Market Overview

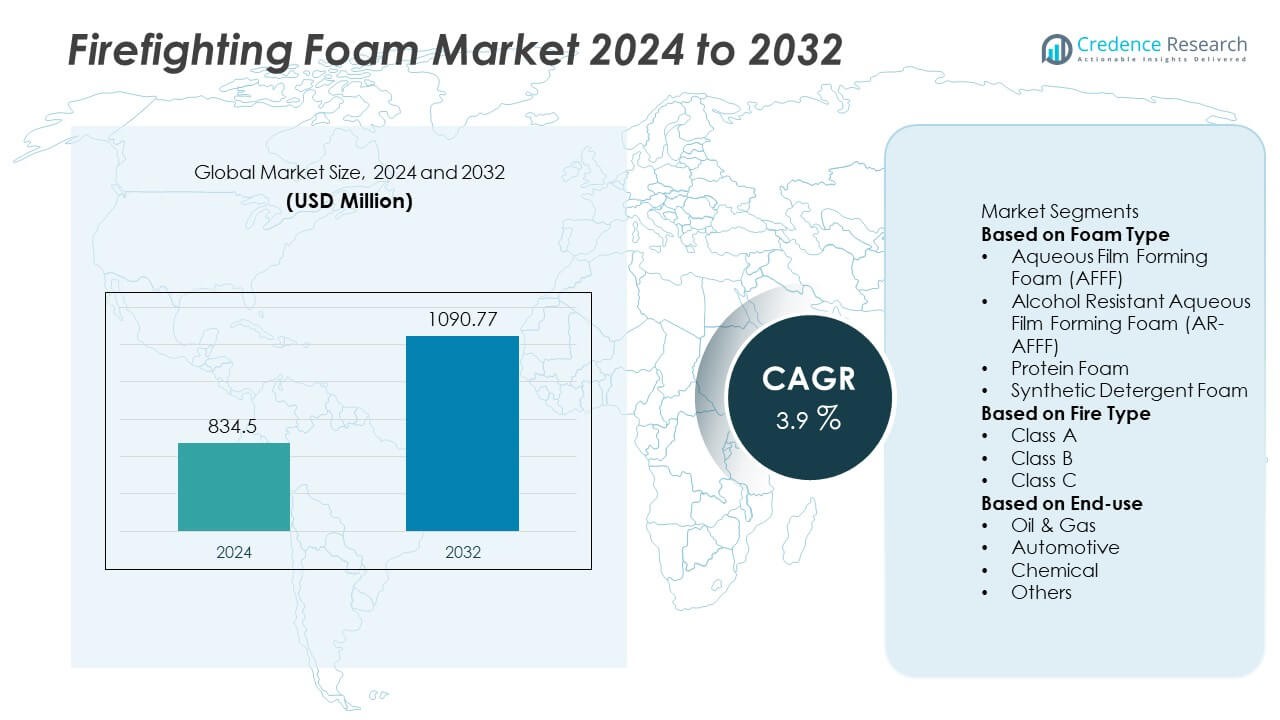

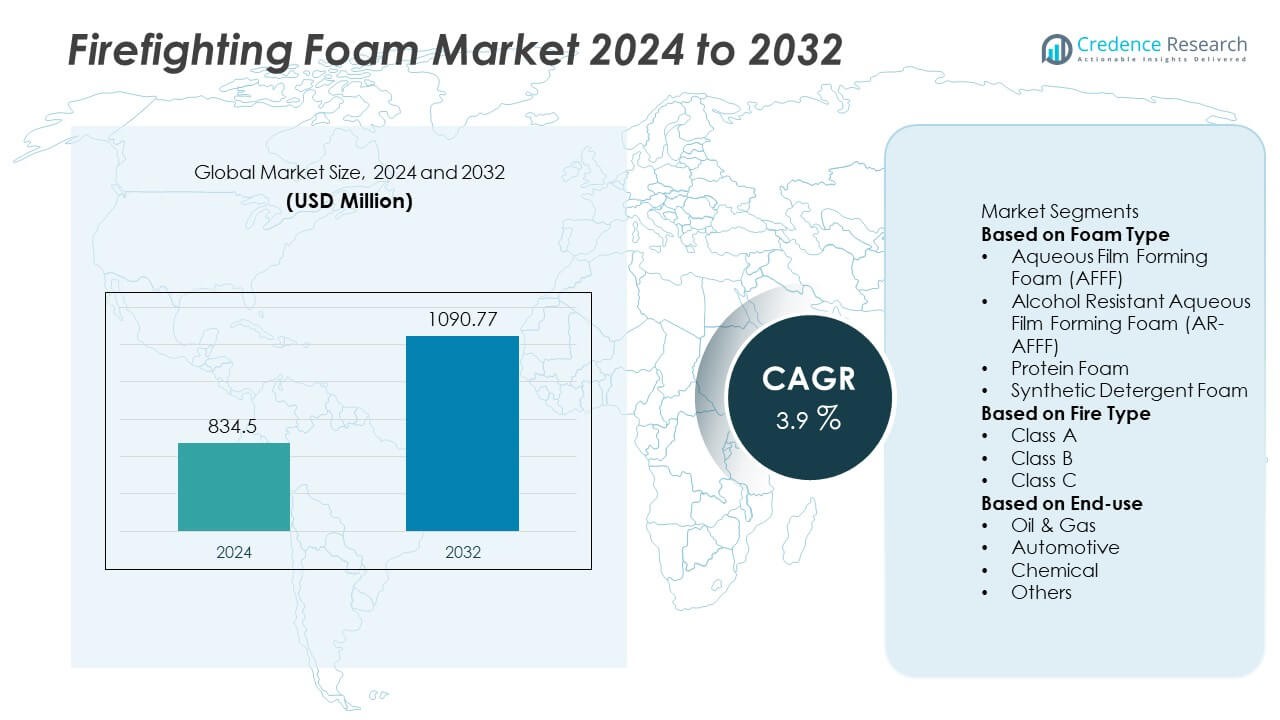

The firefighting foam market size was valued at USD 834.5 million in 2024 and is projected to reach USD 1,090.77 million by 2032, growing at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Firefighting Foam Market Size 2024 |

USD 834.5 Million |

| Firefighting Foam Market, CAGR |

3.9% |

| Firefighting Foam Market Size 2032 |

USD 1,090.77 Million |

The firefighting foam market is led by key players such as Johnson Controls, Kerr Fire, SFFECO GLOBAL, Perimeter Solution, DIC Corp., Dafo Fomtec AB, BIO EX S.A.S., ANGUS FIRE, National Foam, and Fabrik Chemischer Praparate von Dr. Richard Sthamber GmbH & Co. KG. These companies strengthen their positions through product innovation, fluorine-free foam development, and partnerships across oil & gas, aviation, and chemical industries. Regionally, North America held the largest share of 36% in 2024, supported by strict fire safety regulations and heavy investment in industrial safety. Europe followed with 30% share, driven by stringent EU regulations and adoption of sustainable foams, while Asia Pacific accounted for 24%, fueled by industrial expansion and wildfire management programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The firefighting foam market was valued at USD 834.5 million in 2024 and is projected to reach USD 1,090.77 million by 2032, growing at a CAGR of 3.9% during the forecast period.

- Rising demand for advanced fire suppression systems in oil & gas and chemical industries drives market growth, with AFFF holding 38% share in 2024 due to its efficiency against flammable liquid fires.

- Market trends highlight increasing adoption of fluorine-free foams, supported by regulatory push in Europe and North America, and growing use of synthetic detergent foams in industrial and automotive sectors.

- Competition is shaped by Johnson Controls, Perimeter Solution, BIO EX S.A.S., ANGUS FIRE, and National Foam, focusing on innovation, regulatory compliance, and expansion in high-risk end-use sectors.

- Regionally, North America led with 36% share in 2024, followed by Europe at 30%, Asia Pacific at 24%, while Latin America contributed 6% and the Middle East & Africa together held 4%, reflecting balanced but region-specific adoption.

