Market Overview

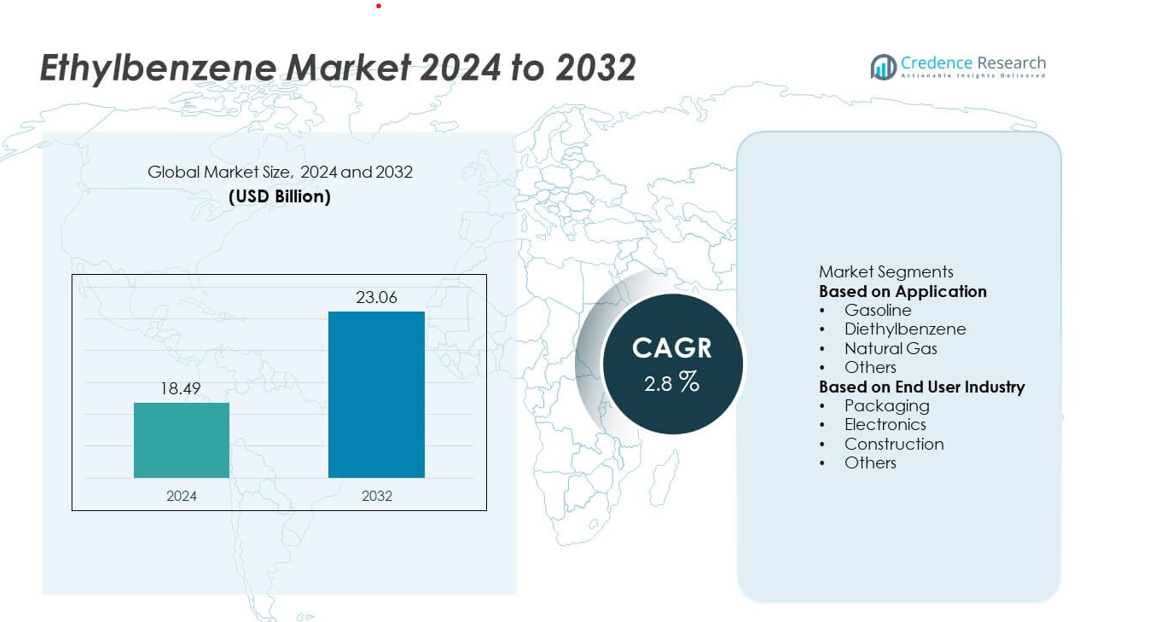

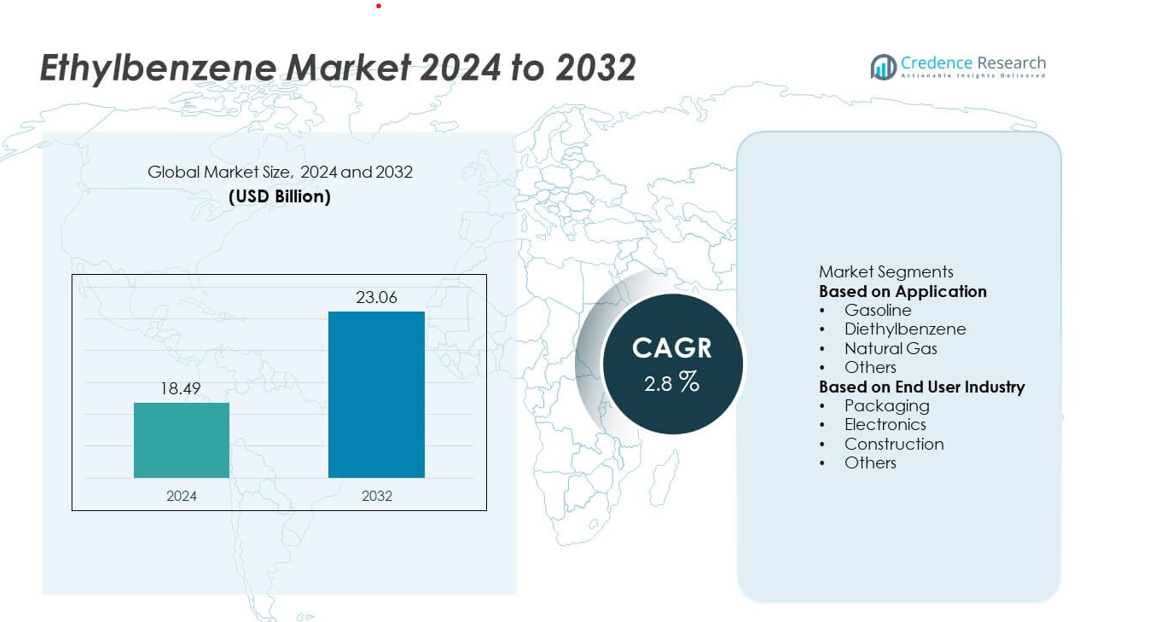

The Ethylbenzene Market was valued at USD 18.49 billion in 2024 and is projected to reach USD 23.06 billion by 2032, growing at a CAGR of 2.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethylbenzene Market Size 2024 |

