Market Overview

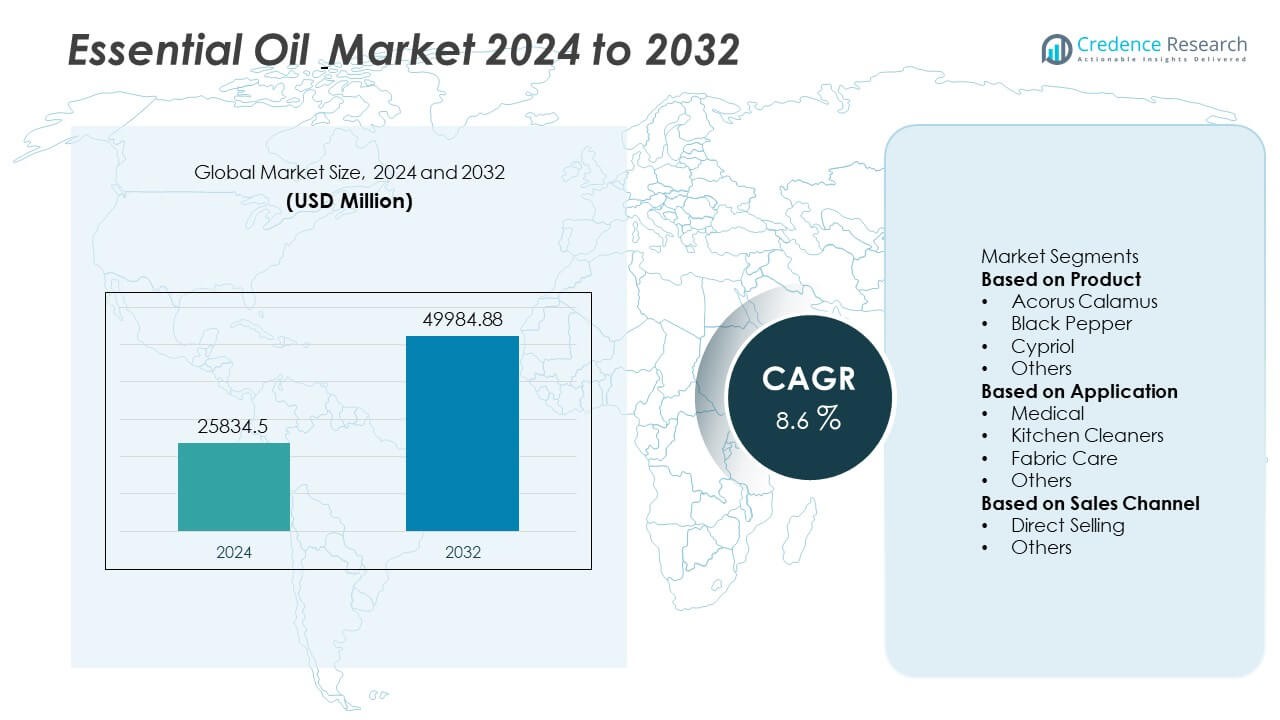

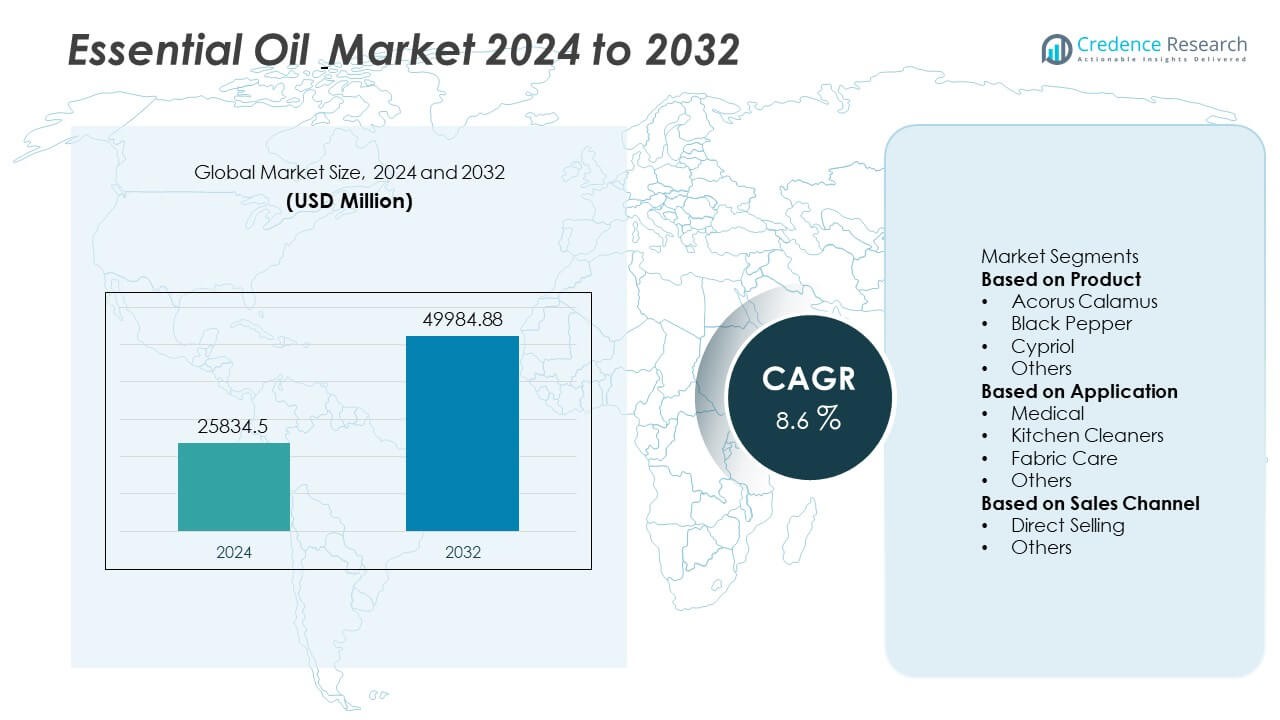

Essential Oil Market size was valued at USD 25,834.5 million in 2024 and is projected to reach USD 49,984.88 million by 2032, growing at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Essential Oil Market Size 2024 |

USD 25,834.5 Million |

| Essential Oil Market, CAGR |

8.6% |

| Essential Oil Market Size 2032 |

USD 49,984.88 Million |

The essential oil market is driven by leading players including Flavex Naturextrakte GmbH, Falcon, Young Living Essential Oils, India Essential Oils, DoTerra, Biolandes SAS, Essential Oils of New Zealand, H. Reynaud & Fils (HRF), Farotti S.R.L., and Sydney Essential Oil Co. (SEOC). These companies strengthen the industry through sustainable sourcing, innovative product portfolios, and wide distribution networks. Young Living and DoTerra dominate direct selling with wellness-focused products, while Biolandes and Flavex emphasize premium extracts for cosmetics and healthcare. Regionally, North America led with 35% share in 2024, followed by Europe at 30% and Asia Pacific at 22%, while Latin America accounted for 7% and the Middle East & Africa together held 6%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The essential oil market was valued at USD 25,834.5 million in 2024 and is projected to reach USD 49,984.88 million by 2032, growing at a CAGR of 8.6%.

- Rising demand for natural and organic products, particularly in medical applications holding 40% share, is driving adoption across healthcare, personal care, and wellness industries.

- Trends such as aromatherapy, eco-friendly household cleaners, and wellness-focused consumer lifestyles are boosting essential oil integration into diverse product categories.

- Key players including Flavex Naturextrakte GmbH, Young Living Essential Oils, DoTerra, Biolandes SAS, and India Essential Oils are enhancing competition through sustainable sourcing, product innovation, and expanding distribution networks.

- Regionally, North America led with 35% share in 2024, followed by Europe at 30% and Asia Pacific at 22%, while Latin America accounted for 7% and the Middle East & Africa together held 6%.

