Market Overview

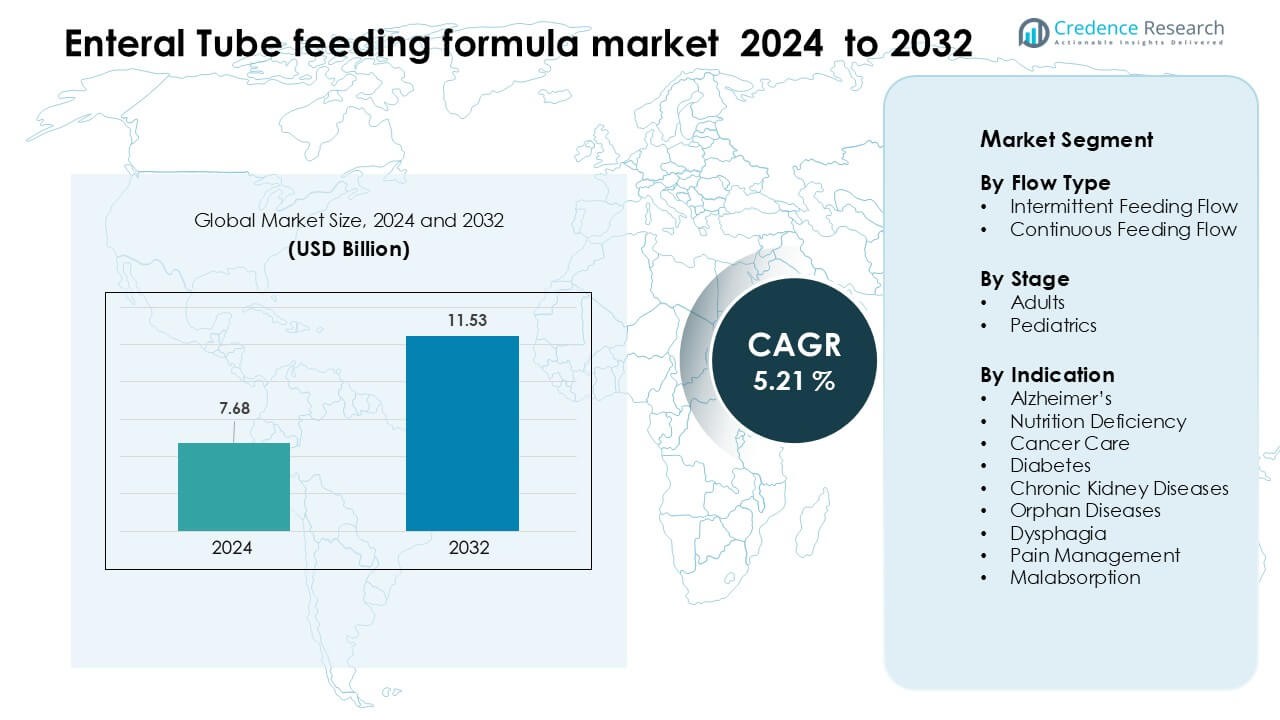

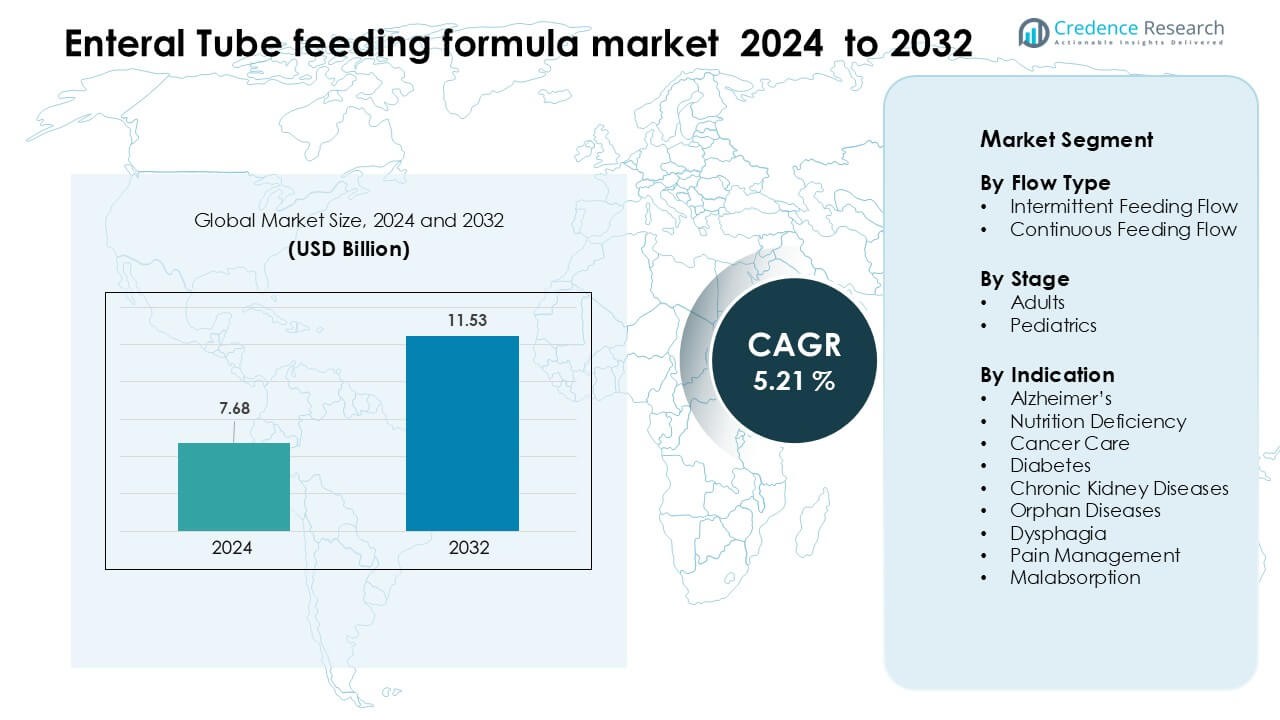

Enteral Tube feeding formula market was valued at USD 7.68 billion in 2024 and is anticipated to reach USD 11.53 billion by 2032, growing at a CAGR of 5.21 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enteral Tube Feeding Formula Market Size 2024 |

USD 7.68 Billion |

| Enteral Tube Feeding Formula Market, CAGR |

5.21 % |

| Enteral Tube Feeding Formula Market Size 2032 |

USD 11.53 Billion |

The enteral tube feeding formula market is shaped by leading companies such as Abbott, Danone S.A, Fresenius Kabi AG, Nestlé, Mead Johnson & Company, LLC, Meiji Holdings Co., Ltd., Primus Pharmaceuticals, Inc., VICTUS, and Alcresta Therapeutics. These players strengthen their positions through advanced clinical nutrition portfolios, disease-specific formulations, and strong partnerships with hospitals and home-care networks. Their focus on peptide-based blends, ready-to-feed sterile formats, and specialized products for oncology, gastrointestinal disorders, and pediatric care supports broad adoption across clinical settings. North America remained the leading region in 2024, holding 34 % of the global market due to strong reimbursement support, advanced ICU care, and well-developed home-enteral nutrition programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The enteral tube feeding formula market reached USD 7.68 billion in 2024 and is projected to hit USD 11.53 billion by 2032, registering a CAGR of 5.21 %.

• Strong demand comes from rising chronic diseases, increasing ICU admissions, and wider adoption of home-enteral nutrition, which pushes higher use of disease-specific and peptide-based formulas.

• Key trends include the shift toward personalized nutrition, growth of ready-to-feed sterile formats, and rapid expansion of digital monitoring tools for patients receiving long-term enteral support at home.

• The competitive landscape includes Abbott, Danone S.A, Fresenius Kabi AG, Nestlé, Mead Johnson & Company, LLC, Meiji Holdings Co., Ltd., Primus Pharmaceuticals, Inc., VICTUS, and Alcresta Therapeutics, competing through innovation and clinical partnerships.

