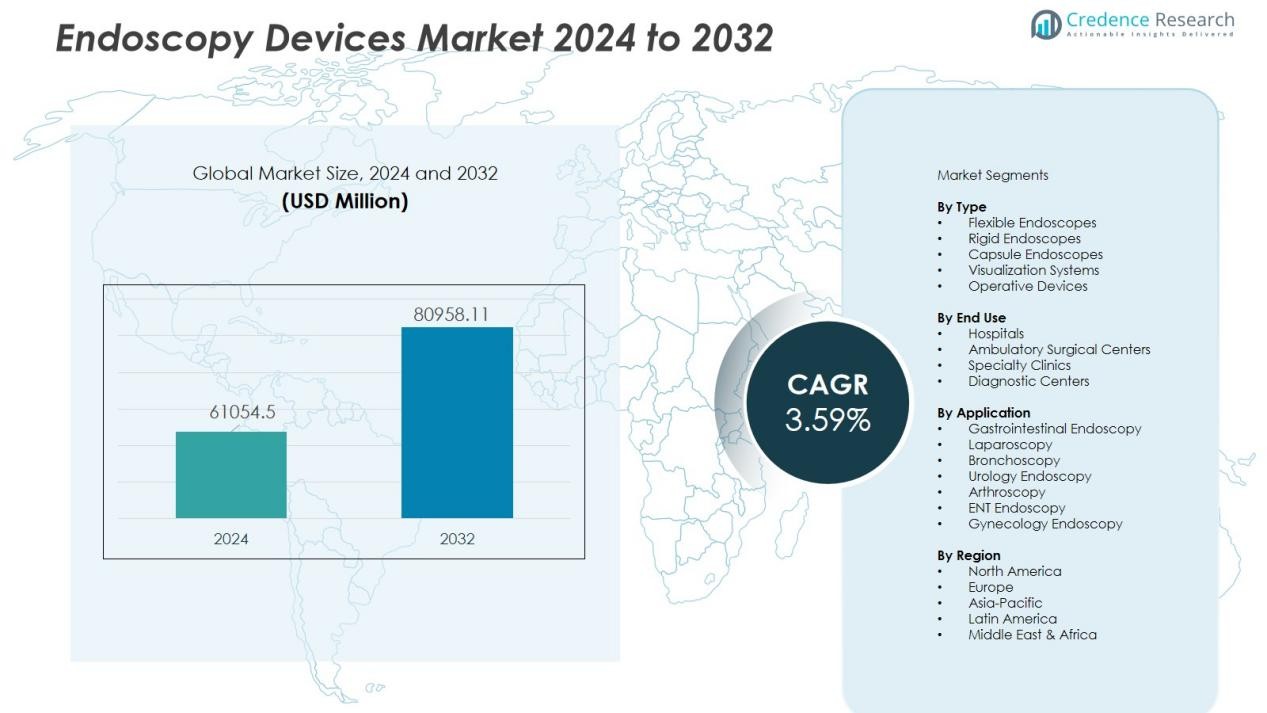

The endoscopy devices market size was valued at USD 61054.5 million in 2024 and is anticipated to reach USD 80958.11 million by 2032, at a CAGR of 3.59 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Endoscopy Devices Market Size 2024 |

USD 61054.5 Million |

| Endoscopy Devices Market, CAGR |

3.59 % |

| Endoscopy Devices Market Size 2032 |

USD 80958.11 Million |

Key market drivers include rising prevalence of gastrointestinal disorders, colorectal cancer, and lifestyle-related conditions requiring endoscopic evaluation and therapeutic intervention. Healthcare providers prioritize minimally invasive procedures to reduce hospitalization time, surgical trauma, and overall treatment costs. Continuous innovation—such as 3D visualization, AI-enabled image analysis, robotic-assisted endoscopy, and disposable endoscopes—further accelerates market adoption. Increasing investments in outpatient surgical centers and expanding reimbursement support for endoscopic procedures strengthen market momentum.

