Market Overview

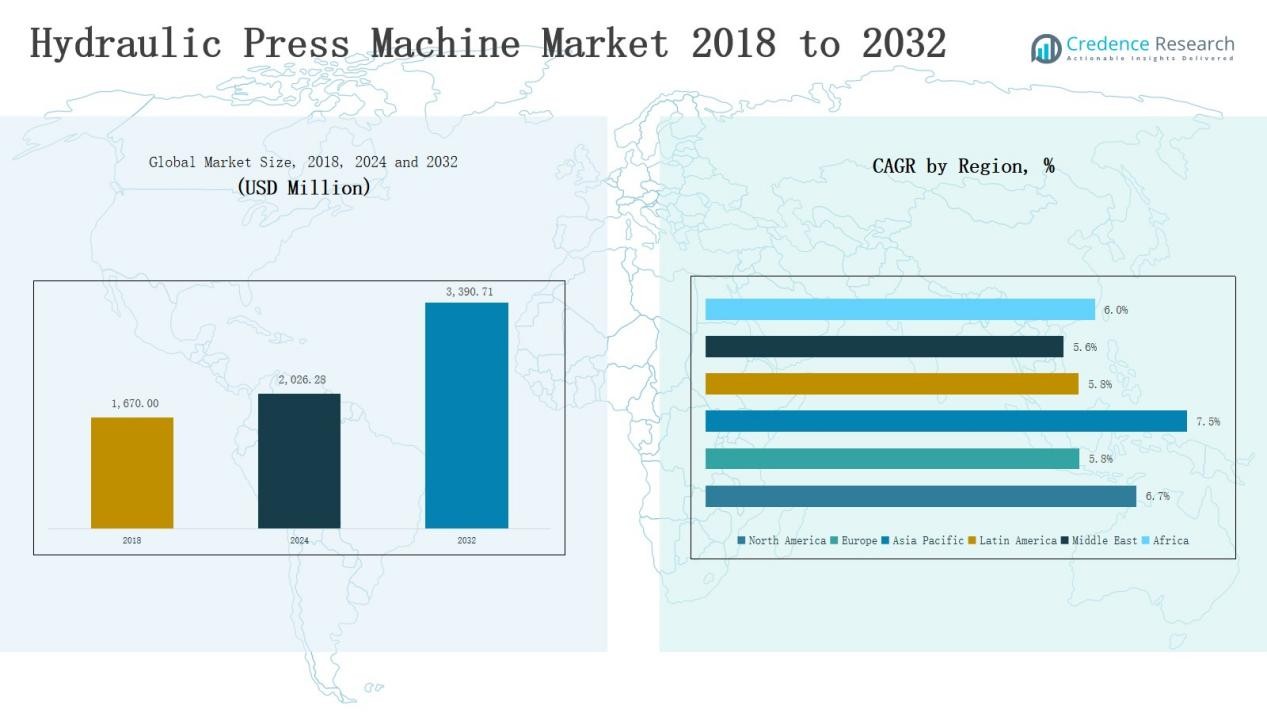

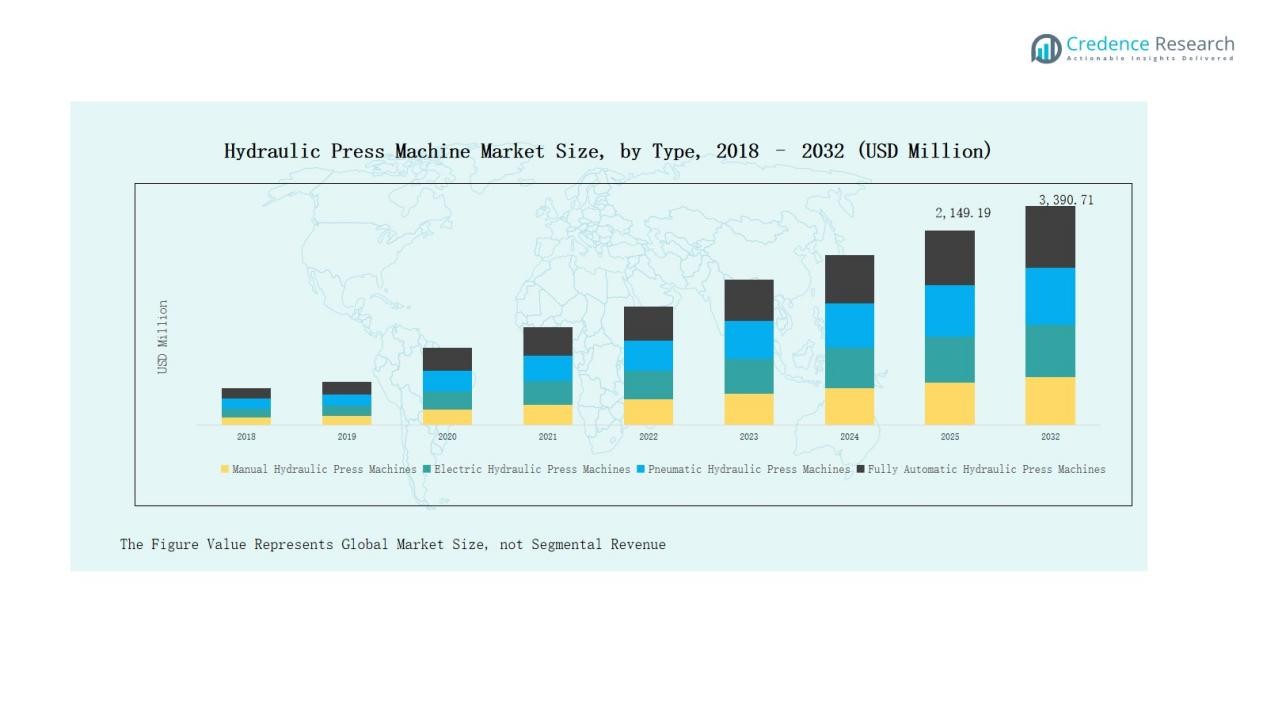

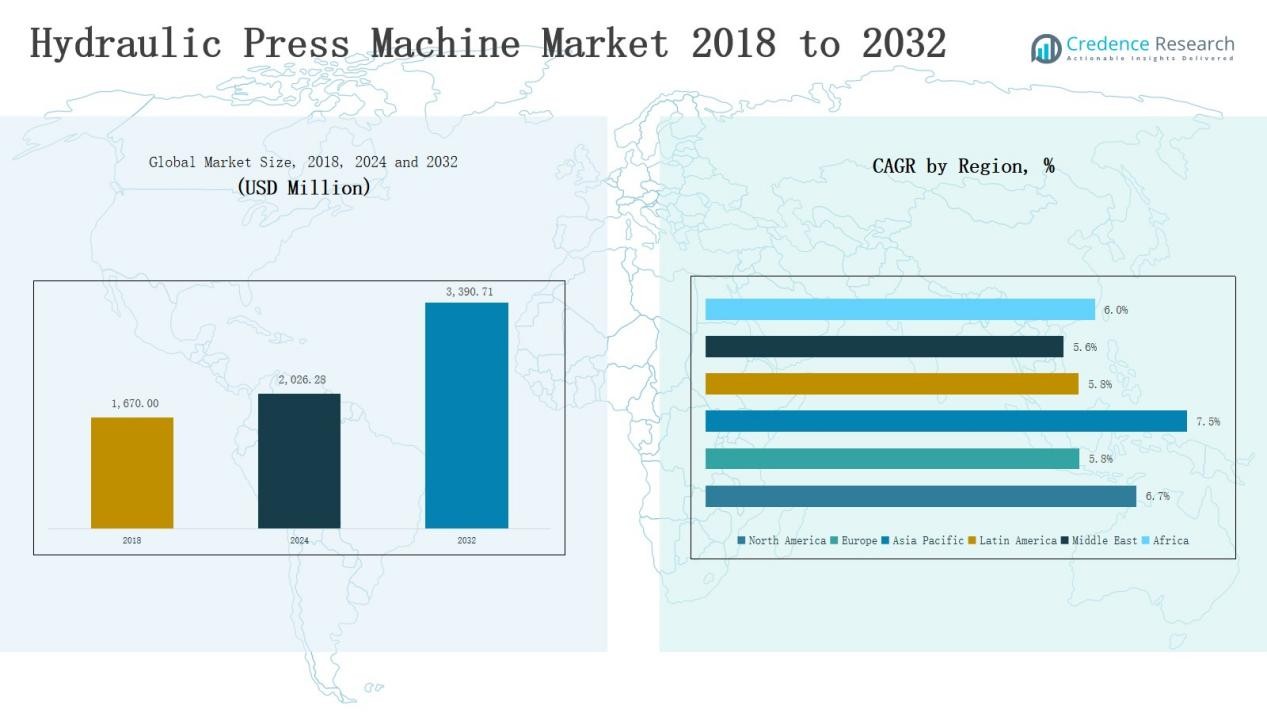

