Market Overview:

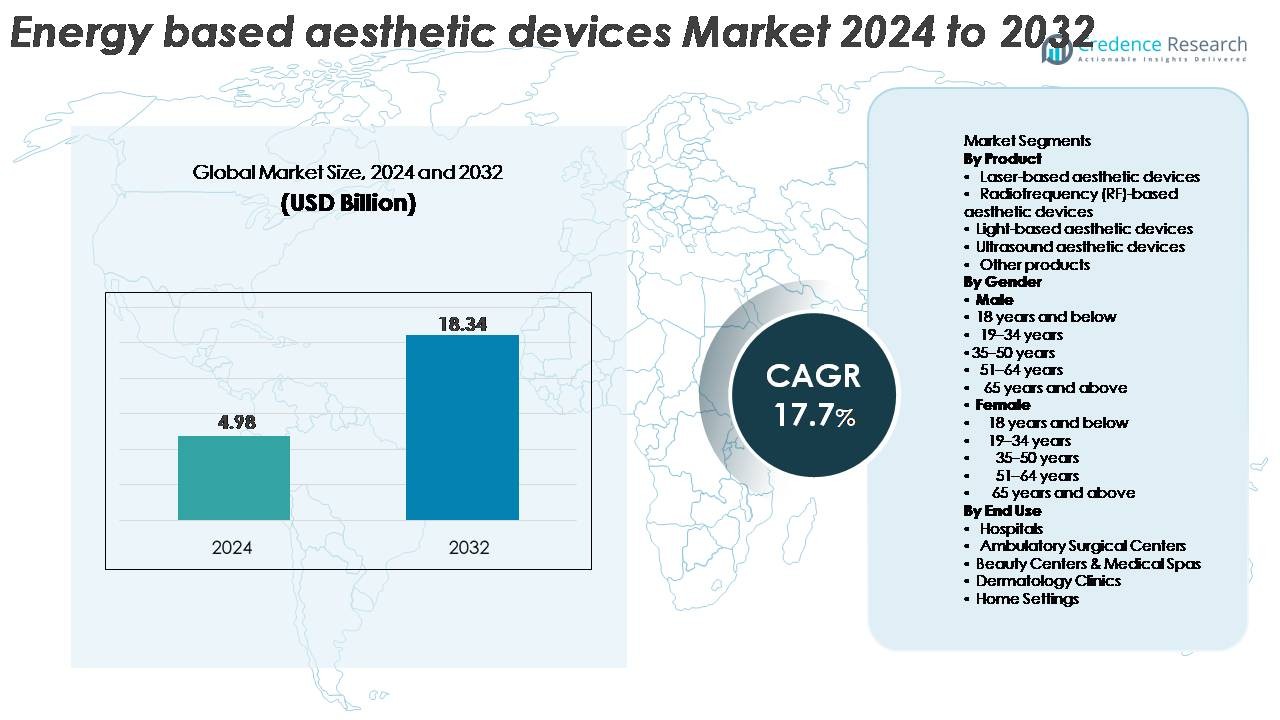

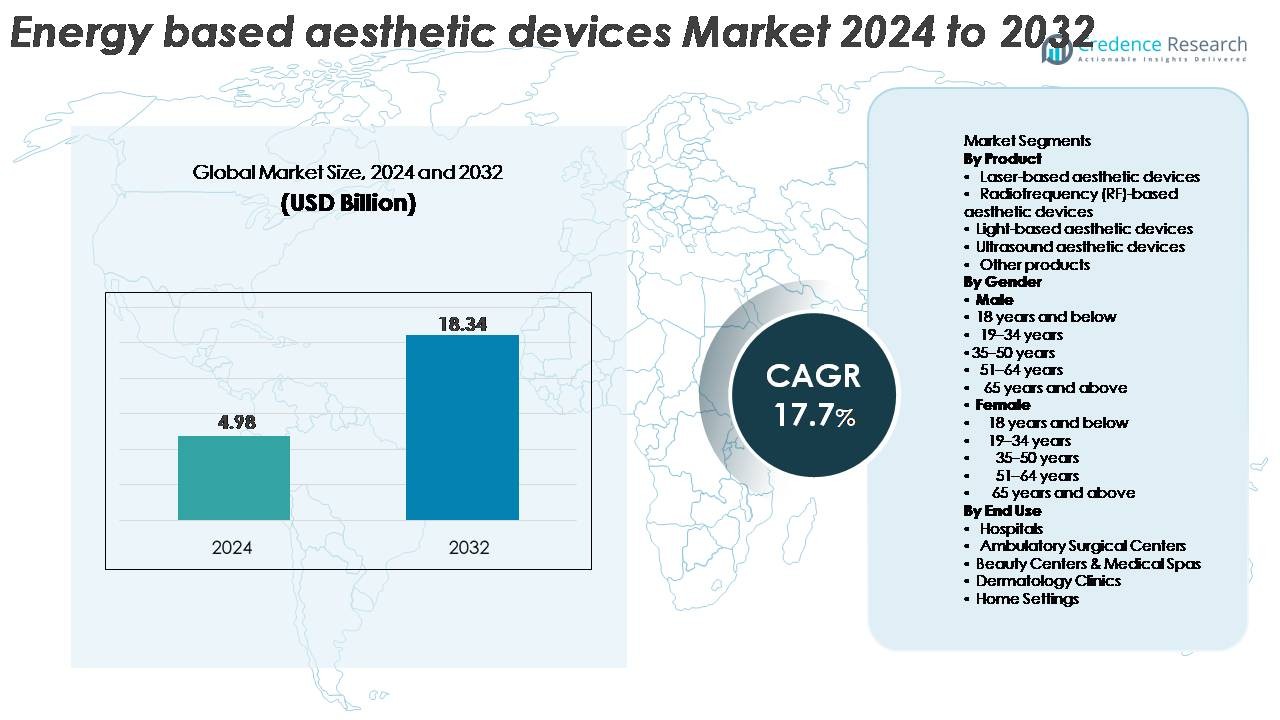

The global Energy-Based Aesthetic Devices market, valued at USD 4.98 billion in 2024, is projected to reach USD 18.34 billion by 2032, expanding at a CAGR of 17.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Energy-Based Aesthetic Devices Market Size 2024 |

USD 4.98 Billion |

| Energy-Based Aesthetic Devices Market, CAGR |

17.7% |

| Energy-Based Aesthetic Devices Market Size 2032 |

USD 18.34 Billion |

The energy-based aesthetic devices market is shaped by a strong group of global leaders, including SharpLight Technologies, Sciton, Hahn & Company, Cutera, Sisram Medical, Merz Pharma GmbH & Co., Tria Beauty, Bausch Health Companies, Boston Scientific Corporation, and Apax Partners. These players focus on multi-platform laser, RF, and light-based technologies, supported by continuous innovation in safety, efficacy, and AI-enhanced treatment systems. North America remains the leading region, commanding approximately 40% of the global market due to advanced clinical infrastructure, high procedure volumes, and early adoption of premium aesthetic technologies. Europe and Asia-Pacific follow as fast-growing hubs with expanding medical spa ecosystems and rising consumer demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Energy-Based Aesthetic Devices market was valued at USD 4.98 billion in 2024 and is projected to reach USD 18.34 billion by 2032, expanding at a strong CAGR of 17.7% driven by rising demand for non-invasive cosmetic treatments.

- Market growth is propelled by increasing consumer preference for minimally invasive procedures, expanding medical spa ecosystems, and adoption of multi-platform laser, RF, and ultrasound systems offering higher precision, shorter recovery, and broader clinical applications.

- Key trends include AI-assisted treatment planning, integration of digital imaging, and rising acceptance of home-use aesthetic devices, alongside growing procedural demand among both younger consumers and aging populations.

- Competitive activity intensifies as major players enhance device safety, treatment versatility, and energy delivery efficiency, while regional players expand affordability-focused portfolios; however, high capital costs and skilled practitioner shortages remain key restraints.

