Market Overview

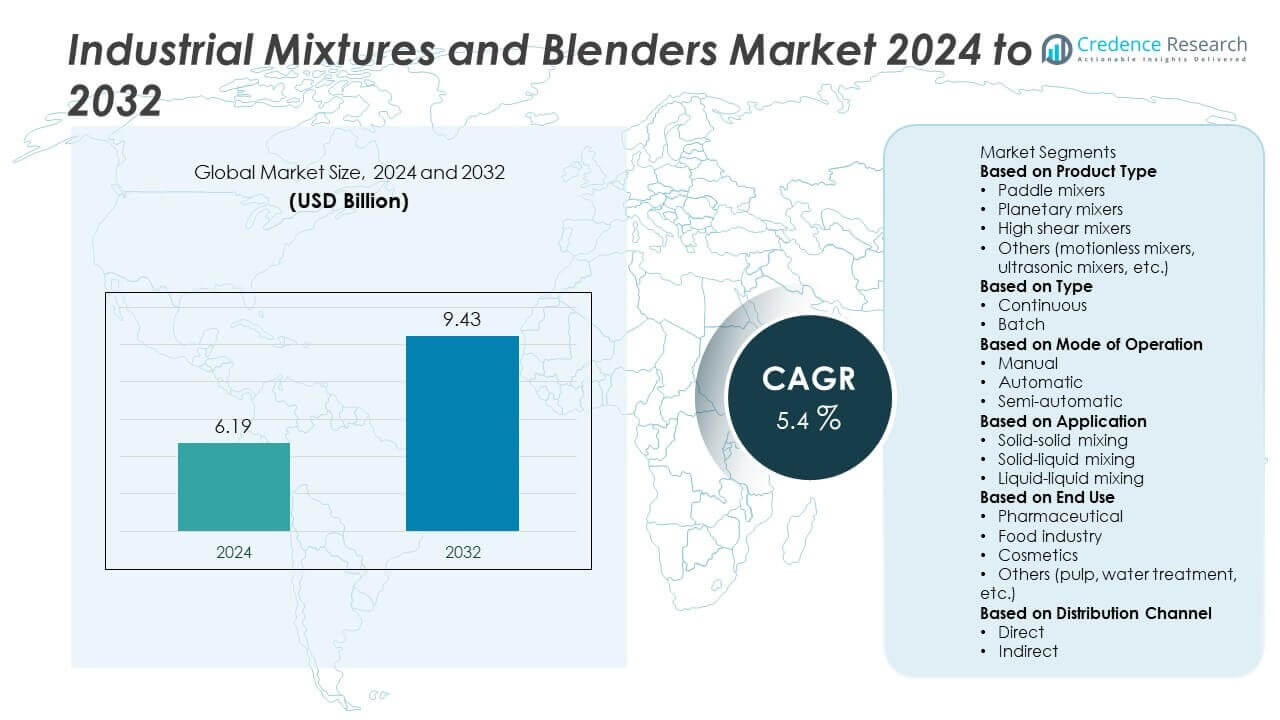

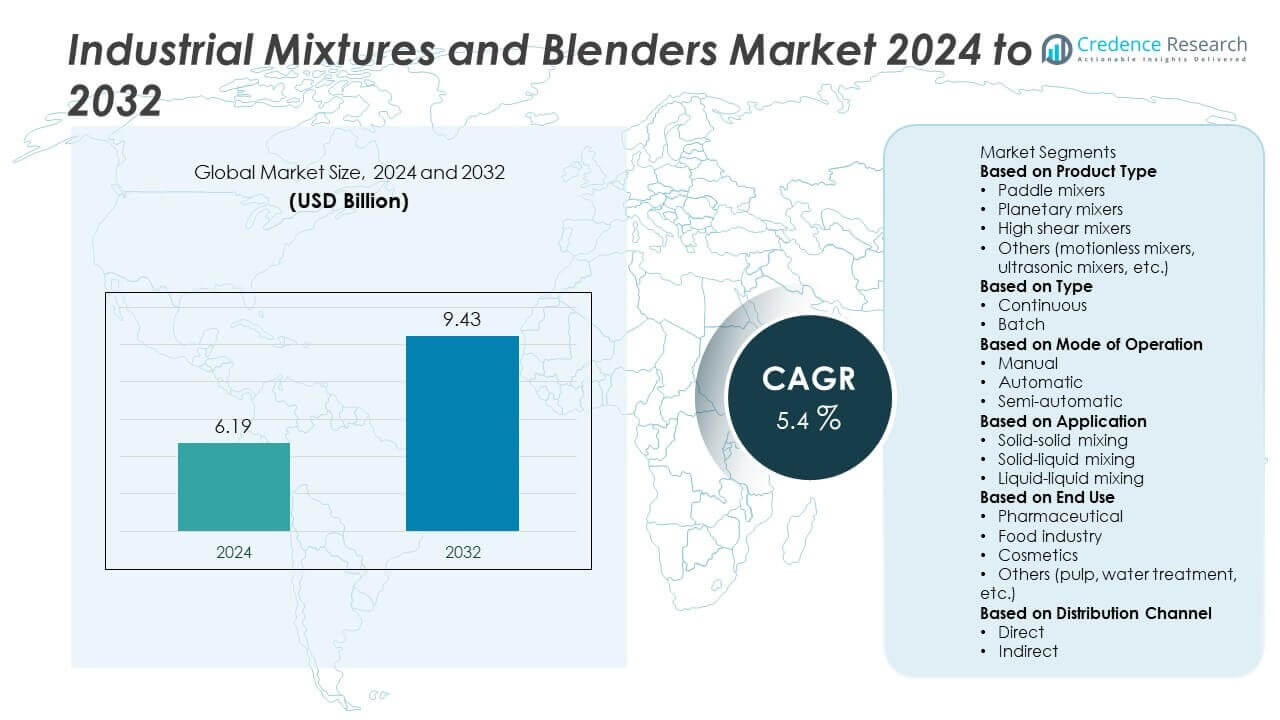

The global Industrial Mixtures and Blenders Market was valued at USD 6.19 billion in 2024 and is projected to reach USD 9.43 billion by 2032, growing at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Mixtures and Blenders Market Size 2024 |

USD 6.19 Billion |

| Industrial Mixtures and Blenders Market, CAGR |

5.4% |

| Industrial Mixtures and Blenders Market Size 2032 |

USD 9.43 Billion |

Industrial Mixtures and Blenders Market grows with rising demand from food, pharmaceutical, and chemical industries for consistent, high-quality blending solutions. Increasing adoption of automation, energy-efficient motors, and real-time monitoring systems improves process reliability and productivity. Geographically, the Industrial Mixtures and Blenders Market shows strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with advanced automation infrastructure and high adoption of hygienic, energy-efficient mixers in food and pharmaceutical sectors. Europe follows with strong demand from chemical, personal care, and specialty materials industries supported by stringent quality and safety standards. Asia-Pacific is expanding rapidly, driven by industrialization, rising food processing capacity, and government initiatives to boost manufacturing. Latin America and Middle East & Africa show steady demand from chemical, beverage, and construction sectors as infrastructure projects grow. Key players shaping the market include GEA Group AG, Alfa Laval AB, Buhler Group, and Hosokawa Micron Corporation, focusing on innovative designs, modular systems, and energy-efficient solutions. These companies invest in R&D, partnerships, and automation technologies to improve efficiency and strengthen their global presence across multiple end-use industries.

Market Insights

- Industrial Mixtures and Blenders Market was valued at USD 6.19 billion in 2024 and is projected to reach USD 9.43 billion by 2032, growing at a CAGR of 5.4%.

- Rising demand from food processing, pharmaceutical, and chemical industries drives adoption of high-performance mixing equipment for consistent product quality.

- Market trends highlight integration of automation, IoT-enabled monitoring, and modular designs that enable scalability and reduce downtime during product changeovers.

- Competitive landscape features key players such as GEA Group AG, Alfa Laval AB, Buhler Group, Hosokawa Micron Corporation, and EKATO Holding GmbH focusing on R&D and energy-efficient technologies.

- High initial investment and maintenance costs act as restraints, limiting adoption among small and medium enterprises in cost-sensitive regions.

- North America leads with strong demand from food and pharmaceutical sectors, while Europe benefits from regulatory push for hygienic and sustainable mixing equipment.

- Asia-Pacific emerges as the fastest-growing region with rapid industrialization, rising food and beverage production, and government-led manufacturing initiatives boosting equipment installations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Food, Beverage, and Pharmaceutical Industries

Industrial Mixtures and Blenders Market grows with increasing demand from food processing, beverage production, and pharmaceutical manufacturing. Blenders play a crucial role in mixing ingredients uniformly to ensure product quality and consistency. It supports efficient processing of powders, granules, and liquids in large-scale operations. Growing consumer demand for processed foods and functional beverages drives equipment adoption. Pharmaceutical companies require precise blending for active ingredients, which boosts demand for advanced solutions. This factor strengthens the market’s expansion across diverse end-use sectors.

- For instance, Alfa Laval’s Hybrid Powder Mixer M15 handles 3000 kilograms per hour of skimmed milk powder, enabling large scale dairy blending operations with consistent output.

Growth in Chemical, Cosmetics, and Specialty Material Production

Industrial Mixtures and Blenders Market benefits from rising production of chemicals, coatings, adhesives, and personal care products. These industries depend on reliable mixing equipment to maintain product stability and achieve desired formulations. It helps improve production efficiency while reducing waste and operational costs. Demand grows for high-capacity and energy-efficient mixers to handle complex formulations. Growth in cosmetics and skincare markets further supports investments in blending technology. Expanding applications in paints, lubricants, and sealants add to market growth.

- For instance, Alfa Laval’s MX mixers are available in four sizes with volumes from 50 up to 280 litres and motor powers from 4.0 to 18.5 kW (at 50 Hz), making them suitable for fats and oils mixing under varying duties.

Technological Advancements and Automation Integration

Industrial Mixtures and Blenders Market sees growth driven by adoption of automation and smart control systems. Advanced mixers feature programmable settings, real-time monitoring, and energy-efficient motors. It enhances process control, reduces human error, and ensures batch-to-batch consistency. Integration with Industry 4.0 platforms allows remote operation and predictive maintenance. Manufacturers invest in developing high-speed, hygienic, and CIP-compatible designs to meet regulatory requirements. These innovations improve productivity and lower long-term operating costs.

Rising Focus on Energy Efficiency and Sustainability

Industrial Mixtures and Blenders Market benefits from growing emphasis on sustainable production practices. Companies seek equipment that minimizes energy consumption and reduces carbon footprint. It drives demand for mixers with optimized motor performance and reduced power requirements. Adoption of eco-friendly manufacturing standards pushes industries to upgrade outdated blending systems. Development of equipment that allows quick cleaning and lower water usage supports environmental goals. These sustainability-driven trends create strong incentives for investment in modern mixing technologies.

Market Trends

Market Trends

Adoption of High-Efficiency and Automated Mixing Systems

Industrial Mixtures and Blenders Market is witnessing a strong shift toward automated and energy-efficient systems. Manufacturers design mixers with programmable controls, variable speed drives, and real-time monitoring. It improves process consistency, reduces downtime, and optimizes energy use. Industries adopt automation to meet growing demand for precision and reduce operational errors. Integration with IoT and Industry 4.0 platforms enables predictive maintenance and remote monitoring. This trend supports higher productivity and better resource utilization.

- For instance, Cytiva’s XDUO 200 single-use mixer achieved mixing to 95% homogeneity (tm95) in 13 seconds at 200 liters volume under 20 cP viscosity using highest impeller speed.

Growing Preference for Hygienic and CIP-Compatible Equipment

Industrial Mixtures and Blenders Market shows increasing demand for equipment designed for sanitary applications. Food, beverage, and pharmaceutical sectors require mixers that comply with strict hygiene standards. It drives adoption of clean-in-place (CIP) and easy-to-disassemble systems that minimize contamination risks. Stainless steel construction and smooth surface finishes become standard features. Companies focus on reducing cleaning time to improve production efficiency. This trend strengthens adoption in regulated industries where safety and quality are priorities.

- For instance, the standard Varimixer ERGO 100-qt mixer offers features including a stainless steel frame, a dishwasher-safe removable bowl guard, variable speed control from 46 to 259 RPMs, and the ability to remove the bowl without detaching the mixing tool. The variable speed range is typically stated as 46 to 259 RPMs, slightly differing from the original figure of 47 RPMs. The bowl guard is also removable and dishwasher-safe, with some options available in plastic or stainless steel depending on the model.

Rising Popularity of Customizable and Modular Solutions

Industrial Mixtures and Blenders Market benefits from the trend toward modular and customizable systems. Manufacturers offer flexible designs that can adapt to different batch sizes and product types. It allows companies to scale production efficiently and switch between formulations with minimal downtime. Demand grows for systems that integrate mixing, blending, and discharge functions in a single unit. Modular equipment helps reduce capital expenditure by enabling phased upgrades. This trend caters to both small-scale producers and large industrial facilities.

Increased Use of Advanced Materials and Energy-Saving Technologies

Industrial Mixtures and Blenders Market is seeing innovations in materials and design for durability and efficiency. Lightweight components and high-performance coatings improve equipment lifespan and reduce maintenance needs. It helps minimize energy loss and supports sustainable manufacturing initiatives. Manufacturers introduce energy-efficient motors and optimized impeller designs for lower power consumption. Adoption of these technologies reduces overall operational costs for end users. This trend aligns with global efforts to improve environmental performance in industrial production.

Market Challenges Analysis

High Initial Investment and Maintenance Costs

Industrial Mixtures and Blenders Market faces challenges due to the significant upfront cost of purchasing advanced equipment. High-capacity mixers with automation and digital control systems require large capital expenditure, which limits adoption by small and medium enterprises. It becomes difficult for cost-sensitive industries to justify replacement of older systems despite efficiency benefits. Maintenance costs for complex machines also add to operational expenses. Frequent servicing and skilled labor requirements can increase downtime and disrupt production schedules. These financial barriers slow the adoption of modern blending technologies in developing regions.

Complex Integration and Regulatory Compliance Issues

Industrial Mixtures and Blenders Market is impacted by challenges related to equipment integration with existing production lines. Customization and compatibility issues can delay installation and increase commissioning costs. It requires specialized engineering expertise to ensure seamless operation across processes. Regulatory compliance, especially in food, pharmaceutical, and chemical sectors, adds further complexity. Companies must meet strict safety, hygiene, and energy efficiency standards before deployment. Failure to comply can lead to costly delays and penalties. These factors create obstacles for rapid modernization of blending facilities.

Market Opportunities

Expansion in Food, Beverage, and Pharmaceutical Production

Industrial Mixtures and Blenders Market holds strong opportunities driven by rising global demand for processed foods, functional beverages, and pharmaceutical products. Manufacturers require high-performance mixers to ensure consistency, quality, and regulatory compliance. It creates demand for automated, high-capacity blending systems capable of handling multiple ingredients. Growth in dietary supplements and nutraceuticals further supports investments in precision mixing equipment. Emerging markets with expanding middle-class populations boost demand for packaged and ready-to-eat products. These trends create a favorable environment for suppliers offering advanced, hygienic, and scalable solutions.

Adoption of Sustainable and Energy-Efficient Technologies

Industrial Mixtures and Blenders Market gains opportunities from increasing focus on sustainability and energy efficiency. Industries seek equipment that reduces power consumption, minimizes material waste, and supports eco-friendly production practices. It encourages manufacturers to introduce mixers with optimized motor efficiency and low-maintenance designs. Companies adopting such technologies can lower operating costs while meeting environmental standards. Demand for recyclable and corrosion-resistant materials in mixer construction is growing. This shift toward green manufacturing opens doors for innovative, energy-saving blending solutions worldwide.

Market Segmentation Analysis:

By Product Type

Industrial Mixtures and Blenders Market is segmented into ribbon blenders, paddle mixers, planetary mixers, and others including vertical and conical mixers. Ribbon blenders hold a significant share due to their versatility in mixing dry powders, granules, and bulk solids. They are widely used in food, chemical, and construction industries where uniform blending is critical. Paddle mixers find strong demand in applications requiring gentle mixing, such as fragile food ingredients and plastic resins. It benefits from growth in industries producing heat-sensitive materials. Planetary mixers are preferred for applications needing precise and thorough mixing, including pharmaceutical and specialty chemical sectors. Manufacturers focus on developing high-capacity and energy-efficient designs to meet diverse production requirements.

- For instance, Ross Ribbon Blenders are fabricated in sizes ranging from ½ to 1000 cubic feet working capacity, with stainless steel wetted parts, enabling handling of batches from small to large scale.

By Type

Industrial Mixtures and Blenders Market by type includes batch mixers and continuous mixers. Batch mixers dominate due to their flexibility and ability to handle a wide range of formulations in small to medium production runs. They are ideal for industries where frequent product changeovers are required. Continuous mixers find demand in large-scale production environments where uniformity and efficiency are key. It supports applications in chemicals, cement, and food processing plants where uninterrupted operations are critical. Rising need for high-throughput solutions drives adoption of continuous mixing systems in high-volume facilities.

- For instance, Co-Nele Continuous Intensive Mixers offer models such as CR15L through CD40L, with capacities from 500 to 12,000 liters and throughput ranging from 20 to 1,400 tons per hour. Power ratings range from 55 kW for smaller models to 160kWx2 + 200kWx2 for the largest CD40L model.

By Mode of Operation

Industrial Mixtures and Blenders Market is segmented into automatic, semi-automatic, and manual operation modes. Automatic mixers hold the largest share as industries prioritize precision, consistency, and labor efficiency. Integration of programmable logic controllers (PLCs) and real-time monitoring enhances productivity and reduces downtime. Semi-automatic mixers remain relevant in facilities balancing cost with automation needs. Manual mixers are still used in small-scale operations or low-budget settings. It gains momentum from Industry 4.0 adoption, which supports connected, fully automated systems for predictive maintenance and optimized performance. Manufacturers continue to innovate with user-friendly control systems to cater to a wide range of end users.

Segments:

Based on Product Type

- Paddle mixers

- Planetary mixers

- High shear mixers

- Others (motionless mixers, ultrasonic mixers, etc.)

Based on Type

Based on Mode of Operation

- Manual

- Automatic

- Semi-automatic

Based on Application

- Solid-solid mixing

- Solid-liquid mixing

- Liquid-liquid mixing

Based on End Use

- Pharmaceutical

- Food industry

- Cosmetics

- Others (pulp, water treatment, etc.)

Based on Distribution Channel

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 33% market share in the Industrial Mixtures and Blenders Market, driven by strong demand from food processing, pharmaceuticals, and chemical industries. The United States leads the region with advanced manufacturing infrastructure, high investment in automation, and strict quality standards that encourage adoption of advanced blending technologies. Canada contributes with growing demand from nutraceutical and packaged food sectors, while Mexico benefits from expanding manufacturing hubs and nearshoring trends. It sees strong adoption of energy-efficient mixers to comply with sustainability goals and reduce operational costs. The presence of leading equipment manufacturers and technology providers ensures continuous innovation and easy access to after-sales services. Government incentives for modernizing production facilities further support market growth across the region.

Europe

Europe holds 27% market share supported by its well-established industrial base and stringent regulations on product safety and quality. Countries such as Germany, France, and the U.K. lead in adoption due to advanced automation infrastructure and high manufacturing output. It benefits from increasing demand for hygienic and clean-in-place (CIP) compatible equipment, particularly in food and pharmaceutical industries. The region shows growing preference for energy-efficient and compact mixers to meet sustainability targets and reduce carbon footprints. Eastern Europe offers growth opportunities as countries modernize production facilities to meet EU quality standards. Continuous investment in R&D and focus on modular and customizable solutions strengthen regional competitiveness and adoption.

Asia-Pacific

Asia-Pacific captures 30% market share and is the fastest-growing region, driven by rapid industrialization, population growth, and expansion of food and beverage manufacturing. China dominates with large-scale production facilities for chemicals, pharmaceuticals, and packaged foods. India follows with government-led initiatives to promote manufacturing under programs like “Make in India,” boosting demand for advanced mixing equipment. It benefits from rising disposable incomes and growing demand for processed foods and beverages. Southeast Asian countries such as Indonesia, Thailand, and Vietnam invest heavily in food processing and chemical production, creating demand for high-performance blenders. Rising foreign investments and establishment of local manufacturing facilities enhance regional capacity and accelerate technology adoption.

Latin America

Latin America represents 6% market share with demand concentrated in Brazil, Mexico, and Argentina. The food and beverage industry remains the primary growth driver as consumer demand for processed foods continues to rise. It gains momentum from the expansion of pharmaceutical production and chemical processing plants. Government programs supporting modernization of industrial infrastructure create new opportunities for equipment suppliers. Limited local manufacturing capacity encourages import of advanced mixers and blenders from North America and Europe. Partnerships with regional distributors help international players expand their presence and provide after-sales services.

Middle East & Africa

Middle East & Africa hold 4% market share supported by growth in oil & gas, chemicals, and food processing sectors. GCC countries such as Saudi Arabia and UAE invest heavily in diversifying their economies and expanding industrial capabilities. It benefits from the establishment of new food production and packaging facilities to meet rising domestic demand. South Africa contributes with strong demand from mining-related chemical processing and agriculture-based industries. Ongoing investments in industrial parks and manufacturing hubs create opportunities for equipment suppliers. International players collaborate with local distributors to improve market penetration and provide maintenance support across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GEA Group AG

- Hosokawa Micron Corporation

- Charles Ross & Son Company

- Buhler Group

- Alfa Laval AB

- Eirich Machines, Inc.

- Admix Inc.

- John Bean Technologies Corporation

- EKATO Holding GmbH

- Krones AG

Competitive Analysis

Competitive landscape of the Industrial Mixtures and Blenders Market features leading players such as GEA Group AG, Alfa Laval AB, Buhler Group, Hosokawa Micron Corporation, EKATO Holding GmbH, Eirich Machines, Inc., Admix Inc., Charles Ross & Son Company, John Bean Technologies Corporation, and Krones AG competing through innovation, product customization, and global presence. These companies focus on developing advanced mixing solutions with automation, energy efficiency, and hygienic design to meet the needs of food, chemical, pharmaceutical, and specialty material producers. They invest heavily in R&D to create modular, scalable systems that support quick changeovers and reduce downtime. Strategic initiatives include capacity expansions, acquisitions, and partnerships to strengthen distribution networks and expand presence in high-growth regions. Key players prioritize after-sales support, predictive maintenance capabilities, and Industry 4.0 integration to improve customer operations. Continuous innovation and compliance with global safety standards help maintain their competitive edge in a highly demanding market.

Recent Developments

- In July 2025, Charles Ross & Son Company unveiled a Custom Coaxial Mixer for precision blending in complex formulas.

- In May 2025, Bühler Group broke ground on a new manufacturing facility in Torreón, Mexico.

- In 2025, EKATO Holding and others are investing in smart agitation technologies with IoT capabilities.

- In June 2024, GEA presented the new ASEPTICSD® spray dryers at ACHEMA (Frankfurt). These are built for pharmaceutical spray-drying with advanced cleaning, steam sterilization, sterile filters, etc.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Type, Mode of Operation, Application, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated and smart mixing systems will continue to grow across industries.

- Adoption of energy-efficient and low-maintenance equipment will rise to support sustainability goals.

- Modular and customizable mixers will gain popularity for flexible production requirements.

- Integration of IoT and real-time monitoring will become standard in modern facilities.

- Growth in food, beverage, and pharmaceutical production will drive higher equipment installations.

- Emerging markets will see increased investments in advanced mixing infrastructure.

- Development of hygienic and CIP-compatible designs will strengthen adoption in regulated industries.

- Manufacturers will focus on reducing downtime through predictive maintenance technologies.

- Continuous innovation in impeller and motor design will improve blending efficiency.

- Strategic collaborations and capacity expansions will enhance global market presence.

Market Trends

Market Trends