Market Overview

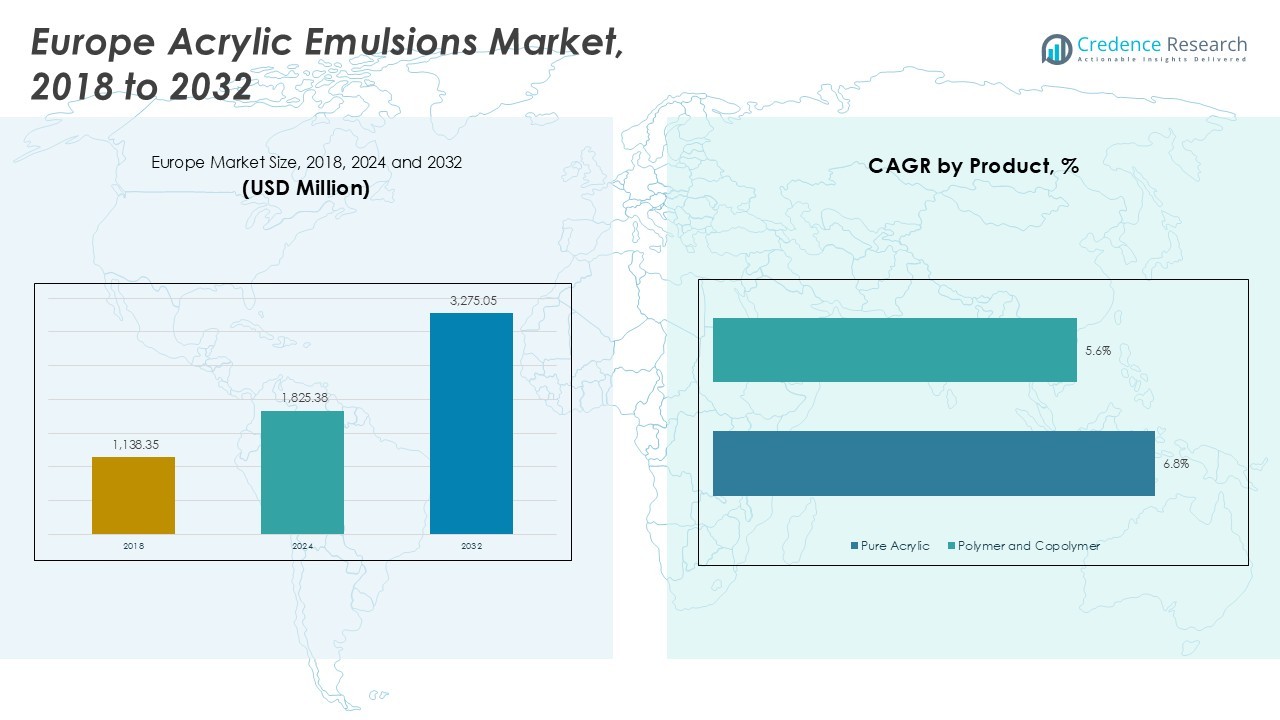

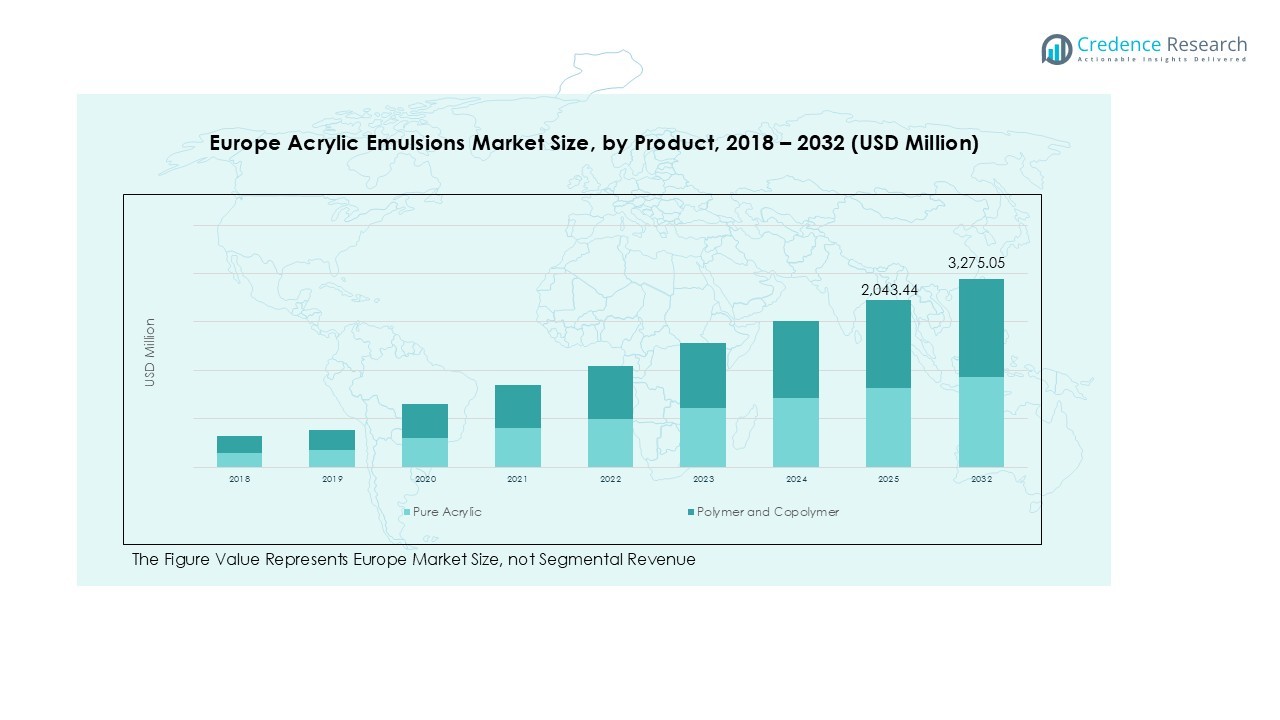

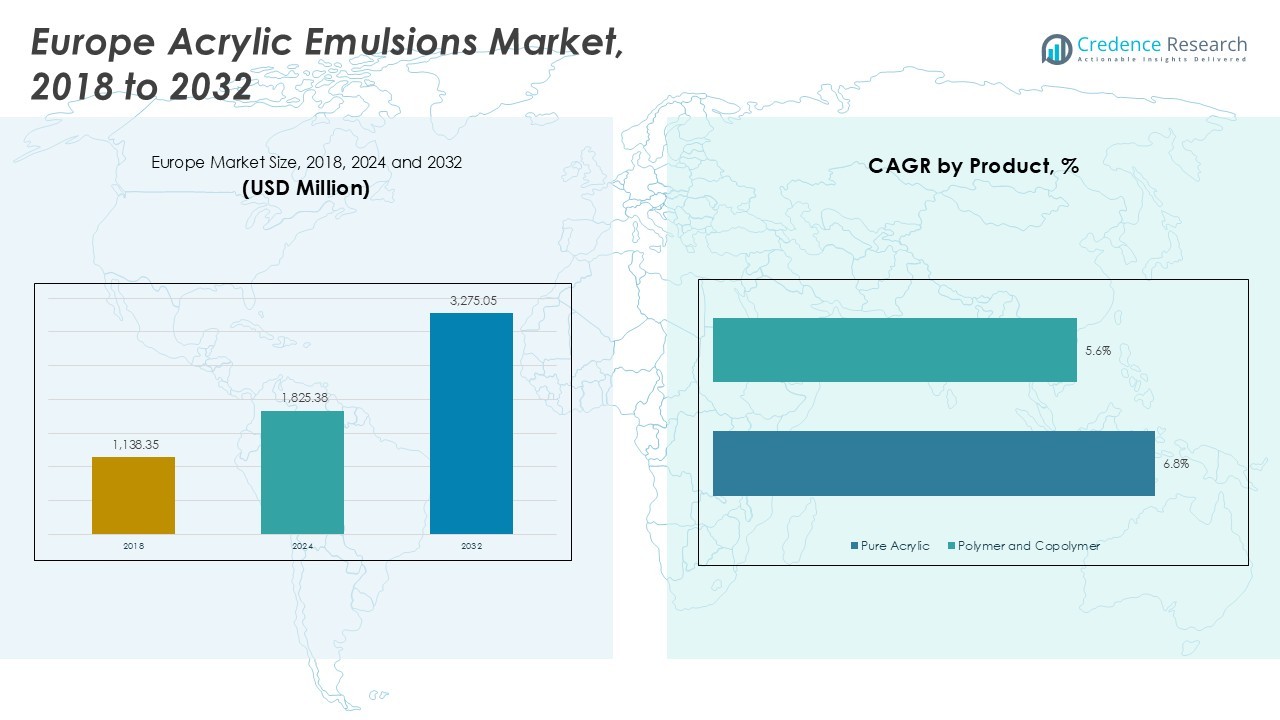

