Market Overview

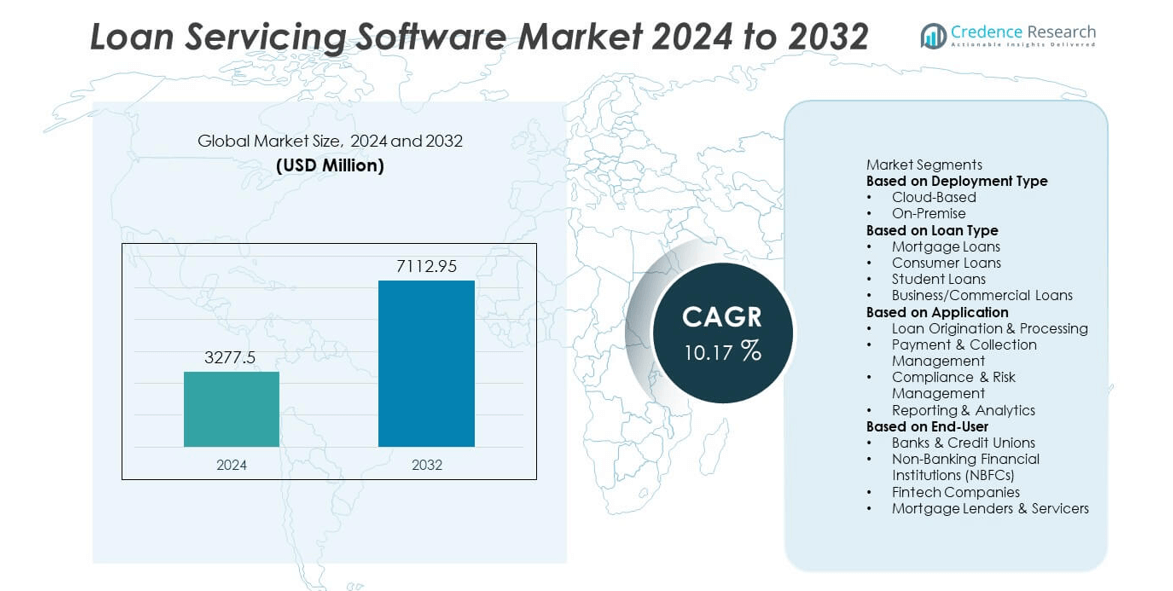

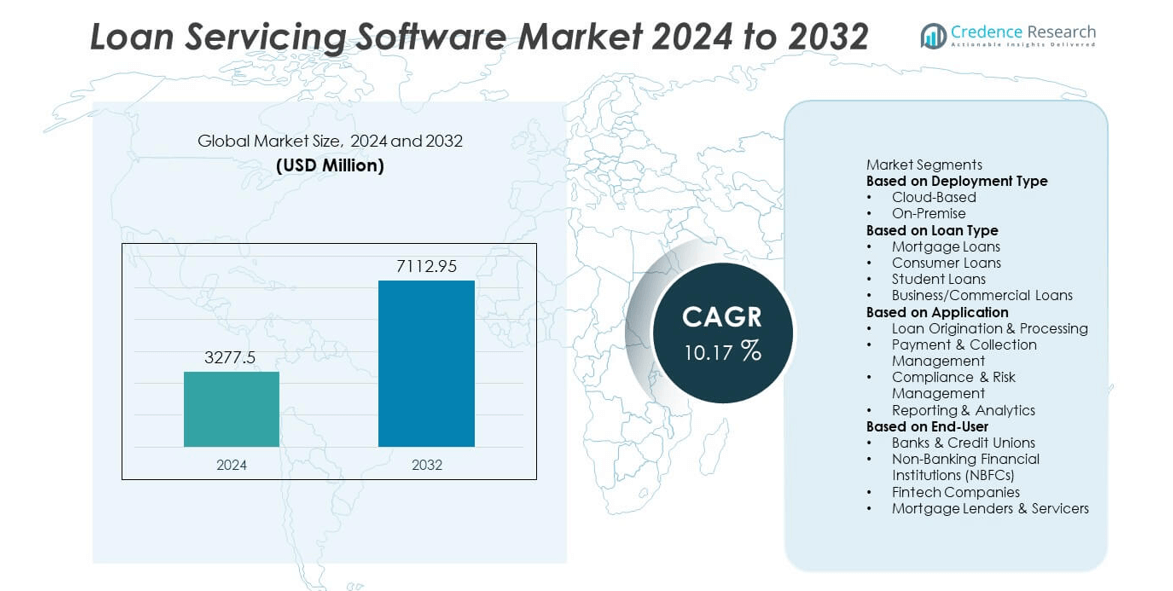

The Loan Servicing Software market reached USD 3,277.5 million in 2024 and is expected to grow to USD 7,112.95 million by 2032, registering a CAGR of 10.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Loan Servicing Software Market Size 2024 |

USD 3,277.5 million |

| Loan Servicing Software Market, CAGR |

10.17% |

| Loan Servicing Software Market Size 2032 |

USD 7,112.95 million |

The Loan Servicing Software market includes leading companies such as Fiserv, FIS Global, Black Knight, Temenos, Pegasystems, Abrigo, TurnKey Lender, Mortgage Cadence, Nortridge Software, and LoanPro. These providers focus on cloud-based servicing platforms, automated payment management, and API-driven integrations to support banks, credit unions, and fintech lenders. North America leads the market with a 38% share, driven by advanced digital lending adoption and strong investment in loan automation. Europe follows with 27%, supported by regulatory compliance needs and open banking expansion, while Asia Pacific holds 23% as digital lending and mobile credit services rapidly grow across emerging financial markets.

Market Insights

- The Loan Servicing Software market reached USD 3,277.5 million in 2024 and is projected to grow at a 10.17% CAGR through 2032, supported by rising digital lending and cloud-based servicing adoption.

- Growing demand for automated payment processing, delinquency tracking, and faster borrower onboarding drives software usage across banks, credit unions, and fintech platforms, with cloud deployment leading at 68% segment share.

- Key trends include AI-powered risk analytics, API-driven integrations, and embedded lending ecosystems that enable retailers and digital marketplaces to offer seamless credit servicing within their platforms.

- Competitive activity intensifies as major vendors invest in cybersecurity, compliance automation, and predictive portfolio analytics, while pricing flexibility and modular deployment models help attract small lenders and microfinance institutions.

