Market Overview:

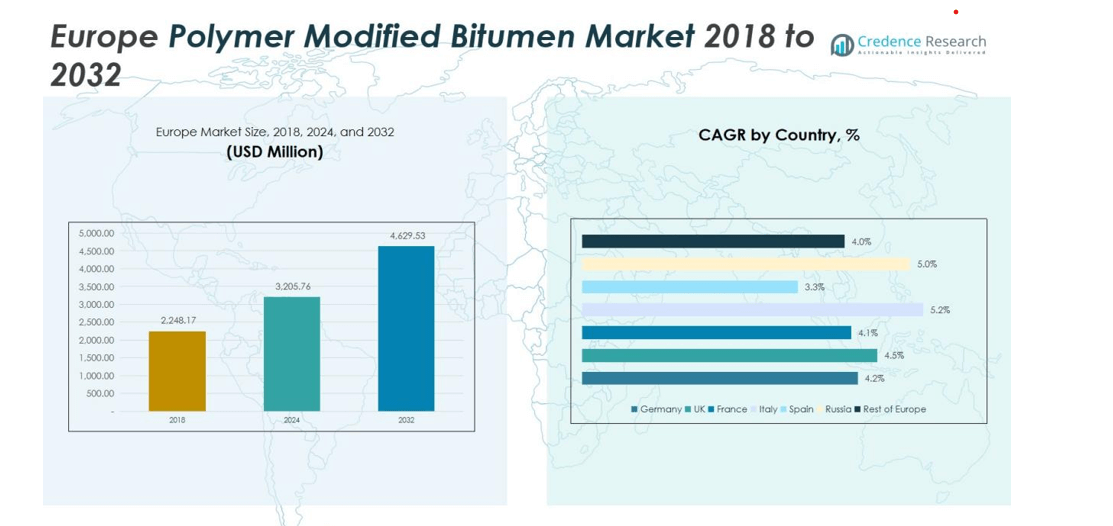

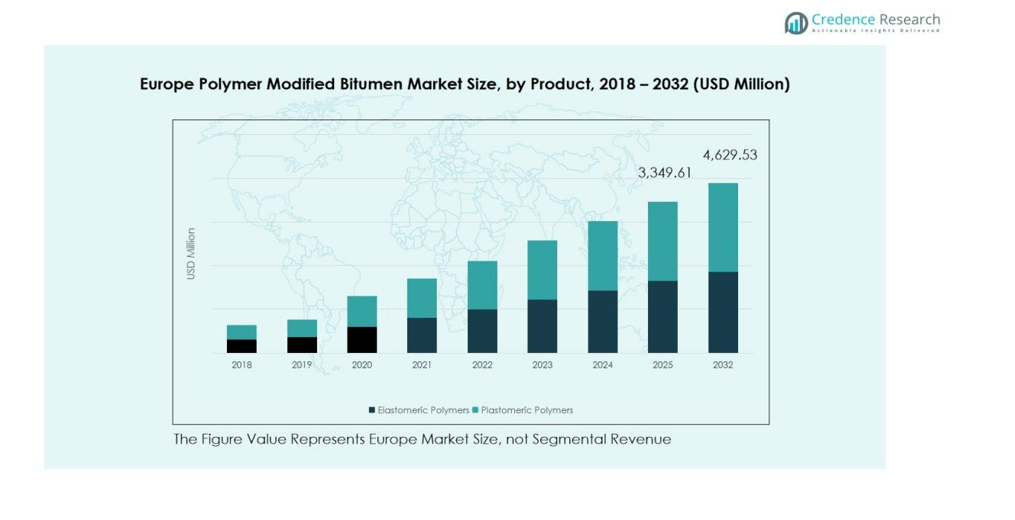

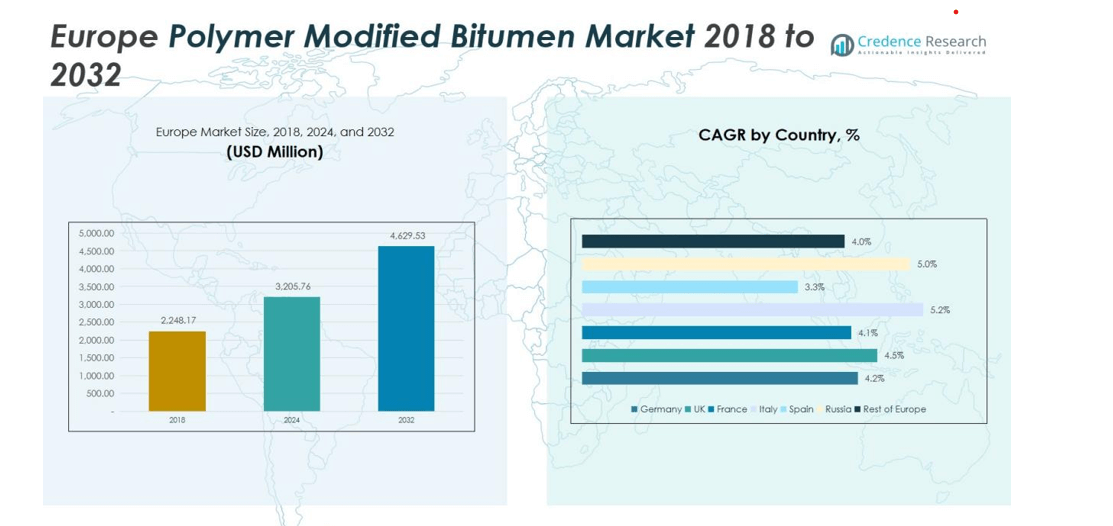

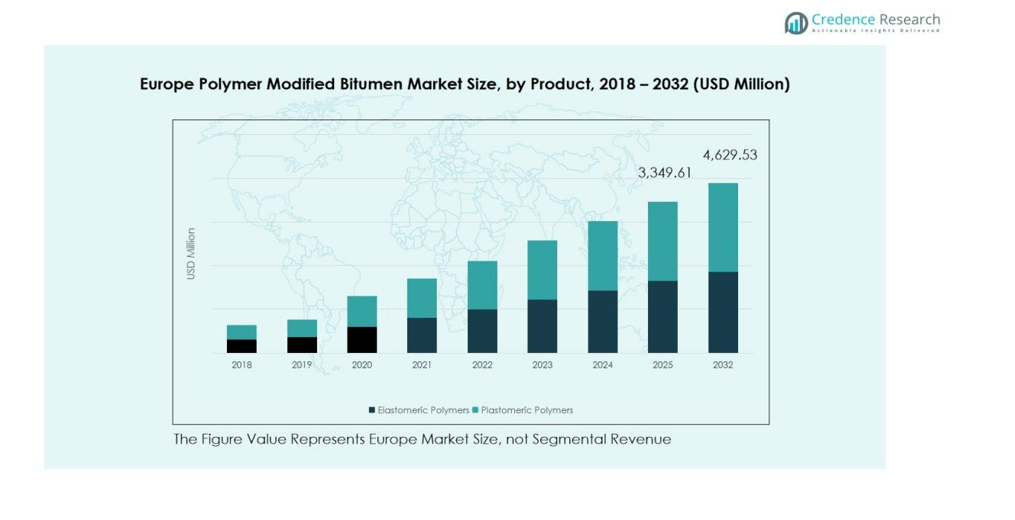

The Europe Polymer Modified Bitumen Market size was valued at USD 2,248.17 million in 2018 to USD 3,205.76 million in 2024 and is anticipated to reach USD 4,629.53 million by 2032, at a CAGR of 5.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Polymer Modified Bitumen Market Size 2024 |

USD 3,205.76 million |

| Europe Polymer Modified Bitumen Market , CAGR |

5.34% |

| Europe Polymer Modified Bitumen Market Size 2032 |

USD 4,629.53 million |

Rising environmental concerns and the shift toward sustainable construction materials also support the market growth. Polymer modified bitumen offers enhanced flexibility, temperature resistance, and durability compared to traditional asphalt, reducing maintenance costs and improving performance in varying climates. The growing adoption of modified bitumen in roofing, waterproofing, and industrial applications further expands its market reach across the region.

