Market overview

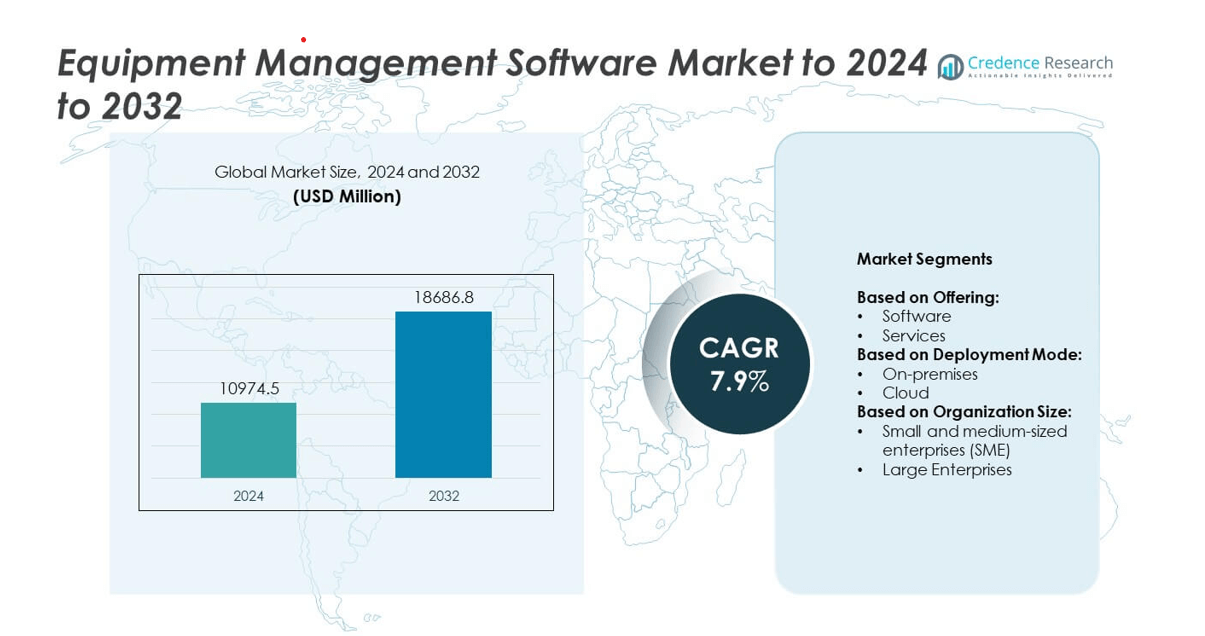

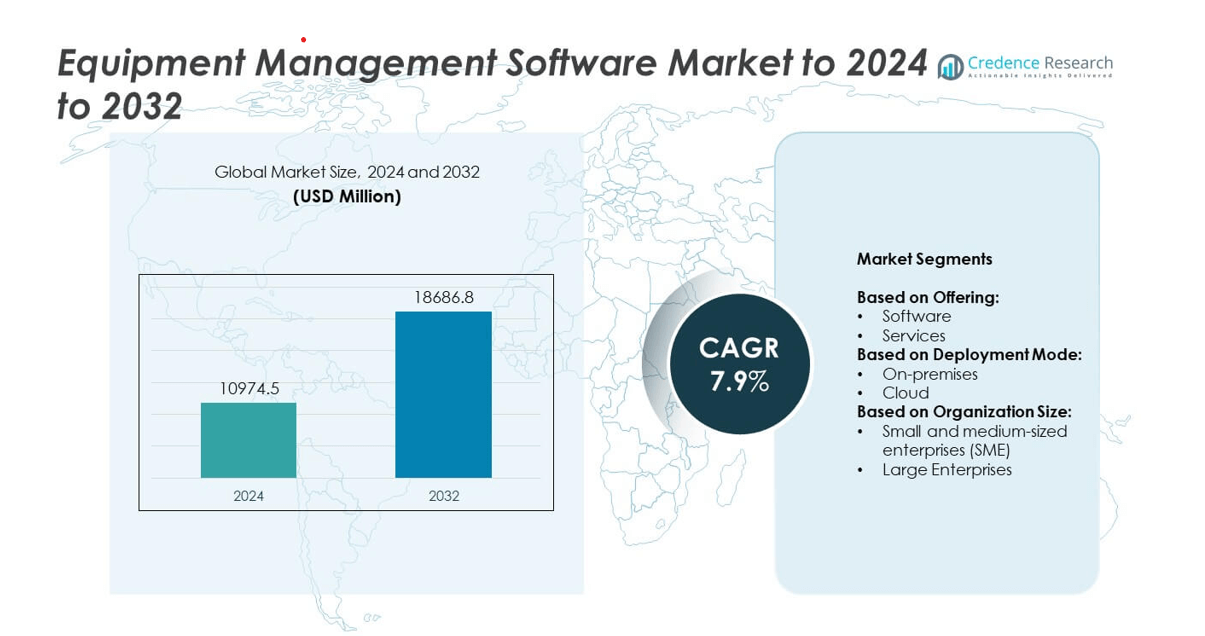

Equipment Management Software Market size was valued USD 10974.5 Million in 2024 and is anticipated to reach USD 18686.8 Million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Equipment Management Software Market Size 2024 |

USD 10974.5 Million |

| Equipment Management Software Market, CAGR |

7.9% |

| Equipment Management Software Market Size 2032 |

USD 18686.8 Million |

The equipment management software market is highly competitive, with major players including Cisco Systems, Accruent, Oracle Corporation, ManageEngine, Siemens AG, IFS AB, Microsoft Corporation, ServiceNow, IBM Corporation, SAP SE, and Infor. These companies are focusing on advanced software solutions that integrate cloud platforms, predictive maintenance, and IoT-enabled monitoring to enhance efficiency and lifecycle management. North America led the global market in 2024, accounting for 37% of total share, driven by strong digital adoption and established industrial infrastructure. Europe followed with 28% share, supported by regulatory compliance and sustainability initiatives, while Asia Pacific captured 22%, fueled by rapid industrialization and expanding SME adoption.

Market Insights

- The equipment management software market size was USD 10974.5 Million in 2024 and is expected to reach USD 18686.8 Million by 2032, growing at a CAGR of 7.9%.

- Rising demand for predictive maintenance and digital transformation initiatives are the key drivers boosting adoption across industries such as manufacturing, construction, and energy.

- Market trends include increasing deployment of cloud-based solutions, integration of IoT and AI technologies, and growing preference for mobile-enabled platforms to ensure real-time monitoring.

- Competition is strong with players investing in innovation, strategic partnerships, and sector-specific solutions to differentiate offerings and expand their global footprint.

- North America led the market with 37% share in 2024, followed by Europe at 28% and Asia Pacific at 22%, while the software segment held over 65% share, highlighting its dominance in enabling asset tracking, predictive analytics, and operational efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering

The software segment held the largest share of the equipment management software market in 2024, accounting for over 65% of total revenue. Its dominance is driven by increasing demand for automated asset tracking, predictive maintenance tools, and integrated workflow solutions. Organizations are prioritizing software adoption to reduce downtime and extend equipment life cycles. The services segment, while smaller, is growing steadily as enterprises require implementation, customization, and training support to optimize system performance, further fueling the market’s expansion.

