Market Overview

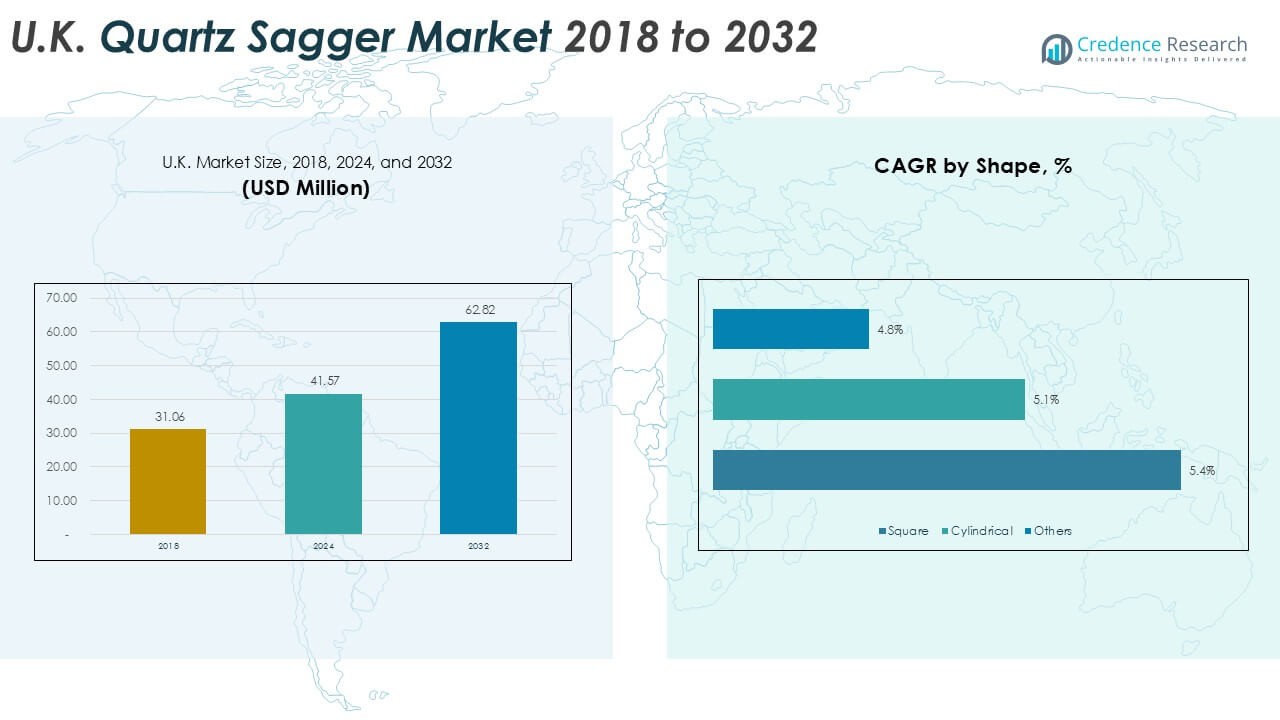

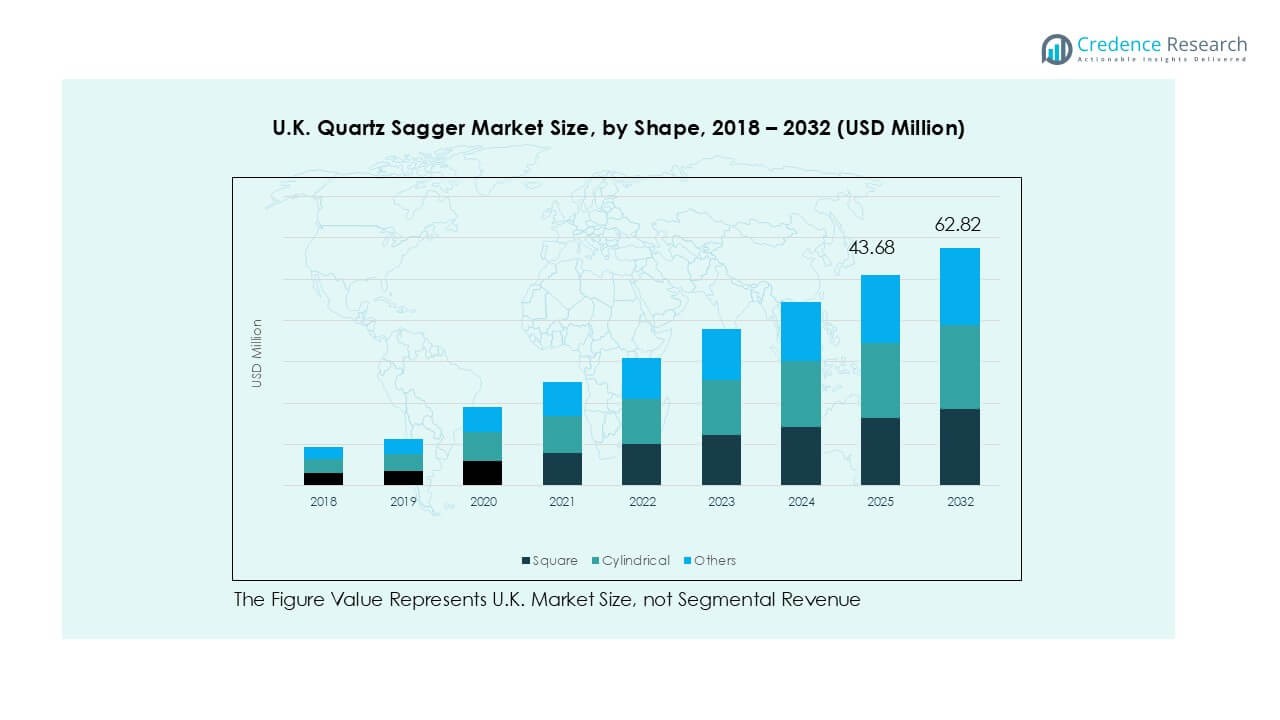

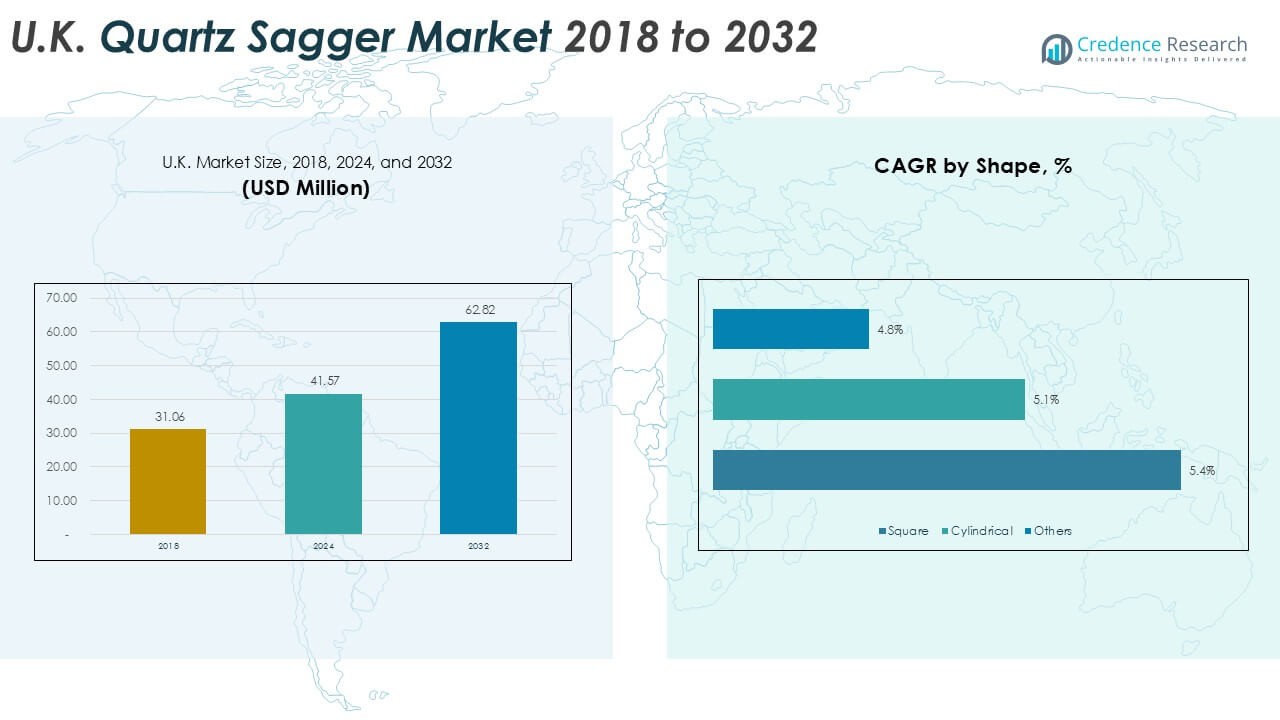

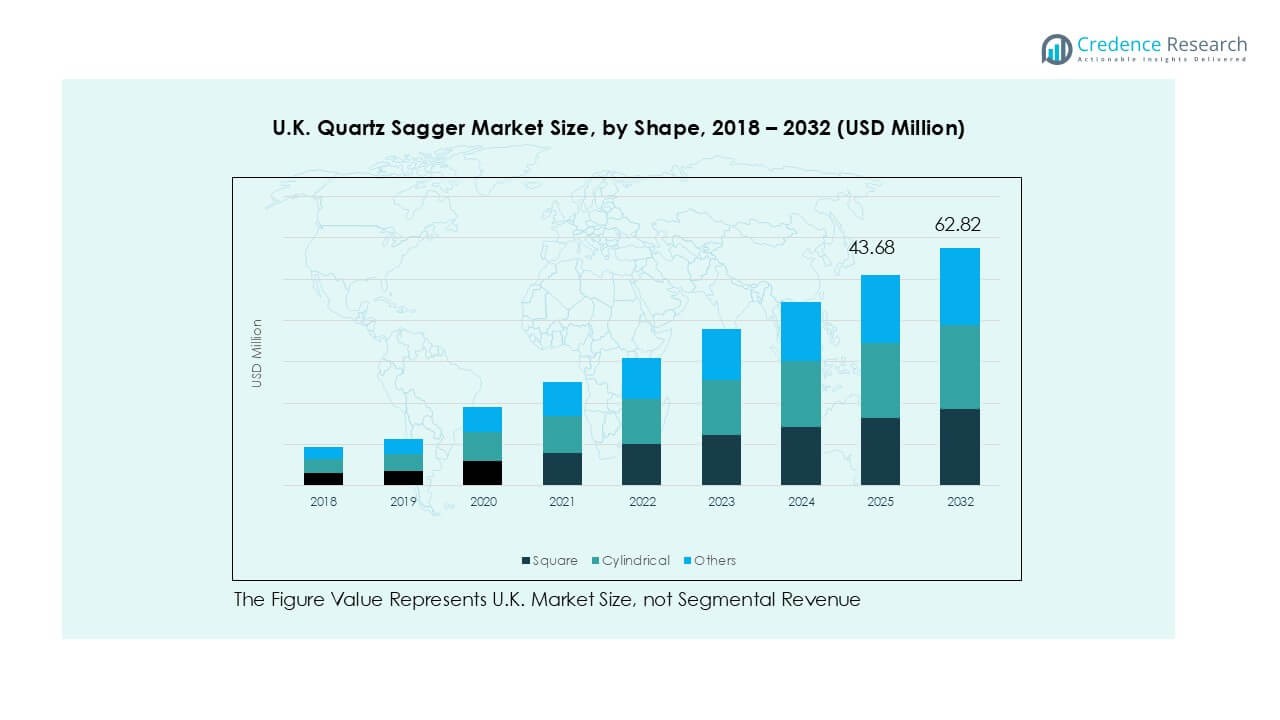

The UK Quartz Sagger market size was valued at USD 31.06 million in 2018, increased to USD 41.57 million in 2024, and is anticipated to reach USD 62.82 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Quartz Sagger Market Size 2024 |

USD 41.57 Million |

| UK Quartz Sagger Market, CAGR |

5.2% |

| UK Quartz Sagger Market Size 2032 |

USD 62.82 Million |

The UK quartz sagger market is led by major players such as Saint-Gobain, NORITAKE CO., LIMITED, Morgan Advanced Materials plc, Zibo Gotrays Industry Co., Ltd., and Liling Zen Ceramic Co., Ltd. These companies hold a strong presence through advanced product portfolios and high-purity solutions tailored for electronics, ceramics, and metallurgy applications. England emerged as the leading region, accounting for over 55% of the total market share in 2024, driven by its robust semiconductor and advanced ceramics industries. Scotland followed with nearly 20%, supported by metallurgy and specialty glass production, while Wales and Northern Ireland contributed 15% and 10%, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Quartz Sagger market size was USD 41.57 million in 2024 and is projected to reach USD 62.82 million by 2032, growing at a CAGR of 5.2%.

