Market Overview

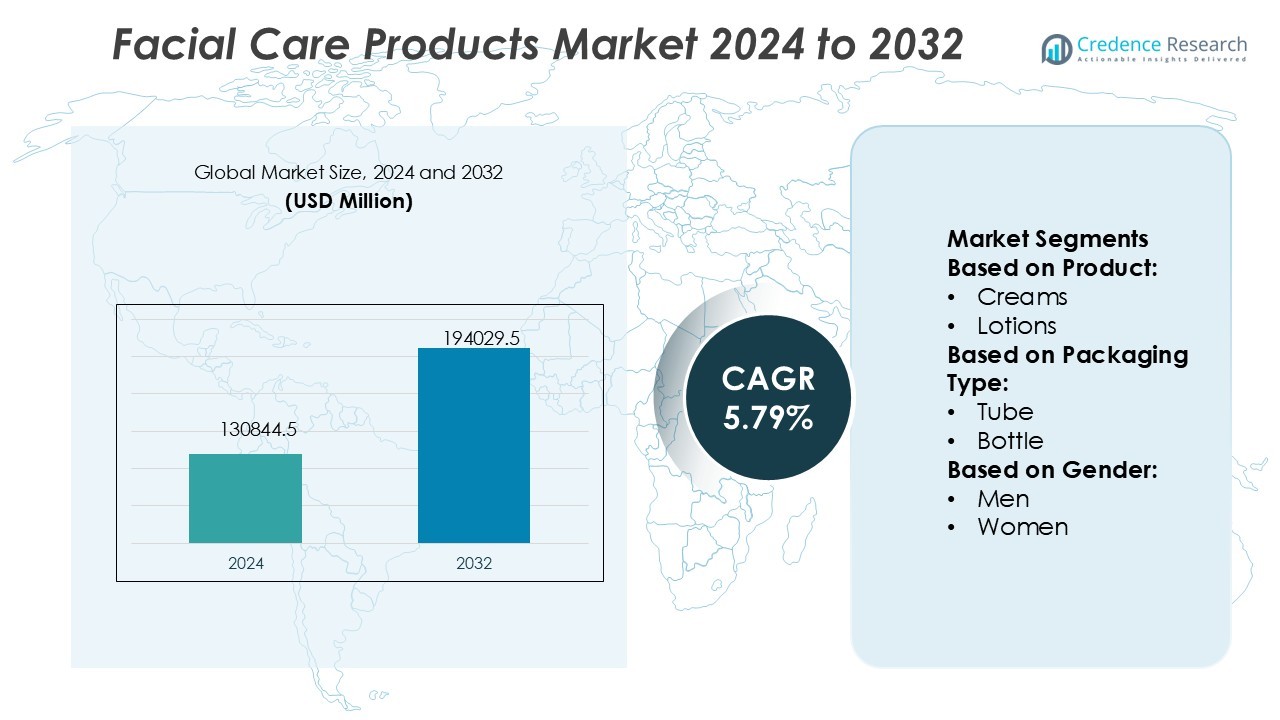

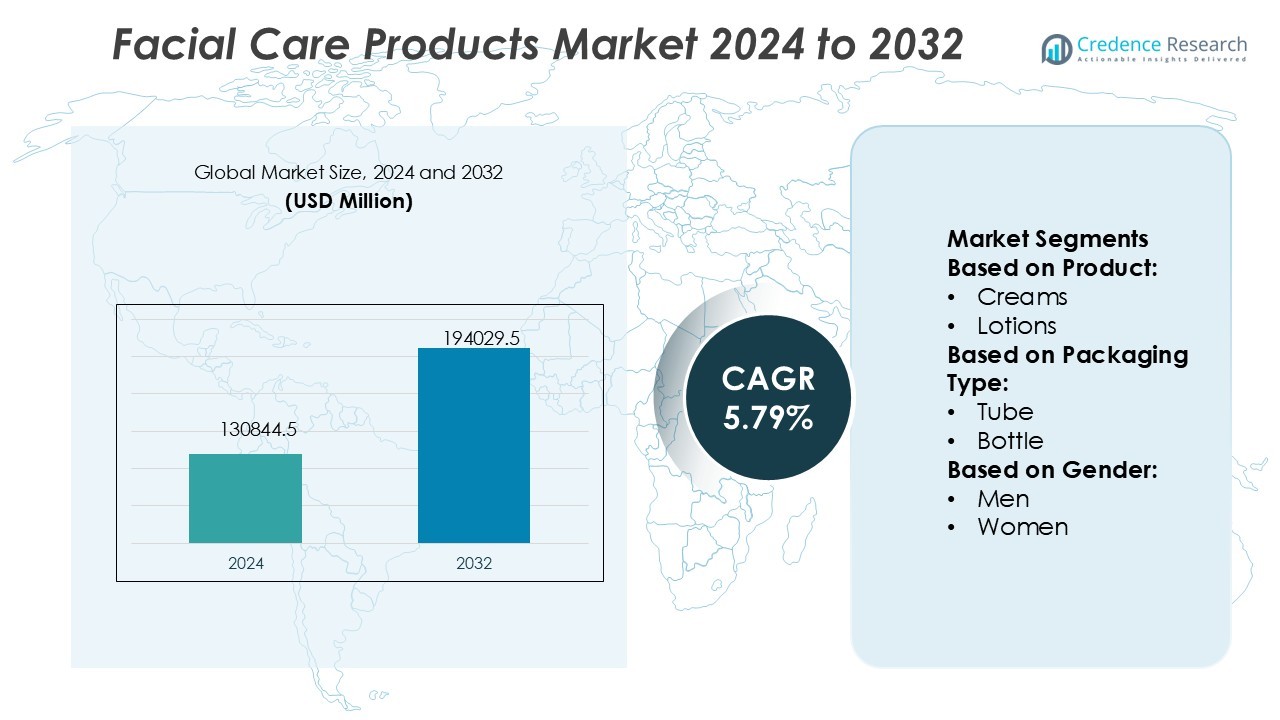

Facial Care Products Market size was valued USD 130844.5 million in 2024 and is anticipated to reach USD 194029.5 million by 2032, at a CAGR of 5.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Facial Care Products Market Size 2024 |

USD 130844.5 Million |

| Facial Care Products Market, CAGR |

5.79% |

| Facial Care Products Market Size 2032 |

USD 194029.5 Million |

The Facial Care Products Market features strong competition from top players such as L’Oréal S.A., Unilever, Procter & Gamble (P&G), Beiersdorf AG, Johnson & Johnson, Inc., Shiseido Co., Ltd., Coty Inc., Avon Products, Inc., Colgate-Palmolive Company, and Revlon. These companies compete through product innovation, extensive distribution networks, and brand-driven strategies that strengthen global presence. Asia-Pacific leads the market with a 34% share, driven by large consumer bases, rising disposable incomes, and cultural emphasis on skincare routines. The region benefits from advanced product innovations, strong adoption of premium and mass-market offerings, and expanding e-commerce penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Facial Care Products Market size was valued at USD 130844.5 million in 2024 and is expected to reach USD 194029.5 million by 2032, growing at a CAGR of 5.79%.

- Growing consumer focus on anti-aging, hydration, and preventive skincare drives consistent demand across creams, lotions, and serums, with creams holding the dominant segment share of over 40%.

- Key players including L’Oréal S.A., Unilever, Procter & Gamble (P&G), Beiersdorf AG, and Shiseido Co., Ltd. strengthen competition through innovation, wide portfolios, and global distribution strategies.

- Market restraints include high competition, regulatory challenges on formulations and labeling, and shifting consumer preferences toward natural and organic solutions requiring reformulation investments.

- Asia-Pacific leads with a 34% share, followed by North America at 32% and Europe at 28%, supported by strong adoption of premium ranges, e-commerce growth, and cultural emphasis on skincare routines in both developed and emerging economies.

