Market Overview:

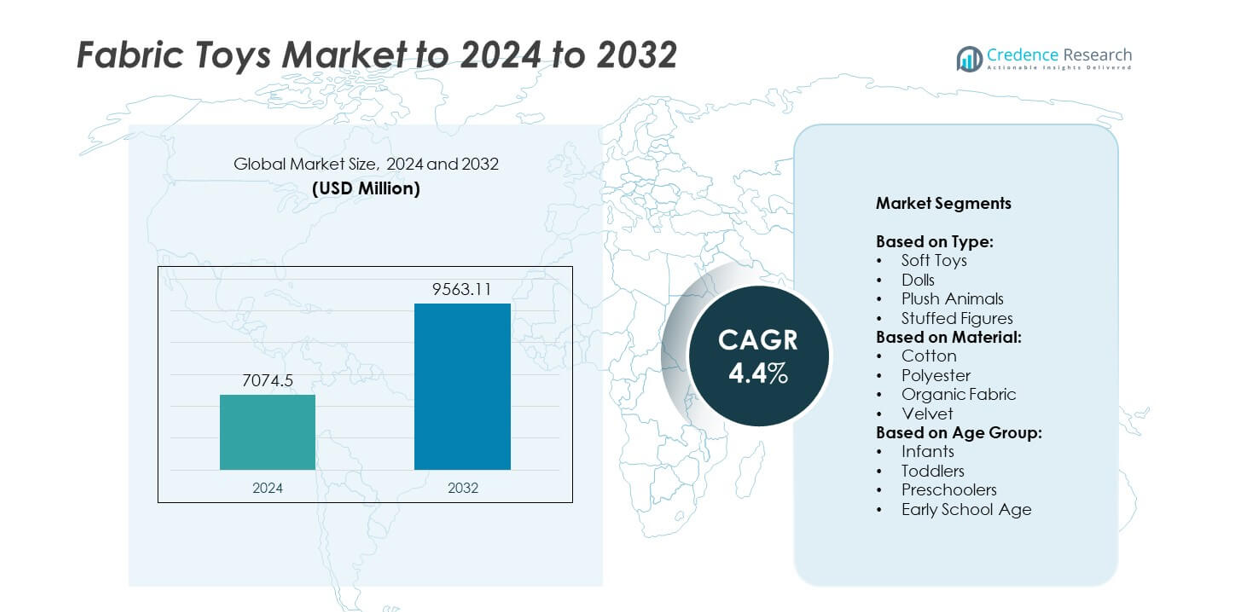

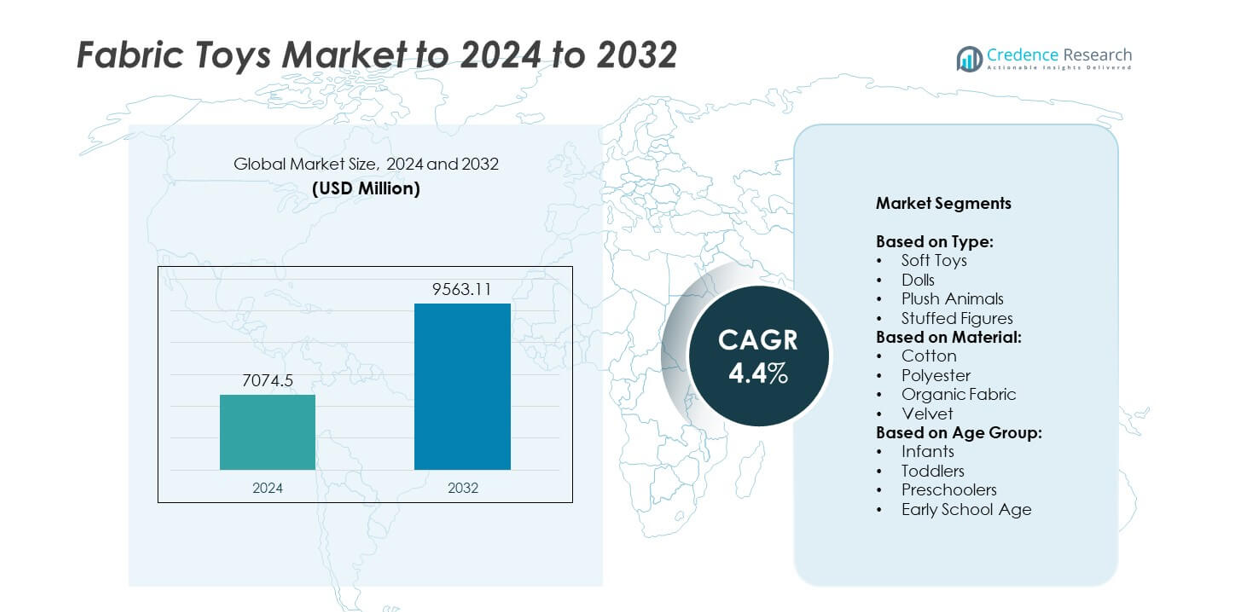

Fabric Toys market size was valued at USD 7074.5 million in 2024 and is anticipated to reach USD 9563.11 million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fabric Toys Market Size 2024 |

