Market Overview

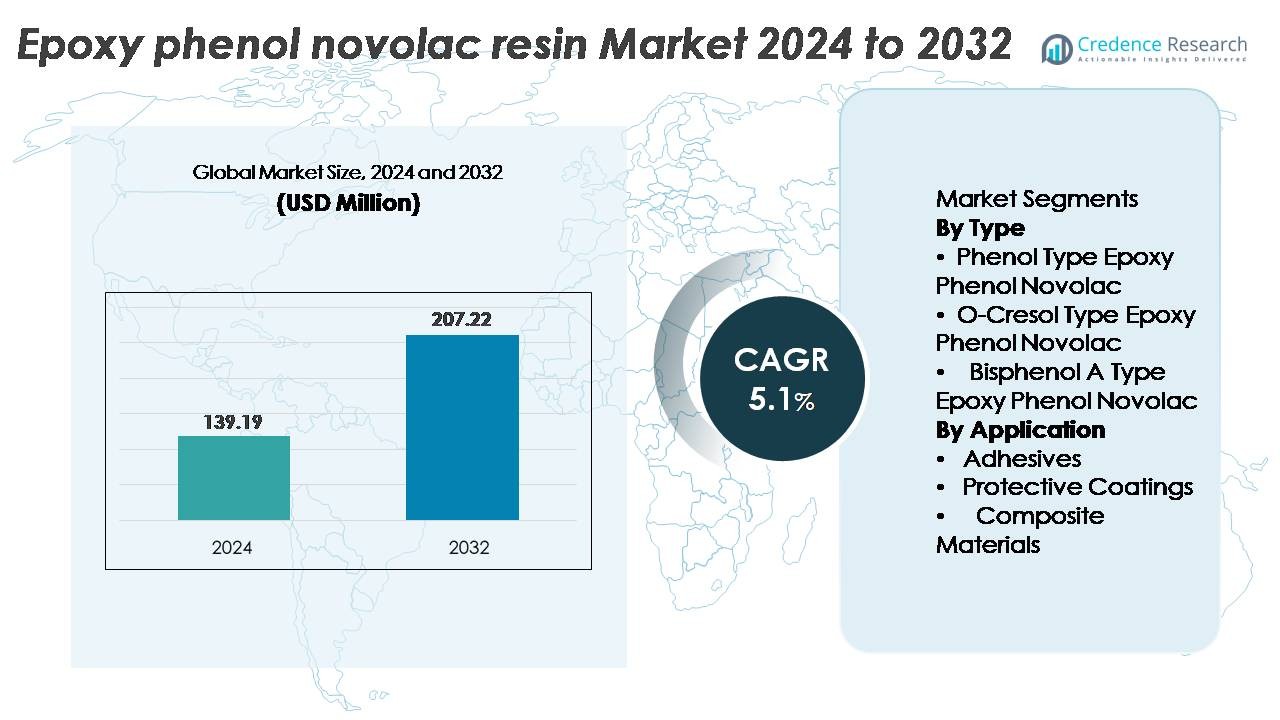

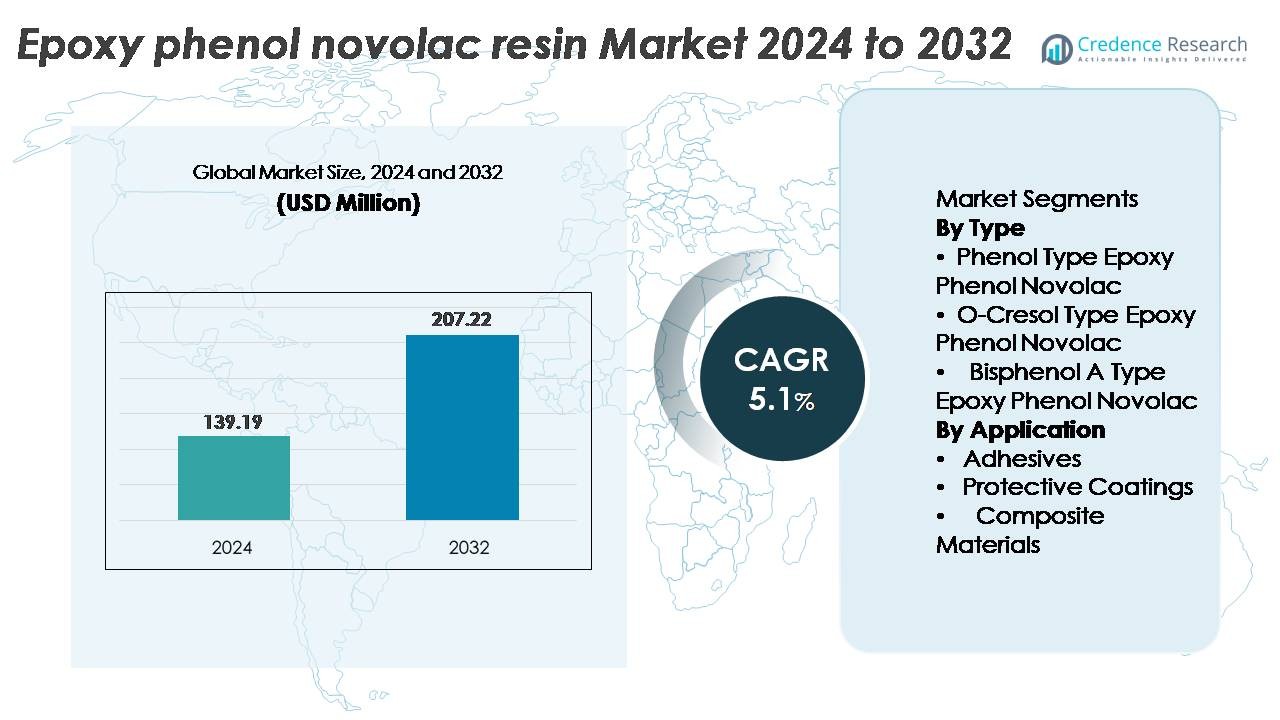

The epoxy phenol novolac resin market was valued at USD 139.19 million in 2024 and is projected to reach USD 207.22 million by 2032, expanding at a CAGR of 5.1% throughout the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Epoxy Phenol Novolac Resin Market Size 2024 |

USD 139.19 Million |

| Epoxy Phenol Novolac Resin Market, CAGR |

5.1% |

| Epoxy Phenol Novolac Resin Market Size 2032 |

USD 207.22 Million |

The epoxy phenol novolac resin market includes several prominent players, such as DIC, Hexion Inc., Kukdo Chemical Industry, CORCHEM, Aditya Birla Group, Huntsman, Momentive, GP Chemicals, DowDuPont, and Emerald Performance Materials, each competing through advancements in resin customization, heat resistance optimization, and supply chain reach. Asia-Pacific remains the leading regional market with approximately 37% share, driven by its dominance in semiconductor packaging, electronics manufacturing, and industrial coatings demand. North America and Europe follow as significant contributors due to stringent industrial safety standards and ongoing infrastructure rehabilitation. Strategic partnerships, technical-grade formulation development, and expansion into high-growth sectors continue to define competitive positioning in this market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The epoxy phenol novolac resin market was valued at USD 139.19 million in 2024 and is projected to reach USD 207.22 million by 2032, expanding at a 5.1% CAGR.

