Market Overview

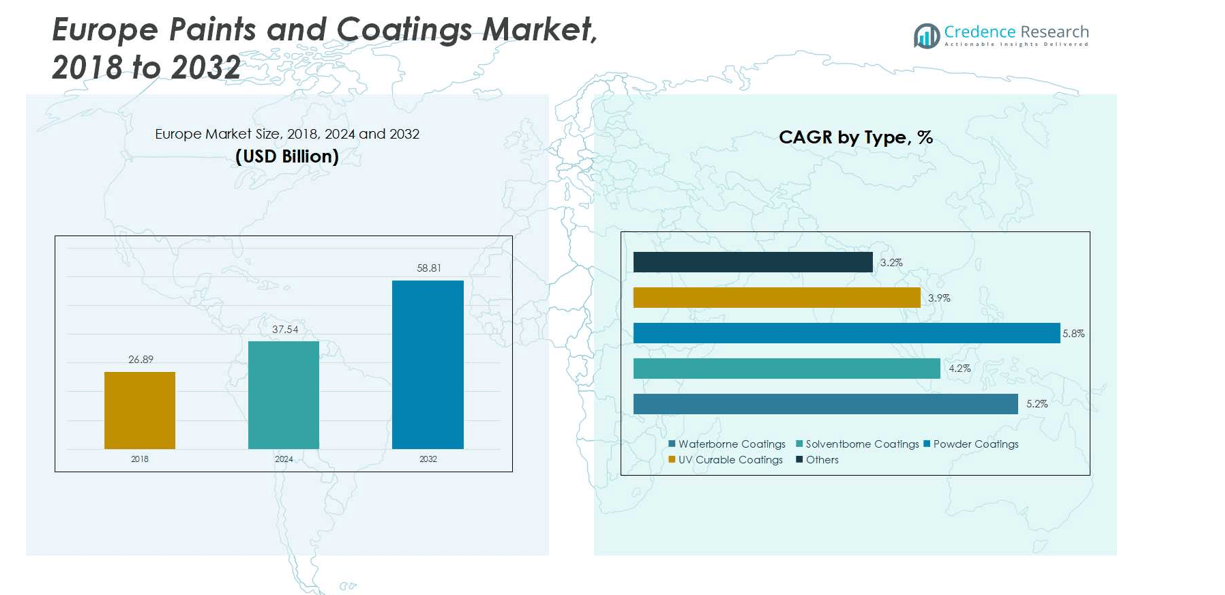

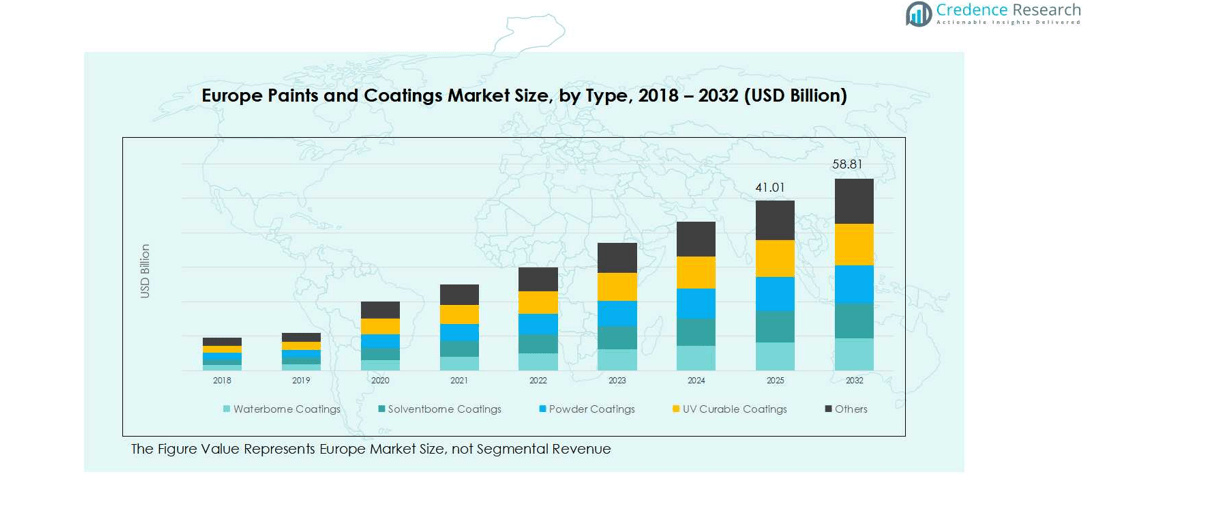

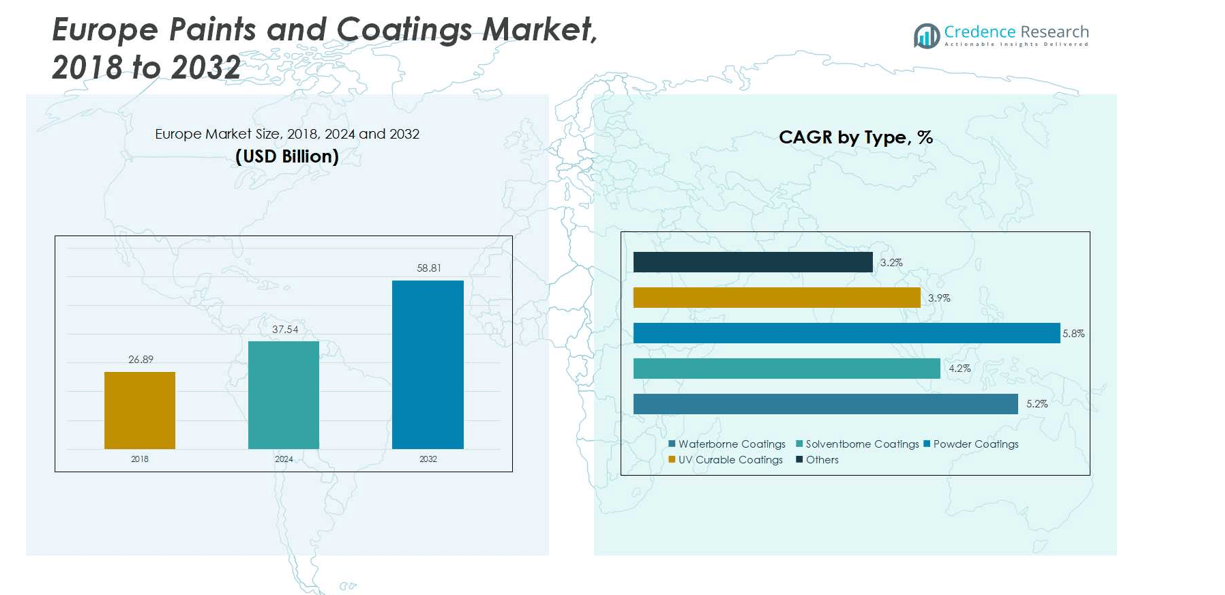

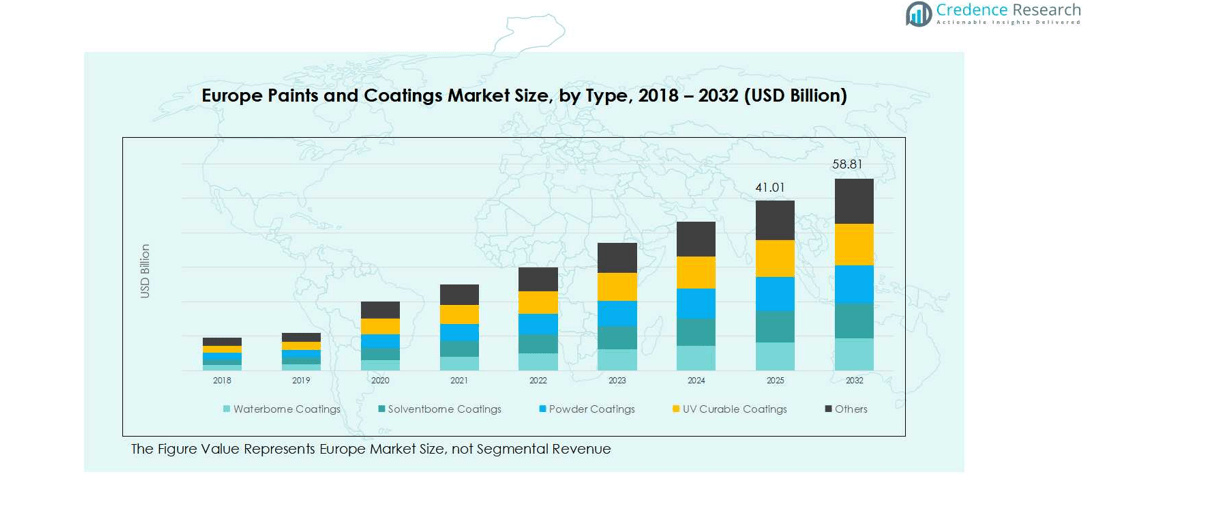

Europe Paints and Coatings Market size was valued at USD 41.78 billion in 2018 and is estimated to reach USD 61.50 billion in 2024, further projected to attain USD 106.48 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Paints and Coatings Market Size 2024 |

USD 61.50 billion |

| Europe Paints and Coatings Market, CAGR |

6.6% |

| Europe Paints and Coatings Market Size 2032 |

USD 106.48 billion |

The competitive landscape of the Europe Paints and Coatings Market is led by major players such as Akzo Nobel N.V., BASF SE, PPG Industries, The Sherwin-Williams Company, RPM International Inc., Axalta Coating Systems, Kansai Paint Co., and Jotun A/S. These companies focus on product innovation, eco-friendly formulations, and regional expansion to strengthen their market positions. Akzo Nobel N.V. and BASF SE hold a prominent presence across multiple European countries through advanced R&D capabilities and sustainable coatings portfolios. Regionally, Germany dominates the market with a 22% share in 2024, driven by strong industrial production, rising construction projects, and technological advancements in coating materials.

Market Insights

- The Europe Paints and Coatings Market was valued at USD 61.50 billion in 2024 and is projected to reach USD 106.48 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

- Market growth is driven by increasing construction activities, rising automotive production, and the growing adoption of sustainable, low-VOC coatings across the region.

- The market trend is shifting toward waterborne coatings, which accounted for nearly 45% of the total share in 2024, supported by stricter EU environmental regulations and the demand for green building materials.

- Leading players such as Akzo Nobel N.V., BASF SE, and PPG Industries dominate the competitive landscape through continuous product innovation and expansion in high-growth sectors like infrastructure and industrial coatings.

- Regionally, Germany held the largest share at 22% in 2024, followed by the UK and France, reflecting strong industrial output and increasing renovation projects in residential and commercial construction