- Regionally, North America leads with 40% share, followed by Europe at 29% and Asia-Pacific at 25%; by product, laser-based devices dominate due to versatile clinical applications and high adoption across dermatology clinics and medical spas.

Market Segmentation Analysis:

By Product

Laser-based aesthetic devices represent the dominant product segment, capturing the largest market share due to their broad clinical utility in hair removal, skin resurfacing, vascular lesion reduction, and pigmentation correction. Their precision, shorter treatment cycles, and consistent results position them ahead of RF, light-based, and ultrasound systems. Growing innovation in diode, erbium:YAG, and picosecond lasers strengthens adoption across dermatology clinics and medical spas. RF-based devices continue to expand in skin tightening and body contouring applications, while light-based and ultrasound platforms gain traction for targeted rejuvenation procedures. Other products serve niche, complementary treatment needs.

- For instance, Cutera’s Enlighten III picosecond platform delivers 670 ps pulse durations with a 1064/532 nm dual-wavelength system, enabling high-speed pigment clearance and tattoo removal across multiple skin types.

By Gender

The female segment remains the clear market leader, accounting for the highest share across all age groups due to stronger demand for facial rejuvenation, body contouring, and hair removal treatments. Women in the 19–34 and 35–50 age brackets drive the majority of procedure volumes, influenced by rising aesthetic awareness, social media exposure, and preventive skincare trends. Although male adoption is increasing particularly in the 19–34 and 35–50 segments overall penetration remains lower. Interest among men is growing for energy-based solutions addressing hair removal, skin tightening, and non-surgical body sculpting, gradually narrowing the gender gap.

- For instance, Candela’s GentleMax Pro integrates a 755 nm Alexandrite and 1064 nm Nd:YAG dual-wavelength system, delivering up to 10 Hz repetition rates for rapid hair-removal sessions making it a preferred choice among female patients seeking faster treatments across large body areas.

By End Use

Beauty centers and medical spas hold the dominant market share, supported by high procedure volumes, expanding service portfolios, and growing consumer preference for non-invasive treatments in accessible, retail-driven environments. Their ability to integrate advanced laser, RF, and light-based systems at scale fuels consistent growth. Dermatology clinics follow closely, benefiting from rising demand for medically supervised aesthetic procedures. Hospitals and ambulatory surgical centers maintain relevance for complex treatments requiring clinical oversight. Meanwhile, home-use devices continue to gain momentum as manufacturers introduce compact, safe, and user-friendly platforms for hair removal and skin rejuvenation.

Key Growth Drivers:

Rising Demand for Minimally Invasive and Non-Invasive Aesthetic Procedures

The global rise in patient preference for minimally invasive and non-invasive procedures is a fundamental catalyst for the energy-based aesthetic devices market. Consumers increasingly favor treatments that offer shorter recovery times, reduced discomfort, and minimal procedural risks. Laser, RF, and ultrasound platforms cater to this demand with capabilities for skin rejuvenation, fat reduction, tightening, and resurfacing without surgical intervention. The expansion of “lunch-time procedures” further accelerates adoption among working professionals seeking convenient treatment options. Social media influence, widespread dermatology awareness, and the growing normalization of aesthetic treatments contribute to rapid procedural uptake. As device manufacturers introduce platforms with faster pulse rates, multi-modal energy delivery, and enhanced safety features, clinics and medical spas continue to expand their service portfolios solidifying non-invasive solutions as the dominant growth engine.

- For instance, InMode’s BodyTite platform uses radiofrequency-assisted lipolysis delivering controlled RF energy at 40–70 W, enabling fat coagulation while maintaining skin temperatures through real-time impedance monitoring resulting in significantly reduced downtime compared to traditional surgical methods.

Technological Advancements in Multi-Platform and Combination-Based Devices

Continuous innovation in multi-platform technologies significantly strengthens market growth. Next-generation systems now integrate multiple energy modalities such as laser plus RF or ultrasound plus RF microneedling within a single device, enabling broader treatment versatility and higher ROI for practitioners. These systems provide comprehensive solutions for pigmentation, skin laxity, body contouring, vascular concerns, and acne management, thereby reducing the need for separate devices. Enhanced cooling mechanisms, AI-guided treatment parameters, advanced fiber optics, and improved energy modulation drive superior patient comfort and consistent outcomes. Compact platforms also target smaller practices, expanding market penetration across emerging economies. High-treatment efficacy combined with workflow efficiency encourages rapid clinical adoption worldwide. This shift toward multi-functional and combination-based aesthetic devices keeps the market technologically dynamic and commercially attractive.

- For instance, Cynosure’s Potenza RF microneedling system offers 1 MHz and 2 MHz RF frequencies across four RF modes (monopolar and bipolar in both insulated and semi-insulated configurations), enabling clinicians to customize depth up to 4 mm for precise dermal stimulation.

Expanding Medical Spa Ecosystem and Increasing Accessibility of Aesthetic Services

The proliferation of medical spas and aesthetic wellness centers has dramatically increased access to energy-based treatment options. These facilities bridge the gap between cosmetic dermatology and lifestyle wellness, appealing to a broad consumer base seeking safe, affordable, and regular aesthetic care. Their rapid expansion particularly in Asia-Pacific, North America, and the Middle East creates a high-volume demand environment for laser, RF, and light-based systems. Medical spas prioritize equipment that offers intuitive interfaces, repeatable outcomes, and high throughput, driving consistent procurement of advanced devices. Additionally, the rise of subscription-based aesthetic programs, membership plans, and bundled treatment packages encourages recurring patient engagement. This commercial model increases procedural frequency and accelerates technology adoption. As more non-physician providers enter the aesthetic practice ecosystem under regulated supervision, the market benefits from a wider practitioner base and diversified service offerings.

Key Trends & Opportunities:

Growing Adoption of AI-Enhanced, Personalized Aesthetic Treatment Platforms

Artificial intelligence and digital imaging technologies increasingly shape the future of energy-based aesthetic treatments. AI-enabled platforms now support automated skin analysis, treatment mapping, and procedural parameter optimization, allowing practitioners to deliver highly personalized interventions. Intelligent imaging devices assess pigmentation levels, vascular structures, collagen distribution, and textural irregularities with high accuracy, improving consultation quality and treatment planning. These systems also enhance patient engagement by providing visual simulations of potential results. Predictive analytics help practitioners tailor energy outputs for different skin types and conditions, reducing the risk of complications and improving safety across Fitzpatrick skin types. Manufacturers investing in AI-driven interfaces and adaptive algorithms unlock opportunities to differentiate their devices, streamline clinical workflows, and elevate treatment precision positioning digital intelligence as a major transformative trend.

- For instance, Canfield Scientific’s VISIA Skin Analysis System captures high-resolution facial images using 8 distinct imaging modalities, quantifies 10+ dermal parameters, and provides AI-driven percentile scoring based on data from over 200,000 analyzed faces.

Rising Popularity of Home-Use Energy-Based Devices and At-Home Aesthetic Care

The shift toward at-home aesthetic care represents a significant growth frontier. Consumers increasingly seek accessible solutions for hair removal, skin rejuvenation, and anti-aging maintenance without visiting clinical settings. Light-based and low-energy laser devices designed for home use have gained strong traction due to improvements in safety mechanisms, ergonomic design, and affordability. Manufacturers are integrating smart sensors, skin tone detectors, and app-based guidance systems to ensure safe and effective user experiences. This segment especially appeals to consumers preferring privacy, flexibility, and long-term cost efficiency. Although clinical-grade devices remain dominant, the home-use category introduces a scalable opportunity for market expansion and helps nurture long-term consumer familiarity with energy-based aesthetic technologies.

