Market Overview

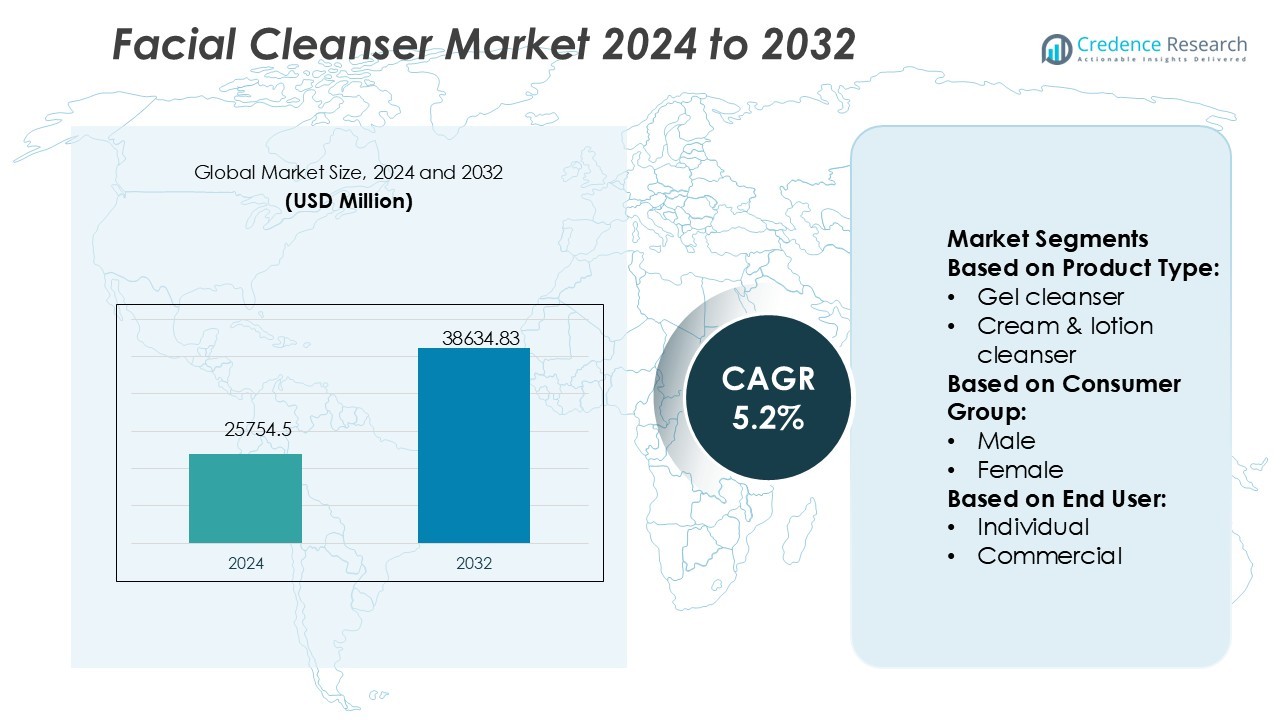

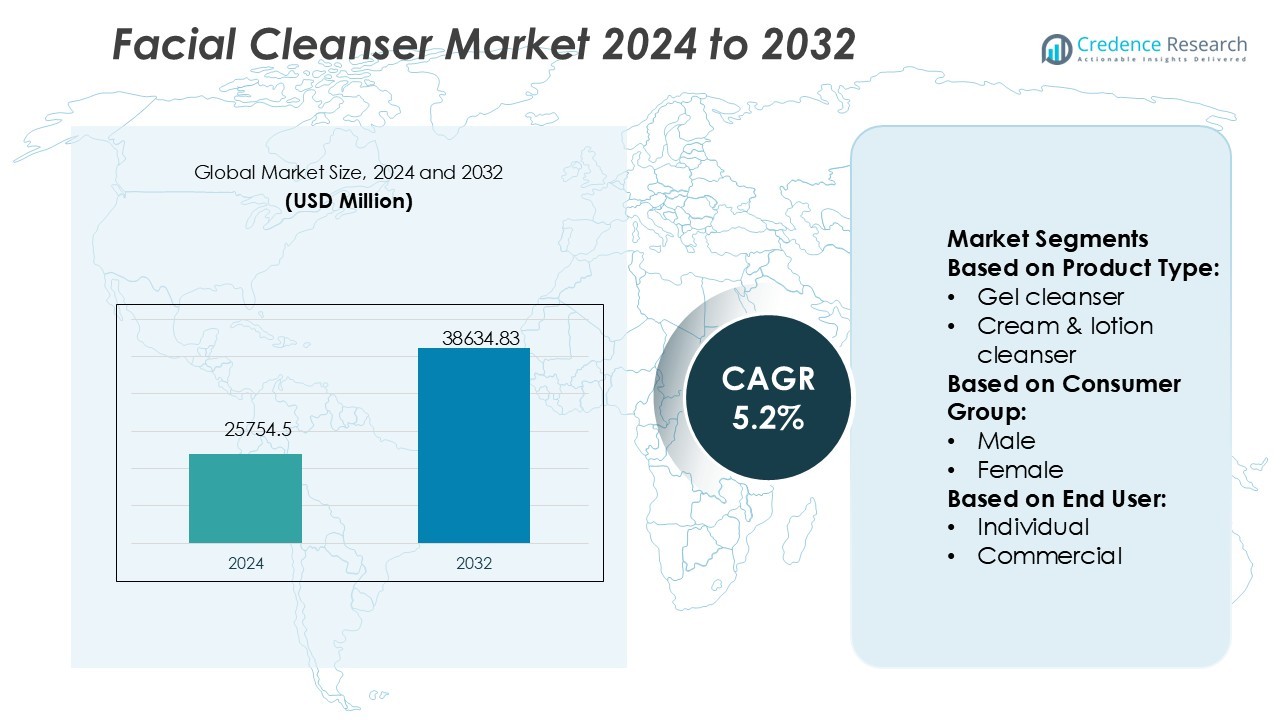

Facial Cleanser Market size was valued USD 25754.5 million in 2024 and is anticipated to reach USD 38634.83 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Facial Cleanser Market Size 2024 |

USD 25754.5 Million |

| Facial Cleanser Market, CAGR |

5.2% |

| Facial Cleanser Market Size 2032 |

USD 38634.83 Million |

The Facial Cleanser Market is driven by strong competition among major players such as L’Oréal S.A., Unilever, Procter & Gamble (P&G), Beiersdorf AG, Johnson & Johnson, Shiseido Co., Ltd., Coty Inc., Avon Products, Colgate-Palmolive Company, and Revlon. These companies focus on product innovation, sustainability, and dermatologically tested formulations to strengthen global presence. L’Oréal and Unilever lead the premium and mass-market segments through extensive distribution networks and advanced R&D capabilities. Beiersdorf and Shiseido emphasize skin health and ingredient transparency to appeal to conscious consumers. Regionally, Asia-Pacific dominates the global market with a 34% share, driven by a large consumer base, increasing urbanization, and rising demand for skincare products among young populations and working professionals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Facial Cleanser Market was valued at USD 25,754.5 million in 2024 and is projected to reach USD 38,634.83 million by 2032, registering a CAGR of 5.2%.

• Market growth is driven by increasing skincare awareness, innovation in formulations, and rising demand for natural and organic ingredients.

• Key trends include the adoption of sustainable packaging, AI-based skin diagnostics, and a shift toward personalized skincare solutions.

• The market faces restraints from high competition, product duplication, and growing consumer sensitivity toward synthetic ingredients.

• Asia-Pacific leads the market with a 34% share, supported by expanding urban populations, higher spending on personal care, and strong e-commerce growth, while cream-based cleansers dominate the segment due to their widespread use across all skin types.

Market Segmentation Analysis:

By Product Type

Gel cleansers lead the facial cleanser market, holding the largest share of over 35%. Their dominance is supported by strong consumer preference for lightweight, oil-free formulas suitable for acne-prone and sensitive skin. Rising awareness of dermatologically tested and pH-balanced solutions further accelerates adoption. Cream and lotion cleansers follow, favored for hydration benefits, while foaming cleansers appeal to consumers seeking deep cleansing effects. Bar cleansers and wipes represent niche demand, largely in travel and on-the-go usage. Innovation in formulations with natural and organic ingredients continues to strengthen the gel cleanser segment’s position.