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

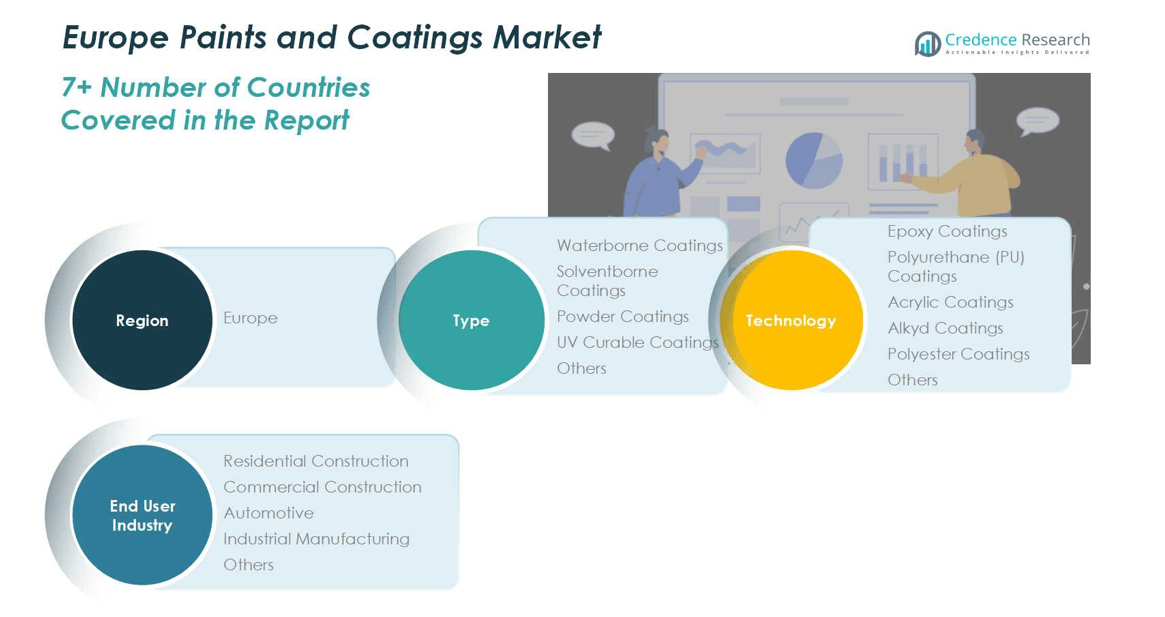

Market Segmentation Analysis:

By Type:

In the Europe Paints and Coatings market, waterborne coatings dominate the segment, holding a market share of around 45% in 2024. Their popularity stems from low VOC emissions, environmental compliance, and superior durability compared to solventborne coatings. Increasing adoption in architectural and industrial applications drives growth, supported by stringent EU environmental regulations. Powder coatings follow closely due to their minimal waste generation and high application efficiency. Meanwhile, UV curable coatings are gaining traction in furniture and packaging industries for their quick curing and energy-efficient performance.

- For instance, AkzoNobel launched a waterborne basecoat called Sikkens Autowave Optima for vehicle repairs in 2025, which reduces process time by up to 50% and lowers carbon emissions by up to 60%, enhancing both efficiency and sustainability in bodyshops.

By Technology:

Among technologies, acrylic coatings account for the largest market share of approximately 38% in the Europe paints and coatings landscape. These coatings offer excellent color retention, weather resistance, and versatility across construction and automotive sectors. Polyurethane (PU) and epoxy coatings also hold significant shares due to their superior chemical resistance and mechanical strength, essential in industrial and protective applications. Alkyd and polyester coatings cater to niche applications where cost-effectiveness and decorative appeal are key, while continuous R&D is enhancing their performance in harsh environments.

- For instance, BASF’s Joncryl acrylic coatings are widely used in automotive refinishing due to their fast drying and durability in varied climates.

By End-User Industry:

The residential construction segment leads the Europe paints and coatings market with a share exceeding 40%, fueled by rising renovation activities and growing urban housing demand. Increased investment in energy-efficient and aesthetic home designs supports the uptake of waterborne and acrylic coatings. The commercial construction sector follows, driven by office and retail infrastructure development. Automotive coatings contribute a notable portion, emphasizing advanced formulations for corrosion resistance and finish quality. Industrial manufacturing and other sectors further enhance market demand through growing adoption of functional and protective coatings in machinery and equipment.

Key Growth Drivers

Rising Construction and Infrastructure Development

Rapid urbanization and large-scale infrastructure investments across Europe are driving significant demand for paints and coatings. Residential and commercial construction projects increasingly prioritize energy-efficient and durable coatings for protection and aesthetics. Countries such as Germany, France, and the UK are investing in smart city projects and renovation of aging infrastructure, boosting the adoption of waterborne and acrylic coatings. The shift toward sustainable housing materials further supports market expansion, as consumers and builders favor eco-friendly products with long-lasting finishes.

- For instance, PPG Industries introduced waterborne automotive finishes in Germany that enhance durability while meeting EU Green Deal standards and reducing carbon footprints.

Growing Automotive and Industrial Applications

The automotive and industrial manufacturing sectors represent crucial growth areas for the Europe paints and coatings market. Automotive refinishing and OEM coatings demand advanced polyurethane and epoxy formulations that offer superior resistance to corrosion and UV degradation. Similarly, industrial applications require coatings that enhance machinery longevity and surface protection. The adoption of automation and robotics in production processes has also led to increased use of high-performance coatings, ensuring better efficiency, durability, and compliance with stringent EU safety and emission standards.

