Market overview

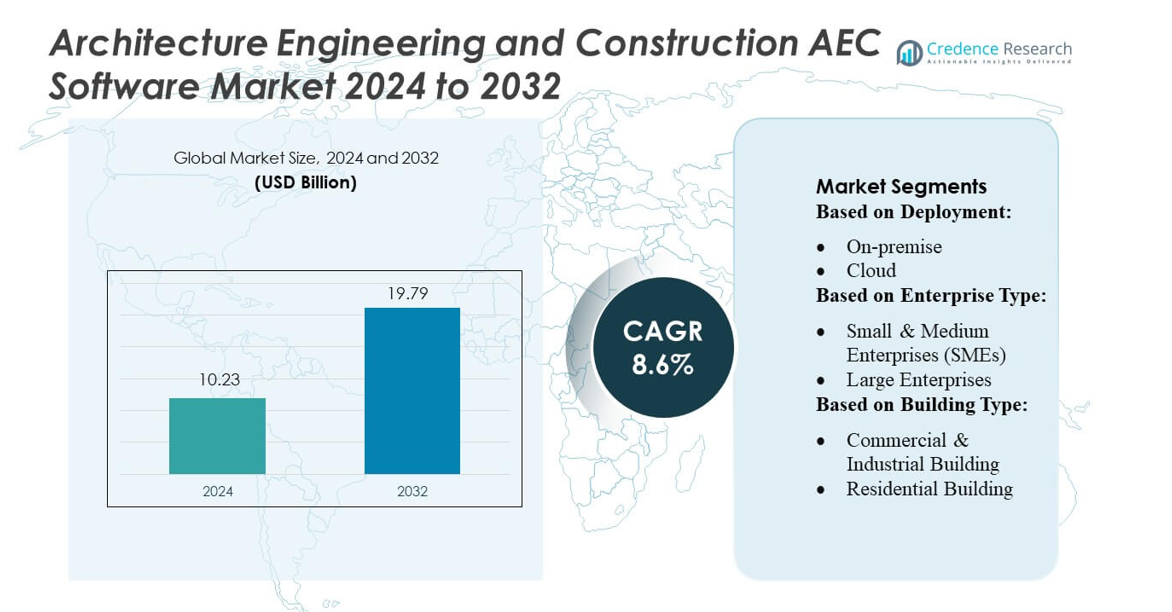

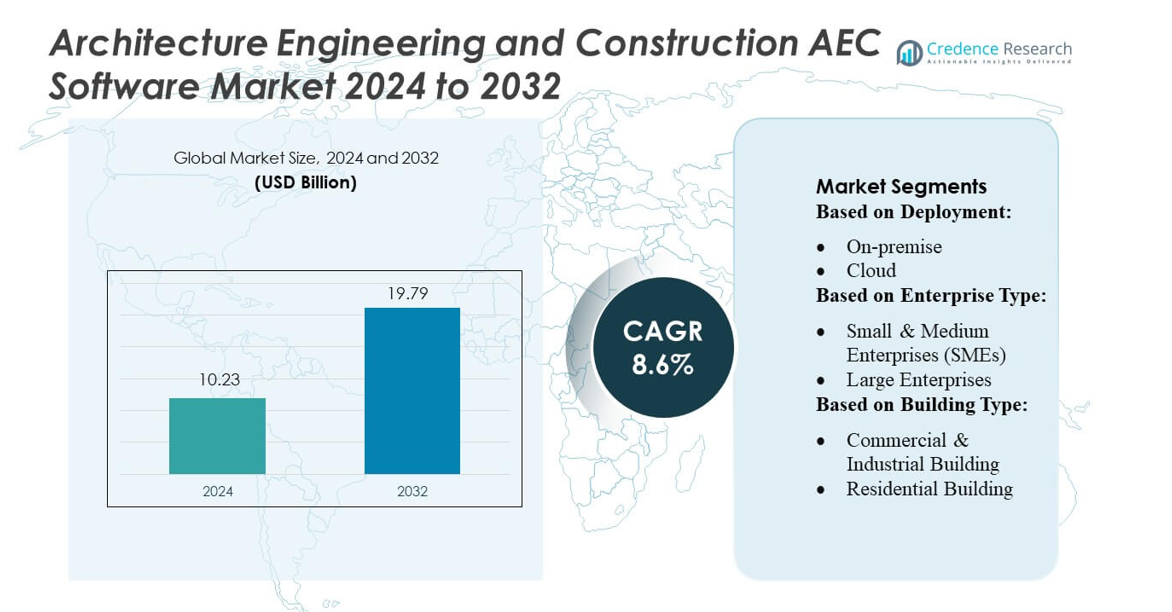

Architecture Engineering and Construction AEC Software Market size was valued USD 10.23 billion in 2024 and is anticipated to reach USD 19.79 billion by 2032, at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Architecture Engineering and Construction (AEC) Software Market Size 2024 |

USD 10.23 billion |

| Architecture Engineering and Construction (AEC) Software Market, CAGR |

8.6% |

| Architecture Engineering and Construction (AEC) Software Market Size 2032 |

USD 19.79 billion |

The Architecture, Engineering, and Construction (AEC) software market is driven by a competitive mix of global technology providers that continue to scale digital capabilities across design, modeling, and project-delivery workflows. Leading vendors strengthen their positions through investments in BIM, cloud collaboration, AI-driven design automation, and digital-twin platforms that enhance efficiency and reduce lifecycle costs. North America remains the dominant regional market, holding 35–38% of the global share due to strong digital adoption, established BIM mandates, and widespread integration of advanced construction technologies across large infrastructure and commercial development projects.

Market Insights

- The AEC software market reached USD 10.23 billion in 2024 and is projected to grow to USD 19.79 billion by 2032, registering a CAGR of 8.6%, supported by rising digital transformation and expanding adoption of BIM-enabled workflows.

- Market growth is primarily driven by increasing integration of cloud platforms, AI-assisted modeling, and digital-twin solutions that enhance project accuracy, reduce rework, and streamline collaboration across architecture, engineering, and construction disciplines.

- Key trends include rapid adoption of automation, mobile-enabled field management, and sustainability-focused design tools, while competitive intensity rises as vendors expand interoperability and real-time data analytics capabilities.

- Market restraints persist due to high implementation costs, complex BIM skill requirements, and interoperability challenges that slow adoption among small and mid-sized firms.