- For instance, Coty states it has over 600 people in R&D across 25 technical disciplines.The company holds 400+ issued patents and pending applications globally. Coty also reports 200+ scientific publications from its teams.

By Consumer Group

The female segment dominates the market with a share exceeding 55%, driven by higher skincare spending and evolving beauty routines. Women’s preference for customized and premium products fuels growth in this category. Marketing campaigns emphasizing skin health and anti-aging benefits reinforce this dominance. The male segment is growing steadily, supported by rising grooming awareness and increased product launches targeted at men’s skin types. The unisex category also gains traction as brands promote inclusive skincare solutions, appealing to households seeking multifunctional cleansers for diverse skin needs.

- For instance, Kao’s prestige brand KANEBO released KANEBO Cream In Day II / Night II incorporating the TAISHI™ Complex (a biomimetic blend of C10-40 isoalkyl acid cholesterol esters, phytosteryl macadamiate, ceramide NG) to mimic vernix’s moisturizing barrier.

By End User

The individual segment holds the majority share of more than 70%, as facial cleansers remain integral to daily personal care routines. Strong retail penetration through supermarkets, pharmacies, and e-commerce platforms supports this demand. Social media influence and brand-led promotional campaigns continue to boost individual adoption. The commercial segment, including spas, salons, and skincare clinics, demonstrates consistent growth, fueled by rising demand for professional-grade products and facial treatments. Increasing partnerships between cosmetic brands and beauty service providers strengthen this segment’s contribution, though individual consumers remain the core driver of market expansion.

Key Growth Drivers

Rising Skincare Awareness and Hygiene Practices

Increasing consumer focus on personal hygiene and skincare health significantly drives demand for facial cleansers. Awareness campaigns highlighting the importance of daily cleansing routines to prevent acne, oil buildup, and pollution damage fuel adoption across age groups. Social media platforms, beauty influencers, and dermatologists further educate consumers about product benefits. Growing demand for specialized formulations, including anti-aging, brightening, and sensitive-skin solutions, strengthens product penetration. This awareness, combined with lifestyle shifts in urban areas, continues to expand the customer base for both premium and affordable cleansers.

- For instance, The Avon Beyond Glow Hyaluronic Acid + Niacinamide Facial Cleanser is supported by a consumer perception study. In this study, 100% of 33 participants reported that their skin felt hydrated after a single use.

Expansion of E-Commerce and Digital Retail

The rapid growth of e-commerce platforms has transformed product accessibility, making facial cleansers available to a wider consumer base. Online channels offer convenience, competitive pricing, and diverse product portfolios that appeal to both urban and rural buyers. Beauty-focused apps, subscription services, and AI-driven skin diagnostic tools enhance personalized recommendations, boosting sales. Global beauty brands and startups leverage digital channels for direct consumer engagement, marketing campaigns, and exclusive online launches. This shift toward digital-first strategies accelerates market expansion while strengthening brand loyalty across consumer segments.

- For instance, L’Oréal’s SkinCeuticals eShop—powered by Appier AI—delivered a 152% quarter-over-quarter increase in Return On Ad Spend (ROAS) and 400% uplift in conversion rate (CVR) from hesitant users.

Product Innovation and Natural Ingredient Demand

Continuous innovation in product formulations is a major driver in the facial cleanser market. Consumers increasingly demand natural, organic, and chemical-free products, pushing brands to introduce eco-friendly, dermatologically tested solutions. Ingredients like aloe vera, green tea, charcoal, and hyaluronic acid are gaining strong traction. Advanced technologies such as micellar water and pH-balanced cleansers also attract health-conscious users. Innovation extends beyond formulation to sustainable packaging, reinforcing eco-friendly preferences. Companies that align product development with wellness and environmental values secure long-term competitive advantage and capture evolving consumer expectations.

Key Trends & Opportunities

Shift Toward Premium and Customized Skincare

Consumers are showing strong interest in premium and tailored facial cleansers that address specific skin concerns. Advanced personalization, enabled by AI skin analysis and AR try-on tools, supports this trend. High demand for cleansers with multifunctional benefits—such as anti-pollution, anti-aging, or hydration—creates opportunities for innovation. Brands are increasingly launching dermatologist-backed and clinically tested products that position themselves as reliable solutions. The growing willingness to spend on premium skincare, particularly among millennials and Gen Z, ensures sustained growth for customized and luxury segments.