- Market growth is driven by increasing demand for high-temperature, chemical-resistant materials used in semiconductor packaging, industrial coatings, and structural repair applications across heavy industrial sectors.

- Trends highlight rising adoption in composite manufacturing and advanced protective coatings, supported by expansion in electronics miniaturization, offshore infrastructure, and long-life corrosion-control systems.

- Competitive momentum centers on resin formulation innovation, sustainability compliance, and supply chain reliability, while restraints include raw material price volatility and evolving environmental regulatory pressures.

- Asia-Pacific leads the market with 37% share, followed by North America at 32% and Europe at 26%, while Phenol Type Epoxy Phenol Novolac remains the dominant segment due to its superior heat resistance and higher crosslinking performance.

Market Segmentation Analysis:

By Type

The epoxy phenol novolac resin market by type is categorized into Phenol Type, O-Cresol Type, and Bisphenol A Type Epoxy Phenol Novolac. The Phenol Type segment holds the dominant market share, supported by its higher thermal stability and stronger mechanical strength compared with alternatives. Its dense crosslinking capacity enables enhanced resistance to corrosive chemicals and moisture, which drives usage in printed circuit boards, semiconductor sealing compounds, and structural adhesives. Growing demand in electronics manufacturing and corrosion-resistant industrial coatings continues to reinforce this segment’s leading market position.

- For instance, DIC Corporation manufactures phenolic novolac epoxy resins designed for high-temperature electronics and industrial coatings, offering glass-transition temperatures above 200°C and strong chemical resistance. These materials are widely used in semiconductor encapsulation and corrosion-resistant coatings where thermal stability and long service life are critical.

By application

The market is segmented into Adhesives, Protective Coatings, and Composite Materials. Protective Coatings stand as the leading sub-segment, attributed to increasing requirements for high-performance coatings in oil & gas infrastructure, marine vessels, and chemical processing equipment. The resin’s ability to withstand elevated temperatures, solvents, and highly acidic environments makes it a preferred material for heavy-duty corrosion prevention solutions. Expansion in industrial refurbishment and long-term asset maintenance strategies further drives the adoption of epoxy phenol novolac coatings, sustaining its dominant share in the application landscape.

- For instance, CORCHEM’s CORCHEM 207 Phenol Novolac Tank Lining is based on an epoxy phenol novolac resin system designed for severe chemical immersion service.

The lining is widely used in oilfield tanks, separators, and pressure vessels due to its strong resistance to hydrocarbons, acids, and abrasion under high-temperature operating conditions.

Key Growth Drivers

Rising Demand for High-Temperature and Chemical-Resistant Materials

Growing industrial requirements for resins with enhanced resistance to corrosive chemicals and elevated temperatures serve as a major catalyst for the epoxy phenol novolac resin market. Industries such as petrochemicals, electronics, aerospace, and marine construction are prioritizing resins capable of providing long service life under demanding conditions. The superior crosslinking structure of epoxy phenol novolac resin delivers high heat deflection temperature, robust solvent resistance, and strong bonding strength, supporting its integration into semiconductor encapsulation, composite structures, and protective linings. The global push toward extending asset lifecycle through advanced corrosion protection also drives usage in tank linings, pipelines, and offshore rigs. As infrastructure investments surge in emerging economies, demand for industrial coatings and engineered materials further accelerates resin adoption. The evolution of high-performance manufacturing environments, particularly in electronics miniaturization and high-temperature mechanical assemblies, reinforces recurring demand for this resin type.

- For instance, Hexion’s EPON™ SU phenolic novolac epoxy systems achieve glass transition temperatures above 200°C, supporting use in chemical tank linings, composite components, and high-temperature industrial coating applications.

Expansion of Electronics and Semiconductor Manufacturing

The rapid scaling of semiconductor packaging, PCB manufacturing, and electronic component protection continues to propel epoxy phenol novolac resin demand. Miniaturization trends require materials with superior electrical insulation, flame retardance, and resistance to delamination under thermal cycling. Epoxy phenol novolac resins offer strong dimensional stability and dielectric capabilities that are critical for use in solder resists, underfill compounds, and chip encapsulation. Growth in electric vehicles, consumer electronics, and renewable energy systems presents additional pathways for adoption due to increasing sensor integration and board density. The expansion of wafer fabrication plants, outsourced semiconductor assembly, and advanced packaging technologies reinforces the need for resins compatible with high-reliability microelectronic manufacturing. With automation and IoT connectivity driving component proliferation, demand for resilient encapsulating and PCB protective materials remains a long-term growth factor.

- For instance, Olin’s D.E.N.™ Novolac epoxy resins are widely used in semiconductor encapsulation and PCB laminates, where formulated systems achieve UL 94 V-0 flame ratings and high dielectric performance required for dense electronic assemblies.

Infrastructure Rehabilitation and Corrosion-Control Investments

The increasing emphasis on maintenance, repair, and service-life extension of aging industrial assets underpins strong market momentum. Epoxy phenol novolac resins provide the mechanical durability, heat resistance, and corrosion performance needed for long-term protective coatings in industrial pipelines, chemical storage facilities, wastewater treatment plants, and marine structures. Governments and private-sector operators are investing heavily in corrosion management and asset protection to reduce downtime and extend operational safety. These resins are widely used in internal tank linings, reinforced composite wraps, and structural repair formulations, supporting infrastructure upgrades and environmental compliance. The shift toward green and sustainable construction practices also supports the use of higher-quality, longer-lasting protective solutions that minimize maintenance cycles. As energy, petrochemical, and marine operations expand into harsher climates and deeper offshore locations, demand for high-performance protective epoxy systems continues to rise.