- For instance, Infor serves over 60,000 customers worldwide with a broad range of enterprise software, including Infor CloudSuite EAM for asset lifecycle management. while other analyses show that Infor software is used in over 175 countries.

By Deployment Mode

The cloud-based segment dominated the market in 2024 with more than 60% share. Businesses are adopting cloud deployment due to its scalability, lower upfront cost, and ease of remote access. Rising digital transformation initiatives and the need for real-time monitoring of equipment across multiple locations are strengthening cloud adoption. On-premises deployment continues to serve industries with strict data security requirements, but the faster integration capabilities of cloud solutions ensure its sustained leadership over the forecast period.

- For instance, Adobe Analytics, a component of the Experience Cloud, is informed by Adobe Experience Platform, which handles massive data volumes, including over 1 trillion visits to retail websites and 17 trillion segment evaluations per day based on data from various Adobe applications.

By Organization Size

Large enterprises captured the dominant market share in 2024, accounting for around 58% of the market. Their leadership is supported by significant investment capacity and the need for advanced equipment monitoring across complex operations. Adoption among SMEs is accelerating, driven by the affordability of cloud-based solutions and subscription pricing models. Vendors are offering flexible packages and easy integration tools that enable SMEs to compete effectively. While large enterprises remain the primary adopters, SMEs are expected to emerge as a high-growth segment during the forecast period.

Key Growth Drivers

Rising Demand for Predictive Maintenance

Predictive maintenance is a primary growth driver, enabling businesses to anticipate equipment failures and reduce downtime. Equipment management software uses AI and IoT sensors to monitor asset health and provide actionable insights. This reduces repair costs, extends equipment life, and enhances operational efficiency. Industries like manufacturing, energy, and construction are investing heavily in predictive tools to streamline workflows. The push for data-driven decision-making further supports adoption, making predictive maintenance a crucial force driving the market’s rapid expansion.

