Market Overview:

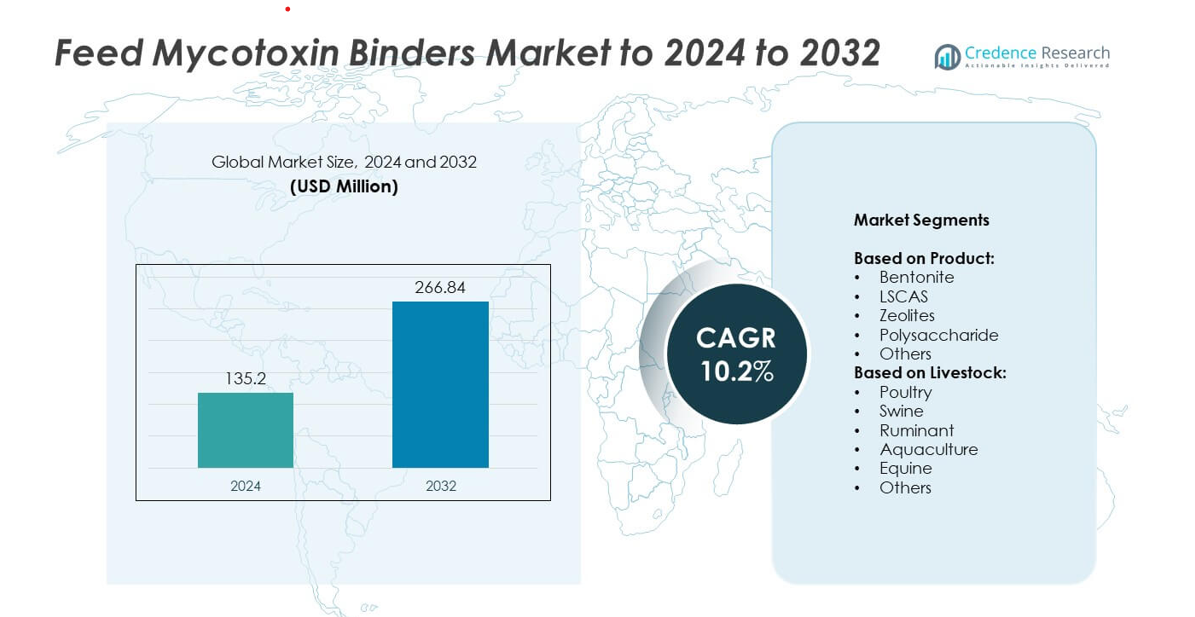

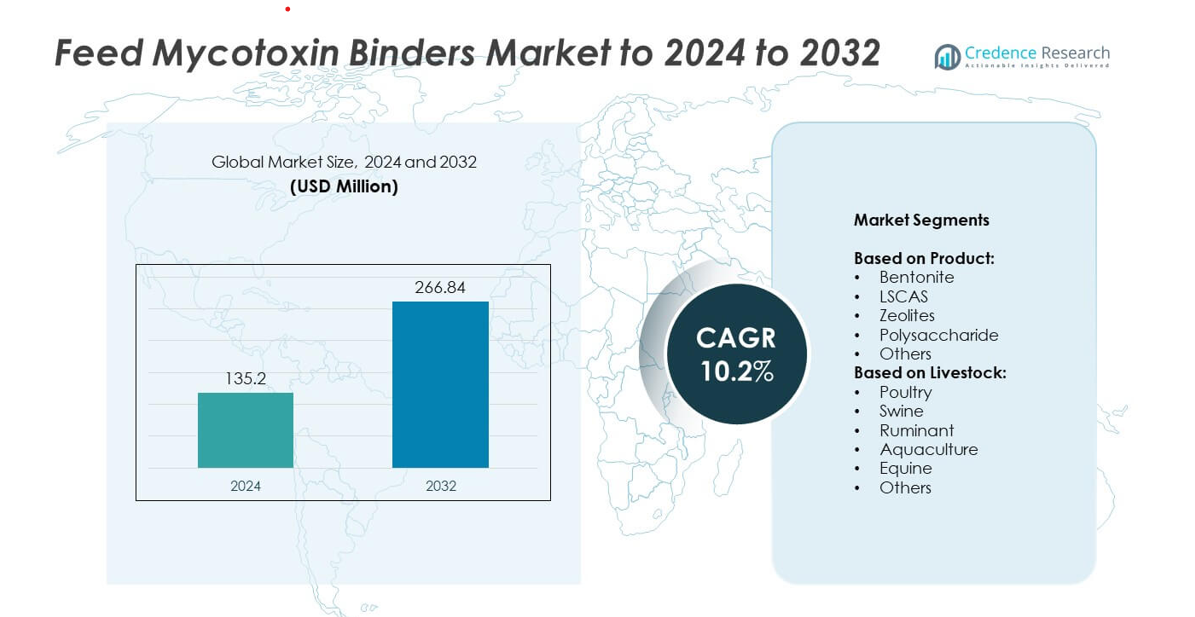

Feed Mycotoxin Binders Market size was valued at USD 135.2 Million in 2024 and is anticipated to reach USD 266.84 Million by 2032, at a CAGR of 10.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Feed Mycotoxin Binders Market Size 2024 |