USD 18.49 billion |

| Ethylbenzene Market, CAGR |

2.8% |

| Ethylbenzene Market Size 2032 |

USD 23.06 billion |

The ethylbenzene market is led by major players such as TotalEnergies SE, LyondellBasell Industries Holdings B.V., Chevron Phillips Chemical Company LLC, Dow Chemical Company, SABIC, Shell plc, INEOS Group Holdings S.A., Reliance Industries Limited, Sinopec, and Formosa Plastics Corporation. These companies dominate through large-scale integrated operations and advanced catalytic technologies that enhance production efficiency and environmental performance. Asia-Pacific led the global market in 2024 with a 37% share, supported by rapid industrialization, expanding petrochemical capacity, and high styrene consumption in China and India. North America followed with a 28% share, driven by technological innovation and strong demand from the construction and packaging industries.

Market Insights

- The ethylbenzene market was valued at USD 18.49 billion in 2024 and is projected to reach USD 23.06 billion by 2032, growing at a CAGR of 2.8% during the forecast period.

- Increasing demand for styrene monomer production used in polystyrene, ABS, and SBR drives steady market growth across major industrial sectors.

- Advancements in catalytic alkylation technologies and the integration of energy-efficient production systems are key trends shaping market competitiveness.

- Leading players such as TotalEnergies, SABIC, Shell, and Reliance Industries focus on production capacity expansion, sustainable operations, and global supply chain optimization.

- Asia-Pacific led the market with a 37% share in 2024, followed by North America (28%) and Europe (24%), while by application, the gasoline segment dominated with a 52% share, driven by increasing refinery modernization and fuel demand in developing economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The gasoline segment dominated the ethylbenzene market in 2024 with a 52% share, driven by its widespread use as an octane enhancer and solvent in fuel blends. Ethylbenzene’s high volatility and efficient combustion characteristics make it a valuable additive in refining processes. Rising demand for high-performance fuels in developing economies further supports market growth. Additionally, the segment benefits from increasing refinery output and modernization of petrochemical complexes in Asia-Pacific and the Middle East, which continue to strengthen ethylbenzene’s role in the global energy and fuel industry.

- For instance, the Chevron Phillips Chemical Company has agreed to make upgrades and perform compliance measures at its Port Arthur, Texas facility to address allegations that it violated the Clean Air Act.

By End User Industry

The packaging segment held the largest share of 37% in 2024, primarily due to growing demand for styrene-based polymers such as polystyrene and EPS in consumer goods and food packaging. Expanding e-commerce, rising disposable incomes, and increasing use of lightweight and durable materials fuel segment growth. The electronics and construction industries also contribute significantly, as ethylbenzene-derived plastics are used in insulation, casings, and components. The packaging industry’s shift toward recyclable and high-performance materials continues to drive ethylbenzene consumption globally.

- For instance, INEOS Styrolution’s Antwerp facility received the first commercial-scale delivery of recycled styrene monomer from Indaver’s newly opened chemical recycling plant, also located in Antwerp.

Key Growth Drivers

Rising Demand for Styrene Monomer Production

The primary growth driver for the ethylbenzene market is its extensive use in styrene monomer manufacturing, which serves as a base for polystyrene, ABS, and SBR products. Increasing consumption of styrene-derived plastics in packaging, automotive, and consumer electronics sectors fuels demand. Growing infrastructure and industrialization activities in emerging economies are also accelerating production capacities. Major producers are investing in integrated styrene-ethylbenzene plants to optimize output and reduce operational costs, reinforcing steady market expansion globally.

- For instance, LyondellBasell Industries’ Channelview Complex in Texas has a styrene production capacity exceeding 600,000 tons per year. In January 2021, LyondellBasell also finalized a joint venture with Sinopec to construct a new propylene oxide and styrene monomer unit in Zhenhai Ningbo, China, which was expected to have a capacity of 275 kilotons per annum (KTA) of propylene oxide and 600 KTA of styrene monomer.

Expansion in Construction and Automotive Sectors

The global rise in construction and automotive manufacturing significantly boosts ethylbenzene demand. Its derivatives, including styrene-based insulation foams and composites, are essential for lightweight and durable components. Increasing urbanization and infrastructure projects in Asia-Pacific, the Middle East, and Latin America are stimulating consumption. Additionally, the automotive industry’s shift toward energy-efficient materials supports higher usage of ethylbenzene-derived resins and plastics for interior panels, trims, and insulation applications, contributing to sustainable market growth.

- For instance, SABIC supplies lightweight composite materials to major automotive manufacturers such as Hyundai, enabling advanced vehicle designs. The company’s innovative thermoplastic solutions contribute to weight and cost reduction, improved energy density, and enhanced thermal control in electric vehicle battery systems.

Technological Advancements in Production Processes

Advancements in catalytic alkylation and energy-efficient production technologies are driving cost optimization and yield improvement in ethylbenzene manufacturing. Refineries are adopting zeolite-based catalysts and continuous flow processes to minimize energy consumption and reduce by-product formation. These technological improvements enhance product purity and reduce environmental impact. Integration of digital monitoring systems and automation in petrochemical plants further supports process reliability, enabling manufacturers to meet rising global demand while maintaining high operational efficiency and sustainability standards.

Key Trends & Opportunities

Growing Use of Ethylbenzene Derivatives in Polystyrene and ABS Plastics

The expanding use of ethylbenzene in producing styrene-based polymers such as polystyrene and acrylonitrile butadiene styrene (ABS) presents significant opportunities. These plastics are widely used in consumer goods, appliances, and packaging applications. Increasing demand for lightweight materials in transportation and electronics industries enhances growth potential. Manufacturers are focusing on optimizing feedstock utilization and expanding downstream capacities to strengthen the supply chain for styrene-based materials across industrial applications.

- For instance, Formosa Chemicals & Fibre Corp. (FCFC) produces ABS polymer with a total annual capacity of 410,000 metric tons at its Hsin Kang and Mailiao plants. The company, part of the larger Formosa Plastics Group, focuses on advanced processing and vertical integration to support the supply of plastics to manufacturers in Asia.

Shift Toward Eco-Efficient and Sustainable Production

The market is witnessing a growing shift toward eco-efficient production and cleaner refining technologies. Producers are investing in low-emission catalysts, renewable feedstocks, and closed-loop processing systems to comply with environmental standards. Circular economy initiatives and increased recycling of styrene-based plastics further enhance sustainability. Companies adopting green production processes gain a competitive advantage as governments enforce stricter emission and waste management regulations. This trend supports long-term growth aligned with global carbon reduction goals.

- For instance, Shell plc installed a Market Development Upgrader (MDU) at its Chemicals Park Moerdijk to process up to 50,000 tons of pyrolysis oil annually from hard-to-recycle plastic waste into chemical feedstock.

Key Challenges

Fluctuating Crude Oil Prices and Feedstock Costs

Ethylbenzene production is heavily dependent on petroleum-based feedstocks such as benzene and ethylene, making it vulnerable to crude oil price volatility. Sudden fluctuations in raw material prices affect production costs and profit margins for manufacturers. Supply chain disruptions caused by geopolitical tensions and refinery shutdowns further increase instability. Producers are focusing on long-term supply agreements and developing alternative sourcing strategies to mitigate feedstock-related risks and ensure consistent production levels.

Environmental and Health Concerns Associated with Production

Strict environmental regulations regarding VOC emissions and hazardous waste disposal pose major challenges for ethylbenzene manufacturers. Prolonged exposure to ethylbenzene can cause health issues, leading to tighter safety standards and compliance costs. Regulatory bodies such as the EPA and REACH are imposing limits on emissions and handling procedures. Companies must invest in advanced emission control systems and process safety measures to maintain compliance, increasing operational costs while ensuring sustainable production practices.

Regional Analysis

North America

North America held a 28% share in 2024, driven by strong demand for styrene-based polymers across packaging, automotive, and construction industries. The United States dominates the regional market due to large-scale petrochemical manufacturing facilities and advanced refining infrastructure. Increasing production of polystyrene and ABS plastics, coupled with technological improvements in catalytic alkylation, supports growth. Environmental regulations are encouraging the adoption of cleaner and more efficient production processes. Continuous investments in chemical plant modernization and energy-efficient operations further enhance the region’s role in global ethylbenzene production.

Europe

Europe accounted for a 24% share in 2024, supported by a mature petrochemical sector and strong downstream demand for styrene monomers. Germany, France, and the United Kingdom lead production due to established refinery networks and high adoption of sustainable materials. Stringent EU environmental standards encourage the use of energy-efficient catalysts and low-emission technologies. Demand for ethylbenzene in insulation foams and automotive plastics is rising with the region’s focus on energy-efficient construction. Industry players are also investing in recycling initiatives and circular economy practices to meet climate targets.

Asia-Pacific

Asia-Pacific dominated the ethylbenzene market in 2024 with a 37% share, driven by rapid industrialization and growing demand from packaging and construction sectors. China remains the largest producer and consumer, supported by expanding petrochemical capacities and rising styrene production. India, Japan, and South Korea are also contributing through increasing demand for ABS and polystyrene applications. Government initiatives promoting industrial self-sufficiency and favorable investment policies attract major petrochemical projects. The region’s robust growth in manufacturing and infrastructure sectors continues to strengthen its global leadership in ethylbenzene consumption.

Latin America

Latin America represented a 6% share in 2024, fueled by growing demand for styrene-based products in automotive and construction industries. Brazil and Mexico lead the market with expanding petrochemical operations and industrial modernization initiatives. Rising investment in downstream chemical processing and the presence of new polymer manufacturing facilities drive regional demand. However, limited refinery capacity and fluctuating crude oil prices pose short-term challenges. Increasing foreign investment and government support for energy and manufacturing projects are expected to enhance ethylbenzene production and consumption across the region.

Middle East & Africa

The Middle East & Africa accounted for a 5% share in 2024, supported by abundant feedstock availability and expanding petrochemical infrastructure. Saudi Arabia and the UAE dominate the regional market, leveraging integrated refinery complexes and low production costs. The growing demand for styrene derivatives in construction and packaging sectors strengthens market potential. In Africa, South Africa and Egypt are key contributors, focusing on industrial development and local chemical production. Ongoing investments in refining capacity and export-oriented projects position the region as an emerging hub for ethylbenzene production.

Market Segmentations:

By Application

- Gasoline

- Diethylbenzene

- Natural Gas

- Others

By End User Industry

- Packaging

- Electronics

- Construction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ethylbenzene market includes key players such as TotalEnergies SE, LyondellBasell Industries Holdings B.V., Chevron Phillips Chemical Company LLC, Dow Chemical Company, SABIC, Shell plc, INEOS Group Holdings S.A., Reliance Industries Limited, China Petroleum & Chemical Corporation (Sinopec), and Formosa Plastics Corporation. These companies focus on expanding production capacities, optimizing catalyst performance, and integrating ethylbenzene facilities with styrene monomer plants to enhance cost efficiency. Strategic collaborations and technological advancements in catalytic alkylation are enabling higher yield and lower emissions. Leading manufacturers are also investing in energy-efficient and sustainable production technologies to comply with tightening environmental regulations. Market competition remains moderately consolidated, with top players emphasizing regional expansion, feedstock security, and long-term supply agreements to strengthen global presence and maintain steady profitability in a dynamic petrochemical landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Dow Chemical Company announced shutdowns of three upstream European assets, restructuring its footprint amid structural challenges that impact aromatics and derivatives chains.

- In March 2025, LyondellBasell Industries Holdings B.V. and Covestro decided to permanently close the Maasvlakte POSM unit, citing overcapacity and high European costs.

- In 2025, TotalEnergies SE introduced its updated strategic roadmap emphasizing growth across its downstream petrochemical operations, including feedstocks like ethylbenzene, to support the company’s broader energy transition goals and maximize integration between refining and petrochemical chains.

- In April 2024, TotalEnergies SE declared force majeure on styrene from the Gonfreville complex after an electrical incident, tightening regional styrene supply.

Report Coverage

The research report offers an in-depth analysis based on Application, End User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ethylbenzene will grow steadily due to rising styrene monomer production.

- Expansion of packaging, automotive, and construction sectors will drive product consumption.

- Asia-Pacific will remain the dominant regional market with strong industrial growth.

- Technological advancements in catalytic alkylation will improve process efficiency and yields.

- Energy-efficient and low-emission production systems will gain wider adoption.

- Integration of ethylbenzene and styrene plants will enhance cost competitiveness.

- Environmental regulations will push companies toward cleaner and sustainable manufacturing practices.

- Market players will invest in capacity expansion and long-term feedstock security.

- Demand for lightweight plastics in automotive and electronics will support growth.

- Strategic collaborations and refinery modernization projects will shape future market dynamics.