- For instance, companies like BASF and PPG develop specialized solvent-borne coatings for robotic systems that withstand extreme mechanical stress and ensure precise application, supporting compliance with stringent EU safety and emission standards.

Environmental Regulations Encouraging Sustainable Formulations

Strict environmental policies set by the European Union are pushing manufacturers toward low-VOC and water-based coatings. These regulations have spurred innovation in bio-based and UV-curable coatings that reduce carbon footprints while maintaining performance. Major companies are investing in R&D to develop sustainable alternatives to solventborne coatings, leading to higher market penetration of eco-friendly options. This regulatory-driven transformation is fostering long-term growth by aligning with Europe’s broader sustainability objectives and consumer preference for green construction materials and coatings solutions.

Key Trends & Opportunities

Technological Advancements in Smart and Functional Coatings

The emergence of smart coatings featuring self-healing, anti-microbial, and thermal insulation properties is creating new opportunities in the European market. These advanced coatings are gaining adoption in automotive, aerospace, and construction applications where performance and safety are critical. Nanotechnology and digital color-matching systems are further revolutionizing product development. European manufacturers are increasingly integrating AI and IoT in coating formulations and quality control, ensuring consistent application and improved sustainability, opening new prospects for high-value, performance-oriented coatings.

- For instance, BASF Coatings has introduced the ScanR spectrophotometer in its digital color-matching platform, delivering the fastest and most precise color identification with automatic vehicle recognition and real-time scratch detection, optimizing paint matching in automotive refinishing.

Expansion of Sustainable and Bio-Based Coatings

Growing awareness of environmental impacts has fueled the shift toward bio-based and recyclable coating materials. Consumers and industries alike are prioritizing coatings with minimal solvent content and reduced carbon emissions. Companies are capitalizing on this trend by launching eco-labeled products and partnering with green chemistry innovators. This trend not only meets regulatory requirements but also provides a competitive edge in branding and customer loyalty. The demand for sustainable coatings is expected to remain strong, creating lasting growth opportunities across Europe’s diverse end-use industries.

- For instance, AkzoNobel developed RUBBOL WF 3350, a waterborne wood coating featuring 20% bio-based content, which maintains high durability without compromising performance.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material costs, particularly for resins, pigments, and solvents, continues to challenge manufacturers in Europe. These materials are often derived from petrochemical sources, making their prices susceptible to global oil market fluctuations. The rising cost of bio-based alternatives also puts pressure on production margins. Manufacturers face difficulty maintaining price stability while ensuring consistent quality, leading many to adopt strategic sourcing and supply chain optimization to mitigate risks and sustain profitability amid volatile input costs.

Stringent Environmental and Safety Regulations

While regulations promote sustainability, they also pose challenges in product development and compliance. The European Chemicals Agency (ECHA) and REACH directives enforce rigorous standards on volatile organic compounds (VOCs) and hazardous chemicals, requiring constant reformulation. These compliance demands increase R&D costs and extend product development cycles. Smaller and mid-sized enterprises often struggle to meet these evolving standards due to limited technical expertise and financial capacity. As a result, market consolidation and partnerships are becoming common strategies to navigate the regulatory landscape effectively.

Regional Analysis

United Kingdom

The United Kingdom holds a market share of 18% in the Europe paints and coatings market, driven by steady growth in residential renovation and commercial infrastructure projects. Demand is rising for eco-friendly, waterborne, and low-VOC coatings as sustainability regulations tighten. The automotive refinish segment also contributes notably due to the country’s strong vehicle maintenance and aftermarket sector. Increasing consumer preference for high-performance decorative paints and advancements in digital color-matching technologies are supporting product innovation. Continuous investments in smart cities and infrastructure refurbishment further reinforce the country’s leadership in sustainable coatings adoption.

France

France accounts for a market share of 16% in the European paints and coatings market, supported by robust demand from the construction and automotive sectors. The government’s initiatives to enhance energy efficiency in buildings have accelerated the adoption of waterborne and UV-curable coatings. Growth in the renovation of historic structures also drives demand for premium decorative paints. France’s strong manufacturing base and focus on eco-label certifications are propelling innovation in bio-based coating solutions. The presence of leading multinational producers enhances the country’s competitive advantage in both decorative and industrial coating applications.