- Regionally, North America leads with 35–38% market share, while cloud deployment dominates with 62–65% share, supported by advanced infrastructure investment and strong BIM regulatory frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

Cloud deployment remains the dominant segment in the AEC software market, accounting for an estimated 62–65% share as firms prioritize scalability, real-time collaboration, and reduced IT overhead. The shift accelerates as architecture and construction teams rely on cloud-based BIM, digital twins, and integrated project-delivery platforms for multi-site coordination. Adoption is further driven by faster updates, remote accessibility, and increasing compatibility with mobile field-management tools. On-premise solutions retain relevance for highly regulated or large-scale infrastructure projects requiring stringent data-sovereignty controls, but growth is slower compared with the cloud segment.

- For instance, Gensler—operating more than 50 offices globally and managing over 6,000 active projects annually—uses cloud-based BIM collaboration environments to support cross-region design workflows, enabling simultaneous model updates across teams working in North America, Europe, and Asia.

By Enterprise Type

Large enterprises lead the market with an estimated 55–58% share, driven by their higher investment capacity, complex project portfolios, and early adoption of BIM Level 2/Level 3 standards. These firms deploy advanced modeling, real-time rendering, and integrated cost-estimation modules to streamline workflows across distributed teams. However, SMEs represent the fastest-growing segment as subscription-based cloud platforms reduce upfront costs and offer modular scalability. Increasing availability of lightweight design tools, automated clash-detection features, and affordable SaaS-based collaboration suites continues to improve SME penetration across design, engineering, and construction environments.

- For instance, AECOM recently enhanced its PlanEngage™ platform by integrating Esri ArcGIS Online, enabling the creation of dynamic geo-digital twins that fuse real-time spatial data, 3D models, satellite imagery, and sensor inputs.

