Market Overview:

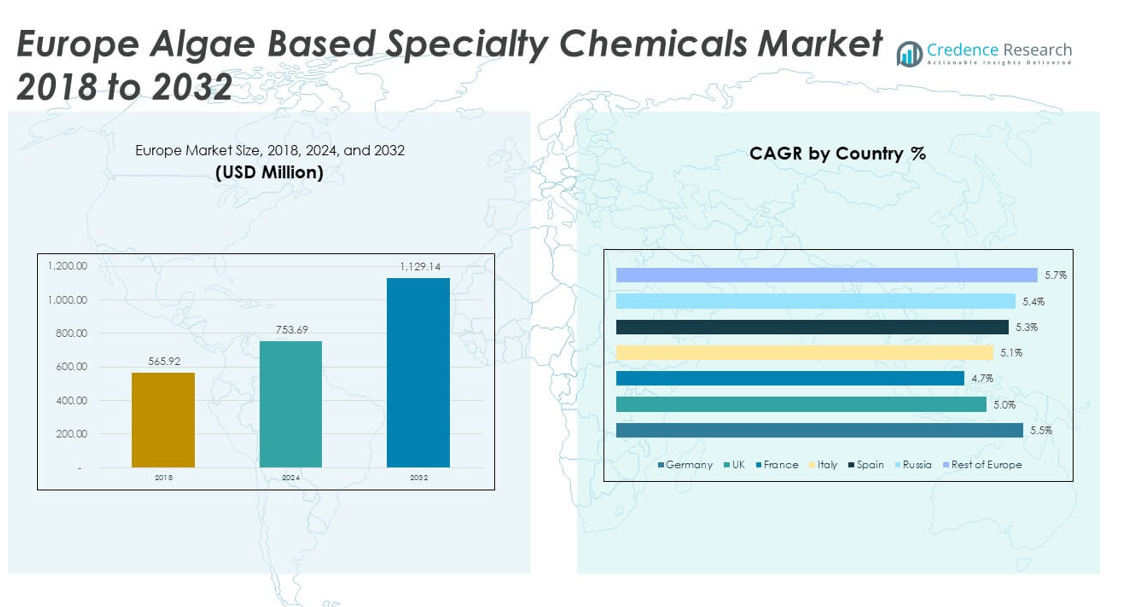

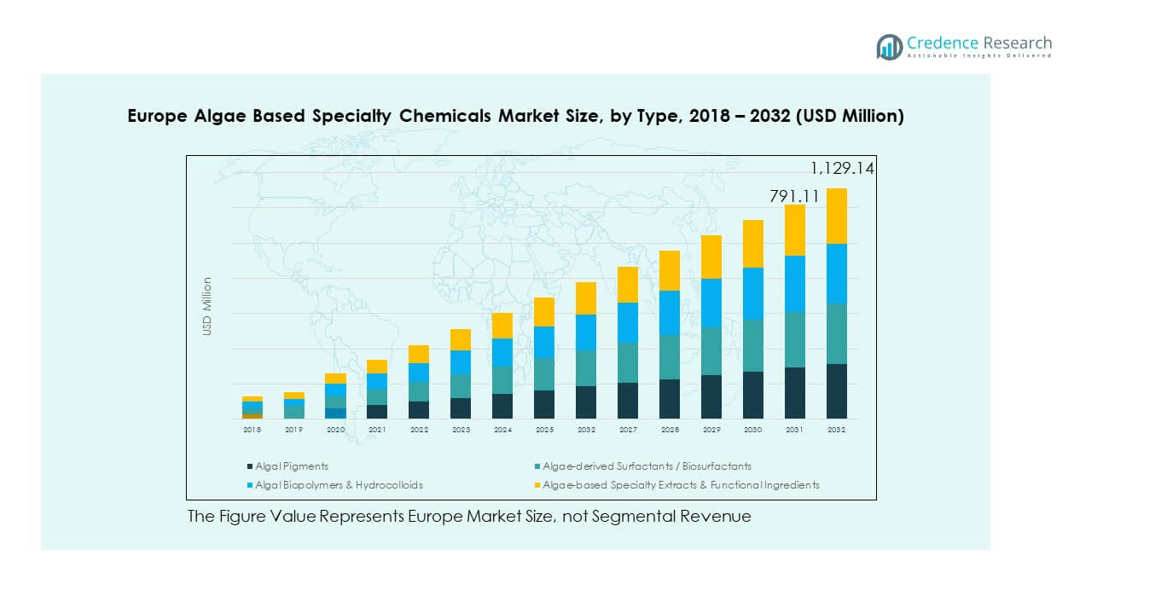

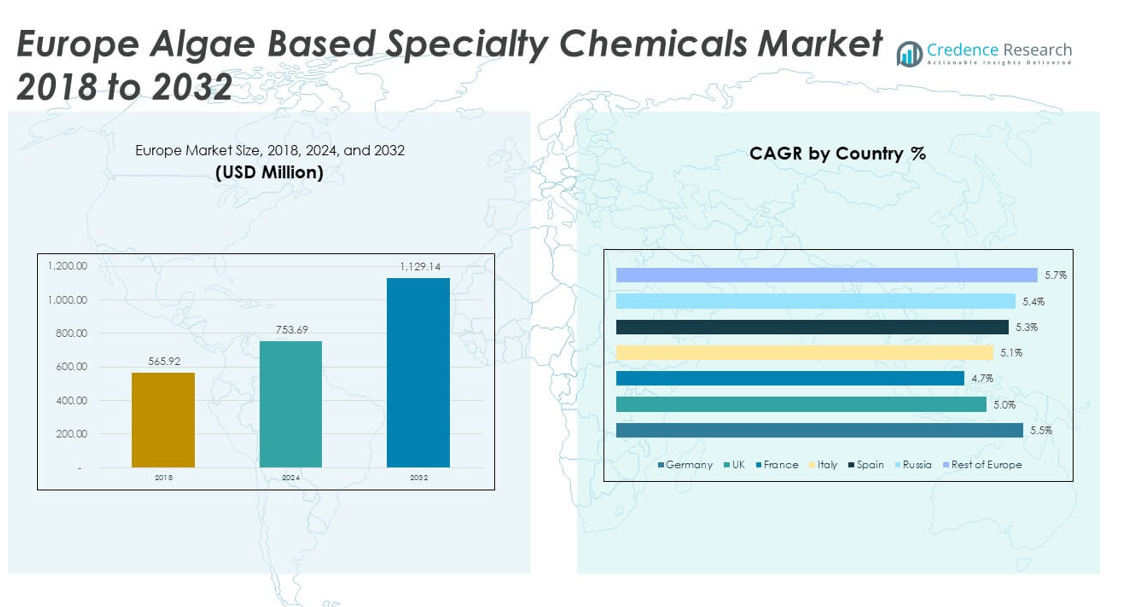

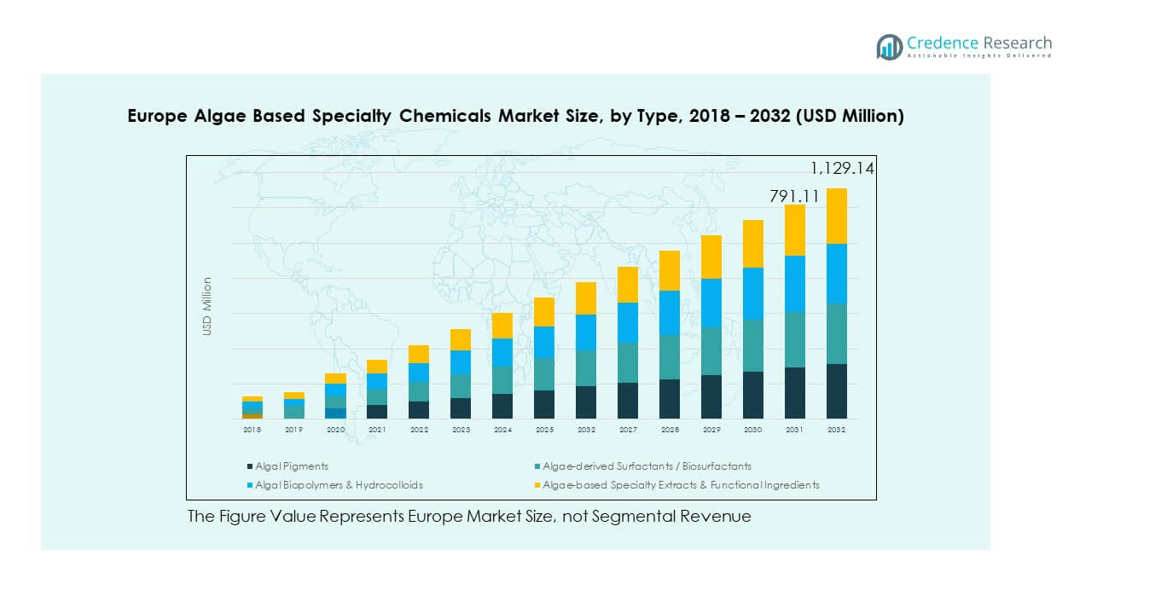

The Europe Algae Based Specialty Chemicals Market size was valued at USD 565.92 million in 2018 to USD 753.69 million in 2024 and is anticipated to reach USD 1,129.14 million by 2032, at a CAGR of 5.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Algae Based Specialty Chemicals Market Size 2024 |

USD 753.69 million |

| Europe Algae Based Specialty Chemicals Market, CAGR |

5.20% |

| Europe Algae Based Specialty Chemicals Market Size 2032 |

USD 1,129.14 million |

Growing adoption in food and beverage, cosmetics, and pharmaceuticals drives the industry forward. Consumer preferences for natural and eco-friendly products stimulate demand for algae-derived ingredients in multiple applications. The versatility of algae in producing pigments, surfactants, biopolymers, and functional extracts increases its attractiveness across sectors. Companies are also leveraging algae’s potential for bio-based packaging and agriculture formulations. This demand encourages advancements in cultivation technologies and commercial-scale production methods, strengthening market momentum.