Market Segmentation Analysis:

By Product

Black pepper oil dominated the essential oil market in 2024, holding 30% of the product share. Its wide use in aromatherapy, pharmaceuticals, and food formulations supports strong demand. Known for antioxidant and anti-inflammatory properties, black pepper oil is increasingly integrated into health supplements and therapeutic blends. Acorus calamus and cypriol oils contribute smaller but steady shares, mainly applied in perfumery and traditional medicine. The “others” category, including lavender, tea tree, and peppermint oils, collectively represented 45% share, reflecting diverse applications in personal care, wellness, and household products.

- For instance, Biolandes SAS sources aromatic plants, such as black pepper and lavender, for its essential oil extractions used in perfumery and cosmetics. The family-owned French company operates production sites near harvest locations, including in Madagascar and Bulgaria, and supplies natural extracts to a global clientele.

By Application

The medical segment led the essential oil market in 2024 with 40% share, driven by rising demand for natural remedies and alternative therapies. Essential oils are increasingly used in pain relief, stress management, and respiratory treatments. Kitchen cleaners followed with 25% share, supported by the shift toward eco-friendly, plant-based cleaning agents. Fabric care accounted for 20% share, with essential oils incorporated into detergents and softeners for fragrance and antibacterial benefits. The “others” segment represented 15%, covering cosmetics, aromatherapy, and spa applications that continue expanding across global markets.

- For instance, doTERRA distributes a wide variety of essential oil-based wellness products and reported more than $2 billion in annual revenue in 2024, indicating millions of units sold. The company offers over 200 products, including essential oils marketed for stress management and wellness.

By Sales Channel

Direct selling emerged as the leading sales channel in 2024, accounting for 55% of the market share. The strong performance is supported by companies using multi-level marketing and personalized customer engagement strategies. Direct sales enable consumer education on product benefits, boosting adoption in health and wellness segments. The “others” category, which includes e-commerce platforms, specialty stores, and retail outlets, captured 45% share. The rise of online shopping and digital distribution channels is accelerating accessibility, particularly in emerging economies, enhancing competition and reshaping consumer purchasing behavior in the essential oil industry.

Key Growth Drivers

Rising Demand for Natural and Organic Products

Consumer preference for natural and chemical-free products is a major driver of the essential oil market. Essential oils are increasingly used in cosmetics, personal care, food, and household products due to their therapeutic properties. Rising awareness of adverse effects from synthetic ingredients boosts adoption of plant-based alternatives. The global wellness trend further accelerates demand, with aromatherapy and natural remedies gaining popularity. Growing health-consciousness ensures sustained consumption of essential oils across multiple industries, positioning natural and organic formulations as a central factor in long-term market growth.

- For instance, Young Living operates numerous corporate-owned farms, partner farms, and Seed to Seal-certified suppliers globally, which produce a variety of essential oils, including lavender, peppermint, and frankincense.

Expanding Applications in Medical and Healthcare

The medical and healthcare sector significantly drives essential oil demand, with 40% application share in 2024. Essential oils such as eucalyptus, peppermint, and tea tree are widely used for respiratory relief, pain management, and antibacterial solutions. Growing interest in complementary and alternative medicine supports their integration into therapeutic treatments. Hospitals and wellness centers increasingly adopt essential oils in aromatherapy and stress-relief programs. Rising research on antimicrobial and anti-inflammatory properties strengthens their medical relevance. This broadening scope within healthcare makes essential oils critical to both preventive care and wellness-focused treatment.

- For instance, Sydney Essential Oil Co. supplies more than 150 types of oils, with eucalyptus and tea tree oils forming a major share for medical-grade applications in antibacterial formulations.

Growth of Direct Selling and E-commerce Channels

Direct selling contributed 55% of sales in 2024, highlighting its strong role in market expansion. Companies leverage multi-level marketing strategies and personal networks to build trust and educate consumers about product benefits. Simultaneously, e-commerce platforms are transforming accessibility, enabling consumers to explore diverse product lines globally. The rise of online distribution, especially in emerging economies, boosts market penetration and brand visibility. The combination of traditional direct selling and modern digital platforms enhances consumer outreach, ensuring sustainable sales growth and expanding the essential oil market’s global footprint.