- North America leads with 38% market share, followed by Europe at 27% and Asia Pacific at 23%, driven by rapid fintech growth and digital financial inclusion; Latin America holds 7% and Middle East & Africa 5%, reflecting gradual technology modernization and cloud adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment Type:

The cloud-based segment leads with a 68% share in the Loan Servicing Software market, driven by rapid adoption across banks, NBFCs, and fintech platforms seeking scalable and cost-efficient loan management systems. Cloud deployment supports faster onboarding, real-time borrower data access, automated reporting, and seamless API integrations with digital payment gateways and credit scoring platforms. Institutions benefit from reduced IT infrastructure costs, improved cybersecurity capabilities, and faster software updates. On-premise systems maintain relevance for financial organizations with strict data residency and regulatory control requirements, yet growth remains slower as lenders accelerate digital transformation and remote servicing capabilities.

- For instance, Temenos provides core banking solutions that can be deployed on-premise for various financial institutions, including Tier-1 banks, to manage operations and customer data within a secured internal network.

By Loan Type:

Mortgage loan servicing holds a 41% market share, making it the dominant loan type segment due to increased mortgage origination, refinancing activities, and long-term loan servicing needs. The segment benefits from automated escrow management, amortization scheduling, and digital documentation workflows that improve servicing accuracy and customer retention. Consumer loans show strong growth driven by rising personal, auto, and buy-now-pay-later lending volumes, while student loan servicing platforms gain traction through federal and private loan restructuring. Business and commercial loan servicing expands with SME lending demand, and lenders rely on analytics-driven risk evaluation to support portfolio performance and regulatory compliance.

