Market Overview:

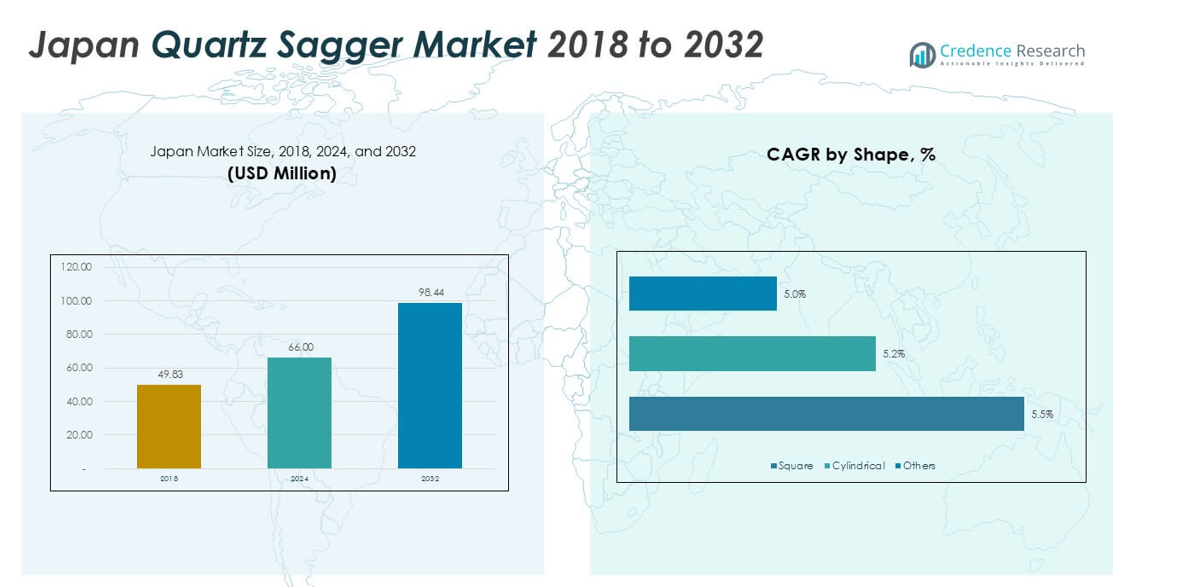

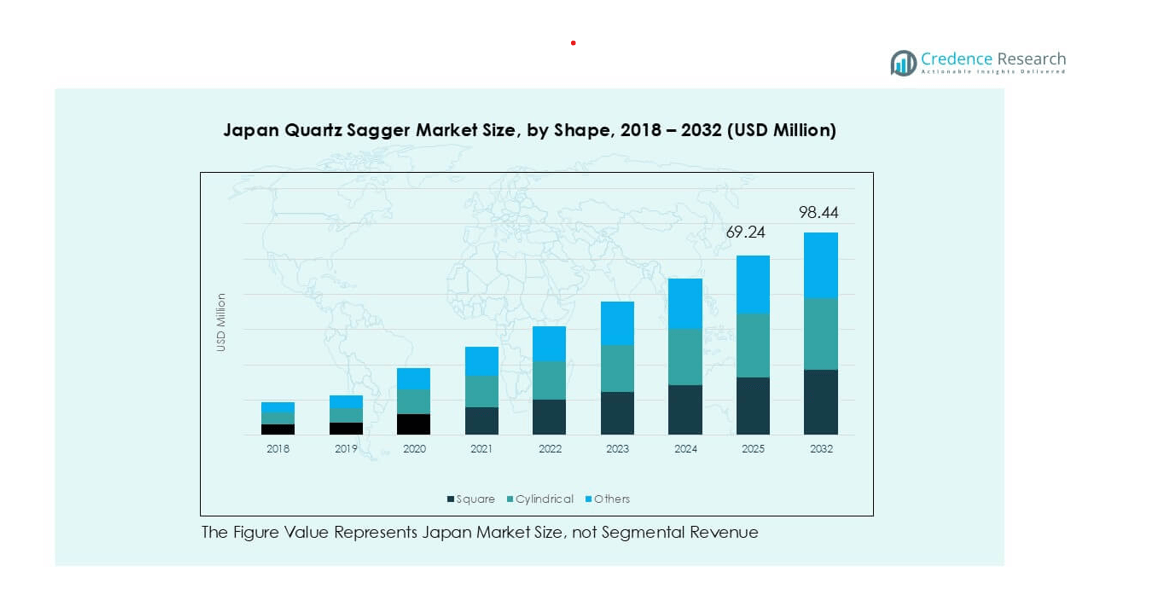

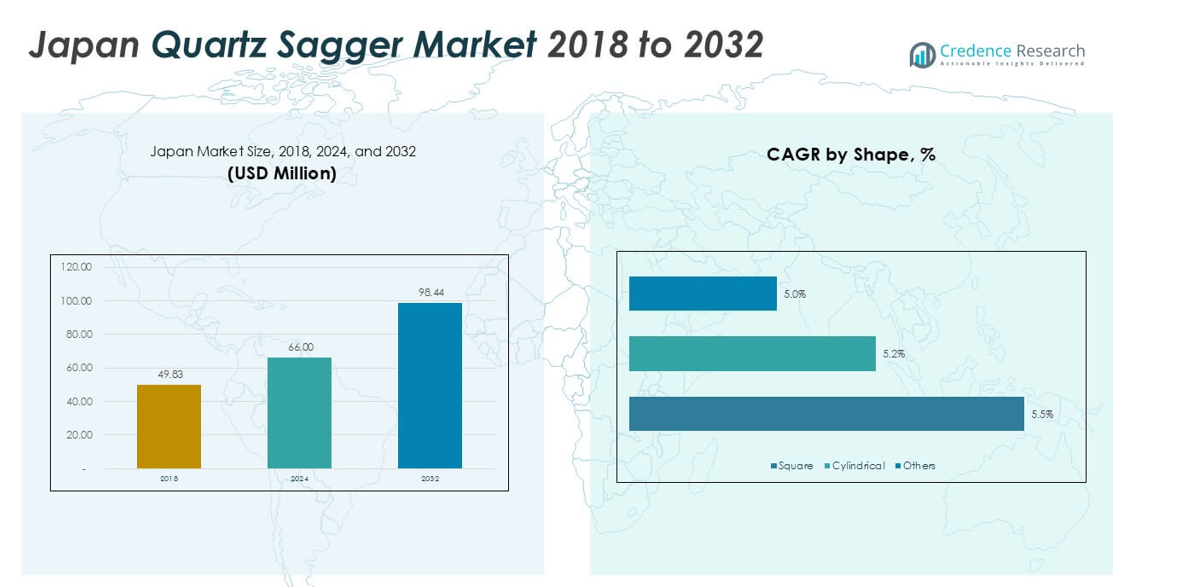

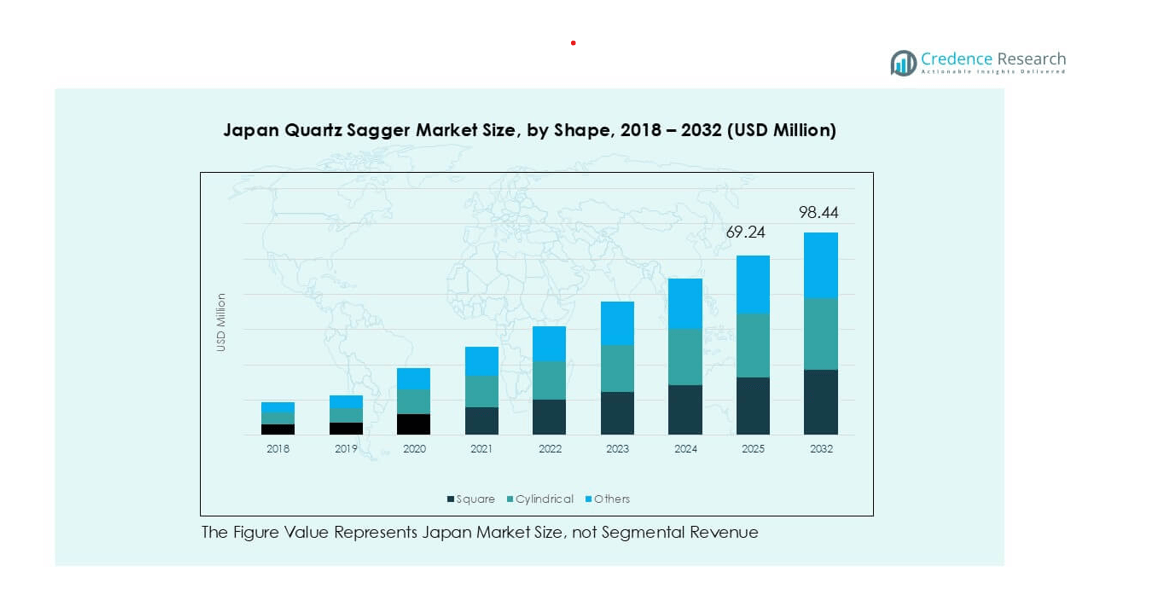

The Japan Quartz Sagger market size was valued at USD 49.83 million in 2018, growing to USD 66.00 million in 2024, and is anticipated to reach USD 98.44 million by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Quartz Sagger Market Size 2024 |

USD 66.00 million |

| Japan Quartz Sagger Market, CAGR |

5.1% |

| Japan Quartz Sagger Market Size 2032 |

USD 98.44 million |

The Japan quartz sagger market is shaped by the presence of global and domestic leaders, including Saint-Gobain, NORITAKE Co., Limited, Morgan Advanced Materials plc, Zibo Gotrays Industry Co., Ltd., and Liling Zen Ceramic Co., Ltd. These companies focus on high-purity quartz materials, advanced design, and strong supply chains to meet the stringent requirements of semiconductor, ceramic, and metallurgy industries. Among regions, the Kanto region led the market in 2024, capturing nearly 35% share, driven by its concentration of electronics and semiconductor manufacturers. Kansai and Chubu followed as strong contributors, supported by their advanced ceramics and automotive manufacturing bases.

Market Insights

- The Japan quartz sagger market was valued at USD 66.00 million in 2024 and is projected to reach USD 98.44 million by 2032, growing at a CAGR of 5.1%.

- Growth is driven by rising demand from the semiconductor and electronics industry, where quartz saggers ensure high-purity firing, sintering, and heat treatment processes.

- A key trend is the shift toward customized, high-purity saggers designed for precision manufacturing, with companies investing in advanced R&D and sustainable production practices.

- Competition is intense, with leading players such as Saint-Gobain, NORITAKE Co., Limited, and Morgan Advanced Materials plc focusing on innovation, while regional firms like Zibo Gotrays Industry Co., Ltd. strengthen their presence through cost-effective solutions.

- Regionally, Kanto held 35% share in 2024, Kansai followed with 20%, and Chubu accounted for 18%, while Kyushu and Okinawa contributed 12%, reflecting the dominance of semiconductor and ceramic hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Shape

The square segment dominated the Japan quartz sagger market in 2024, holding over 45% of the total share. Square saggers are widely preferred for their structural stability, uniform heat distribution, and efficient stacking capability during high-temperature processing. Their durability and ability to withstand repeated thermal cycles make them the leading choice in large-scale firing operations. Cylindrical saggers are also gaining traction, especially in precision sintering processes, while other shapes remain limited to niche applications. Rising demand from high-volume manufacturing industries continues to reinforce the leadership of square saggers in the market.

- For instance, AGC Ceramics, a subsidiary of AGC, manufactures and supplies a wide range of advanced ceramics and refractory materials, including some that can withstand high temperatures, for industrial applications in Japan and worldwide.

By Application

Firing ceramics accounted for the largest share of the Japan quartz sagger market in 2024, with more than 40% of demand. This dominance is driven by extensive use in ceramic component production for electronics, automotive, and construction applications. Quartz saggers provide high thermal resistance and chemical inertness, ensuring defect-free ceramic products, which is critical in advanced applications. Sintering powders and heat-treating metals follow, supported by their growing role in precision manufacturing and metallurgy. The strong expansion of ceramic materials in electronic devices continues to sustain the leadership of this segment.

- For instance, Kyocera and Murata Manufacturing both use high-temperature sintering in their production of electronic-grade ceramic components, such as multi-layer ceramic capacitors and crystal devices. This manufacturing process involves firing ceramic components inside specialized containers called saggers to protect them from contamination.

By End User

The electronics and semiconductors industry led the Japan quartz sagger market in 2024, capturing nearly 50% of the total share. This dominance stems from the country’s strong semiconductor ecosystem, where quartz saggers are essential in firing and sintering processes for components such as wafers and substrates. The demand is reinforced by Japan’s growing investment in chip production and advanced electronic materials. Metallurgy industries and glass industries represent secondary markets, utilizing quartz saggers in specialized heat treatment and glass forming processes. The rapid expansion of semiconductor fabrication drives the growth of this leading end-user segment.

Key Growth Drivers

Expanding Semiconductor and Electronics Industry

The rapid expansion of Japan’s semiconductor and electronics industry is the primary driver for quartz sagger demand. Quartz saggers are essential in firing and sintering processes for wafers, substrates, and ceramic-based electronic components. With Japan investing heavily in semiconductor R&D and capacity expansion, the need for high-purity materials that ensure stable performance at extreme temperatures is increasing. The government’s strategic initiatives to strengthen the domestic chip supply chain further support demand. As production volumes grow, manufacturers rely on quartz saggers for consistent quality, long service life, and compatibility with advanced electronic materials.

- For instance, a major semiconductor fabrication plant utilizes thousands of specialized high-purity quartz wafer boats in its manufacturing operations. These quartz components, which are rated for thermal endurance and stability at temperatures exceeding 1,200°C, are used to hold and transport wafers during high-temperature thermal processes like oxidation and annealing to ensure purity and stability.

Rising Demand for Advanced Ceramics in Industrial Applications

Advanced ceramics play a key role in multiple industries, including automotive, construction, and consumer electronics, fueling quartz sagger adoption. These saggers withstand high thermal loads during ceramic firing, ensuring defect-free outputs for components such as insulators, substrates, and heat-resistant coatings. Japan’s strong presence in ceramics manufacturing, particularly for precision parts in electronics and mobility solutions, reinforces this trend. Increasing applications of ceramics in electric vehicles and renewable energy systems further stimulate market growth. The high performance and durability of quartz saggers make them indispensable for industries seeking both reliability and energy efficiency.

- For instance, in 2024, Kyocera manufactured and supplied advanced technical ceramic components for a variety of high-tech applications, including the production of electric vehicle (EV) batteries and electronic packaging.

Growth in Metallurgy and Heat-Treating Processes

The metallurgy industry in Japan contributes significantly to quartz sagger demand, especially in sintering and heat-treating applications. Saggers are vital for controlling thermal processes in metals, ensuring material integrity and high-quality output. Japan’s focus on producing advanced alloys and specialty metals for aerospace, automotive, and high-performance equipment drives adoption. Additionally, the growing need for energy-efficient and eco-friendly processes in metallurgy aligns with quartz saggers’ capability to withstand repeated thermal cycles. As demand rises for high-strength materials across end-user industries, quartz saggers remain a preferred solution due to their superior thermal stability and resistance.

Key Trends & Opportunities

Shift Toward High-Purity and Customized Quartz Saggers

A growing trend in Japan is the shift toward high-purity and customized quartz saggers to meet the strict quality needs of semiconductors and advanced ceramics. Manufacturers increasingly require saggers designed for specific thermal loads, chemical resistance, and geometries. Customized solutions reduce contamination risk and extend lifecycle, supporting higher yields in production. Companies are also focusing on saggers with improved structural designs for precision applications. This trend offers opportunities for suppliers to expand through value-added services, catering to niche requirements of semiconductor fabs and advanced manufacturing industries across Japan.