Regionally, North America leads due to advanced healthcare infrastructure, high screening rates, and rapid integration of next-generation visualization technologies. Europe follows with strong government-backed screening programs and growing adoption of minimally invasive interventions. Asia-Pacific is expected to record the fastest growth, supported by rising healthcare expenditure, expanding hospital infrastructure, and increasing awareness of preventive diagnostic procedures across China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The endoscopy devices market is projected to grow from USD 61,054.5 million in 2024 to USD 80,958.11 million by 2032, at a CAGR of 3.59%.

- Rising adoption of minimally invasive procedures boosts demand for advanced endoscopes across major specialties, improving patient recovery and procedural efficiency.

- Increasing burden of gastrointestinal diseases, colorectal cancer, and chronic conditions drives higher screening and diagnostic endoscopy volumes globally.

- Continuous innovation—such as AI-enhanced imaging, robotics, and disposable scopes—improves clinical accuracy and reduces infection risks.

- North America leads the market, while Asia-Pacific records the fastest growth due to expanding healthcare infrastructure and rising preventive screening awareness.

Market Drivers:

Rising Need for Minimally Invasive Procedures Strengthens Technology Adoption

The endoscopy devices market gains strong momentum as healthcare providers shift toward minimally invasive procedures that reduce recovery time and surgical risk. It supports improved patient comfort and shortens hospital stays, which enhances treatment efficiency. Demand rises in gastroenterology, pulmonology, urology, and gynecology as physicians prefer precise, image-guided interventions. Hospitals expand procurement of rigid and flexible endoscopes to improve procedural accuracy. Growing preference for outpatient care further encourages device adoption.

- For instance, Olympus Corporation’s EVIS X1 endoscopy system features advanced imaging technologies such as Texture and Color Enhancement Imaging (TXI™), Red Dichromatic Imaging (RDI™), and Narrow Band Imaging (NBI™), designed to enhance the visibility of lesions, deep blood vessels, and mucosal patterns.

Expanding Burden of Gastrointestinal and Chronic Diseases Drives Procedure Volume

The endoscopy devices market benefits from rising cases of colorectal cancer, inflammatory bowel disease, GERD, liver disorders, and age-related gastrointestinal complications. It supports earlier disease detection and timely therapeutic intervention. Screening programs in developed and emerging economies raise the number of diagnostic endoscopies. Strong clinical guidelines encourage routine colonoscopy and upper GI evaluations. Higher disease prevalence increases the need for advanced visualization platforms.

- For Instance, The Endotics™ system, a robotic-assisted colonoscopy technology, achieved a cecal intubation rate of 82% in a study of 71 unsedated patients. This system has been shown to be better tolerated with less pain compared to conventional colonoscopy, reducing the need for sedation.

Continuous Advancements in Imaging, AI, and Robotics Enhance Clinical Outcomes

The endoscopy devices market advances with the integration of high-definition imaging, enhanced optics, robotic assistance, and AI-supported image interpretation. It improves lesion detection and strengthens decision-making accuracy. Manufacturers introduce next-generation endoscopes with better maneuverability and disposable options that reduce infection risk. Hospitals evaluate digital integration features that support workflow efficiency. Increased R&D investments accelerate the introduction of smart endoscopy systems.

Rising Investments in Healthcare Infrastructure and Ambulatory Surgical Centers Boost Device Utilization

The endoscopy devices market benefits from strong investments in ambulatory surgical centers and specialty clinics that focus on cost-efficient minimally invasive care. It supports wider access to diagnostic and therapeutic procedures in urban and semi-urban regions. Governments strengthen screening programs that require high-quality visualization systems. Private healthcare providers expand endoscopy units to meet growing patient demand. Infrastructure upgrades create consistent procurement opportunities for advanced devices.