Key Trends and Opportunities

Rising Popularity of Aromatherapy and Wellness

Aromatherapy has emerged as a prominent trend, driven by consumer focus on mental health and relaxation. Essential oils such as lavender, chamomile, and sandalwood are widely used in stress management, sleep improvement, and spa treatments. With increasing wellness spending, spa chains and wellness centers are integrating aromatherapy services into their offerings. The growing urban population, rising work stress, and preference for holistic therapies create long-term opportunities. Expanding product availability in retail and e-commerce channels further strengthens aromatherapy’s role as a high-potential growth segment within the essential oil market.

- For instance, Farotti S.R.L. produces sandalwood and chamomile oils for luxury perfumery and spa-grade aromatherapy, exporting hundreds of kilograms each year to European wellness markets.

Integration into Sustainable Cleaning and Household Products

The shift toward eco-friendly and chemical-free cleaning products is driving essential oil adoption in home care. Oils like lemon, eucalyptus, and tea tree are increasingly incorporated into kitchen cleaners, detergents, and disinfectants for their antibacterial and aromatic properties. With 25% share from kitchen cleaners in 2024, demand is rising as consumers prioritize sustainability and natural ingredients. Brands highlight non-toxic and biodegradable formulations to align with green consumer trends. This integration into everyday household care provides a strong opportunity for companies to diversify applications and strengthen essential oil consumption globally.

- For instance, H. Reynaud & Fils (HRF) is a French family-owned company that produces and trades aromatic raw materials, including citrus and eucalyptus essential oils, to manufacturers for use in products distributed globally.

Key Challenges

Price Volatility of Raw Materials

Essential oil production depends on agricultural crops, making the industry vulnerable to supply fluctuations. Climate change, seasonal variations, and unpredictable weather patterns impact crop yields, driving price volatility. High costs of raw materials such as lavender, peppermint, and citrus directly affect profit margins for manufacturers. Limited production capacity in certain regions further intensifies supply constraints. These challenges create pricing instability across end-use industries, hindering large-scale adoption. Managing supply chain risks and developing sustainable sourcing strategies will be essential to stabilizing growth in the essential oil market.

Regulatory and Quality Standardization Issues

The lack of uniform regulations and quality standards poses significant challenges in the essential oil market. Variations in labeling, purity testing, and certification across countries create consumer mistrust. Adulteration and counterfeit products further threaten credibility and limit adoption in sensitive applications such as healthcare. Stricter compliance requirements in regions like Europe and North America add complexities for exporters. Ensuring consistent product quality and transparency remains a challenge for companies aiming to expand globally. Establishing standardized frameworks will be crucial to safeguard consumer trust and sustain long-term growth in the market.

Regional Analysis

North America

North America accounted for 35% of the essential oil market share in 2024, leading the global landscape. The region’s dominance is supported by strong consumer demand for natural and organic personal care, aromatherapy, and household products. Widespread adoption of essential oils in alternative medicine and wellness practices fuels steady growth. The presence of major players and robust retail and e-commerce channels further strengthens distribution. Rising preference for chemical-free cleaning and personal care products continues to drive market expansion, positioning North America as a mature and influential hub for essential oil innovation and consumption.

Europe

Europe held 30% of the essential oil market share in 2024, supported by a strong cultural tradition of herbal and plant-based products. Countries such as France, Germany, and the United Kingdom lead demand due to high integration of essential oils in cosmetics, aromatherapy, and wellness industries. Strict regulatory standards ensure high product quality, boosting consumer trust and adoption. The growing use of natural ingredients in pharmaceuticals and food flavorings further drives expansion. With rising health awareness and strong manufacturing expertise, Europe remains a key growth driver and second-largest region in the essential oil market.

