Market Overview:

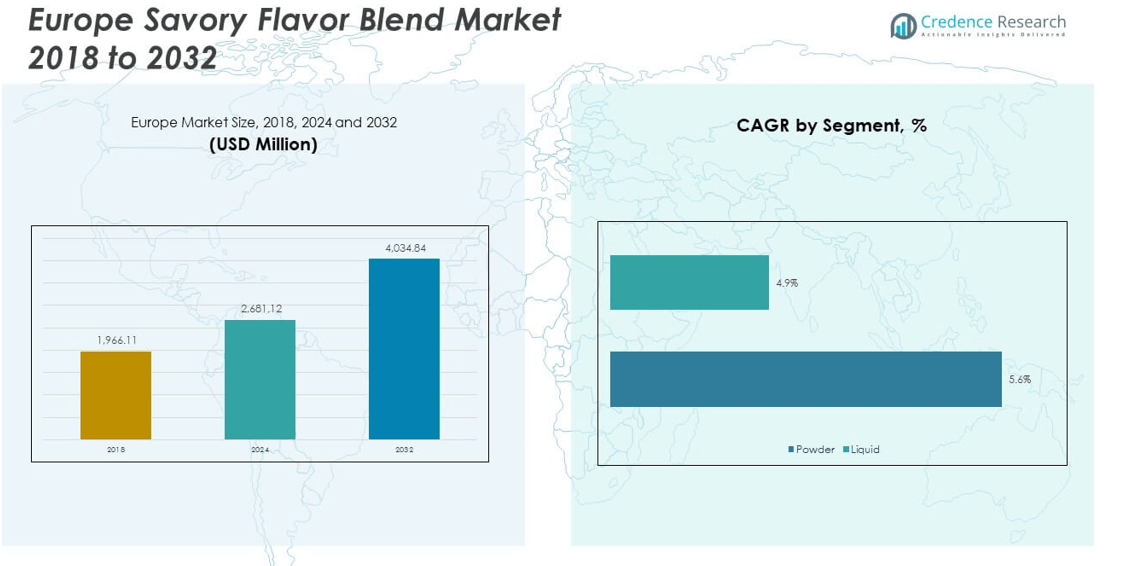

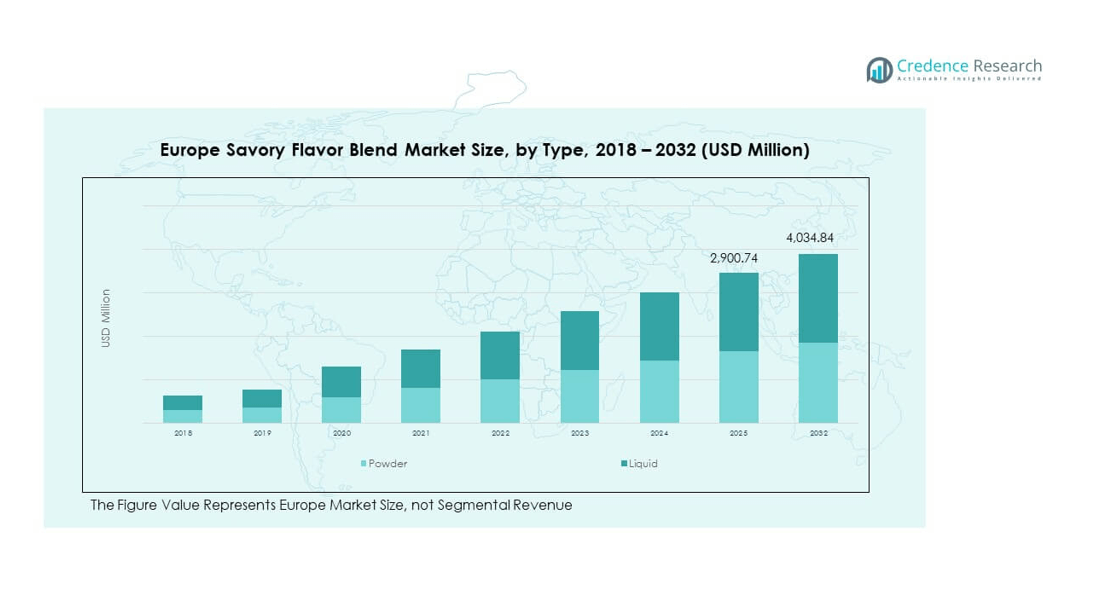

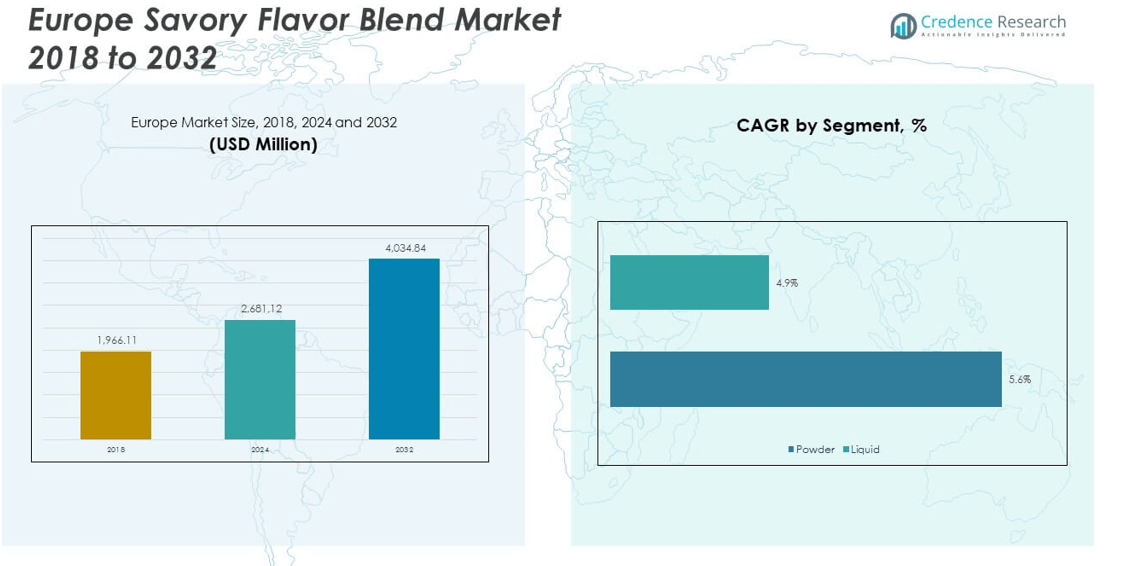

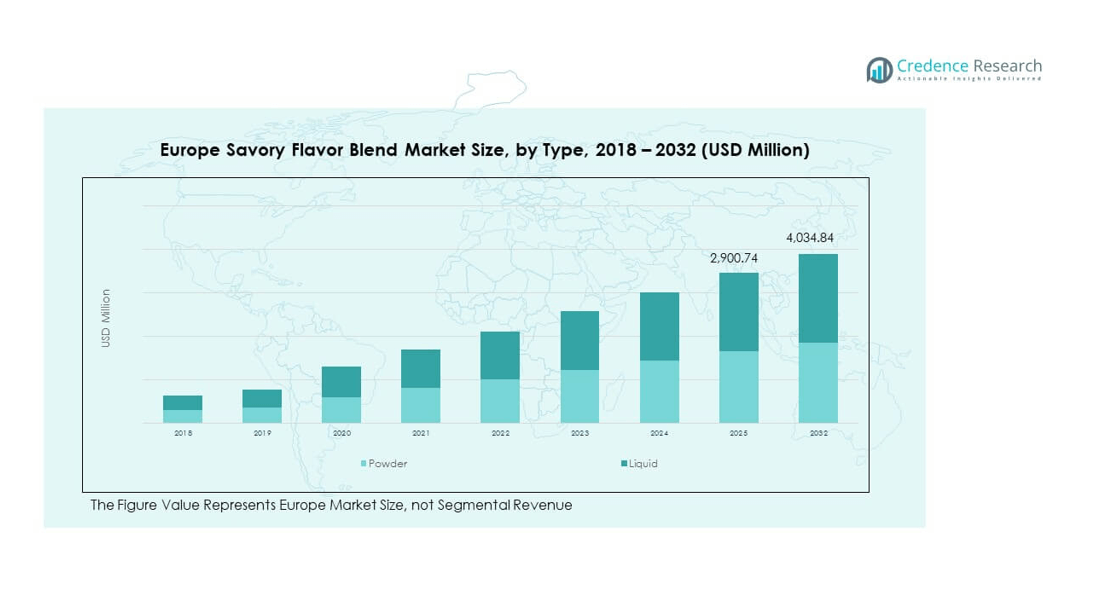

The Europe Savory Flavor Blend Market size was valued at USD 1,966.11 million in 2018 to USD 2,681.12 million in 2024 and is anticipated to reach USD 4,034.84 million by 2032, at a CAGR of 4.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Savory Flavor Blend Market Size 2024 |

USD 2,681.12 million |

| Europe Savory Flavor Blend Market, CAGR |

4.83% |

| Europe Savory Flavor Blend Market Size 2032 |

USD 4,034.84 million |

The Europe Savory Flavor Blend Market is experiencing steady growth driven by rising consumer preference for natural and clean-label ingredients. Increasing demand for convenience foods, ready-to-eat meals, and plant-based alternatives is fueling adoption. Food manufacturers are integrating savory blends to enhance taste profiles while addressing health-conscious trends. Growth in the hospitality sector, combined with rising experimentation in international cuisines, is further strengthening demand across Europe. Innovation in seasoning technologies and tailored blends for processed foods continue to support market expansion.

