Market Overview:

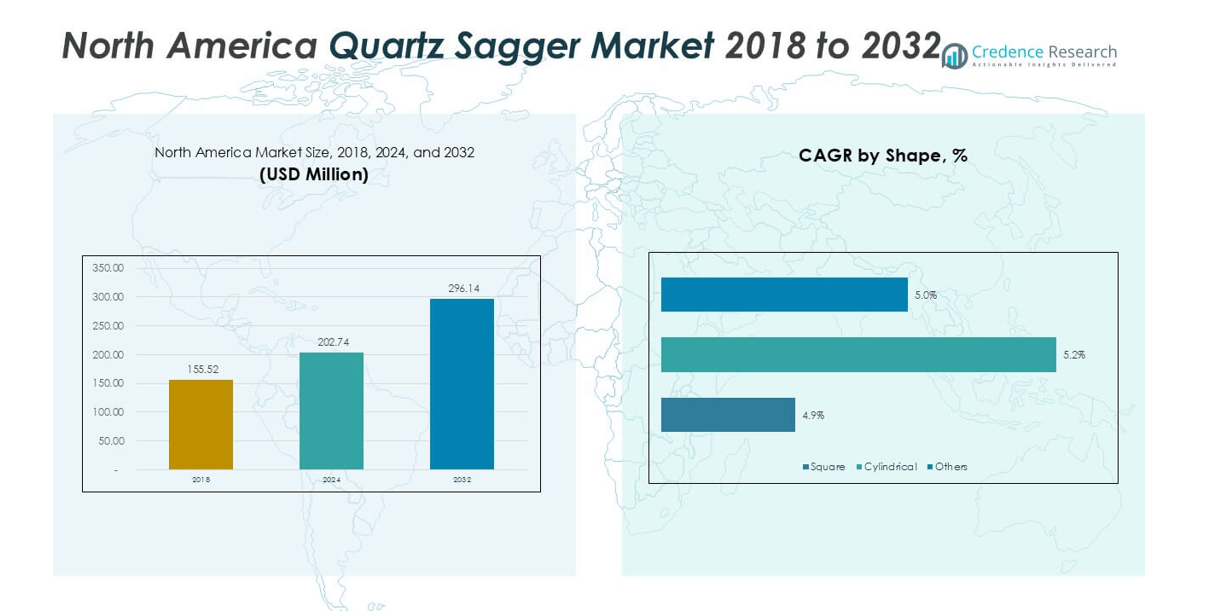

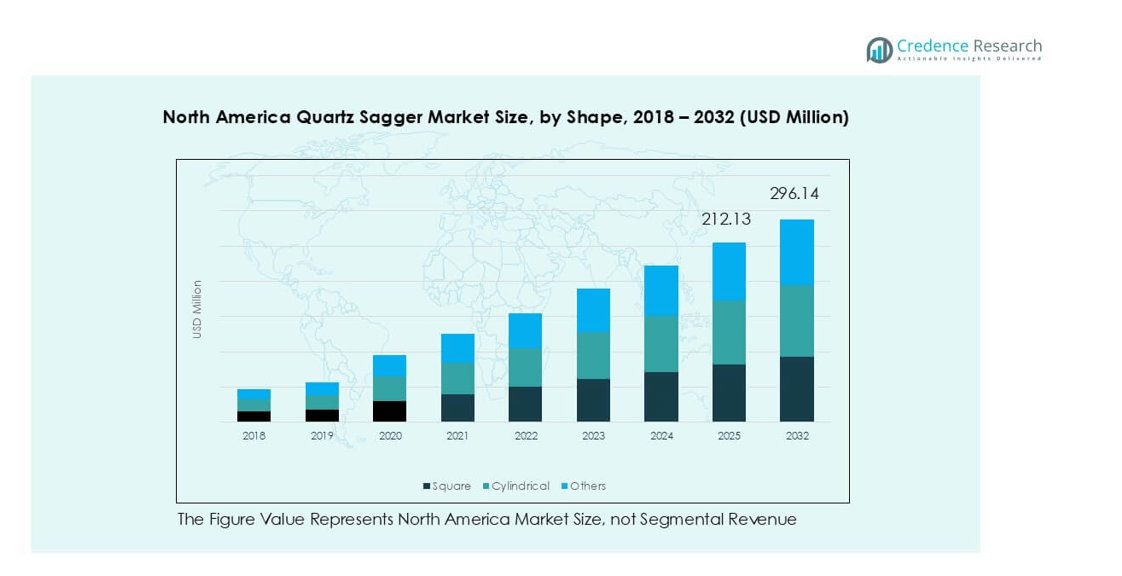

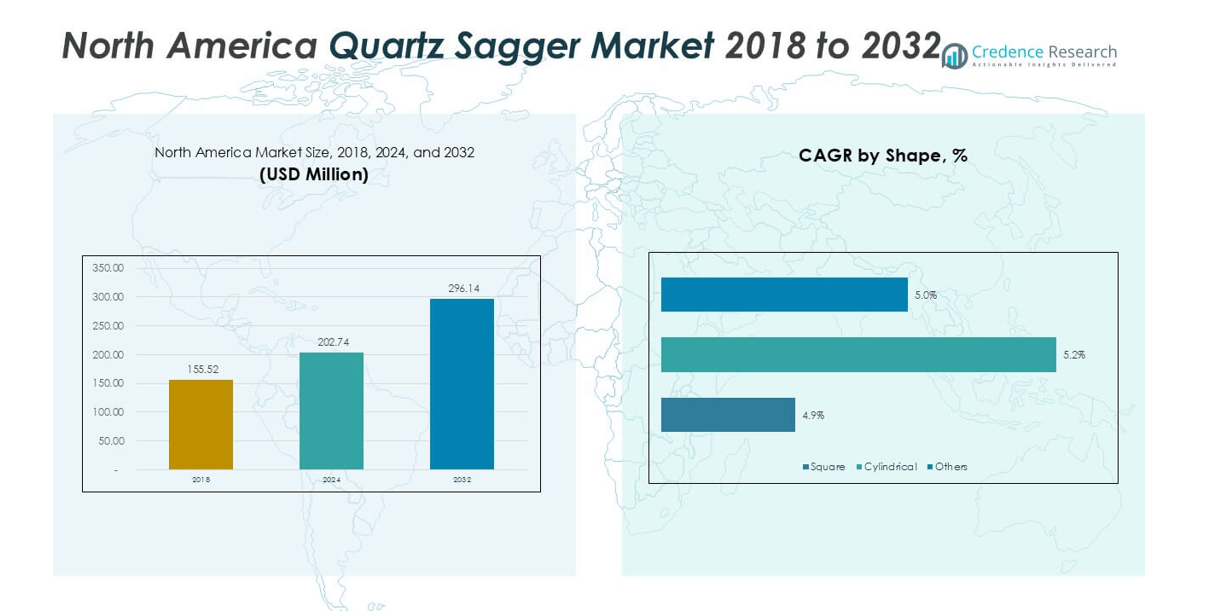

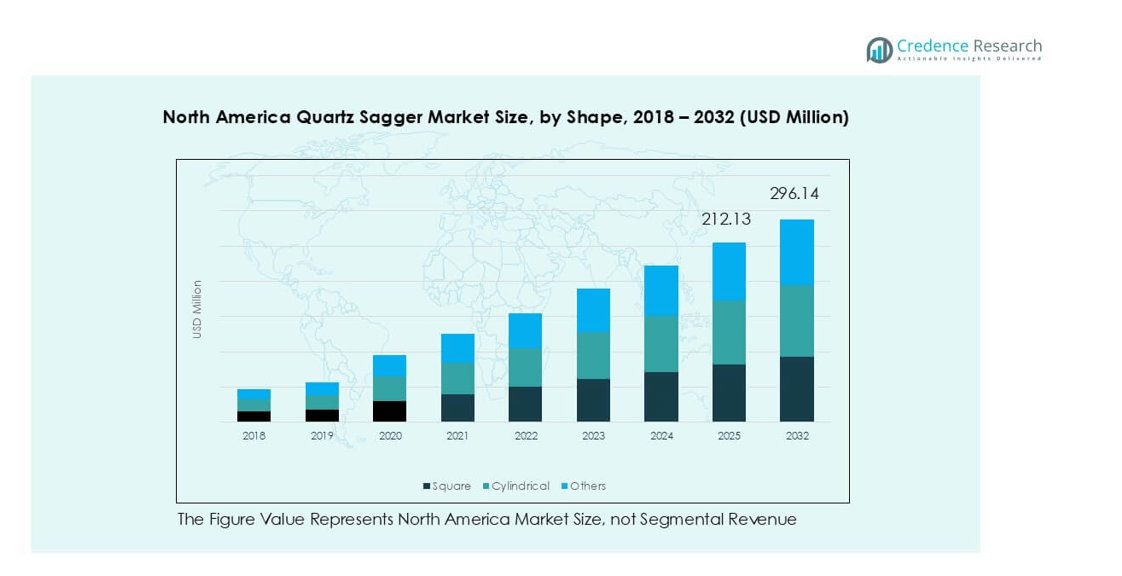

North America Quartz Sagger market size was valued at USD 155.52 million in 2018 and increased to USD 202.74 million in 2024. It is projected to reach USD 296.14 million by 2032, registering a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Quartz Sagger Market Size 2024 |