- For instance, Tria Beauty’s 4X Laser uses a diode laser at 810 nm and delivers up to 22 J/cm² fluence making it the only FDA-cleared at-home laser that employs the same wavelength range used in professional hair-removal systems

Key Challenges:

High Capital Costs and Maintenance Requirements for Advanced Aesthetic Devices

One of the most significant barriers to broader adoption is the high upfront cost of advanced energy-based aesthetic devices, particularly multi-platform laser and RF systems. Small clinics, start-up aesthetic practices, and providers in developing regions often struggle to justify these investments due to limited initial patient volume and slower ROI cycles. Beyond acquisition costs, ongoing maintenance such as replacement handpieces, consumables, calibration, and device servicing creates additional financial strain. These expenses can restrict technology upgrades and limit the availability of cutting-edge treatments in price-sensitive markets. Financing options do exist, but inconsistent reimbursement structures for aesthetic procedures further complicate purchase decisions. Manufacturers must address affordability challenges through leasing models, modular system designs, or lower-cost device alternatives to unlock full market potential.

Safety Concerns, Regulatory Variability, and Skilled Practitioner Shortages

Safety-related concerns continue to pose challenges, particularly in markets with inconsistent practitioner training standards and fragmented regulatory frameworks. Improper use of high-energy devices can lead to burns, hyperpigmentation, scarring, or suboptimal results, especially when treating darker skin types. Variations in device approval pathways across countries create compliance complexities for manufacturers entering new regions. Additionally, the shortage of certified aesthetic practitioners limits the safe delivery of advanced energy-based treatments. Training disparities also hinder uniform treatment quality across facilities. Addressing these challenges requires standardized certification programs, enhanced safety automation in devices, and strengthened regulatory clarity all crucial for ensuring responsible market expansion.

Regional Analysis:

North America

North America holds the dominant position with approximately 40% of the global energy-based aesthetic devices market, supported by strong procedural demand, mature aesthetic infrastructure, and widespread adoption of advanced laser and RF technologies. The United States leads growth due to high consumer spending on cosmetic treatments, rapid expansion of medical spas, and early acceptance of multi-platform aesthetic systems integrating AI and imaging tools. A robust ecosystem of dermatologists, plastic surgeons, and technology-focused manufacturers sustains continuous device upgrades. Favorable regulatory clarity, high awareness of minimally invasive aesthetics, and steady innovation pipelines strengthen long-term market leadership.

Europe

Europe accounts for nearly 29% of the global market, driven by rising demand for non-surgical rejuvenation, expanding dermatology networks, and increasing adoption of clinically validated laser and light-based platforms. Countries such as Germany, France, and the U.K. lead technological uptake, supported by well-regulated healthcare environments and strong practitioner expertise. The region benefits from growing interest in anti-aging solutions, body contouring, and pigmentation correction procedures. Additionally, heightened emphasis on CE-certified equipment and standardized training protocols enhances device safety and clinical outcomes. The expansion of aesthetic tourism in Southern and Eastern Europe further boosts device utilization.

Asia-Pacific

Asia-Pacific stands as the fastest-growing region and captures around 25% of the global market, propelled by rapid urbanization, rising disposable incomes, and increasing aesthetic preferences among younger demographics. South Korea, China, Japan, and India drive device adoption through large procedural volumes, strong consumer familiarity with aesthetic treatments, and accelerated clinic expansion. Technological adoption is supported by the region’s preference for skin-brightening, pigmentation reduction, and acne-related treatments that leverage advanced laser and light-based systems. Medical tourism hubs in South Korea, Thailand, and Malaysia further amplify demand. Growing investments from global manufacturers strengthen regional distribution and service networks.

Latin America

Latin America holds an estimated 8% market share, supported by increasing interest in body contouring, skin rejuvenation, and non-invasive tightening procedures across major countries such as Brazil, Mexico, and Colombia. Brazil remains a key growth engine due to its large aesthetic practitioner base and high cultural acceptance of cosmetic enhancements. Growing penetration of RF microneedling and diode laser platforms is driven by demand for safe treatments across diverse skin types. Although economic fluctuations influence purchasing power, expanding medical spa chains and improved device financing options support steady adoption of energy-based aesthetic technologies.

Middle East & Africa

The Middle East & Africa region represents approximately 6% of the global market, with growth concentrated in the UAE, Saudi Arabia, and South Africa. Rising medical tourism, expanding premium aesthetic clinics, and increasing preference for laser-based hair removal and skin rejuvenation treatments fuel demand. High disposable incomes in Gulf economies accelerate adoption of advanced multi-platform aesthetic systems. Ongoing investments in dermatology centers and wellness-focused healthcare infrastructure further strengthen market presence. Despite uneven distribution of high-end facilities across the broader region, urban clusters continue to experience strong uptake of non-invasive aesthetic technologies.