Market Segmentation Analysis:

By Product

Creams dominate the Facial Care Products Market with a market share exceeding 40%. Their strong position is supported by widespread daily use for hydration, anti-aging, and sun protection. Consumers prefer creams due to their rich texture, longer-lasting moisture, and advanced formulations containing vitamins, peptides, and SPF protection. Lotions follow as the second-largest segment, driven by lighter application benefits in warmer climates. Rising awareness of preventive skincare and demand for multifunctional products continues to drive the creams category, making it the most preferred choice among consumers across age groups.

- For instance, Revlon established a 62,000-square-foot innovation center in Kenilworth, New Jersey, which houses over 150 scientists and formulators. This facility is designed to accelerate the testing of cream formulations with precise ingredient controls, enabling over 500 stability studies annually on creams infused with SPF and peptides.

By Packaging Type

Tubes hold the largest market share in packaging, accounting for over 35%. Their popularity comes from convenience, hygienic dispensing, and portability, which align with on-the-go lifestyles. Tubes also minimize product wastage and ensure better shelf life, driving consumer trust. Bottles stand as a strong secondary option, particularly for liquid-based skincare like toners and sprays. The demand for sustainable packaging further strengthens the tube segment, with recyclable and eco-friendly designs gaining traction. Brands emphasize compact, travel-friendly tubes to meet consumer demand for practicality and sustainability in facial care.

- For instance, Johnson & Johnson’s consumer health division revealed 16 new skincare research studies at the 2021 American Academy of Dermatology Virtual Meeting. The presentations, which included 3 oral publications and 13 poster presentations, highlighted targeted innovation in various aspects of skin health, including for women, cancer patients, and multicultural populations.

By Gender

Women account for the dominant market share of nearly 70% in facial care products. Their higher spending on skincare routines, anti-aging solutions, and cosmetic enhancements drives this leadership. Female consumers actively adopt new formulations such as serums, brightening creams, and organic solutions, fueling demand. The men’s segment is expanding steadily, supported by rising grooming awareness and targeted product launches like beard care creams and oil-control lotions. However, women remain the largest consumer group, driven by strong cultural emphasis on skincare, premium product adoption, and broader availability across both offline and online channels.

Key Growth Drivers

Rising Demand for Anti-Aging Solutions

The global increase in aging populations is driving demand for anti-aging facial care products. Consumers actively seek solutions that address wrinkles, fine lines, and age spots. Brands are introducing creams, serums, and masks enriched with retinol, peptides, and hyaluronic acid to meet this need. The growth of premium anti-aging ranges further accelerates adoption, especially among middle-aged and senior demographics. Growing consumer willingness to invest in preventive skincare ensures steady demand, positioning anti-aging solutions as a critical growth driver for the facial care products market.

- For instance, Coty employs over the same webpage confirms this detail 600+ people work in our R&D centers around the world across 25 technical disciplines.

Increasing Male Grooming Awareness

The male grooming segment is emerging as a significant contributor to market expansion. Men are adopting skincare routines that include moisturizers, anti-acne creams, and sun protection products. Rising exposure to global lifestyle trends and targeted marketing campaigns encourage higher consumption. Companies are launching male-focused product lines addressing oil control, beard care, and hydration. E-commerce platforms also improve accessibility, boosting product uptake. This shift in perception around grooming and self-care among men is expanding the customer base and creating new growth avenues for facial care products.

- For instance, Shiseido introduced “SIDEKICK,” a Gen-Z male skincare brand comprising 8 SKUs combining naturally-derived ingredients and advanced actives, aimed at Asian male skin concerns like oil/dry balance.

Expansion of E-Commerce and Online Retail

E-commerce has transformed the way consumers purchase facial care products, offering convenience, variety, and price transparency. Online platforms provide access to both premium and budget-friendly brands, encouraging wider adoption across demographics. Personalized product recommendations, digital promotions, and influencer-driven marketing enhance customer engagement. Subscription models and same-day delivery services add value, improving repeat purchases. Rapid internet penetration in emerging markets further supports this growth. As digital shopping channels expand, e-commerce stands as a vital driver fueling global sales of facial care products.