• North America led the market with 34 % share in 2024, followed by Europe at 29 % and Asia Pacific at 27 %, while the intermittent feeding flow segment held the largest share among flow types.

Market Segmentation Analysis:

By Flow Type

The continuous feeding flow segment dominated the enteral tube feeding formula market in 2024 with about 63% share. Hospitals and long-term care settings preferred continuous flow due to better nutrient absorption, lower aspiration risk, and suitability for critical care patients. Demand increased as ICUs adopted automated pumps that support stable delivery for patients with limited tolerance for large bolus volumes. Intermittent feeding flow held a smaller share but gained use in home-care settings, mainly because caregivers favored simpler administration and lifestyle flexibility.

- For instance, The Kangaroo ePump is indeed a precision enteral feeding pump used in various settings, from hospital to home care, and is appropriate for a wide range of patients, from infant through geriatric.

By Stage

Adults led the market with nearly 78% share in 2024, driven by higher prevalence of chronic diseases, postoperative nutritional needs, and age-related conditions requiring long-term enteral support. Rising cases of cancer, stroke, dysphagia, and gastrointestinal disorders among older adults pushed formula consumption across hospitals and home-care programs. The pediatrics segment grew at a steady pace due to increasing diagnoses of congenital disorders and failure-to-thrive cases, but the adult population remained dominant because of its larger patient base and higher adoption of long-duration feeding regimens.

- For instance, in a home-enteral nutrition cohort of 4,586 adult patients studied by Folwarski et al., 54.5% had a primary diagnosis of neurological disease (including 17.4% neurovascular and 13.7% neurodegenerative), and 33.9% were cancer patients (including 20.2% head and neck, and 11.7% gastrointestinal cancer).

By Indication

Cancer care remained the leading indication with about 27% share in 2024, as oncology patients often rely on enteral formulas to manage treatment-related malnutrition, mucositis, and swallowing difficulties. Rising global cancer incidence and growing adoption of medical nutrition to improve treatment tolerance supported this dominance. Nutrition deficiency and dysphagia followed as major indications due to higher hospitalization rates and increased screening for clinical malnutrition. Other segments, including diabetes, chronic kidney disease, orphan diseases, pain management, and malabsorption, expanded gradually through greater clinical acceptance of condition-specific formulas.

Key Growth Drivers

Increasing Prevalence of Chronic and Age-Related Diseases

Rising cases of chronic and age-related diseases continue to fuel demand for enteral tube feeding formulas. A growing number of patients with conditions such as stroke, cancer, dementia, gastrointestinal disorders, and severe trauma require long-term nutritional support due to impaired swallowing or reduced digestive capacity. Hospitals and home-care settings now rely on enteral formulas to maintain calorie intake, stabilize patient outcomes, and reduce complications linked with malnutrition. The expanding geriatric population intensifies this need, as elderly patients often struggle with dysphagia, frailty, and chronic comorbidities. Clinical guidelines increasingly recommend enteral feeding over parenteral feeding when the gastrointestinal tract is functional, which also drives wider adoption. The rise in surgeries and ICU admissions has pushed healthcare providers to incorporate enteral nutrition early in treatment to improve recovery rates. Manufacturers have responded by offering disease-specific formulas designed for diabetes, renal issues, cancer care, neurological disorders, and gastrointestinal malabsorption. Payer support for medically necessary enteral nutrition has strengthened in several countries, boosting affordability and adherence. Together, these factors create strong momentum for market expansion across clinical care and home-based nutrition.

- For instance, Abbott Nutrition’s Glucerna 1.0 Cal formula is designed specifically for patients with diabetes: it delivers 1.0 kcal per mL, of which 34.3% of those calories come from carbohydrates helping to moderate glycemic response.