Regionally, Western Europe dominates the Europe Polymer Modified Bitumen Market due to extensive infrastructure networks in Germany, France, and the United Kingdom. Central and Eastern European countries are emerging as high-growth markets, supported by EU-funded development projects and expanding road connectivity. Northern Europe also shows strong potential driven by strict environmental standards and increased use of eco-friendly polymer additives in construction applications.

Market Insights:

- The Europe Polymer Modified Bitumen Market was valued at USD 2,248.17 million in 2018, reached USD 3,205.76 million in 2024, and is projected to reach USD 4,629.53 million by 2032, growing at a CAGR of 5.34% during the forecast period.

- Western Europe holds the largest share of 46%, driven by major infrastructure investments in Germany, France, and the United Kingdom. Central and Eastern Europe account for 31%, supported by EU-funded highway and logistics projects, while Northern Europe holds 15%, boosted by sustainability-focused construction standards.

- Central and Eastern Europe represent the fastest-growing region with a 6.1% CAGR, fueled by expanding road networks, industrial zones, and public–private infrastructure partnerships.

- By product, elastomeric polymers dominate with a 58% share, led by strong use of SBS and SBR materials for road and bridge construction.

- By application, road construction contributes 64% of total revenue, driven by long-term maintenance programs and national infrastructure modernization across major European economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Infrastructure Development and Road Modernization Projects

The Europe Polymer Modified Bitumen Market benefits from large-scale infrastructure investments across the continent. Countries such as Germany, France, and the United Kingdom are expanding road networks, airports, and urban transport systems. Governments emphasize high-performance materials for longer-lasting pavements, which drives the use of polymer-modified bitumen. It offers superior elasticity, load-bearing capacity, and resistance to deformation under heavy traffic. This growing focus on long-term infrastructure durability continues to strengthen market growth.

- For instance, Germany’s Federal Road and Transportation Research Association published the TL Bitumen-StB 25 technical standards in 2025, establishing updated specifications for polymer-modified bitumen that incorporate European norms DIN EN 14023 to ensure enhanced flexibility and resistance to deformation across national road construction projects.

Rising Preference for Sustainable and Eco-Friendly Construction Materials

Sustainability trends are reshaping the Europe Polymer Modified Bitumen Market, with policymakers encouraging the use of recyclable and low-emission materials. Polymer-modified bitumen supports reduced maintenance frequency, which lowers lifecycle emissions and costs. The incorporation of eco-polymers and bio-based additives aligns with the European Green Deal objectives. It helps reduce environmental impact while improving pavement performance under diverse weather conditions. This shift toward green infrastructure enhances adoption across public and private sectors.

- For instance, Arkema developed Cecabase RT additives containing surfactants that are 50% bio-based, enabling asphalt production and application at temperatures up to 50°C cooler than standard processes.

Enhanced Performance Characteristics of Polymer-Modified Bitumen

The Europe Polymer Modified Bitumen Market gains momentum from its superior mechanical and thermal properties compared to conventional bitumen. It offers higher resistance to cracking, rutting, and temperature fluctuations, ensuring better road safety and longer service life. The material’s flexibility and adhesion improve waterproofing and resilience in roofing and industrial applications. It also reduces repair costs, making it a cost-effective solution for long-term infrastructure projects. The consistent performance advantage drives widespread industry preference.

Expanding Industrial and Residential Construction Activities

Urbanization and industrial expansion across Europe are stimulating the demand for polymer-modified bitumen. The construction of commercial complexes, logistics hubs, and housing projects requires durable materials for waterproofing and insulation. The Europe Polymer Modified Bitumen Market benefits from this rise in construction spending. It provides versatile applications in pavements, roofing, and bridge decks, supporting performance under heavy load and temperature stress. The surge in construction activity is a key factor fueling market expansion.

Market Trends:

Adoption of Advanced Polymer Technologies and Performance-Enhancing Additives

The Europe Polymer Modified Bitumen Market is witnessing a steady shift toward advanced polymer technologies that enhance elasticity, durability, and temperature tolerance. Manufacturers are integrating styrene-butadiene-styrene (SBS), ethylene-vinyl-acetate (EVA), and crumb rubber polymers to achieve superior performance under heavy traffic and extreme climates. These materials improve bonding with aggregates and extend pavement life while reducing cracking and rutting. It is also driving interest in nanotechnology and reactive polymers for optimized mechanical strength and adhesion. Producers are investing in research and development to customize formulations that meet regional weather and traffic conditions. This trend is strengthening product differentiation and creating new opportunities for specialized bitumen solutions across infrastructure and roofing applications.

- For instance, Kraton Corporation launched the CirKular+ Paving Circularity Series in April 2025, enabling asphalt mixes to incorporate 50% or more reclaimed asphalt content in surface layers while maintaining performance standards.

Rising Focus on Circular Economy and Sustainable Infrastructure Development

Sustainability goals are reshaping the Europe Polymer Modified Bitumen Market, with emphasis on recycled materials and lower carbon footprints. Industry participants are adopting reclaimed asphalt pavement (RAP) and recycled polymer blends to support circular construction practices. It aligns with EU directives promoting reduced waste and energy-efficient road construction. The trend extends to bio-based polymer modifiers derived from natural oils and agricultural waste, offering improved environmental compliance. European road agencies and contractors are increasingly specifying sustainable bitumen grades in public tenders. This growing focus on green infrastructure and resource efficiency is expected to redefine material innovation and long-term market strategies across the region.

- For Instance, Vinci subsidiary Eurovia, in collaboration with Vinci Autoroutes, completed a one-kilometer section of the A10 motorway in southwest France using a ‘fully recycled’ road technique with up to 100% recycled asphalt aggregates

Market Challenges Analysis:

High Production Costs and Volatile Raw Material Prices

The Europe Polymer Modified Bitumen Market faces challenges from fluctuating raw material costs and complex production processes. Polymers such as SBS and EVA require precise formulation and temperature control, raising operational expenses for manufacturers. Rising crude oil prices also influence bitumen and polymer supply costs, impacting overall profitability. It creates pressure on producers to balance quality and cost efficiency while maintaining product standards. Smaller contractors and regional suppliers often struggle to compete with established brands offering cost-optimized formulations. This volatility limits adoption in price-sensitive projects, particularly across developing European regions.

Stringent Environmental Regulations and Technical Standardization Issues

Evolving environmental regulations across the European Union present compliance challenges for bitumen manufacturers. Strict emission norms and waste management requirements increase production costs and necessitate technology upgrades. It also demands continuous testing and certification to align with national and EU standards. Lack of uniformity in technical specifications across countries complicates supply chain operations. The need for sustainable sourcing and controlled polymer usage further restricts flexibility in product development. These regulatory and standardization pressures continue to influence production efficiency and market competitiveness across Europe.

Market Opportunities:

Expansion of Smart Infrastructure and Green Mobility Projects Across Europe

The Europe Polymer Modified Bitumen Market is positioned to benefit from the region’s focus on smart and sustainable infrastructure. The European Union’s funding for low-carbon transport networks and energy-efficient urban development projects supports steady market expansion. Polymer-modified bitumen offers performance suited for high-stress applications in highways, airports, and electric vehicle charging corridors. It enhances durability and reduces maintenance costs, aligning with green infrastructure objectives. Governments are integrating advanced pavement technologies to improve safety and reduce lifecycle emissions. This transition toward intelligent, eco-friendly infrastructure presents strong growth potential for manufacturers and contractors.

Rising Demand for High-Performance Roofing and Waterproofing Materials

Rapid urbanization and growing commercial construction projects across Europe are boosting demand for advanced waterproofing solutions. The Europe Polymer Modified Bitumen Market benefits from its suitability in roofing membranes and industrial coatings that require flexibility and heat resistance. It supports the construction of energy-efficient buildings that comply with EU green building standards. The increasing preference for long-lasting and thermally stable materials strengthens product adoption in both residential and industrial segments. It also creates opportunities for specialized formulations with improved UV resistance and reduced environmental impact. Expanding construction activity and energy efficiency regulations are expected to fuel sustained market growth.

Market Segmentation Analysis:

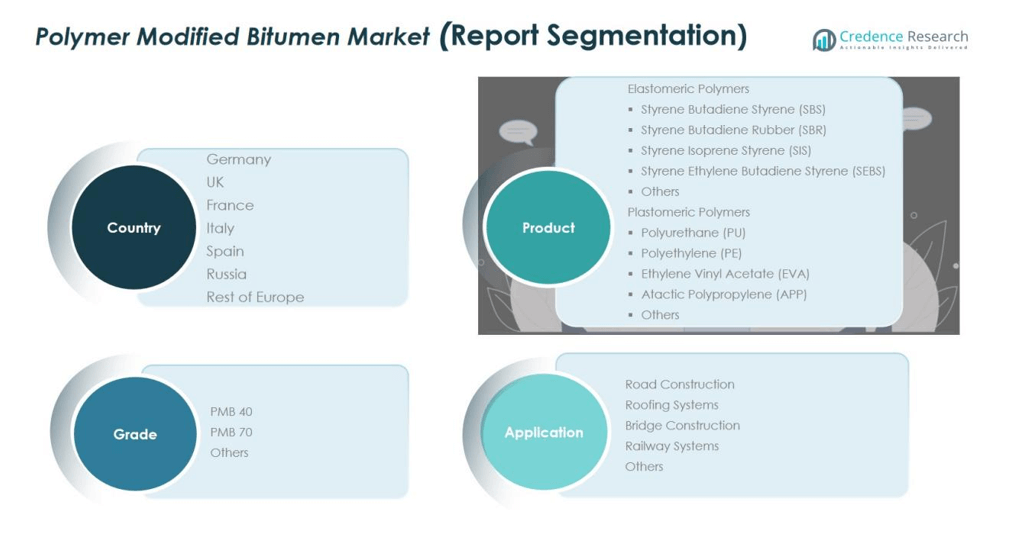

By Product

The Europe Polymer Modified Bitumen Market is segmented into elastomeric and plastomeric polymers. Elastomeric polymers such as Styrene Butadiene Styrene (SBS) and Styrene Butadiene Rubber (SBR) dominate due to their high elasticity, temperature resistance, and superior performance in heavy traffic conditions. It continues to gain demand in highway and bridge applications requiring enhanced durability. Plastomeric polymers including Ethylene Vinyl Acetate (EVA) and Atactic Polypropylene (APP) are widely used in roofing and waterproofing due to their rigidity and UV resistance. The growing shift toward high-performance elastomeric materials supports long-term market expansion.

- For instance, Kraton Corporation expanded its SBS production capacity in Europe by 20 kilotons through efficient capital investments in core manufacturing assets and developed an additional 40 kilotons of cost-effective expansions across the European footprint to support anticipated growth in paving applications.

By Application

Key application areas include road construction, roofing systems, bridge construction, and railway infrastructure. Road construction holds the largest share, supported by ongoing highway modernization and maintenance projects across Europe. It offers enhanced load-bearing capacity and reduces cracking under thermal stress. Roofing and waterproofing applications are growing steadily, driven by the rise in energy-efficient and commercial building construction.

- For instance, Nynas delivered over 20,000 tons of polymer modified bitumen for the A14 Cambridge to Huntingdon highway project in England, where the Nypol 77 binder was used for super-thin top layers to create a durable yet low-noise road surface fit for heavy traffic.

By Grade

Based on grade, PMB 40 and PMB 70 are the primary categories. PMB 40 is preferred for moderate climates, while PMB 70 is used in heavy-duty and high-temperature conditions. It provides consistent performance under mechanical stress, which enhances adoption in transport and industrial projects across the region.

Segmentations:

By Product Type

Elastomeric Polymers

- Styrene Butadiene Styrene (SBS)

- Styrene Butadiene Rubber (SBR)

- Styrene Isoprene Styrene (SIS)

- Styrene Ethylene Butadiene Styrene (SEBS)

- Others

Plastomeric Polymers

- Polyurethane (PU)

- Polyethylene (PE)

- Ethylene Vinyl Acetate (EVA)

- Atactic Polypropylene (APP)

- Others

By Grade

By Application

- Road Construction

- Roofing Systems

- Bridge Construction

- Railway Systems

- Others

By Country

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe Dominating the Market Through Strong Infrastructure Investments

Western Europe holds the largest share in the Europe Polymer Modified Bitumen Market, led by Germany, France, and the United Kingdom. These countries continue to invest heavily in modernizing road networks, airports, and smart city projects. Governments prioritize advanced and durable construction materials that enhance longevity and reduce maintenance costs. It benefits from strong industrial infrastructure, established suppliers, and advanced manufacturing capabilities. Growing demand for sustainable materials in public works also strengthens market presence across the subregion. Continuous adoption of innovative polymer blends is reinforcing Western Europe’s leadership position.