USD 7074.5 million |

| Fabric Toys Market, CAGR |

4.4% |

| Fabric Toys Market Size 2032 |

USD 9563.11 million |

The fabric toys market is shaped by leading players such as Cloud b, Spin Master, Gund, Melissa and Doug, Aurora World, Hasbro, Jellycat, Folkmanis, Ty Inc., Snoozies, Mattel, North American Bear Co., MGA Entertainment, Sassy, VTech, and Kidoozie. These companies focus on innovation, character licensing, eco-friendly materials, and expanding online retail channels to strengthen their competitive positions. Regional analysis shows that North America led the market in 2024, holding 32% share, driven by high consumer spending, strong retail infrastructure, and demand for sustainable and licensed products. Europe followed with 28% share, supported by strict safety standards and preference for eco-conscious toys, while Asia Pacific accounted for 25%, fueled by rising disposable incomes and production hubs.

Market Insights

- The fabric toys market size reached USD 7074.5 million in 2024 and is expected to reach USD 9563.11 million by 2032, growing at a CAGR of 4.4%.

- Rising demand for developmental and educational toys, along with growing parental focus on safe and sensory play, is fueling consistent growth across product categories, with soft toys leading at over 35% share in 2024.

- Key trends include increasing adoption of sustainable fabrics such as organic cotton and recycled polyester, along with growing interest in licensed and character-based toys linked to global entertainment franchises.

- The competitive landscape is shaped by global leaders and niche manufacturers emphasizing eco-friendly innovations, customization, and e-commerce expansion, while facing challenges from local low-cost producers and strict safety compliance costs.

- North America led with 32% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while Latin America and Middle East & Africa accounted for smaller but steadily growing shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Soft toys dominated the fabric toys market in 2024, capturing over 35% of the share. Their popularity stems from wide appeal across age groups and strong gifting demand. Plush animals follow closely, driven by themed collections and licensed characters from entertainment franchises. Dolls maintain steady growth supported by cultural traditions and interactive play features. Stuffed figures are expanding due to demand for customized and character-based designs. The dominance of soft toys reflects their versatility, emotional connection for children, and increasing product innovations such as washable and hypoallergenic fabrics.

- For instance, As of August 2024, Jazwares’ Squishmallows brand had sold over 400 million units across more than 3,000 unique styles.

By Material

Polyester emerged as the leading material segment, accounting for more than 40% of the fabric toys market in 2024. Its durability, affordability, and ease of mass production make it highly preferred by manufacturers. Cotton ranks second, benefiting from its natural feel and safety appeal for infants and toddlers. Organic fabrics are witnessing rising adoption, driven by eco-conscious parents seeking non-toxic, sustainable options. Velvet remains a niche but growing material due to its premium texture and demand in collectible toys. Polyester dominance is fueled by scalability and broad acceptance across global markets.

- For instance, Paramount reports ~100,000 PAW Patrol products in market across categories, underscoring preschool pull.

By Age Group

Toddlers represented the dominant age group in the fabric toys market, securing over 38% of total share in 2024. This segment benefits from strong parental spending on developmental toys that enhance sensory skills and comfort. Infants contribute significantly, as soft and plush designs meet safety and soothing needs. Preschoolers show consistent adoption due to role-play and learning-focused toys, while early school-age children engage with themed and collectible stuffed figures. The leading toddler segment reflects high replacement cycles, gifting occasions, and demand for safe, washable, and engaging fabric-based play products.

Key Growth Drivers

Rising Demand for Educational and Developmental Toys

The growing emphasis on early childhood learning strongly drives the fabric toys market. Parents and educators increasingly prefer toys that stimulate cognitive, sensory, and emotional development. Soft toys, dolls, and plush animals support imaginative play, language development, and motor skills. Rising disposable incomes in emerging economies further encourage higher spending on interactive and safe toys. The demand for fabric toys as both comforting companions and learning tools ensures their steady adoption, making this the key growth driver shaping global market expansion.