Market Segmentation Analysis:

By Foam Type

The aqueous film forming foam (AFFF) segment dominated the firefighting foam market in 2024, holding 42% share. Its leadership is driven by its fast-spreading film-forming ability that suppresses flammable liquid fires efficiently, particularly in oil, gas, and petrochemical facilities. The alcohol-resistant aqueous film forming foam (AR-AFFF) segment also gained strong traction due to its effectiveness against polar solvent fires, while protein foam and synthetic detergent foam continue to serve niche applications. Rising industrial safety standards and rapid emergency response needs maintain AFFF’s leading position.

- For instance, Johnson Controls manufactures non-fluorinated firefighting foams under the Ansul brand, with formulations like the NFF 3×3 UL201 verified to achieve effective suppression on Class B hydrocarbon fuel fires in UL 162 trials.

By Fire Type

Class B fire applications accounted for the largest share of 48% in 2024, driven by their prevalence in oil, gas, and chemical industries. Firefighting foam’s ability to smother flammable liquid fires makes it the preferred choice for hydrocarbon and solvent-based hazards. Class A fires, covering wood, paper, and general combustibles, held a smaller but growing share supported by urban and structural firefighting. Class C applications, involving electrical fires, represent a niche category. The dominance of Class B reflects continued reliance on foam for industrial fire safety.

- For instance, Perimeter Solutions’ Solberg SPARTAN foam achieved UL 162 and ULC S654 certification for Class B hydrocarbon fires at just 1% concentration, reducing water use by 40%.

By End-use

The oil and gas sector dominated the firefighting foam market in 2024 with 46% share, supported by stringent fire protection standards in refineries, offshore platforms, and storage terminals. The segment benefits from mandatory compliance measures and high fire risk associated with hydrocarbons. Automotive and chemical industries followed with notable adoption, using foams for facility safety and incident response. Other end uses, including airports and marine operations, contribute to steady demand. With oil and gas maintaining the highest risk profile, it continues to anchor the firefighting foam market’s growth trajectory.

Key Growth Drivers

Rising Fire Safety Regulations

Stringent safety regulations across industries are a major driver for firefighting foam adoption. Oil and gas, aviation, and petrochemical facilities are mandated to comply with fire safety protocols that demand effective suppression agents. Governments and international agencies enforce strict standards for fire response preparedness, boosting foam usage. The emphasis on workplace safety, disaster management, and environmental protection further accelerates adoption. Growing global awareness of industrial fire hazards ensures steady demand for advanced foams capable of handling large-scale and high-risk fire scenarios.

- For instance, Angus Fire’s Alcoseal AR-FFFP achieved certification under ICAO Level B performance, extinguishing aviation fuel fires on a 4.5m² (approximately 48.4 ft²) test pan within a specific timeframe.

Increasing Industrialization and Energy Demand

Rapid industrialization and rising global energy consumption are fueling the demand for firefighting foam. Expanding oil refineries, chemical plants, and power generation facilities face higher fire risk due to combustible materials. Firefighting foam plays a critical role in protecting assets, minimizing downtime, and ensuring safety compliance in these industries. The surge in offshore drilling and LNG projects adds further opportunities. As industrial infrastructure expands worldwide, particularly in emerging economies, firefighting foams remain essential components of fire protection systems.

- For instance, National Foam and other manufacturers have provided Alcohol-Resistant Aqueous Film-Forming Foam (AR-AFFF) to industrial facilities, including U.S. refineries, for safeguarding against catastrophic Class B hydrocarbon incidents. These facilities can include large storage tank farms in areas like the Gulf Coast.

Expansion of Aviation and Transportation Sectors

The aviation and transportation industries significantly contribute to firefighting foam demand. Airports, aircraft hangars, and fuel storage areas require high-performance foams for Class B fires involving jet fuels and hydrocarbons. Similarly, road and marine transport hubs prioritize foam-based fire suppression systems due to increasing traffic and flammable cargo. Rising air passenger traffic and global trade growth are leading to larger facilities, requiring advanced safety mechanisms. Firefighting foams with rapid deployment capabilities continue to serve as the frontline defense in these sectors.

Key Trends & Opportunities

Shift Toward Eco-Friendly Foam Solutions

A major trend is the transition to fluorine-free and biodegradable firefighting foams. Growing concerns about PFAS contamination are prompting industries and regulators to phase out traditional foams with persistent chemicals. Manufacturers are investing in eco-friendly formulations that balance effectiveness with environmental safety. This shift opens opportunities for companies that can provide compliant and sustainable solutions while meeting strict performance standards.

