Market Overview:

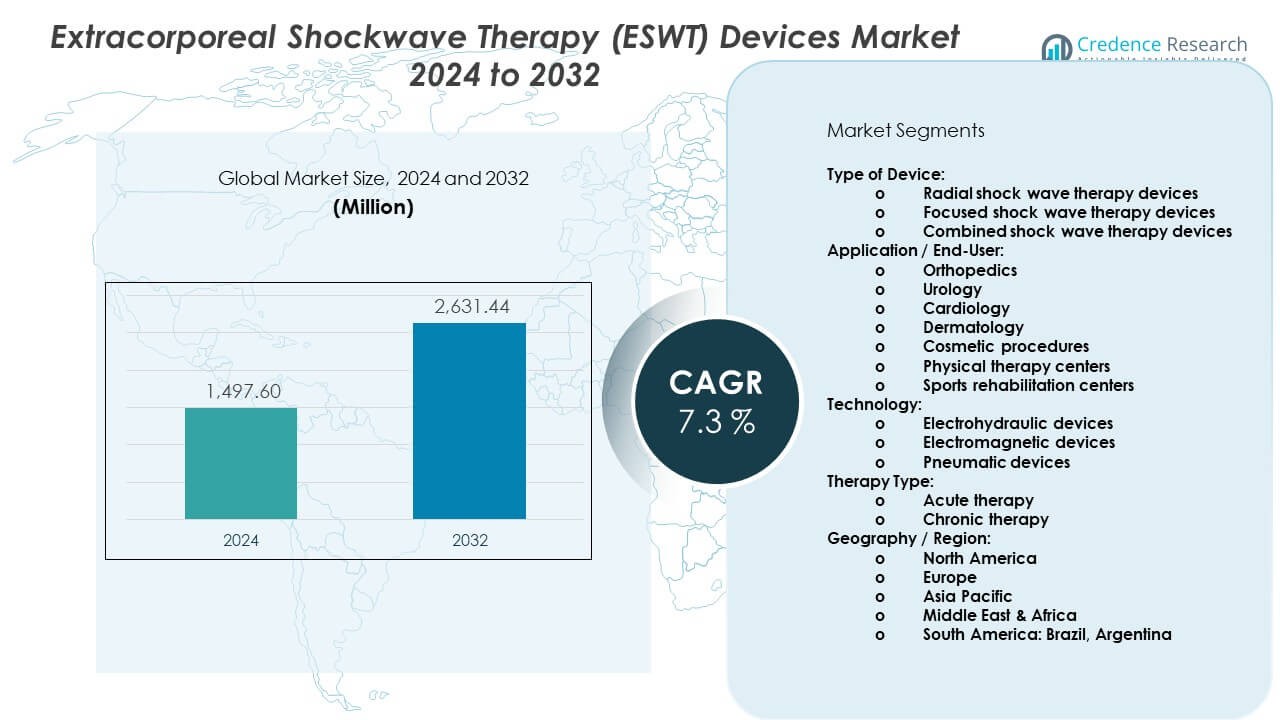

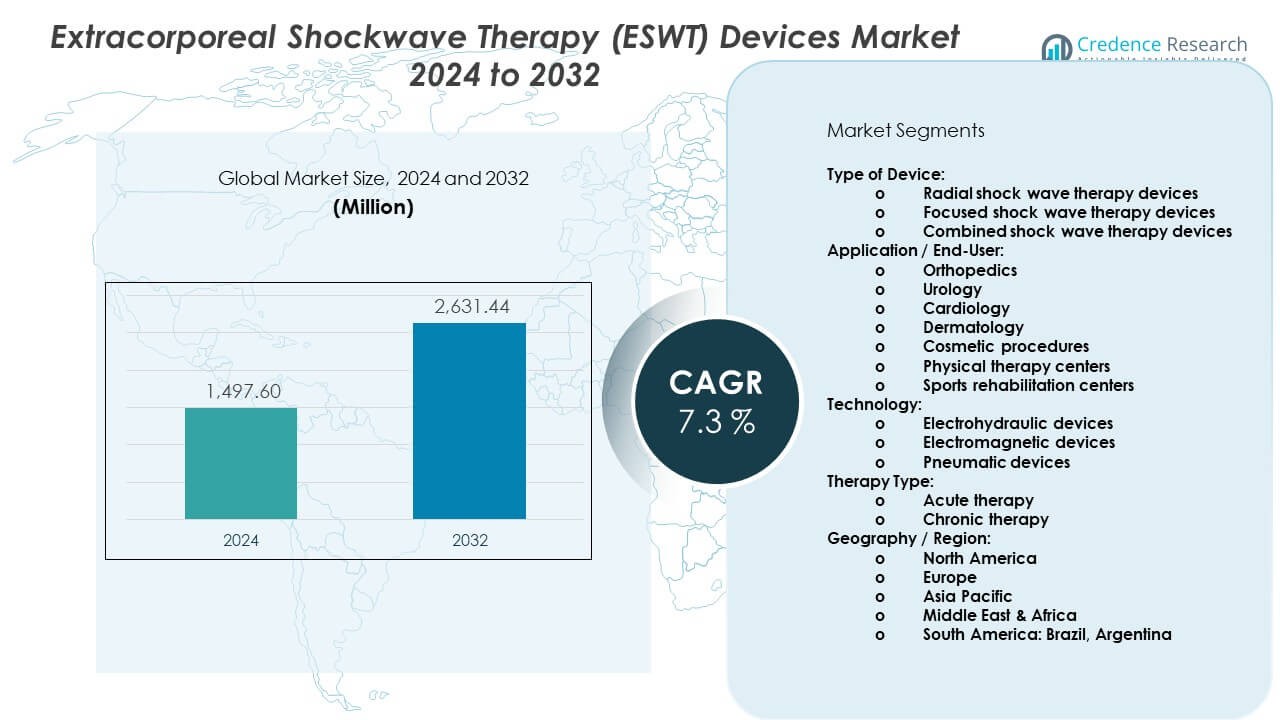

The Extracorporeal Shockwave Therapy (ESWT) Devices Market is projected to grow from USD 1497.6 million in 2024 to an estimated USD 2631.44 million by 2032, with a compound annual growth rate (CAGR) of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Extracorporeal Shockwave Therapy (ESWT) Devices Market Size 2024 |

USD 1497.6 Million |

| Extracorporeal Shockwave Therapy (ESWT) Devices Market, CAGR |

7.3% |

| Extracorporeal Shockwave Therapy (ESWT) Devices Market Size 2032 |

USD 2631.44 Million |

Growing demand for non-invasive pain relief drives the Extracorporeal Shockwave Therapy (ESWT) Devices Market. Healthcare teams prefer ESWT systems because they reduce downtime and support faster tissue repair. Patients seek safer alternatives to surgery across orthopedic and rehabilitation settings. Device makers introduce portable and digital units that improve treatment flexibility. Strong awareness of long-term pain management pushes wider use in outpatient care. Sports clinics expand their device base due to higher injury incidence. User-friendly interfaces improve efficiency for physiotherapists during routine sessions.

North America leads the Extracorporeal Shockwave Therapy (ESWT) Devices Market due to advanced pain management infrastructure and strong adoption in sports medicine. Europe follows with steady demand supported by broad physiotherapy networks and higher acceptance of non-invasive therapies. Asia Pacific emerges as the fastest-growing region driven by rising sports injuries, expanding healthcare access, and growing awareness of rehabilitation solutions. Latin America and the Middle East show gradual uptake as clinics modernize treatment facilities and adopt portable ESWT systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Extracorporeal Shockwave Therapy (ESWT) Devices Market reached USD 1497.6 million in 2024 and is projected to hit USD 2631.44 million by 2032, expanding at a 3% CAGR due to rising demand for non-invasive pain and mobility treatments.

- North America (38%), Europe (32%), and Asia Pacific (22%) lead global share, driven by strong physiotherapy networks, high sports injury treatment demand, and growing adoption of advanced ESWT technologies.

- Asia Pacific, holding 22%, remains the fastest-growing region due to expanding healthcare access, growing sports participation, and rapid adoption of portable ESWT systems in major urban centers.

- Orthopedics accounts for the largest application share at around 45%, supported by high treatment volume for tendon disorders, plantar fasciitis, and chronic musculoskeletal pain.

- Radial shockwave devices hold the highest device share at about 50%, driven by wide clinical usage, ease of operation, and suitability for routine physiotherapy and sports recovery sessions.

Market Drivers:

Market Drivers:

Growing Preference for Non-Invasive Pain Management Across Musculoskeletal Disorders

The Extracorporeal Shockwave Therapy (ESWT) Devices Market grows through rising demand for safe treatment options across orthopedic and sports injury cases. Many clinics invest in ESWT units to avoid surgical procedures for tendon issues. Patients choose these therapies for faster recovery support. Healthcare teams use shockwave sessions to treat chronic plantar fasciitis and calcific shoulder pain. It helps reduce downtime in daily routines. Sports facilities depend on ESWT systems to manage recurring injuries. Hospitals expand physical therapy wings with advanced devices. Strong awareness of non-invasive care strengthens overall adoption.