Regionally, Western Europe leads the savory flavor blend market due to strong food processing industries and high consumer demand for premium flavors. Countries such as Germany, France, and the U.K. drive significant adoption, supported by established culinary traditions and advanced manufacturing capabilities. Meanwhile, Eastern Europe is emerging as a promising market, driven by rising disposable incomes and urbanization. Increasing preference for global cuisines and the expansion of quick-service restaurants further support market growth in developing regions.

Market Insights:

- The Europe Savory Flavor Blend Market was valued at USD 1,966.11 million in 2018, reached USD 2,681.12 million in 2024, and is projected to hit USD 4,034.84 million by 2032, growing at a CAGR of 4.83%.

- Western Europe holds the largest share at 38%, driven by strong food processing industries and advanced culinary demand. Northern Europe follows with 27% share, supported by high disposable incomes and preference for premium flavors. Southern Europe captures 20%, fueled by rich culinary traditions and tourism-driven foodservice growth.

- Eastern Europe, with a 15% share, is the fastest-growing region, supported by urbanization, rising incomes, and adoption of global cuisines.

- Powder-based savory flavor blends account for nearly 60% share in 2024, due to ease of application and longer shelf life.

- Liquid blends hold around 40% share, favored for ready meals, sauces, and convenience foods requiring quick flavor dispersion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Demand for Natural and Clean-Label Flavor Blends Driving Adoption:

The Europe Savory Flavor Blend Market is witnessing strong growth due to increasing consumer demand for natural, organic, and clean-label ingredients. Food buyers seek transparency in labeling and prefer products with recognizable components. Manufacturers are introducing savory blends free from artificial additives and preservatives to match these preferences. Growing awareness about health and wellness is pushing consumers toward blends enriched with herbs and spices. It supports reformulation efforts across the processed food industry. Convenience food brands are integrating clean-label seasoning to align with health-focused trends. Retailers are expanding product portfolios with healthier savory solutions. This demand is creating consistent momentum across both premium and mass-market categories.