- For instance, Keel Toys’ Keeleco range is made from 100% recycled plastic waste, with the number of bottles used varying by product size.

Growing Popularity of Licensed and Character-Based Products

Licensed fabric toys tied to movies, cartoons, and gaming franchises are fueling sales globally. Children’s fascination with characters such as superheroes, animated animals, and fantasy figures has significantly boosted demand for branded plush animals and stuffed figures. Manufacturers collaborate with entertainment companies to create exclusive collections that enhance brand value. These products also enjoy strong gifting appeal and collectability among both children and adults. The increasing influence of pop culture ensures continued momentum for licensed toys, reinforcing brand loyalty and driving repeat purchases.

- For instance, the Ty Inc. Beanie Boos line features over 600 distinct items

Expansion of Sustainable and Eco-Friendly Materials

Sustainability has become a critical driver as parents prioritize safe, non-toxic, and eco-friendly products. The use of organic fabrics, cotton, and recycled polyester in fabric toys is rising sharply. Regulatory frameworks promoting sustainable materials also push manufacturers to shift toward eco-conscious production. Brands adopting biodegradable packaging and recyclable textiles attract environmentally aware consumers. This transition is especially prominent in developed markets such as Europe and North America, where sustainability strongly influences purchasing decisions. The expansion of eco-friendly toys opens long-term growth opportunities for ethical brands.

Key Trends & Opportunities

Customization and Personalization of Toys

A major trend shaping the fabric toys market is customization, where consumers seek personalized products for gifting and emotional connection. Parents often prefer toys embroidered with names or tailored designs reflecting children’s interests. E-commerce platforms support this trend by offering easy customization options and direct-to-consumer models. Personalized plush animals, dolls, and soft toys enhance attachment and increase consumer loyalty. The shift toward bespoke toys not only adds premium value but also creates opportunities for niche players and startups to differentiate their offerings in competitive markets.

- For instance, Budsies states it has produced over 200,000 custom plush designs for customers worldwide.

Digital Integration and Interactive Features

The integration of technology into fabric toys is opening fresh opportunities. Interactive toys embedded with sound chips, sensors, or augmented reality features provide immersive play experiences. Parents increasingly adopt smart toys that combine traditional fabric comfort with modern digital engagement. These innovations appeal to tech-savvy families and align with the rising preference for multi-sensory learning tools. Companies are investing in safe, durable, and washable digital fabric toys to ensure practicality. This trend is expected to grow as digital-native children demand engaging and interactive play products.

- For instance, Hasbro’s 2023 Furby features 5 voice-activated modes and 600+ phrases/songs in a plush form factor.

Key Challenges

Safety Regulations and Compliance Costs

Strict safety standards present a major challenge for the fabric toys market. Regulations require toys to be free from toxic dyes, small detachable parts, and hazardous chemicals. Meeting these standards increases production costs and limits the use of cheaper materials. Frequent recalls due to safety violations can damage brand reputation and reduce consumer trust. Smaller manufacturers face difficulty in sustaining compliance expenses, leading to competitive disadvantages. As authorities continue tightening regulations, manufacturers must balance innovation and affordability while maintaining strict adherence to global safety norms.

Intense Competition and Price Pressure

The fabric toys market faces intense competition from both global brands and regional manufacturers. Local producers often compete on price, offering lower-cost alternatives to branded products. This exerts strong pricing pressure on established players, reducing profit margins. Additionally, the availability of counterfeit licensed toys threatens market credibility. Consumers in price-sensitive markets may opt for cheaper options despite quality concerns. Companies are forced to focus on differentiation through sustainability, innovation, and branding to maintain competitive advantage, but this requires high investment and marketing efforts.

Regional Analysis

North America

North America held the largest share of the fabric toys market in 2024, accounting for 32%. Strong consumer spending, high demand for licensed character toys, and a mature retail infrastructure support regional dominance. The U.S. leads with extensive product innovation and collaborations with global entertainment brands. Rising awareness of eco-friendly materials also drives adoption of organic and sustainable toys. Canada contributes steadily, with growing interest in educational and sensory toys for toddlers. The established distribution networks across online and offline channels further enhance accessibility, reinforcing North America’s leadership in the global fabric toys market.

Europe

Europe captured 28% of the fabric toys market in 2024, supported by strong demand for sustainable and ethically produced toys. Countries such as Germany, France, and the UK lead adoption due to strict safety regulations and consumer preference for eco-friendly materials. Educational toys tailored to developmental needs also gain traction, reflecting the region’s emphasis on child learning. Licensed toys inspired by European entertainment franchises further fuel sales. The popularity of premium-quality toys among middle- and high-income families strengthens market presence. E-commerce expansion and gifting culture during holidays provide an additional boost to Europe’s position.