- For instance, Storz Medical’s DUOLITH SD1 “ultra” delivers focused energy flux densities up to 0.55 mJ/mm², supporting precise treatment of chronic tendinopathies.

Advancements in Portable and Digitally Controlled Treatment Systems

Portable ESWT devices improve reach for small clinics and home-care providers. Digital consoles offer preset modes that support treatment accuracy. It helps physiotherapists maintain consistent delivery during sessions. User-friendly screens make training easier for new operators. Device makers upgrade power controls for deeper tissue penetration. Wireless units reduce room setup time. Hospitals prefer systems that integrate with therapy workflows. The Extracorporeal Shockwave Therapy (ESWT) Devices Market gains momentum from these technology upgrades.

- For instance, the Chattanooga Intelect RPW 2 system offers variable pressure between 1 and 5 bar and supports up to 21 Hz, enabling adaptable treatments in compact clinical setups.

Rising Sports Participation and Higher Incidence of Overuse Injuries

Sports involvement drives higher injury rates linked to tendons and soft tissues. Trainers choose ESWT treatments to reduce strain-linked pain in athletes. Recovery cycles shorten due to focused shockwave pulses. Clinics install more systems to manage peak sports seasons. It helps reduce pressure on surgical units in hospitals. Growing interest in fitness raises demand for early injury intervention. Rehabilitation centers use ESWT therapy for faster mobility gains. The Extracorporeal Shockwave Therapy (ESWT) Devices Market expands through wider sports medicine use.

Higher Adoption in Rehabilitation and Long-Term Pain Care Networks

Rehabilitation centers integrate ESWT units to support long-term mobility recovery. Many facilities use shockwave therapy for chronic heel pain and elbow injuries. It aids patients who require repeated sessions. Hospitals connect ESWT devices with broader physiotherapy programs. Remote therapy tools support wider user groups. Clinics reduce load on pain medication channels through therapy programs. Patient preference for drug-free care pushes wider uptake. The Extracorporeal Shockwave Therapy (ESWT) Devices Market strengthens through growing adoption across rehab units.

Market Trends:

Expansion of Smart Therapy Platforms With Real-Time Response Monitoring

Digital ESWT platforms gain traction through real-time feedback features. Sensors help track tissue response during shockwave delivery. It supports stronger control in precision-based sessions. Clinics value systems that guide intensity selection. Smart software improves consistency across repeated treatments. Portable units integrate cloud dashboards for better case tracking. Remote monitoring improves patient follow-up. The Extracorporeal Shockwave Therapy (ESWT) Devices Market benefits from the shift toward intelligent platforms.

- For instance, EMS Swiss DolorClast devices use real-time pneumatic control to maintain consistent pressure up to 4 bar and frequencies up to 20 Hz, enabling stable treatment performance.

Growing Use of Radial and Focused ESWT in Combined Therapy Protocols

Therapists merge focused and radial shockwave modes for complex injuries. It supports layered treatment plans across tendon and ligament pain. Clinics design dual-mode protocols for faster relief. Physiotherapists train staff to handle deeper tissue cases with focused waves. Sports clinics adopt radial units for broad coverage needs. Treatment diversity helps expand patient segments. Orthopedic units promote multi-mode care for chronic conditions. The Extracorporeal Shockwave Therapy (ESWT) Devices Market sees stronger acceptance for combined approaches.

- For instance, Zimmer MedizinSysteme’s enPuls 2.0 radial system delivers energy levels up to 185 mJ with adjustable frequencies from 8–22 Hz, supporting high-volume sports rehabilitation programs.

Integration of ESWT Devices Into Digital Rehabilitation Ecosystems

Rehab centers use ESWT devices alongside mobile recovery platforms. Digital apps guide home routines after therapy sessions. It helps maintain patient engagement. Wearable sensors track strain patterns to support therapy planning. Clinics upload progress charts into unified care dashboards. Hospitals align ESWT therapy with virtual care expansion. Software-driven tracking boosts treatment continuity. The Extracorporeal Shockwave Therapy (ESWT) Devices Market grows with broader digital ecosystem adoption.

Rising Preference for Energy-Efficient and Low-Noise Therapy Systems

Manufacturers design ESWT devices that run with reduced noise levels. Clinics value quieter therapy rooms for patient comfort. It helps improve experience in high-traffic centers. Energy-efficient motors lower operational costs. Upgraded components extend long-term device life. Portable designs reduce power needs during peak schedules. Hospitals replace older units with quieter, compact versions. The Extracorporeal Shockwave Therapy (ESWT) Devices Market shifts toward improved comfort-focused systems.