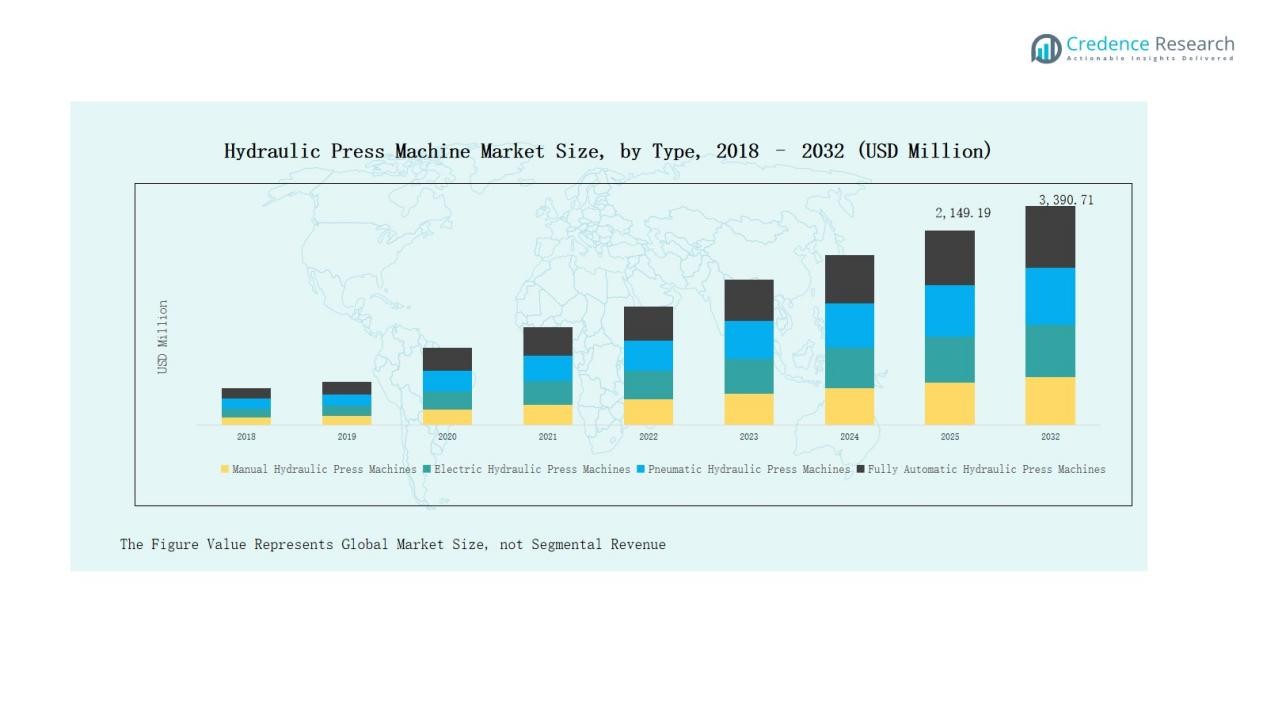

Hydraulic Press Machine Market size was valued at USD 1,670.00 million in 2018 to USD 2,026.28 million in 2024 and is anticipated to reach USD 3,390.71 million by 2032, at a CAGR of 6.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydraulic Press Machine Market Size 2024 |