Key Trends & Opportunities

Shift Toward Natural and Organic Products

Consumers increasingly prefer natural, organic, and clean-label facial care solutions. Demand is rising for products free from parabens, sulfates, and artificial fragrances. Plant-based ingredients like aloe vera, green tea, and turmeric are gaining traction due to their perceived safety and effectiveness. Brands investing in certified organic formulations and sustainable sourcing strategies capture strong loyalty among health-conscious buyers. This trend presents an opportunity for companies to differentiate through eco-friendly, transparent, and ethically produced offerings in the facial care market.

- For instance, L’Oréal’s new North America Research & Innovation Center spans 250,000 sq ft and houses a 26,000 sq ft modular lab, on-site mini factory, and capacity for daily user testing with up to 400 consumers.

Personalization and Technology Integration

Personalized skincare is a growing trend, with brands adopting AI, AR, and skin diagnostic tools to offer tailored solutions. Consumers seek customized products that match skin type, lifestyle, and environmental exposure. Online tools and mobile apps enable real-time product recommendations, boosting customer engagement and satisfaction. The integration of technology allows brands to deliver targeted treatments and improve efficacy. This opportunity not only enhances brand value but also positions companies at the forefront of innovation in the facial care products market.

- For instance, Unilever has built one of the largest proprietary skin microbiome databases, analyzing over 30,000 skin samples and securing more than 100 patents in microbiome science.

Key Challenges

High Competition and Market Saturation

The facial care products market faces intense competition, with global, regional, and niche brands competing for consumer attention. Product similarity and the presence of numerous substitutes limit differentiation. Price wars and aggressive promotional campaigns further squeeze profit margins. Consumers are also quick to shift between brands, raising challenges in building long-term loyalty. Companies must consistently innovate and strengthen branding strategies to sustain growth in this crowded marketplace.

Regulatory and Compliance Constraints

Strict regulations on cosmetic formulations, labeling, and claims create challenges for manufacturers. Compliance with regional standards such as FDA, EU Cosmetics Regulation, and others requires constant investment in testing and reformulation. Delays in product approval and restrictions on certain ingredients hinder market entry. Failure to meet these regulations can result in fines, recalls, and reputational damage. Navigating evolving compliance frameworks while maintaining innovation remains a critical challenge for players in the facial care products market.

Regional Analysis

North America

North America holds 32% of the global facial care products market, supported by high consumer spending and strong adoption of premium skincare brands. The U.S. leads the region with demand for anti-aging creams, organic solutions, and technologically advanced products. High awareness of sun protection and dermatology-backed treatments further drives adoption. Online retail platforms and influencer-led marketing campaigns enhance accessibility and visibility for both established and emerging brands. Canada shows steady growth due to increasing interest in natural and eco-friendly formulations. The region remains a leader in innovation and brand-driven premium facial care solutions.

Europe

Europe accounts for 28% of the facial care products market, driven by strong demand for sustainable and dermatologically tested products. Countries such as Germany, France, and the U.K. dominate consumption, with consumers highly valuing natural, eco-certified, and organic skincare. Stringent regulatory standards encourage safe and high-quality formulations, enhancing trust among buyers. Anti-aging creams and serums record significant traction among aging populations, while urban consumers increasingly prefer multi-functional products. E-commerce penetration and specialty retail outlets continue to expand market reach. Europe’s emphasis on clean beauty and sustainability strengthens its role as a key global facial care hub.

Asia-Pacific

Asia-Pacific leads the market with a 34% share, driven by large populations and rising disposable incomes. China, Japan, and South Korea are major contributors, supported by advanced skincare innovations and cultural emphasis on beauty routines. K-beauty trends, sheet masks, and high-performance serums gain strong traction across demographics. Increasing urbanization and exposure to global brands expand adoption among middle-class consumers. Digital platforms, live-stream shopping, and social media influencers accelerate sales growth. Asia-Pacific continues to outpace other regions due to its combination of cultural preference, technological advancement, and wide availability of affordable as well as premium facial care solutions.