- For instance, Dafo Fomtec conducted more than 3,500 full-scale fire trials with its Enviro range of fluorine-free foams, which has led to certain products meeting the ICAO Level B standards.

Integration of Advanced Additives and Technology

Firefighting foam technology is evolving with the integration of additives that improve burn-back resistance, stability, and expansion ratios. Modern formulations are designed for faster spread and enhanced coverage, improving fire control efficiency. Opportunities lie in developing foams compatible with advanced delivery systems, including automated sprinklers and drone-based applications. These innovations support both industrial and municipal fire departments in responding more effectively to emergencies.

- For instance, DIC Corporation collaborated with FP Corporation (FPCO) to achieve the closed-loop recycling of colored and patterned foamed polystyrene food trays. By leveraging a proprietary dissolution and separation recycling technology, DIC removes coloring components from recycled black pellets, allowing for their reuse in new food trays.

Growing Adoption in Emerging Economies

Emerging markets present strong opportunities for firefighting foam growth. Rapid urbanization, rising infrastructure investments, and industrial expansion in Asia Pacific, Latin America, and the Middle East increase fire risk. Governments are strengthening fire safety regulations and emergency response systems, creating higher demand for foam-based suppression solutions. With expanding oil, gas, and chemical sectors in these regions, suppliers have opportunities to tap into large-scale procurement programs.

Key Challenges

Environmental and Regulatory Concerns

One of the key challenges is the growing restriction on PFAS-based firefighting foams due to environmental and health concerns. Regulations in Europe and North America are pushing for bans on long-lasting chemicals, creating compliance challenges for manufacturers. Transitioning to fluorine-free alternatives requires costly R&D and reformulation, which may strain smaller companies. Meeting both regulatory and performance standards poses a significant barrier to growth in this sector.

High Maintenance and Disposal Costs

Firefighting foams also face challenges related to maintenance, storage, and disposal costs. Facilities must invest in proper storage systems and equipment calibration to maintain foam effectiveness. Disposal of used or expired foam, especially PFAS-based types, is costly and subject to strict regulations. These factors increase the total cost of ownership for end-users, particularly in developing economies. Such financial burdens may slow adoption in price-sensitive markets, despite growing fire safety needs.

Regional Analysis

North America

North America held 36% share of the firefighting foam market in 2024, driven by strict fire safety regulations and high adoption in the oil and gas sector. The U.S. leads the region with extensive deployment in refineries, airports, and military facilities, supported by government funding for fire protection systems. Canada also contributes significantly with industrial and aviation applications. Ongoing regulatory pressure to phase out PFAS-based foams is driving demand for eco-friendly alternatives. The region’s strong focus on compliance and advanced fire suppression infrastructure continues to reinforce its dominant position in the global market.

Europe

Europe accounted for 30% of the firefighting foam market share in 2024, supported by stringent regulatory frameworks and widespread use in aviation, automotive, and petrochemical industries. Countries such as Germany, France, and the United Kingdom drive demand through strict workplace safety laws and advanced firefighting systems. The European Union’s move toward fluorine-free foams has accelerated innovation, creating opportunities for sustainable product adoption. Growing wildfire management efforts in Southern Europe further enhance foam demand. Europe remains a strong market with a focus on balancing fire safety performance with environmental responsibility.

Asia Pacific

Asia Pacific captured 24% share of the firefighting foam market in 2024, emerging as the fastest-growing region. Expanding oil and gas operations in China, India, and Southeast Asia are fueling demand for foam-based suppression systems. Rapid industrialization, rising aviation traffic, and infrastructure investments strengthen adoption across end-use sectors. Australia’s wildfire-prone landscape also drives demand for effective foam solutions in municipal and defense applications. Increasing government initiatives on safety compliance and expanding manufacturing bases for fire suppression systems position Asia Pacific as a major growth hub in the coming years.

Latin America

Latin America held 6% share of the firefighting foam market in 2024, led by Brazil and Mexico. Strong growth in oil refining, petrochemicals, and industrial sectors supports adoption, while increasing awareness of fire risks in urban and industrial zones boosts demand. Brazil’s focus on protecting critical infrastructure in the energy sector drives large-scale procurement of firefighting foams. However, economic volatility and uneven regulatory enforcement present challenges to broader adoption. Despite these hurdles, partnerships with international suppliers and growing infrastructure investments are strengthening Latin America’s position as an emerging market for firefighting foam.

Middle East and Africa

The Middle East and Africa together accounted for 4% share of the firefighting foam market in 2024. The Middle East drives demand with extensive oil and gas exploration, refineries, and petrochemical plants that require foam-based fire suppression systems. Countries such as Saudi Arabia and the United Arab Emirates are leading adopters due to high energy infrastructure investments. In Africa, South Africa is a key contributor with rising use in mining and industrial facilities. While limited infrastructure remains a barrier, growing emphasis on industrial safety and energy projects creates steady growth potential for this region.

Market Segmentations:

By Foam Type

- Aqueous Film Forming Foam (AFFF)

- Alcohol Resistant Aqueous Film Forming Foam (AR-AFFF)

- Protein Foam

- Synthetic Detergent Foam

By Fire Type

By End-use

- Oil & Gas

- Automotive

- Chemical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the firefighting foam market is shaped by leading players including Johnson Controls, Kerr Fire, SFFECO GLOBAL, Perimeter Solution, DIC Corp., Dafo Fomtec AB, BIO EX S.A.S., ANGUS FIRE, National Foam, and Fabrik Chemischer Praparate von Dr. Richard Sthamber GmbH & Co. KG. These companies focus on developing advanced foam formulations with higher fire suppression efficiency while meeting evolving environmental regulations, especially the global shift toward fluorine-free alternatives. Strategic priorities include research into eco-friendly foams, mergers and acquisitions to expand regional footprints, and partnerships with oil & gas and aviation sectors. Johnson Controls and National Foam emphasize large-scale supply for critical infrastructure, while BIO EX S.A.S. and Dafo Fomtec AB are pioneers in fluorine-free innovations. ANGUS FIRE and Perimeter Solution maintain strong global distribution networks, reinforcing market competitiveness. With rising fire safety standards worldwide, players are intensifying efforts to balance performance, regulatory compliance, and sustainability, keeping the market highly dynamic.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson Controls

- Kerr Fire

- SFFECO GLOBAL

- Perimeter Solution

- DIC Corp.

- Dafo Fomtec AB

- BIO EX S.A.S.

- ANGUS FIRE

- National Foam

- Fabrik Chemischer Praparate von Dr. Richard Sthamber GmbH & Co. KG

Recent Developments

- In May 2025, Perimeter Solutions introduced an Industrial Foam School targeting training for industrial firefighters, where the first session was held on May 28–29, 2025 in Dover, Delaware.

- In April 2025, Dafo Fomtec AB announced that Enviro Mil foam concentrate was confirmed by the U.S. Department of the Navy to conform to Type 3 under MIL-PRF-32725(2) standards.

- In April 2025, Dafo Fomtec AB revealed that Enviro Mil will be listed on the U.S. Navy’s Qualified Products List (QPL-32725) in container sizes of 5, 55, and 265 US gallons.

- In April 2025, Perimeter Solutions launched SOLBERG SPARTAN 1% Fluorine-Free Class A/B Foam Concentrate at FDIC 2025, which reportedly cuts cooling time and reduces water demand by 40% compared to water alone.

Report Coverage

The research report offers an in-depth analysis based on Foam Type, Fire Type, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for firefighting foam will rise with increasing fire incidents in oil and gas facilities.

- Fluorine-free foam adoption will grow as regulations tighten on environmental compliance.

- AFFF will continue dominating but eco-friendly alternatives will gradually replace its use.

- Industrial sectors like automotive and chemicals will drive steady demand for foam solutions.

- Research and development will focus on sustainable and biodegradable foam formulations.

- Governments will strengthen procurement of foams for defense and aviation safety operations.

- Asia Pacific will emerge as the fastest-growing region with rising industrialization.

- Private and public partnerships will expand distribution networks for firefighting solutions.

- Technological advancements in foam concentrates will enhance fire suppression efficiency.

- Market players will pursue mergers and acquisitions to strengthen their global presence.