- For instance, Johnson & Johnson’s consumer health division revealed 16 new skincare research studies at the 2021 American Academy of Dermatology Virtual Meeting. The presentations, which included 3 oral publications and 13 poster presentations, highlighted targeted innovation in various aspects of skin health, including for women, cancer patients, and multicultural populations.

Sustainability and Clean Beauty Adoption

Sustainability is emerging as a central trend, shaping consumer choices in the facial cleanser market. Demand for clean-label products free from parabens, sulfates, and synthetic fragrances continues to rise. Eco-friendly packaging, refillable bottles, and biodegradable wipes create new opportunities for brands to differentiate themselves. Companies integrating cruelty-free and vegan certifications gain favor with environmentally conscious buyers. Retailers and e-commerce platforms also highlight sustainable collections, amplifying visibility. This shift creates space for both established and niche brands to capitalize on green innovation and appeal to a growing ethical consumer base.

- For instance, L’Oréal’s new North America Research & Innovation Center spans 250,000 sq ft and houses a 26,000 sq ft modular lab, on-site mini factory, and capacity for daily user testing with up to 400 consumers.

Key Challenges

Intense Market Competition and Price Pressure

The facial cleanser market faces intense competition from both global giants and emerging local brands. Companies engage in aggressive pricing strategies and frequent product launches to secure market share. While this fosters innovation, it creates price sensitivity, especially in developing regions. Established players must continuously differentiate through premium formulations, sustainability, or digital engagement to maintain loyalty. For smaller entrants, competing against strong distribution networks and marketing budgets remains challenging, limiting their ability to scale in competitive environments.

Regulatory and Ingredient Safety Concerns

Stringent regulations around cosmetic ingredients and labeling pose challenges for manufacturers. Consumers are increasingly scrutinizing ingredient lists, raising demand for transparency and safety certifications. Regulatory bodies impose strict standards on claims like “organic” or “dermatologically tested,” which can delay product launches. Recalls due to harmful ingredients or allergens risk damaging brand reputation and consumer trust. Companies must invest heavily in compliance, testing, and certification processes, increasing operational costs. Navigating these complex regulatory landscapes while meeting evolving consumer demands remains a significant industry challenge.

Regional Analysis

North America

North America holds a 28% share of the global facial cleanser market, driven by high consumer spending on skincare and strong awareness of dermatological health. The U.S. dominates the region, supported by widespread adoption of premium, organic, and dermatologist-recommended cleansers. The presence of leading brands such as Procter & Gamble, Johnson & Johnson, and Unilever strengthens market penetration. E-commerce platforms and beauty subscription services further enhance accessibility and product variety. Increasing male grooming trends and demand for multifunctional cleansers also contribute to growth. Regulatory standards ensure product safety, reinforcing consumer trust and brand loyalty across this region.

Europe

Europe accounts for 25% of the global facial cleanser market, benefiting from strong consumer preference for natural and eco-friendly skincare products. Countries such as Germany, France, and the U.K. lead the regional demand, supported by high per capita income and advanced beauty retail networks. Sustainability trends, clean-label formulations, and cruelty-free certifications are major growth drivers. European consumers increasingly invest in premium cleansers with anti-aging and hydration benefits. Strict regulations on cosmetic ingredients foster innovation in safer and environmentally responsible products. Regional competition remains strong, with both global and local brands actively expanding their presence across retail and e-commerce platforms.

Asia-Pacific

Asia-Pacific dominates the global facial cleanser market with a 34% share, driven by large consumer populations and rising disposable incomes. China, Japan, South Korea, and India are key contributors, supported by beauty-conscious cultures and rapid urbanization. K-beauty and J-beauty trends heavily influence consumer demand for innovative, multifunctional, and dermatologist-tested cleansers. E-commerce growth and social media marketing further expand reach among younger demographics. Affordable product lines by domestic brands challenge global players, enhancing competitive intensity. Increasing demand for organic, herbal, and sensitive-skin formulations reinforces growth. The region’s dominance is expected to strengthen further due to ongoing lifestyle shifts and expanding middle-class populations.