- For instance, In the past, Hitachi reported reducing downtime by up to 50% for a separate “Predictive Maintenance Suite” on railways

Increasing Digital Transformation Across Industries

Digital transformation across industries is fueling strong demand for advanced equipment management solutions. Enterprises are modernizing legacy systems and adopting automation-driven platforms to improve asset visibility. Cloud integration, mobile accessibility, and advanced analytics are becoming central to these transformations. Organizations seek real-time monitoring and reporting to ensure compliance and optimize resource allocation. This trend not only accelerates software adoption but also supports innovation in deployment models. The focus on efficiency and transparency in operations reinforces digital transformation as a major driver.

- For instance, Salesforce reported that over 150,000 companies worldwide use its cloud-based solutions to accelerate digital transformation and workflow automation.

Focus on Cost Optimization and Efficiency

Cost optimization is a significant driver propelling the equipment management software market. Companies face rising operational costs and must maximize resource utilization to remain competitive. The software enables better asset scheduling, reduces unplanned downtime, and optimizes workforce allocation. By minimizing equipment idle time and avoiding unnecessary repairs, organizations achieve considerable savings. Industries with capital-intensive assets, such as oil and gas, construction, and logistics, are leveraging these tools to drive cost efficiency. This focus on cost reduction continues to anchor market growth.

Key Trends & Opportunities

Adoption of Cloud-Based Solutions

Cloud-based equipment management software represents a major trend, offering scalability, lower upfront costs, and remote access. Organizations are shifting to SaaS-based solutions to support decentralized operations and mobile workforce management. The flexibility of cloud platforms makes them suitable for SMEs and large enterprises alike. Integration with advanced analytics and AI also provides real-time insights into asset utilization. As companies expand across geographies, the demand for seamless cloud-based systems grows. This shift creates significant opportunities for vendors offering secure and scalable solutions.

- For instance, Workday’s cloud ERP has more than 65 million users across 175 countries.

Integration with IoT and AI Technologies

Integration of IoT and AI into equipment management solutions is opening vast opportunities. IoT sensors collect real-time performance data, while AI algorithms analyze it to deliver predictive insights. This combination enhances operational safety, asset performance, and lifecycle management. Industries are increasingly adopting these intelligent platforms to gain a competitive edge. The ability to link connected devices with centralized dashboards helps companies make faster, data-driven decisions. As industrial IoT expands, the fusion of AI and IoT emerges as a powerful trend.

- For instance, PTC’s ThingWorx IoT platform is used by numerous customers for digital transformation and Industrial IoT applications, connecting millions of devices for real-time performance monitoring, with PTC claiming that 95% of Fortune 500 discrete manufacturers rely on its technology.

Key Challenges

High Implementation and Maintenance Costs

High implementation costs remain a challenge for widespread adoption of equipment management software. Small and medium-sized enterprises often face budget limitations that restrict investment in advanced platforms. Expenses include software licensing, customization, training, and system integration, which can be substantial. Additionally, ongoing maintenance costs and updates add to the financial burden. These hurdles can slow adoption, particularly in price-sensitive markets. Vendors must address this issue by offering flexible pricing models and modular solutions tailored to SME budgets.

Concerns Around Data Security and Compliance

Data security and compliance risks pose another significant challenge for the market. Equipment management software often integrates with cloud platforms and IoT networks, making them vulnerable to cyberattacks. Industries such as healthcare, defense, and energy require strict adherence to regulatory standards. Breaches could expose sensitive operational data and disrupt business continuity. Ensuring secure access, encryption, and regulatory compliance increases complexity for vendors. Addressing these concerns is vital for building customer trust and ensuring long-term adoption in sensitive industries.

Regional Analysis

North America

North America dominated the equipment management software market in 2024 with a market share of 37%. The region benefits from early adoption of advanced digital technologies, strong presence of leading vendors, and high demand across industries such as construction, manufacturing, and oil and gas. Companies are heavily investing in predictive maintenance and cloud-based platforms to improve asset performance and compliance. The U.S. leads the regional market due to large-scale industrialization and advanced IT infrastructure, while Canada is showing strong adoption in manufacturing and energy sectors, driving steady growth during the forecast period.