Market Trends:

Growing Integration of AI, Robotics, and Digital Platforms Reshapes Procedural Capabilities

The endoscopy devices market advances with rapid integration of AI algorithms that support real-time lesion detection and automated image interpretation. It improves diagnostic accuracy and reduces variation in clinical outcomes. Robotic-assisted endoscopy gains momentum due to better navigation control and enhanced precision in complex interventions. Hospitals adopt digital ecosystems that connect towers, scopes, and software into unified platforms. Cloud-based data management strengthens documentation and remote collaboration. Disposable endoscopes gain attention because they reduce infection risk and simplify reprocessing steps. Manufacturers expand portfolios to match hospital demand for fully digital and intelligent endoscopy suites.

- For instance, the Olympus AI-assisted colonoscopy systems, such as those integrated into the EVIS X1 platform (using the ENDO-AID CADe application) and the cloud-based OLYSENSE suite, provide real-time computer-aided detection and characterization of suspected lesions.

Shift Toward Minimally Invasive Screening, Specialty Procedures, and Outpatient Care Reshapes Market Dynamics

The endoscopy devices market benefits from rising focus on early detection programs for gastrointestinal cancers and chronic digestive disorders. It supports procedure volume growth across colonoscopy, bronchoscopy, and laparo-endoscopic segments. Demand increases for compact, mobile, and high-definition systems that improve workflow in ambulatory surgical centers. Hospitals adopt 4K and 3D visualization technologies that enhance tissue differentiation during examinations. Integration of narrow-band imaging and fluorescence technology strengthens clinical decision accuracy. New product development focuses on ergonomic scope designs that reduce operator fatigue. The expansion of outpatient care settings accelerates procurement of cost-efficient and portable endoscopy platforms.

- For instance, the Image1 S™ Rubina® system combines 4K imaging, 3D visualization, and ICG fluorescence, enabling surgeons to visualize blood flow and tissue perfusion in real-time.

Market Challenges Analysis:

High Capital Costs, Maintenance Demands, and Complex Reprocessing Limit Technology Adoption

The endoscopy devices market faces constraints due to high procurement costs for advanced visualization systems and robotic-assisted platforms. It creates financial pressure on small hospitals and ambulatory centers with limited budgets. Complex reprocessing protocols increase the burden on staff and raise operational risks when sterilization steps are incomplete. Disposable scopes help reduce contamination concerns but elevate per-procedure expenses. Frequent maintenance needs disrupt workflow and extend downtime. High repair costs for delicate optics and electronics add further challenges. Budget constraints slow upgrades in facilities that operate older endoscopy systems.

Shortage of Skilled Professionals and Rising Regulatory Requirements Slow Market Expansion

The endoscopy devices market is challenged by a shortage of trained endoscopists and technicians who can handle advanced digital and AI-enabled systems. It restricts utilization rates and weakens efficiency in high-volume centers. Regulatory agencies enforce strict safety, performance, and sterilization standards that increase compliance costs. Lengthy approval timelines delay product launches in global markets. Training requirements rise as new technologies enter clinical practice. Hospitals allocate significant resources to adopt updated guidelines. Operational gaps appear when staff struggle to adapt to rapidly evolving endoscopic techniques.

Market Opportunities:

Growing Demand for AI-Enabled, Disposable, and Smart Visualization Platforms Expands Growth Potential

The endoscopy devices market gains new opportunities as hospitals pursue AI-supported systems that elevate diagnostic precision and streamline clinical workflows. It encourages adoption of image-guided platforms that detect early-stage lesions with higher accuracy. Demand rises for disposable endoscopes that reduce infection risk and eliminate complex sterilization steps. Manufacturers invest in lightweight, ergonomic designs that improve operator comfort during high-volume procedures. Integrated digital ecosystems create avenues for remote collaboration and tele-endoscopy. Cloud-enabled platforms support real-time data sharing and strengthen decision pathways. Product portfolios expand to include smart scopes with enhanced optics and embedded sensors.