- For instance, Bell Flavors & Fragrances utilizes proprietary natural extraction technologies, including industry-standard methods like steam-distillation and cold-press extraction, to produce an extensive portfolio of natural and organic flavors. Their flavor library, Botanicals®, contains over 10,000 unique botanical extracts sourced from a wide variety of plants, such as food-grade fenugreek, coriander, and nutmeg, to reduce the use of synthetic compounds in their formulations.

Expansion of Ready-to-Eat and Processed Food Consumption Strengthening Flavor Demand:

Changing lifestyles in Europe are boosting demand for ready-to-eat and processed foods, creating direct opportunities for savory blends. Consumers prioritize convenience while still expecting rich flavor experiences. Manufacturers use blends to maintain consistent taste profiles in mass production. It helps address the challenge of balancing efficiency with quality. The rising popularity of frozen meals, snacks, and packaged foods has amplified flavor innovation. Food service providers also rely on blends to deliver reliable taste across menus. The ability to standardize flavor while cutting preparation time benefits quick-service restaurants. This factor has become one of the strongest growth drivers for the market.

- For instance, UK brand THIS launched new plant-based ready meals at Tesco, highlighting growth in convenience and plant-based RTE food products.

Rising Popularity of Plant-Based and Alternative Protein Products Supporting Growth:

Plant-based foods are gaining traction, supported by vegan and flexitarian movements in Europe. The Europe Savory Flavor Blend Market benefits from this trend, as alternative protein sources often require enhanced flavor. Savory blends improve taste, texture, and appeal of soy, pea, and mycoprotein-based items. Food producers depend on blends to overcome taste barriers associated with plant proteins. It enables brands to create products with broader mainstream acceptance. The versatility of savory profiles helps replicate traditional meat-based flavors. This trend aligns with sustainability-focused consumer choices. It also allows producers to tap into growing environmentally conscious demographics.

Growth of Foodservice Industry and Culinary Experimentation Fueling Flavor Innovation:

The expanding foodservice industry across Europe is fueling steady demand for seasoning solutions. Restaurants, cafés, and catering businesses use savory blends to deliver consistent taste experiences. Chefs increasingly experiment with international cuisines, driving demand for innovative flavor systems. It supports the diversification of menus and enhances customer satisfaction. Street food, fast-casual, and premium dining outlets actively source customized blends. Hospitality growth in tourist-heavy markets such as France, Italy, and Spain boosts adoption further. Savory blends enable cost-effective consistency for large-scale foodservice operations. Their flexibility has positioned them as a staple for culinary professionals across the region.

Market Trends:

Rising Integration of Functional Ingredients in Flavor Blends Shaping New Product Development:

The market is evolving with the integration of functional ingredients into flavor blends. Food companies are enhancing products with ingredients that offer both taste and health benefits. Probiotic and antioxidant-infused blends are gaining traction in bakery and snacks. The Europe Savory Flavor Blend Market is increasingly shaped by consumer focus on wellness-linked flavors. It allows producers to differentiate products while promoting better nutrition. Functional flavors are now marketed as solutions that combine indulgence with health. This trend is expected to encourage higher-value product launches. Innovation pipelines reflect strong alignment between taste enhancement and functional nutrition.

- For instance, Probiotic, antioxidant-infused blends are being used in snacks and bakery to simultaneously enhance taste and nutrition.

Increased Adoption of Advanced Flavor Encapsulation Technologies Across the Industry:

Technological advancements are reshaping flavor delivery methods in the European market. Encapsulation technologies preserve volatile compounds and improve stability during processing. They enhance shelf life while ensuring consistent flavor release in finished products. The use of microencapsulation is expanding across snacks, ready meals, and soups. The Europe Savory Flavor Blend Market benefits from these innovations by ensuring uniform consumer experiences. It strengthens product reliability and reduces waste from flavor degradation. Food companies are investing in R&D to scale these applications. The adoption of advanced flavor technology is a critical trend shaping industry competitiveness.

