Market Overview:

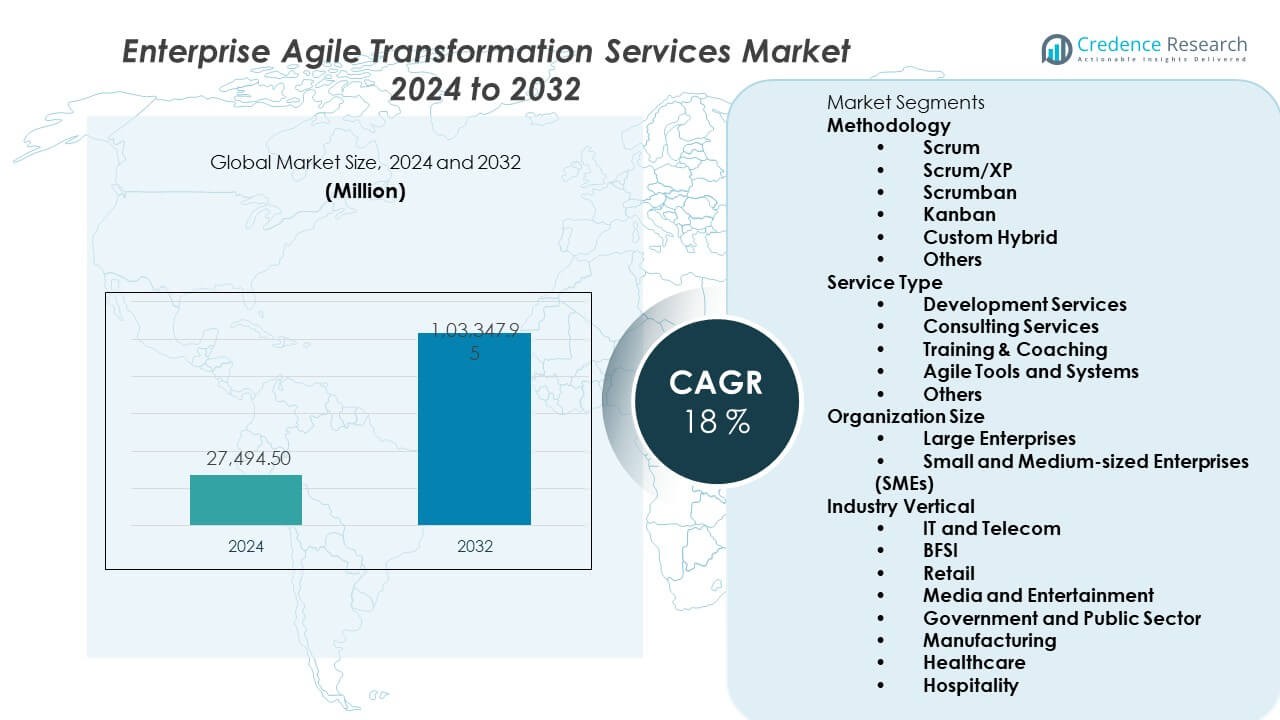

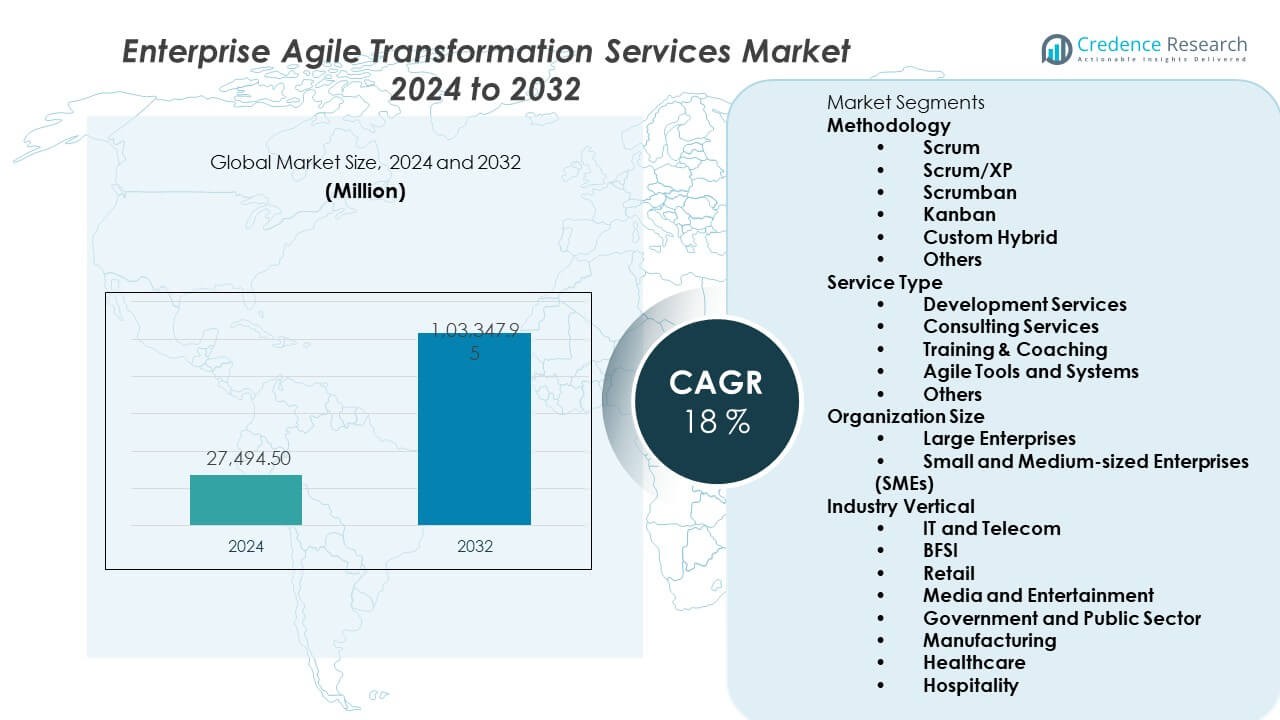

The Enterprise agile transformation services market is projected to grow from USD 27,494.5 million in 2024 to an estimated USD 103,348 million by 2032, with a compound annual growth rate (CAGR) of 18% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enterprise Agile Transformation Services Market Size 2024 |

USD 27,494.5 Million |

| Enterprise Agile Transformation Services Market, CAGR |

18% |

| Enterprise Agile Transformation Services Market Size 2032 |

USD 103,348 Million |

Rising demand for digital acceleration drives strong adoption of agile transformation services across global enterprises. Organizations use agile systems to improve software delivery, enhance adaptability, and modernize operating structures. Cloud migration, platform engineering, and automation programs strengthen the appeal of scaled agile models. Firms adopt structured training, governance change, and cultural alignment to support faster execution. Large enterprises seek predictable delivery cycles for complex multiregion programs. Mid-sized firms use external specialists to reduce transformation risks. Industry-specific digital roadmaps push deeper use of agile frameworks. The market expands as leaders invest in efficiency, visibility, and faster release cycles.

North America leads due to strong enterprise digital maturity and broad adoption of scaled agile programs across major industries. Europe shows steady demand as organizations focus on workflow modernization, regulatory compliance, and enterprise-wide DevOps alignment. Asia Pacific emerges as the fastest-growing region, driven by rising cloud investments, expanding software development hubs, and rapid digital expansion among mid-sized firms. The Middle East gains traction due to national digital strategies and modernization across banking and government sectors. Latin America sees growing adoption among telecom, retail, and BFSI companies seeking operational agility. Africa begins to adopt agile programs as cloud platforms expand and regional enterprises modernize delivery structures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Enterprise agile transformation services market is valued at USD 27,494.5 million in 2024 and is projected to reach USD 103,348 million by 2032, expanding at a CAGR of 18% during 2024–2032.

- North America (38%), Europe (29%), and Asia Pacific (23%) hold the top shares due to strong digital maturity, regulatory-aligned transformation programs, and large-scale enterprise modernization initiatives.

