Market Overview:

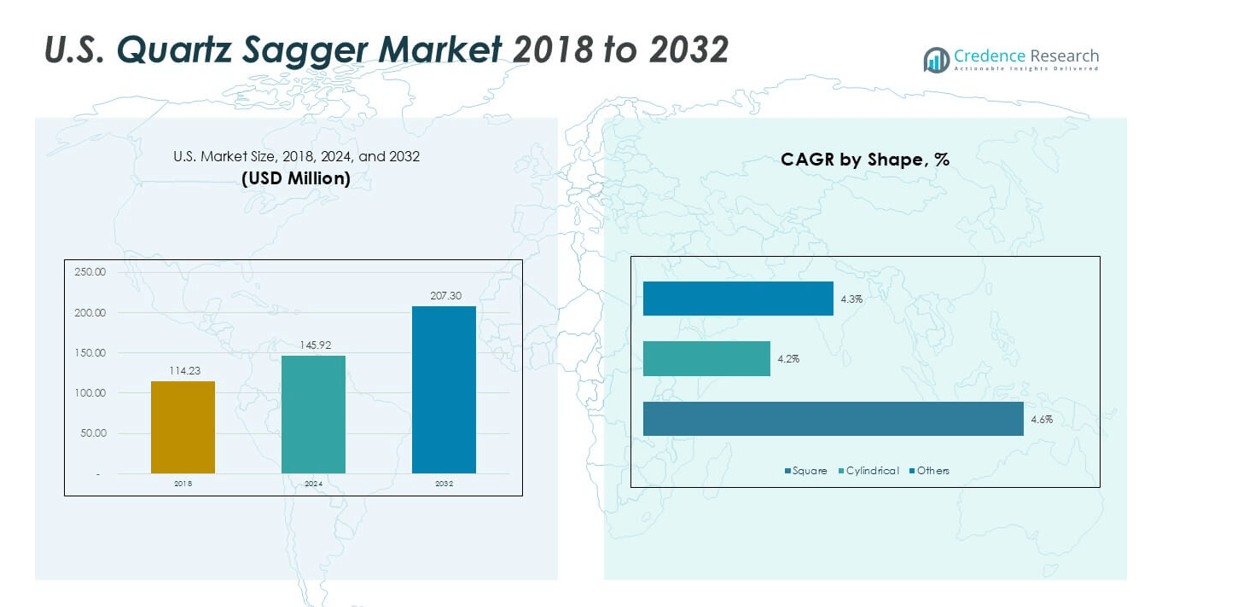

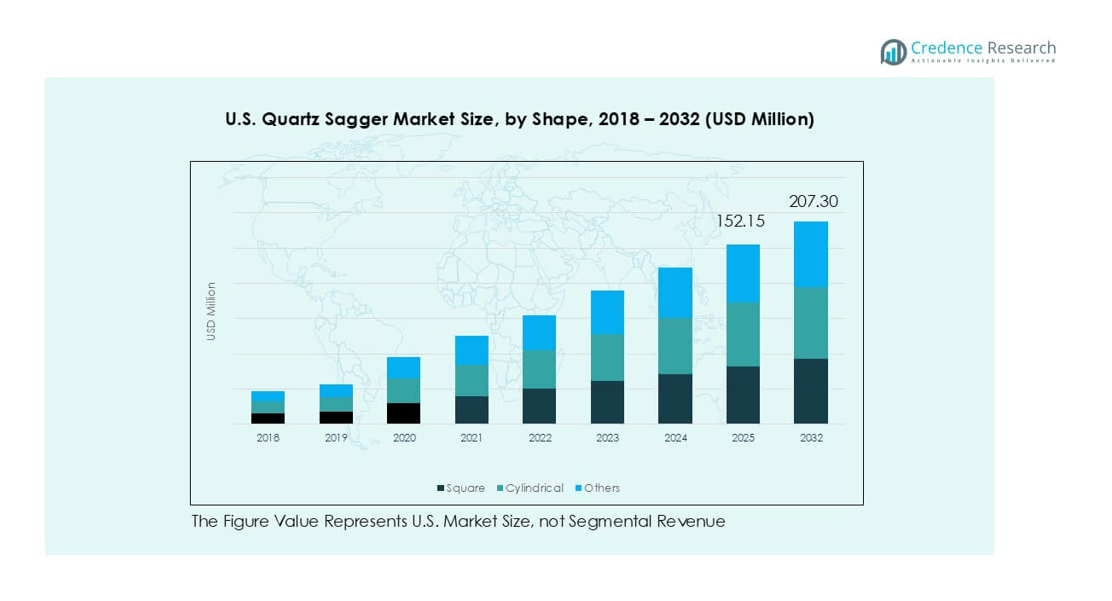

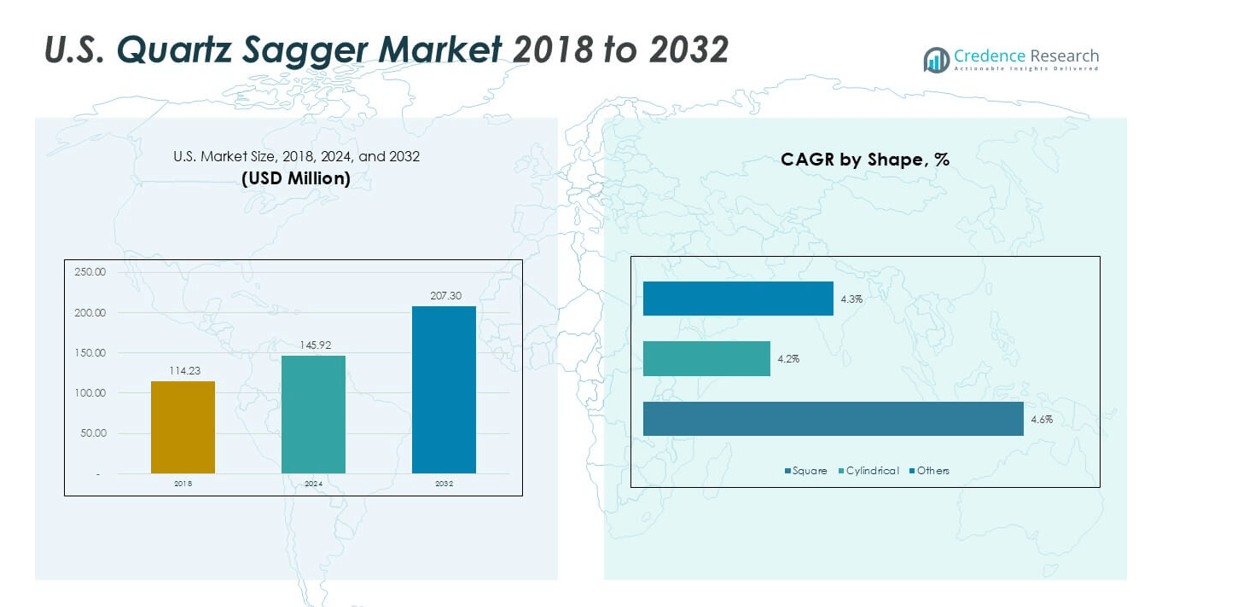

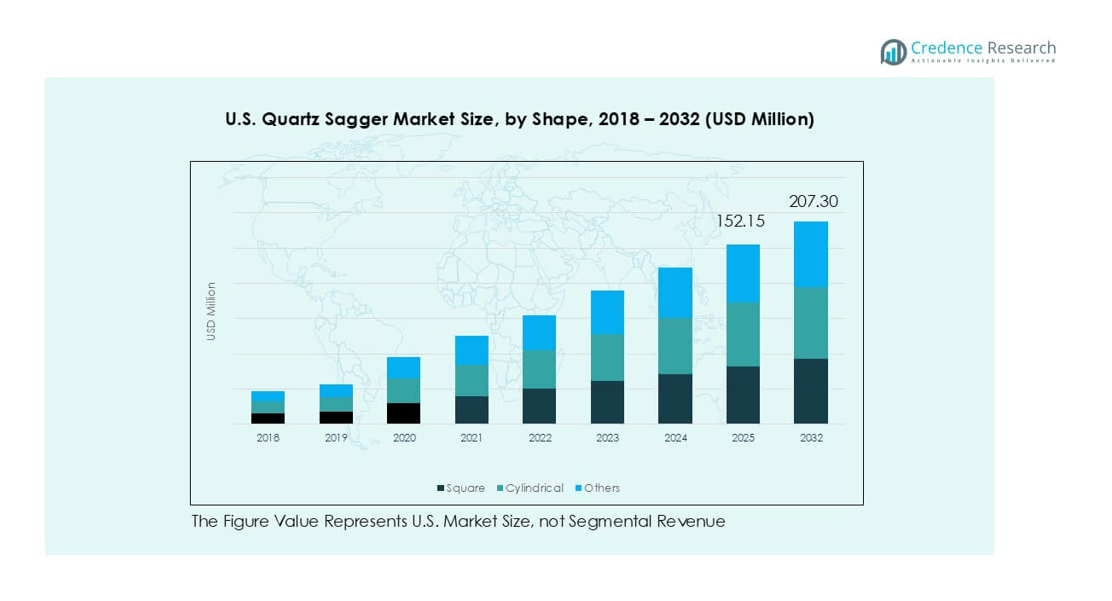

U.S. Quartz Sagger market size was valued at USD 114.23 million in 2018, reaching USD 145.92 million in 2024, and is anticipated to reach USD 207.30 million by 2032, at a CAGR of 4.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Sagger Market Size 2024 |

USD 145.92 million |

| U.S. Quartz Sagger Market, CAGR |

4.47% |

| U.S. Quartz Sagger Market Size 2032 |

USD 207.30 million |

The U.S. quartz sagger market is shaped by a mix of global leaders and regional specialists, each competing on product quality, innovation, and supply reliability. Companies such as Saint-Gobain, NORITAKE CO., LIMITED, and