- For instance, Microencapsulation technology use is expanding in snacks, ready meals, and soups for consistent flavor delivery.

Growing Popularity of Ethnic and Regional Flavor Influences in Product Portfolios:

Globalization has increased exposure to diverse cuisines, fueling demand for ethnic flavor blends. European consumers show strong interest in Mediterranean, Asian, and Middle Eastern taste profiles. The trend reflects a desire for culinary exploration without leaving home. The Europe Savory Flavor Blend Market is evolving to accommodate this cultural diversity. It allows brands to appeal to adventurous eaters and niche segments. Retail shelves are witnessing expansion in globally inspired flavor options. Food service players also use these blends to craft new menu offerings. This rising cross-cultural influence is creating ongoing flavor innovation.

Shift Toward Premium and Gourmet Flavor Profiles Driving Value Creation:

Premiumization remains a strong trend across Europe’s food sector. Consumers are willing to pay more for high-quality, gourmet-inspired flavor experiences. The Europe Savory Flavor Blend Market is responding with premium blends offering authentic and artisanal tastes. It creates differentiation for brands competing in saturated categories. Gourmet herbs, rare spices, and customized seasoning systems are gaining ground. Producers highlight craftsmanship and origin stories to enhance product appeal. Food retailers also promote premium flavor lines to boost margins. The growing demand for gourmet products contributes to significant value creation in the market.

Market Challenges Analysis:

Complexity of Regulatory Standards and Labeling Requirements in Europe Restricting Growth:

The regulatory landscape in Europe poses a consistent challenge for flavor manufacturers. Strict requirements around ingredient labeling, allergen declaration, and clean-label certification increase compliance costs. The Europe Savory Flavor Blend Market must navigate differing rules across countries, making expansion complex. It creates barriers for smaller companies that lack resources to manage certifications. Growing consumer skepticism toward artificial additives intensifies pressure on producers. Companies must invest in transparency and documentation to build trust. Product reformulation adds to development costs while extending launch timelines. These regulatory complexities continue to hinder the pace of growth across the region.

Rising Competition and Price Pressure Among Flavor Manufacturers Impacting Profit Margins:

The savory flavor blend sector faces stiff competition from multinational and regional players. Intense rivalry has led to aggressive pricing strategies, placing strain on profit margins. The Europe Savory Flavor Blend Market operates in an environment where innovation is essential for survival. It forces companies to invest heavily in R&D while maintaining cost efficiency. Smaller producers struggle to compete with established brands offering diversified portfolios. Market saturation in mature economies further intensifies competitive pressure. Rising raw material costs add another layer of financial challenge. Sustaining profitability remains a key concern for companies across the industry.

Market Opportunities:

Expansion of Plant-Based Food Innovation and Sustainable Consumer Preferences Offering Growth Scope:

The plant-based movement in Europe is unlocking new opportunities for flavor blend providers. Alternative protein products often require specialized seasoning systems to appeal to mainstream consumers. The Europe Savory Flavor Blend Market benefits by supplying blends that enhance taste and texture. It supports brands aiming to replicate traditional meat flavors with plant proteins. Sustainability-conscious buyers are driving adoption of eco-friendly and cruelty-free options. Companies tailoring blends for vegan and vegetarian markets see strong demand. Growing alignment between health, taste, and sustainability creates long-term prospects. This convergence offers suppliers a chance to scale revenue in premium niches.

Rising Demand for Customized and Region-Specific Blends in Foodservice and Retail Segments:

Customization is emerging as a powerful opportunity across both retail and foodservice industries. Consumers increasingly prefer unique, tailored flavors aligned with regional and cultural preferences. The Europe Savory Flavor Blend Market can leverage this demand through targeted offerings. It enables food brands and restaurants to differentiate menus with signature blends. Personalized flavor systems also enhance customer loyalty in competitive markets. Growing urbanization and exposure to global cuisines increase appetite for distinct taste experiences. Producers investing in R&D to craft bespoke blends stand to gain significantly. This emphasis on customization is expected to boost market penetration in emerging regions.