- For instance, Black Knight MSP mortgage platform serviced over 37 million active first-lien and home equity loans across the U.S., processing more than 68 million automated escrow transactions per year.

By Application:

Payment & collection management accounts for 36% of the Loan Servicing Software market, making it the largest application segment. Financial institutions prioritize automation of EMI scheduling, delinquency tracking, auto-debit processing, and digital reminders to reduce default risk and enhance borrower experience. Loan origination and processing platforms support KYC verification, underwriting, and digital document handling, boosting efficiency across lending channels. Compliance & risk management tools remain critical as lenders address evolving regulatory reporting and stress-testing requirements. Reporting and analytics applications grow as institutions leverage AI-driven dashboards to improve credit decision-making, refinancing strategies, and portfolio profitability across lending operations.

Key Growth Drivers

Rising Adoption of Digital Lending and Automation

Growing demand for digital lending platforms drives the need for advanced loan servicing software. Banks, NBFCs, and fintechs automate loan onboarding, payment scheduling, and delinquency tracking to improve accuracy and reduce operational costs. The shift from manual processing to automated servicing enhances customer experience by enabling faster approvals and real-time repayment updates. Remote access and self-service borrower portals support higher engagement. Increasing consumer preference for instant credit, buy-now-pay-later programs, and mobile banking accelerates software adoption across financial institutions of all sizes.

- For instance, FIS facilitates the movement of roughly $9 trillion annually by processing approximately 75 billion transactions across its various services for over 20,000 clients.

Expansion of Cloud-Based Loan Servicing Solutions

Cloud-based loan servicing systems gain strong traction as lenders seek scalable, subscription-based deployment models that reduce infrastructure expenses. Cloud platforms enhance data accessibility, integration capabilities, and cybersecurity protections for distributed lending operations. Financial institutions benefit from continuous system updates, improved regulatory compliance, and seamless API connectivity with payment processors and credit scoring engines. Cloud adoption is further supported by remote workforce models and hybrid banking environments. As digital lending volumes grow, cloud servicing platforms play a critical role in improving operational resilience and business continuity.

- For instance, Mortgage Cadence, while it was an Accenture company (acquired in 2013), successfully migrated its entire client base to an enhanced cloud platform (the Accenture Mortgage Cadence Cloud) in 2016, which enabled greater system reliability and scalability.

Increasing Regulatory Compliance Requirements

Strict regulatory frameworks and risk management mandates strengthen the adoption of loan servicing software. Lenders must comply with credit reporting rules, consumer data protection laws, and anti-money laundering standards, pushing demand for automated compliance monitoring and auditing tools. Software platforms help institutions manage documentation, reporting deadlines, and financial disclosures while reducing non-compliance penalties. Advanced risk modeling, stress testing, and loan portfolio monitoring support stronger underwriting practices. As oversight of digital lending intensifies, regulatory technology capabilities become a core driver of market growth.

Key Trends & Opportunities

AI-Driven Servicing, Analytics, and Borrower Decision Support

AI and machine learning enhance risk analysis, payment prediction, and smart workflow automation across loan servicing platforms. Predictive analytics support delinquency forecasting and restructuring strategies, improving portfolio performance. Chatbots and AI-enabled borrower communication systems reduce call center workload and support faster resolution of payment queries. Lenders use AI to assess creditworthiness, identify fraud patterns, and improve loan modification decisions, creating opportunities for advanced analytics vendors. These capabilities drive more accurate servicing and stronger borrower experience management.

- For instance, Pegasystems deploys an AI-based loan servicing module which helps automate labor-intensive tasks like data extraction and analysis, thereby improving accuracy, reducing processing times, and ensuring consistent decision-making in compliance with regulations.