Morgan Advanced Materials plc dominate with their advanced manufacturing capabilities and established global presence. Regional players including Zibo Gotrays Industry Co., Ltd., Liling Zen Ceramic Co., Ltd., and Shandong Topower Pte Ltd. strengthen competition through cost-effective and customized product offerings. In terms of geography, the Northeast U.S. led with 30% market share in 2024, supported by strong semiconductor activity, followed by the Midwest at 25%, driven by metallurgy and automotive industries. The South accounted for 23%, fueled by electronics and aerospace hubs, while the West contributed 22%, led by California’s semiconductor and technology manufacturing base. This balance of global expertise and regional specialization drives steady growth and innovation across the market.

Market Insights

- The U.S. quartz sagger market was valued at USD 145.92 million in 2024 and is projected to reach USD 207.30 million by 2032, growing at a CAGR of 4.47% during the forecast period.

- Growth is driven by rising demand from electronics and semiconductor industries, which accounted for over 40% share in 2024, supported by expansion in chip and display panel production.

- A major trend is the adoption of high-purity and durable quartz saggers, with opportunities in advanced ceramics and powder sintering for energy storage and aerospace materials.

- Competition is led by Saint-Gobain, NORITAKE CO., LIMITED, Morgan Advanced Materials, Zibo Gotrays Industry Co., Ltd., and Shandong Topower Pte Ltd., with players focusing on innovation and capacity expansion.