Central and Eastern Europe Experiencing Rapid Growth Through Infrastructure Expansion

Central and Eastern European countries are witnessing rising demand for polymer-modified bitumen due to expanding transportation and logistics networks. EU-backed funding programs support highway development, cross-border trade routes, and industrial zone construction. It benefits from cost-effective labor, increasing urbanization, and strong government incentives for green infrastructure. Countries such as Poland, the Czech Republic, and Hungary are accelerating road modernization to align with Western standards. The growth in regional construction activities and public-private partnerships continues to create favorable opportunities. Strong support from EU cohesion funds is expected to sustain this momentum in the near term.

Northern and Southern Europe Advancing Toward Sustainable Construction Solutions

Northern and Southern Europe are increasingly adopting eco-friendly construction practices and performance-enhancing bitumen solutions. Countries like Sweden, Norway, Spain, and Italy focus on reducing carbon emissions and improving energy efficiency in road and building construction. The Europe Polymer Modified Bitumen Market benefits from these sustainability-driven policies and technology upgrades. It also gains traction from innovations in bio-based polymers and recycled materials for environmentally conscious projects. Growing coastal development and climatic challenges further drive the need for temperature-resistant and flexible bitumen. These factors collectively position both regions for steady growth within Europe’s evolving construction ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Repsol

- BIOTUM LLC

- Petrom

- CEPSA

- MOL Group

- NIS Group

- Aliagas SA

- Sika AG

- Royal Dutch Shell

- Puma Energy

Competitive Analysis:

The Europe Polymer Modified Bitumen Market features a moderately consolidated structure with several leading regional and multinational players. Key participants such as Repsol, BIOTUM LLC, Petrom, CEPSA, MOL Group, NIS Group, Aliagas SA, and Sika AG compete based on product quality, innovation, and regional reach. It focuses on technological advancement, sustainable formulations, and cost efficiency to strengthen competitive positioning. Companies are investing in polymer innovation and green manufacturing to meet strict European Union environmental standards. Strategic alliances, capacity expansions, and customized formulations for varied climatic conditions support market competitiveness. Continuous product development and government-backed infrastructure projects are expected to keep competition intense across the European landscape.

Recent Developments:

- In October 2025, Repsol announced a major partnership with MotoGP™ to become the official lubricant supplier for Moto2™ and Moto3™ categories, and a title sponsor of a MotoGP™ Grand Prix each season, marking its return to top-tier motorcycle racing beginning in 2026.

- In September 2025, OMV Petrom completed the acquisition of a 50% stake in Bulgaria’s 400 MW Gabare photovoltaic project, developed by Enery, marking one of the largest solar power investments in the region and strengthening Petrom’s renewable energy portfolio.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Grade, Application and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Polymer Modified Bitumen Market is expected to experience steady growth driven by infrastructure modernization across the region.

- Rising government investments in highway rehabilitation and sustainable transport networks will continue to fuel demand.

- Manufacturers are likely to focus on developing bio-based and recyclable polymer additives to meet EU sustainability goals.

- Smart road technologies and energy-efficient construction materials will support innovation in bitumen formulations.

- It is expected to benefit from an expanding urban population that drives housing and commercial construction.

- Collaborations between contractors, research institutes, and material suppliers will enhance product performance and quality standards.

- Growing adoption of polymer-modified bitumen in cold regions will improve road durability and reduce maintenance costs.

- Technological advancements in nanopolymer modification and automated mixing systems will improve production efficiency.

- Stringent emission and waste regulations will push manufacturers toward cleaner and low-emission production processes.

- The overall market outlook remains positive with increasing focus on sustainable, long-life materials for Europe’s next-generation infrastructure.