Market Challenges Analysis:

High Capital Costs and Limited Access Across Smaller Clinics

High device prices restrict adoption for smaller clinics that manage low patient volume. It pushes some centers to depend on older therapy models. Training requirements add extra spending for new operators. Maintenance costs remain high due to precision components. Providers face difficulty in upgrading systems during budget cycles. Patients in rural regions experience limited service access. Hospitals try to balance investment priorities with expansion plans. The Extracorporeal Shockwave Therapy (ESWT) Devices Market encounters slow uptake in cost-sensitive settings.

Inconsistent Reimbursement and Limited Awareness in Developing Regions

Reimbursement gaps reduce demand in markets with unstructured insurance coverage. Clinics struggle to justify investments without strong payment support. Limited awareness lowers patient willingness to try ESWT sessions. It affects treatment frequency in aging populations. Some regions lack trained therapists for advanced systems. Regulatory delays slow device approvals. Hospitals face challenges in building therapy programs. The Extracorporeal Shockwave Therapy (ESWT) Devices Market sees fragmented expansion in emerging economies.

Market Opportunities:

Growth Potential in Sports Rehabilitation and Home-Based Therapy Programs

The Extracorporeal Shockwave Therapy (ESWT) Devices Market gains opportunity through expanding sports rehab centers. Rising fitness engagement lifts demand for faster injury recovery support. Clinics explore personal-use ESWT units for controlled home therapy cycles. It increases flexibility for patients who need multiple sessions. Digital guides help improve treatment confidence. Portable designs boost adoption across remote locations. Rehabilitation teams widen target groups through tailored therapy plans. Strong interest in next-generation sports care creates long-term growth potential.

Expansion in Aging Populations and Chronic Pain Management Networks

Aging populations experience higher tendon degeneration and chronic heel pain. Clinics position ESWT therapy as a safer alternative to invasive orthopedic care. It supports long-term recovery goals for seniors. Hospitals invest in low-intensity systems to treat recurring pain issues. Rehab chains adopt ESWT units to strengthen geriatric mobility programs. Awareness campaigns improve patient understanding of benefits. Portable devices expand reach in community health settings. This shift creates attractive openings for wider market penetration.

Market Segmentation Analysis:

Type of Device

Radial, focused, and combined systems shape the competitive structure of the Extracorporeal Shockwave Therapy (ESWT) Devices Market. Radial devices lead usage in clinics due to broad tissue coverage and ease of handling. Focused devices support deeper penetration for chronic tendon injuries. Combined systems gain traction among advanced therapy centers that require flexible protocols. It helps hospitals treat varied pain conditions without multiple units. Sports facilities adopt radial models for routine treatments. Specialty centers rely on focused devices for precision. Demand grows across diverse care settings.

Application / End-User

Orthopedics remains the largest segment due to high cases of chronic heel pain and tendinopathies. Urology departments use shockwave systems for non-invasive stone management. Cardiology teams explore low-intensity therapy for vascular support. Dermatology and cosmetic centers use ESWT for cellulite and skin regeneration procedures. Physical therapy clinics handle growing referrals for mobility recovery. Sports rehabilitation units treat athletes with repetitive strain injuries. It supports care pathways that reduce surgical load. Adoption widens across multidisciplinary medical networks.

- For instance, MTS Medical’s lithotripsy platforms deliver focused shockwaves with precision-controlled energy levels to support non-invasive stone fragmentation in urology departments.

Technology

Electrohydraulic systems deliver strong energy pulses for deep tissue cases. Electromagnetic devices offer consistent output and longer service life. Pneumatic units remain popular for radial applications due to simpler mechanics. Each technology supports specific treatment goals for pain relief, mobility improvement, and tissue repair. Clinics select platforms based on patient volume and condition severity. It helps providers balance performance with operational costs. Technology choice aligns with training needs. Demand grows for reliable and low-maintenance systems.

Therapy Type

Acute therapy supports early-stage injury care across sports and occupational cases. Chronic therapy dominates due to rising long-term tendon degeneration and persistent musculoskeletal pain. Clinics use multiple sessions to restore function in chronic patients. It helps reduce dependency on medication. Hospitals design long-term plans covering both therapy types. Physical therapy units integrate shockwave programs into recovery routines. Demand increases with aging populations. Therapy segmentation guides device selection across clinical environments.