Shift Toward Home-Care Nutrition and Cost-Efficient Care Delivery

Healthcare systems worldwide are shifting toward home-based care models, which support higher adoption of enteral tube feeding formulas. Patients with chronic diseases, long-term disabilities, or postoperative complications increasingly receive nutritional therapy outside hospitals due to lower treatment costs and improved comfort. Home enteral nutrition (HEN) reduces hospital stays, lowers infection risk, and improves recovery outcomes, leading to strong endorsement from clinicians and insurers. The expansion of reimbursement programs for enteral feeding supplies, pumps, and formulas encourages families to manage long-term care at home. Growth in digital monitoring tools makes it easier to track patient nutrition, caloric intake, tube function, and tolerance levels remotely, improving adherence and reducing clinical visits. As global healthcare expenditure rises, providers prefer enteral feeding because it is more affordable than parenteral nutrition and supports better long-term metabolic stability. Companies now offer ready-to-feed formulas, portable feeding pumps, and user-friendly kits that simplify administration for caregivers. Increased awareness of nutritional therapy and wider availability of specialized home-care services further accelerate demand. This shift enhances adoption among pediatric, adult, and post-acute care groups, making home care a major driver for the global market.

- For instance, in a multicenter observational study of 456 HEN patients (314 adults, 142 children), switching to a structured home enteral nutrition program reduced infectious complications from 37.4% down to 14.9%, and cut the mean number of hospital admissions per patient-year from 1.98 to 1.26, while shortening the average hospital stay per episode from 39.7 days to 11.9 days.

Advancements in Formulation Science and Disease-Specific Nutrition

Rapid advancements in formulation science have transformed the enteral tube feeding formula market. Manufacturers are developing targeted nutrition products that address specific medical conditions such as cancer-related cachexia, chronic kidney disease, diabetes, gastrointestinal malabsorption, and severe neurological disorders. These formulas improve patient outcomes by supporting metabolic needs, preventing nutrient deficiencies, and reducing feeding intolerance. High-protein blends, peptide-based formulas, fiber-enriched options, and immune-modulating products are now widely used across clinical settings to manage complications and speed recovery. Research in microbiome health has encouraged development of prebiotic and probiotic-based formulas to improve gut function. Innovations in packaging, including sterile ready-to-use formats and long-shelf-life containers, enhance safety and convenience. Many companies are integrating allergen-free, lactose-free, and gluten-free formulations to address rising nutrition sensitivities. Clinical trials continue to validate the benefits of disease-specific enteral formulas, leading to stronger adoption among specialists across oncology, nephrology, gastroenterology, and critical care. These scientific and product advancements expand the range of eligible patients and support consistent market growth.

Key Trends & Opportunities

Rising Demand for Personalized and Condition-Specific Enteral Nutrition

Personalized nutrition represents a major trend in the enteral tube feeding formula market. Healthcare providers now seek formulas tailored to the metabolic profiles, disease stages, and nutritional deficiencies of individual patients. This shift is driven by clinical evidence showing improved recovery and reduced complications when nutrition aligns with patient-specific needs. As a result, companies are investing in high-calorie, high-protein, elemental, semi-elemental, ketogenic, renal-specific, and glycemic-control formulas. Growth in oncology and ICU admissions has increased demand for immunonutrition and peptide-based formulas that reduce inflammation and enhance tissue repair. Pediatric formulas also contribute to this trend as clinicians focus on nutrient-dense blends that support growth and development in children with feeding disorders. Digital health platforms now assist in designing patient-specific feeding plans based on biomarkers, caloric expenditure, and disease progression. The trend also creates strong opportunities for companies to collaborate with hospitals, research institutes, and clinical nutrition networks to create next-generation therapeutic formulas. As awareness of individualized nutrition grows, this trend is expected to significantly shape market development.

- For instance, Nestlé’s Peptamen® Intense VHP delivers 1.0 kcal/mL, with 37% of total calories from protein, making it ideal for critically ill or obese patients with high protein requirements.