API Integration and Embedded Lending Ecosystems

API-driven loan servicing creates new opportunities through seamless integration with core banking, CRM, accounting, and payment systems. Embedded lending models allow retailers, marketplaces, and B2B platforms to offer financing without maintaining full servicing infrastructure. Software providers partner with fintechs, ERP platforms, and digital wallets to expand distribution. Open banking initiatives support data sharing and faster credit decisioning. These partnerships strengthen cross-industry lending ecosystems and increase demand for modular, integration-ready servicing software.

- For instance, Temenos connected its servicing engine through over 700 pre-configured APIs and over 120 pre-packaged banking products, enabling banks and fintechs to launch a Minimum Viable Product (MVP) within months of the project launch, or get a build and test environment within 24 hours, with the company serving over 140 million authenticated borrower records across global environments.

Key Challenges

Data Security Risks and Cyber Threats

Growing digital loan servicing increases exposure to cyberattacks, data breaches, and identity fraud. Financial institutions must protect borrower information, payment data, and digital communication channels. Advanced security layers, encryption, and continuous monitoring increase deployment and maintenance costs for lenders. Regulatory requirements for data privacy create added compliance complexity. Rising cyber threats require ongoing software upgrades and cybersecurity investments, creating adoption challenges for smaller lenders.

Integration Complexity and High Implementation Costs

Legacy system integration and customization needs raise deployment challenges for some financial institutions. On-premise environments, outdated core systems, and fragmented data sources slow implementation timelines. High licensing fees, migration expenses, and training requirements limit adoption among small lenders and credit unions. Resistance to digital transformation and limited IT expertise further delay modernization. Vendors must offer flexible pricing and low-code integration capabilities to increase market penetration and support broader usage.

Regional Analysis

North America

North America holds a 38% share of the Loan Servicing Software market, driven by high digital lending penetration and strong adoption of cloud-based servicing platforms across banks, credit unions, and fintech lenders. The United States leads the region due to advanced regulatory compliance systems, strong investment in automation, and rapid growth of online and embedded lending models. Lenders focus on API-enabled integrations, risk analytics, and AI-powered servicing tools to enhance portfolio performance and borrower experience. Canada shows steady expansion supported by modernization of credit infrastructure and increased digital mortgage processing. The region benefits from strong technology vendor presence and continuous product innovation.

Europe

Europe accounts for a 27% share, supported by strict regulatory frameworks, rapid digital banking transformation, and rising adoption of loan automation solutions by traditional banks and alternative lenders. The United Kingdom, Germany, and France lead demand due to advanced consumer lending ecosystems and growth in digital mortgage platforms. Compliance management and risk monitoring features drive software usage as lenders prepare for evolving credit reporting and open banking mandates. Cloud deployment accelerates as financial institutions seek secure and scalable servicing capabilities. Increased SME financing through digital channels and strong government-backed lending programs continue to support market growth.

Asia Pacific

Asia Pacific holds a 23% share and represents the fastest-growing region due to expanding digital lending ecosystems in China, India, and Southeast Asian economies. Fintech-driven credit models, smartphone-based micro-lending, and BNPL platforms fuel the need for automated servicing and real-time payment tracking. Large unbanked and underbanked populations create strong demand for simplified loan management technologies. Governments encourage digital financial inclusion and electronic KYC, supporting software adoption across NBFCs and online lenders. Local and global vendors focus on cloud-first platforms, AI-based risk scoring, and multi-language borrower interfaces to strengthen penetration in diverse financial markets.

Latin America

Latin America holds a 7% share, supported by the rise of fintech lending, digital microfinance, and alternative consumer credit services. Brazil and Mexico lead regional adoption as lenders deploy cloud-based servicing platforms to manage high loan volumes and reduce delinquency rates. Economic volatility increases the need for accurate risk monitoring and borrower analytics. Regulatory modernization and open finance initiatives support wider implementation of automated credit decisioning and collections management. Market growth is supported by mobile-based credit access and partnerships between banks and digital lenders, although limited IT investment in smaller institutions remains a barrier.