Emerging Markets, Preventive Screening Programs, and Outpatient Expansion Create Strong Adoption Pathways

The endoscopy devices market benefits from growth opportunities in emerging economies where healthcare investments accelerate and screening programs expand. It supports wider access to colonoscopy, bronchoscopy, and GI diagnostic procedures in urban and semi-urban regions. Rising healthcare insurance coverage encourages patients to seek early diagnosis. Ambulatory surgical centers invest in compact and cost-efficient endoscopy towers to manage rising procedure volumes. Governments promote cancer prevention initiatives that require high-quality visualization tools. Market players introduce affordable systems tailored for low-resource settings. Strengthening healthcare infrastructure creates consistent demand for advanced endoscopic technologies

Market Segmentation Analysis:

By Type

The endoscopy devices market expands across flexible endoscopes, rigid endoscopes, capsule endoscopes, and visualization equipment. Flexible endoscopes hold a major share due to wide use in GI, pulmonary, and urology procedures. It supports enhanced maneuverability and high-quality imaging for complex internal examinations. Rigid endoscopes remain essential in laparoscopy, arthroscopy, ENT, and gynecology. Capsule endoscopy gains traction due to patient comfort and improved small-bowel diagnostics. Visualization systems with 4K, 3D, and fluorescence technologies strengthen clinical accuracy. Rising demand for portable towers boosts procurement in outpatient facilities.

- For instance, Olympus’ reusable flexible endoscopes integrate high pixel count CCD or CMOS sensors, providing advanced diagnostic imaging capabilities through technologies like Narrow Band Imaging (NBI) and Extended Depth of Field (EDOF), thereby enhancing real-time visualization with superior image quality during procedures.

By Application

The endoscopy devices market benefits from strong adoption across gastrointestinal endoscopy, laparoscopy, bronchoscopy, arthroscopy, urology, and ENT procedures. Gastrointestinal applications dominate due to the high prevalence of colorectal cancer, GERD, and inflammatory bowel conditions. It contributes to strong demand for advanced scopes with AI-assisted detection. Laparoscopy gains steady growth driven by minimally invasive surgical preferences. Bronchoscopy and urology procedures expand with rising respiratory diseases and prostate disorders. ENT and arthroscopy maintain consistent utilization in routine diagnostics and targeted interventions.

- For instance, Intuitive Surgical’s da Vinci system features EndoWrist instruments with 7 degrees of freedom, enabling precise movements that reduce tremor by up to 5 times compared to traditional laparoscopy.

By End Use

The endoscopy devices market records strong use across hospitals, ambulatory surgical centers, and specialty clinics. Hospitals lead due to high patient volume, broad specialty coverage, and access to advanced visualization platforms. It supports adoption of next-generation endoscopy suites with integrated digital systems. Ambulatory surgical centers gain momentum with a focus on cost-efficient minimally invasive procedures. Specialty clinics increase procurement for GI, pulmonary, and urology services. Rising preference for outpatient care boosts demand for compact and mobile endoscopy systems.

Segmentations:

By Type

- Flexible Endoscopes

- Rigid Endoscopes

- Capsule Endoscopes

- Visualization Systems

- Operative Devices

By Application

- Gastrointestinal Endoscopy

- Laparoscopy

- Bronchoscopy

- Urology Endoscopy

- Arthroscopy

- ENT Endoscopy

- Gynecology Endoscopy

By End Use

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Diagnostic Centers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Market Leadership in North America Driven by Advanced Healthcare Infrastructure

The endoscopy devices market maintains a strong presence in North America due to high procedure volumes, widespread adoption of minimally invasive techniques, and early access to next-generation visualization platforms. It benefits from well-established cancer screening programs that raise demand for colonoscopy and bronchoscopy. Hospitals expand investments in 4K, 3D, and AI-enhanced imaging systems that improve diagnostic accuracy. Reimbursement support strengthens procurement across large health systems. The U.S. leads the region with strong uptake of robotic-assisted endoscopy and disposable scopes. Canada follows with steady modernization of endoscopy units and a growing focus on early GI disease detection.