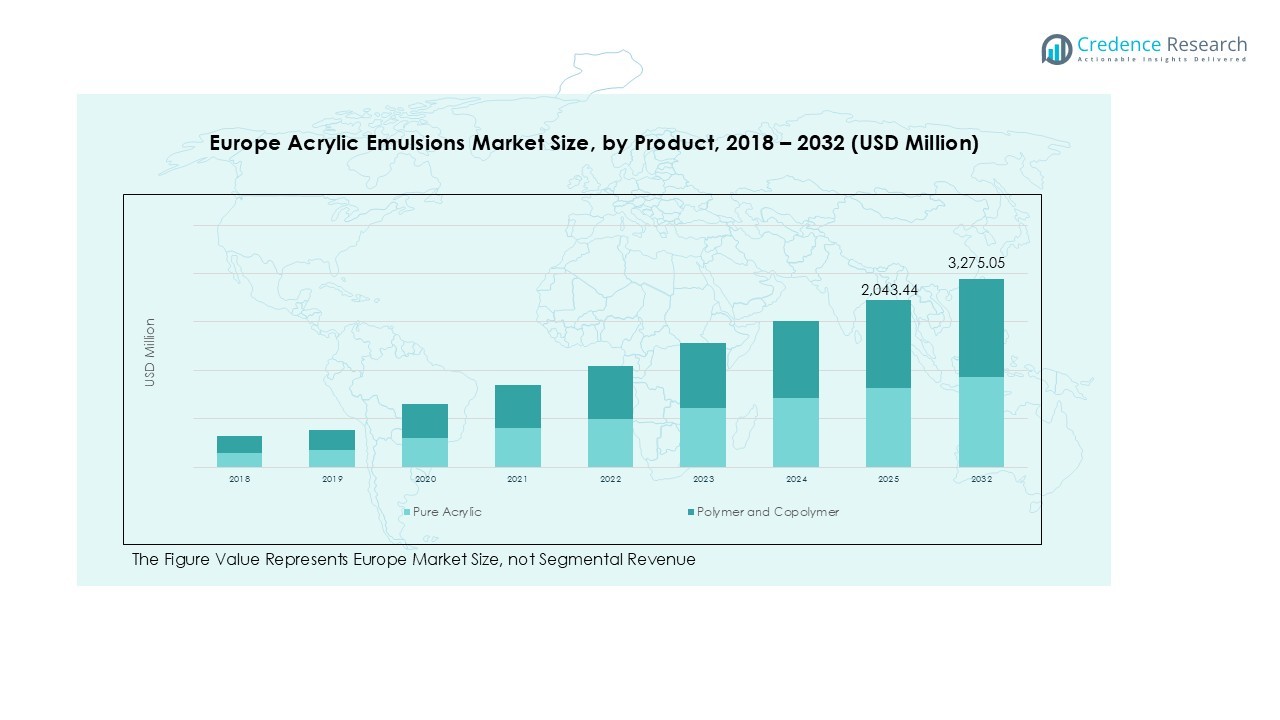

The Europe Acrylic Emulsions market size was valued at USD 1,138.35 million in 2018 and grew to USD 1,825.38 million in 2024. It is anticipated to reach USD 3,275.05 million by 2032, reflecting a CAGR of 6.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Acrylic Emulsions Market Size 2024 |