Latin America

Latin America captures 4% of the facial care products market, with Brazil and Mexico as the leading countries. Growth is driven by rising awareness of skincare routines, increasing female workforce participation, and expanding middle-class spending. Consumers in the region show preference for moisturizing creams and sun protection products, given the hot and humid climate. Local brands emphasize affordable pricing, while international companies introduce targeted premium ranges to attract aspirational buyers. E-commerce penetration is rising, though offline retail remains dominant. Latin America’s growth potential lies in increasing urbanization and evolving beauty standards across diverse consumer groups.

Middle East & Africa

The Middle East & Africa holds 2% of the global market, with gradual but steady expansion. Demand is primarily concentrated in Gulf countries such as the UAE and Saudi Arabia, where consumers invest in luxury and premium skincare products. Hot climates drive high usage of moisturizers and sun protection creams. In Africa, affordability remains key, with demand focused on basic creams and lotions. Rising awareness through social media and global beauty trends supports growth. International players are strengthening presence through retail expansion, while local brands compete with cost-effective offerings. The region shows promising long-term potential.

Market Segmentations:

By Product:

By Packaging Type:

By Gender:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Facial Care Products Market is shaped by leading players including Revlon, Johnson & Johnson, Inc., Coty Inc., Shiseido Co., Ltd., Avon Products, Inc., Colgate-Palmolive Company, L’Oréal S.A., Procter & Gamble (P&G), Beiersdorf AG, and Unilever. The facial care products market is highly competitive, characterized by continuous innovation, evolving consumer preferences, and strong brand-driven strategies. Companies compete through product differentiation, with emphasis on natural ingredients, anti-aging benefits, and multifunctional solutions. The rise of e-commerce has intensified rivalry, as digital platforms enable both established and emerging brands to reach broader audiences. Marketing campaigns driven by influencers, social media engagement, and personalization tools further shape competitive dynamics. Sustainability and eco-friendly packaging have become key differentiators, while regulatory compliance and premiumization strategies continue to influence competitive positioning in this rapidly expanding market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Revlon

- Johnson & Johnson, Inc.

- Coty Inc.

- Shiseido Co., Ltd.

- Avon Products, Inc.

- Colgate-Palmolive Company

- L’Oréal S.A.

- Procter & Gamble (P&G)

- Beiersdorf AG

- Unilever

Recent Developments

- In May 2025, Meta announced a feature internally referred to as “super sensing.” In super sensing mode, the glasses’ built-in cameras and sensors will remain on and recording throughout the wearer’s day.

- In May 2025, the U.S. surveillance watchdog said expanded use of facial recognition at airports should be voluntary. It further concludes that more transparency and procedures should be improved to further protect the data privacy of passengers and the accuracy of results.

- In July 2024, American Exchange Group acquired Indie Lee, a leading clean beauty brand known for its plant-based skincare products. The acquisition enhances American Exchange Group’s position in the premium, sustainable beauty market.

- In June 2024, Google, a leading software company, is testing the facial tracking system for the corporate campus with the help of Google’s Security and Resilience Services (GSRS) team; the test is currently taking place in Kirkland, Washington.

Report Coverage

It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for anti-aging and preventive skincare will continue to expand across demographics.

- Natural and organic formulations will gain stronger consumer preference globally.

- E-commerce and digital platforms will drive higher sales and brand visibility.

- Personalized skincare solutions using AI and diagnostics will see wider adoption.

- Men’s grooming products will register faster growth with targeted launches.

- Sustainable packaging and eco-friendly sourcing will become central to brand strategies.

- Premium and luxury skincare ranges will strengthen presence in urban markets.

- Emerging economies will contribute significantly to overall market expansion.

- Multi-functional products combining hydration, sun protection, and repair will dominate.

- Strategic collaborations and acquisitions will intensify competition among global brands.