USD 2,026.28 Million |

| Hydraulic Press Machine Market, CAGR |

6.73% |

| Hydraulic Press Machine Market Size 2032 |

USD 3,390.71 Million |

The Hydraulic Press Machine Market is shaped by key players such as Schuler, Beckwood Press, Komatsu America Corp., Jier Machine Tool, Asai Corporation, Amino Corporation, Betenbender Manufacturing Inc., ENERPAC, Greenerd Press & Machine Co., and Jiangsu Yangli Group. These companies focus on product innovation, automation, and energy-efficient solutions to strengthen their competitive positions. Schuler and Komatsu dominate with large-scale operations and advanced technologies, while Beckwood and Greenerd emphasize customization and niche solutions. Asian manufacturers such as Jier and Jiangsu Yangli benefit from cost advantages and regional demand. Geographically, Asia Pacific leads the market with a 39% share in 2024, driven by rapid industrialization, automotive manufacturing, and infrastructure growth across China, India, Japan, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hydraulic Press Machine Market grew from USD 1,670.00 million in 2018 to USD 2,026.28 million in 2024, projected at USD 3,390.71 million by 2032.

- Fully automatic machines lead by type with 38% share, followed by electric presses at 27%, reflecting demand for efficiency and automation in manufacturing.

- By application, metal forming dominates with 42% share, supported by automotive and heavy machinery demand, while plastic molding holds 24% driven by consumer goods growth.

- Manufacturing industries lead with 40% share by end-use, followed by automotive at 25%, as rising EV production strengthens the need for precision forming equipment.

- Asia Pacific holds 39% share in 2024, the largest regional market, supported by rapid industrialization, strong automotive production, and infrastructure development across China, India, and Southeast Asia.

Market Segment Insights

By Type

Fully automatic hydraulic press machines account for the largest share at 38%. Their dominance stems from high adoption in large-scale manufacturing due to precision, efficiency, and reduced labor needs. Electric presses follow closely with 27%, driven by demand for energy-efficient solutions in industries focusing on sustainability. Custom hydraulic press machines hold 15%, supported by tailored applications across aerospace and specialized metal forming. Pneumatic and manual presses capture 12% and 8% respectively, with steady use in small workshops and cost-sensitive sectors.

- For instance, Beckwood introduced its Triform electric servo press models designed for aerospace forming, cutting energy usage by up to 70% compared to traditional hydraulic systems.

By Application

Metal forming leads the segment with a 42% market share, fueled by growing demand from the automotive and heavy machinery industries. Plastic molding follows at 24%, supported by rising use in consumer goods and packaging. Automotive manufacturing captures 18%, as hydraulic presses remain critical in producing structural components. Woodworking holds 9%, particularly in furniture and construction materials, while other applications make up 7%, driven by electronics and specialized fabrication.

- For instance, Engel Austria introduced its duo speed injection molding machine, designed to meet packaging and consumer goods needs with high energy efficiency.

By End-use

Manufacturing industries dominate with 40% share, as they rely heavily on hydraulic presses for stamping, forging, and molding. The automotive sector follows at 25%, supported by rising EV production and lightweight material processing. Construction applications hold 12%, with demand for presses in prefabricated structures and building components. Aerospace contributes 10%, where precision forming drives adoption of advanced presses. Energy and power generation account for 8%, supported by turbine and component production, while consumer goods capture 5%, mainly from household appliances and packaging equipment.

Key Growth Drivers

Rising Demand from Automotive and Manufacturing Industries

The hydraulic press machine market benefits from robust demand from automotive and general manufacturing sectors. Automakers rely heavily on hydraulic presses for stamping, molding, and assembly of body parts, including lightweight alloys for electric vehicles. Similarly, general manufacturing leverages presses for metal forming, forging, and plastic molding applications. Expanding global vehicle production and automation in manufacturing further strengthen adoption. This demand not only boosts sales of fully automatic and high-capacity presses but also encourages innovation in efficiency and precision technologies.

- For instance, Hefei Metalforming Machine Tool Co. launched its YH27 series hydraulic press with improved digital control systems to boost precision for forging and plastic molding industries.

Advancements in Automation and Energy Efficiency

Automation and energy-efficient technologies are driving adoption of modern hydraulic press machines. Fully automatic presses dominate due to their ability to increase throughput while minimizing human error and labor costs. Integration of servo-hydraulic and intelligent control systems enhances efficiency, reduces energy consumption, and supports sustainable operations. These improvements align with industries focusing on lowering carbon footprints while achieving precision in operations. Manufacturers investing in advanced automation are gaining a competitive edge, making automation a central driver of long-term market expansion.

- For instance, Beckwood Press announced its EVOx servo-electric press line, which offers greater precision and eliminates the use of hydraulic fluid, significantly improving energy efficiency.

Growing Infrastructure and Construction Activities

Infrastructure development worldwide contributes significantly to the adoption of hydraulic press machines. The construction sector uses these machines in producing prefabricated components, structural beams, and specialized building materials. Rapid urbanization in Asia-Pacific, along with government-backed infrastructure projects in developing economies, accelerates equipment demand. Hydraulic presses also play a vital role in energy and power generation, supporting turbine component production. This construction and energy-linked demand complements industrial applications, making hydraulic presses essential in addressing large-scale and high-capacity production requirements.

Key Trends & Opportunities

Shift Toward Custom and Modular Press Designs

Industries are increasingly seeking custom-built and modular hydraulic press systems to address diverse application needs. Custom presses enable flexibility for aerospace, defense, and specialized metal forming, where high precision is critical. Modular designs support scalability, allowing manufacturers to expand production capacity without replacing entire systems. This trend creates opportunities for suppliers to focus on offering tailored solutions, boosting competitiveness. Companies delivering innovation in adaptability and integration are well-positioned to capture market share in both developed and emerging economies.

- For instance, Hydrotecks introduced custom hydraulic press systems with integrated force and torque monitoring tailored for extended 24/7 operation in automotive component production.

Expansion in Emerging Economies and EV Sector

The growth of emerging economies in Asia-Pacific, Latin America, and Africa offers significant opportunities for hydraulic press manufacturers. Rising industrialization, expanding automotive production, and increasing adoption of electric vehicles (EVs) fuel demand for presses in these regions. EV manufacturing, in particular, requires lightweight materials and precision forming, creating avenues for advanced hydraulic solutions. Global players are targeting these markets through partnerships, joint ventures, and localized manufacturing, strengthening their regional presence. The ongoing EV transition adds long-term opportunities for equipment suppliers.

- For instance, in 2021, AP&T received its first major order in India from ALF Engineering for a fully automated press-hardening line, with the hydraulic press built by local partner ISGEC based on AP&T’s designs.

Key Challenges

High Initial Investment and Maintenance Costs

Hydraulic press machines require significant upfront investment, particularly fully automatic and high-capacity models. The costs include installation, infrastructure adaptation, and ongoing maintenance, which deter small and medium enterprises (SMEs). Additionally, frequent servicing and high energy consumption raise operational expenses, limiting affordability. This financial barrier slows adoption in cost-sensitive markets, where manual or pneumatic presses still find preference. Companies must offer financing solutions or modular upgrade paths to attract broader customer bases and overcome cost-related adoption challenges.

Environmental and Energy Efficiency Concerns

Hydraulic presses consume considerable energy and often face criticism for hydraulic fluid leakage, which impacts sustainability goals. With industries under growing regulatory pressure to reduce emissions and adopt cleaner practices, traditional machines face compliance challenges. Manufacturers must address energy efficiency and fluid management through advanced servo-hydraulic systems and eco-friendly fluids. Failure to adapt could limit market growth, particularly in Europe and North America, where environmental regulations are stricter. Energy-efficient innovations will be essential to maintain competitiveness and customer trust.

Competition from Alternative Technologies

The market faces growing competition from mechanical and electric press machines that offer greater efficiency in certain applications. Electric presses, in particular, are gaining popularity for their precision, speed, and lower energy use, challenging traditional hydraulic solutions. While hydraulic presses remain dominant in heavy-duty applications, alternatives erode share in lightweight and mid-capacity markets. This competitive landscape pressures manufacturers to innovate and integrate hybrid systems combining hydraulic strength with electronic precision. Without adaptation, traditional hydraulic press providers risk losing market relevance.

Regional Analysis

North America

North America holds a 24% share of the hydraulic press machine market in 2024, valued at USD 515.27 million, and is projected to reach USD 858.16 million by 2032 at a CAGR of 6.7%. Growth is driven by strong demand from the automotive and aerospace industries, coupled with widespread adoption of advanced automated press systems. The U.S. leads regional growth due to technological innovation and established manufacturing infrastructure, while Canada and Mexico support expansion through rising industrialization and integration into global supply chains.

Europe

Europe represents a 19% market share in 2024, with revenues of USD 416.95 million, expected to reach USD 650.18 million by 2032 at a CAGR of 5.8%. The region benefits from a strong automotive base, particularly in Germany, Italy, and France, where hydraulic presses are essential in precision metal forming. Investments in energy-efficient and environmentally compliant technologies also support market expansion. While Western Europe dominates, Eastern Europe presents emerging opportunities with its growing industrial output and favorable government support for manufacturing modernization.

Asia Pacific

Asia Pacific leads the global market with a commanding 39% share in 2024, valued at USD 828.03 million, projected to reach USD 1,467.20 million by 2032 at a CAGR of 7.5%. The region’s dominance is fueled by rapid industrialization, large-scale automotive production, and infrastructure growth in China, India, Japan, and Southeast Asia. The increasing demand for high-capacity presses in heavy industries, coupled with localized manufacturing and cost-effective production, makes Asia Pacific the fastest-growing and most lucrative region for hydraulic press machine manufacturers.

Latin America

Latin America accounts for a 6% share of the market in 2024, valued at USD 132.09 million, and is forecast to reach USD 205.71 million by 2032 at a CAGR of 5.8%. Brazil leads regional demand, supported by its growing automotive and construction industries. Argentina and other nations contribute modestly, with increased adoption of hydraulic presses in small- to mid-scale manufacturing. Infrastructure development and industrial modernization efforts create gradual opportunities, though growth remains constrained by economic volatility and uneven technology adoption across the region.

Middle East

The Middle East holds a 4% share of the market in 2024, valued at USD 82.66 million, and is expected to reach USD 126.49 million by 2032 at a CAGR of 5.6%. Demand is driven by large-scale infrastructure projects, energy and power generation, and industrial diversification efforts under government initiatives. GCC countries lead with strong investments in manufacturing and construction, while Turkey also shows rising adoption. However, dependency on oil-linked economies and fluctuating investments pose moderate restraints on long-term market expansion.

Africa

Africa represents an emerging market with a 3% share in 2024, valued at USD 51.27 million, projected to reach USD 82.97 million by 2032 at a CAGR of 6.0%. South Africa dominates regional demand, supported by its automotive and mining industries, while Egypt and other African nations show potential through infrastructure development projects. Adoption remains limited by high initial costs and underdeveloped industrial capacity. However, foreign investments and government-backed industrial growth initiatives provide opportunities for gradual expansion of hydraulic press machine adoption.

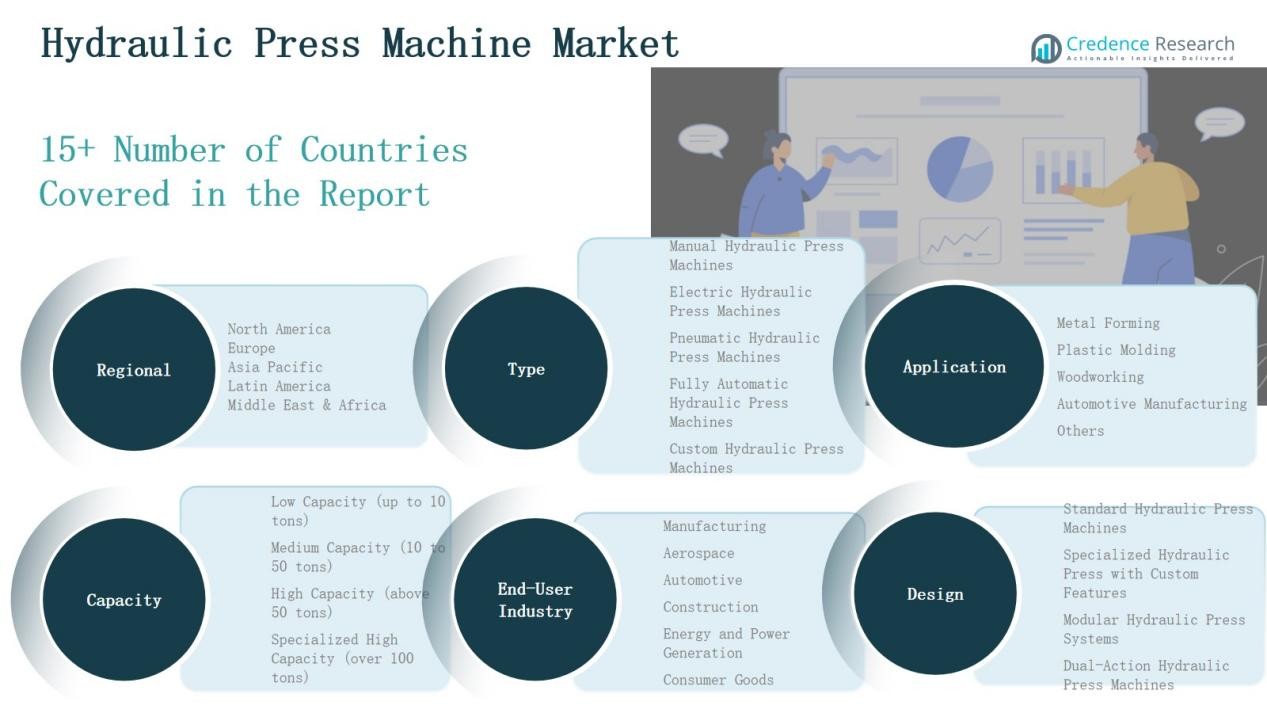

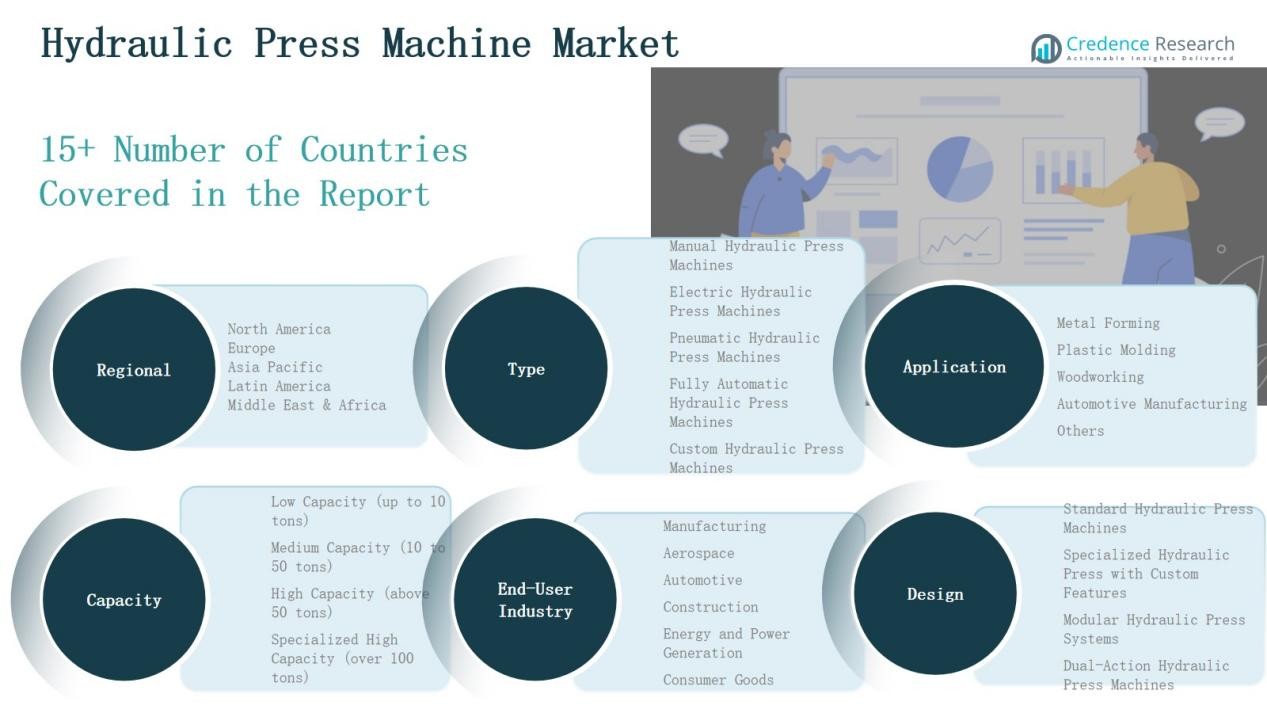

Market Segmentations:

By Type

- Manual Hydraulic Press Machines

- Electric Hydraulic Press Machines

- Pneumatic Hydraulic Press Machines

- Fully Automatic Hydraulic Press Machines

- Custom Hydraulic Press Machines

By Application

- Metal Forming

- Plastic Molding

- Woodworking

- Automotive Manufacturing

- Others

By End-use

- Manufacturing

- Aerospace

- Automotive

- Construction

- Energy and Power Generation

- Consumer Goods

By Capacity

- Low Capacity (up to 10 tons)

- Medium Capacity (10 to 50 tons)

- High Capacity (above 50 tons)

- Specialized High Capacity (over 100 tons)

By Design

- Standard Hydraulic Press Machines

- Specialized Hydraulic Press with Custom Features

- Modular Hydraulic Press Systems

- Dual-Action Hydraulic Press Machines

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East (GCC, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Competitive Landscape

The hydraulic press machine market is highly competitive, with global and regional players focusing on innovation, customization, and automation to strengthen their market positions. Leading companies such as Schuler, Beckwood Press, Komatsu America Corp., Jier Machine Tool, and Asai Corporation dominate through advanced product portfolios, large-scale manufacturing capabilities, and strong global distribution networks. Mid-sized players, including Betenbender Manufacturing, Greenerd Press & Machine, and DAKE, cater to niche and cost-sensitive markets with flexible and durable press solutions. Asian manufacturers like Jiangsu Yangli Group and Amino Corporation benefit from cost efficiency and rising domestic demand, particularly in China and Japan. Key strategies across the industry include investment in servo-hydraulic technology, energy-efficient systems, and modular designs to address sustainability concerns and evolving industrial needs. Additionally, partnerships, mergers, and capacity expansion are central to sustaining competitiveness, while aftersales service and customization capabilities are becoming critical differentiators in buyer decision-making.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Beckwood Press

- Schuler

- Asai Corporation

- Amino Corporation

- DAKE

- Betenbender Manufacturing Inc.

- DORST Technologies GmbH & Co. KG

- ENERPAC

- Greenerd Press & Machine Co.

- Japan Automatic Machine Co., Ltd.

- J. Hare Limited

- Gasbarre Products, Inc.

- Kojima Iron Works Co. Ltd.

- Jier Machine Tool

- Jiangsu Yangli Group

- Komatsu America Corp.

Recent Developments

- In January 2025, Halliburton and Coterra Energy launched the Octiv® Auto Frac, the first fully automated hydraulic fracturing program in North America.

- In April 2025, SAFIM and FLUID-PRESS (part of AL-KO Vehicle Technology Group) announced they would showcase new hydraulic system enhancements and an expanded product line at Bauma Munich 2025, including innovations in brake systems and cartridge valves.

- In April 2025 at bauma, Parker Hannifin unveiled its new NX8xHM series low-voltage electro-hydraulic pump suited for 48V DC machinery, showing push toward electrification in hydraulics.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use, Capacity, Design and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fully automatic hydraulic presses will continue to rise across industrial applications.

- Asia Pacific will remain the fastest-growing region driven by industrial expansion and infrastructure projects.

- Automotive and aerospace sectors will increase adoption for precision forming of lightweight materials.

- Custom and modular hydraulic press systems will gain traction for specialized applications.

- Energy-efficient and eco-friendly press technologies will see higher investments and adoption.

- Manufacturers will expand their presence in emerging economies through joint ventures and partnerships.

- Digital integration and smart control systems will enhance machine performance and monitoring.

- The construction and energy sectors will drive steady demand for high-capacity press machines.

- Competition from electric presses will push hydraulic press makers toward hybrid and advanced solutions.

- After-sales service, maintenance, and customization will become critical factors influencing customer loyalty.