- Regionally, the Northeast led with 30% share in 2024, followed by the Midwest at 25%, South at 23%, and West at 22%, reflecting the spread of semiconductor hubs, metallurgy, and aerospace industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Shape

Square saggers dominated the U.S. quartz sagger market in 2024, holding nearly 50% share. Their widespread adoption is attributed to uniform structural strength, thermal stability, and cost efficiency in repeated firing cycles. Square designs are preferred in ceramic production lines where stacking efficiency and consistent thermal distribution are critical. Cylindrical saggers followed as the second-largest segment due to their use in powder sintering processes requiring controlled atmospheres. The “Others” category, including customized and irregular shapes, caters to niche applications where specialized geometries are essential for precision manufacturing.

- For instance, CoorsTek Inc. operates multiple ceramic production lines in Colorado and Oklahoma using square saggers capable of withstanding temperatures up to 1,700°C for alumina and zirconia components.

By Application

Firing ceramics emerged as the leading application in 2024, contributing over 45% of revenue share. The dominance is driven by extensive use of quartz saggers in high-temperature kilns for advanced ceramics and refractories. Rising demand for ceramic substrates in electronics and energy applications strengthens growth prospects. Sintering powders also represent a strong segment, benefiting from increased adoption in battery materials and specialty alloys. Heat treating metals utilizes saggers for thermal protection and contamination control, while “Others” include research and laboratory-scale applications requiring controlled heating environments.

- For instance, Kyocera AVX Components Corporation, headquartered in Fountain Inn, South Carolina, manufactures ceramic capacitors as part of its broad portfolio of electronic components. The production of these capacitors involves high-temperature processes like firing and sintering to ensure the ceramic’s density and electrical properties.

By End User

The electronics and semiconductors industry accounted for the largest end-user share, exceeding 40% in 2024. This leadership is fueled by the rising production of semiconductors, LEDs, and display panels requiring quartz saggers for contamination-free processing. Metallurgy industries formed the second-largest segment, using saggers in heat treatment and sintering of advanced alloys. Glass industries also represent a significant share, where saggers provide thermal protection during high-temperature glass processing. The “Others” category includes laboratories and specialty manufacturers, where saggers are adopted for experimental and small-batch high-temperature applications.

Key Growth Drivers

Rising Demand from Electronics and Semiconductors Industry

The electronics and semiconductors industry is the primary growth driver of the U.S. quartz sagger market, accounting for more than 40% of demand in 2024. The surge in semiconductor fabrication, LED production, and display panel manufacturing fuels the need for high-purity quartz saggers. These components prevent contamination, withstand extreme thermal conditions, and enable precise firing cycles, making them indispensable in chip and component production. Growing investments in domestic semiconductor manufacturing under U.S. federal initiatives further amplify demand. As companies ramp up advanced node fabrication, the need for reliable, contamination-free saggers continues to strengthen market growth.

- For instance, Intel announced a $20 billion investment in 2021 to build two new advanced fabrication plants, Fab 52 and Fab 62, at its Ocotillo campus in Chandler, Arizona.

Expansion in Advanced Ceramics and Powder Sintering

Advanced ceramics and powder metallurgy represent a significant driver for quartz sagger adoption. Quartz saggers provide consistent temperature control and structural integrity during firing and sintering, making them essential for high-performance ceramics and specialty powders. Increasing applications in energy storage materials, aerospace alloys, and medical devices expand the scope of demand. The push for next-generation ceramic substrates in 5G devices and EV batteries also accelerates usage. With powder sintering emerging as a critical step in manufacturing lithium-ion cathodes and rare-earth magnets, quartz saggers are becoming central to high-value industrial processes, enhancing production efficiency and product performance.

- For instance, CoorsTek Inc., a leading global manufacturer of engineered ceramics, produces a vast array of advanced materials in its numerous worldwide facilities. For high-temperature firing processes, such as those used for alumina and zirconia components, the company and other industry players typically use kiln furniture (like saggers) made from more durable and heat-resistant refractory materials, such as high-purity alumina, mullite, or silicon carbide.

Growing Adoption in Metallurgy and Heat Treatment

The metallurgy industry relies on quartz saggers for high-temperature processing of alloys and specialty metals. Their superior thermal shock resistance and chemical inertness allow controlled heating cycles without material contamination. Demand is expanding in aerospace and defense sectors where precision metallurgy supports turbine components and structural materials. Furthermore, the shift toward lightweight alloys for EVs and renewable energy equipment reinforces demand for saggers in advanced metal processing. Heat-treating applications, particularly for stainless steels and titanium-based alloys, benefit from saggers’ durability and uniform heat distribution. The growing industrial base and focus on high-performance metals sustain this demand trajectory.

Key Trends & Opportunities

Integration with Semiconductor Manufacturing Expansion

The U.S. push to localize semiconductor manufacturing presents a strong opportunity for quartz sagger suppliers. Federal incentives such as the CHIPS and Science Act are prompting large-scale investment in fabrication plants. As fabs expand, the demand for saggers tailored to advanced semiconductor processes, including 3D packaging and MEMS devices, is rising. Manufacturers offering customized, contamination-free saggers optimized for these processes will gain a competitive edge. Additionally, the shift toward sustainable manufacturing creates opportunities for developing longer-lasting, energy-efficient saggers, reducing replacement cycles and overall operating costs.

- For instance, TSMC’s Arizona fab is designed to produce 4-nm wafers, using high-purity quartz saggers for dielectric annealing and oxidation, and is expected to scale up to a capacity of 30,000 wafers per month.

Innovation in Material Engineering for Durability

A key trend shaping the U.S. quartz sagger market is material innovation aimed at extending product lifespan and thermal performance. Manufacturers are developing saggers with improved microstructural uniformity, enhancing resistance to thermal shock and cracking under repeated firing cycles. This innovation supports industries where downtime due to sagger failure leads to high production losses. The push toward high-purity quartz formulations and advanced fabrication techniques creates opportunities for premium saggers with enhanced durability. Companies investing in R&D for specialized saggers targeting high-value applications, such as gallium nitride semiconductors and advanced ceramics, are positioned to capture emerging market segments.

Key Challenges

High Production Costs and Limited Availability of Raw Materials

Quartz sagger manufacturing depends on high-purity quartz, which is costly and regionally concentrated. Rising raw material prices and energy-intensive production processes elevate overall costs. This limits scalability and creates barriers for smaller manufacturers entering the market. The reliance on consistent quartz supply chains also makes the market vulnerable to disruptions. For U.S. producers, maintaining cost competitiveness against global suppliers, particularly from Asia, remains challenging. Balancing cost efficiency with the need for high-purity saggers represents a major constraint for market expansion.

Performance Limitations under Extreme Cycles

Although quartz saggers are valued for thermal stability, repeated use in extreme firing cycles leads to gradual degradation. Cracking, deformation, and contamination risks increase with prolonged exposure, reducing operational lifespan. In semiconductor and advanced ceramics industries, even minor contamination can compromise product quality, leading to significant losses. This performance limitation drives frequent replacement cycles, raising operational costs for end users. The challenge lies in enhancing durability without significantly increasing production costs. Overcoming this constraint requires sustained innovation in design and materials, which not all manufacturers can achieve efficiently.

Regional Analysis

Northeast U.S.

The Northeast region accounted for 30% of the U.S. quartz sagger market share in 2024, driven by its strong concentration of semiconductor fabrication facilities and advanced research centers. States such as New York and Massachusetts lead adoption due to ongoing investments in microelectronics and advanced ceramics. The presence of specialized universities and innovation hubs further supports R&D in high-temperature materials. Demand is particularly strong in electronics and semiconductor applications, where contamination-free and durable saggers are essential. The region’s expanding high-tech manufacturing ecosystem ensures steady growth in quartz sagger consumption.

Midwest U.S.