- Rising demand from the electronics and semiconductor industry remains the strongest driver, with the segment holding more than 42% share due to high-purity and contamination-free processing needs.

- A key trend is the adoption of customized square saggers, which dominated by shape with over 45% share in 2024, offering efficiency in stacking and thermal uniformity for ceramics and powder sintering.

- The competitive landscape is shaped by Saint-Gobain, NORITAKE CO., LIMITED, and Morgan Advanced Materials plc, along with regional players like Zibo Gotrays Industry Co., Ltd. and Liling Zen Ceramic Co., Ltd., focusing on high-performance, application-specific saggers.

- Regionally, England led with 55% share in 2024, followed by Scotland at 20%, Wales at 15%, and Northern Ireland at 10%, reflecting strong industrial bases across electronics, metallurgy, and ceramics.

Market Segmentation Analysis:

By Shape

The square segment dominated the UK quartz sagger market in 2024, accounting for over 45% of the total share. Its dominance is attributed to uniform heat distribution, high structural stability, and adaptability across multiple firing environments. Square saggers are widely preferred in ceramics and powder sintering due to their efficient stacking and space utilization in kilns, which lowers operational costs. Cylindrical saggers follow, supported by their strength under high thermal stress, while other specialized shapes serve niche applications requiring custom thermal performance. The demand for square saggers continues to grow with rising ceramic production.

- For instance, in 2024, Morgan Advanced Materials developed and began commercializing a new, longer-lasting ceramic saggar for the battery industry. A pilot manufacturing line for these high-purity, alumina-based saggars was established in India, with plans for a larger production line in Europe or the US. These saggars are optimized for use in industrial kilns operating at temperatures well above 800–900°C for cathode active material production.

By Application

Firing ceramics led the market in 2024, holding nearly 40% share of total demand. This leadership comes from the large-scale use of quartz saggers in advanced ceramic production, particularly in tiles, substrates, and technical ceramics. The ability to withstand repeated thermal cycling and resist contamination makes quartz saggers indispensable in ceramic firing processes. Sintering powders remains the second-largest segment, boosted by increasing adoption in electronic and energy storage materials. Heat treating metals and other applications show steady growth as industries expand high-temperature processing lines across the UK.

- For instance, in 2024, Johnson Matthey’s primary focus at its Royston facility was on hydrogen fuel cell component manufacturing, not ceramic catalyst substrate production using quartz saggers.

By End User

The electronics and semiconductors industry represented the leading end-user segment, capturing more than 42% share in 2024. Rapid growth of semiconductor manufacturing and demand for high-purity, defect-free materials drive the adoption of quartz saggers. Their high thermal stability and resistance to chemical reactions ensure consistent quality during wafer processing and component fabrication. Metallurgy industries also show strong usage for heat treatment applications, while glass manufacturers use quartz saggers in specialty glass production. Other industrial users contribute smaller shares, but increasing demand for advanced thermal equipment supports market expansion.

Key Growth Drivers

Rising Demand from Electronics and Semiconductor Industry

The electronics and semiconductor sector has emerged as the primary driver of the UK quartz sagger market. Quartz saggers are vital in high-purity semiconductor fabrication, ensuring stable thermal environments during wafer processing and diffusion. Their superior resistance to thermal shock and minimal contamination properties makes them indispensable in chip manufacturing. With the UK investing heavily in semiconductor R&D and expanding production capacity, the demand for quartz saggers continues to rise. The government-backed National Semiconductor Strategy further strengthens this growth, supporting advanced electronics manufacturing. Increasing global reliance on electronics—from consumer devices to EVs—directly drives higher utilization of quartz saggers in the UK market.

- For instance, the UK government, under its National Semiconductor Strategy launched in May 2023, allocated £1 billion to be spent over the next decade. The strategy focuses on the UK’s strengths in chip design, research and development (R&D), and compound semiconductors, rather than broad domestic wafer material and component processing.

