Market Overview:

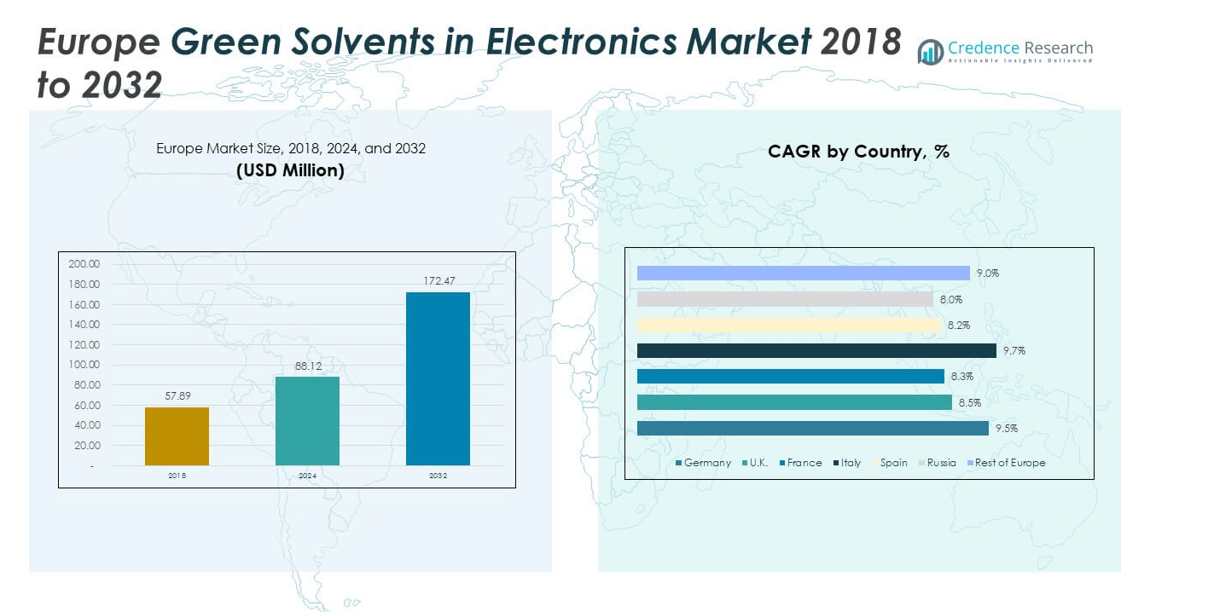

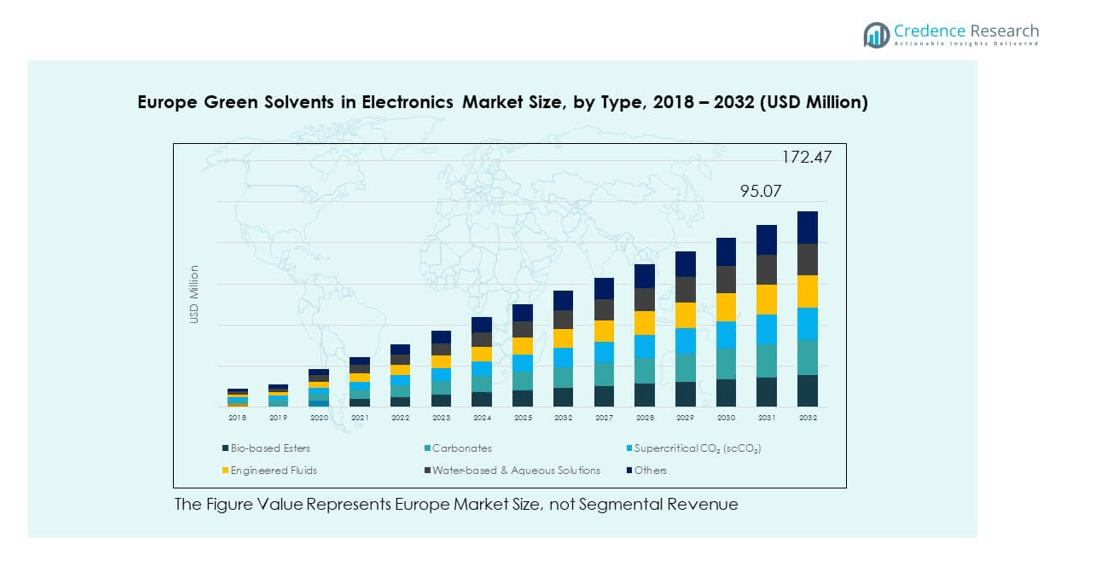

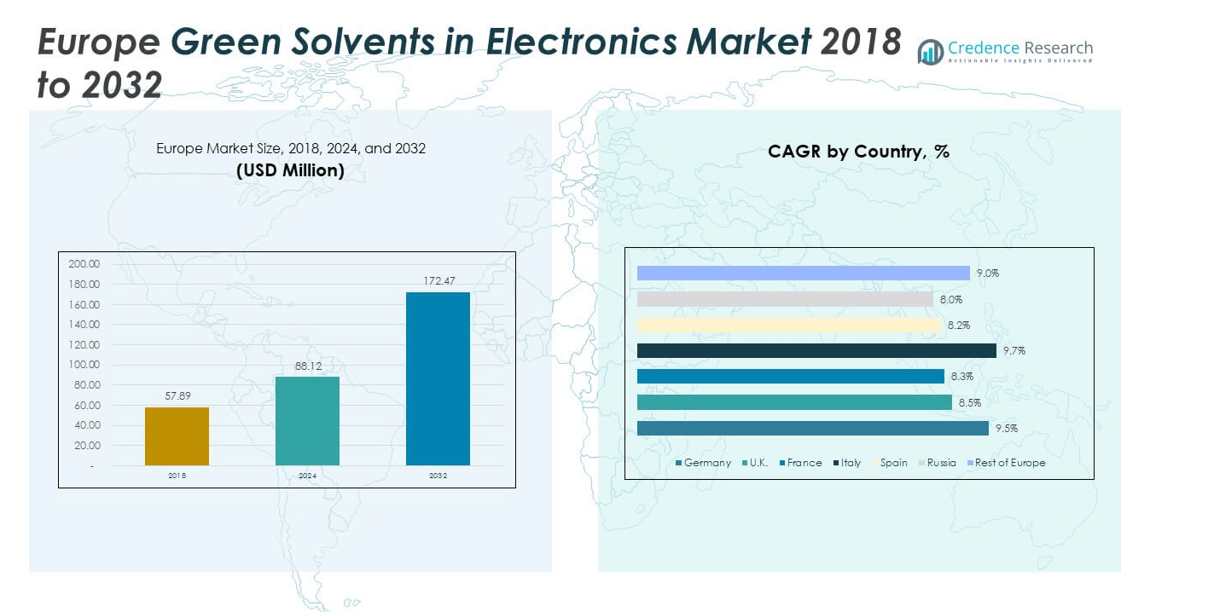

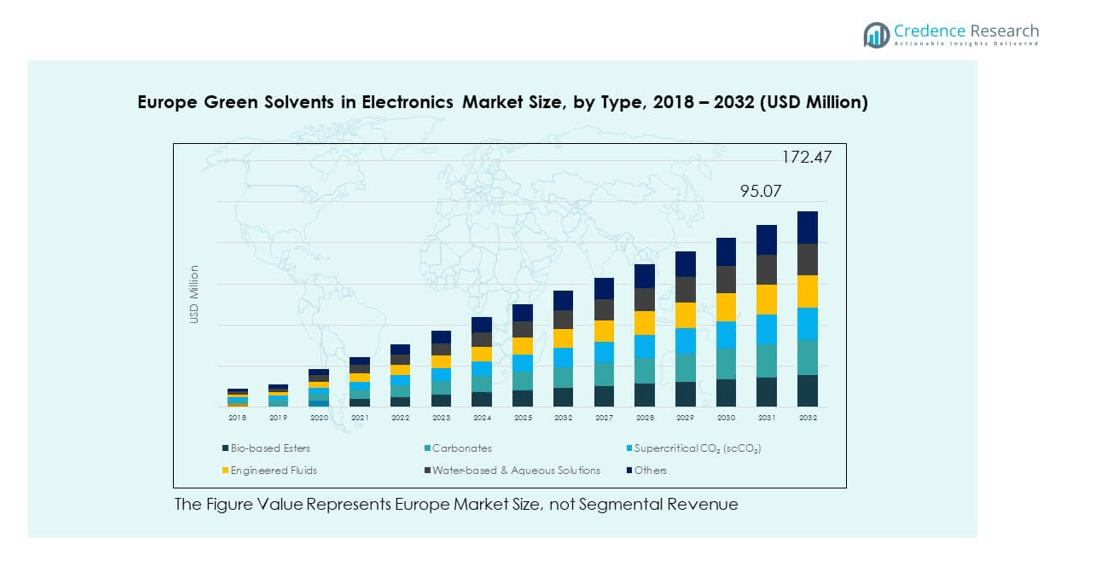

The Europe Green Solvents in Electronics Market size was valued at USD 57.89 million in 2018 to USD 88.12 million in 2024 and is anticipated to reach USD 172.47 million by 2032, at a CAGR of 8.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Green Solvents in Electronics Market Size 2024 |

USD 88.12 million |

| Europe Green Solvents in Electronics Market, CAGR |

8.76% |

| Europe Green Solvents in Electronics Market Size 2032 |

USD 172.47 million |

Rising demand for eco-friendly solvents is driving the market. Electronics manufacturers are increasingly adopting green alternatives to reduce environmental risks, comply with regulations, and meet sustainability commitments. The industry’s push toward energy-efficient devices, advanced semiconductors, and high-performance displays is fueling adoption. Companies are also responding to consumer demand for sustainable electronics, boosting investment in bio-based and low-VOC solvents. Continuous innovations in cleaning, assembly, and precision applications further reinforce demand.

Geographically, Western Europe leads with strong adoption in countries like Germany, France, and the UK, supported by robust manufacturing bases, stringent environmental laws, and sustainability targets. Southern and Eastern Europe show emerging potential due to expanding electronics production hubs and supportive government policies. The Nordic region demonstrates rapid growth, fueled by advanced R&D ecosystems and an early shift to greener technologies, positioning it as a strategic growth zone.