By Building Type

Commercial and industrial buildings dominate the AEC software market with an estimated 60–63% share, supported by rising demand for high-precision modeling, sustainability optimization, and advanced construction-management tools in large-scale projects. Infrastructure modernization, smart-building deployment, and complex mechanical-electrical-plumbing (MEP) requirements further strengthen adoption. The residential segment grows steadily as developers adopt BIM-enabled quantity takeoff, energy-analysis modules, and 3D visualization tools to enhance design accuracy and reduce construction delays. Increasing use of prefabrication and modular construction also drives broader software usage in residential planning and project execution.

Key Growth Drivers

Rapid Digital Transformation and BIM Mandates

Governments and large construction firms increasingly mandate Building Information Modeling (BIM), accelerating AEC software adoption. Organizations prioritize end-to-end digital workflows to improve accuracy, reduce rework, and enhance project coordination. The shift toward BIM Level 2 and Level 3 compliance drives investments in modeling, simulation, and integrated design platforms. As infrastructure and real-estate projects scale, firms rely on digital tools to manage complex structural, MEP, and sustainability requirements. This momentum positions BIM-centric software as a primary catalyst for long-term market growth.

- For instance, Schneider Electric joined the Alliance for OpenUSD with AVEVA and ETAP to publish SimReady 3D assets for digital twins in infrastructure systems using standards from NVIDIA Omniverse.

Rising Demand for Cost Efficiency and Project Automation

AEC firms adopt software solutions to address cost overruns, schedule delays, and resource inefficiencies across project lifecycles. Automation in quantity takeoff, clash detection, scheduling, and procurement significantly reduces manual workloads and operational risks. Cloud-enabled project-delivery platforms improve visibility, enabling data-driven decisions and real-time collaboration among architects, engineers, and contractors. As competitive pressures rise, companies increasingly leverage digital tools to enhance productivity, minimize waste, and shorten construction cycles. This focus on automation and cost optimization strengthens market expansion across global construction sectors.

- For instance, HDR created a city-scale digital twin for Toronto’s Ontario Line by merging 16 km of GIS mapping, 3D BIM data, reality mesh, and point-cloud scans to enable real-time simulation and performance optimization.

Increasing Adoption of Cloud and Remote Collaboration Tools

The industry’s shift toward distributed teams and multi-site operations continues to boost cloud-based AEC software adoption. Cloud platforms enable seamless document sharing, remote model updates, and unified project oversight, improving coordination among stakeholders. Advanced mobility tools support on-site reporting, digital inspections, and real-time issue tracking, reducing delays and enhancing project quality. As firms prioritize flexible workflows and reduced IT infrastructure costs, cloud deployment becomes a core driver of digital transformation. This transition supports greater scalability and integration with AI, GIS, and IoT technologies.

Key Trends & Opportunities

Integration of AI, Digital Twins, and Generative Design

AI-driven automation enhances design accuracy, risk prediction, and site analysis, creating new opportunities for high-value digital workflows. Generative design tools enable engineers and architects to optimize structures based on cost, material efficiency, and sustainability goals. Digital twin adoption expands as firms seek real-time insights into building performance, operational behavior, and asset lifecycle management. These advanced capabilities support smarter infrastructure development and accelerate innovation. Vendors investing in AI-enabled modeling and simulation tools are positioned to capture emerging demand in next-generation construction environments.

- For instance, Oracle offers 50+ embedded generative AI functions in its Fusion Cloud Applications, fine-tuned for engineering workflows via large-language models deployed on OCI.

Growing Focus on Sustainability and Green-Building Design

Global sustainability regulations and carbon-reduction targets increase demand for AEC software capable of performing energy modeling, material optimization, and lifecycle assessment. Architects and developers adopt advanced analytical modules to meet green certification standards and optimize environmental performance early in the design phase. Tools supporting renewable-energy simulation, embodied-carbon tracking, and resource-efficient construction provide a competitive advantage. As net-zero construction gains momentum, software vendors offering integrated sustainability dashboards and automated compliance tools stand to benefit from expanding opportunities in eco-friendly infrastructure development.