Asia Pacific

Asia Pacific accounted for 25% of the fabric toys market in 2024, driven by rapid urbanization and rising disposable incomes. China dominates production and consumption, supported by cost-efficient manufacturing hubs and strong domestic demand. India shows robust growth with increasing middle-class spending on educational and sensory toys. Japan and South Korea contribute through premium character-based toys tied to popular media franchises. Growing awareness of child development and safety standards is pushing demand for quality fabric toys. Expanding e-commerce platforms and affordable product ranges further support Asia Pacific’s growth, positioning it as a fast-evolving regional market.

Latin America

Latin America represented 9% of the fabric toys market in 2024, with Brazil and Mexico driving regional growth. Rising birth rates and increasing parental focus on developmental play support demand. Licensed toys connected to global and regional entertainment franchises remain popular among children. However, economic fluctuations and price sensitivity influence purchasing behavior, pushing preference for affordable options. Online platforms are expanding their role in distribution, offering wider access to diverse product ranges. Growing awareness of child safety and the introduction of organic materials are also encouraging higher-quality purchases in Latin American markets.

Middle East and Africa

The Middle East and Africa held 6% of the fabric toys market in 2024, reflecting steady but smaller-scale growth. Urban centers such as the UAE and South Africa show rising demand, supported by expanding retail infrastructure and a growing young population. High preference for plush animals and soft toys as gifting items enhances sales. However, limited awareness of eco-friendly and educational toys restrains broader adoption. Economic disparity across regions creates uneven market penetration, with premium toys mainly restricted to high-income groups. Gradual improvements in e-commerce and retail channels are expected to support future expansion.

Market Segmentations:

By Type:

- Soft Toys

- Dolls

- Plush Animals

- Stuffed Figures

By Material:

- Cotton

- Polyester

- Organic Fabric

- Velvet

By Age Group:

- Infants

- Toddlers

- Preschoolers

- Early School Age

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Cloud b, Spin Master, Gund, Melissa and Doug, Aurora World, Hasbro, Jellycat, Folkmanis, Ty Inc., Snoozies, Mattel, North American Bear Co., MGA Entertainment, Sassy, VTech, and Kidoozie are among the prominent companies shaping the competitive landscape of the fabric toys market. The industry is characterized by a blend of global leaders and niche specialists competing across product innovation, sustainability, and licensed character partnerships. Companies focus heavily on integrating eco-friendly materials, enhancing safety standards, and expanding customization options to attract environmentally conscious and value-driven consumers. The rise of online retail channels has intensified competition, with firms leveraging e-commerce to extend their global reach and offer direct-to-consumer models. Collaborations with entertainment franchises remain a critical strategy, ensuring consistent demand through character-driven toys. Market rivalry is further heightened by regional manufacturers offering low-cost alternatives, pushing established players to differentiate through quality, brand reputation, and innovation-driven product portfolios.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cloud b

- Spin Master

- Gund

- Melissa and Doug

- Aurora World

- Hasbro

- Jellycat

- Folkmanis

- Ty Inc.

- Snoozies

- Mattel

- North American Bear Co.

- MGA Entertainment

- Sassy

- VTech

- Kidoozie

Recent Developments

- In 2025, GUND introduced an updated Muttsy plush as part of its new Forever Friends line and Forever Friends Promise initiative. The updated plush is softer, features new red heart stitching on its paw pads, and comes with a scannable tag that provides special benefits

- In January 2024, Spin Master completed its acquisition of Melissa & Doug, a move positioned to drive innovation and growth in the toy industry.

- In 2023, Ty Inc. launched a special edition gold beanie baby teddy bear named Aloha

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The fabric toys market will expand steadily with growing demand for developmental play products.

- Sustainability will shape consumer preferences, boosting adoption of organic and eco-friendly materials.

- Licensed and character-based toys will continue driving brand collaborations and premium sales.

- Digital integration in plush and soft toys will enhance interactive learning experiences.

- E-commerce platforms will strengthen distribution, offering customization and wider global reach.

- Emerging markets will witness faster growth due to rising disposable incomes and urbanization.

- Safety regulations will push manufacturers to invest in high-quality, compliant production processes.

- Personalization trends will create premium opportunities in gifting and niche toy categories.

- Competition will intensify, with companies focusing on innovation and brand differentiation.

- Educational toys will remain central to market growth, appealing to parents worldwide.