Germany

Germany dominates the European paints and coatings market with a market share of 22%, backed by its advanced automotive, industrial, and construction sectors. High-quality standards and emphasis on sustainable production have made Germany a hub for technological innovation in coatings. The country’s push for energy-efficient buildings and electric vehicles supports the shift toward waterborne and powder coatings. Strong R&D investment from domestic and international manufacturers is leading to breakthroughs in corrosion-resistant and functional coatings. Germany’s well-established industrial infrastructure continues to make it the key growth engine for the regional market.

Italy

Italy captures a market share of 12% in the Europe paints and coatings market, driven by vibrant residential and commercial construction activities. Growing demand for aesthetic and durable finishes in interior decoration fuels sales of decorative coatings. The automotive sector also contributes significantly, particularly through refinishing applications and OEM production. Italian manufacturers are focusing on sustainable and VOC-compliant coatings to align with EU green policies. Increasing renovation of heritage buildings and tourism-related infrastructure further stimulates demand for high-quality architectural coatings, positioning Italy as a vital market within Southern Europe.

Spain

Spain holds a market share of 10% in the European paints and coatings market, with growth supported by ongoing residential projects and tourism-driven commercial construction. The shift toward eco-friendly materials has encouraged the adoption of waterborne coatings across both decorative and industrial segments. The Spanish automotive aftermarket and marine industries also create consistent demand for corrosion-resistant coatings. Government efforts to promote sustainable urban development and refurbish public spaces continue to drive steady consumption. Local producers are increasingly investing in R&D and partnerships to expand their product portfolios and enhance competitiveness.

Russia

Russia commands a market share of 9% in the Europe paints and coatings market, primarily driven by industrial and infrastructure development projects. Domestic demand is fueled by the need for protective coatings in the oil and gas, automotive, and heavy machinery sectors. Despite geopolitical and economic challenges, the market remains resilient due to growing local manufacturing capabilities. Russian producers are increasingly adopting waterborne and powder technologies to meet international standards. Expansion in residential housing construction, combined with a rising preference for long-lasting coatings, is gradually transforming the competitive landscape in this region.

Rest of Europe

The Rest of Europe region, encompassing smaller markets such as the Netherlands, Poland, and Nordic countries, collectively holds a market share of 13%. Growth is fueled by rapid urbanization, smart city projects, and strong demand for green building materials. Northern European countries, in particular, emphasize eco-friendly coatings and advanced formulations suited for harsh climatic conditions. Industrial growth in Eastern Europe supports the uptake of protective coatings for manufacturing and energy applications. The increasing presence of multinational players and technological collaborations are further enhancing market penetration across these emerging European economies.