Regionally, Western Europe leads due to established biotechnology clusters, strong regulatory frameworks, and advanced R&D capabilities. Countries such as Germany, France, and the UK dominate through robust industrial adoption and investments in sustainable chemicals. Southern and Eastern Europe are emerging with growing interest in renewable solutions and government-backed initiatives. Expanding aquaculture in coastal regions supports algae sourcing, boosting opportunities in Spain and Italy. Demand in Russia is gradually rising with growing agricultural and industrial applications.

Market Insights:

- The Europe Algae Based Specialty Chemicals Market was valued at USD 565.92 million in 2018, USD 753.69 million in 2024, and is projected to reach USD 1,129.14 million by 2032, at a CAGR of 5.20%.

- Western Europe leads with 58% share, driven by strong biotechnology clusters, regulatory support, and advanced industrial adoption in Germany, France, and the UK.

- Southern Europe holds 25% share, supported by aquaculture growth in Spain and Italy, while Eastern Europe and Russia account for 17% with emerging adoption in agriculture and industrial applications.

- Algal pigments represent around 35% of the segment share, fueled by high demand in natural food colorants and cosmetics.

- Algae-derived surfactants and biosurfactants account for nearly 28%, reflecting their rising use in sustainable cleaning and personal care products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Preference for Natural and Eco-Friendly Ingredients:

The Europe Algae Based Specialty Chemicals Market benefits from rising consumer demand for sustainable and plant-based solutions. Consumers increasingly favor bio-based products over synthetic alternatives, particularly in food, personal care, and pharmaceuticals. This shift reflects a growing awareness of environmental impact and health concerns. It encourages manufacturers to integrate algae-derived specialty ingredients into product formulations. Companies respond with innovation in natural colorants, biopolymers, and surfactants. Regulatory support for green chemistry further accelerates adoption. It enhances competitiveness by aligning with eco-conscious consumer expectations. Market growth is reinforced by branding strategies emphasizing natural and renewable sourcing.

- For instance, Evonik Industries AG opened a biosurfactant production facility in Slovakia capable of producing rhamnolipids at an industrial scale, supporting eco-friendly cleaning product lines compliant with EU Green Deal ambitions.