Latin America

Latin America holds a 7% share of the global facial cleanser market, supported by rising beauty consciousness and urbanization. Brazil and Mexico lead the regional demand, driven by strong consumer interest in personal grooming and premium skincare. Growing awareness of pollution’s impact on skin health boosts adoption of deep-cleansing and hydrating products. Economic fluctuations influence consumer purchasing power, pushing demand for affordable yet effective cleansers. Expanding e-commerce and beauty retail chains enhance accessibility across the region. Both local and international brands invest in marketing campaigns and product launches, strengthening regional penetration despite challenges from price sensitivity and market fragmentation.

Middle East & Africa

The Middle East & Africa region contributes 6% to the global facial cleanser market, with demand concentrated in urban hubs such as the UAE, Saudi Arabia, and South Africa. Rising disposable incomes and increased adoption of premium skincare products drive growth. Consumers prefer cleansers addressing hydration and sun protection, reflecting the region’s climatic needs. International brands dominate, though local players are gradually expanding through herbal and natural product offerings. The region also witnesses growing online sales and beauty retail expansions. Market growth is tempered by economic disparities across countries, but premiumization and digital engagement sustain positive long-term opportunities.

Market Segmentations:

By Product Type:

- Gel cleanser

- Cream & lotion cleanser

By Consumer Group:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Facial Cleanser Market is highly competitive, with key players including Beiersdorf, Estée Lauder Companies, Neutrogena, Mary Kay, Johnson & Johnson, Coty, Amorepacific, Kao, Avon Products, and L’Oréal. The Facial Cleanser Market demonstrates intense competition driven by innovation, branding, and digital engagement. Leading manufacturers focus on product differentiation through advanced formulations, natural ingredients, and skin-type-specific solutions. Companies increasingly invest in research and technology integration, such as AI-based skin analysis and personalization tools, to enhance consumer satisfaction. Sustainability and eco-friendly packaging have become key priorities, aligning with shifting consumer preferences. E-commerce platforms and social media marketing also play vital roles in expanding market reach and brand awareness. Strategic collaborations, product diversification, and premium skincare lines continue to shape the competitive dynamics of this rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Beiersdorf

- Estée Lauder Companies

- Neutrogena

- Mary Kay

- Johnson & Johnson

- Coty

- Amorepacific

- Kao

- Avon Products

- L’Oréal

Recent Developments

- In October 2024, Kenvue declared that its Neutrogena brand is advancing dermatological beauty through multi-year collaborations with the world’s most followed dermatologist, Dr. Muneeb Shah, and renowned skincare pioneer, Dr. Dhaval Bhanusali. This partnership reaffirms Neutrogena’s dedication to combining science and beauty to provide exceptional product experiences and cutting-edge clinical efficacy.

- In July 2024, American Exchange Group acquired Indie Lee, a leading clean beauty brand known for its plant-based skincare products. The acquisition enhances American Exchange Group’s position in the premium, sustainable beauty market.

- In May 2024, Mary Kay further established its commitment to women’s empowerment in Scandinavia by announcing its expansion into Denmark. One of the most egalitarian societies in the world, Denmark is a founding member of the European Union and ranks third in the EU on the Gender Equality Index, a measure that emphasizes gender equality.

- In April 2024, L’Occitane divested its ownership of Grown Alchemist, two years after acquiring the clean beauty brand, signaling a strategic shift in its portfolio. This move aligns with L’Occitane’s ongoing realignment toward core brands.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Consumer Group, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising skincare awareness among all age groups.

- Demand for natural and organic cleansers will continue to expand globally.

- Brands will focus more on personalized and AI-driven skincare solutions.

- Sustainable packaging and refillable containers will become key market differentiators.

- Online and direct-to-consumer sales channels will capture higher market shares.

- Technological innovations will improve product performance and skin compatibility.

- Men’s grooming and skincare products will see increasing adoption and product launches.

- Premium facial cleansers will gain traction due to growing disposable incomes.

- Strategic mergers and influencer marketing will strengthen global brand presence.

- Asia-Pacific and emerging economies will remain major contributors to long-term market growth.