Middle East & Africa

The Middle East & Africa region accounts for a 5% share, driven by increasing digital banking activity, government-led financial inclusion programs, and expanding SME lending. The United Arab Emirates and Saudi Arabia lead adoption as financial institutions deploy AI-enabled portfolio monitoring and cloud servicing systems. African markets such as South Africa, Kenya, and Nigeria leverage loan servicing platforms to support mobile lending and microfinance operations. Infrastructure gaps and integration challenges slow adoption in some areas, yet regulatory digitization and fintech growth continue to improve credit servicing efficiency. Vendor partnerships and cloud deployment models support long-term regional expansion.

Market Segmentations:

By Deployment Type

By Loan Type

- Mortgage Loans

- Consumer Loans

- Student Loans

- Business/Commercial Loans

By Application

- Loan Origination & Processing

- Payment & Collection Management

- Compliance & Risk Management

- Reporting & Analytics

By End-User

- Banks & Credit Unions

- Non-Banking Financial Institutions (NBFCs)

- Fintech Companies

- Mortgage Lenders & Servicers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis of the Loan Servicing Software market includes key players such as Fiserv, FIS Global, Black Knight, Temenos, Pegasystems, Abrigo, TurnKey Lender, Mortgage Cadence, Nortridge Software, and LoanPro. These companies compete by offering cloud-based loan servicing platforms, automated payment management, digital onboarding tools, and AI-driven credit risk analytics. Vendors invest in API-enabled ecosystems that integrate with core banking, CRM, and digital payment systems, supporting seamless lending operations across banks, NBFCs, and fintech lenders. Strategic partnerships with digital lending platforms, embedded finance providers, and mortgage servicers expand product reach. Providers differentiate through regulatory compliance tools, cybersecurity safeguards, and borrower self-service portals that improve customer experience and reduce servicing costs. Market competition intensifies as lenders adopt predictive analytics, automated collections, and machine learning models to enhance portfolio performance. Continuous innovation, scalable subscription pricing, and multi-region product availability help leading vendors strengthen market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fiserv, Inc.

- FIS Global

- Black Knight, Inc.

- Temenos AG

- Pegasystems Inc.

- Abrigo

- TurnKey Lender

- Mortgage Cadence (Accenture)

- Nortridge Software, LLC

- LoanPro (a Nelnet company)

Recent Developments

- In March 2024, Bain Capital Tech Opportunities, a worldwide software investor, announced that it agreed to invest in Finova, a player in servicing software and savings and mortgage origination, and to acquire this software business.

- In February 2024, Sagent, a fintech-software-backed company upgrading mortgage servicing for lenders and banks, launched the Dara, a mortgage software platform.

- In January 2024, TurnKey Lender released version 7.11 of its servicing platform, featuring generative-AI enhancements and local integrations for lenders.

- In January 2023, Temenos AG launched the next-generation, AI-driven corporate lending solution that enables banks to consolidate global commercial loan portfolios and unify servicing on the Temenos platform

Report Coverage

The research report offers an in-depth analysis based on Deployment Type, Loan Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated loan servicing platforms will rise as digital lending expands.

- AI-driven portfolio risk analytics will enhance loan performance and loss prevention.

- Cloud-based servicing solutions will dominate due to lower infrastructure and maintenance costs.

- Open banking and API integrations will enable stronger embedded lending ecosystems.

- Self-service borrower portals will improve repayment visibility and customer experience.

- BNPL, microfinance, and peer-to-peer lending growth will increase software adoption.

- Cybersecurity and data privacy investments will intensify across financial institutions.

- Real-time payment tracking and automated collections will reduce delinquency rates.

- Analytics-based loan restructuring tools will support stressed credit portfolios.

- Regional alliances between fintechs and traditional lenders will accelerate market penetration.