| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Factory Automation Software Market Size 2024 |

USD 11,440.06 Million |

| Factory Automation Software Market, CAGR |

11.59% |

| Factory Automation Software Market Size 2032 |

USD 21,517.36 Million |

Market Overview

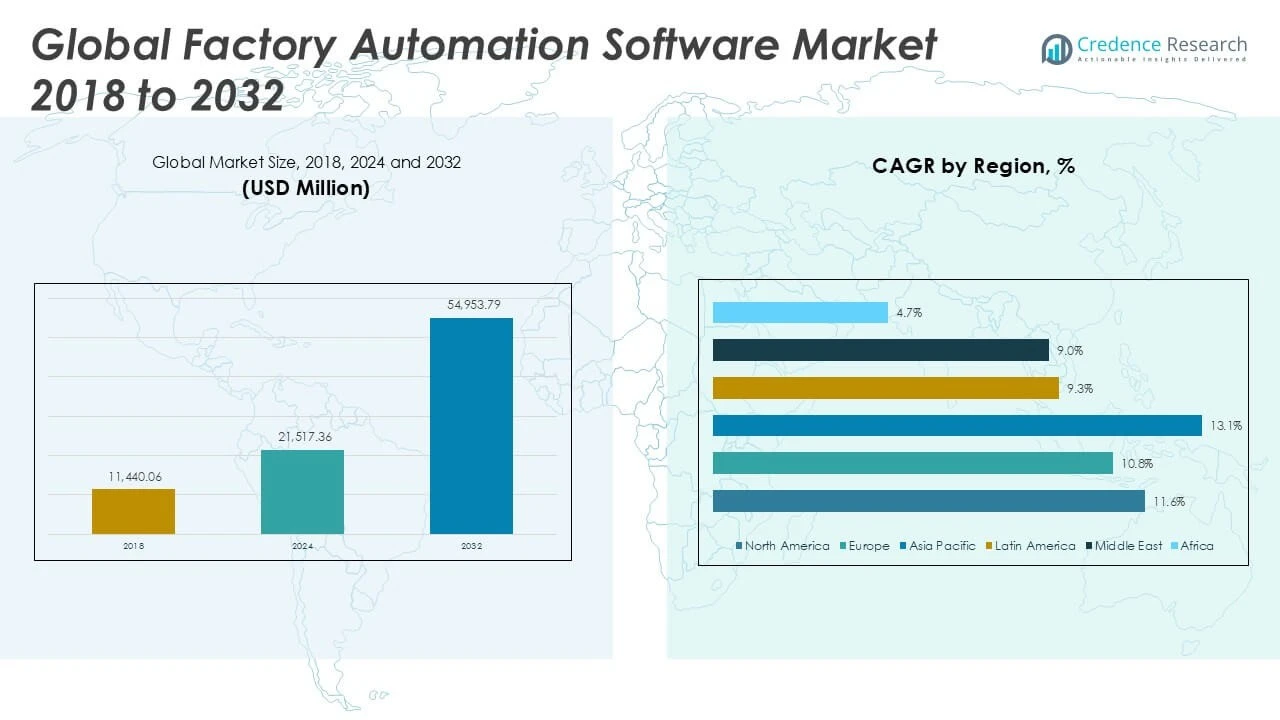

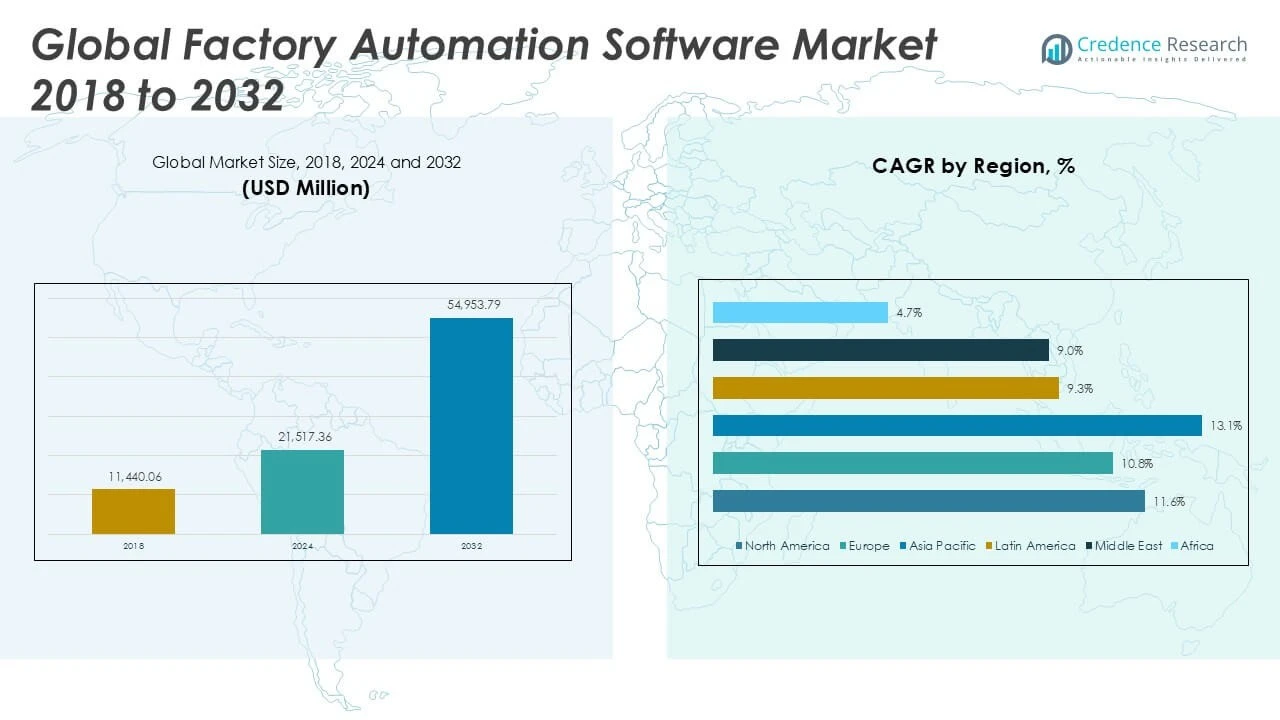

The Factory Automation Software Market size was valued at USD 11,440.06 million in 2018, reached USD 21,517.36 million in 2024, and is anticipated to reach USD 54,953.79 million by 2032, at a CAGR of 11.59% during the forecast period.

The Factory Automation Software Market experiences strong growth due to rising demand for improved operational efficiency, enhanced productivity, and reduced manufacturing costs across industries. Adoption of Industry 4.0, digital transformation, and increased integration of IoT and artificial intelligence are driving rapid software deployment in automated processes. Manufacturers prioritize real-time data analytics and remote monitoring to achieve predictive maintenance and minimize downtime, fueling further software investments. The trend toward smart factories, coupled with the need for flexible, scalable, and interoperable automation solutions, accelerates market expansion. Stringent regulatory requirements regarding product quality and workplace safety also encourage automation adoption. Moreover, the growing focus on energy efficiency and sustainability compels industries to implement advanced automation software for optimized resource utilization. Continuous technological advancements and strategic collaborations among key players foster innovation, shaping the competitive landscape and expanding the adoption of automation software globally.

The geographical analysis of the Factory Automation Software Market highlights strong growth in North America, Europe, and Asia Pacific, fueled by robust industrialization, rising adoption of smart manufacturing, and ongoing digital transformation initiatives. North America, led by the United States and Canada, benefits from advanced infrastructure and a high concentration of technology-driven industries. Europe, with key contributions from Germany, France, and the United Kingdom, focuses on quality standards and sustainable manufacturing practices. Asia Pacific, particularly China, Japan, and India, drives significant expansion due to rapid industrialization, government support, and investments in automation. Leading players shaping the competitive landscape include Siemens Digital Industries Software, Rockwell Automation, and Schneider Electric, each offering comprehensive automation solutions and continuously innovating to address evolving industry demands. These companies maintain a strong presence in global markets and play a critical role in advancing automation technology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Factory Automation Software Market is projected to grow from USD 11,440.06 million in 2018 to USD 21,517.36 million in 2024 and reach USD 54,953.79 million by 2032, registering a CAGR of 11.59% over the forecast period.

- Demand for enhanced operational efficiency and reduced manufacturing costs drives rapid adoption of automation software across key industries.

- Market trends highlight increasing integration of cloud platforms, artificial intelligence, and IoT technologies, supporting real-time monitoring and predictive maintenance.

- Leading players such as Siemens Digital Industries Software, Rockwell Automation, and Schneider Electric focus on expanding their automation portfolios, strategic partnerships, and technological innovation to maintain global competitiveness.

- Complex integration requirements, legacy system compatibility challenges, and high initial investment costs limit the pace of adoption, especially for small and mid-sized enterprises.

- North America, Europe, and Asia Pacific lead the market due to high industrialization rates, advanced infrastructure, and strong investments in smart manufacturing, while Latin America, Middle East, and Africa show steady but slower growth.

- The market benefits from ongoing digital transformation, regulatory support for quality and safety, and the emergence of new opportunities in cloud-based and edge computing solutions.

Market Drivers

Rising Focus on Operational Efficiency and Cost Reduction Across Manufacturing Sectors

The Factory Automation Software Market continues to grow as manufacturers intensify efforts to optimize processes and control costs. Companies seek advanced automation software to reduce manual errors, speed up production cycles, and manage complex operations with greater precision. By streamlining workflows and enabling centralized monitoring, these solutions contribute to higher output with fewer resources. Firms also aim to minimize energy consumption and waste, supporting long-term profitability and sustainability goals. With global competition increasing, businesses view automation software as a strategic investment to enhance their competitive edge. The ability to deliver consistent product quality and reduce downtime further strengthens market demand.

For instance, a Siemens survey of over 2,000 industrial firms revealed that many manufacturers reported double-digit reductions in machine downtime after software upgrades.

Accelerated Adoption of Industry 4.0 and Integration of Smart Technologies

Industry 4.0 and the proliferation of smart technologies remain central to market expansion. Manufacturers implement automation software to connect devices, machines, and systems, achieving seamless data exchange and real-time process optimization. IoT-enabled sensors and artificial intelligence enhance predictive maintenance, asset management, and quality assurance. It empowers organizations to transition towards data-driven decision-making, improving responsiveness and flexibility. Companies leverage smart technologies to achieve mass customization and cater to evolving customer needs. The growing importance of cyber-physical systems fuels investments in secure, scalable, and interoperable automation platforms.

For instance, data from the International Federation of Robotics highlights that companies integrating IoT-enabled sensors reported an increase in machine utilization hours annually.

Emphasis on Regulatory Compliance, Product Quality, and Workplace Safety

Stringent regulations regarding product safety, traceability, and workplace standards play a vital role in driving automation software adoption. Compliance requirements compel manufacturers to maintain precise records, implement automated quality checks, and monitor critical parameters throughout production. Automation software helps companies standardize operations and document processes to meet international certifications and legal obligations. It reduces the risk of human error and supports incident prevention, creating safer and more reliable manufacturing environments. The emphasis on consistent product quality and transparent reporting reinforces the value of these solutions. Industry leaders recognize the necessity of staying ahead of regulatory changes to safeguard market reputation.

Sustained Investments in Innovation, Customization, and Global Expansion

Continuous investments in research and development shape the future of automation software by introducing new features and capabilities. Companies prioritize software that offers flexibility and scalability to address specific production requirements and business objectives. Strategic partnerships between technology providers and manufacturers facilitate the creation of tailored solutions that integrate seamlessly with existing systems. The trend toward global expansion increases the need for multi-language support and compliance with regional standards. It enables organizations to manage distributed operations and coordinate supply chains across multiple locations. The pursuit of innovation and customization supports long-term growth and helps maintain a dynamic, competitive landscape.

Market Trends

Widespread Implementation of Cloud-Based Automation Solutions in Manufacturing

Cloud-based automation solutions have gained significant momentum in the Factory Automation Software Market. Organizations deploy cloud platforms to access real-time production data, enhance collaboration, and manage operations remotely. This shift allows manufacturers to scale resources efficiently and reduce IT infrastructure costs. It improves system flexibility and ensures seamless updates and integration with new applications. Cloud solutions enable enterprises to centralize data management and drive faster decision-making across multiple sites. The widespread embrace of cloud-based systems supports business continuity and disaster recovery, establishing a new standard for modern factory operations.

For instance, in a Rockwell Automation industry survey, respondents from over 15 countries reported deploying cloud-based platforms in multi-site operations, reducing the number of local servers required by several hundred per enterprise.

Growing Role of Artificial Intelligence and Machine Learning in Process Optimization

Artificial intelligence (AI) and machine learning (ML) technologies play a pivotal role in shaping the future of the Factory Automation Software Market. Companies integrate AI and ML algorithms to optimize process efficiency, enhance predictive maintenance, and detect anomalies in production lines. These technologies empower businesses to identify patterns, forecast equipment failures, and optimize scheduling. It leads to reduced downtime, improved asset utilization, and consistent product quality. Adoption of AI-driven analytics accelerates the transition towards fully autonomous manufacturing environments. The integration of advanced analytics continues to transform operational strategies and competitive dynamics.

For instance, a leading German automotive manufacturer reported identifying over 400 patterns of machine behavior during its initial year of AI deployment, resulting in detection of more than 120 critical anomalies before they caused any production stoppage.

Increasing Emphasis on Cybersecurity and Data Protection in Automated Factories

The rise in interconnected devices and data-driven processes has heightened concerns about cybersecurity in the Factory Automation Software Market. Manufacturers focus on strengthening digital infrastructure to safeguard sensitive production information and protect critical assets. It necessitates robust encryption, real-time monitoring, and proactive threat mitigation strategies. Industry stakeholders invest in advanced security frameworks to comply with regulatory standards and assure business partners of safe data practices. Enhanced cybersecurity measures support the reliable functioning of automated systems. The ongoing development of secure automation software is essential to maintaining trust and resilience in industrial operations.

Expansion of Modular and Interoperable Software Platforms Across Global Enterprises

Manufacturers increasingly prefer modular and interoperable software platforms in the Factory Automation Software Market. These platforms support integration with a wide range of hardware, legacy systems, and third-party applications. It allows organizations to customize automation solutions based on unique operational needs and evolving technologies. The modular approach accelerates deployment timelines and reduces overall costs by enabling incremental upgrades. Interoperability enhances supply chain visibility and supports agile manufacturing practices across geographically dispersed facilities. The expansion of flexible software architectures sets the foundation for continuous improvement and sustained innovation in factory automation.

Market Challenges Analysis

Complex Integration Requirements and Legacy System Compatibility Issues

Complex integration demands present a significant challenge for the Factory Automation Software Market. Many manufacturers operate with a mix of old and new equipment, creating barriers to seamless software deployment. Compatibility issues often lead to extended implementation timelines and higher integration costs. It becomes difficult to achieve full interoperability across various machines and control systems, particularly in industries with deeply embedded legacy technologies. The need for custom solutions and specialized technical expertise further complicates the process. These challenges hinder automation initiatives and impact the pace of digital transformation.

High Initial Investment and Limited Skilled Workforce Hamper Adoption

High initial costs for automation software and associated infrastructure deter small and medium-sized enterprises from adopting advanced solutions. The expense includes licensing, hardware upgrades, and ongoing maintenance, which can strain organizational budgets. The Factory Automation Software Market faces a persistent shortage of skilled professionals who can design, implement, and manage complex systems. It limits organizations’ ability to maximize software capabilities and keep pace with evolving technologies. Continuous training and upskilling are necessary to bridge this talent gap. Companies must balance technology investments with workforce development to ensure long-term operational efficiency.

Market Opportunities

Expansion of Smart Manufacturing and Digital Transformation Initiatives

Smart manufacturing initiatives offer strong opportunities for the Factory Automation Software Market. Global industries are accelerating digital transformation to enhance productivity, quality, and agility. Governments and organizations support investments in advanced automation to achieve strategic economic and operational objectives. It drives demand for intelligent software capable of real-time monitoring, predictive analytics, and adaptive process control. The move toward connected factories and integrated supply chains allows manufacturers to streamline operations and respond rapidly to market changes. Companies that leverage these digital solutions position themselves for greater competitiveness and sustained growth.

Rising Adoption of Cloud and Edge Computing Solutions Across Industries

Cloud and edge computing present new avenues for innovation in the Factory Automation Software Market. Manufacturers benefit from scalable, flexible software that supports decentralized data processing and secure remote management. It enables organizations to deploy advanced automation without significant upfront investment in physical infrastructure. The shift to cloud-based and edge-enabled platforms facilitates real-time data access, collaboration, and process optimization across multiple sites. These technologies lower barriers to adoption for small and mid-sized enterprises. The expanding ecosystem of cloud and edge solutions is expected to create long-term growth opportunities and redefine global automation strategies.

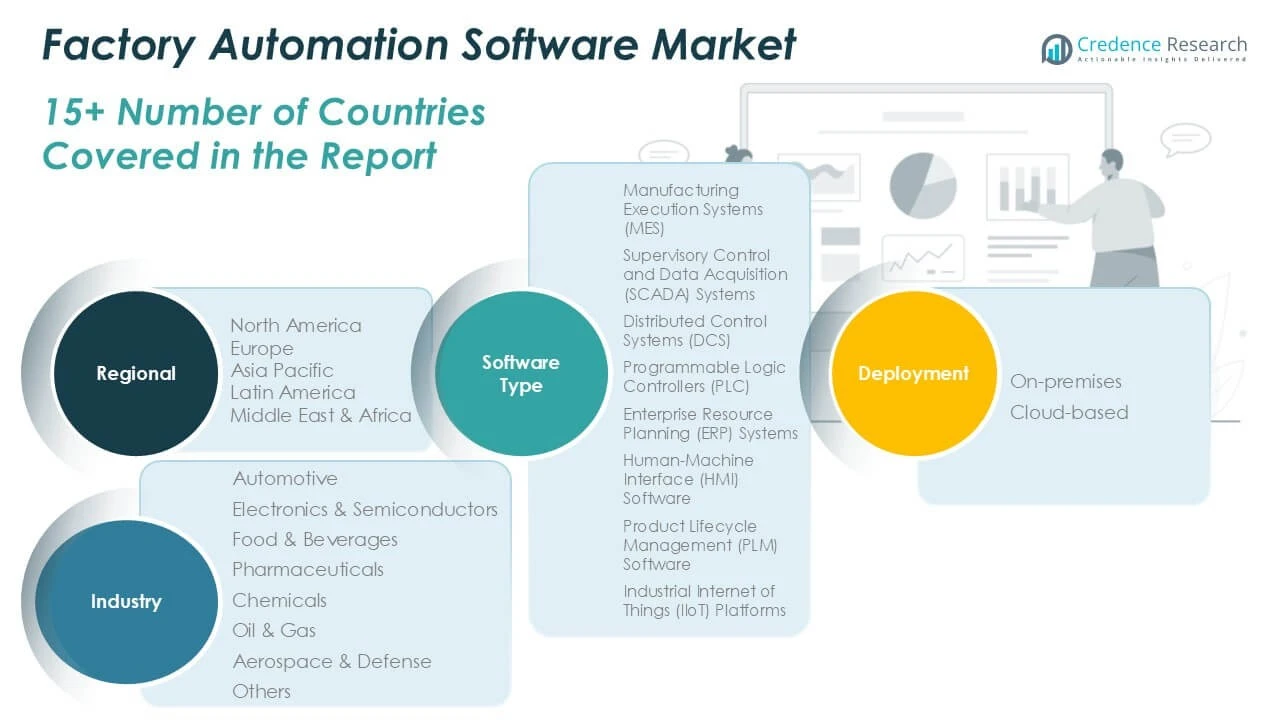

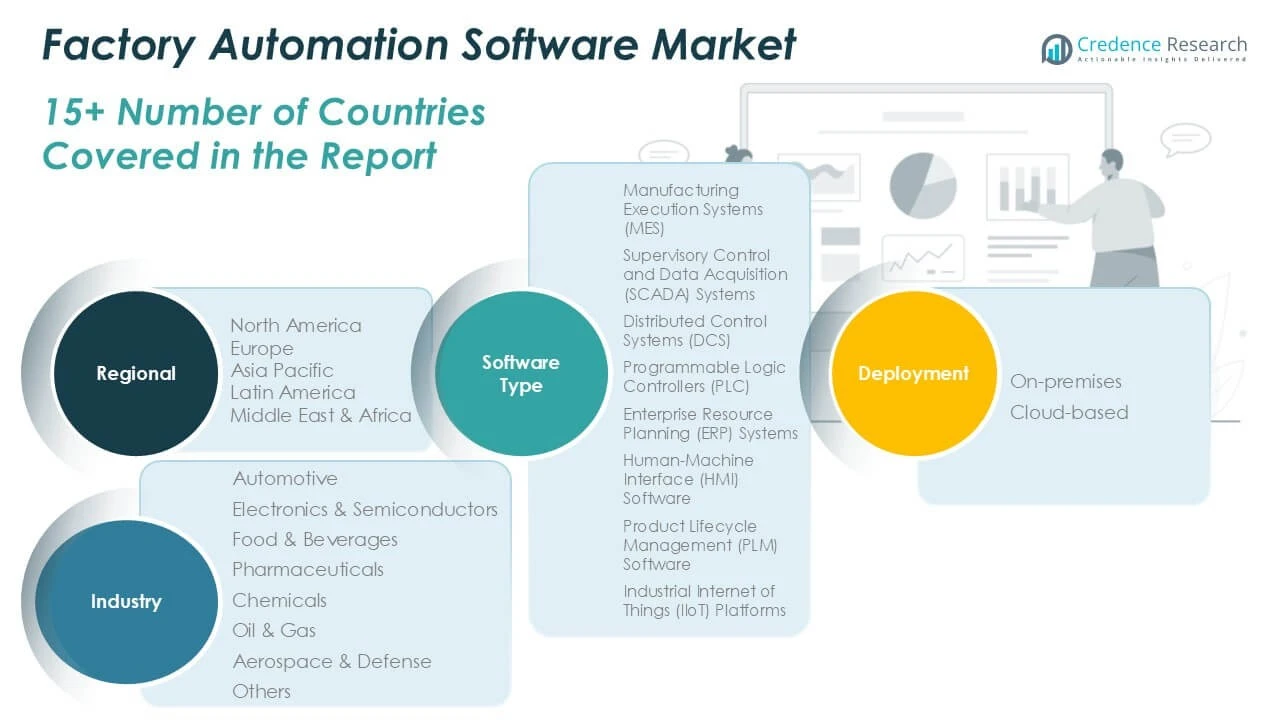

Market Segmentation Analysis:

By Software Type:

The Factory Automation Software Market includes a diverse range of software types, each designed to address specific manufacturing challenges and operational requirements. Manufacturing Execution Systems (MES) enable real-time production management, process monitoring, and performance optimization at the shop floor level. Supervisory Control and Data Acquisition (SCADA) Systems offer centralized control and data visualization, supporting large-scale manufacturing and utility environments. Distributed Control Systems (DCS) focus on complex, continuous processes such as those in chemical or oil and gas industries, delivering high reliability and scalability. Programmable Logic Controllers (PLC) provide robust automation for repetitive tasks, machine control, and safety-critical applications. Enterprise Resource Planning (ERP) Systems streamline business processes and integrate manufacturing with supply chain and financial management. Human-Machine Interface (HMI) Software facilitates intuitive interaction between operators and automated systems, improving usability and reducing human error. Product Lifecycle Management (PLM) Software supports product design, development, and innovation, while Industrial Internet of Things (IIoT) Platforms connect devices, enable predictive analytics, and support data-driven decision-making.

For instance, a Honeywell study showed that plants deploying MES recorded thousands of real-time data points daily, supporting precise adjustments and quality checks.

By Deployment:

Deployment segment analysis reveals a significant shift toward cloud-based solutions. Organizations select on-premises deployment when security, customization, or regulatory compliance require localized control and management of software. Cloud-based solutions are gaining preference due to their flexibility, scalability, and lower upfront costs. These platforms enable remote access, seamless software updates, and simplified integration with new technologies. Companies value the ability to manage global operations and maintain business continuity using cloud architectures. The choice between deployment models depends on industry requirements, data sensitivity, and IT infrastructure maturity.

For instance, a Japanese industrial conglomerate saw remote access capability increase to over 2,500 staff members globally after a transition to cloud-based factory automation platforms.

By Industry:

The Factory Automation Software Market serves multiple industries with distinct automation needs. The automotive sector invests in advanced software to enhance precision, reduce cycle times, and enable high-volume, high-mix production environments. Electronics and semiconductor manufacturers adopt automation solutions to ensure cleanroom compliance, process accuracy, and rapid product innovation. Food and beverages companies implement software for traceability, quality assurance, and compliance with stringent safety regulations. Pharmaceutical manufacturers require robust automation to meet regulatory standards and maintain product consistency. Chemical, oil and gas, and aerospace and defense industries focus on complex process control, safety, and mission-critical operations. The market also supports diverse applications in other sectors seeking to improve efficiency and competitiveness through factory automation software.

Segments:

Based on Software Type:

- Manufacturing Execution Systems (MES)

- Supervisory Control and Data Acquisition (SCADA) Systems

- Distributed Control Systems (DCS)

- Programmable Logic Controllers (PLC)

- Enterprise Resource Planning (ERP) Systems

- Human-Machine Interface (HMI) Software

- Product Lifecycle Management (PLM) Software

- Industrial Internet of Things (IIoT) Platforms

Based on Deployment:

Based on Industry:

- Automotive

- Electronics & Semiconductors

- Food & Beverages

- Pharmaceuticals

- Chemicals

- Oil & Gas

- Aerospace & Defense

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Factory Automation Software Market

North America Factory Automation Software Market grew from USD 4,877.35 million in 2018 to USD 9,076.13 million in 2024 and is projected to reach USD 23,245.73 million by 2032, reflecting a compound annual growth rate (CAGR) of 11.6%. North America is holding a 28% market share. The United States and Canada lead regional demand, driven by high levels of industrial automation across automotive, electronics, and food processing sectors. U.S.-based manufacturers invest heavily in advanced automation to address labor shortages and improve productivity. Canada focuses on digital transformation and innovation, strengthening the region’s competitive position. Strong emphasis on Industry 4.0 and government incentives encourage ongoing software adoption.

Europe Factory Automation Software Market

Europe Factory Automation Software Market grew from USD 3,275.75 million in 2018 to USD 5,941.22 million in 2024 and is projected to reach USD 14,294.18 million by 2032, at a CAGR of 10.8%. Europe is holding a 18% market share. Germany, France, and the United Kingdom drive demand due to established manufacturing bases and early adoption of smart factory technologies. Germany leads with advanced automotive and industrial sectors, while France and the UK focus on digital integration and sustainable manufacturing. European Union regulations for quality, safety, and environmental compliance continue to support market growth. Regional initiatives such as “Made in Europe” further accelerate adoption.

Asia Pacific Factory Automation Software Market

Asia Pacific Factory Automation Software Market grew from USD 2,486.38 million in 2018 to USD 5,023.77 million in 2024 and is expected to reach USD 14,349.26 million by 2032, demonstrating a CAGR of 13.1%. Asia Pacific is holding a 26% market share. China, Japan, South Korea, and India are key countries propelling growth. China invests in smart manufacturing and IIoT, while Japan and South Korea adopt robotics and automation to enhance competitiveness. India’s manufacturing sector embraces automation for cost savings and quality improvements. The region benefits from rapid industrialization, government support, and growing foreign investments.

Latin America Factory Automation Software Market

Latin America Factory Automation Software Market grew from USD 415.73 million in 2018 to USD 769.31 million in 2024 and is forecast to reach USD 1,670.20 million by 2032, with a CAGR of 9.3%. Latin America is holding a 2% market share. Brazil and Mexico represent the largest markets due to expanding automotive and electronics industries. Companies in these countries adopt automation software to meet international standards and boost export competitiveness. The region also benefits from a growing focus on industrial efficiency and digitalization. Market expansion remains moderate due to economic volatility and infrastructure challenges.

Middle East Factory Automation Software Market

Middle East Factory Automation Software Market grew from USD 301.33 million in 2018 to USD 514.99 million in 2024 and is projected to reach USD 1,095.42 million by 2032, with a CAGR of 9.0%. The Middle East holds a 1% market share. The United Arab Emirates and Saudi Arabia invest in automation to support large-scale industrial and infrastructure projects. Oil and gas, chemicals, and utilities are key sectors driving software adoption. Regional governments focus on economic diversification and smart city initiatives, encouraging digital transformation. Market penetration varies across countries based on industrial maturity.

Africa Factory Automation Software Market

Africa Factory Automation Software Market grew from USD 83.51 million in 2018 to USD 191.96 million in 2024 and is estimated to reach USD 299.01 million by 2032, at a CAGR of 4.7%. Africa accounts for a 1% market share. South Africa and Egypt lead adoption, focusing on modernization of manufacturing and energy sectors. Infrastructure development and foreign investment create opportunities for automation software growth. Limited IT infrastructure and skilled labor slow adoption rates. Ongoing government initiatives aim to strengthen local capabilities and support gradual digital transformation.

Key Player Analysis

- Siemens Digital Industries Software

- Rockwell Automation

- Inductive Automation

- Dassault Systèmes (DELMIA)

- GE Digital

- Honeywell Process Solutions

- Emerson Electric

- Schneider Electric

- ABB Ltd.

- Mitsubishi Electric

- Yokogawa Electric Corporation

- Panasonic Corporation

- Bosch Rexroth

- Omron Corporation

Competitive Analysis

The Factory Automation Software Market remains highly competitive, shaped by leading players such as Siemens Digital Industries Software, Rockwell Automation, Schneider Electric, Emerson Electric, ABB Ltd., Mitsubishi Electric, Honeywell Process Solutions, Inductive Automation, Dassault Systèmes (DELMIA), GE Digital, Yokogawa Electric Corporation, Panasonic Corporation, Bosch Rexroth, and Omron Corporation. These companies maintain a strong global presence and continually invest in research and development to expand and enhance their automation portfolios. They focus on integrating cutting-edge technologies like artificial intelligence, Industrial Internet of Things (IIoT), and cloud-based platforms to address evolving industry requirements. Strategic partnerships, mergers, and acquisitions remain common strategies for broadening market reach and strengthening solution capabilities. Leading players differentiate themselves through comprehensive product offerings, seamless system integration, and advanced analytics capabilities. Customization and scalability are key priorities as clients demand solutions tailored to specific manufacturing environments. Customer service, technical support, and robust training programs further enhance market position and brand loyalty. Regional expansion and collaboration with local technology providers help address regulatory requirements and customer preferences. The competitive landscape will continue to evolve as market leaders focus on innovation, operational efficiency, and digital transformation to meet the growing needs of manufacturers worldwide.

Recent Developments

- In March 2025, Siemens AG completed its acquisition of Altair Engineering Inc. for approximately USD 10 billion, marking a significant expansion of its industrial software capabilities. This strategic move enhances Siemens AG’s leadership in simulation and industrial artificial intelligence (AI) by integrating Altair’s strengths in mechanical and electromagnetic simulation, high-performance computing (HPC), data science, and AI.

- In December 2024, Fuji Electric Co., Ltd. announced plans to augment its switchboard and uninterruptible power supply (UPS) production facilities at the Kobe Factory. The expansion includes installing skid system production equipment, which allows for consolidated wiring, testing, and inspections, reducing on-site installation time by 40%. This investment is expected to increase production capacity by 50%, addressing labor shortages and enhancing efficiency for internet data center projects.

- In April 2024, Omron Corporation introduced the VT-X850, a next-generation 3D Computed Tomography (CT) Automatic X-ray Inspection (AXI) system tailored for electric vehicle (EV) Surface Mount Technology (SMT) manufacturing lines. This advanced inspection solution addresses the complexities of inspecting large, intricate, and dense materials, integrating a high-voltage X-ray tube and Artificial Intelligence (AI) to deliver speed, accuracy, and ease of use.

- In June 2022, Mitsubishi Electric Corporation announced that it would invest around INR 2.2 billion in its subsidiary Mitsubishi Electric India Pvt. Ltd. to establish a new factory in India. The company is expected to start factory operations in December 2023, with the factory manufacturing inverters and other factory automation (FA) control system products, expanding the company’s capabilities to meet the growing demand in India.

- In May 2022, Emerson announced the release of its PACSystems RSTi-EP CPE 200 programmable automation controllers (PAC). The new family of compact PACs helps OEMs successfully meet customer requirements by minimizing the need for specialized software engineering talent.

Market Concentration & Characteristics

The Factory Automation Software Market exhibits moderate to high market concentration, with a handful of global leaders commanding significant market influence through expansive product portfolios and technological expertise. It is characterized by strong barriers to entry, driven by high initial investment requirements, complex integration demands, and the necessity for industry-specific solutions. Leading players leverage advanced research and development capabilities to maintain their competitive edge, while strategic partnerships and acquisitions allow them to broaden their reach and address evolving customer needs. The market’s structure supports both established multinational corporations and innovative niche vendors, each offering unique value propositions. Customers value reliability, scalability, and seamless integration with existing industrial systems, making technical support and service a crucial differentiator. Rapid technological advancements, ongoing digital transformation, and the shift toward smart manufacturing environments define the dynamic nature of the market, encouraging continuous innovation and adaptation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Software Type, Deployment, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to continue its robust growth trajectory, driven by the increasing adoption of automation technologies across various industries.

- Integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Industrial Internet of Things (IIoT) is expected to enhance operational efficiency and predictive maintenance capabilities.

- Cloud-based deployment models are anticipated to gain significant traction, offering scalability, flexibility, and cost-effectiveness to manufacturers.

- The demand for real-time data analytics and visualization tools will rise, enabling manufacturers to make informed decisions and optimize production processes.

- Cybersecurity will become a critical focus area, with companies investing in robust security solutions to protect sensitive manufacturing data and systems.

- The market will witness increased collaboration between software providers and manufacturing firms to develop customized solutions tailored to specific industry needs.

- Emerging economies will play a pivotal role in market expansion, driven by industrialization initiatives and government support for smart manufacturing.

- The adoption of digital twins and simulation software will enhance product design and testing, reducing time-to-market and production costs.

- Sustainability and energy efficiency will drive the development of automation software that supports eco-friendly manufacturing practices.

- Continuous innovation and technological advancements will remain essential for companies to maintain a competitive edge in the evolving market landscape.