Market Segmentations:

By Product

- Laser-based aesthetic devices

- Radiofrequency (RF)-based aesthetic devices

- Light-based aesthetic devices

- Ultrasound aesthetic devices

- Other products

By Gender

Male

- 18 years and below

- 19–34 years

- 35–50 years

- 51–64 years

- 65 years and above

Female

- 18 years and below

- 19–34 years

- 35–50 years

- 51–64 years

- 65 years and above

By End Use

- Hospitals

- Ambulatory Surgical Centers

- Beauty Centers & Medical Spas

- Dermatology Clinics

- Home Settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the energy-based aesthetic devices market is characterized by a mix of global technology leaders, specialized aesthetic manufacturers, and rapidly expanding regional players. Competition centers on innovation in multi-platform systems, enhanced safety features, treatment versatility, and improved energy delivery mechanisms. Leading companies invest heavily in R&D to advance laser, RF, ultrasound, and light-based technologies while integrating AI-driven treatment guidance and digital imaging tools to differentiate their offerings. Strategic initiatives including mergers, acquisitions, and distributor partnerships expand geographic reach and strengthen product portfolios. Manufacturers increasingly target medical spas, dermatology clinics, and premium aesthetic centers with modular systems designed for high procedural throughput. Additionally, companies focus on device ergonomics, shorter downtime, and clinically validated outcomes to maintain practitioner loyalty. As consumer demand shifts toward non-invasive solutions, market players emphasize training programs, after-sales support, and user-friendly interfaces to sustain competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SharpLight Technologies

- Sciton

- Hahn & Company

- Cutera

- Sisram Medical

- Merz Pharma GmbH & Co.

- Tria Beauty

- Bausch Health Companies

- Boston Scientific Corporation

- Apax Partners

Recent Developments:

- Sisram Medical launched Alma Harmony™ in March 2025 (North America H1 2024), a multi-modal anti-aging platform with FDA clearance for 130+ indications across all skin types. Additional releases include Alma IQ™ skin analysis tool (global rollout 2025), plus strategic partnerships: Nurse Jamie collaboration (September 4, 2025) for consumer expansion and Prollenium for Revanesse® fillers distribution (January 2024)

- In October 2024, Sciton followed up with SkinSmooth, an enhanced BBL HEROic offering for dermal renewal and skin-smoothing treatments, indicating ongoing product upgrades.

- In April 2024, Sciton launched BBL HEROic, a next-generation pulsed light platform, advancing its light-based aesthetic technology line.

- In February 2024, Cutera launched AviClear, the FDA cleared energy based devices, used for long term acne treatment. This product launch significantly represented a milestone in the field of dermatology and escalating the company’s product portfolio.

Report Coverage:

The research report offers an in-depth analysis based on Product, Gender, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue expanding rapidly as demand for minimally invasive and non-invasive aesthetic procedures rises across all age groups.

- Multi-platform systems combining laser, RF, ultrasound, and light-based technologies will gain strong clinical and commercial traction.

- AI-driven treatment customization and automated safety controls will become standard features in next-generation aesthetic devices.

- Medical spas will play a central role in driving procedural volume and accelerating device adoption globally.

- Home-use energy-based devices will grow quickly as consumers seek accessible, convenience-focused aesthetic solutions.

- Technological innovation will emphasize faster treatment times, improved comfort, and enhanced outcomes across diverse skin types.

- Aesthetic tourism in Asia-Pacific, the Middle East, and Latin America will stimulate demand for advanced platforms.

- Device manufacturers will strengthen training programs to address practitioner shortages and ensure safe treatment delivery.

- Sustainability-focused device designs and energy-efficient systems will gain importance in procurement decisions.

- Increased regulatory standardization across major regions will support safer market expansion and faster technology approvals.