USD 135.2 Million |

| Feed Mycotoxin Binders Market, CAGR |

10.2% |

| Feed Mycotoxin Binders Market Size 2032 |

USD 266.84 Million |

The feed mycotoxin binders market is shaped by leading players such as Huvepharma, Alltech Inc., CHR Hansen, Novus International Inc., BASF SE, Selko B.V., Adisseo, DSM, Perstorp, Cargill, BIOMIN Holding GmbH, Trouw Nutrition, and Kemin Industries Inc. These companies focus on advanced binder formulations, multi-functional solutions, and regulatory compliance to strengthen their global positions. North America emerged as the leading region in 2024, accounting for 30% of the total market share, supported by stringent feed safety standards and large-scale livestock industries. Europe followed with 25%, while Asia Pacific captured 28%, driven by rising poultry and swine production

.Market Insights

- The feed mycotoxin binders market was valued at USD 135.2 million in 2024 and is projected to reach USD 266.84 million by 2032, growing at a CAGR of 10.2%.

- Rising mycotoxin contamination in animal feed and increasing livestock production are key drivers fueling demand.

- Market trends highlight growing adoption of multifunctional binders that combine toxin adsorption with gut health support, alongside rising demand for natural and bio-based solutions.

- Competition is strong with global players investing in research, regional expansion, and partnerships to strengthen market presence, while smaller players focus on cost-effective offerings.

- North America led the market with 30% share in 2024, followed by Asia Pacific at 28% and Europe at 25%, while poultry remained the dominant livestock segment, holding nearly 40% share of overall demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Bentonite held the largest share in the feed mycotoxin binders market in 2024, accounting for more than 35% of total demand. Its dominance comes from its high adsorption efficiency, low cost, and proven safety across multiple feed formulations. Bentonite is widely preferred for binding aflatoxins, which remain one of the most common mycotoxin threats in animal diets. Demand is further supported by its ease of incorporation into feed mixes and regulatory acceptance in key regions. Growth in the livestock sector continues to reinforce bentonite’s leadership over LSCAS, zeolites, polysaccharides, and other binders.

- For instance, EW Nutrition manufactures a range of mycotoxin binders, including the smectite-based Solis line. In one in vitro trial, the product Solis Max 2.0 demonstrated a high adsorption capacity for mycotoxins like aflatoxin B1 (80-90%), as well as other toxins like fumonisin B1.

By Livestock

Poultry dominated the feed mycotoxin binders market in 2024, capturing nearly 40% of the overall share. The segment benefits from intensive poultry farming practices, where feed quality directly influences egg and meat production. Poultry feed is highly vulnerable to contamination by aflatoxins, ochratoxins, and fumonisins, making mycotoxin binders essential. Rising global consumption of poultry products, combined with stringent safety standards in regions such as North America and Europe, drives adoption. The need to maintain animal health, improve feed efficiency, and safeguard end-product quality continues to secure poultry’s leading position among livestock categories.

- For instance, the dsm-firmenich World Mycotoxin Survey for 2024 analyzed 28,388 feed samples from 95 countries.

Key Growth Drivers

Rising Incidence of Mycotoxin Contamination

The increasing prevalence of mycotoxin contamination in animal feed remains the primary growth driver for the feed mycotoxin binders market. Climate change and poor storage conditions have led to higher fungal growth in cereals and grains, raising contamination risks. Mycotoxin outbreaks significantly impact livestock health, causing reduced productivity and economic losses. To counter these risks, feed producers are investing in advanced binders with proven adsorption capabilities. Growing awareness among farmers and stricter feed safety regulations further fuel adoption, reinforcing contamination control as the central growth driver.

- For instance, the Alltech 2024 European Harvest Analysis reported that 99% of European wheat samples and 98% of barley samples contained multiple mycotoxins. The average concentration of deoxynivalenol (DON), which posed a high risk in straw samples, reached 1,928 ppb in 2024. Overall mycotoxin risk was rated moderate to high, with significant regional variations.

Expanding Global Livestock Production

Rising demand for poultry, swine, and dairy products globally has driven livestock production, creating strong demand for feed safety solutions. Intensive farming systems, especially in Asia-Pacific and Latin America, are highly vulnerable to feed contamination risks. Mycotoxin binders help improve animal performance, feed efficiency, and product safety, making them essential in large-scale farming operations. The expansion of commercial farming and integrated feed mills has accelerated the adoption of advanced binders. This growing livestock base strongly supports the long-term market demand for effective mycotoxin management solutions.

- For instance, Cargill publishes a World Mycotoxin Report that provides data on global mycotoxin prevalence. The 2022 report found that 75% of more than 300,000 analyses were positive for mycotoxins globally.

Regulatory Push for Feed Safety Standards

Stringent regulations by global agencies such as the European Food Safety Authority (EFSA) and the U.S. FDA on feed safety have emerged as a key growth driver. These regulations limit permissible mycotoxin levels in animal diets, creating strong demand for binders to ensure compliance. Feed manufacturers increasingly adopt certified binders to meet export requirements and avoid penalties. The regulatory emphasis on livestock welfare and product traceability has compelled feed producers to adopt preventive safety measures. This compliance-driven adoption ensures sustained growth for the mycotoxin binders market.

Key Trends & Opportunities

Shift Toward Multi-Functional Binders

One major trend is the rising demand for multi-functional binders that offer both binding and detoxifying capabilities. Unlike traditional binders, these advanced formulations target a broader spectrum of mycotoxins and improve animal health through additional benefits like immune modulation and gut protection. Companies are investing in R&D to develop innovative products that combine binding efficiency with nutritional support. This shift toward multifunctionality presents strong opportunities for differentiation and value creation in the market, catering to the growing need for performance-oriented feed additives.

- For instance, in Trouw Nutrition trials, the product TOXO-XL was shown to mitigate the negative effects of mycotoxins in broilers. Compared to a control group challenged with mycotoxins, broilers treated with TOXO-XL showed a 29.20% increase in body weight and a 40.15% reduction in the sphinganine:sphingosine ratio.

Rising Adoption in Emerging Markets

Emerging economies in Asia-Pacific, Africa, and Latin America are creating significant opportunities for feed mycotoxin binders. Rapid urbanization and rising disposable incomes are fueling higher meat and dairy consumption, driving demand for safe livestock feed. However, these regions face greater exposure to mycotoxin contamination due to tropical climates and limited storage infrastructure. Governments are strengthening feed regulations, which pushes adoption of advanced binders. As awareness grows among local farmers and feed producers, the adoption rate in these markets is expected to rise sharply, opening lucrative opportunities.

- For instance, Kemin reports on mycotoxin prevalence based on its Customer Laboratory Services (CLS) analyses, which have identified high levels of co-contamination in feed ingredients, a 2022 survey noted that 100% of the 75 corn by-product samples tested contained more than one mycotoxin, and 57% of 284 standard corn samples had more than one mycotoxin present.

Key Challenges

High Costs of Advanced Binders

The development and commercialization of advanced multi-functional binders come with high production costs, which limit their accessibility for small and mid-sized farmers. Traditional low-cost options like bentonite dominate in price-sensitive regions, but they offer limited coverage against diverse mycotoxins. The cost disparity between basic and advanced binders creates challenges in adoption, especially in developing markets. Balancing affordability with performance remains a critical issue for manufacturers, slowing the penetration of premium solutions despite their higher efficacy and broader protective benefits.

Lack of Awareness in Developing Regions

Limited awareness among small-scale farmers in developing regions poses a key challenge for the market. Many producers underestimate the economic impact of mycotoxin contamination and rely on traditional feed management practices rather than preventive binders. This knowledge gap reduces the adoption of advanced solutions, despite higher contamination risks in tropical climates. Insufficient extension services and poor access to training on feed safety add to the problem. Overcoming this awareness barrier will be critical for binder manufacturers aiming to expand their presence in emerging markets.

Regional Analysis

North America

North America accounted for around 30% share of the feed mycotoxin binders market in 2024, driven by strong regulatory oversight and advanced feed safety practices. The United States and Canada lead adoption due to large-scale poultry, swine, and dairy industries that require contamination control for export compliance. Stringent standards set by the FDA and growing consumer demand for high-quality meat and dairy products strengthen the region’s position. Widespread use of advanced multi-functional binders and increasing focus on preventive animal health strategies further contribute to North America’s leadership in the global market.

Europe

Europe held nearly 25% of the market share in 2024, supported by strict feed safety regulations and strong adoption in intensive livestock farming. Countries such as Germany, France, and the Netherlands lead usage due to their well-established poultry and dairy industries. The European Food Safety Authority’s strict limits on mycotoxin levels continue to drive adoption of certified binders. Sustainability and animal welfare initiatives also encourage producers to adopt multifunctional solutions. Continuous innovation and a preference for premium feed additives sustain Europe’s strong position in the feed mycotoxin binders market.

Asia Pacific

Asia Pacific captured approximately 28% of the global market in 2024, driven by expanding livestock production and rising feed contamination risks in tropical climates. China and India are leading contributors, supported by rapid poultry and swine farming growth. Increasing meat consumption, rising urbanization, and government emphasis on food safety are pushing adoption across the region. However, variability in farmer awareness and feed infrastructure remains a barrier in rural areas. The growing presence of international and local binder manufacturers, along with stricter regional feed regulations, continues to accelerate market growth in Asia Pacific.

Latin America

Latin America held close to 10% market share in 2024, with Brazil and Mexico as leading markets due to large-scale poultry and swine production. The region’s warm climate makes livestock feed highly prone to fungal contamination, driving the demand for effective binders. Adoption is growing as producers aim to meet both domestic safety standards and international export requirements. Cost-effective products remain the primary preference among local farmers, but increasing adoption of multifunctional binders is visible in industrial farming operations. Expanding agribusiness activities and trade integration continue to support regional growth.

Middle East and Africa

The Middle East and Africa accounted for about 7% share of the feed mycotoxin binders market in 2024. The region’s growth is fueled by rising poultry and aquaculture industries, particularly in countries like South Africa, Egypt, and Saudi Arabia. Mycotoxin contamination is a persistent challenge due to hot climates and limited storage infrastructure. While adoption of advanced binders remains lower than in developed regions, awareness programs and government support for livestock development are boosting demand. International players are increasing their footprint through partnerships and training initiatives, gradually expanding adoption across the region.

Market Segmentations:

By Product:

- Bentonite

- LSCAS

- Zeolites

- Polysaccharide

- Others

By Livestock:

- Poultry

- Swine

- Ruminant

- Aquaculture

- Equine

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The feed mycotoxin binders market is characterized by strong competition among key players such as Huvepharma, Alltech Inc., CHR Hansen, Novus International Inc., Vibrac, BASF SE, Selko B.V., Adisseo, DSM, Perstorp, Cargill, EWOS, Vetline, BIOMIN Holding GmbH, Trouw Nutrition, and Kemin Industries Inc. Companies compete on product innovation, regulatory compliance, and feed safety performance, with a growing focus on multi-functional binders that not only adsorb toxins but also support animal health and immunity. Investments in research and development are central to expanding portfolios and addressing a broader spectrum of mycotoxins. Strategic partnerships with feed manufacturers, expansions into emerging regions, and acquisitions remain common approaches to strengthen market presence. Sustainability and bio-based solutions are also gaining prominence, as producers aim to align with environmental standards and consumer-driven demand for safe and natural feed additives. The competitive environment is expected to intensify as demand rises in both developed and developing markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huvepharma

- Alltech Inc.

- CHR Hansen

- Novus International Inc.

- Vibrac

- BASF SE

- Selko B.V.

- Adisseo

- DSM

- Perstorp

- Cargill

- EWOS

- Vetline

- BIOMIN Holding GmbH

- Trouw Nutrition

- Kemin Industries Inc.

Recent Developments

- In 2024, Cargill continued its enzyme-based solutions partnership with BASF to support animal health and productivity in the United States.

- In 2023, Alltech published its Alltech Asia Import Risk Analysis,” revealing widespread mycotoxin contamination in grains imported into the Asia-Pacific region.

- In 2023, BIOMIN Holding GmbH announced the launched of Biofix Pro, a new mycotoxin binder specifically designed for poultry feed

Report Coverage

The research report offers an in-depth analysis based on Product, Livestock and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The feed mycotoxin binders market will expand steadily with rising livestock production.

- Demand will grow due to stricter global feed safety regulations.

- Multi-functional binders combining adsorption and detoxification will gain strong adoption.

- Poultry will remain the dominant livestock segment for binder usage.

- Asia Pacific will emerge as the fastest-growing regional market.

- Climate change will increase mycotoxin risks, driving higher binder consumption.

- Innovation in natural and bio-based binders will attract greater market attention.

- Large-scale farms will adopt advanced solutions for higher productivity.

- Cost pressures may limit adoption among small-scale farmers in developing regions.

- Awareness programs and training initiatives will strengthen adoption in emerging markets.