Expanding Applications Across Diverse Industries:

The market is advancing as industries embrace algae-derived chemicals for broader uses. Food and nutraceutical sectors adopt algae-based extracts for functional benefits. Cosmetics rely on algae for natural pigments and skin-enhancing bioactives. Pharmaceuticals utilize algae-derived compounds in drug formulations and biomarkers. Agriculture explores algae for fertilizers and feed applications. Industrial cleaning and packaging sectors adopt biopolymers and biosurfactants. The Europe Algae Based Specialty Chemicals Market leverages this cross-sector versatility to sustain growth. Companies diversify portfolios and strengthen collaboration with end users. It fosters innovation and establishes long-term market demand across industries.

- For instance, Microphyt’s facility in Montpellier, France, produces algae compounds for nutrition and beauty markets, supplying weight management and cognitive health supplements as well as skin enhancers. Meanwhile, the NENU2PHAR project in Europe has developed PHA bioplastic polymers from microalgal biomass, targeting 8 product lines for packaging, agricultural, and medical applications benchmarked against fossil-based materials.

Regulatory Support and Sustainability Policies Encouraging Bio-Based Innovation:

Government regulations in Europe strongly favor the adoption of bio-based chemicals. Policies targeting reduction of carbon emissions support algae-based alternatives. The European Union promotes green transition initiatives with bioeconomy strategies. This regulatory push compels industries to align with sustainable practices. The Europe Algae Based Specialty Chemicals Market benefits from compliance-driven adoption. Manufacturers gain incentives to invest in algae-based production technologies. It ensures scalability and market stability while addressing climate targets. The regulatory framework creates a predictable growth environment. Industry stakeholders prioritize bio-based innovation to meet policy goals and consumer demand.

Technological Advancements in Algae Cultivation and Extraction:

The development of advanced cultivation systems accelerates algae-based chemical production. Closed photobioreactors and controlled open-pond systems increase yield efficiency. Innovations in downstream processing improve extraction of pigments, proteins, and biopolymers. The Europe Algae Based Specialty Chemicals Market gains from improved scalability and cost reductions. Companies invest in automation, genetic engineering, and precision cultivation. These technologies enhance quality consistency and lower production costs. It makes algae-based specialty chemicals more competitive with synthetic substitutes. Rising private and public funding supports research breakthroughs. Long-term adoption relies on innovation in production and extraction processes.

Market Trends:

Growing Demand for Algae in High-Value Nutraceuticals and Functional Foods:

The Europe Algae Based Specialty Chemicals Market observes rising use in nutraceuticals. Algae-derived omega-3 fatty acids, proteins, and antioxidants gain traction. Consumers seek functional foods that support health and wellness. This trend strengthens algae’s position as a premium ingredient source. Companies launch fortified foods and dietary supplements with algae-based bioactives. Retailers highlight algae’s clean-label appeal. It aligns with Europe’s strong demand for plant-based nutrition. Growing vegan and vegetarian populations reinforce this momentum.

- For instance, Germany leads the European market for algae-sourced EPA and DHA omega-3 supplements due to its strong manufacturing, R&D, and high consumer demand for plant-based alternatives. Companies like ADM and Croda International have expanded production capacity to meet this rising demand for sustainable, high-purity omega-3 ingredients, with algal oil delivering concentrated EPA and DHA oils that appeal to eco-conscious consumers.

Increasing Role of Algae in Sustainable Packaging and Bioplastics:

The push toward eco-friendly packaging boosts algae’s relevance in biopolymer production. Companies use algae-derived materials for biodegradable films and plastics. The Europe Algae Based Specialty Chemicals Market benefits from Europe’s strict regulations on plastic waste. Bioplastics manufacturers invest in algae-based feedstocks to reduce carbon footprint. Packaging innovators explore algae-based coatings for extended shelf life. Retailers adopt algae packaging to strengthen sustainability branding. It reduces reliance on petroleum-based plastics in multiple industries. Market growth aligns with the EU’s circular economy targets. Consumer acceptance of biodegradable options drives adoption further.