- For instance, Stantec used Forma’s embedded carbon analysis to model a transit-oriented development of over 723,000 tons CO₂, then reduced emissions by 42,000 tons (to 681,000 tons) by switching three towers to mass timber.

Expansion of Modular, Prefabricated, and Offsite Construction

The rise of industrialized construction fuels demand for design-for-manufacturing (DfMA) tools, parametric modeling, and fabrication-ready BIM workflows. Modular and prefabricated building processes require precise modeling, clash-free component engineering, and seamless coordination between factories and job sites. AEC software enabling automation, digital fabrication, and real-time production monitoring unlocks efficiencies in speed, quality, and material use. As developers pursue faster and cost-effective building methods, software providers integrating manufacturing capabilities emerge well-positioned to capitalize on this accelerating construction shift.

Key Challenges

High Upfront Costs and Skill Gaps in Digital Adoption

Despite proven benefits, many firms—particularly SMEs—struggle with the high cost of BIM platforms, training, and digital transformation. Complex modeling workflows require specialized expertise, creating a skills gap that slows adoption. Organizations face challenges integrating new tools with legacy systems and maintaining consistent software proficiency across teams. Limited digital literacy among field workers further restricts full utilization of advanced features. These barriers increase dependence on external consultants and introduce implementation delays, hindering widespread market penetration.

Data Security, Interoperability, and Fragmented Tool Ecosystems

AEC projects involve multiple stakeholders exchanging sensitive drawings, models, and specifications, making data security and privacy critical concerns. Firms face risks from cyberattacks, insecure file transfers, and lack of standardized access controls. Interoperability challenges arise when different teams use incompatible software tools, leading to data loss, duplication, and workflow disruptions. The highly fragmented technology ecosystem complicates model sharing and version control. Without universal BIM standards and secure cloud frameworks, project collaboration becomes inefficient, limiting the industry’s digital transformation potential.

Regional Analysis

North America

North America holds the largest share of the AEC software market, accounting for approximately 35–38%, driven by high digital maturity, strong BIM mandates, and widespread adoption of cloud-based design and project-management platforms. The U.S. leads with rapid adoption of generative design, digital twins, and integrated construction-management suites across large infrastructure and commercial projects. Government-funded smart city and transportation programs further stimulate demand. Strong presence of major software vendors, combined with advanced construction technologies such as IoT-enabled site monitoring and AI-driven modeling, reinforces the region’s dominant market position.

Europe

Europe captures around 28–30% of the global market, supported by stringent regulatory requirements for BIM adoption across public infrastructure projects, particularly in the UK, Germany, and Nordic countries. The region prioritizes sustainable design, energy modeling, and lifecycle assessment, driving strong uptake of advanced simulation tools. Growing investment in green buildings, prefabricated construction, and urban redevelopment projects increases reliance on digital platforms. European firms emphasize cross-border project collaboration, encouraging adoption of interoperable, cloud-based solutions. The presence of technologically advanced engineering consultancies further strengthens market penetration across both commercial and industrial building segments.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, holding approximately 22–25% of the AEC software market, driven by rapid urbanization, large-scale infrastructure development, and rising investment in smart cities across China, India, Japan, and Southeast Asia. Governments increasingly mandate BIM in megaprojects, accelerating digital adoption among contractors and engineering firms. Expanding construction activity in residential and industrial sectors fuels demand for cost-efficient design, simulation, and project-delivery platforms. The region’s growing reliance on cloud deployment, mobile field-management tools, and AI-enabled planning solutions positions Asia-Pacific as a high-growth hub for AEC technology providers.

Latin America

Latin America accounts for around 6–8% of the market, with adoption driven by modernization of public infrastructure, increasing foreign investment, and growth in commercial real estate projects. Countries such as Brazil, Mexico, and Chile gradually integrate BIM guidelines into government procurement processes, supporting digital uptake. Construction firms adopt AEC software to improve project transparency and reduce cost overruns, especially in transportation, energy, and industrial projects. However, digital adoption remains uneven due to budget constraints and limited technical expertise, creating opportunities for affordable cloud-based and subscription AEC platforms.

Middle East & Africa

The Middle East & Africa region holds approximately 4–6% of the market, supported by large-scale urban development, tourism megaprojects, and infrastructure expansion in the UAE, Saudi Arabia, and Qatar. Vision-driven national development programs accelerate adoption of BIM, project-management systems, and advanced modeling tools. The region increasingly prioritizes smart city frameworks, digital twin utilization, and sustainable building design. Africa shows gradual adoption, led by South Africa and Kenya, where construction firms seek improved project efficiency. Despite growth momentum, limited digital expertise and high initial costs remain key constraints to widespread AEC software deployment.

Market Segmentations:

By Deployment:

By Enterprise Type:

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Building Type:

- Commercial & Industrial Building

- Residential Building

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Architecture, Engineering, and Construction (AEC) software market features prominent players such as Gensler, Trimble, AECOM, Schneider Electric SE, HDR, Inc., Oracle, Autodesk, HEXAGON, Stantec, and AVEVA Group Plc. The Architecture, Engineering, and Construction (AEC) software market is characterized by rapid digital innovation, expanding cloud adoption, and increasing integration of BIM, AI, and digital twins across project lifecycles. Vendors differentiate through advanced modeling accuracy, real-time collaboration features, and seamless interoperability with enterprise systems. The market continues to shift toward cloud-first platforms that support remote coordination, mobile-enabled field operations, and automated compliance management. Competition intensifies as firms invest in modular construction workflows, sustainability analytics, and data-driven project controls. Additionally, strategic partnerships with contractors, engineering consultancies, and technology providers strengthen ecosystem capabilities and enhance market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gensler

- Trimble

- AECOM

- Schneider Electric SE

- HDR, Inc.

- Oracle

- Autodesk

- HEXAGON

- Stantec

- AVEVA Group Plc

Recent Developments

- In August 2024, AECOM partnered with One Click LCA, a Finland-based company, to enhance its ScopeX approach and aim for a 50% carbon reduction in buildings and infrastructure projects. This collaboration integrates One Click LCA’s carbon assessment and sustainability tools into AECOM’s strategy to improve decarbonization efforts on a global scale.

- In April 2024, Fujita Corporation and India-based Neilsoft announced plans to expand the scope of their co-operative working by agreeing to increase the size of their BIM Center in Pune, India. This understanding not only signifies the growing acceptance and need for Building Information Modelling (BIM) Technology Services in the Engineering & Construction industry but also showcases the growing bilateral business relationships between Japan and India.

- In January 2024, Stantec agreed to acquire Morrison Hershfield, an engineering and management firm based in Markham, Ontario. This acquisition enhances Stantec’s footprint in key Canadian markets and bolsters its presence in the U.S. building engineering sector.

- In January 2024, Eiffage, through its subsidiary Eiffage Construction, has secured two of the four works new construction packages for the project launched by the City of Paris to redevelop the former Saint-Vincent-de-Paul hospital site as an Eco district, in the 14th district

Report Coverage

The research report offers an in-depth analysis based on Deployment, Enterprise Type, Building Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will accelerate cloud-first adoption as firms prioritize scalable, collaborative, and remote project-delivery workflows.

- BIM will move toward higher maturity levels with wider integration of 4D, 5D, and 6D modeling across global construction projects.

- AI-driven design automation and predictive analytics will become standard tools for planning, risk management, and cost optimization.

- Digital twins will see broader adoption for real-time asset monitoring, operational efficiency, and lifecycle management.

- Demand for interoperable platforms will rise as firms seek seamless data exchange across diverse tools and project stages.

- Sustainability-focused design software will expand as green-building regulations and energy-performance targets intensify.

- Modular and offsite construction will increase reliance on fabrication-ready modeling and digital manufacturing tools.

- Cybersecurity requirements will strengthen as cloud collaboration and data-rich models become industry norms.

- Mobile-enabled field management solutions will gain traction for real-time reporting, inspections, and site coordination.

- Partnerships between tech vendors, engineering firms, and contractors will deepen to support integrated digital ecosystems.