Market Overview

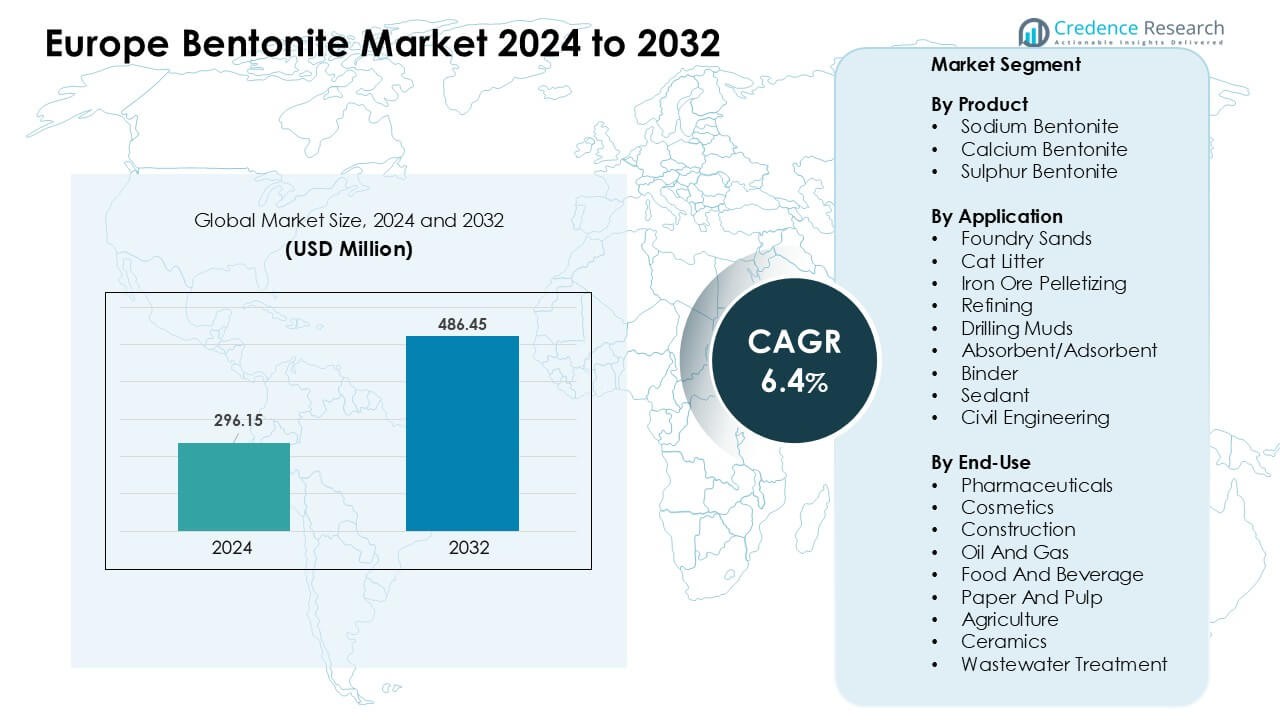

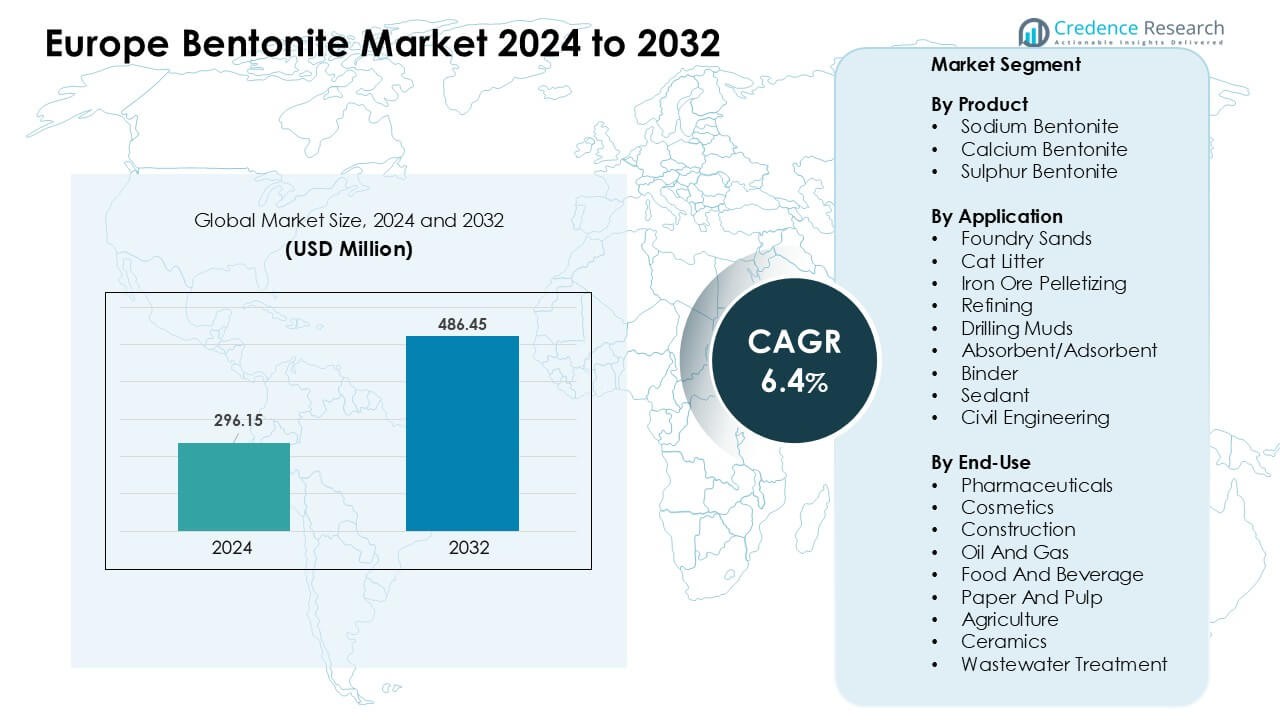

Europe Bentonite Market was valued at USD 296.15 million in 2024 and is anticipated to reach USD 486.45 million by 2032, growing at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Bentonite Market Size 2024 |

USD 296.15 Million |

| Europe Bentonite Market, CAGR |

6.4% |

| Europe Bentonite MarketSize 2032 |

USD 486.45 Million |

The Europe Bentonite Market includes major players such as Imerys S.A., Tolsa Group, Sepiolsa, Pettex Limited, Catsan, Sanicat, Ever Clean, Agrimont SpA, Tigerino, and Europet Bernina International. These companies compete through strong processing capabilities, wide product portfolios, and established retail and industrial networks. Many focus on high-performance grades for construction, foundry, pet-care, and environmental applications, which supports stable regional demand. Western Europe emerged as the leading regional market in 2024 with about 41% share, driven by strong infrastructure activity, advanced manufacturing, and high consumption of bentonite-based cat litter and engineered sealing solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Europe Bentonite Market reached about USD 296.15 million in 2024 and is projected to reach around USD 486.45 million by 2032, growing at a CAGR of nearly 6.4% during the forecast period.

- Growth is driven by strong demand from construction, foundry, cat litter, and wastewater treatment, with sodium bentonite holding the largest product share at about 58%.

- Key trends include rising adoption of eco-friendly absorbents, higher consumption of clumping cat litter, and wider use of bentonite in soil management and environmental sealing applications.

- The competitive landscape includes Imerys, Tolsa Group, Sepiolsa, Pettex, Catsan, Sanicat, Ever Clean, Agrimont, Tigerino, and EBI, with firms expanding processing quality and distribution reach.

- Western Europe leads the market with nearly 41% share, while construction remains the top end-use segment, supported by large-scale tunneling, infrastructure upgrades, and regulatory pressure for natural sealing materials.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

Sodium bentonite led the product segment in 2024 with about 58% share across Europe. Users preferred sodium grades due to strong swelling ability and high viscosity, which improved performance in drilling fluids, foundry molds, and civil engineering barriers. Demand grew as energy firms expanded drilling programs and construction projects increased their use of bentonite-based liners. Calcium bentonite maintained steady use in cat litter and absorbent products, while sulphur bentonite saw gradual growth in farming due to rising soil enrichment needs.

- For instance, Sodium bentonite is the most common type of bentonite used in clumping cat litter because it swells up to 15-20 times its original volume when exposed to moisture, forming the hard, solid clumps that are easy to scoop.