USD 202.74 million |

| North America Quartz Sagger Market, CAGR |

4.8% |

| North America Quartz Sagger Market Size 2032 |

USD 296.14 million |

The North America quartz sagger market is led by major players such as Saint-Gobain, Morgan Advanced Materials plc, NORITAKE CO., LIMITED, and Zibo Gotrays Industry Co., Ltd., each contributing significantly through advanced material innovations and strong regional distribution. These companies dominate due to their expertise in high-purity quartz processing and customized thermal solutions. Liling Zen Ceramic Co., Ltd. and Shandong Topower Pte Ltd. are strengthening their foothold with cost-effective, high-durability products targeting semiconductor and ceramics industries. Regionally, the United States holds over 70% of the market share, driven by large-scale semiconductor manufacturing and strong industrial infrastructure, positioning it as the regional growth hub.

Market Insights

- The North America quartz sagger market was valued at USD 202.74 million in 2024 and is projected to reach USD 296.14 million by 2032, growing at a CAGR of 4.8%.

- Demand is driven by rapid semiconductor manufacturing growth, increased adoption in ceramics firing, and the need for high-purity materials in heat treatment applications.

- The market trend shows a clear shift toward contamination-free, ultra-high-purity quartz saggers, supported by automation and precision machining advancements.

- Leading companies such as Saint-Gobain, Morgan Advanced Materials plc, and NORITAKE CO., LIMITED dominate through innovation, while regional players expand with cost-effective, durable products.

- The United States holds over 70% of the market share, followed by Canada at 20% and Mexico at 10%; by shape, the square segment accounts for 45%, driven by its widespread use in semiconductor and electronics manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Shape

The square segment dominated the North America quartz sagger market in 2024, accounting for nearly 45% of the total share. Its dominance is driven by wide use in semiconductor and electronics manufacturing, where uniform heat distribution and structural stability are critical. Square saggers offer efficient stacking, higher load capacity, and reduced thermal deformation, making them ideal for high-temperature applications. Their compatibility with automated handling systems further supports adoption. Cylindrical saggers follow closely, preferred for precision sintering processes that require even heat flow and minimal edge stress.

- For instance, Kyocera Corporation manufactures high-purity alumina and silicon carbide setters and plates, which can be used as sintering supports and components in heat treatment processes. These materials are designed to withstand the high temperatures required for sintering electronic components like multilayer ceramic capacitors (typically 1,100–1,500°C) and for high-temperature semiconductor manufacturing processes.

By Application

The firing ceramics segment held the largest share at about 40% of the market in 2024. The growth is attributed to the rising use of high-purity ceramics in advanced electronics, aerospace, and industrial components. Quartz saggers ensure controlled firing, preventing contamination and thermal shock during sintering. Increasing demand for defect-free ceramic substrates and multilayer components supports this segment. Sintering powders and heat-treating metals applications are expanding as industries pursue precision material processing and high-temperature stability for critical components in energy and semiconductor fabrication.

- For instance, Saint-Gobain Performance Ceramics supplies high-density quartz saggers for firing alumina and zirconia components used in semiconductor wafer carriers and turbine blades.

By End User

The electronics and semiconductors industry dominated with over 50% share of the regional market in 2024. This leadership stems from extensive quartz sagger use in wafer diffusion, thermal oxidation, and substrate annealing processes. The sector’s demand is reinforced by increasing investments in chip manufacturing and cleanroom technologies across the U.S. and Canada. Quartz saggers’ superior purity and heat resistance ensure minimal contamination, vital for semiconductor yield. Metallurgy and glass industries also contribute steady demand for customized saggers in high-temperature refining, melting, and forming applications.

Key Growth Drivers

Expansion of the Semiconductor Manufacturing Sector

The rapid expansion of semiconductor manufacturing facilities across North America is a major growth driver for the quartz sagger market. The United States and Canada are increasing local chip fabrication to strengthen supply chain resilience and reduce reliance on imports. Quartz saggers are essential in wafer diffusion, oxidation, and sintering processes due to their excellent thermal stability and purity. The U.S. CHIPS and Science Act has further accelerated investment in semiconductor foundries, boosting demand for high-precision, contamination-free quartz components. As fabrication plants adopt larger wafer sizes and more advanced nodes, the need for premium-grade saggers capable of withstanding extreme processing temperatures continues to grow.

- For instance, Intel’s new fabrication plant in New Albany, Ohio, is currently under construction, with the initial completion and operational timelines delayed to 2030 and 2031, respectively. The facility will include two advanced chip foundries, which will utilize high-purity quartz components in wafer manufacturing processes.

Rising Adoption in High-Temperature Industrial Processes

The increasing use of quartz saggers in high-temperature processes such as powder sintering, ceramic firing, and metal heat treatment drives market growth. Their superior mechanical strength, resistance to deformation, and minimal gas permeability make them ideal for maintaining structural integrity during repeated thermal cycles. Industries such as aerospace, advanced ceramics, and metallurgy are shifting toward energy-efficient and precise heating systems, fueling sagger adoption. Demand is especially strong in applications where product quality and uniformity depend on controlled furnace conditions. Quartz saggers’ low thermal expansion rate reduces cracking risks, extending service life and lowering replacement costs, thus improving operational efficiency for end users.

- For instance, Saint-Gobain Performance Ceramics & Refractories is a manufacturer of advanced ceramic products, including saggers and fused quartz materials, for demanding high-temperature applications.

Technological Advancements in Material Purity and Manufacturing

Advancements in high-purity quartz material processing and precision fabrication technologies are creating new opportunities for manufacturers. Companies are developing saggers with ultra-low impurity levels and improved dimensional accuracy to meet stringent performance standards in semiconductor and electronics industries. Techniques such as controlled-atmosphere sintering and CNC-based shaping enhance strength and surface smoothness, reducing contamination risks. Additionally, investments in automation and digital monitoring systems ensure quality consistency and production scalability. These innovations enable suppliers to meet growing demands for defect-free, durable saggers that perform reliably under extreme thermal and chemical stress, making technology development a critical competitive advantage.

Key Trend & Opportunity

Shift Toward Contamination-Free and High-Purity Materials

A major trend shaping the North American quartz sagger market is the shift toward ultra-pure, contamination-free products. Semiconductor and advanced ceramics manufacturers increasingly demand saggers with impurity levels below one part per million to prevent yield losses. This trend aligns with the region’s growing focus on sustainable and high-quality production standards. Manufacturers are responding by refining raw quartz, improving furnace environments, and adopting advanced cleaning technologies. The move toward cleaner manufacturing enhances product reliability and strengthens supplier relationships with top-tier semiconductor producers. This transition also opens new opportunities for high-end quartz material suppliers and custom fabrication specialists.

- For instance, Momentive Technologies produces fused quartz saggers with impurity levels under 0.5 ppm, used by major chipmakers for 300 mm wafer fabrication processes requiring extreme purity and zero alkali contamination

Growth in Smart Manufacturing and Process Automation

Automation and digital monitoring technologies are transforming quartz sagger production and usage. Smart manufacturing enables real-time monitoring of sagger performance under thermal stress, improving predictive maintenance and reducing downtime. In the end-use industries, automated handling systems enhance furnace loading efficiency and minimize product damage. Manufacturers leveraging robotics and IoT-integrated systems can deliver more consistent product quality and faster turnaround times. This trend also supports customization, allowing saggers to be produced in complex geometries with tighter tolerances. As factories modernize across North America, suppliers adopting smart production technologies will gain a strong competitive edge in the evolving market.

Key Challenge

High Production Costs and Raw Material Dependence

The production of high-purity quartz saggers requires specialized materials and precision processes, leading to elevated costs. North American manufacturers often rely on imported quartz raw materials from limited global sources, exposing them to price fluctuations and supply risks. The energy-intensive nature of sagger fabrication further adds to operational expenses, especially under tightening energy regulations. Smaller producers face difficulties competing with established suppliers that operate at scale. High costs can deter price-sensitive industries from adopting premium saggers, slowing market expansion. Addressing this challenge requires investments in local quartz processing and sustainable production practices to enhance supply stability.

Limited Awareness and Customization Constraints Among End Users

Despite their advantages, quartz saggers face limited awareness and adoption in several industrial sectors beyond semiconductors. Many manufacturers in metallurgy and ceramics continue using lower-cost alternatives like alumina or silicon carbide, which restricts market penetration. Additionally, the customization of saggers to match specific furnace dimensions and thermal conditions can be complex and time-consuming. These factors often delay procurement and increase project costs. Expanding technical education and providing design support to end users can help overcome this barrier. Collaborations between sagger producers and OEMs will be essential to demonstrate performance benefits and increase market visibility.

Regional Analysis

United States

The United States dominated the North America quartz sagger market in 2024, capturing over 70% of the regional share. Its leadership is driven by extensive semiconductor manufacturing, advanced ceramics production, and growing investments in high-temperature processing technologies. The U.S. CHIPS and Science Act has accelerated domestic wafer fabrication and electronics component manufacturing, boosting sagger demand. Leading manufacturers are also expanding local quartz refining and machining capabilities to meet stringent purity standards. Rising adoption of automation and contamination-free materials in industries such as aerospace, electronics, and metallurgy continues to strengthen the U.S. market position.

Canada

Canada accounted for around 20% of the North America quartz sagger market in 2024, supported by growing industrial and research applications. The country’s focus on clean energy, advanced materials, and metallurgy sectors drives quartz sagger usage in high-temperature and precision processes. Investments in research laboratories and technology parks further expand demand for high-purity saggers. Canadian firms are increasingly importing advanced sagger designs for pilot-scale semiconductor and ceramics production. Government incentives for clean manufacturing and technology innovation are expected to encourage local production capabilities, supporting steady market growth through 2032.

Mexico

Mexico held approximately 10% of the North America quartz sagger market share in 2024, with growth led by expanding electronics assembly and glass manufacturing industries. The country’s strong industrial base and integration into the regional semiconductor supply chain are fueling adoption. Quartz saggers are increasingly used in metal heat treatment and component sintering for automotive and electrical applications. Government-backed manufacturing incentives and foreign direct investments in advanced material processing support further expansion. As industrial modernization continues, Mexico is emerging as a cost-effective hub for downstream quartz component utilization within North America.

Market Segmentations:

By Shape

- Square

- Cylindrical

- Others

By Application

- Firing Ceramics

- Sintering Powders

- Heat Treating Metals

- Others

By End User

- Electronics and Semiconductors Industry

- Metallurgy Industries

- Glass Industries

- Others

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

The North America quartz sagger market is moderately consolidated, with global and regional manufacturers competing on purity levels, durability, and customization capabilities. Saint-Gobain, Morgan Advanced Materials plc, and NORITAKE CO., LIMITED hold leading positions due to their advanced production technologies and wide industrial networks. Zibo Gotrays Industry Co., Ltd. and Liling Zen Ceramic Co., Ltd. focus on cost-efficient, high-purity saggers for semiconductor and ceramics applications. Emerging players such as Shandong Topower Pte Ltd. and Magma Group are strengthening regional presence through strategic distribution and product diversification. Companies are investing in advanced machining, automation, and quality control to meet stringent semiconductor-grade requirements. Collaborations with foundries and research institutions are increasing to enhance product innovation and material performance. Competitive differentiation now relies heavily on consistent purity standards, long lifecycle products, and strong supply reliability within the expanding North American manufacturing ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, Sumitomo Refractories announces the development of a sustainable, recyclable quartz sagger.

- In 2022, RHI Magnesita invests in a new manufacturing facility for advanced quartz saggers in China.

Report Coverage

The research report offers an in-depth analysis based on Shape, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as semiconductor fabrication facilities increase across the U.S. and Canada.

- Growing investment in high-purity quartz processing will strengthen local supply chains.

- Automation and precision machining will enhance the consistency and durability of sagger production.

- Rising adoption of contamination-free materials will boost demand from advanced electronics industries.

- Technological upgrades in furnace operations will drive innovation in sagger design and performance.

- Collaborations between material manufacturers and chipmakers will accelerate customized sagger development.

- Environmental compliance and sustainability goals will push manufacturers toward eco-friendly production methods.

- The shift toward large wafer production will require saggers with improved thermal stability.

- Emerging players from Asia may expand partnerships with North American distributors to increase market reach.

- The United States will remain the leading regional hub, supported by growing semiconductor and advanced ceramics output.