USD 1,825.38 Million |

| Europe Acrylic Emulsions Market, CAGR |

6.97% |

| Europe Acrylic Emulsions Market Size 2032 |

USD 3,275.05 Million |

The Europe acrylic emulsions market is dominated by key players including BASF SE, Arkema, Dow, Celanese Corporation, Ashland, The Lubrizol Corporation, H.B. Fuller, Synthomer plc, KAMSONS CHEMICALS PVT. LTD., and Astra Chem Tech Private Limited. These companies lead through strategic investments in R&D, sustainable product development, and regional expansion. Germany emerges as the largest regional market with a 20% share, driven by robust industrial and construction activities. The United Kingdom and France follow with 18% and 15% shares, respectively, fueled by increasing demand for high-performance, low-VOC paints and coatings in architectural and industrial applications. Other significant markets include Italy (12%), Spain (10%), and Russia (8%), supported by growing construction, renovation, and industrial manufacturing. Collectively, these players leverage innovation, sustainability, and regional expertise to strengthen their competitive position across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe acrylic emulsions market was valued at USD 1,825.38 million in 2024 and is projected to reach USD 3,275.05 million by 2032, growing at a CAGR of 6.97% during the forecast period. Germany holds the largest regional share at 20%, followed by the UK (18%) and France (15%).

- Rising construction, residential renovations, and industrial activities are driving demand, particularly for paints, coatings, and adhesives, which remain the dominant product applications.

- Technological innovation in low-VOC, waterborne, and hybrid polymer emulsions is shaping market trends, offering enhanced performance and eco-friendly solutions.

- The market is competitive, led by key players such as BASF SE, Arkema, Dow, Celanese Corporation, and Synthomer plc, who focus on R&D, sustainability, and regional expansion to capture market share.

- Market growth is restrained by volatility in raw material prices and strict European environmental regulations, which increase production costs and compliance requirements.

Market Segmentation Analysis:

By Product:

In Europe, the acrylic emulsions market by product is dominated by Pure Acrylic, accounting for approximately 60% of the segment share. Pure acrylic offers superior durability, weather resistance, and flexibility, making it highly suitable for coatings and adhesives in architectural and industrial applications. The Polymer and Copolymer sub-segment, with a share of around 40%, is gaining traction due to its cost-effectiveness and versatile performance in specialty applications. Rising demand from paints and construction sectors continues to drive growth across both sub-segments, supported by innovations in eco-friendly formulations and sustainable production practices.

- For instance, Dow’s PRIMAL™ AC-2337 pure acrylic emulsion is expressly formulated for exterior house paints in European climates, delivering excellent gloss retention and alkali resistance.

By Application:

Among applications, Paints and Coatings lead with a share of 55%, fueled by increasing construction activities and the rising need for decorative and protective coatings in residential and commercial projects. Construction Material Additives follow with 20%, while Paper Coating and Adhesives contribute around 15% and 7%, respectively. The growth in the paints and coatings segment is driven by technological advancements in low-VOC formulations, improved adhesion properties, and rising consumer awareness about long-lasting finishes. Other applications, accounting for 3%, include textile coatings and specialty industrial uses, supporting diversified market expansion.

- For instance, Asian Paints leads the paint and coatings segment with products like Royale Luxury Emulsion, which is low-VOC (less than 50 g/L), non-toxic, and offers stain resistance and antibacterial properties, catering to increasing consumer demand for healthier indoor environments.

