| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Electrophysiology Devices Market Size 2024 |

USD 2,242.82 million |

| Europe Electrophysiology Devices Market, CAGR |

13.5% |

| Europe Electrophysiology Devices Market Size 2032 |

USD 6,161.39 million |

Market Overview

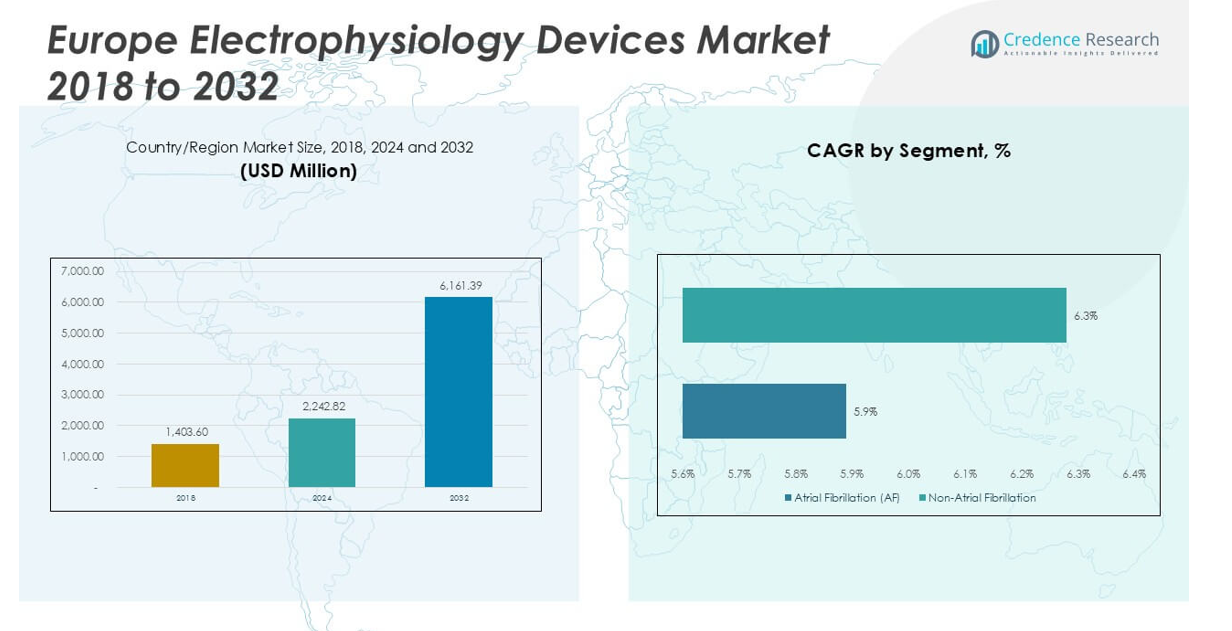

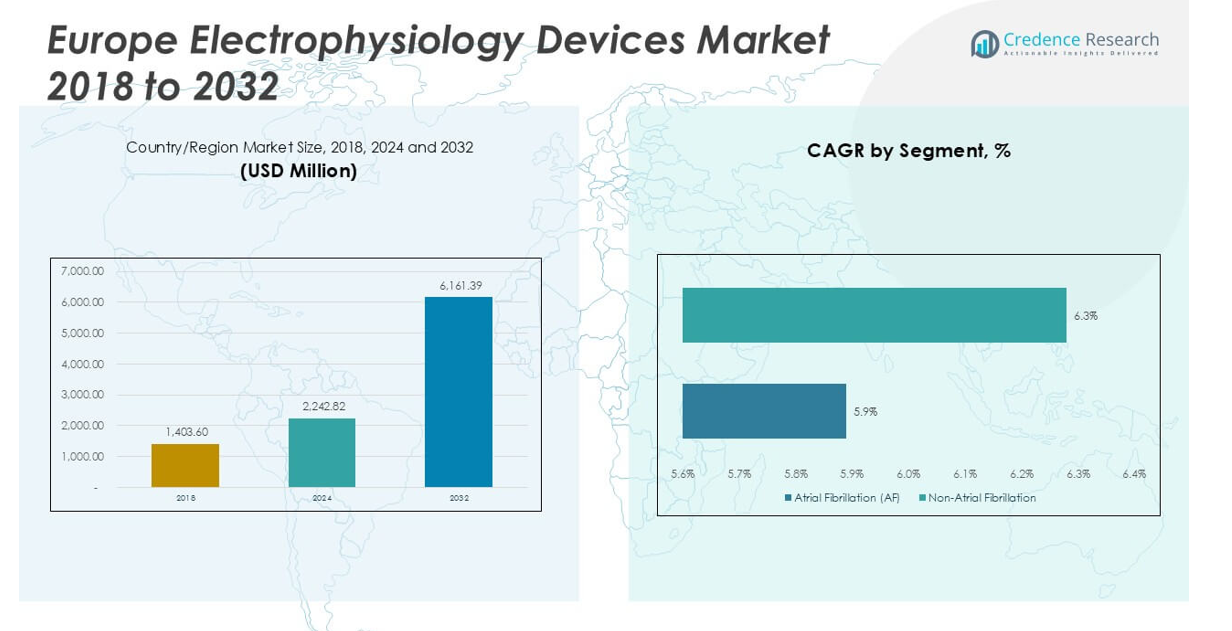

Europe Electrophysiology Devices Market size was valued at USD 1,403.60 million in 2018 to USD 2,242.82 million in 2024 and is anticipated to reach USD 6,161.39 million by 2032, at a CAGR of 13.5% during the forecast period.

Rising prevalence of cardiovascular diseases, increasing geriatric population, and growing awareness regarding early diagnosis are key drivers fueling the Europe Electrophysiology Devices Market. Healthcare providers are investing in advanced diagnostic tools and minimally invasive procedures, which are gaining preference due to reduced recovery times and improved patient outcomes. Continuous technological advancements, such as 3D mapping systems and next-generation ablation catheters, are further accelerating market expansion. Favorable reimbursement policies and expanding healthcare infrastructure across European countries are creating a conducive environment for market growth. The region is also witnessing a surge in research collaborations and strategic partnerships among key players, which is leading to the rapid introduction of innovative devices. Trends such as the integration of artificial intelligence for precise arrhythmia detection and remote patient monitoring solutions are reshaping clinical practice and strengthening market demand, positioning Europe as a prominent region in the global electrophysiology devices landscape.