By Application

Foundry sands dominated the application segment in 2024 with nearly 34% share. European metal casting plants relied on bentonite to improve mold strength, thermal stability, and casting precision. Growth increased as automotive and machinery producers raised output and upgraded casting systems. Cat litter followed due to high pet adoption, while drilling muds gained traction with renewed upstream activity. Iron ore pelletizing also expanded in select regions as steelmakers focused on efficient and low-emission production routes.

- For instance, Black Hills Bentonite, LLC is a real company that supplies high-quality Wyoming sodium bentonite for a variety of industrial and commercial applications, including metal casting.

By End-Use

Construction emerged as the leading end-use segment in 2024 with about 29% share. Builders used bentonite for tunneling, diaphragm walls, waterproof barriers, and soil sealing, which supported strong demand across Europe’s infrastructure programs. Growth rose as governments funded transport upgrades and urban redevelopment. Pharmaceuticals and cosmetics kept steady use due to bentonite’s natural binding and clarifying properties. Wastewater treatment also expanded because utilities adopted bentonite-based adsorbents to improve contaminant removal.

Key Growth Drivers

Rising Demand from Construction and Infrastructure Projects

Europe’s bentonite market grows strongly due to heavy use in construction and infrastructure work. Many countries continue to invest in tunnels, metro systems, foundations, and water-retention structures. Builders use bentonite because the material offers high swelling capacity, strong sealing behavior, and reliable stability for ground engineering. Growth also rises as urban areas expand and redevelopment projects need slurry walls, bored piles, and trenching support. Environmental rules push builders to use safer and natural sealing materials, which increases bentonite use. Public spending on rail links, bridges, and water networks strengthens long-term demand, and suppliers expand capacity to meet steady needs across the region.

- For instance, in slurry-wall construction for deep urban tunnels and metro shafts, a mixture of sodium bentonite and water is used to maintain trench-wall stability, with the slurry’s thixotropic behaviour generating sufficient hydrostatic pressure to counteract soil and groundwater inward pressure.

Expanding Use in Foundry and Metal Casting Applications

Foundries remain a major driver as bentonite supports stronger molds, better thermal resistance, and higher casting accuracy. Europe’s automotive and machinery sectors depend on precision casting for engine blocks, transmission parts, and industrial components. Bentonite helps reduce defects and improves mold bonding, which raises efficiency in metal plants. The market benefits from the recovery of vehicle production and the shift toward lightweight parts that still require strong mold performance. Several casting plants also upgrade processes to reduce waste, and bentonite improves sand recyclability. Demand rises further as Europe promotes domestic manufacturing and focuses on stable supply chains, encouraging more foundry investments across key countries.

- For instance, foundry-grade bentonite used in green-sand molding typically contains 60-80% montmorillonite, and exhibits a swelling capacity of 18–20 ml/g when hydrated properties that impart high binding strength and thermal stability to sand molds.

Growing Adoption in Environmental and Wastewater Applications

Rising focus on sustainability boosts bentonite use in soil sealing, landfill liners, and wastewater treatment. Utilities and industrial plants use bentonite because the mineral adsorbs heavy metals, dyes, oils, and other contaminants. Europe’s strict water rules push treatment plants to choose natural and low-toxicity materials, which increases bentonite demand. Farmers also use bentonite to improve soil quality and moisture retention, helping fields adapt to climate-driven dryness. More countries invest in flood-control and groundwater-protection projects, and bentonite serves as a reliable barrier material. These environmental uses create a stable and growing demand base across both public and private sectors.

Key Trends & Opportunities

Rising Trend Toward Natural and Sustainable Materials

Consumers and industries in Europe prefer natural and eco-safe inputs, which boosts bentonite adoption. Cosmetics, personal care, and food processing companies use bentonite as a natural stabilizer and clarifying agent. Waste treatment firms also favor bentonite because it offers strong adsorption without synthetic chemicals. This shift helps producers market bentonite as a clean and renewable solution. The trend aligns with EU sustainability targets, which encourage wider use of natural minerals in packaging, filtration, and soil conditioning. These shifts create new growth paths in high-value segments and increase long-term product relevance across end users.

- For instance, cosmetic-grade bentonite is used in face masks and shampoos because of its strong oil-absorbing and clarifying capacity: when hydrated and applied, bentonite absorbs excess sebum and impurities a function repeatedly cited in cosmetic-formulation guides as a “safe, natural oil-absorbing clay.