- For instance, the European NENU2PHAR project is developing innovative microalgal PHA bioplastics underpinned by 16 partners working to upscale production. This project targets consumer products and packaging with compostable, recyclable, or reusable end-of-life cycles. Key partners optimized microalgal biomass to achieve high starch content as carbon sources for bacterial synthesis of PHA polymers.

Rising Integration of Algae-Based Ingredients in Personal Care Products:

Algae is gaining attention in cosmetics for natural and skin-beneficial properties. The Europe Algae Based Specialty Chemicals Market supports this demand with diverse specialty extracts. Beauty brands adopt algae for moisturizers, sunscreens, and anti-aging products. Functional ingredients derived from algae offer antioxidants and hydration benefits. It provides safer alternatives to synthetic additives. Rising demand for premium natural cosmetics boosts algae’s value. Brands leverage algae’s clean-label and eco-friendly image. Consumer awareness of sustainable beauty accelerates this trend. R&D pipelines expand to develop algae-based cosmetic innovations.

Expansion of Industrial Applications Beyond Traditional Sectors:

The market experiences rising adoption in non-traditional industrial domains. Algae-based surfactants are integrated into cleaning products. Biopolymers find uses in automotive components and textiles. The Europe Algae Based Specialty Chemicals Market expands with new industrial collaborations. Industrial adoption supports circular economy practices. Companies view algae as a renewable raw material. It reduces environmental impact while enhancing product performance. Emerging sectors like biofuels and biomaterials stimulate innovation. This trend widens the revenue base and diversifies growth avenues.

Market Challenges Analysis:

High Production Costs and Scalability Limitations:

The Europe Algae Based Specialty Chemicals Market faces challenges from high costs of production. Large-scale algae cultivation requires advanced infrastructure and energy-intensive processes. Scaling production to meet industrial demand is complex. It limits competitiveness against synthetic chemicals with established supply chains. Companies struggle with balancing cost and quality consistency. Advanced technologies exist but require heavy capital investment. Limited production efficiency slows adoption across industries. Market participants must overcome these hurdles to achieve long-term scalability.

Regulatory Complexities and Standardization Gaps Across Europe:

Diverse regulations across European countries create compliance challenges. The Europe Algae Based Specialty Chemicals Market must navigate multiple approval frameworks. Lack of standardization for algae-based product classification adds complexity. Manufacturers face delays in product launches due to regulatory processes. It reduces speed-to-market and increases compliance costs. Differences in national policies hinder cross-border expansion. Market players invest in certifications to build consumer trust. Collaborative efforts between regulators and industry are essential. Addressing policy inconsistencies can streamline market adoption.

Market Opportunities:

Expanding Role of Algae in Food Security and Aquaculture:

The Europe Algae Based Specialty Chemicals Market holds opportunities in aquaculture and food production. Algae-derived feed formulations support sustainable fish farming. Rising demand for alternative proteins drives adoption in food security initiatives. It positions algae as a key solution to Europe’s growing protein needs. Nutritional benefits create high-value opportunities in livestock and aquaculture. Countries with strong aquaculture sectors invest in algae-based solutions. Research institutions collaborate with industries to scale algae feed applications. These opportunities strengthen the role of algae in food ecosystems.

Growing Investment in Circular Economy and Green Technologies:

The market offers growth potential through integration with green technologies. The Europe Algae Based Specialty Chemicals Market aligns with circular economy goals. Companies invest in algae as renewable inputs for multiple applications. Algae supports carbon capture and bio-based material innovation. It complements Europe’s transition to low-carbon industries. Investment in waste-to-resource technologies drives algae integration. Green finance initiatives promote algae-based sustainability projects. Companies pursuing ESG strategies view algae as a high-value opportunity. Demand is reinforced by Europe’s commitment to sustainable industries.

Market Segmentation Analysis:

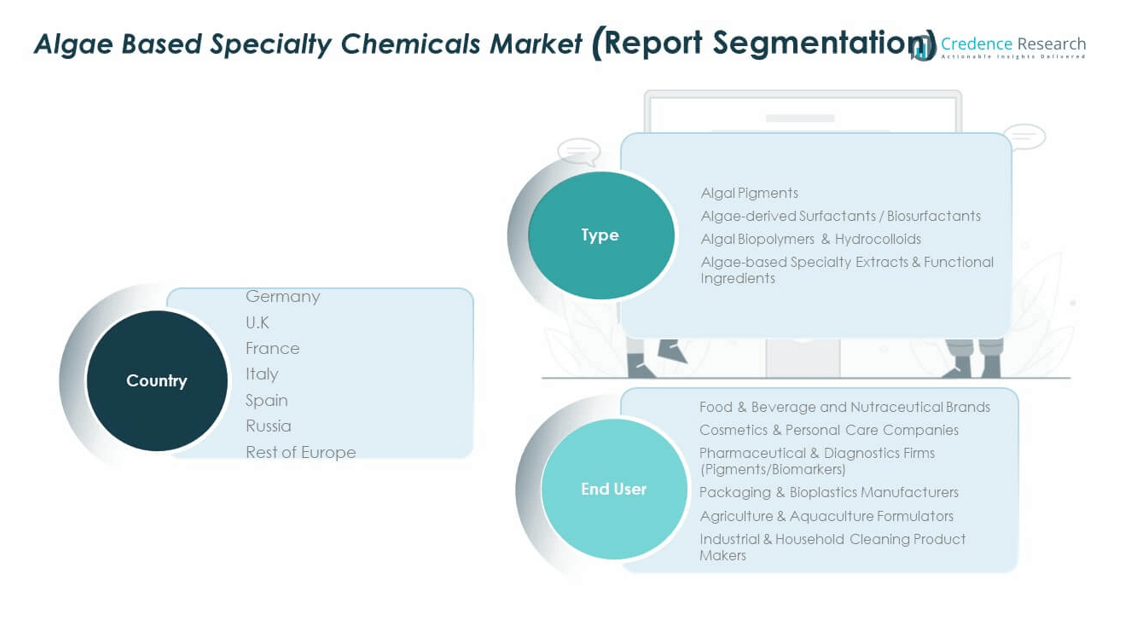

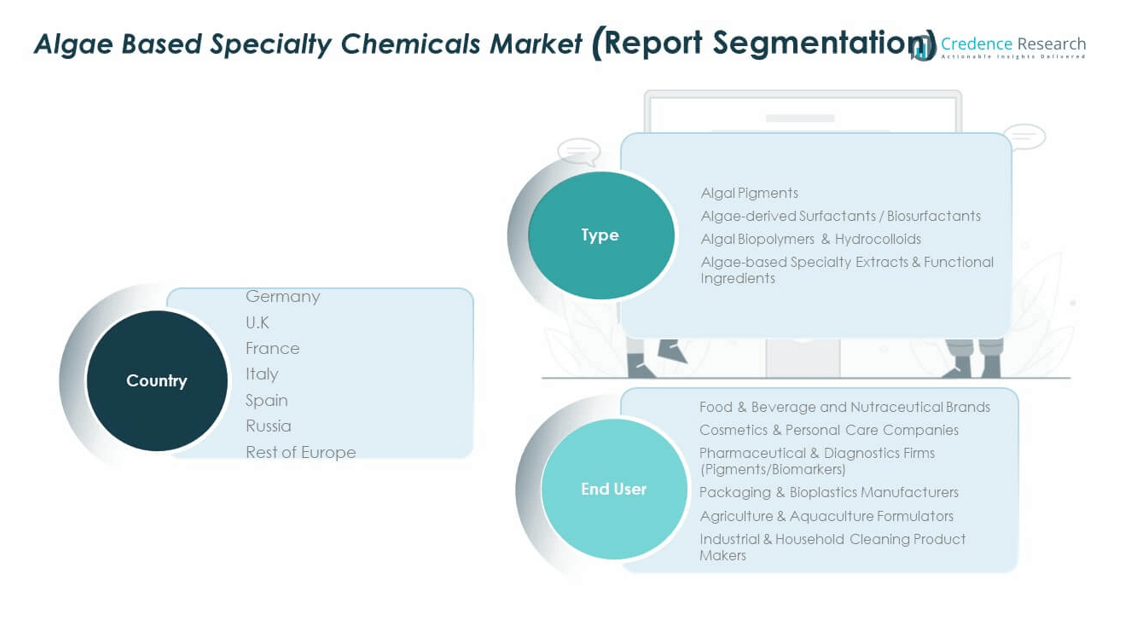

By Type

The Europe Algae Based Specialty Chemicals Market is segmented into algal pigments, algae-derived surfactants, algal biopolymers and hydrocolloids, and algae-based specialty extracts and functional ingredients. Algal pigments hold a strong position due to rising demand in food coloring and cosmetics, reflecting consumer preference for natural alternatives. Algae-derived surfactants find growing acceptance in sustainable cleaning and personal care products, supported by regulatory pressure for greener formulations. Algal biopolymers and hydrocolloids serve expanding roles in packaging and bioplastics, aligning with Europe’s circular economy initiatives. Specialty extracts and functional ingredients gain traction in nutraceuticals and pharmaceuticals, highlighting algae’s role in health-focused innovation.

- For instance, BASF SE and Clariant AG have enhanced their green chemistry portfolios with algae-based surfactants and pigments, achieving sales growth in sulfate-free and plant-derived surfactants used in personal care. Germany remains a hub with multiple companies leveraging Industry 4.0 automation to scale biopolymer manufacturing.

By End User

The market spans a wide range of end-user industries. Food and beverage and nutraceutical brands lead adoption by integrating algae-based compounds for nutrition, flavoring, and functional benefits. Cosmetics and personal care companies apply algae-derived pigments and bioactives to meet clean-label and eco-conscious consumer expectations. Pharmaceutical and diagnostics firms utilize algae compounds in pigments and biomarkers, enhancing medical and biotech applications. Packaging and bioplastics manufacturers increasingly adopt algae-based biopolymers to reduce reliance on petroleum-derived materials. Agriculture and aquaculture formulators leverage algae in sustainable feed and fertilizers. Industrial and household cleaning product makers integrate algae-derived surfactants, reinforcing the shift toward bio-based solutions. It reflects balanced demand across consumer, healthcare, and industrial markets.

- For instance, Allmicroalgae, a verifiable company from Europe, produces sustainably cultivated microalgae and supplies pigments and proteins to cosmetic, food, and pharmaceutical companies. Kuehnle AgroSystems, a U.S. company, utilizes a patented dark fermentation process to produce astaxanthin and algae proteins. While KAS claims “up to 90% cost reductions” compared to traditional production, this is a company marketing claim and lacks independent verification. The company supplies nutraceuticals and animal feed sectors.

Segmentation:

By Type

- Algal Pigments

- Algae-derived Surfactants / Biosurfactants

- Algal Biopolymers & Hydrocolloids

- Algae-based Specialty Extracts & Functional Ingredients

By End User

- Food & Beverage and Nutraceutical Brands

- Cosmetics & Personal Care Companies

- Pharmaceutical & Diagnostics Firms (Pigments/Biomarkers)

- Packaging & Bioplastics Manufacturers

- Agriculture & Aquaculture Formulators

- Industrial & Household Cleaning Product Makers

Regional Analysis:

Western Europe: Established Leader with Strong Biotechnology Ecosystem

Western Europe dominates the Europe Algae Based Specialty Chemicals Market, holding nearly 58% of the total share in 2024. Countries such as Germany, France, and the UK lead due to strong biotechnology clusters, advanced R&D facilities, and wide adoption of sustainable chemicals across industries. High consumer demand for natural cosmetics, nutraceuticals, and eco-friendly packaging reinforces market strength. Regulatory frameworks supporting the bioeconomy further enhance competitiveness in this region. It continues to attract investment from multinational companies seeking growth opportunities in specialty chemicals. Western Europe is expected to maintain its leadership through continuous innovation and strong industrial infrastructure.