By End-Use:

The Architectural end-user segment dominates with 50% market share, primarily due to robust demand in residential and commercial infrastructure projects requiring durable and aesthetic coatings. Industrial applications hold a 25% share, benefiting from increased usage in manufacturing, machinery coatings, and adhesives. Commercial and Residential end-users contribute 15% and 10%, respectively, driven by interior and exterior renovation projects and growing DIY trends. Market growth across these end-users is supported by ongoing urbanization, rising construction spending, and demand for energy-efficient, eco-friendly acrylic solutions.

Key Growth Drivers

Rising Construction and Infrastructure Activities

Robust growth in construction and infrastructure projects across Europe continues to drive the demand for acrylic emulsions. Increasing urbanization, residential renovations, and commercial building expansions have heightened the need for paints, coatings, and construction material additives. Acrylic emulsions provide superior durability, weather resistance, and flexibility, making them ideal for these applications. The construction sector’s reliance on long-lasting, eco-friendly materials ensures steady growth, with demand concentrated in countries such as Germany, France, and the UK, where infrastructure modernization projects are prioritized.

- For instance, BASF’s Acronal® acrylic dispersions are engineered for diverse construction applications including roofing, waterproofing membranes, and adhesives, providing sustainable solutions with excellent mechanical properties for building durability.

Expansion of the Paints and Coatings Industry

The growing paints and coatings sector significantly contributes to acrylic emulsions market expansion. Rising consumer preference for decorative and protective coatings with improved adhesion, low VOC content, and eco-friendly formulations drives adoption. Industrial and architectural applications increasingly rely on emulsions for their performance and aesthetic benefits. Technological advancements, such as waterborne formulations and high-performance hybrid products, further boost market growth, as manufacturers invest in innovative solutions to meet evolving quality standards and environmental regulations across Europe.

- For instance, AkzoNobel developed a new generation of waterborne basecoats for vehicle repair shops, enhancing body shop productivity and performance while meeting environmental regulations.

Increasing Focus on Sustainability and Eco-Friendly Products

The shift toward environmentally friendly and low-VOC products is a major growth driver in the European acrylic emulsions market. Regulatory pressure and consumer demand for sustainable solutions have encouraged manufacturers to develop bio-based and waterborne emulsions. These products reduce environmental impact while maintaining performance, particularly in paints, adhesives, and coatings. Companies adopting green chemistry practices gain competitive advantages, reinforcing market expansion. Sustainability initiatives also support long-term demand growth by aligning with energy efficiency, climate commitments, and stricter environmental standards in major European countries.

Key Trends & Opportunities

Technological Innovation in Emulsion Formulations

Innovation in acrylic emulsion formulations presents significant opportunities. Developments in high-performance, low-VOC, and waterborne emulsions allow manufacturers to meet stringent environmental standards while enhancing durability and versatility. Specialty emulsions for adhesives, paper coatings, and construction materials open new application avenues. Additionally, hybrid copolymer emulsions and tailored products for industrial and architectural use are gaining traction, offering improved adhesion, gloss, and chemical resistance. This trend encourages differentiation, strengthens market positioning, and provides opportunities to cater to niche applications and premium product segments.

- For instance, Dow’s DOWSIL™ 8016 waterborne resin offers a high-performance, low-VOC emulsion that meets rigorous environmental standards while enhancing durability in coatings and sealants, exemplifying the trend toward sustainable, waterborne acrylic technologies.

Growing Demand from Industrial and Commercial End Users

Industrial and commercial sectors are emerging as key opportunities for acrylic emulsions. Manufacturing industries increasingly adopt emulsions for machinery coatings, packaging adhesives, and specialty paper coatings. Commercial buildings require durable, aesthetic finishes for interiors and exteriors. Rising industrial automation and advanced manufacturing processes also boost usage. Companies that strategically target these sectors with customized emulsions can capture incremental market share, while collaborations with construction and industrial firms can drive long-term contracts and recurring demand, further strengthening their presence in the European market.

- For instance, Dow Inc. develops specialized acrylic emulsions for packaging adhesives that improve bond strength and flexibility, catering to industrial automation processes.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of key raw materials, including acrylic monomers and chemical additives, pose a significant challenge. Price volatility can impact production costs, reduce profit margins, and create uncertainty for manufacturers. Sudden increases in input costs may limit the adoption of premium or specialty emulsions, particularly for small and medium-sized producers. Companies must implement efficient supply chain strategies, long-term procurement contracts, and cost-optimization measures to mitigate risks and maintain stable pricing for end users, ensuring consistent market growth.

Stringent Regulatory Environment

The European acrylic emulsions market faces strict environmental and safety regulations. Compliance with low-VOC limits, chemical restrictions, and waste management standards increases production complexity and operational costs. Companies must continuously innovate to meet evolving regulations while maintaining product performance. Failure to comply may result in penalties, product recalls, or market withdrawal. Navigating these regulatory challenges requires robust R&D capabilities, sustainable product development, and close monitoring of changing legislation, which can strain resources, particularly for smaller or emerging players in the market.

Regional Analysis

United Kingdom

The United Kingdom holds a market share of 18% in the Europe acrylic emulsions market, driven by robust construction and renovation activities in residential and commercial sectors. Paints and coatings dominate end-use applications, supported by rising demand for durable, low-VOC, and eco-friendly formulations. Industrial adoption is also increasing, particularly in adhesives and specialty coatings. Growth is further fueled by technological innovations and sustainable product offerings from key manufacturers. The UK market benefits from government initiatives promoting energy-efficient buildings and infrastructure development, providing consistent opportunities for expansion across both architectural and industrial segments.

France

France accounts for a market share of 15%, led by increasing construction projects and a growing focus on high-performance paints and coatings. The architectural end-user segment drives demand, while industrial applications, including adhesives and paper coatings, contribute significantly. Manufacturers are investing in waterborne and eco-friendly emulsions to comply with stringent environmental regulations. The French market emphasizes sustainability and aesthetic appeal in residential and commercial developments, creating opportunities for premium acrylic emulsions. Rising urbanization, renovations, and infrastructure modernization support steady growth, while technological advancements and collaborations with local contractors strengthen market penetration.

Germany

Germany commands a market share of 20%, representing the largest market in Europe for acrylic emulsions. Strong industrialization, advanced manufacturing, and extensive construction activities drive consistent demand. Paints and coatings remain the dominant application, particularly for architectural projects and industrial machinery coatings. The market benefits from innovations in polymer and copolymer emulsions that provide durability, chemical resistance, and environmental compliance. Germany’s focus on energy-efficient construction and sustainable materials further stimulates the adoption of eco-friendly acrylic solutions. Leading manufacturers continue to expand production capacities and develop high-performance emulsions to cater to both commercial and residential infrastructure projects.

Italy

Italy holds a market share of 12%, supported by growing demand in the architectural segment for decorative and protective coatings. Residential renovations, commercial building expansions, and infrastructure projects drive market growth. Paints and coatings dominate applications, followed by adhesives and construction material additives. Manufacturers are increasingly offering low-VOC, waterborne, and sustainable emulsions to meet regulatory requirements and consumer preferences. Technological advancements in hybrid and polymer emulsions enhance performance in weather-resistant and long-lasting applications. Italy’s focus on heritage building restoration and modern construction projects creates continuous opportunities for premium and specialty acrylic emulsions.

Spain

Spain represents a market share of 10%, fueled by strong growth in construction, renovation, and industrial sectors. Architectural applications, including residential and commercial coatings, lead demand, supported by adhesives and paper coatings in industrial use. The market is benefiting from government initiatives promoting energy efficiency and sustainable building materials. Manufacturers are responding with advanced waterborne and low-VOC emulsions, providing long-lasting performance and aesthetic appeal. Rising urbanization and infrastructure modernization contribute to steady growth, while increasing interest in eco-friendly products opens opportunities for market expansion in both commercial and residential projects.