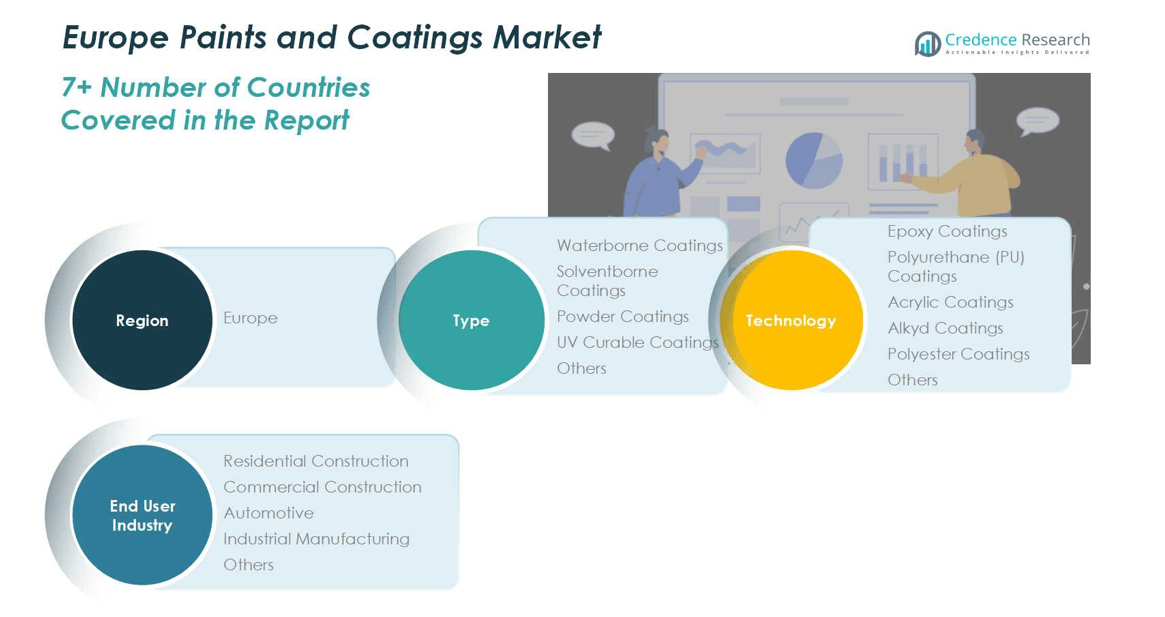

Market Segmentations:

By Type

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- UV Curable Coatings

- Others

By Technology

- Epoxy Coatings

- Polyurethane (PU) Coatings

- Acrylic Coatings

- Alkyd Coatings

- Polyester Coatings

- Others

By End-User Industry

- Residential Construction

- Commercial Construction

- Automotive

- Industrial Manufacturing

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe paints and coatings market is defined by the presence of major players such as Sherwin-Williams Company, Akzo Nobel N.V., PPG Industries, BASF SE, RPM International Inc., Asian Paints Limited, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Axalta Coating Systems, and Jotun A/S. These companies maintain strong market positions through continuous product innovation, sustainability initiatives, and strategic acquisitions. Leading players are investing heavily in waterborne and bio-based coating technologies to meet stringent EU environmental standards. Mergers, partnerships, and capacity expansions remain key growth strategies, allowing firms to strengthen distribution networks and enhance regional reach. Local manufacturers are also gaining traction by offering cost-effective and customized coating solutions tailored to specific industrial and architectural needs. The competitive environment emphasizes innovation in eco-friendly formulations, smart coatings, and performance-driven technologies, reflecting the market’s transition toward sustainable and high-performance materials across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sherwin-Williams Company

- Akzo Nobel N.V.

- PPG Industries, Inc.

- BASF SE

- RPM International Inc.

- Asian Paints Limited

- Nippon Paint Holdings Co., Ltd.

- Kansai Paint Co., Ltd.

- Axalta Coating Systems

- Jotun A/S

Recent Developments

- On October 14, 2025, Roquette unveiled its enhanced Health & Pharma Solutions division at CPhI Frankfurt. This move follows its acquisition of IFF Pharma Solutions and the integration of Qualicaps, positioning Roquette as a comprehensive partner in excipients, capsules, APIs, and drug delivery technologies.

- On June 3, 2025, US-based telehealth company Hims & Hers announced the acquisition of London-based Zava, a telehealth provider serving over 1.3 million patients annually across the UK, Ireland, Germany, and France.

- On October 9, 2025, Revelation Pharma announced the acquisition of Acacia Apothecary & Wellness, a respected compounding pharmacy serving the Tucson, Arizona community.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe paints and coatings market will continue to expand with rising demand from the construction and automotive sectors.

- Sustainable and low-VOC coatings will dominate future product innovations across the region.

- Waterborne coatings will gain stronger adoption due to stricter environmental regulations.

- Increasing renovation and restoration projects will boost decorative coatings demand.

- Technological advancements in smart and self-healing coatings will create new growth avenues.

- Bio-based raw materials will become a key focus for manufacturers pursuing green chemistry.

- The industrial manufacturing segment will drive demand for high-performance protective coatings.

- Strategic mergers and acquisitions will enhance market consolidation and regional competitiveness.

- Expansion in digital color technologies will improve customization and consumer engagement.

- Rising infrastructure investments and smart city developments will sustain long-term market growth across Europe.