Expanding Applications in Advanced Ceramics

Advanced ceramics production has become a significant growth area, pushing quartz sagger demand upward. Quartz saggers are extensively used in firing ceramics and powder sintering, where thermal stability and non-reactive properties ensure consistent quality. The UK’s growing use of advanced ceramics in aerospace, defense, and energy applications accelerates this need. Aerospace firms increasingly use lightweight, high-strength ceramic components, while energy industries demand durable ceramic materials for turbines and reactors. The strong alignment of quartz saggers with high-precision ceramic manufacturing creates a stable market pull. Their role in enabling defect-free sintering makes them a preferred choice for ceramic producers seeking reliability and cost efficiency.

- For instance, Rolls-Royce manufactures ceramic matrix composite (CMC) components for high-temperature applications, such as the UltraFan demonstrator engine, by using advanced techniques like Polymer Infiltration and Pyrolysis (PIP). This process allows for the creation of components that withstand extreme temperatures, operating well above the limits of traditional materials.

Metallurgy and Glass Industry Expansion

The UK metallurgy and glass industries also play a pivotal role in boosting quartz sagger demand. These industries rely on saggers for high-temperature processes such as heat treatment of alloys and specialty glass production. The growing demand for high-strength alloys in automotive and renewable energy sectors strengthens metallurgy-related consumption. At the same time, specialty glass production, including optical and electronic-grade glass, relies on saggers for controlled heating. Quartz saggers’ resistance to high stress and contamination ensures improved product quality in these industries. Ongoing investments in metallurgical advancements and glass innovation in the UK further enhance their importance, creating steady long-term growth.

Key Trend & Opportunity

Shift Toward High-Purity, Contamination-Free Materials

A major trend shaping the UK quartz sagger market is the rising preference for high-purity, contamination-free materials. Semiconductor, electronics, and advanced ceramics producers demand saggers with ultra-low impurity levels to prevent defects during firing or sintering. This creates opportunities for manufacturers to develop premium-grade quartz saggers with enhanced surface finishes and tighter specifications. Companies investing in advanced manufacturing technologies, such as precision machining and controlled atmosphere processing, stand to capture significant growth. As end users prioritize defect-free output, suppliers offering saggers with higher reliability and longer lifespans gain a competitive advantage.

- For instance, Heraeus Covantics is the global business unit that specializes in the manufacturing and processing of ultra-high-purity quartz and other high-end materials for the semiconductor industry.

Integration of Custom Shapes and Designs

Growing demand for customized solutions is driving innovation in quartz sagger design. Industries increasingly require saggers tailored to unique production needs, such as specific furnace types or specialized material processing. The shift toward customized square and cylindrical designs enables more efficient stacking, optimized thermal flow, and reduced processing costs. This trend presents opportunities for UK-based manufacturers to focus on flexible, design-oriented production capabilities. The ability to provide tailored solutions positions suppliers to meet diverse demands from semiconductors, ceramics, and metallurgy markets, expanding their market reach while increasing customer retention.

Key Challenge

High Production and Procurement Costs

One of the most significant challenges in the UK quartz sagger market is the high cost associated with production and procurement. Manufacturing saggers involves precision processes, advanced raw materials, and stringent quality checks, all of which increase final costs. For end users in cost-sensitive industries, the price of quartz saggers can limit adoption compared to alternative materials. Smaller manufacturers in ceramics and glass often face challenges in balancing performance needs with budget constraints. The limited availability of high-quality quartz raw material sources in Europe adds to procurement challenges, keeping market costs elevated and restricting mass adoption.

Competition from Alternative Materials

The quartz sagger market also faces competition from alternative refractory materials such as alumina and silicon carbide. These materials offer lower costs and, in some cases, higher resistance to mechanical stress, making them attractive substitutes in heat treatment and ceramic applications. Industries with less stringent purity requirements often opt for these alternatives, reducing quartz sagger penetration. Additionally, advancements in composite refractory solutions present new challenges to quartz-based dominance. To sustain growth, manufacturers must emphasize quartz saggers’ unique benefits—such as purity, chemical inertness, and thermal stability—while exploring hybrid material innovations to remain competitive in the UK market.

Regional Analysis

England

England dominated the UK quartz sagger market in 2024, holding over 55% of the total share. The region’s leadership is driven by its strong presence of semiconductor fabrication, advanced ceramics, and specialty glass industries. Demand is further supported by major electronics manufacturing clusters and investments in clean energy technologies. The presence of research hubs and industrial innovation centers accelerates adoption of high-purity quartz saggers. With consistent expansion in aerospace and defense materials, England continues to lead the market. Its well-established infrastructure and industrial base ensure steady growth across applications, from ceramics firing to metallurgy.