Market Insights:

- The Europe Green Solvents in Electronics Market was valued at USD 57.89 million in 2018, reached USD 88.12 million in 2024, and is projected to hit USD 172.47 million by 2032, growing at a CAGR of 8.76%.

- Western Europe held the largest share at 48% in 2024, followed by Eastern and Southern Europe at 32%, while the Nordic and Rest of Europe contributed 20%, driven by strong regulations, advanced manufacturing, and sustainability programs.

- Asia Pacific is the fastest-growing global region with a share of around 36%, supported by large-scale electronics manufacturing, regulatory reforms, and sustainability-driven demand.

- Bio-based esters accounted for about 34% of the type segment in 2024, leading adoption due to eco-friendly properties and compliance with EU environmental policies.

- Water-based and aqueous solutions represented nearly 27% of the market share, reflecting their strong role in semiconductors, PCB cleaning, and display manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Regulatory Push for Sustainable Chemical Use in Electronics Manufacturing:

The Europe Green Solvents in Electronics Market benefits strongly from strict European Union regulations. Authorities emphasize the replacement of hazardous and volatile solvents with safer, eco-friendly alternatives. Compliance requirements under REACH and RoHS regulations strengthen the adoption of bio-based solvents. Manufacturers face growing pressure to demonstrate sustainable production practices to meet legal and consumer expectations. It is leading to increased R&D spending on safer solvent compositions. Governments also promote subsidies for green technology investments. Industrial players consider compliance a strategic priority. Strong policy backing directly accelerates market penetration across major European countries.

- For instance, In August 2024, BASF announced plans to transition to bio-based ethyl acrylate (EA), sourced from European bioethanol, by the fourth quarter of 2024. This bio-based EA has a certified 40% bio-content and a 30% lower carbon footprint compared to the fossil-based alternative.

Increasing Adoption of Bio-Based Solvents Across Electronics Applications:

Bio-based solvents gain wide acceptance in semiconductor, PCB assembly, and display manufacturing. Their lower toxicity and biodegradability make them suitable for precision processes. Electronics manufacturers integrate such solvents to enhance safety in production environments. Companies recognize that greener solvents support sustainable branding. End users value reduced emissions during production and disposal. Growing awareness among OEMs drives demand for bio-based cleaning and etching solutions. It encourages suppliers to expand product portfolios. Market growth reflects the balance between performance and eco-compatibility.

- For instance, Solvay reported the commercial deployment of its bio-based ester solvent for PCB cleaning, which reduced volatile organic compound emissions by 18% and improved biodegradability, utilized by over 15 semiconductor fabs in Europe as of mid-2025.

Strong Demand for High-Performance Cleaning and Assembly Solutions:

Electronics applications require solvents with high precision, stability, and thermal resistance. Green solvents provide effective cleaning of sensitive microelectronics without damaging materials. PCB assembly relies on advanced solvents to ensure reliable adhesion and insulation. Display manufacturers need solvents with uniform performance across large surfaces. The demand for defect-free components intensifies interest in sustainable yet high-performing options. Manufacturers benefit from reduced worker exposure risks. Green solvents meet both performance benchmarks and health standards. This dual advantage makes them the preferred choice for leading electronics companies in Europe.

Growing Corporate Sustainability Commitments by Electronics Leaders:

Major European and global electronics companies have pledged carbon neutrality targets. These initiatives directly impact supply chain requirements, including solvent selection. Companies prioritize vendors with sustainable product lines. The Europe Green Solvents in Electronics Market grows as multinationals align with ESG reporting obligations. It is shaping procurement strategies, where green solvents secure priority consideration. Industry-wide collaborations between suppliers and manufacturers accelerate technology adoption. Sustainability reporting frameworks encourage transparent use of eco-friendly solvents. The trend boosts long-term market stability and competitive differentiation.

Market Trends:

Expansion of Circular Economy Practices in Electronics Supply Chains:

Circular economy adoption is reshaping how solvents are sourced and reused. Manufacturers invest in solvent recovery systems to minimize waste. Green solvents fit seamlessly into recycling-oriented strategies. Companies highlight solvent recovery as part of broader sustainability goals. It reduces environmental footprints and operational costs. Partnerships with recycling specialists enhance recovery efficiency. The trend creates opportunities for suppliers offering solvents compatible with closed-loop systems. This integration strengthens the long-term relevance of green solvents in electronics.

- For instance, Mirai Intex, in collaboration with Refolution GmbH and HOF SonderanlagenGmbH, deploys advanced solvent recovery systems using distillation and condensation technologies that enable up to 95% solvent reuse efficiency and reduce chemical waste disposal costs by over 90%. These systems also lower volatile organic compound emissions and onsite hazardous waste storage, enhancing environmental safety in electronics manufacturing operations.

Increasing Penetration of Water-Based and Aqueous Cleaning Solutions:

Water-based solvents are gaining traction as safer substitutes in electronics cleaning. They offer reduced toxicity and strong compatibility with sensitive devices. Electronics firms highlight their use in removing flux residues and impurities. Demand rises in PCB assembly lines across Europe. It improves workplace safety by lowering hazardous exposure levels. Suppliers invest in improving aqueous formulations for higher stability. It enables their adoption across wider electronic manufacturing processes. Market expansion reflects rising confidence in water-based solutions.

- For instance, EnviroTech Europe has developed next-generation PFAS-free vapour degreasing solvent cleaners that maintain high-performance precision cleaning with zero ozone depletion potential (ODP) and very low global warming potential (GWP), meeting stringent environmental and safety regulations.

Shift Toward Low-VOC and Ultra-Low Emission Solvents in Manufacturing:

Low-VOC formulations are central to reducing environmental risks. Companies adopt these solvents to meet stringent emission caps. Semiconductor foundries integrate ultra-low VOC solvents to ensure compliance. It supports both occupational safety and global sustainability goals. Suppliers emphasize transparency in VOC levels to win customer trust. Demand is particularly strong in Western Europe, where regulations are strictest. Research focuses on scaling low-emission solvent technologies. The trend strengthens long-term adoption across electronics production units.

Increasing Focus on Specialty Solvents for Advanced Electronics Applications:

Specialty solvents tailored for OLED displays, batteries, and precision microelectronics gain attention. These solvents deliver high selectivity and thermal stability. Manufacturers demand customized formulations for evolving device requirements. Suppliers partner with electronics leaders to co-develop new solvent technologies. It ensures compatibility with next-generation materials. The trend is strongest in Germany, France, and Nordic markets with advanced R&D. Expansion of niche applications sustains premium pricing. Specialty solvent innovation reinforces Europe’s position as a hub for advanced electronics manufacturing.

Market Challenges Analysis:

High Production Costs of Bio-Based and Specialty Solvents Limit Adoption:

The Europe Green Solvents in Electronics Market faces cost challenges due to expensive raw materials. Bio-based and specialty solvents often exceed the cost of conventional options. Small and medium electronics firms find it difficult to justify the premium. Price sensitivity impacts adoption in emerging European markets. Supply chain volatility in bio-feedstocks raises additional risks. It slows down scalability for large-scale adoption. High R&D costs further add to market barriers. Addressing these issues requires strong partnerships and cost-sharing models across the value chain.

Limited Performance Consistency Compared to Conventional Solvents in Some Applications:

Green solvents face challenges in matching the consistency of traditional solvents. In high-performance semiconductor and display manufacturing, minor deviations can cause defects. Manufacturers hesitate to switch when performance risks exist. It creates a gap in full-scale adoption across critical processes. Some green solvents require further optimization to handle advanced applications. Lack of global standardization adds complexity for multinational producers. Performance concerns hinder rapid substitution. Industry players must focus on bridging these reliability gaps through innovation and testing.

Market Opportunities:

Expansion of Electronics Manufacturing Hubs in Emerging European Countries:

The Europe Green Solvents in Electronics Market benefits from new production facilities in Eastern and Southern Europe. Countries expand their manufacturing ecosystems to attract foreign investment. Electronics hubs create demand for sustainable production inputs. Green solvents gain attention as companies aim for compliant operations. Governments offer incentives for sustainable investments. It strengthens demand from PCB and display manufacturers. Emerging hubs provide suppliers with untapped growth avenues. Strategic partnerships ensure strong market penetration.

Rising Integration of Green Solvents in Battery and Energy Storage Production:

Battery production creates a growing demand for safe and efficient solvents. Green solvents align with the industry’s sustainability focus. Their use in electrolyte processing and cleaning supports energy storage development. European initiatives for EV and renewable integration further increase demand. It offers suppliers long-term opportunities to serve high-growth applications. Collaborations with battery makers accelerate adoption. Expansion into this sector diversifies supplier revenue streams. Market opportunities align with Europe’s green energy roadmap.

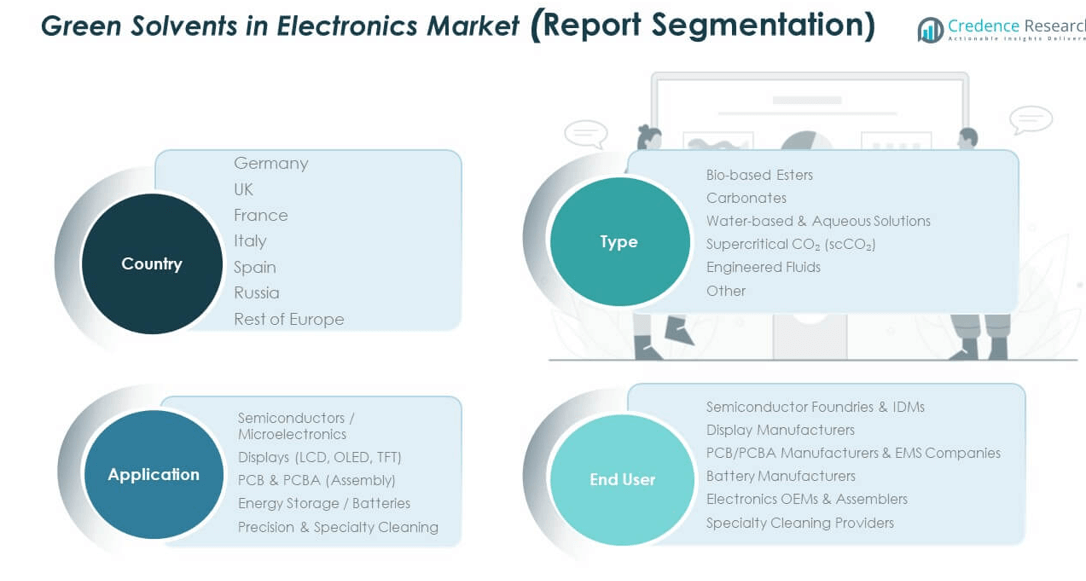

Market Segmentation Analysis:

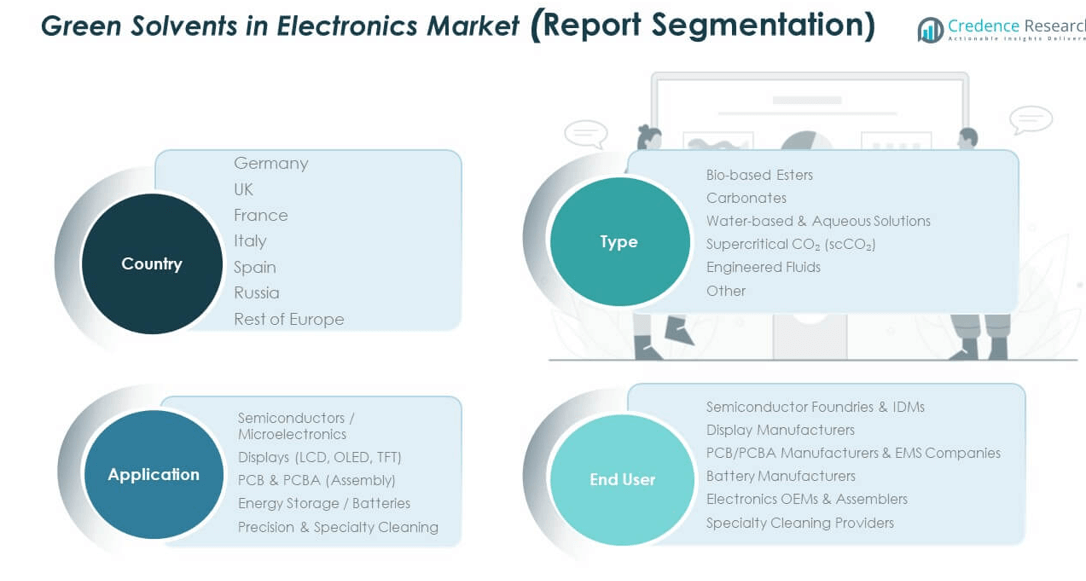

Type

The Europe Green Solvents in Electronics Market includes bio-based esters, carbonates, water-based solutions, supercritical CO₂, engineered fluids, and others. Bio-based esters and aqueous solvents lead demand, favored for safety and environmental compliance. Specialty segments such as engineered fluids support advanced applications like semiconductors and displays.

- For example, Vertec BioSolvents formulates bio-based solvents specifically for electronics cleaning applications, effectively removing residues and contaminants in precision electronic components without compromising component integrity, contributing to manufacturing sustainability.

Application

Applications span semiconductors, displays, PCB/PCBA, batteries, and precision cleaning. Semiconductor and PCB manufacturing remain key drivers due to precision needs, while displays demand solvents with optical consistency. Battery production emerges as a high-growth segment aligned with EV expansion.

- For instance, the European ELIBAMA project enhanced lithium-ion battery manufacturing processes by improving LiTFSI electrolyte salt production, achieving up to 80% battery life improvement and a 7% reduction in full manufacturing costs, reflecting significant advances in eco-friendly electrode and cell manufacturing suitable for electric vehicle batteries.

End-User

End users include semiconductor foundries, display manufacturers, PCB producers, battery makers, OEMs, and specialty cleaning providers. Foundries and IDMs dominate, reflecting strict compliance and performance requirements. Battery manufacturers present rising opportunities due to EV and renewable integration.

Segmentation:

By Type

- Bio-based Esters

- Carbonates

- Water-based & Aqueous Solutions

- Supercritical CO₂ (scCO₂)

- Engineered Fluids

- Others

By Application

- Semiconductors / Microelectronics

- Displays (LCD, OLED, TFT)

- PCB & PCBA (Assembly)

- Energy Storage / Batteries

- Precision & Specialty Cleaning

By End User

- Semiconductor Foundries & IDMs

- Display Manufacturers

- PCB/PCBA Manufacturers & EMS Companies

- Battery Manufacturers

- Electronics OEMs & Assemblers

- Specialty Cleaning Providers

By Country (Europe)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe Dominates with Largest Market Share

Western Europe holds the largest share of the Europe Green Solvents in Electronics Market, commanding nearly 48% in 2024. Strong regulatory frameworks and a focus on sustainable manufacturing practices support adoption in Germany, France, and the UK. These countries lead due to established semiconductor, display, and PCB industries. Companies in this region prioritize eco-friendly processes to align with EU environmental directives. It benefits from advanced R&D facilities and high investments in electronics production. Sustainability-driven procurement practices strengthen market expansion further. The region remains the core hub for green solvent demand in Europe.

Eastern and Southern Europe Emerging as Growth Hubs

Eastern and Southern Europe collectively accounted for around 32% of the market share in 2024. Countries such as Poland, Czech Republic, Italy, and Spain show rising adoption supported by expanding electronics production bases. Governments encourage foreign investment and sustainable technology adoption. It creates opportunities for suppliers targeting PCB, assembly, and specialty cleaning applications. Growth is also reinforced by increasing demand for low-cost manufacturing sites that meet environmental standards. These regions are developing as strong contributors to the future growth of the market. Expanding local ecosystems help balance Europe’s overall production network.

Nordic and Rest of Europe Showcase Rising Potential

The Nordic countries and the Rest of Europe together represented about 20% of the market share in 2024. Nations such as Sweden, Denmark, and Finland lead with early adoption of green technologies. Their advanced R&D ecosystems and sustainability-focused policies drive innovation in solvent applications for semiconductors and batteries. It benefits from collaborations between electronics manufacturers and chemical suppliers. Russia and other smaller European markets also show steady development as electronics capacity grows. Though smaller in scale, these regions are critical for long-term adoption. Their forward-looking policies and clean energy goals reinforce future market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Corbion N.V.

- Musashino Chemical Laboratory

- Vertec BioSolvents Inc.

- Godavari Biorefineries Ltd.

- Galactic

- Yancheng Hongtai Bioengineering Co.

- UBE Corporation

- Shandong Shida Shenghua Chemical Group

- Lotte Chemical

- SABIC

- Huntsman Corporation

- Merck KGaA

- BASF SE

- Dow Inc.

- Other Key Players

Competitive Analysis:

The Europe Green Solvents in Electronics Market features intense competition among multinational chemical producers and regional suppliers. Companies focus on innovation in bio-based and aqueous formulations to gain market differentiation. It emphasizes compliance with EU sustainability regulations, driving investment in R&D. Strategic partnerships between solvent manufacturers and electronics companies strengthen supply reliability. Market leaders expand product portfolios to serve multiple applications, from semiconductors to batteries. Competitive rivalry also revolves around pricing, as cost pressures challenge adoption. Strong emphasis on eco-certification and sustainability branding creates added value. Players consolidate market positions through acquisitions, alliances, and geographic expansions.

Recent Developments:

- Galactic made news in August 2025 by launching the Galactic Games event for its gaming titles, introducing new gameplay mechanics and cosmetic content, signaling continuous product engagement rather than direct green solvents activities.

- UBE Corporation announced in June 2025 that two of its products received the U-BE-INFINITY® eco-product certification, spotlighting its commitment to eco-friendly materials including bio-circular caprolactam and recycled polyamide composites, which contribute to the circular economy and sustainable manufacturing.

- Godavari Biorefineries Ltd. prepared for a significant IPO in October 2024, emphasizing its integrated biorefinery capabilities with ethanol production capacity of 570 KLPD. The proceeds aim to bolster innovation and expansions in bio-based chemical products, reinforcing its market stature in sustainable chemicals.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for eco-friendly solvents in electronics manufacturing.

- Strong regulatory push enhances compliance-driven adoption.

- Bio-based esters expected to dominate type segments.

- Semiconductor and PCB applications remain key demand drivers.

- Battery production creates high-growth opportunities.

- Western Europe maintains leadership in adoption.

- Eastern Europe emerges as a fast-expanding hub.

- Innovation in specialty solvents supports advanced applications.

- Strategic partnerships enhance supply chain stability.

- Sustainability branding strengthens competitive positions.