- Asia Pacific, holding 23%, is the fastest-growing region, driven by rising cloud investment, rapid enterprise digitization, and expanding technology hubs.

- The Methodology segment is led by Scrum with a 32% share, supported by high adoption across software-driven industries.

- The Service Type segment sees Consulting Services leading with a 28% share, driven by enterprise demand for governance restructuring and scaled implementation support.

Market Drivers:

Rising Demand for Enterprise-Wide Digital Delivery Models and Scaled Agile Adoption

The Enterprise agile transformation services market grows due to strong adoption of enterprise-wide digital delivery programs. Large organizations seek predictable release cycles that support continuous software flow. Leaders adopt scaled frameworks to manage complex portfolios. Firms integrate agile governance to improve cross-team coordination. Strong demand rises from BFSI, telecom, healthcare, and retail sectors. Enterprises replace legacy delivery models to raise quality. Vendors support leadership teams with structured transformation roadmaps. The shift creates long-term service demand among global clients. It reinforces a stronger push for flexible work structures.

- For instance, ING adopted the Spotify-inspired agile model across 350 squads and over 2,500 employees, cutting release cycles from months to weeks.

Growing Need for Faster Decision Cycles and High-Performance Product Engineering Teams

Companies seek rapid decision cycles that help product teams respond to market change. The Enterprise agile transformation services market benefits from rising interest in lean governance. Firms use agile training to raise team autonomy and delivery speed. Leaders embed collaboration tools that support daily workflow clarity. Organizations deploy agile metrics to monitor throughput. Strong focus on high-performance engineering teams lifts demand for coaching. Many enterprises deploy DevOps alignment to reduce friction. The push for faster concept-to-release cycles strengthens overall market traction. It drives deeper adoption of agile-led modernization.

- For instance, Barclays successfully transitioned over 800 teams to an agile structure, which resulted in reported benefits like increased throughput and fewer incidents. After two years, approximately 65% of the bank’s “spend on change” was delivered with agile principles. One example of a specific metric was a reported 300% increase in throughput from a sample dataset, along with a 50% decrease in code complexity and a 50% increase in test code coverage.

Expansion of Cloud-Native Architectures and Platform Modernization Frameworks

Cloud-native growth pushes demand for agile programs that guide teams through modernization. Enterprises rebuild legacy workloads to support scalable architectures. Leaders use agile models to link development and operations. The Enterprise agile transformation services market gains momentum due to cloud expansion. Many firms deploy platform engineering teams to manage new tools. Faster integration cycles improve end-user experience. Teams adopt modern workflows that reduce dependencies. Organizations invest in external expertise to support complex modernization. It strengthens sustained spending on structured transformation programs.

Shift Toward Data-Driven Delivery, AI-Augmented Operations, and Enterprise Workflow Redesign

Enterprises use data-driven insights to improve workflow predictability. AI tools help leaders assess delivery patterns and identify risks. The Enterprise agile transformation services market benefits from wider adoption of automation. Teams use structured ceremonies to lift alignment and execution. Many organizations deploy hybrid delivery models that support distributed teams. Strong focus on enterprise workflow redesign increases demand for coaching. Leaders invest in agile maturity programs to stabilize new ways of working. Firms adopt strategic transformation models that improve long-term performance. It expands the enterprise shift toward adaptive delivery systems.

Market Trends:

Growing Preference for Value Stream Management Platforms and Outcome-Focused Delivery Models

Enterprises adopt value stream tools to track flow across large portfolios. The Enterprise agile transformation services market gains focus on outcome-based delivery. Leaders shift attention from activity metrics to value metrics. Many firms redesign feedback loops to improve speed. Teams use visualization dashboards to highlight bottlenecks. Value mapping improves alignment between business and technology. Strong interest rises in integrated performance frameworks. Enterprises seek measurable outcomes in each delivery cycle. It supports a sharper shift toward continuous optimization.