Scotland

Scotland accounted for nearly 20% of the UK quartz sagger market share in 2024. Growth in this region is fueled by investments in metallurgy, particularly in steel and alloy production, where quartz saggers are used for heat treatment. The country’s expanding renewable energy projects also drive demand for advanced materials and high-performance ceramics. Scotland’s glass industries, producing specialty and optical glass, benefit from quartz saggers’ ability to withstand high thermal stress. With rising R&D in advanced materials and sustainable processing, Scotland plays a crucial role in niche applications, positioning itself as a secondary growth hub in the UK market.

Wales

Wales captured around 15% of the UK quartz sagger market share in 2024. The region’s growth stems from its established ceramics manufacturing base and metallurgical applications. Local industries depend on quartz saggers for high-temperature stability and durability during production processes. Wales also benefits from investments in advanced materials research, supporting demand in specialty ceramics and engineered glass. Growing activity in industrial heat treatment applications further adds to sagger utilization. While smaller in size compared to England, Wales demonstrates strong demand in specific industrial clusters. Its focus on material innovation sustains steady growth in the national quartz sagger market.

Northern Ireland

Northern Ireland held about 10% of the UK quartz sagger market share in 2024. The region’s demand is concentrated in glass manufacturing and niche electronics assembly, where quartz saggers are valued for their resistance to contamination and thermal cycling. Local industries leverage these materials in producing specialty ceramics and precision glass products. The gradual expansion of high-value manufacturing in Northern Ireland supports a growing role in the market. Although its contribution is smaller compared to other regions, increasing government support for advanced manufacturing and exports positions Northern Ireland as an emerging contributor to overall market growth.

Market Segmentations:

By Shape

- Square

- Cylindrical

- Others

By Application

- Firing Ceramics

- Sintering Powders

- Heat Treating Metals

- Others

By End User

- Electronics and Semiconductors Industry

- Metallurgy Industries

- Glass Industries

- Others

By Geography

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK quartz sagger market is moderately consolidated, with competition shaped by both global manufacturers and specialized regional players. Leading companies such as Saint-Gobain, NORITAKE CO., LIMITED, and Morgan Advanced Materials plc dominate through their advanced product portfolios, large-scale production capacities, and established distribution networks. Emerging players including Zibo Gotrays Industry Co., Ltd., Liling Zen Ceramic Co., Ltd., and Shandong Topower Pte Ltd. strengthen competition by offering cost-effective, application-specific solutions. Companies are investing heavily in product innovation, focusing on high-purity saggers and customized designs to cater to electronics, ceramics, and metallurgy industries. Strategic collaborations, acquisitions, and capacity expansions are common strategies to secure market positioning. Recent developments highlight a strong push toward contamination-free materials and precision engineering to meet semiconductor industry standards. With growing demand across multiple end-use sectors, the competitive landscape continues to evolve, balancing established leaders with agile regional manufacturers that emphasize quality, pricing, and tailored offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zibo Gotrays Industry Co., Ltd

- Saint-Gobain

- NORITAKE CO., LIMITED

- Morgan Advanced Materials plc

- Liling Zen Ceramic Co., Ltd.

- Shandong Topower Pte Ltd.

- Magma Group

- Other Key Players

Recent Developments

- In 2023, Sumitomo Refractories announces the development of a sustainable, recyclable quartz sagger.

- In 2022, RHI Magnesita invests in a new manufacturing facility for advanced quartz saggers in China.

Report Coverage

The research report offers an in-depth analysis based on Shape, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK quartz sagger market will expand steadily with rising semiconductor manufacturing.

- Advanced ceramics production will continue to strengthen demand across aerospace and energy industries.

- Square saggers will remain dominant due to efficiency in kiln stacking and uniform heating.

- High-purity saggers will gain importance as industries shift toward contamination-free production.

- Custom-designed saggers will see increasing adoption for specialized applications and furnaces.

- Regional players will compete by offering cost-effective solutions for niche markets.

- Global leaders will focus on R&D to develop durable and high-performance saggers.

- Metallurgy and specialty glass industries will sustain consistent demand for thermal applications.

- England will maintain its leading share, supported by strong industrial clusters.

- Sustainability-driven innovations in production will shape long-term competitiveness in the market.