Rising Technology Integration and Screening Initiatives Support Europe’s Growth Outlook

The endoscopy devices market records strong growth in Europe due to structured clinical guidelines, government-supported screening programs, and increasing preference for minimally invasive interventions. It gains momentum as hospitals integrate advanced imaging modalities and fluorescence-guided systems into routine clinical practice. Demand rises in Germany, the U.K., and France where cancer prevention strategies drive high colonoscopy uptake. Manufacturers introduce AI-enabled solutions that align with Europe’s focus on precision diagnostics. Regulatory frameworks encourage safe adoption of digital endoscopy platforms. Eastern Europe expands its healthcare infrastructure, which strengthens market penetration.

Rapid Healthcare Modernization and Expanding Patient Access Accelerate Asia-Pacific Growth

The endoscopy devices market gains significant traction in Asia-Pacific due to rising healthcare investments, expanding hospital networks, and growing awareness of early disease detection. It benefits from stronger adoption in China, India, Japan, and South Korea where gastrointestinal and respiratory disorders remain prevalent. Governments promote preventive screening programs that raise demand for high-quality scopes and visualization systems. Private hospitals invest in advanced endoscopy suites to meet rising procedural needs. Local manufacturing capabilities expand, which improves device availability and pricing flexibility. Emerging Southeast Asian markets strengthen uptake with increasing insurance coverage and greater access to specialty care.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AnX Robotics

- Arthrex Inc.

- asap endoscopic products GmbH

- Braun SE

- Boston Scientific Corp.

- Clarus Medical LLC

- Conmed Corp.

- Cook Group Inc.

- Ecleris USA

- ESC Medicams

- FUJIFILM Corp.

- Integrated Endoscopy

- Johnson and Johnson Services Inc.

- KARL STORZ SE and Co. KG

Competitive Analysis:

The endoscopy devices market features strong competition driven by continuous innovation, expanding product portfolios, and strategic investments in advanced imaging technologies. Major players such as AnX Robotics, Arthrex Inc., asap endoscopic products GmbH, B. Braun SE, and Boston Scientific Corp. strengthen their positions through R&D initiatives, geographic expansion, and partnerships with healthcare institutions. It benefits from rapid integration of AI-enabled detection tools, lightweight ergonomic scopes, and digital visualization platforms that enhance clinical precision. Companies focus on disposable endoscopes to address infection control concerns and support high-volume centers. Product differentiation relies on image quality, ease of use, workflow integration, and compatibility with robotic-assisted systems. Market participants accelerate innovation to capture demand from hospitals and ambulatory centers seeking minimally invasive solutions. Intensifying competition encourages continuous upgrades and faster adoption of smart endoscopy technologies.

Recent Developments:

- In December 2024, AnX Robotica was awarded a national group purchasing agreement for Gastrointestinal Endoscopy Products with Premier, Inc., effective February 1, 2025. This allows Premier members access to special pricing and terms for Small Bowel Video Capsule Endoscopy products.

- In July 2025, B. Braun Medical Inc. expanded its heparin portfolio with the launch of two new premixed Heparin Sodium Injection products (25,000 Units in 0.45% Sodium Chloride at 50 units/mL and 100 units/mL)

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- AI-driven detection capabilities will gain wider integration across routine diagnostic and interventional procedures.

- Demand for disposable endoscopes will rise as hospitals prioritize infection control and streamlined workflows.

- Hybrid surgical platforms will expand adoption as physicians combine endoscopy with advanced minimally invasive techniques.

- Outpatient and ambulatory surgical centers will increase procurement of compact, mobile, and cost-efficient endoscopy systems.

- Digital ecosystems will enhance workflow efficiency through real-time data sharing, remote guidance, and automated documentation.

- Manufacturers will introduce ergonomic scope designs that reduce operator fatigue and support longer procedures.

- Fluorescence, narrow-band imaging, and 3D visualization will strengthen early lesion detection in high-risk patient groups.

- Global screening programs for gastrointestinal cancers will expand, driving consistent demand for advanced visualization tools.

- Emerging markets will accelerate adoption due to healthcare modernization, insurance penetration, and infrastructure upgrades.

- Collaborations between med-tech companies and AI innovators will reshape competitive strategies and product development timelines.