Europe

Europe accounted for 28% of the equipment management software market in 2024, driven by increasing focus on digital transformation and regulatory compliance. Countries like Germany, the UK, and France are leading adopters, supported by robust manufacturing, automotive, and energy industries. The region emphasizes sustainability and efficient resource utilization, encouraging deployment of predictive and preventive maintenance solutions. Cloud adoption continues to expand as enterprises modernize legacy systems. European vendors also invest in AI-enabled tools for predictive insights, ensuring operational efficiency and cost reduction, which strengthens the overall growth of the market in the region.

Asia Pacific

Asia Pacific held a 22% share of the equipment management software market in 2024, supported by rapid industrialization, urbanization, and strong demand from emerging economies such as China, India, and Japan. Expanding construction projects, manufacturing hubs, and adoption of IoT-based monitoring systems are key factors boosting growth. Cloud deployment is gaining traction, especially among SMEs seeking affordable solutions. Governments across the region are also investing in digital infrastructure and smart manufacturing initiatives. With growing awareness of predictive maintenance benefits, Asia Pacific is expected to register the fastest growth among all regions during the forecast period.

Latin America

Latin America represented 7% of the equipment management software market in 2024, with Brazil and Mexico leading adoption. The region is experiencing gradual digital transformation across industries like mining, construction, and energy. Growing awareness about asset lifecycle management and cost optimization is driving uptake of cloud-based platforms. Limited IT infrastructure and budget constraints among SMEs pose challenges, but rising partnerships with global vendors are bridging gaps. Government initiatives to modernize industrial operations further support adoption, making Latin America a promising region for steady growth in the equipment management software market over the forecast period.

Middle East and Africa

The Middle East and Africa captured a 6% market share in 2024, driven by rising demand from oil and gas, construction, and utilities sectors. Countries such as the UAE, Saudi Arabia, and South Africa are investing in advanced digital solutions to optimize asset performance. Adoption of cloud-based platforms is growing due to their scalability and remote monitoring capabilities. However, challenges like high implementation costs and limited digital infrastructure slow down broader adoption. Increasing focus on operational efficiency and predictive maintenance is expected to gradually boost demand, positioning the region for moderate but consistent growth.

Market Segmentations:

By Offering:

By Deployment Mode:

By Organization Size:

- Small and medium-sized enterprises (SME)

- Large Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the equipment management software market features leading players such as Cisco Systems, Accruent, Oracle Corporation, ManageEngine, Siemens AG, IFS AB, Microsoft Corporation, ServiceNow, IBM Corporation, SAP SE, and Infor. These companies focus on enhancing product portfolios through innovations in cloud deployment, AI integration, and IoT-enabled monitoring solutions. The market is highly dynamic, with vendors competing on factors such as scalability, customization, and real-time data analytics. Strategic partnerships, mergers, and acquisitions are common approaches to strengthen global presence and expand customer bases. Providers are also emphasizing industry-specific solutions to address the distinct requirements of manufacturing, construction, energy, and healthcare sectors. Growing demand for predictive maintenance and mobile-enabled platforms further intensifies competition, encouraging continuous technological advancements. By offering cost-efficient, flexible, and secure solutions, players aim to differentiate themselves in a competitive environment where operational efficiency and sustainability remain critical decision-making factors for end users.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, SAP announced it would have around 400 embedded AI use cases across its cloud portfolio. This effort focuses on unlocking business value through AI for various business processes, including equipment management.

- In 2024, ServiceNow introduced its Workflow Data Fabric, is an enhanced integrated data layer that unifies business and technology data across the enterprise, powering all workflows and AI agents.

- In 2023, Oracle was named a Representative Vendor for its Utilities Work and Asset Management and Fusion Cloud Maintenance products in Gartner Market Guide for EAM.

Report Coverage

The research report offers an in-depth analysis based on Offering, Deployment Mode, Organization Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily with strong demand for predictive maintenance tools.

- Cloud deployment will expand further as businesses prioritize scalability and cost efficiency.

- Integration of IoT and AI will drive real-time equipment monitoring and analytics adoption.

- Large enterprises will remain key adopters, but SME adoption will rise with affordable SaaS models.

- Vendors will focus on offering industry-specific solutions to meet sector-driven requirements.

- Data security will become a central priority as connected systems expand globally.

- Mobile-enabled platforms will gain traction for remote asset tracking and management.

- Partnerships between global vendors and regional players will support wider market reach.

- Regulatory compliance needs will encourage organizations to adopt advanced monitoring systems.

- Sustainability and efficiency goals will accelerate investment in next-generation equipment management solutions.