Segmentation:

Type of Device:

- Radial shock wave therapy devices

- Focused shock wave therapy devices

- Combined shock wave therapy devices

Application / End-User:

- Orthopedics

- Urology

- Cardiology

- Dermatology

- Cosmetic procedures

- Physical therapy centers

- Sports rehabilitation centers

Technology:

- Electrohydraulic devices

- Electromagnetic devices

- Pneumatic devices

Therapy Type:

- Acute therapy

- Chronic therapy

Geography / Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Extracorporeal Shockwave Therapy (ESWT) Devices Market with around 38%. Strong adoption across orthopedic and sports medicine centers drives higher placement rates. Clinics invest in focused and combined systems to support chronic tendon care. Hospitals expand physiotherapy networks that use ESWT to reduce surgical load. It benefits from strong insurance penetration and higher awareness of non-invasive treatments. Research institutions evaluate ESWT for broader clinical use. Industry growth stays steady across the United States and Canada.

Europe

Europe captures nearly 32% of the global market supported by mature physiotherapy infrastructure and strong acceptance of shockwave protocols. Germany, Italy, and the UK lead usage in chronic pain management programs. Clinics deploy ESWT devices across orthopedics, dermatology, and rehabilitation pathways. Hospitals integrate digital therapy records with ESWT systems for better treatment planning. It supports wider adoption in public and private health networks. Sports rehabilitation centers drive consistent unit demand. The region maintains strong regulatory clarity that helps manufacturers scale operations.

Asia Pacific

Asia Pacific accounts for about 22% of global share and represents the fastest-growing regional cluster. Rising sports participation lifts demand for tendon injury care across China, India, and South Korea. Hospitals upgrade therapy units to manage higher patient volumes linked to urban lifestyles. Clinics adopt ESWT devices for both acute and chronic pain cases. It supports expanded access to non-invasive therapy in major cities. Dermatology and cosmetic centers push additional demand. Growth accelerates as providers invest in portable and affordable models tailored for local needs.

Key Player Analysis:

- Chattanooga (DJO)

- BTL Industries

- Storz Medical

- EMS Electro Medical Systems

- MTS Medical

- Zimmer MedizinSysteme

- Gymna

- Likamed GmbH

- Hanil-TM

- HnT Medical

- Urontech

- Wikkon

- Longest

- Xiangyu Medical

- Shengchang Medical

Competitive Analysis:

The Extracorporeal Shockwave Therapy (ESWT) Devices Market features strong competition led by global manufacturers that invest in advanced energy delivery systems and ergonomic designs. Companies refine device performance to improve precision and treatment comfort. It helps providers manage both acute and chronic conditions across clinical settings. Firms expand product lines to serve orthopedics, sports care, dermatology, and urology. Digital upgrades strengthen device compatibility with therapy software. Partnerships with rehab centers support wider deployment. Competitors focus on reliability, portability, and long-term value to maintain advantage. Market presence grows through targeted regional expansion and structured distribution networks.

Recent Developments:

- In November 2025, at MEDICA 2025 in Düsseldorf, Germany (November 17-20), Longest Medical announced four brand-new product releases that garnered significant industry attention. The company unveiled the LGT-3500 High Frequency Therapy Device powered by advanced TECAR Therapy technology, the LGT-2640AP Electromagnetic Stimulator for treating pelvic floor and urinary system disorders, and the LGT-2660 Series Electromagnetic Stimulator for musculoskeletal pain management. The company also showcased its flagship devices including the PowerShocker LGT-2500X, a compressed pneumatic ballistic shockwave therapy device, and the LGT-2520GP Electromagnetic Focused Shockwave Therapy Device with adjustable-depth treatment capability (0-70 mm).

- In May 2025, Enovis announced a strategic visual transformation uniting its iconic product brands including DonJoy, Chattanooga, and Aircast under a cohesive brand identity. While maintaining their individual legacies of innovation, these brands now share a unified visual identity under the Enovis family structure. Chattanooga continues to provide rehabilitation equipment including its Focus Shockwave and Radial Pressure Wave (RPW2) devices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type of Device, Application / End-User, Technology, and Therapy Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage].

Future Outlook:

- Growing use of ESWT systems across sports medicine will widen treatment demand.

- Hospitals will invest in advanced focused units to support chronic tendon care.

- Clinics will adopt portable devices to increase treatment flexibility.

- Digital integration will improve progress tracking for long-term recovery.

- Wider training programs will improve operator skill levels across regions.

- Dermatology and cosmetic centers will expand use of low-energy therapies.

- Manufacturers will design quieter and more energy-efficient models.

- Rehabilitation chains will scale ESWT programs for mobility improvement.

- Urology applications will gain traction through non-invasive treatment needs.

- Global expansion of physiotherapy networks will strengthen therapy adoption.

Market Drivers:

Market Drivers: