Market overview

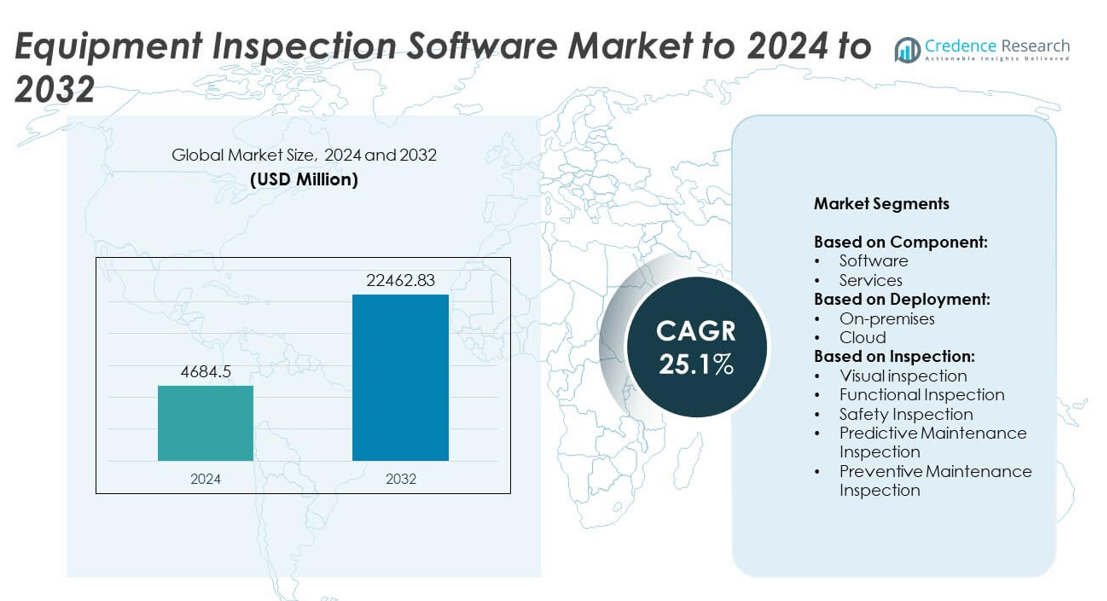

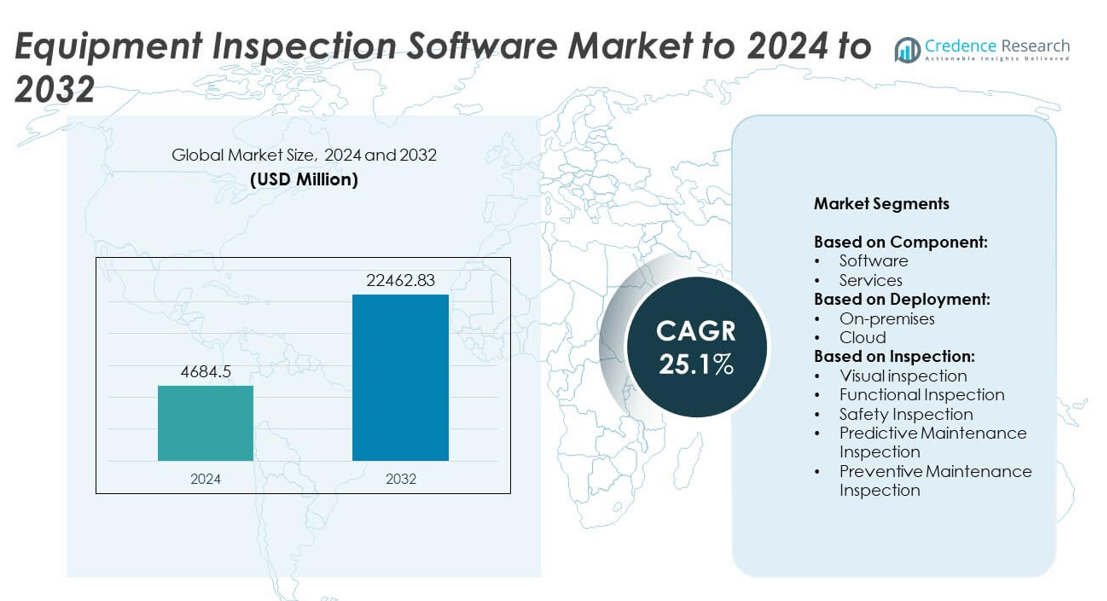

Equipment Inspection Software Market size was valued USD 4684.5 Million in 2024 and is anticipated to reach USD 22462.83 Million by 2032, at a CAGR of 25.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Equipment Inspection Software Market Size 2024 |

USD 4684.5 Million |

| Equipment Inspection Software Market, CAGR |

25.1% |

| Equipment Inspection Software Market Size 2032 |

USD 22462.83 Million |

The equipment inspection software market is highly competitive, with leading players including Core Inspection, BlueFolder, Limble CMMS, Fiix Inc., Hexagon, and Wolters Kluwer driving innovation. These companies focus on AI-enabled predictive maintenance, cloud-based deployment, and mobile inspection solutions to enhance efficiency and ensure compliance across industries such as oil & gas, manufacturing, and construction. Regional analysis shows that North America led the market in 2024, holding a dominant 36% share, supported by strong regulatory frameworks and rapid Industry 4.0 adoption. Europe followed with 28%, while Asia Pacific accounted for 22%, reflecting growing industrialization and digital transformation in emerging economies.

Market Insights

- The equipment inspection software market was valued at USD 4684.5 Million in 2024 and is projected to reach USD 22462.83 Million by 2032, growing at a CAGR of 25.1%.

- Rising adoption of predictive maintenance solutions, regulatory compliance needs, and Industry 4.0 initiatives are driving rapid market expansion across industrial sectors.

- Key trends include AI and machine learning integration for predictive analytics, cloud-based deployment for scalability, and mobile-enabled inspections for real-time efficiency.

- The market is highly competitive with players focusing on innovation, subscription-based pricing, and integration of compliance management tools to strengthen their customer base.

- North America led with 36% share in 2024, Europe followed with 28%, Asia Pacific accounted for 22%, while Latin America and Middle East & Africa held 8% and 6% respectively; the software segment dominated by contributing over 65% of total revenue.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The software segment held the dominant share of the equipment inspection software market in 2024, accounting for over 65% of revenue. The dominance is driven by demand for advanced inspection platforms offering automated reporting, real-time analytics, and integration with enterprise systems. Companies increasingly adopt AI-powered software tools to enhance defect detection and reduce downtime. Services are also growing steadily, supported by training, customization, and managed inspection solutions. The strong adoption of software highlights the industry’s shift toward digitalized inspection processes for operational efficiency and compliance.

- For instance, Cognex states that more than 1 billion products are inspected, evaluated, tracked, and traced using its systems every day.

By Deployment

Cloud deployment emerged as the dominant model, representing nearly 60% of the total market in 2024. The growth is fueled by the scalability, remote accessibility, and cost-effectiveness offered by cloud platforms. Organizations benefit from real-time data sharing and seamless updates, making it the preferred choice for enterprises with distributed operations. On-premises deployment continues to serve industries with strict data security and regulatory requirements, such as energy and defense. The strong adoption of cloud-based models underlines the industry’s move toward digital transformation and remote equipment monitoring.

- For instance, SafetyCulture’s cloud platform completes more than 1 billion checks annually, according to official company data.

By Inspection

Predictive maintenance inspection led the market, holding over 40% share in 2024. The dominance is attributed to rising demand for AI-driven solutions that forecast equipment failures before breakdowns occur. This approach reduces unplanned downtime, lowers maintenance costs, and improves asset lifespan. Functional and safety inspections also show consistent adoption, particularly in manufacturing and oil & gas sectors where regulatory compliance and worker safety are critical. Preventive maintenance inspection continues to gain traction, though predictive solutions dominate as industries prioritize efficiency and cost optimization.

Key Growth Drivers

Rising Demand for Predictive Maintenance Solutions

The adoption of predictive maintenance software is a major growth driver for the equipment inspection software market. Organizations prioritize tools that reduce unplanned downtime and extend asset life. AI and IoT-enabled platforms allow early detection of failures, saving costs and improving efficiency. Manufacturing, energy, and transportation sectors are leading adopters due to high equipment dependency. The shift toward condition-based monitoring highlights predictive maintenance as the central force driving large-scale adoption across industries.

- For instance, SKF has used predictive maintenance solutions to improve equipment reliability and availability for its clients, achieving specific, documented results in case studies, a refinery increased the Mean Time Between Failures (MTBF) of a pump from 18 to 54 months over a ten-year period.

Strict Regulatory Compliance and Safety Standards

Stringent global regulations and safety standards drive the deployment of inspection software. Industries such as oil & gas, construction, and automotive face increasing pressure to comply with workplace safety and equipment inspection rules. Digital inspection tools provide automated compliance reports, reducing human error and ensuring accuracy. By addressing regulatory demands, these solutions help firms avoid penalties and enhance worker safety. This growing emphasis on compliance is accelerating investment in advanced inspection platforms across multiple verticals.

- For instance, Honeywell reports providing safety and productivity solutions to over 10,000 industrial plants and 10 million buildings globally.

Digital Transformation and Industry 4.0 Adoption

Industry 4.0 initiatives are transforming how organizations manage and monitor assets. The integration of AI, cloud, and IoT in equipment inspection software enables real-time monitoring and data-driven decisions. Businesses adopting smart factories increasingly rely on software-driven inspections for operational efficiency. Cloud connectivity and mobile access empower remote inspections, reducing downtime and costs. The alignment of equipment inspection with digital transformation initiatives makes this trend a powerful growth driver in global industrial sectors.

Key Trends & Opportunities

Integration of AI and Machine Learning

A key trend in the equipment inspection software market is the integration of AI and machine learning capabilities. These technologies enhance defect detection accuracy and predictive maintenance capabilities. AI-driven analytics allow companies to minimize false positives and optimize inspection schedules. This improves efficiency and reduces operational costs, creating opportunities for vendors to innovate with intelligent inspection platforms. The increasing use of computer vision in visual inspections further expands the software’s potential across industries.

- For instance, an IBM Research-developed model trained on over 200,000 high-resolution images of concrete structures detects critical defects.

Expansion of Cloud-Based Platforms

Cloud-based deployment remains a key opportunity, enabling enterprises to scale inspection solutions with flexibility. Cloud platforms support remote inspections, real-time collaboration, and easier integration with enterprise resource planning systems. This makes them highly attractive for organizations with distributed operations. Vendors offering hybrid models also gain traction, catering to firms balancing security and scalability. The expansion of cloud services creates opportunities for global adoption, especially among small and medium enterprises seeking cost-effective inspection solutions.

- For instance, As a global provider of enterprise cloud computing, Oracle serves hundreds of thousands of customers in 175 countries, with Oracle serves 430,000 customers globally.

Key Challenges

High Implementation and Integration Costs

One of the key challenges in the equipment inspection software market is high upfront investment. Enterprises face costs related to software deployment, employee training, and integration with existing systems. Small and medium-sized businesses often struggle with affordability, slowing adoption. While the long-term benefits include efficiency and reduced downtime, the significant initial spending remains a barrier. Vendors are increasingly offering subscription-based pricing models to overcome cost hurdles and drive wider accessibility.

Cybersecurity and Data Privacy Concerns

Data security is another major challenge impacting the growth of cloud-based inspection software. Companies handle sensitive operational and compliance data, which becomes vulnerable to breaches and cyberattacks. Regulatory requirements for data protection add complexity to global deployments. Organizations with strict security mandates, such as defense and energy, often hesitate to adopt cloud-based platforms. Vendors must invest in robust encryption, authentication, and compliance certifications to address these concerns and ensure customer trust.

Regional Analysis

North America

North America accounted for the largest share of the equipment inspection software market in 2024, representing nearly 36%. The region’s dominance is supported by strong adoption of predictive maintenance and cloud-based solutions across industries such as oil & gas, automotive, and aerospace. Regulatory standards and workplace safety rules have accelerated software integration for compliance and operational efficiency. The presence of leading technology providers and early Industry 4.0 adoption further boost growth. Rising investments in AI-driven inspection platforms ensure that North America continues to lead the global market during the forecast period.

Europe

Europe held around 28% of the market share in 2024, driven by strict industrial safety regulations and sustainability goals. Industries such as manufacturing, automotive, and energy are major adopters of inspection software to ensure compliance with EU standards. The region’s focus on digital transformation initiatives, including Industry 4.0 frameworks, is encouraging the use of cloud and AI-enabled inspection platforms. Countries like Germany, the UK, and France dominate adoption due to advanced industrial bases. Increasing demand for predictive and preventive inspection services strengthens Europe’s position as a key growth region.

Asia Pacific

Asia Pacific captured nearly 22% of the global market share in 2024, emerging as one of the fastest-growing regions. Expanding manufacturing hubs in China, India, and Southeast Asia are fueling adoption of inspection software for quality control and maintenance optimization. The growing reliance on digital tools to reduce equipment downtime supports this trend. Strong government initiatives to promote industrial automation and smart manufacturing also accelerate adoption. Rising investment in cloud-based deployment and AI-powered inspection systems further enhances Asia Pacific’s growth prospects, positioning the region as a major contributor in the coming years.

Latin America

Latin America accounted for approximately 8% of the equipment inspection software market share in 2024. The adoption is driven by increasing demand in the oil & gas, mining, and manufacturing sectors where equipment reliability is critical. Brazil and Mexico lead the regional market, supported by growing investments in digital transformation. While the overall adoption lags behind developed regions, cloud-based solutions are gaining popularity due to their cost efficiency and scalability. Rising industrial activity and infrastructure projects are expected to provide growth opportunities for inspection software vendors in this region.

Middle East & Africa

The Middle East & Africa region held a 6% share of the global equipment inspection software market in 2024. Growth is primarily driven by the oil & gas sector, where inspection software helps ensure safety and compliance with strict regulations. Countries like Saudi Arabia and the UAE are key adopters, with investments in predictive maintenance and Industry 4.0 initiatives. Africa’s adoption remains modest, but increasing industrialization is creating opportunities. Cloud-based platforms are gradually expanding, offering scalable solutions for industries seeking cost-effective ways to improve equipment reliability and operational performance.

Market Segmentations:

By Component:

By Deployment:

By Inspection:

- Visual inspection

- Functional Inspection

- Safety Inspection

- Predictive Maintenance Inspection

- Preventive Maintenance Inspection

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the equipment inspection software market features key players such as Core Inspection, BlueFolder, Inc., e-Emphasys, Limble CMMS, Certainty Software, UpKeep Technologies, Inc., Driveroo, Inspect Point, Fiix Inc., Alpha Software, HCSS, AssetWorks LLC, KPA, eMaint Enterprises, LLC, Wolters Kluwer, and Hexagon. The market is characterized by strong competition among vendors offering advanced digital inspection solutions tailored for diverse industries including manufacturing, oil & gas, construction, and automotive. Companies compete by enhancing AI-driven predictive maintenance, cloud-based platforms, and mobile-enabled inspection capabilities that streamline operations and reduce downtime. Vendors focus on compliance management features to address growing regulatory requirements across global markets. Innovation in real-time analytics, seamless integration with enterprise systems, and subscription-based pricing models further intensify competition. With the rising demand for smart factories and Industry 4.0 adoption, market participants are strengthening their portfolios through continuous product upgrades, partnerships, and service expansions to capture larger customer bases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Core Inspection

- BlueFolder, Inc.

- e-Emphasys

- Limble CMMS

- Certainty Software

- UpKeep Technologies, Inc.

- Driveroo

- Inspect Point

- Fiix Inc.

- Alpha Software

- HCSS

- AssetWorks LLC

- KPA

- eMaint Enterprises, LLC

- Wolters Kluwer

- Hexagon

Recent Developments

- In 2024, Certainty Software Launched version 4.6 and 4.7: key upgrades include AI Vision for automated answers to inspection questions via images/PDFs, checklist reusability, bulk user/asset management, and scheduling/reporting improvements

- In 2024, Wolters Kluwer launched the Enablon Vision Platform. It features enhanced analytics and data visualization capabilities, and integrates governance, risk, compliance, environmental, and health and safety management to streamline inspection workflows.

- In November 2023, Hexagon launched the Nexus Connected Worker manufacturing software suite.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Inspection and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with rising adoption of predictive maintenance solutions.

- Cloud-based deployment will dominate as enterprises seek scalability and remote accessibility.

- AI and machine learning integration will enhance defect detection and inspection accuracy.

- Regulatory compliance requirements will continue to drive investment in inspection platforms.

- Mobile-enabled inspections will gain popularity, improving flexibility for field technicians.

- Cybersecurity measures will become critical to support trust in cloud-based systems.

- Small and medium enterprises will increasingly adopt subscription-based models for affordability.

- Industry 4.0 and smart factory initiatives will accelerate software integration.

- Visual and safety inspections will evolve with advanced computer vision technologies.

- Emerging markets in Asia Pacific and Latin America will provide strong growth opportunities.