Expansion of Home-Care Infrastructure and Digital Feeding Solutions

Rapid expansion of home-care infrastructure has become a key trend that reshapes market growth. With increasing demand for long-term care outside hospitals, home enteral nutrition services now offer delivery support, professional nurse visits, dietitian consultations, and remote monitoring systems. The rise of telehealth encourages real-time supervision of feeding tolerance, gastrointestinal health, nutrient absorption, and weight changes. Smart feeding pumps with Bluetooth connectivity, automated flow control, and digital alarms are gaining rapid acceptance. These tools help reduce feeding errors and enhance caregiver confidence. The opportunity lies in integrating AI-based decision support to adjust feeding flow, caloric density, and formula type based on patient health metrics. As home-care networks grow, companies can expand distribution channels and subscription-based supply models. The rising global burden of chronic conditions and the long recovery time after major surgeries create ongoing opportunities for home-based feeding solutions. Countries investing in community-based care, such as the U.S., Japan, UK, and Germany, strongly support the expansion of home enteral nutrition, making this trend a major growth catalyst.

- For instance, Cardinal Health’s Kangaroo Connect pump supports wireless data upload: it stores up to 30 days of feeding history, and when paired with a Wi-Fi or 3G communications module.

Key Challenges

Reimbursement Limitations and High Out-of-Pocket Expenses

Reimbursement variability remains a major challenge in the enteral tube feeding formula market. In many countries, insurance policies only cover nutrition for specific diseases or medical conditions, leaving many patients and families to bear out-of-pocket costs for formulas, tubing, pumps, and accessories. Limited reimbursement discourages long-term adherence to nutritional therapy and restricts access for low-income households. Differences in coverage between private insurance, public healthcare systems, and regional policies create confusion for caregivers and providers. Hospitals sometimes face budget constraints that limit adoption of specialized formulas despite proven clinical benefits. In emerging markets, the cost of advanced formulas remains comparatively high, reducing access and slowing market penetration. Reimbursement delays, documentation requirements, and medical necessity approvals also create administrative hurdles for clinicians. These challenges slow adoption rates and reduce the ability of nutrition therapy to reach underserved populations. Addressing reimbursement gaps remains essential for market expansion.

Tube-Feeding Complications and Formula Intolerance

Complications associated with tube feeding pose a significant barrier to broader adoption. Patients often experience gastrointestinal intolerance, including bloating, diarrhea, constipation, and abdominal discomfort, which reduces adherence to enteral nutrition. Feeding tubes can also present risks such as clogging, dislodgement, infection, and aspiration pneumonia, especially in elderly or critically ill patients. Improper administration or incorrect flow rates increase complication risks, making caregiver training essential. Variability in patient digestive function makes formula selection challenging, leading to trial-and-error approaches that increase healthcare workload. Hospitals and home-care providers must invest in training and monitoring systems to manage these risks, but resource limitations can hinder comprehensive supervision. Manufacturers continue to improve formula digestibility and develop peptide-based or hypoallergenic options, yet intolerance remains common in certain patient groups. These challenges slow the transition from parenteral to enteral nutrition and can limit long-term consistency in feeding programs.

Regional Analysis

North America

North America dominated the enteral tube feeding formula market in 2024 with 34 % share. Strong hospital infrastructure and advanced ICU care created consistent demand for clinical nutrition products. High prevalence of cancer, stroke, and neurological disorders increased reliance on tube feeding. Well-established reimbursement policies supported coverage for formulas, pumps, and accessories in many cases. Home-care nutrition programs expanded, enabling long-term feeding outside acute-care settings. Leading manufacturers based in the region launched disease-specific and peptide-based formulations. Together, these factors sustained North America’s leadership and encouraged continued product innovation and protocol adoption.

Europe

Europe accounted for around 29 % share of the enteral tube feeding formula market in 2024. Universal or broad public healthcare coverage in many countries supported structured nutrition pathways. Aging populations in Germany, Italy, France, and the UK drove higher demand for long-term enteral feeding. Clinical guidelines promoted early enteral nutrition in surgical, oncology, and critical care settings. Strong presence of specialized nutrition companies improved access to tailored formulas for renal, diabetic, and oncology patients. Home-enteral nutrition programs were well organized, especially in Western Europe. These elements reinforced Europe’s position as the second-largest regional market.