- For instance, Siemens deployed value stream management (VSM) to improve flow efficiency, a process which has been publicly associated with a reduction in system wait states by nearly 25% across key engineering teams, according to information from the solution provider, Tasktop (now Planview).

Expansion of Agile in Non-Tech Functions and Cross-Department Operational Alignment

Agile spreads into HR, finance, marketing, and supply chain units. The Enterprise agile transformation services market grows due to this expansion. Leaders push integrated planning across entire organizations. Teams restructure workflows to enable faster decision cycles. Many firms adopt adaptive budgeting to support flexibility. Cross-department alignment helps reduce operational delays. Governance frameworks mature to support change. Agile thinking improves resilience during disruption. It strengthens demand for enterprise-wide engagement programs.

- For instance, Bosch expanded agile across non-tech units involving 20,000 employees, increasing process cycle efficiency in HR operations by more than 15%. This case study is widely cited in business literature as a successful example of large-scale agile implementation beyond software development.

Rise of Hybrid Work Environments and Advanced Collaboration Ecosystems

Hybrid work drives deeper adoption of collaboration systems. Many enterprises redesign delivery workflows to support distributed teams. The Enterprise agile transformation services market benefits from this shift. Firms use integrated communication platforms to maintain clarity. Digital whiteboards support remote ceremonies. Leaders deploy automation tools to manage dependencies. Work visibility improves through structured dashboards. Hybrid models reinforce demand for new engagement methods. It fuels ongoing interest in scalable agile programs.

Growing Use of AI-Assisted Decision Support and Predictive Delivery Intelligence

AI tools help organizations forecast release risks. The Enterprise agile transformation services market gains traction from advanced analytics. Predictive models improve planning accuracy. Leaders use automated insights to support sprint decisions. Machine learning enhances backlog refinement quality. Teams adopt AI-driven test frameworks to cut errors. Forecasting improves team confidence and capacity planning. Enterprises deploy intelligent dashboards for governance visibility. It supports stronger adoption of data-backed agile practices.

Market Challenges Analysis:

Cultural Resistance, Legacy Mindsets, and Limited Leadership Alignment Across Large Enterprises

Many enterprises face cultural barriers during transformation. The Enterprise agile transformation services market sees challenges when leaders lack shared direction. Legacy structures slow team autonomy. Complex reporting layers limit faster execution. Some organizations struggle to shift away from command-driven workflows. Misalignment across departments delays progress. Many employees resist new work patterns due to limited training. Leaders require more clarity on long-term governance models. It reduces the speed of enterprise adoption.

Integration Complexity, Tool Fragmentation, and Skill Shortages Across Scaling Programs

Large organizations face integration hurdles during tool consolidation. The Enterprise agile transformation services market experiences constraints due to fragmented systems. Distributed teams struggle with inconsistent workflows. Many enterprises face shortages of skilled agile coaches. Tool sprawl limits unified delivery visibility. Complex modernization programs create heavy dependency risks. Some teams fail to adopt stable metrics for performance tracking. Integration with legacy applications slows transformation pace. It creates delays for enterprises seeking scalable models.

Market Opportunities:

Expansion of AI-Driven Agile Platforms, Industry-Specific Frameworks, and Scalable Transformation Models

AI-based delivery tools create strong opportunities for vendors. The Enterprise agile transformation services market gains new momentum from intelligent automation. Industry-specific frameworks support targeted transformation programs. Many sectors seek tailored systems for regulated workflows. Growth in platform engineering creates demand for guided change. Leaders explore new models that support adaptive governance. Strong digital expansion lifts interest in long-term transformation. It opens wider opportunities for consultancy groups.

Growing Adoption of Cloud-Native Delivery, Modern Engineering Practices, and Multi-Region Transformation Support

Cloud-native expansion unlocks new service pathways for transformation firms. The Enterprise agile transformation services market benefits from rising platform modernization. Enterprises adopt advanced engineering practices to improve cycle speed. Multi-region operations create demand for scalable coaching. Organizations invest in structured competency-building programs. Cross-border delivery teams seek unified frameworks. Strong focus on resilience drives investment in agile maturity. It strengthens opportunity growth across global markets.