Key Trends & Opportunities

Shift Toward High-Performance Composite Adoption

Lightweight and performance-driven composite materials are emerging as a significant opportunity within the epoxy phenol novolac resin market. These resins serve as critical matrix materials for fiber-reinforced composites utilized in aerospace components, automotive lightweighting, high-speed rail, and industrial structural applications. Their ability to deliver thermal stability, structural rigidity, and chemical resistance expands their suitability as a replacement for metal components. The increasing design flexibility and weight reduction benefits of composites align with global regulatory and efficiency targets. With the adoption of hydrogen storage tanks, advanced rotating equipment, and engineered structural reinforcements, demand for resin-based composite systems is positioned for long-term growth. Advancements in continuous carbon fiber processing and resin infusion techniques further widen commercialization potential.

- For instance, Momentive’s fast-cure epoxy systems for RTM and liquid compression molding enable cycle times below 2 minutes, supporting high-volume production of structural composite components in automotive manufacturing.

Emergence of Advanced Coating Formulations

The coatings industry presents expanding opportunities as specialized resin formulations evolve for extreme temperature, abrasion, and chemical exposure environments. Epoxy phenol novolac systems enable enhanced film hardness, prolonged corrosion protection, and improved resistance to solvents and acids, making them suitable for industrial flooring, marine applications, and chemical tank insulation. Renewable energy facilities, including offshore wind turbines and geothermal plants, require protective coatings capable of withstanding severe operational conditions, opening new demand segments. Technological progress in solvent-less and waterborne epoxy novolac systems also aligns with emission reduction mandates. The shift toward low-VOC and high-solid coating formulations presents a market opportunity for manufacturers capable of delivering environmentally compliant yet high-performance solutions.

- For instance, Hexion’s waterborne epoxy coating systems are formulated to achieve VOC levels below 100 g/L while delivering corrosion protection suitable for industrial and infrastructure applications under global emission regulations.

Key Challenges

Raw Material Cost Volatility and Supply Uncertainty

Volatility in raw material pricing, particularly phenolic feedstocks and epoxy precursors, presents a significant challenge for market stability. Fluctuations driven by petrochemical capacity constraints, geopolitical issues, and global trade dynamics impact resin production costs and margins. Additionally, competitive pressures from alternative thermoset and composite resins may restrict pricing flexibility. Many resin producers face supply chain disruptions tied to chemical plant shutdowns, transportation bottlenecks, or environmental regulatory tightening affecting phenol production. Long-term contracts and backward integration strategies help mitigate risk, but smaller manufacturers remain exposed. Consistent availability and cost management of monomers and curing agents are essential to maintain profitability and meet demand reliably.

Stringent Environmental Regulations and Compliance Pressures

Environmental regulations related to VOC emissions, chemical handling, and industrial waste disposal continue to challenge resin producers. As regulatory bodies push for low-toxicity and reduced-emission formulations, manufacturers must innovate without compromising performance characteristics that define epoxy phenol novolac resins. This requires costly R&D investments and reformulation cycles that may limit smaller market participants. Restrictions affecting phenolic chemistry, hazardous disposal protocols, and workplace exposure standards also increase compliance-related operational costs. Shifts toward bio-based and low-solvent alternatives create competitive pressure and potential substitution risks. Balancing sustainability expectations with performance-intensive applications remains a key barrier to widespread adoption and cost-efficient production.

Regional Analysis

North America

North America holds approximately 32% of the epoxy phenol novolac resin market share, driven by strong consumption in protective coatings, semiconductor packaging, and industrial repair systems. The U.S. leads regional demand due to established petrochemical, aerospace, and marine infrastructure requiring high-temperature and corrosion-resistant materials. Investments in semiconductor assembly and EV component manufacturing sustain application growth in electronic encapsulation and PCB protection. Ongoing refurbishment of pipelines and chemical storage facilities increases deployment in heavy-duty coatings and composite wraps. Environmental compliance standards also encourage adoption of long-lasting, maintenance-reducing resin systems across industrial operators.

Europe

Europe accounts for nearly 26% of the market share, supported by stringent environmental and asset safety regulations that accelerate demand for high-performance coatings and composite repairs. Countries such as Germany, France, and the Netherlands drive usage in chemical processing, offshore wind energy, and industrial coatings aligned with sustainability targets. Growth in aerospace lightweighting and industrial 3D printing applications reinforces resin demand in composite matrices. Pipeline rehabilitation across Eastern Europe further elevates requirements for chemically resistant epoxy systems. Regulatory frameworks for low-VOC and corrosion-resistant formulations contribute to continued regional adoption.