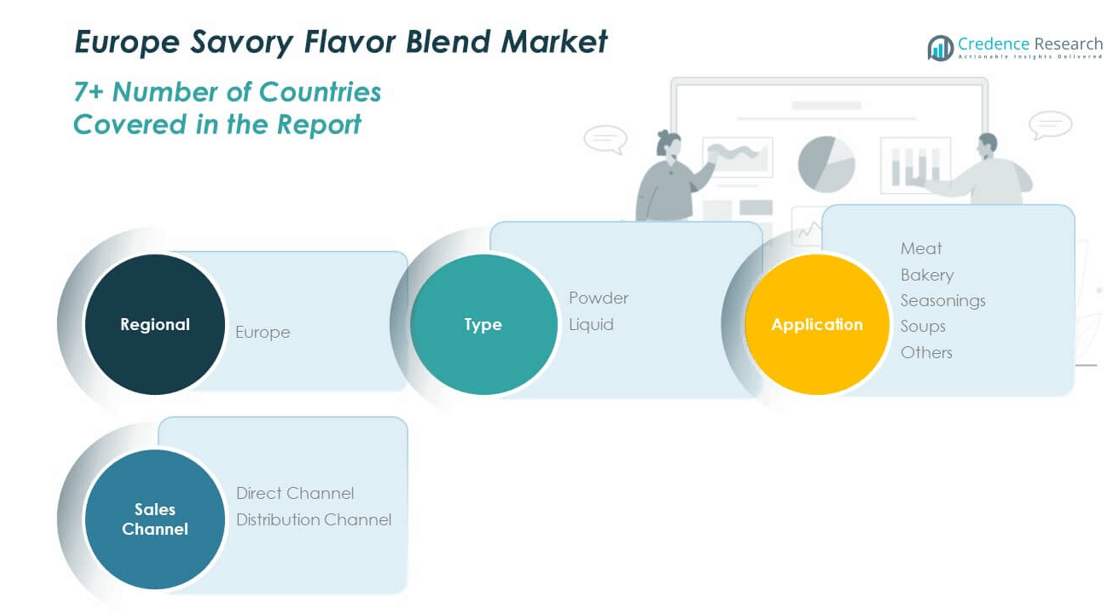

Market Segmentation Analysis:

By Type

Powder-based blends dominate the Europe Savory Flavor Blend Market due to their longer shelf life, ease of storage, and broad application in processed foods. It finds extensive use in snacks, sauces, and frozen meals where consistent flavor delivery is critical. Liquid blends hold a smaller but vital share, serving sectors that demand fast solubility and fresh dispersion, particularly in soups and ready-to-eat meals.

- For instance, Liquid blends are used where quick solubility and fresh dispersion are key, such as soups and ready-to-eat meals.

By Application

Meat applications lead the market, driven by strong consumption of processed and ready-to-cook meat products across Europe. Bakery follows with growing adoption of savory profiles in breads and snacks, reflecting consumer demand for innovative flavors. Seasonings are another strong segment, catering to households and foodservice outlets seeking ready-to-use flavor mixes. Soups demonstrate steady uptake, supported by rising demand for convenience meals. The “Others” category, which includes plant-based products, is gaining momentum with the growth of vegan and flexitarian diets.

- For instance, Meat product applications dominate savory flavor blend use in Europe, driven by processed and ready-to-cook meat consumption patterns.

By Sales Channel

Direct channels contribute significantly to market revenues, particularly among large food manufacturers that prefer tailored supply contracts and assured quality. It ensures strong supplier relationships and consistency in product standards. Distribution channels, including wholesalers and retailers, play a critical role in expanding product availability across diverse markets. Their reach supports small and medium enterprises while facilitating penetration in emerging regions within Europe.