- For instance, AGC offers various high-purity materials, such as synthetic quartz glass and specialized ceramics, for semiconductor processing equipment. These materials are critical for ensuring contamination-free wafer manufacturing during high-temperature processes like sintering.

Adoption of Sustainable and Energy-Efficient Manufacturing Practices

Sustainability is creating opportunities for quartz sagger manufacturers, with growing emphasis on energy-efficient production and longer lifecycle products. Industries seek saggers that minimize energy losses during high-temperature operations and withstand multiple reuse cycles. Japan’s regulatory focus on reducing carbon footprints in industrial processes aligns with this opportunity, driving demand for durable, recyclable, and eco-friendly materials. Manufacturers adopting advanced production techniques, such as low-defect quartz processing, gain a competitive advantage. This shift positions quartz saggers as enablers of sustainable manufacturing practices while addressing the long-term cost concerns of end users.

Key Challenges

High Manufacturing Costs and Price Sensitivity

One of the major challenges in the Japan quartz sagger market is the high cost of production. The fabrication of saggers requires high-purity raw quartz, precision processing, and advanced thermal treatment, all of which contribute to elevated costs. Price-sensitive industries, particularly smaller manufacturers in ceramics and metallurgy, often struggle to adopt premium quartz saggers. This restricts broader market penetration. Additionally, fluctuations in raw material prices further increase financial pressure on producers. Balancing cost competitiveness with product quality remains a critical hurdle for suppliers in sustaining growth.

Intense Competition from Alternative Materials

The market also faces challenges from alternative materials such as alumina and silicon carbide saggers, which offer comparable thermal resistance at lower costs in certain applications. These alternatives are gaining popularity in metallurgy and ceramic firing where purity levels are less critical. While quartz saggers hold advantages in high-precision and contamination-sensitive processes, their higher cost limits adoption against cost-effective substitutes. This competitive pressure forces quartz sagger manufacturers to continuously innovate, differentiate, and prove long-term performance benefits to retain market share in Japan’s evolving industrial landscape.

Regional Analysis

Kanto Region

The Kanto region dominated the Japan quartz sagger market in 2024, accounting for nearly 35% of the overall share. The region’s dominance is driven by its concentration of electronics and semiconductor manufacturers, including Tokyo and surrounding industrial hubs. High demand for quartz saggers in semiconductor wafer firing, powder sintering, and advanced ceramics production strengthens its leadership. Growing investments in R&D and technological advancements by leading firms in Kanto continue to fuel demand. The strong presence of Japan’s major electronic material producers ensures this region remains the largest contributor to the quartz sagger market.

Kansai Region

The Kansai region held about 20% of the Japan quartz sagger market in 2024. This share is supported by its diverse industrial base, particularly ceramics and metallurgy, which extensively use saggers for firing and heat treatment. The region’s manufacturing hubs in Osaka and Kyoto also contribute to demand, with a focus on precision ceramics for electronics and optical applications. Investments in energy-efficient production and material innovation further drive adoption. The Kansai region benefits from strong academic-industry collaboration, reinforcing its role as the second-largest regional market for quartz saggers in Japan.

Chubu Region

The Chubu region accounted for approximately 18% of the quartz sagger market share in 2024. This region, home to Japan’s robust automotive and electronics industries, drives demand through applications in ceramics, powder sintering, and glass components. Aichi and Nagoya serve as major industrial centers, supporting extensive usage in both automotive-grade ceramics and semiconductor supply chains. The presence of precision manufacturing facilities also reinforces steady growth. Expanding material applications in electric vehicles and electronic devices enhances demand for quartz saggers, ensuring Chubu’s strong position as a significant regional market in the country.

Kyushu and Okinawa Region

The Kyushu and Okinawa region represented around 12% of the Japan quartz sagger market in 2024. Kyushu is a growing semiconductor hub, housing several fabrication plants and electronics manufacturers, which directly boosts quartz sagger usage in wafer processing and sintering. The region’s rising investment in advanced semiconductor projects has positioned it as a rapidly expanding market. Okinawa’s smaller industrial footprint contributes minimally, but the overall demand is reinforced by Kyushu’s high-tech industry base. The focus on next-generation electronics manufacturing continues to strengthen this region’s share and growth potential within the quartz sagger market.

Hokkaido and Tohoku Region

The Hokkaido and Tohoku region accounted for nearly 8% of the quartz sagger market in 2024. This region benefits from government-backed initiatives to expand semiconductor and electronics material production, especially in Tohoku, which has seen new investments in fabrication facilities. Quartz saggers are increasingly adopted in sintering and ceramic component processing to support these industries. Hokkaido’s limited industrial activity results in a smaller share, but the region’s growing role in Japan’s semiconductor strategy ensures gradual expansion. The ongoing push to decentralize semiconductor production from Kanto further supports market growth in this northern region.

Chugoku and Shikoku Region

The Chugoku and Shikoku region held about 7% of the quartz sagger market in 2024. Demand is largely supported by metallurgy, glass manufacturing, and ceramics industries located in Hiroshima and surrounding areas. The region’s contribution is smaller compared to major hubs but remains consistent due to its industrial specialization. Heat-treating metals and firing ceramics are the main applications of quartz saggers in this region. Continued development of local manufacturing capacity and government incentives for regional industries are expected to sustain steady growth, keeping Chugoku and Shikoku as stable contributors to the national market.

Market Segmentations:

By Shape

- Square

- Cylindrical

- Others

By Application

- Firing Ceramics

- Sintering Powders

- Heat Treating Metals

- Others

By End User

- Electronics and Semiconductors Industry

- Metallurgy Industries

- Glass Industries

- Others

By Geography

- Kanto Region

- Kansai Region

- Chubu Region

- Kyushu and Okinawa Region

- Hokkaido and Tohoku Region

- Chugoku and Shikoku Region

Competitive Landscape

The competitive landscape of the Japan quartz sagger market is characterized by the presence of both international leaders and domestic manufacturers, each focusing on specialized strengths. Global players such as Saint-Gobain, Morgan Advanced Materials plc, and NORITAKE Co., Limited emphasize high-performance materials, extensive product portfolios, and innovation tailored for advanced ceramics and semiconductor processes. Meanwhile, regional firms like Zibo Gotrays Industry Co., Ltd, Liling Zen Ceramic Co., Ltd., and Shandong Topower Pte Ltd. maintain strong positions through cost efficiency, customization, and supply chain proximity. Companies are increasingly investing in R&D to develop high-purity quartz saggers that address contamination concerns and extend product lifecycles. Recent developments show collaborations with semiconductor and electronics industries, as well as strategies focused on expanding production capacity to meet growing demand. The competition remains intense, with differentiation largely based on material purity, durability, pricing strategies, and the ability to meet strict end-user requirements in Japan’s advanced manufacturing ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zibo Gotrays Industry Co., Ltd

- Saint-Gobain

- NORITAKE CO., LIMITED

- Morgan Advanced Materials plc

- Liling Zen Ceramic Co., Ltd.

- Shandong Topower Pte Ltd.

- Magma Group

- Other Key Players

Recent Developments

- In 2023, Sumitomo Refractories announces the development of a sustainable, recyclable quartz sagger.

- In 2022, RHI Magnesita invests in a new manufacturing facility for advanced quartz saggers in China.

Report Coverage

The research report offers an in-depth analysis based on Shape, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan quartz sagger market will expand steadily, driven by rising semiconductor production.

- Demand will grow for high-purity saggers to ensure contamination-free processing.

- Advanced ceramics applications will strengthen adoption across automotive and electronics industries.

- Metallurgy will remain a consistent user, especially for high-strength alloys and specialty metals.

- Companies will invest in R&D to deliver customized saggers with longer service life.

- Regional hubs like Kanto and Kansai will continue leading due to strong industrial bases.

- Sustainability goals will push manufacturers toward energy-efficient and recyclable quartz saggers.

- Competition from alternative materials will intensify, requiring continuous innovation.

- Strategic collaborations with electronics and semiconductor companies will shape future growth.

- The market will witness increased localization of production to meet rising domestic demand.