Geographical analysis of the Europe Electrophysiology Devices Market highlights strong demand in Western European countries, where advanced healthcare infrastructure and a high prevalence of cardiovascular diseases support widespread adoption of innovative electrophysiology technologies. Nations such as Germany, the UK, and France stand out as key hubs for clinical research, investment in minimally invasive procedures, and rapid integration of digital health solutions. These countries drive regional innovation and set benchmarks for the introduction of new devices. Among the leading players, Boston Scientific Corp., Medtronic, and Biosense Webster have established a significant presence through extensive product portfolios, ongoing research initiatives, and collaborations with top medical institutions. Their commitment to product development and clinical excellence continues to shape the competitive landscape and support the market’s robust growth across Europe.

Market Insights

- The Europe Electrophysiology Devices Market is projected to grow from USD 2,242.82 million in 2024 to USD 6,161.39 million by 2032, at a CAGR of 13.5%.

- Rising prevalence of cardiovascular diseases and an aging population are driving increased demand for advanced electrophysiology devices across the region.

- Growing adoption of minimally invasive procedures and integration of artificial intelligence into diagnostics and monitoring are transforming clinical practice.

- Leading companies such as Boston Scientific Corp., Medtronic, and Biosense Webster maintain a competitive edge through innovation, partnerships, and comprehensive product portfolios.

- Stringent regulatory requirements, lengthy approval processes, and disparities in healthcare infrastructure pose challenges to new entrants and market expansion.

- Western European countries like Germany, the UK, and France remain major contributors due to well-developed healthcare systems, high patient awareness, and proactive investment in new technologies.

- Ongoing investments in research, training, and telehealth platforms support the rapid introduction of digital health solutions and next-generation devices, further strengthening the market outlook in Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Incidence of Cardiovascular Diseases and Growing Aging Population Fuel Market Demand

The increasing prevalence of cardiovascular diseases, particularly atrial fibrillation and other arrhythmias, is a primary driver for the Europe Electrophysiology Devices Market. Aging demographics across Europe continue to contribute to a higher patient pool requiring advanced cardiac care and rhythm management solutions. Healthcare providers are recognizing the urgent need for early diagnosis and effective intervention, driving the adoption of innovative electrophysiology devices. Countries such as Germany, France, and the UK are witnessing a notable rise in hospital admissions related to heart rhythm disorders, further intensifying the demand for advanced diagnostic and therapeutic devices. Public health initiatives and awareness campaigns around cardiovascular risk factors are also stimulating market growth by encouraging individuals to seek timely medical attention. The market benefits from an increased focus on preventative healthcare and proactive disease management.

- For instance, atrial fibrillation affects over 11 million Europeans, with projections indicating a 30% increase by 2030 due to aging populations.

Technological Advancements in Electrophysiology Devices Boost Market Expansion

Rapid advancements in medical technology continue to reshape the Europe Electrophysiology Devices Market, enabling the introduction of high-precision mapping systems, enhanced ablation catheters, and smart wearable monitoring devices. Leading manufacturers are investing in research and development to launch next-generation products that offer improved accuracy and patient safety. The integration of digital health tools, such as remote monitoring and AI-based arrhythmia detection, strengthens the clinical value proposition of electrophysiology devices. Hospitals and clinics are embracing these technologies to streamline workflows and optimize patient outcomes. The adoption of minimally invasive procedures reduces hospitalization times, supporting healthcare system efficiency. It accelerates market expansion by addressing the needs of both healthcare providers and patients.

- For instance, hospitals in Europe are increasingly adopting AI-driven electrophysiology solutions to enhance arrhythmia detection and optimize treatment strategies.

Favorable Reimbursement Policies and Expanding Healthcare Infrastructure Support Growth

Supportive reimbursement frameworks in several European countries play a significant role in driving the Europe Electrophysiology Devices Market. National health services and private insurers are broadening coverage for electrophysiology procedures, making advanced diagnostic and treatment options more accessible to a wider population. Governments are investing in the modernization and expansion of healthcare infrastructure, enabling more facilities to offer specialized electrophysiology services. These developments increase the availability of advanced technologies in both urban and rural settings. Favorable reimbursement and infrastructure expansion strengthen market penetration for device manufacturers. The policy environment remains conducive for innovation and adoption.

Strategic Collaborations and Research Initiatives Accelerate Innovation in the Market

Collaboration among hospitals, research institutions, and industry players is a hallmark of the Europe Electrophysiology Devices Market, driving rapid advancements in device development and clinical practice. Research grants, clinical trials, and partnerships help accelerate the introduction of new products and facilitate knowledge exchange. Strategic alliances with technology firms are supporting the integration of artificial intelligence and digital health features into electrophysiology solutions. These partnerships help stakeholders respond swiftly to evolving clinical needs and regulatory requirements. The region’s robust research ecosystem ensures a continuous pipeline of innovation, contributing to Europe’s position as a leader in the global electrophysiology devices industry. It sustains long-term growth and competitiveness for market participants.

Market Trends

Adoption of Advanced Mapping and Imaging Technologies Drives Clinical Precision

The adoption of advanced mapping and imaging technologies is transforming the Europe Electrophysiology Devices Market. High-definition 3D mapping systems and real-time imaging tools allow electrophysiologists to visualize cardiac anatomy and electrical activity with greater accuracy. Clinicians are now able to identify complex arrhythmias more efficiently, leading to improved ablation outcomes and reduced procedure times. Hospitals across Europe are investing in these sophisticated systems to enhance diagnostic capabilities and deliver better patient care. The trend toward higher precision in diagnostics supports the demand for innovative electrophysiology devices. It is setting new standards in clinical practice and procedural success rates.

- For instance, high-resolution 3D mapping systems are being integrated into hospitals across Europe to improve catheter placement accuracy and procedural success rates.

Rise of Minimally Invasive Procedures and Outpatient Care Models

Minimally invasive techniques are gaining traction in the Europe Electrophysiology Devices Market, with a clear shift toward outpatient care models. Catheter-based ablation and advanced mapping technologies enable physicians to treat arrhythmias with smaller incisions, lower complication risks, and quicker patient recovery. Hospitals and ambulatory centers are expanding their electrophysiology service offerings, providing more convenient care options. Patients prefer less invasive procedures that reduce their hospital stay and improve overall experience. This trend is influencing device innovation and design, with manufacturers focusing on user-friendly and patient-centric solutions. It is driving greater acceptance and accessibility of electrophysiology therapies.

- For instance, catheter ablation procedures for atrial fibrillation have increased significantly due to their effectiveness in restoring normal heart rhythm.

Integration of Artificial Intelligence and Digital Health Solutions Reshapes Patient Management

Artificial intelligence and digital health solutions are becoming integral to the Europe Electrophysiology Devices Market, supporting remote patient monitoring and predictive analytics. AI-powered software assists clinicians in detecting subtle arrhythmic events and interpreting complex data sets from implantable devices. Telemedicine platforms are enabling follow-up care outside traditional hospital settings, improving patient compliance and outcomes. Device manufacturers are collaborating with technology firms to embed smart features and connectivity in their products. The move toward digital transformation helps streamline workflows and enhances clinical decision-making. It is redefining the patient journey and standardizing advanced electrophysiology care.

- For instance, stringent approval processes for medical devices in Europe require extensive clinical evidence, leading to prolonged market entry timelines.

Emphasis on Research, Training, and Clinical Collaboration Fuels Continuous Innovation

Continuous innovation in the Europe Electrophysiology Devices Market is supported by an active ecosystem of research, training, and clinical collaboration. Academic hospitals and research institutes are leading multicenter studies to evaluate new devices and optimize procedural techniques. Ongoing educational programs and professional training initiatives ensure that clinicians stay updated with the latest advancements. The market benefits from cross-border collaborations that facilitate the rapid exchange of best practices and research findings. Device manufacturers invest in clinical partnerships to validate technologies and accelerate regulatory approvals. It promotes sustainable growth and maintains Europe’s reputation for medical excellence in electrophysiology.

Market Challenges Analysis

Regulatory Complexity and Lengthy Approval Processes Hinder Market Entry

The regulatory landscape for the Europe Electrophysiology Devices Market presents significant challenges for device manufacturers. Stringent standards and evolving requirements from bodies such as the European Medicines Agency (EMA) and the Medical Device Regulation (MDR) create hurdles in bringing new devices to market. Companies must navigate complex documentation, extensive clinical trial demands, and frequent updates in compliance protocols. The lengthy and costly approval process can delay product launches, impacting innovation cycles and revenue generation. Smaller firms face greater barriers due to limited resources and expertise. It puts pressure on manufacturers to maintain continuous vigilance in quality assurance and regulatory affairs.

Cost Constraints and Disparities in Healthcare Access Limit Adoption

Cost pressures and disparities in healthcare infrastructure across the region affect the widespread adoption of advanced electrophysiology devices. Many hospitals, particularly in Central and Eastern Europe, face budget limitations that restrict investments in state-of-the-art technologies. High upfront costs of equipment and ongoing maintenance create barriers for facilities aiming to expand electrophysiology services. The Europe Electrophysiology Devices Market contends with uneven access to skilled personnel and specialized training, further impacting utilization rates. It can lead to delayed diagnosis and limited availability of cutting-edge therapies for patients in less developed regions. Addressing cost and access issues remains a priority for long-term market growth.

Market Opportunities

Expansion of Remote Monitoring and Telehealth Solutions Opens New Revenue Streams

The rapid expansion of remote monitoring and telehealth solutions creates significant opportunities for the Europe Electrophysiology Devices Market. Healthcare providers are increasingly adopting digital platforms to track patient health outside traditional clinical settings, improving continuity of care for individuals with cardiac arrhythmias. Device manufacturers have the opportunity to develop connected devices that integrate seamlessly with electronic health records and telemedicine infrastructure. It can improve patient outcomes by enabling real-time data sharing and early intervention. Hospitals and clinics benefit from more efficient resource allocation and reduced hospital readmissions. The ongoing shift toward digital health is driving innovation and enabling new business models in electrophysiology.

Rising Demand for Minimally Invasive Procedures in Emerging European Markets

The rising demand for minimally invasive electrophysiology procedures across emerging European markets presents strong growth potential. Countries in Central and Eastern Europe are expanding their healthcare capabilities, creating a favorable environment for the adoption of advanced diagnostic and therapeutic devices. The Europe Electrophysiology Devices Market stands to benefit from investments in modernizing hospital infrastructure and enhancing clinician training. Increased awareness among patients about the benefits of minimally invasive treatments is strengthening market penetration. Strategic partnerships with local healthcare providers can accelerate the introduction of next-generation technologies in these regions. It positions manufacturers to capture untapped demand and reinforce their presence across Europe.

Market Segmentation Analysis:

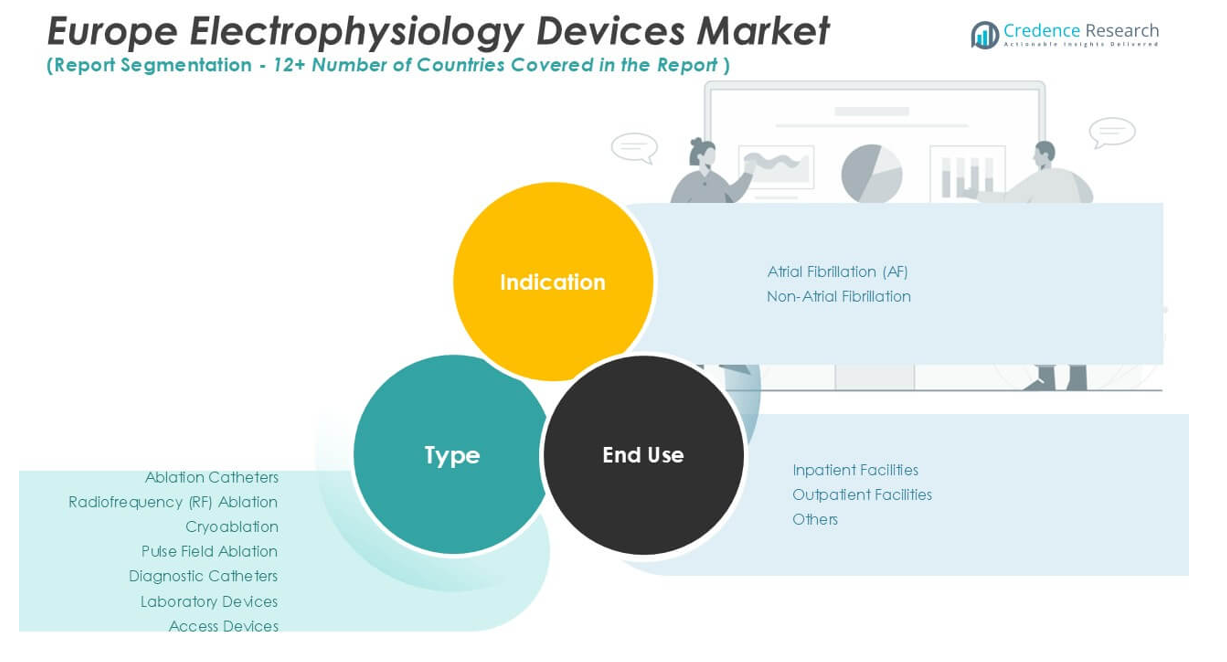

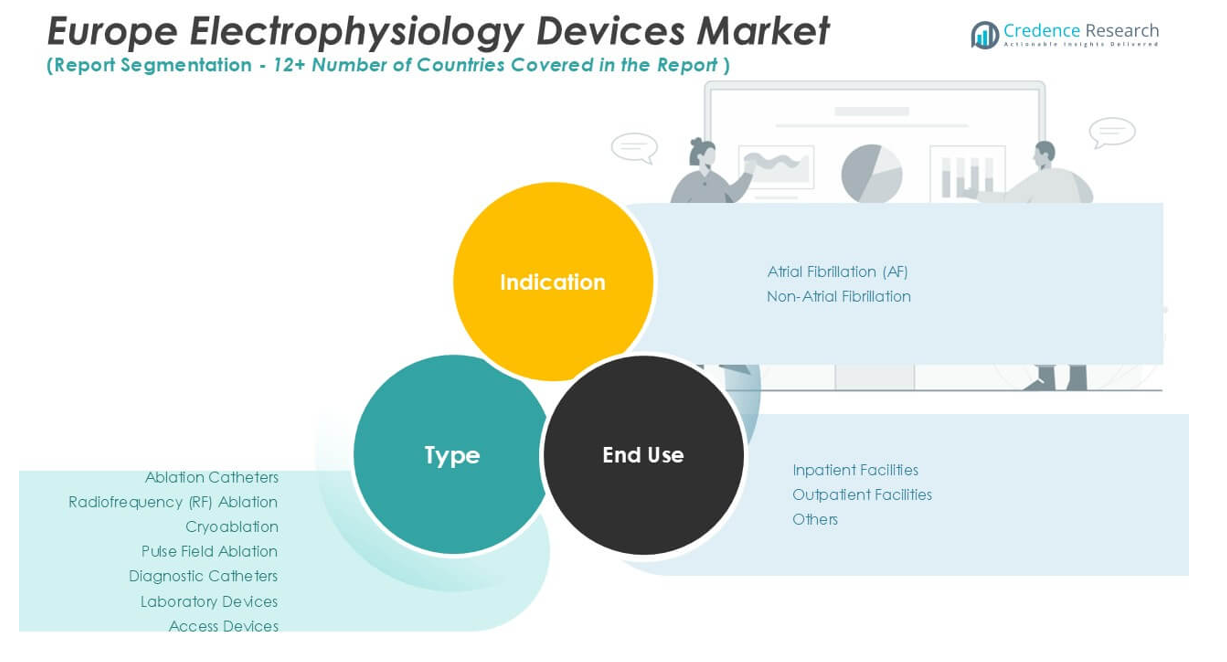

By Type:

Ablation catheters account for a significant share, driven by their widespread adoption in treating complex arrhythmias. The ablation catheters segment further divides into radiofrequency (RF) ablation, cryoablation, and pulse field ablation. RF ablation remains the most commonly used method due to its established efficacy, while cryoablation is gaining traction for its safety profile in specific patient groups. Pulse field ablation represents a newer, innovative technology with the potential to transform treatment protocols. Diagnostic catheters play a vital role in mapping and detecting arrhythmic foci, supporting effective therapy planning. Laboratory devices, which include mapping systems and electrophysiology recording systems, are critical for precise diagnostics and successful ablation outcomes. Access devices facilitate catheter placement and ensure procedural efficiency, contributing to streamlined clinical workflows.

By Indication:

The market divides into atrial fibrillation (AF) and non-atrial fibrillation cases. Atrial fibrillation dominates the Europe Electrophysiology Devices Market due to the rising prevalence of this arrhythmia in the region’s aging population. Growing awareness and early diagnosis of AF drive high demand for both diagnostic and therapeutic electrophysiology solutions. Non-atrial fibrillation indications, including ventricular tachycardia and supraventricular tachycardia, also contribute to market growth, though they represent a smaller segment. Demand for tailored devices designed for non-AF indications is increasing as clinicians seek optimal tools for managing diverse arrhythmic disorders.

By End-Use:

Inpatient facilities such as hospitals and specialty cardiac centers remain the primary consumers of electrophysiology devices in Europe. These settings offer the infrastructure and expertise required for advanced procedures, supporting high-volume utilization of both diagnostic and ablation technologies. Outpatient facilities are emerging as an important segment, fueled by the shift toward minimally invasive procedures and shorter recovery times. Ambulatory centers and specialized clinics are expanding access to electrophysiology services, addressing patient preferences for convenience and lower healthcare costs. The “others” category includes research institutes and academic hospitals engaged in device evaluation and clinical studies. It reflects the growing scope of electrophysiology applications beyond traditional healthcare delivery, supporting market innovation and advancement.

Segments:

Based on Type:

- Ablation Catheters

- Radiofrequency (RF) Ablation

- Cryoablation

- Pulse Field Ablation

- Diagnostic Catheters

- Laboratory Devices

- Access Devices

Based on Indication:

- Atrial Fibrillation (AF)

- Non-Atrial Fibrillation

Based on End-Use:

- Inpatient Facilities

- Outpatient Facilities

- Others

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

United Kingdom

The United Kingdom accounts for 18% of the total Europe Electrophysiology Devices Market, reflecting its leadership in adopting advanced medical technologies and a robust healthcare infrastructure. The UK’s National Health Service (NHS) provides comprehensive cardiac care services, supporting early diagnosis and widespread access to electrophysiology procedures. Strategic investments in research and continuous professional training ensure that healthcare professionals remain updated with the latest device innovations. The country’s focus on minimally invasive interventions and data-driven patient management accelerates demand for ablation and diagnostic catheters. Collaborations between academic institutions, private providers, and medical device manufacturers further reinforce the UK’s prominent market position.

France

France holds a 16% market share in the Europe Electrophysiology Devices Market, supported by its strong public healthcare system and a growing focus on preventative cardiology. French hospitals and cardiac centers are increasing their investments in modern laboratory and mapping equipment, facilitating precise arrhythmia diagnosis and treatment. National initiatives to reduce cardiovascular disease incidence drive the adoption of advanced electrophysiology devices. French manufacturers and research institutes contribute to market innovation, while government reimbursement policies make state-of-the-art therapies accessible to a broad patient base. The demand for catheter-based ablation procedures continues to grow, solidifying France’s status as a major regional market.

Germany

Germany captures the largest share in the region at 21%, making it the leading country in the Europe Electrophysiology Devices Market. Germany’s extensive network of specialized cardiac centers, high volume of cardiac procedures, and continuous investments in healthcare technology create a favorable environment for market expansion. The country’s focus on clinical excellence drives the uptake of next-generation ablation and diagnostic technologies. German hospitals benefit from partnerships with global device manufacturers and active participation in multicenter clinical trials. Strong reimbursement structures and government support for innovation further reinforce Germany’s leading role in the European market.

Italy

Italy represents 9% of the Europe Electrophysiology Devices Market, driven by a rising incidence of arrhythmias and improved access to specialized cardiac care. Italian hospitals and clinics are expanding their capacity to perform both inpatient and outpatient electrophysiology procedures. Increasing awareness among healthcare professionals and patients stimulates the demand for advanced diagnostic and therapeutic solutions. Investment in training and infrastructure supports the growth of minimally invasive electrophysiology services throughout the country. It ensures that Italy remains a key market for device manufacturers looking to strengthen their European presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boston Scientific Corp.

- Medtronic

- Abbott

- Biosense Webster

- Biotronik

- General Electric Company

- Siemens Healthcare AG

- MicroPort Scientific Corporation

- Koninklijke Philips N.V.

- Johnson & Johnson Services Inc.

- Atricure Inc.

- Stereotaxis Inc.

Competitive Analysis

The Europe Electrophysiology Devices Market features a highly competitive landscape dominated by established global players such as Boston Scientific Corp., Medtronic, Abbott, Biosense Webster, Biotronik, General Electric Company, Siemens Healthcare AG, MicroPort Scientific Corporation, Koninklijke Philips N.V., and Johnson & Johnson Services Inc. These companies leverage strong research and development capabilities, extensive product portfolios, and strategic partnerships with leading hospitals and research institutions to reinforce their market positions. Innovation remains a key differentiator, with leading players focusing on advanced mapping systems, minimally invasive ablation technologies, and integrated digital health solutions. Continuous investments in clinical trials and regulatory approvals ensure a steady pipeline of next-generation devices. Companies also pursue collaborations and acquisitions to expand geographic reach and address evolving clinical needs. The emphasis on personalized medicine, remote monitoring, and artificial intelligence integration sets the stage for ongoing product differentiation. Competitive dynamics are further shaped by aggressive marketing strategies and dedicated training programs for clinicians, ensuring widespread adoption of new technologies. These strengths enable the leading players to maintain a significant influence on market direction and growth in the European electrophysiology devices sector.

Recent Developments

- In August 2023, Biosense Webster received approval for various atrial fibrillation ablation products that can be utilized in a workflow without fluoroscopy during catheter ablation procedures.

- In August 2023, Boston Scientific Corporation (US) launched the POLARx cryoablation system. This system is used to treat patients with paroxysmal atrial fibrillation.

- In May 2023 Abbott Laboratories launched the Tactiflex ablation catheter which is sensor-enabled and it is used to treat the most common abnormal heart rhythm.

Market Concentration & Characteristics

The Europe Electrophysiology Devices Market demonstrates a moderate to high level of market concentration, with a few multinational corporations dominating the competitive landscape. It is characterized by a strong focus on innovation, rapid technological advancements, and an emphasis on minimally invasive procedures. Leading companies invest heavily in research and development, enabling the introduction of advanced mapping systems, ablation technologies, and AI-driven diagnostic tools. The market reflects a high degree of regulatory oversight, with strict quality standards influencing product development and market entry. It benefits from a robust network of academic centers, research institutions, and healthcare providers that drive clinical adoption and facilitate continuous training. Product differentiation centers on safety, precision, and digital integration, while the growing demand for remote monitoring and outpatient care shapes ongoing evolution in device design and application.

Report Coverage

The research report offers an in-depth analysis based on Type, Indication, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe electrophysiology devices market is expected to witness steady growth due to the rising prevalence of cardiac arrhythmias.

- Increasing adoption of minimally invasive procedures will continue to support the demand for advanced electrophysiology devices.

- Technological innovations in catheter design and mapping systems are likely to improve procedural efficiency and outcomes.

- Aging population and the associated rise in cardiovascular diseases will drive the long-term market expansion.

- Strategic collaborations among hospitals and device manufacturers are expected to improve access to innovative technologies.

- Growing investment in healthcare infrastructure and electrophysiology labs will support market growth across the region.

- Favorable reimbursement policies in several European countries will encourage the use of electrophysiology procedures.

- Increasing clinical research and trials in the field of electrophysiology will drive the adoption of next-generation devices.

- Market players will likely focus on expanding their regional footprint through mergers, acquisitions, and distribution agreements.

- Rising awareness among physicians and patients regarding the benefits of early diagnosis and treatment will fuel market penetration.