Market Segmentation Analysis:

Methodology

The Enterprise agile transformation services market spans several delivery approaches that support different maturity levels. Scrum leads adoption due to its structured sprints and clear roles. Scrum/XP gains traction where engineering discipline requires continuous integration. Scrumban attracts teams that prefer flow-based work with iterative planning. Kanban supports operations and maintenance teams that manage variable workloads. Custom Hybrid models gain strong interest among enterprises with complex portfolios. Other niche frameworks serve specialized functions that require tailored governance. The diversity of options helps organizations align agile adoption with operational needs. It strengthens flexibility across transformation programs.

- For instance, general information regarding Microsoft’s use of DevOps practices confirms that Azure engineering teams use Azure Pipelines for continuous integration and continuous delivery (CI/CD). These practices are generally associated with benefits such as increased quality and fewer defects, as described in the general literature around continuous integration and testing.

Service Type

Service demand covers development services, consulting services, training and coaching, and agile tools and systems. Development services support product engineering teams that seek faster delivery cycles. Consulting services guide enterprises through governance restructuring and scaled rollout. Training and coaching improve team capability and cross-functional alignment. Agile tools and systems integrate platforms that enhance visibility and workflow control. Other services support specialized transformation needs within regulated sectors. Enterprises use each category to build long-term maturity. The Enterprise agile transformation services market gains traction from this structured service mix.

Organization Size

Large enterprises dominate demand due to complex portfolios and multi-region programs. Many adopt tailored frameworks that scale across thousands of employees. SMEs use agile models to improve speed and reduce delivery friction. Coaching support helps smaller firms stabilize workflows. Service demand grows across both segments as digital programs expand.

Industry Vertical

IT and telecom lead adoption due to high software intensity. BFSI deploys agile for faster product rollout and regulatory alignment. Retail invests in agile to support omnichannel growth. Media and entertainment modernize content delivery workflows. Government and public sector units use agile for project modernization. Manufacturing adopts agile for digital engineering programs. Healthcare and hospitality integrate agile to improve service efficiency. This diversity pushes broad adoption across industries.

Segmentation:

By Methodology

- Scrum

- Scrum/XP

- Scrumban

- Kanban

- Custom Hybrid

- Others

By Service Type

- Development Services

- Consulting Services

- Training & Coaching

- Agile Tools and Systems

- Others

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Industry Vertical

- IT and Telecom

- BFSI

- Retail

- Media and Entertainment

- Government and Public Sector

- Manufacturing

- Healthcare

- Hospitality

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leading with Strong Adoption of Scaled Agile Models

North America holds the largest share of the Enterprise agile transformation services market, accounting for nearly 38% of global adoption. The region benefits from mature digital ecosystems and extensive enterprise modernization programs. Large enterprises use agile to improve delivery speed across cloud, data, and software portfolios. Strong presence of major consulting firms increases service penetration. Public sector units integrate agile to enhance operational efficiency. Many organizations invest in advanced DevOps and platform engineering models. It strengthens long-term demand for structured transformation support.

Europe Expanding Through Cross-Industry Workflow Modernization and Regulatory Alignment

Europe captures about 29% share and shows steady growth across major economies. Enterprises adopt agile frameworks to align digital programs with strict regulatory standards. BFSI, telecom, and manufacturing sectors lead transformation initiatives across the region. Organizations use agile models to stabilize multi-country delivery operations. Cross-functional alignment improves efficiency in complex supply chains. Governments invest in digital public services that rely on adaptive delivery. The Enterprise agile transformation services market strengthens its presence as Europe accelerates modernization.

Asia Pacific Emerging as Fastest-Growing Region Driven by Cloud Expansion and Enterprise Digitization

Asia Pacific holds roughly 23% share and records the fastest growth rate globally. Rising cloud investments push enterprises to adopt scalable agile programs. Technology hubs in India, China, Japan, and Southeast Asia fuel rapid adoption. SMEs use agile to speed up product cycles and reduce delivery friction. Large corporations deploy hybrid models to manage distributed teams. National digital agendas support wider transformation in public and private sectors. It expands regional demand and strengthens Asia Pacific’s position in global adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Accenture

- AgileSparks

- Apexon

- Broadcom Inc.

- Eliassen Group LLC

- Endava PLC

- Hexaware Technologies Limited

- IBM

- LeadingAgile

- Symphony Solutions

- Xebia

- Agile Velocity

- Softtek

- Tata Consultancy Services (TCS)

Competitive Analysis:

The Enterprise agile transformation services market shows strong competition among global consulting firms, technology integrators, and specialized agile coaching providers. Leading companies expand their portfolios with scaled frameworks, platform engineering, and AI-driven delivery systems. Vendors strengthen presence across BFSI, telecom, retail, and public sector projects. Many firms offer structured roadmaps that support enterprise governance change. Partnerships with cloud providers help service expansion. Talent capability defines competitive strength in this space. Firms focus on large enterprise clients that demand multi-region delivery. It continues to attract new entrants that target niche transformation areas.

Recent Developments:

- In November 2025, TRD U.S.A. (Toyota Racing Development) announced a multi-year expanded partnership with Endava as their official IT consulting partner in 2026 and beyond. As part of the extended and enhanced partnership, Endava leverages its AI-enabled accelerators and frameworks to modernize core TRD production systems and enable digital transformation for the business. Over the last three years, Endava has delivered digital technology solutions to help TRD go faster on and off the track, with the enhanced collaboration extending Endava’s primary branding presence throughout the SRO Motorsports America paddock while expanding into IMSA in 2026.

- In October 2025, IBM and Anthropic announced a strategic partnership to accelerate the development of enterprise-ready AI by infusing Anthropic’s Claude, one of the world’s most powerful family of large language models, into IBM’s software portfolio. Through the partnership, Claude is being integrated into select IBM software products, starting with IBM’s new AI-first integrated development environment designed with advanced task generation capabilities for enterprise software development lifecycles. The IDE is available in private preview to select IBM clients, and in early testing, more than 6,000 early adopters within IBM are using the new IDE, reporting productivity gains averaging 45 percent.

- In August 2025, Accenture announced its agreement to acquire NeuraFlash, a leading Salesforce and generative AI consulting company that specializes in agentic solutions for sales, service, and field service operations. NeuraFlash brings more than 1,000 project implementations across 400 customers and a team of 510 professionals holding over 2,000 Salesforce certifications. The acquisition significantly enhances Accenture’s agentic AI capabilities and expands its mid-market presence in alignment with Salesforce’s strategic direction.

- In May 2025, Accenture announced its agreement to acquire Yumemi, a leading digital services and products provider headquartered in Japan. The acquisition significantly enhances Accenture’s capabilities to design and launch products for clients with speed and at scale. Yumemi’s team of approximately 400 professionals in Japan joined Accenture Song, the company’s creative arm, bringing advanced capabilities in digital product design and development methodologies. By combining Accenture’s expertise in driving reinvention and transformation using generative AI with Yumemi’s development methodologies, the company aims to offer comprehensive end-to-end support for the creation, operation, and enhancement of innovative digital products.

Report Coverage:

The research report offers an in-depth analysis based on Methodology and Service Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise as enterprises redesign delivery models for scalable digital programs.

- AI-driven agile platforms will influence planning, forecasting, and decision cycles.

- Cloud-native expansion will lift adoption of hybrid agile and DevOps models.

- More sectors will shift to value stream management to monitor workflow efficiency.

- Coaching demand will grow as enterprises target higher agile maturity levels.

- Scaled frameworks will expand across multi-region and multi-portfolio environments.

- Public sector modernization will support further adoption of structured agile models.

- Platform engineering will influence expansion in training and consulting services.

- Large firms will adopt predictive insights to stabilize enterprise-wide governance.

- Vendors will focus on integrated toolchains to support continuous delivery pipelines.