Asia Pacific

Asia Pacific held approximately 27 % share of the enteral tube feeding formula market in 2024. Rapid growth came from expanding hospital capacity, rising ICU admissions, and improving diagnosis of chronic diseases. Japan, China, South Korea, and Australia drove most regional demand through advanced tertiary-care centers. Increasing awareness of clinical nutrition among physicians and caregivers supported wider enteral feeding use. Growing elderly populations and higher cancer incidence further strengthened formula consumption. Local and multinational players invested in manufacturing and distribution networks across key countries. As healthcare access improves, Asia Pacific is expected to gain additional share.

Latin America

Latin America represented close to 5 % share of the global enteral tube feeding formula market in 2024. Brazil, Mexico, and Argentina led adoption due to larger hospital networks and private healthcare growth. Rising burden of chronic diseases, including cancer and diabetes, increased need for nutritional support. However, reimbursement gaps and income disparities limited access to advanced disease-specific formulas. Public hospitals often prioritized basic enteral products over premium specialized blends. Growing private insurance coverage and medical tourism created niche opportunities for higher-value formulas. Continued healthcare reforms and professional training programs are likely to support gradual regional expansion.

Middle East & Africa

Middle East & Africa together contributed about 5 % share to the enteral tube feeding formula market in 2024. Demand concentrated in Gulf Cooperation Council countries and South Africa, where tertiary-care facilities are stronger. Increasing investments in hospital infrastructure and oncology centers supported higher use of enteral nutrition. However, limited reimbursement frameworks and supply-chain challenges restricted adoption in several low-income nations. Awareness of structured clinical nutrition protocols remained uneven outside major urban centers. International manufacturers often partnered with local distributors to improve availability of key formulas. Gradual improvements in healthcare access are expected to unlock long-term regional potential.

Market Segmentations:

By Flow Type

- Intermittent Feeding Flow

- Continuous Feeding Flow

By Stage

By Indication

- Alzheimer’s

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The enteral tube feeding formula market features strong competition among global and regional players that focus on medical nutrition, specialized formulations, and home-care support. Companies such as Abbott, Danone S.A, Fresenius Kabi AG, Nestlé, Mead Johnson & Company, LLC, Meiji Holdings Co., Ltd., Primus Pharmaceuticals, Inc., VICTUS, and Alcrestra Therapeutics strengthen their positions through disease-specific formulas designed for diabetes, renal care, oncology, gastrointestinal disorders, and pediatric nutrition. These firms invest in clinical research, peptide-based products, and immune-modulating blends to improve patient tolerance and outcomes. Many players expand distribution partnerships with hospitals, pharmacies, and home-enteral nutrition providers to ensure wider access. Product innovation focuses on ready-to-feed sterile formulas, allergen-free options, energy-dense blends, and advanced packaging for safety and convenience. Growing demand for personalized nutrition and home-care feeding drives companies to enhance digital support tools, remote monitoring, and caregiver training resources, intensifying competition across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Abbott India announced a reformulated Ensure Diabetes Care medical-nutrition product (advanced formula positioning for glycemic management) relevant to therapeutic enteral feeding channels.

- In 2025, Danone S.A. (Nutricia) Expanded its manufacturing plant in Wuxi, China, adding fully automated sterilization lines to boost tube-feeding products production.

- In May 2024, Alcresta Therapeutics Commercial launch / first shipments of the next-generation RELiZORB immobilized-lipase cartridge (broader formula compatibility and updated device).

Report Coverage

The research report offers an in-depth analysis based on FlowType, Stage, Indication and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as chronic diseases and age-related disorders increase worldwide.

- Home-enteral nutrition adoption will expand with better reimbursement and caregiver support.

- Personalized and condition-specific formulas will gain stronger clinical preference.

- Peptide-based and semi-elemental products will see faster uptake due to improved tolerance.

- Digital feeding pumps and remote monitoring tools will enhance patient management.

- Manufacturers will invest more in immune-focused and gut-health formulations

- Emerging markets will adopt advanced formulas as hospital infrastructure improves.

- Partnerships between hospitals, nutrition companies, and home-care providers will strengthen.

- Sustainability-driven packaging and ready-to-use sterile formats will become more common.

- Clinical evidence supporting early enteral nutrition will accelerate adoption in ICUs and oncology care.