Asia-Pacific

Asia-Pacific represents the largest market with approximately 37% share, attributed to rapid industrialization, infrastructure expansion, and dominant electronics manufacturing output in China, South Korea, and Japan. The region’s strong role in semiconductor packaging and PCB fabrication drives resin adoption for heat-resistant encapsulation and solder mask coatings. Large-scale petrochemical plants, marine construction, and offshore operations expand utilization in corrosion-resistant coatings. Rising investments in transportation, renewable energy, and urban infrastructure reinforce protective resin requirements. Increasing domestic production capabilities support cost-competitive manufacturing and strengthen Asia-Pacific’s position as the fastest-growing consumer and supplier.

Latin America

Latin America holds around 3% of the market share, with demand concentrated in Brazil, Mexico, and Chile across petrochemical processing, mining infrastructure, and marine coatings. The replacement of aging industrial assets and expansion of offshore projects stimulate adoption of corrosion-resistant epoxy novolac systems. Growth remains steady due to refinery upgrades and protective coatings used in fertilizers, pulp and paper, and chemical storage facilities. Although pricing sensitivity and import dependency constrain market penetration, opportunities are emerging through regional investments in composite pipe systems and industrial flooring solutions for manufacturing expansions.

Middle East & Africa

Middle East & Africa account for nearly 2% market share, primarily driven by oil & gas infrastructure, desalination facilities, and chemical-resistant coatings for extreme temperature and saline environments. The Gulf region relies heavily on corrosion control materials for pipelines, offshore drilling structures, and refinery assets. Rising industrial diversification in Saudi Arabia and the UAE supports demand for advanced coatings and composite repair technologies. In Africa, adoption remains gradual but increasing with mining sector expansion and urban infrastructure development. Limited local manufacturing capacity creates scope for strategic distribution and joint ventures.

Market Segmentations:

By Type

- Phenol Type Epoxy Phenol Novolac

- O-Cresol Type Epoxy Phenol Novolac

- Bisphenol A Type Epoxy Phenol Novolac

By Application

- Adhesives

- Protective Coatings

- Composite Materials

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the epoxy phenol novolac resin market is moderately consolidated, with competition shaped by technology capabilities, formulation expertise, and application-specific customization. Leading manufacturers focus on enhancing thermal stability, chemical resistance, and adhesion performance to strengthen their product portfolios in electronics, protective coatings, and composite applications. Strategic priorities include scaling production capacity, optimizing manufacturing efficiencies, and expanding distribution networks across high-growth industrial regions. Partnerships with semiconductor packaging firms, coating formulators, and composite producers support value-added integration. Companies increasingly invest in low-VOC, solvent-free, and advanced curing systems in response to environmental regulations and sustainability expectations. Competitive differentiation also stems from technical service support, custom resin development, and reliability in supply chain performance. Market participants continue to pursue mergers, licensing arrangements, and long-term contracts with industrial operators to safeguard market presence and reinforce application relevance in evolving high-performance sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DIC

- Hexion Inc.

- Kukdo Chemical Industry

- CORCHEM

- Aditya Birla Group

- Huntsman

- Momentive

- GP Chemicals

- DowDuPont

- Emerald Performance Materials

Recent Developments

- In August 2024, Hexion introduced fire-retardant epoxy resins, expanding its product range for high-safety applications.

- In June 2024, Aditya Birla Group the company announced plans to build a new epoxy resin manufacturing and R&D facility on a 35-acre site at Beaumont, Texas, USA, aiming to address demand in North America.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for epoxy phenol novolac resin will strengthen as industries prioritize long-life corrosion protection and heat-resistant materials.

- Semiconductor packaging and miniaturized electronics will continue driving the need for high-performance encapsulation and PCB insulation.

- Growth in renewable energy infrastructure will expand opportunities in advanced coatings and composite applications.

- Adoption of lightweight composite components will increase in automotive, rail, and aerospace sectors.

- Regulatory focus on safety and durability will support higher-quality resin formulations for industrial infrastructure.

- Emerging offshore and deepwater projects will elevate requirements for chemically resistant epoxy coatings.

- Low-VOC and eco-optimized resin development will gain traction due to sustainability standards.

- Expansion of chemical storage and processing facilities will boost demand for high-resistance tank linings.

- Manufacturers will invest more in custom formulations tailored to specialized end-user requirements.

- Strategic partnerships between resin producers and coating or composite systems manufacturers will intensify.