Opportunities from Agricultural Productivity and Soil Management

Farmers across Europe face soil depletion, water stress, and climate challenges, which create opportunities for bentonite-based soil conditioners. The mineral improves water retention, nutrient absorption, and soil structure, helping crops grow under dry conditions. Several regions invest in sustainable farming programs, and bentonite fits well into these initiatives. Blended fertilizers with bentonite also gain traction as they release nutrients slowly and reduce losses. The move toward regenerative farming expands market potential, and suppliers develop bentonite grades tailored to crops, vineyards, and horticulture. These trends help open new revenue streams outside traditional industrial uses.

- For instance, a recent study found that applying hydrated bentonite to greenhouse soil allowed lettuce cultivation with a 25% reduction in watering without compromising yield.

Key Challenges

Volatile Raw Material Supply and Mining Restrictions

Europe depends partly on imported bentonite, and supply chains face delays from mining limits, transport gaps, and trade disruptions. Environmental rules in some producing countries also affect output, which raises cost pressure. Local mining faces strict land-use and emission controls, slowing new project approvals. These issues lead to fluctuating prices for processors, foundries, and construction users. Many buyers look for stable sources, but limited high-quality deposits restrict flexibility. Supply instability pushes companies to hold larger inventories, raising operational costs and reducing responsiveness to demand shifts across the region.

Competition from Substitute Materials in Key Applications

In some industrial uses, bentonite competes with polymers, synthetic absorbents, resins, and advanced sealing materials. These substitutes offer consistent performance and targeted properties, which attract manufacturers seeking tighter process control. In drilling, polymers can improve fluid stability; in wastewater treatment, activated carbon offers strong adsorption. Such competition limits bentonite penetration in high-tech processes. Some users also shift to faster-acting binders in casting and construction. To stay competitive, bentonite suppliers must improve product quality, refine processing, and develop engineered blends. Slow adoption of innovation creates risk for market share erosion over time.

Regional Analysis

Italy and Spain

Italy and Spain together accounted for nearly 22% share of the Europe Bentonite Market in 2024. Both countries relied heavily on bentonite for civil engineering, tunneling, and coastal protection projects driven by urban expansion and transport upgrades. Strong pet ownership supported bentonite cat litter demand, while wineries and food processors used bentonite for clarification. Agriculture also contributed as farmers adopted bentonite-based soil enhancers to address moisture stress. Rising investment in water treatment and industrial waste management strengthened long-term demand. The combined influence of construction, agriculture, environmental uses, and pet-care markets kept Italy and Spain among the region’s fastest-growing clusters.

Germany

Germany held the largest individual country share in 2024 at about 19% of the Europe Bentonite Market. The country’s strong industrial base drove bentonite use in foundry sands, drilling fluids, and advanced construction projects. High pet ownership rates further boosted demand for clumping cat litter. Germany also expanded bentonite use in wastewater treatment and landfill sealing to meet strict environmental rules. Growth in automotive and machinery production supported stable demand in precision casting applications. Large infrastructure upgrades, including tunnels and transport corridors, reinforced Germany’s position as a key consumption hub with broad industrial and environmental usage.

United Kingdom

The United Kingdom accounted for roughly 11% share in 2024, supported by strong consumption in pet-care, construction, and environmental protection. Cat litter dominated nationwide use as rising pet adoption increased demand for high-absorbency bentonite. Construction firms used bentonite in piling, trenching, and groundwater sealing for infrastructure upgrades. Wastewater and landfill projects also relied on bentonite due to strict regulatory standards. The UK’s cosmetic and personal-care sector added niche demand for purified grades. Despite moderate industrial activity, the UK maintained consistent market growth through diverse applications and rising sustainability-driven adoption.

Turkey

Turkey represented about 9% share of the Europe Bentonite Market in 2024 and remained both a major consumer and producer. Strong domestic mining output supported bentonite use in drilling muds, iron ore pelletizing, and foundry processes. Construction was another major driver, with bentonite used for tunneling, soil sealing, and large infrastructure works. Cat litter manufacturing expanded due to Turkey’s strong production base and export activity. Agriculture also relied on bentonite for soil conditioning in dry regions. Turkey’s industrial diversity and competitive bentonite reserves strengthened its role as a key contributor to regional supply and demand.

France

France accounted for close to 10% share of the Europe Bentonite Market in 2024. The country showed balanced demand across pet-care, construction, cosmetics, and wastewater treatment sectors. Cat litter remained a major consumer segment as urban households increased adoption of bentonite-based products. Construction firms used bentonite for geotechnical sealing and foundation work. The cosmetics industry also relied on refined grades in skincare formulations. Environmental applications expanded as France tightened waste and water regulations. Stable industrial activity and growing sustainability goals helped maintain steady bentonite demand across multiple end-use sectors.

Russia

Russia held approximately 13% share in 2024, driven by strong industrial use in mining, foundry, pelletizing, and oil and gas drilling. Iron ore pelletizing plants relied heavily on bentonite as a binder, supporting significant volume consumption. Drilling mud applications grew with upstream exploration activity, while construction demand rose through soil sealing and foundation projects. The country’s wastewater and land management sectors also used bentonite due to its absorbent and sealing properties. Despite economic fluctuations, Russia remained a major user of industrial-grade bentonite, supported by its large resource base and broad manufacturing industries.

Market Segmentations:

By Product

- Sodium Bentonite

- Calcium Bentonite

- Sulphur Bentonite

By Application

- Foundry Sands

- Cat Litter

- Iron Ore Pelletizing

- Refining

- Drilling Muds

- Absorbent/Adsorbent

- Binder

- Sealant

- Civil Engineering

By End-Use

- Pharmaceuticals

- Cosmetics

- Construction

- Oil And Gas

- Food And Beverage

- Paper And Pulp

- Agriculture

- Ceramics

- Wastewater Treatment

By Geography

- Italy and Spain

- Germany

- United Kingdom

- Turkey

- France

- Russia

Competitive Landscape

The competitive landscape of the Europe Bentonite Market features a mix of established mineral producers, pet-care brands, and specialized industrial suppliers that shape demand across diverse end-use sectors. Leading players such as Imerys S.A., Tolsa Group, Sepiolsa, Pettex Limited, Catsan, Sanicat, Ever Clean, Agrimont SpA, Tigerino, and Europet Bernina International strengthen their positions through wide product portfolios, strong distribution networks, and continuous innovation in bentonite processing. Many companies focus on high-purity grades for cosmetics, pharmaceuticals, and food clarification, while others expand capacity for clumping cat litter, construction additives, and environmental sealing products. Expansion in refining technologies, improved granulation quality, and tailored bentonite blends help brands differentiate in a competitive market. Several producers invest in sustainable mining and advanced purification to meet rising regulatory expectations in Europe. The market remains moderately consolidated, with players competing on product consistency, absorbency performance, technical support, and long-term supply reliability.

Key Player Analysis

- Imerys S.A.

- Sepiolsa

- Pettex Limited

- Tolsa Group

- Catsan (Owned by Mars, Incorporated)

- Sanicat (Part of Tolsa Group)

- Ever Clean (Owned by Clorox)

- Agrimont SpA

- Tigerino (Zooplus AG brand)

- Europet Bernina International

Recent Developments

- In April 2025, Pettex cat litter and small animal business was acquired by Pets Choice Ltd. (effective 6 April 2025). The acquisition transferred Peter’s bentonite‑based cat litter brands to Pets Choice’s portfolio.

- In February 2025, Clorox expanded its Ever-Clean brand in Europe with Ever Clean Senior Cats Litter, formulated for senior cats with stronger odour control and higher urine absorption, with shipments into European markets starting from April 2025.

- In January 2025, Imerys completed the acquisition of the European diatomite and perlite business of Chemviron (a subsidiary of Calgon Carbon). This gave Imerys three additional mining / industrial assets in France and Italy, boosting its filtration and life‑sciences minerals footprint.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as Europe expands construction, tunneling, and infrastructure projects.

- Cat litter consumption will grow with higher pet ownership and preference for clumping products.

- Environmental rules will push wider use of bentonite in landfill liners and wastewater treatment.

- Foundry and metal casting applications will stay stable with steady automotive output.

- Agriculture will adopt more bentonite-based soil conditioners to manage water stress.

- Producers will invest in higher-purity grades for cosmetics, pharmaceuticals, and food processing.

- Supply chains will strengthen as Europe reduces reliance on imported bentonite.

- Companies will expand engineered blends to meet technical needs in drilling and sealing.

- Digital retail growth will boost sales of bentonite cat litter across major markets.

- Sustainability goals will support long-term adoption of natural and safe mineral-based products.

Market Segmentation Analysis:

Market Segmentation Analysis: