| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Medical Device Contract Manufacturing Market Size 2024 |

USD 15,155.34 Million |

| Europe Medical Device Contract Manufacturing Market, CAGR |

10.51% |

| Europe Medical Device Contract Manufacturing Market Size 2032 |

USD 33,703.26 Million |

Market Overview

Europe Medical Device Contract Manufacturing Market size was valued at USD 15,155.34 million in 2024 and is anticipated to reach USD 33,703.26 million by 2032, at a CAGR of 10.51% during the forecast period (2024-2032).

The Europe medical device contract manufacturing market is experiencing significant growth, driven by increasing demand for cost-efficient and high-quality manufacturing solutions among OEMs. Rising healthcare expenditure, an aging population, and the growing prevalence of chronic diseases have accelerated the need for advanced medical devices. Additionally, rapid technological advancements, including miniaturization, smart devices, and integration of IoT, are reshaping the manufacturing landscape. Companies are increasingly outsourcing to specialized contract manufacturers to streamline operations, reduce time-to-market, and maintain regulatory compliance. The trend toward value-based healthcare and personalized medicine further supports the shift towards innovative, customized production capabilities. Furthermore, stringent EU regulations, such as MDR, are prompting OEMs to seek partners with proven expertise in regulatory affairs and quality assurance. Together, these factors are fostering a robust and evolving market, with contract manufacturers expanding their capabilities to meet the dynamic needs of the European healthcare sector.

The Europe medical device contract manufacturing market is characterized by a diverse geographical landscape, with key players spread across several major countries. Germany leads the market with its advanced manufacturing capabilities and strong presence of OEMs, followed by the UK, France, and Italy, each contributing significantly to the sector’s growth. The demand for contract manufacturing is also expanding in countries like Spain, Belgium, and the Netherlands, driven by increasing healthcare needs and regulatory advancements. Key players in the market include Freudenberg Medical, Lohmann & Rauscher, SteriPack Group, Creganna Medical, and Nemera, all of which are renowned for their expertise in producing a wide range of medical devices, from simple components to complex systems. These companies leverage their technological innovations, regulatory knowledge, and robust supply chains to cater to the growing demand for high-quality, compliant medical devices in the European region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe medical device contract manufacturing market was valued at USD 15,155.34 million in 2024 and is projected to reach USD 33,703.26 million by 2032, growing at a CAGR of 10.51% from 2024 to 2032.

- The global medical device contract manufacturing market was valued at USD 79,181.52 million in 2024 and is expected to reach USD 1,90,413.88 million by 2032, growing at a CAGR of 11.59% during the forecast period (2024-2032).

- Increasing demand for cost-effective and high-quality manufacturing solutions among OEMs is driving the market.

- Technological advancements, including IoT integration and miniaturization of devices, are reshaping manufacturing processes.

- The shift towards outsourcing production and strategic partnerships is becoming more prominent in the market.

- Regulatory challenges, especially with the implementation of EU MDR and IVDR, are restraining growth and increasing compliance costs.

- Germany, the UK, and France are the leading markets in Europe, with Germany holding the largest market share.

- Key players such as Freudenberg Medical, Lohmann & Rauscher, SteriPack Group, and Creganna Medical are dominating the competitive landscape.

Report Scope

This report segments the Europe Medical Device Contract Manufacturing Market as follows:

Market Drivers

Rising Demand for Cost-Efficient and Scalable Manufacturing

One of the primary drivers of the Europe medical device contract manufacturing market is the increasing demand among original equipment manufacturers (OEMs) for cost-efficient and scalable production solutions. For instance, European medical device companies are increasingly outsourcing production to contract manufacturers to optimize costs and streamline operations. By partnering with contract manufacturers, companies can focus more on core competencies such as research, development, and marketing, while ensuring timely delivery and consistent product quality. Moreover, contract manufacturers provide flexible production capacity, allowing OEMs to quickly scale operations based on market demand without significant capital expenditure.

Technological Advancements and Innovation in Medical Devices

The integration of advanced technologies such as miniaturization, microelectronics, wearable sensors, and Internet of Things (IoT) into medical devices has significantly increased the complexity of manufacturing processes. Many OEMs lack the in-house expertise or resources to manage these innovations effectively. Contract manufacturers are stepping up to fill this gap by investing in cutting-edge technologies, automation, and skilled labor. Their ability to produce highly complex and customized medical devices positions them as valuable partners in the development and production of next-generation healthcare solutions. This technological evolution is pushing more OEMs toward contract manufacturing arrangements to remain competitive.

Stringent Regulatory Landscape and Quality Compliance

The implementation of the European Union Medical Device Regulation (EU MDR) and In Vitro Diagnostic Regulation (IVDR) has heightened the emphasis on product safety, traceability, and clinical evidence. Compliance with these stringent regulations requires deep expertise in regulatory affairs, documentation, and quality assurance. Contract manufacturers that possess well-established quality management systems and proven compliance track records are in high demand. They help OEMs navigate the regulatory landscape efficiently, reduce the risk of non-compliance, and ensure timely product approvals. This regulatory pressure is driving OEMs to collaborate with specialized manufacturers who understand the nuances of European compliance standards.

Aging Population and Rising Chronic Disease Burden

Demographic changes in Europe, particularly the increasing aging population and the rising incidence of chronic diseases such as diabetes, cardiovascular disorders, and cancer, are fueling the demand for advanced and reliable medical devices. For instance, Europe’s aging population has led to increased demand for medical devices that support chronic disease management. This growing healthcare need is prompting OEMs to accelerate the development and production of innovative diagnostic and therapeutic devices. Contract manufacturers play a vital role in supporting this demand by offering end-to-end services, from prototyping to final production, across a wide range of device categories. Their ability to deliver high-quality products at scale enables healthcare providers to meet the needs of patients more effectively, further strengthening the role of contract manufacturing in the European medical device ecosystem.

Market Trends

Shift Towards Outsourcing and Strategic Partnerships

One of the most prominent trends in the Europe medical device contract manufacturing market is the continued shift towards outsourcing production to specialized partners. OEMs are increasingly recognizing the value of leveraging the expertise, resources, and infrastructure of contract manufacturers to optimize their operations. By outsourcing non-core manufacturing processes, OEMs can reduce operational complexity, improve efficiency, and mitigate risks associated with managing production in-house. This trend is particularly strong in small-to-medium enterprises (SMEs) and startups that lack the scale or capital to invest in manufacturing facilities. Strategic partnerships with contract manufacturers provide access to a wealth of knowledge in process optimization, product development, and regulatory compliance, enabling companies to focus on innovation and market growth.

Focus on Regulatory Compliance and Quality Assurance

As the regulatory environment in Europe becomes more stringent with the implementation of the European Union Medical Device Regulation (EU MDR) and In Vitro Diagnostic Regulation (IVDR), ensuring compliance has become a key trend in the medical device manufacturing sector. OEMs are increasingly seeking contract manufacturers with proven expertise in navigating complex regulatory landscapes. These manufacturers must have robust quality management systems and certifications such as ISO 13485 to meet both European and international standards. The focus on quality assurance has led to the development of advanced manufacturing processes, including strict testing protocols and traceability measures. This trend highlights the growing need for contract manufacturers to provide more than just production capabilities, but also regulatory and quality consulting to ensure products meet the highest standards.

Adoption of Advanced Manufacturing Technologies

These technologies are enabling contract manufacturers to produce high-quality medical devices with greater speed, accuracy, and flexibility. For instance, the European medical device sector has embraced 3D printing, automation, and precision engineering to enhance healthcare solutions. The use of 3D printing, for instance, allows for the rapid prototyping of devices, reducing time-to-market and enabling more customized solutions for specific patient needs. Automation is driving cost reductions and efficiency improvements, particularly in mass production, while precision engineering ensures the high tolerance and reliability required for medical devices. As technology continues to advance, contract manufacturers are investing in these innovations to stay competitive and meet the increasingly complex demands of the medical device market.

Shift Towards Personalized Medicine and Customized Solutions

The growing trend towards personalized medicine is influencing the medical device manufacturing sector in Europe. For instance, Europe’s aging population and advancements in biotechnology have led to increased demand for personalized medical devices. With advancements in genomics, biotechnology, and data analytics, there is a shift toward more tailored healthcare solutions that cater to individual patient needs. This shift is leading to a rising demand for customized medical devices, such as implants, prosthetics, and diagnostic tools. Contract manufacturers are adapting to this trend by offering flexible production capabilities that can support small, customized batches of devices while maintaining high quality and regulatory compliance. By offering personalized production solutions, contract manufacturers can meet the evolving needs of the healthcare sector, ensuring that devices are specifically designed to address the unique characteristics of patients, disease conditions, and treatment protocols.

Market Challenges Analysis

Navigating Complex Regulatory Requirements

One of the significant challenges in the Europe medical device contract manufacturing market is the increasingly complex and stringent regulatory environment. The introduction of the EU Medical Device Regulation (EU MDR) and In Vitro Diagnostic Regulation (IVDR) has raised the bar for compliance, requiring manufacturers to adhere to more rigorous safety, quality, and documentation standards. Navigating these evolving regulations demands expertise in regulatory affairs, which can be a resource-intensive process for contract manufacturers. Furthermore, the increased emphasis on traceability, clinical evidence, and post-market surveillance adds additional layers of complexity, making it more difficult for manufacturers to maintain compliance and avoid costly delays. Contract manufacturers must invest heavily in their quality management systems, continuous training, and regulatory consultations to ensure they meet these growing demands while minimizing the risk of non-compliance.

Supply Chain Disruptions and Raw Material Shortages

Shortages of critical raw materials, particularly specialized components for advanced medical devices, have led to production delays and increased material costs. For instance, European medical device manufacturers have faced supply chain disruptions due to global events, including the COVID-19 pandemic and geopolitical tensions. This volatility not only affects production timelines but also impacts the pricing structure, making it more difficult for manufacturers to offer competitive pricing to their clients. Additionally, fluctuations in the availability of skilled labor and the increasing complexity of supply chain management further strain the ability of contract manufacturers to deliver timely, cost-effective solutions. In response, manufacturers are exploring local sourcing options, diversifying their supplier base, and investing in supply chain resilience strategies to mitigate these risks, but uncertainties remain.

Market Opportunities

The Europe medical device contract manufacturing market presents several lucrative opportunities driven by the increasing demand for advanced and cost-effective manufacturing solutions. As the healthcare industry continues to grow, driven by an aging population and rising prevalence of chronic diseases, there is a significant opportunity for contract manufacturers to cater to the growing demand for medical devices. This demand extends across various device categories, including diagnostics, implants, wearables, and surgical instruments. Manufacturers who can offer specialized services such as custom device production, prototyping, and small-scale manufacturing are particularly well-positioned to capitalize on the increasing trend of personalized medicine and tailored healthcare solutions. As more OEMs seek to reduce operational costs and time-to-market, the outsourcing of production to experienced contract manufacturers offers a compelling value proposition.

Furthermore, advancements in manufacturing technologies, such as automation, 3D printing, and precision engineering, are creating new growth opportunities within the market. These technologies enable contract manufacturers to produce high-quality, complex medical devices with improved efficiency and lower production costs. The rising focus on patient-specific solutions further underscores the need for flexible, scalable manufacturing options. Additionally, as the regulatory landscape becomes more stringent with the EU MDR and IVDR, there is a growing demand for contract manufacturers with expertise in navigating compliance and ensuring high-quality standards. Manufacturers who can meet these regulatory demands while providing innovative, cost-effective, and efficient production solutions are well-positioned to capture market share in the rapidly evolving European medical device market. The increasing focus on sustainability, through the use of eco-friendly materials and energy-efficient processes, also offers an opportunity for manufacturers to differentiate themselves in a competitive market.

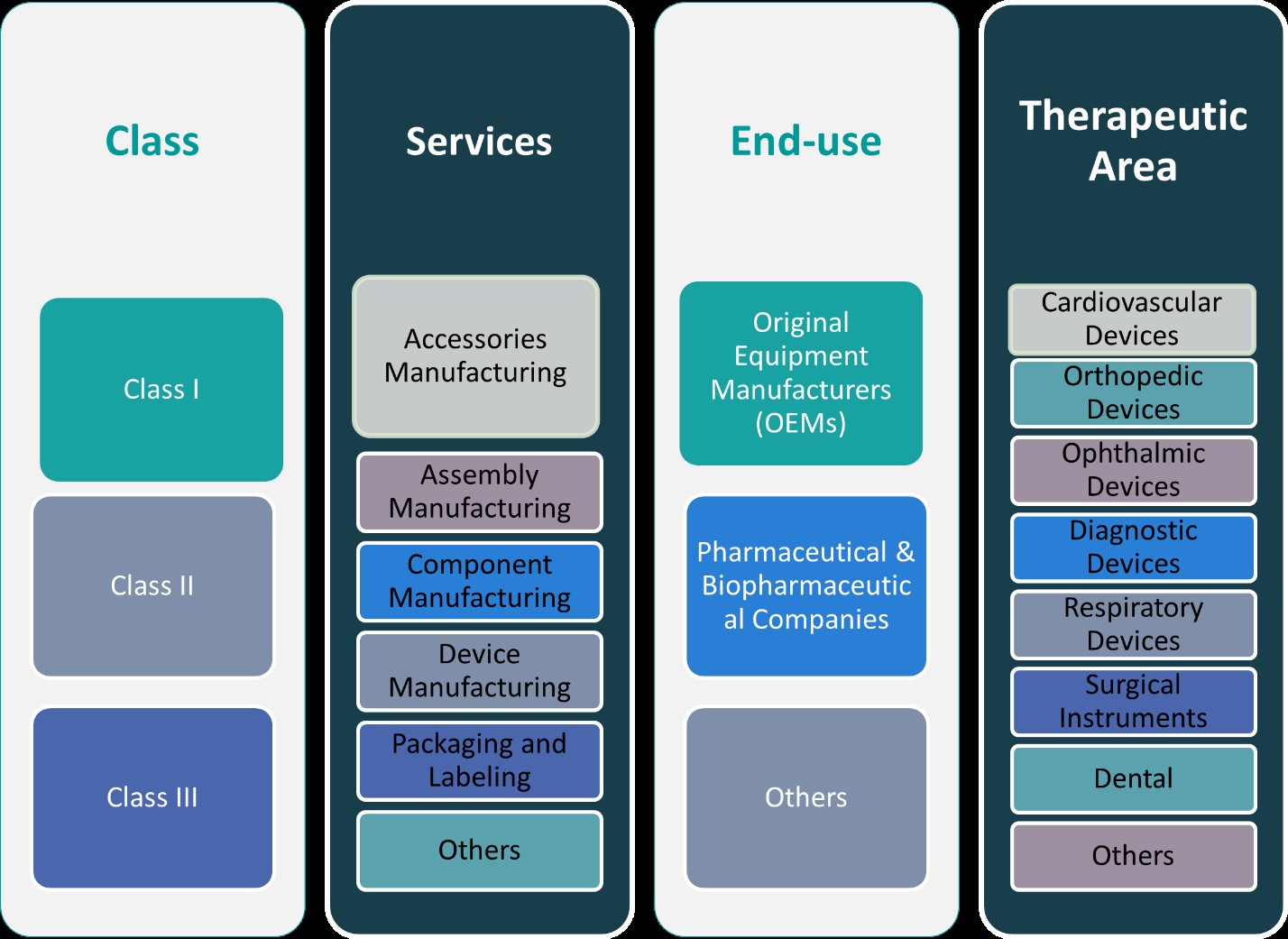

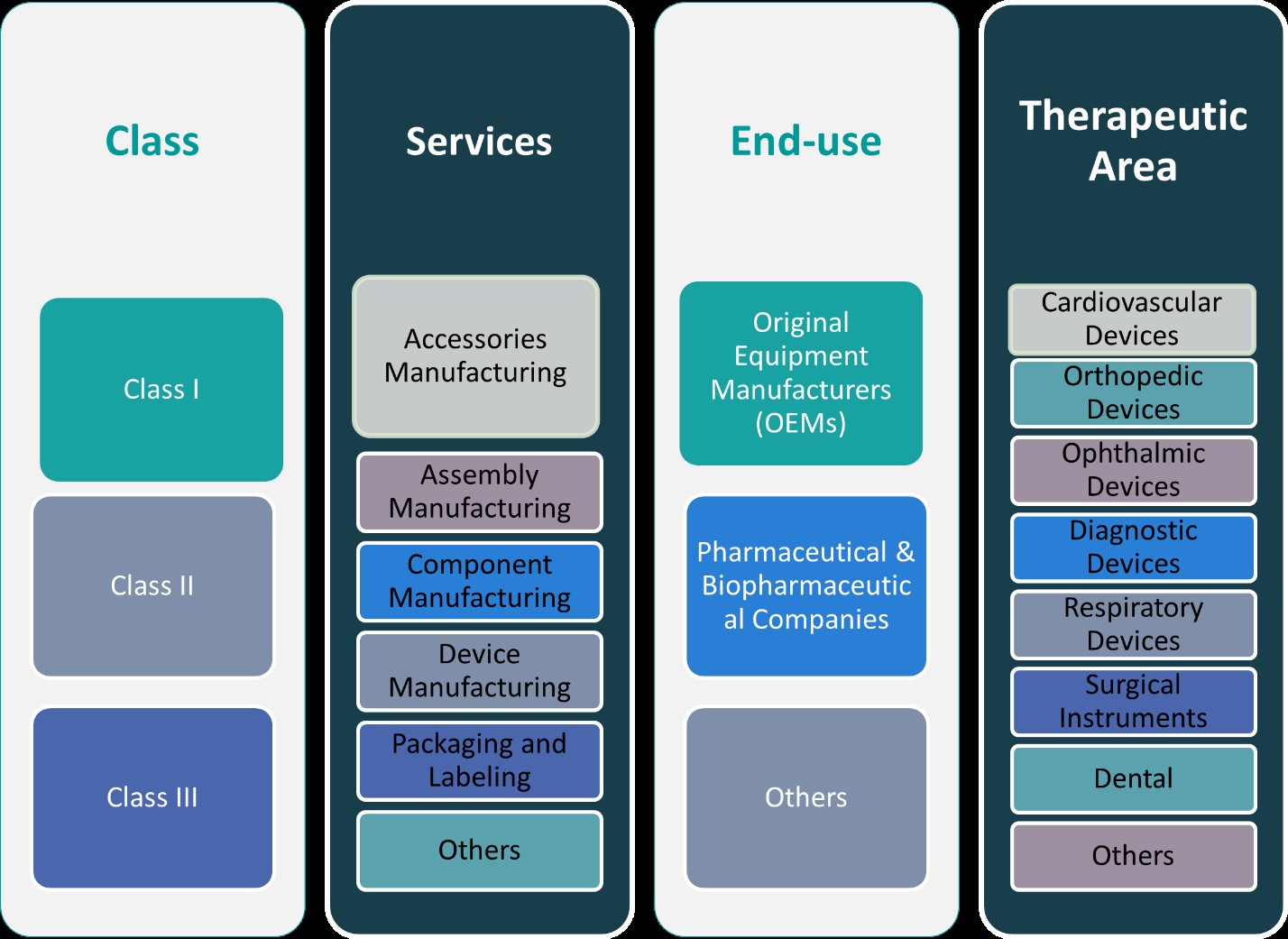

Market Segmentation Analysis:

By Class:

The Europe medical device contract manufacturing market is segmented into three major classes based on device risk and regulatory requirements: Class I, Class II, and Class III devices. Class I devices, which pose minimal risk to patients, represent the largest portion of the market. These devices typically include items like bandages, handheld surgical instruments, and dental instruments, which require basic manufacturing capabilities. Class II devices, such as infusion pumps and diagnostic imaging systems, have moderate risks and require more complex manufacturing processes, including stringent quality control and regulatory compliance. The Class III segment includes high-risk devices like pacemakers, heart valves, and neurostimulators, requiring highly specialized manufacturing capabilities, advanced technology, and extensive regulatory documentation. With growing healthcare demands and advancements in technology, each class presents unique opportunities. Contract manufacturers that can provide tailored solutions across all three classes, from simple accessories to complex devices, are strategically positioned to meet the diverse needs of OEMs in the European market.

By Services:

In addition to class-based segmentation, the European medical device contract manufacturing market is also divided based on services. Key service segments include accessories manufacturing, assembly manufacturing, component manufacturing, device manufacturing, packaging and labeling, and others. Accessories manufacturing involves producing supplementary components such as straps, grips, and covers for medical devices. Assembly manufacturing focuses on assembling multiple parts into finished medical devices, ensuring functionality and precision. Component manufacturing, which is essential for high-quality devices, includes the production of individual parts like sensors, circuits, and connectors. Device manufacturing involves end-to-end production of finished medical devices, incorporating all necessary components and ensuring compliance with regulatory standards. Packaging and labeling, a critical service segment, ensures that medical devices meet industry-specific standards for protection, handling, and traceability. Other services include testing, sterilization, and regulatory consulting. As OEMs seek more specialized services, the demand for comprehensive contract manufacturing solutions, encompassing multiple service segments, continues to grow in Europe.

Segments:

Based on Class:

- Class I

- Class II

- Class III

Based on Services:

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Packaging and Labelling

- Others

Based on End- Use:

- Original Equipment Manufacturers (OEMs)

- Pharmaceutical & Biopharmaceutical Companies

- Others

Based on Therapeutic Area:

- Cardiovascular Devices

- Orthopedic Devices

- Ophthalmic Devices

- Diagnostic Devices

- Respiratory Devices

- Surgical Instruments

- Dental

- Others

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

UK

The UK holds a significant share of the Europe medical device contract manufacturing market, accounting for approximately 18% of the total market. As one of the largest healthcare markets in Europe, the UK benefits from a robust healthcare system, advanced technological infrastructure, and a strong demand for innovative medical devices. The growing need for cost-effective and high-quality manufacturing solutions, particularly in the fields of diagnostics and surgical instruments, has driven the growth of the contract manufacturing sector. Additionally, the UK’s established regulatory framework, alongside favorable research and development policies, has further bolstered its position in the market. Despite challenges posed by Brexit, the UK remains a crucial hub for medical device production, attracting both domestic and international OEMs seeking contract manufacturing services.

Germany

Germany is another key player in the European market, holding the largest market share at approximately 25%. Known for its advanced engineering and manufacturing capabilities, Germany has established itself as the leading country in the European medical device sector. The demand for high-quality medical devices such as diagnostic imaging systems, implants, and surgical instruments continues to rise, contributing to the growth of contract manufacturing services. Germany’s well-developed healthcare infrastructure, strong emphasis on innovation, and comprehensive regulatory standards make it an attractive destination for both contract manufacturers and OEMs. The presence of several global medical device companies also drives the country’s market leadership, fostering both local and international business partnerships.

France

France represents a significant portion of the European medical device contract manufacturing market, contributing around 14% of the market share. France benefits from a strong medical device industry driven by a large domestic market and government investments in healthcare infrastructure. The country’s demand for advanced medical devices, particularly in the fields of diagnostic equipment and implantable devices, has led to increased reliance on contract manufacturing. France’s emphasis on regulatory compliance and quality standards ensures that contract manufacturers operate in alignment with European Union regulations. Additionally, the country’s central location within Europe enhances its logistical advantages, making it an attractive option for OEMs looking to streamline their manufacturing and distribution processes.

Rest of Europe

The Rest of Europe, which includes countries like Italy, Spain, Russia, Belgium, and others, collectively holds around 43% of the market share. Italy and Spain are notable contributors, with Italy’s strong tradition in manufacturing and innovation supporting its medical device contract manufacturing sector. Russia, despite facing economic and political challenges, remains a growing market with increasing demand for medical devices. Belgium and the Netherlands are also vital players, known for their highly developed healthcare systems and regulatory expertise. The Rest of Europe has a diverse and dynamic market, with each country offering unique strengths in terms of manufacturing capabilities, access to talent, and regulatory expertise. This region is expected to witness steady growth, driven by the increasing demand for advanced, high-quality medical devices and growing outsourcing trends among OEMs.

Key Player Analysis

- Freudenberg Medical

- Lohmann & Rauscher

- SteriPack Group

- Creganna Medical

- Nemera

Competitive Analysis

The competitive landscape of the Europe medical device contract manufacturing market is shaped by several leading players, each specializing in different aspects of the manufacturing process. Freudenberg Medical, Lohmann & Rauscher, SteriPack Group, Creganna Medical, and Nemera dominate the market by offering a diverse range of services, from component manufacturing to complete device assembly and packaging. These companies leverage their advanced technological capabilities, extensive regulatory knowledge, and robust supply chains to meet the growing demand for high-quality medical devices. These players differentiate themselves through their technological capabilities, including precision molding, automation, and advanced production systems that ensure high-quality, reliable medical devices. Many companies in the market are focusing on niche areas such as drug delivery systems, diagnostic devices, and complex components like catheters and surgical instruments. To stay competitive, contract manufacturers are increasingly investing in advanced manufacturing technologies such as 3D printing, IoT integration, and automated assembly, which enhance product accuracy, reduce time-to-market, and lower production costs. Additionally, with the growing complexity of medical devices, companies are placing a strong emphasis on regulatory expertise and compliance with stringent European standards, including the EU Medical Device Regulation (EU MDR). The market also sees fierce competition in terms of supply chain management, where companies are looking for ways to enhance flexibility, reduce lead times, and maintain cost efficiency. Moreover, companies are increasingly focusing on providing end-to-end solutions, which include not only manufacturing but also services like packaging, labeling, and sterilization, to cater to the diverse needs of OEMs and ensure customer satisfaction.

Recent Developments

- In February 2025, Jabil completed the acquisition of Pii, a contract development and manufacturing organization (CDMO) specializing in aseptic filling, lyophilization, and oral solid dose manufacturing.

- In November 2024, Integer completed the sale of its non-medical Electrochem business for $50 million, making it a pure-play medical technology company and allowing it to redeploy capital into high-growth medtech markets.

- In October 2024, At CPHI Milan 2024, Thermo Fisher launched its Accelerator Drug Development platform, a 360° CDMO and CRO offering. This service provides customizable manufacturing, clinical research, and supply chain solutions for small molecules, biologics, and cell and gene therapies, covering the full drug development lifecycle.

Market Concentration & Characteristics

Market concentration in Europe’s medical device contract manufacturing sector is influenced by a few key players who dominate the industry, establishing significant control over production processes. Large multinational corporations, alongside specialized contract manufacturers, hold substantial market shares, contributing to higher levels of consolidation. This concentration fosters competitive pricing, streamlined supply chains, and enhanced economies of scale, benefiting both manufacturers and end-users. However, it can also result in reduced market entry opportunities for smaller players. Key characteristics of this market include stringent regulatory requirements, advanced technological capabilities, and a growing demand for customized solutions. Companies are increasingly focusing on innovation, particularly in areas such as automation, digitalization, and product development, to stay ahead in a highly competitive landscape. Additionally, contract manufacturers are diversifying their services, offering integrated solutions that span design, development, and regulatory compliance to meet the evolving needs of medical device companies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Class, Services, End-Use, Therapeutic Area and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for outsourced manufacturing in Europe’s medical device industry is expected to grow due to increased regulatory complexity and cost pressure on OEMs.

- Automation and digitalization will play a key role in improving production efficiency and reducing time-to-market for medical devices.

- Companies will increasingly adopt Industry 4.0 technologies to enhance manufacturing processes, ensuring higher precision and scalability.

- There will be a continued focus on compliance with strict EU medical device regulations, driving investments in quality management systems.

- The trend towards personalized and customized medical devices will lead to more contract manufacturers offering tailored solutions.

- Sustainability and eco-friendly manufacturing practices will become a priority, with companies seeking to reduce their environmental footprint.

- Strategic partnerships between contract manufacturers and device developers will grow to optimize the R&D-to-production pipeline.

- Increased outsourcing to Europe from non-EU countries is likely due to the region’s robust regulatory framework and manufacturing expertise.

- The shift toward minimally invasive and wearable devices will require specialized manufacturing capabilities and advanced technologies.

- Competition will intensify as more players enter the market, pushing for innovation, cost-efficiency, and faster time-to-market solutions.