Russia

Russia accounts for a market share of 8%, driven primarily by industrial and construction sectors. High demand for durable coatings, adhesives, and paper coatings supports the adoption of acrylic emulsions. Growth is fueled by rising infrastructure investments, commercial building projects, and industrial manufacturing requirements. Waterborne and polymer-based emulsions are increasingly preferred due to their performance and compliance with environmental regulations. Local manufacturers and international players are expanding production and distribution to cater to growing demand. Russia’s market potential is reinforced by government support for industrial modernization and energy-efficient building initiatives, providing long-term growth opportunities.

Rest of Europe

The rest of Europe holds a market share of 17%, encompassing countries with emerging construction and industrial activities. Architectural applications, including residential and commercial coatings, dominate, while adhesives and paper coatings drive industrial use. Market growth is supported by urbanization, infrastructure development, and increased demand for sustainable and eco-friendly acrylic emulsions. Manufacturers are investing in regional production facilities and introducing innovative waterborne and low-VOC products to strengthen their presence. Opportunities arise from rising construction standards, renovation projects, and industrial modernization, enabling both local and international players to capture incremental market share across these diverse European regions.

Market Segmentations:

By Product

- Pure Acrylic

- Polymer and Copolymer

By Application

- Paints and Coatings

- Construction Material Additives

- Paper Coating

- Adhesives

- Others

By End User

- Architectural

- Industrial

- Commercial

- Residential

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe acrylic emulsions market features key players such as BASF SE, Arkema, Dow, Celanese Corporation, Ashland, The Lubrizol Corporation, H.B. Fuller, Synthomer plc, KAMSONS CHEMICALS PVT. LTD., and Astra Chem Tech Private Limited. These companies focus on expanding their regional footprint, enhancing product portfolios, and adopting innovative technologies to meet evolving customer demands. Strategic initiatives include mergers, acquisitions, partnerships, and investments in R&D to develop sustainable and high-performance acrylic emulsions. Emphasis on low-VOC, waterborne, and polymer-based emulsions helps companies comply with stringent environmental regulations while catering to architectural, industrial, and commercial applications. Competitive differentiation is also driven by customization, cost efficiency, and timely delivery. Overall, market players are leveraging technological advancements, strategic collaborations, and sustainable practices to strengthen their presence and capture incremental market share across Western and Eastern Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Arkema

- Dow

- Celanese Corporation

- Ashland

- The Lubrizol Corporation

- B. Fuller

- Synthomer plc

- KAMSONS CHEMICALS PVT. LTD.

- Astra Chem Tech Private Limited

Recent Developments

- In April 2024, Lubrizol invested $20 million to expand its acrylic emulsion manufacturing capacity at its Gastonia, North Carolina facility, aiming to meet growing demand for innovative emulsions in coatings applications.

- In July 2023, Nippon Paint Holdings completed the acquisition of a 51% stake in N.P.T. s.r.l., an Italy-based manufacturer of sealants and adhesives, to strengthen its foothold in the European market.

- In October 2024, Nippon Paint Holdings entered into an agreement to acquire all equity interests of LSF11 A5 TopCo LLC and its subsidiaries (AOC) for approximately $2.3 billion. AOC specializes in resins and systems for coatings, adhesives, sealants, and elastomers, with operations across the United States and Europe.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for acrylic emulsions is expected to grow steadily across residential, commercial, and industrial sectors.

- Paints and coatings will remain the dominant application, driven by infrastructure and renovation projects.

- Pure acrylic products will continue to lead the product segment due to durability and weather resistance.

- Polymer and copolymer emulsions are likely to gain market share in specialty applications.

- Architectural end users will maintain the largest share, supported by urbanization and modern construction trends.

- Industrial applications, including adhesives and paper coatings, will witness gradual growth.

- Manufacturers will focus on eco-friendly and low-VOC formulations to meet sustainability requirements.

- Technological advancements in waterborne and hybrid emulsions will create new market opportunities.

- Eastern Europe and underpenetrated regions will emerge as growth hubs.

- Strategic collaborations, mergers, and R&D investments will strengthen competitive positioning of key players.