Segmentation

By Type

By Application

- Meat

- Bakery

- Seasonings

- Soups

- Others

By Sales Channel

- Direct Channel

- Distribution Channel

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis: each para should contain 9 to 10 lines]

Western and Northern Europe

Western Europe holds the largest share of the Europe Savory Flavor Blend Market, accounting for 38% in 2024. Strong food processing industries, premium product demand, and established culinary traditions drive growth in countries such as Germany, France, and the U.K. It benefits from high consumer purchasing power and an active hospitality sector. Northern Europe contributes 27%, supported by higher disposable incomes and a preference for healthier and premium flavors. Scandinavian countries lead with innovations in clean-label and natural blends. It reflects the region’s strong alignment with sustainable and health-focused consumption patterns.

Southern Europe

Southern Europe represents 20% of the market, influenced by vibrant culinary traditions and robust tourism-driven food demand. Countries such as Italy and Spain actively adopt savory flavor blends to enhance bakery, meat, and seasoning applications. It benefits from strong local cuisines that blend with global flavor influences. Seasonal demand from tourism and the foodservice industry amplifies consumption in hospitality-heavy regions. Rising urbanization and growing packaged food adoption are shaping opportunities for manufacturers. The region demonstrates a balance of traditional and modern demand drivers, sustaining steady growth in the mid-term.

Eastern Europe

Eastern Europe accounts for 15% of the total share, but it represents the fastest-growing regional segment. Rising disposable incomes and expanding urban populations are supporting demand for packaged and convenience foods. It is also experiencing growth through increased exposure to global cuisines and quick-service restaurants. Russia and Poland are emerging as key contributors due to rising investments in food processing. Local manufacturers are adopting global best practices to meet consumer expectations on quality and taste. The region’s growth trajectory highlights its potential to increase its market contribution over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe Savory Flavor Blend Market is moderately consolidated, with global leaders and regional players competing for share. Givaudan, Firmenich, and Kerry Group dominate through broad portfolios, advanced R&D, and strong client relationships. It benefits from their investment in natural, clean-label, and plant-based solutions that align with consumer demand. Mid-sized firms such as Bell Flavors & Fragrances and Limagrain Ingredients provide flexibility with customized blends for local clients. Euroma and Savoury Flavours Ltd hold relevance through regional presence and targeted innovations. Price competition, innovation, and regulatory compliance remain critical to differentiation. Companies focus on partnerships with foodservice and retail sectors to strengthen penetration. The competitive landscape reflects a balance of scale-driven advantages and niche specialization.

Recent Developments:

- In June 2025, Givaudan announced it would showcase cutting-edge digital innovations in fragrance and flavor at VivaTech 2025 in Paris, highlighting projects like Guardians of Memories and the Scent Piano, reflecting its commitment to transforming consumer interaction with flavors and fragrances.

- In February 2025, dsm-firmenich completed the sale of its stake in the Feed Enzymes Alliance to Novonesis for €1.5 billion. The Feed Enzymes business represented approximately €300 million in annual net sales in 2024. dsm-firmenich will maintain a commercial relationship for resale through its Animal Nutrition & Health network.

- In February 2025, dsm-firmenich completed the sale of its stake in the Feed Enzymes Alliance to Novonesis for €1.5 billion. The Feed Enzymes business represented approximately €300 million in annual net sales in 2024. dsm-firmenich will maintain a commercial relationship for resale through its Animal Nutrition & Health network.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Sales Channel, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for plant-based food will boost customized savory flavor blends.

- Clean-label and natural formulations will remain a central focus for innovation.

- Foodservice industry partnerships will strengthen flavor integration strategies.

- Technological advances in flavor encapsulation will improve product performance.

- Premiumization trends will support the growth of gourmet and artisanal blends.

- Regional cuisines will shape product innovation across Western and Southern Europe.

- Eastern Europe will emerge as the fastest-expanding geography in the market.

- E-commerce distribution will accelerate accessibility of blends for small businesses.

- Regulatory frameworks will push transparency and reformulation in product lines.

- Sustainability initiatives will drive eco-friendly sourcing of raw ingredients.