The Midwest captured 25% of the U.S. quartz sagger market share in 2024, supported by a robust metallurgy and automotive supply chain. States such as Ohio, Michigan, and Illinois play a central role in advanced alloy processing and heat-treating industries. Quartz saggers are widely used in powder sintering and metallurgy applications, aligning with the region’s strong base in metal fabrication and specialty manufacturing. Increasing adoption in EV component production and renewable energy equipment further enhances demand. The Midwest market benefits from its industrial infrastructure, ensuring consistent consumption of saggers in both traditional and emerging applications.

South U.S.

The South represented 23% of the U.S. quartz sagger market share in 2024, driven by expanding electronics manufacturing clusters and growing aerospace activity. Texas and North Carolina are key states, with rising semiconductor fabrication and advanced materials industries fueling demand. The region also benefits from its strong base in glass and ceramics production, where saggers are used for high-temperature firing. Aerospace hubs in states like Florida and Alabama drive additional consumption for precision metal processing. Favorable investment policies and proximity to energy resources further support quartz sagger adoption, positioning the South as a rapidly expanding market.

West U.S.

The West held 22% of the U.S. quartz sagger market share in 2024, led by California’s dominance in semiconductor and electronics manufacturing. The region is a hub for technology-driven industries, where quartz saggers are critical in semiconductor wafer processing and advanced ceramic substrates. Strong demand is also recorded in aerospace and defense sectors across Washington and Arizona. California’s significant role in innovation and sustainability has encouraged adoption of longer-lasting, high-performance saggers. With the West’s concentration of high-tech industries, coupled with continuous investments in R&D and clean energy, the region remains a vital growth contributor to the U.S. market.

Market Segmentations:

By Shape

- Square

- Cylindrical

- Others

By Application

- Firing Ceramics

- Sintering Powders

- Heat Treating Metals

- Others

By End User

- Electronics and Semiconductors Industry

- Metallurgy Industries

- Glass Industries

- Others

By Geography

- Northeast U.S.

- Midwest U.S.

- South U.S.

- West U.S.

Competitive Landscape

The U.S. quartz sagger market features a moderately consolidated landscape, with competition shaped by both multinational corporations and specialized regional manufacturers. Leading players such as Saint-Gobain, NORITAKE CO., LIMITED, and Morgan Advanced Materials plc dominate with strong product portfolios, global distribution networks, and advanced R&D capabilities. Domestic companies including Zibo Gotrays Industry Co., Ltd., Liling Zen Ceramic Co., Ltd., and Shandong Topower Pte Ltd. strengthen their position through customized solutions and competitive pricing, particularly for metallurgy and ceramics applications. Firms are investing in high-purity quartz formulations and enhanced thermal performance to meet semiconductor industry requirements. Strategic initiatives such as capacity expansions, product innovations, and partnerships with electronics and aerospace industries are becoming central to growth. Recent developments highlight increased focus on sustainability, with manufacturers working on longer-lasting saggers to reduce replacement cycles. This competitive environment encourages continuous innovation while maintaining a balance between cost efficiency and advanced performance standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, Sumitomo Refractories announces the development of a sustainable, recyclable quartz sagger.

- In 2022, RHI Magnesita invests in a new manufacturing facility for advanced quartz saggers in China.

Report Coverage

The research report offers an in-depth analysis based on Shape, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. quartz sagger market will expand steadily with growing semiconductor fabrication capacity.

- Advanced ceramics production will continue to strengthen demand for high-performance saggers.

- Electronics and semiconductor industries will remain the leading end-user segment.

- Metallurgy applications will see increasing adoption in aerospace and EV component manufacturing.

- Innovation in high-purity quartz materials will improve durability and thermal resistance.

- Sustainability initiatives will drive development of longer-lasting saggers to reduce replacement cycles.

- Regional growth will be strongest in the Northeast, supported by semiconductor hubs.

- The Midwest will maintain demand through metallurgy and automotive manufacturing bases.

- The South and West will benefit from rising aerospace and technology-driven industries.

- Competition will intensify as global and regional players invest in R&D and product customization.