Southern Europe: Emerging Growth Driven by Aquaculture and Industrial Adoption

Southern Europe accounts for about 25% of the Europe Algae Based Specialty Chemicals Market share in 2024. Spain and Italy drive this growth, supported by expanding aquaculture, coastal algae cultivation, and growing adoption of bio-based materials in food and personal care industries. These countries benefit from favorable climatic conditions for algae sourcing and government-backed sustainability initiatives. Industrial adoption in agriculture and packaging creates fresh opportunities for algae-derived solutions. It remains an emerging hub with high potential for expanding applications across multiple sectors. Southern Europe’s increasing focus on renewable inputs ensures its importance in shaping regional growth.

Eastern Europe and Russia: Developing Region with Growing Bio-Based Adoption

Eastern Europe, including Russia, holds nearly 17% of the Europe Algae Based Specialty Chemicals Market share in 2024. Market growth is fueled by rising investments in agriculture, aquaculture, and industrial applications of algae-derived chemicals. Countries in this region are gradually aligning with EU sustainability goals, supporting wider adoption of bio-based products. Limited infrastructure and production capacity restrain growth but also create opportunities for partnerships with Western European players. It is positioned as a developing market, with demand gradually expanding across pharmaceuticals and industrial cleaning products. Eastern Europe’s growing emphasis on sustainability strengthens its long-term role within the regional landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- CABB Chemicals

- BASF SE

- I.D. Parry (Parry Nutraceuticals)

- Cyanotech Corporation

- Earthrise Nutritionals

- Algatechnologies (Algatech)

- CP Kelco

- Cargill

- AlgaEnergy

- Other Key Players

Competitive Analysis:

The Europe Algae Based Specialty Chemicals Market is characterized by strong competition among established players and emerging innovators. Leading companies such as BASF SE, CABB Chemicals, E.I.D. Parry, Cyanotech Corporation, and Algatechnologies dominate with diverse product portfolios. CP Kelco, Cargill, and AlgaEnergy further strengthen competitive intensity. It fosters innovation in pigments, biopolymers, and functional extracts. Strategic moves such as partnerships, product launches, and acquisitions are common. Competition extends to pricing strategies and technological advancements in algae cultivation. Players focus on R&D investment to maintain differentiation. Collaboration with research institutes ensures long-term innovation pipelines. The market’s competitive environment is defined by a mix of multinational leaders and niche specialists.

Recent Developments:

- In May 2025, CABB Chemicals entered a strategic partnership to establish a pioneering algae biorefinery at its Kokkola Industrial Park site in Finland. This facility will utilize patented technology from Origin by Ocean to convert invasive brown algae (sargassum) into high-value ingredients like alginate and fucoidan, targeting industries such as cosmetics and detergents. Operation is planned to begin in 2028 with potential expansion globally.

- In May 2025, BASF SE signed an agreement to acquire the remaining shares of its Alsachimie joint venture from DOMO Chemicals, aiming to strengthen its production capacity for key chemicals including specialty compounds used in various industries. Additionally, BASF partnered with Solix Biofuels to explore algae-based chemical production, supporting sustainability efforts.

- In October 2024, E.I.D. Parry’s nutraceutical division, Parry Nutraceuticals, obtained the EU import license to reintroduce organic spirulina products into Europe after a two-year hiatus caused by regulatory issues. The division has been working on improved spirulina and chlorella products for the EU market addressing high-quality standards.

- Cargill has been advancing its algae-based DHA ingredient, extracted from microalgae through sustainable fermentation, supporting vegan and plant-based Omega-3 supplements. This innovation targets European markets including maternal and infant nutrition sectors with emphasis on supply chain transparency and high quality.

Report Coverage:

The research report offers an in-depth analysis based on type and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing role of algae in sustainable packaging solutions.

- Expanding applications in pharmaceuticals and biotechnology.

- Rising integration of algae-based pigments in cosmetics.

- Growing demand for algae-derived proteins in functional foods.

- Strong regulatory push for bio-based chemicals adoption.

- Scaling innovations in photobioreactors and cultivation systems.

- Increased collaborations between European and Asian players.

- Rising investments in algae-based aquaculture feed solutions.

- Expansion of algae biopolymers in industrial manufacturing.

- Stronger branding of algae as a premium eco-friendly ingredient.