Asia Pacific

Asia Pacific captured 22% of the essential oil market share in 2024, emerging as one of the fastest-growing regions. China, India, and Japan dominate regional demand due to large populations, expanding wellness industries, and traditional practices incorporating essential oils. Rising disposable incomes and increasing interest in natural healthcare strengthen adoption. Growth in aromatherapy centers, spas, and eco-friendly consumer products also supports demand. With expanding e-commerce penetration and growing middle-class purchasing power, Asia Pacific is expected to play a pivotal role in shaping global essential oil consumption trends during the forecast period.

Latin America

Latin America represented 7% of the essential oil market share in 2024, with Brazil and Mexico as leading contributors. The region benefits from a rich biodiversity that supports essential oil production, particularly in citrus and herbal categories. Rising awareness of natural remedies and expanding spa and wellness industries drive growth. Increasing demand for eco-friendly cleaning products and aromatherapy further enhances market penetration. However, economic fluctuations and supply chain challenges pose constraints. Despite this, expanding export potential and rising domestic consumption position Latin America as a promising and steadily growing market for essential oils.

Middle East and Africa

The Middle East and Africa together accounted for 6% of the essential oil market share in 2024, supported by growing investments in wellness, spa, and natural product industries. Countries such as the United Arab Emirates and South Africa are leading markets, driven by rising consumer interest in aromatherapy and natural cosmetics. Increasing tourism in the Middle East boosts demand for essential oils in hospitality and spa services. Africa benefits from the availability of raw materials, though limited processing capacity restricts large-scale adoption. Ongoing investments in local manufacturing highlight strong potential for future regional growth.

Market Segmentations:

By Product

- Acorus Calamus

- Black Pepper

- Cypriol

- Others

By Application

- Medical

- Kitchen Cleaners

- Fabric Care

- Others

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the essential oil market is defined by leading players such as Flavex Naturextrakte GmbH, Falcon, Young Living Essential Oils, India Essential Oils, DoTerra, Biolandes SAS, Essential Oils of New Zealand, H. Reynaud & Fils (HRF), Farotti S.R.L., and Sydney Essential Oil Co. (SEOC). These companies shape the market through diversified product portfolios, global distribution networks, and continuous investment in innovation. Young Living and DoTerra dominate direct selling, driving strong consumer engagement with wellness and aromatherapy products. European firms such as Biolandes and Flavex focus on sustainable sourcing and high-quality extracts for cosmetics, food, and pharmaceuticals. India Essential Oils leverages regional raw material availability to serve global demand, while firms like Essential Oils of New Zealand and SEOC highlight niche, region-specific offerings. Collectively, these players enhance market competitiveness, with strategies centered on sustainability, product innovation, and expanding applications across healthcare, personal care, and household industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Flavex Naturextrakte GmbH

- Falcon

- Young Living Essential Oils

- India Essential Oils

- DoTerra

- Biolandes SAS

- Essential Oils of New Zealand

- Reynaud & Fils (HRF)

- Farotti S. R. L.

- Sydney Essential Oil Co. (SEOC)

Recent Developments

- In 2025, Flavex Naturextrakte published a carbon footprint report for 2024 under the “VEA Initiative Klimafreundlicher Mittelstand” to highlight its energy management.

- In 2025, DBR Exports India was named a top essential oil manufacturer, increasing export orders from global brands.

- In 2024, Young Living celebrated its 30th anniversary during its YL30 International Grand Convention and introduced new products at that event.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The essential oil market will maintain steady growth driven by rising wellness adoption.

- Medical applications will expand further as natural therapies gain wider clinical acceptance.

- Direct selling and e-commerce platforms will strengthen global consumer outreach.

- Aromatherapy and spa treatments will remain key demand generators worldwide.

- Eco-friendly household cleaning products will boost essential oil integration in daily use.

- Sustainable sourcing practices will become a priority for leading manufacturers.

- Asia Pacific will emerge as a high-growth region with rising disposable incomes.

- Product innovation in blends and formulations will diversify end-use applications.

- Strategic collaborations and mergers will shape competitive positioning in global markets.

- Regulatory frameworks and quality standardization will enhance consumer trust and adoption.