Market Overview

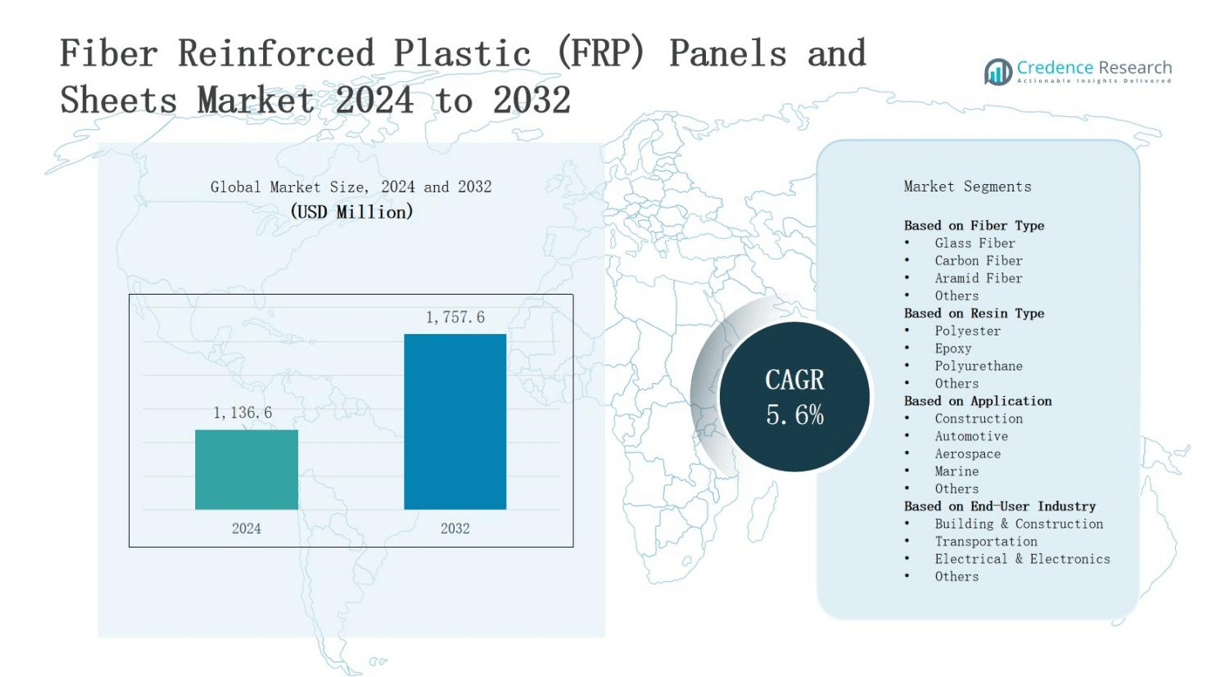

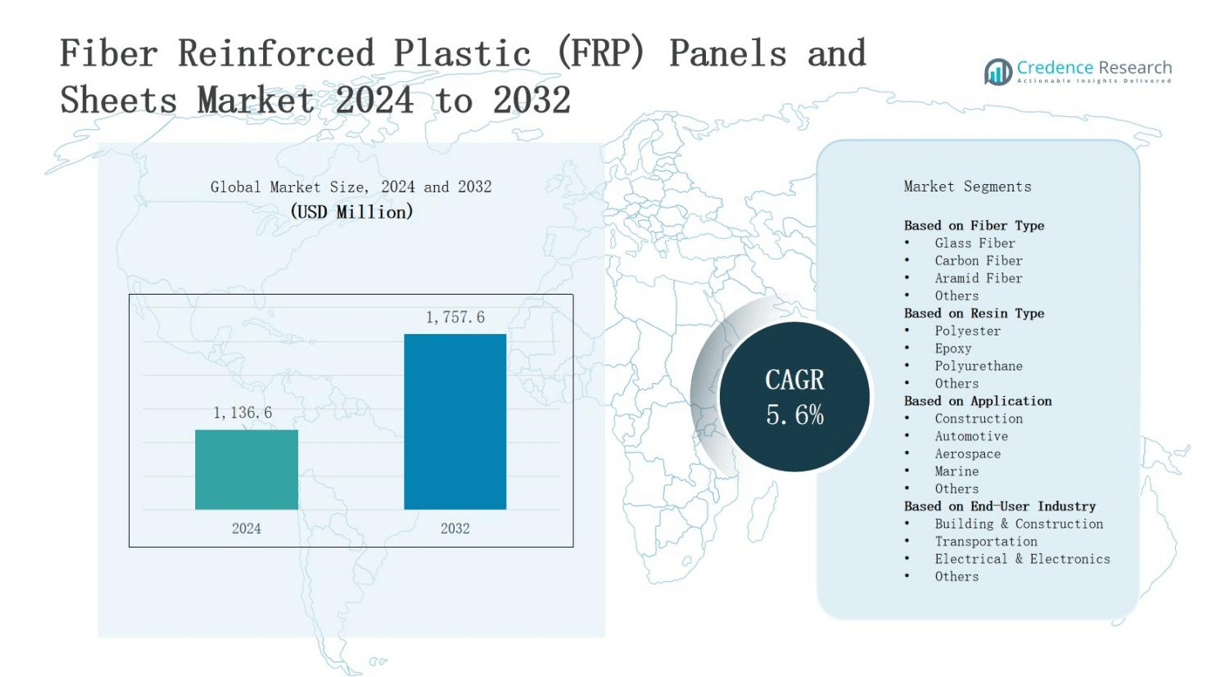

The fiber reinforced plastic (FRP) panels and sheets market is projected to grow from USD 1,136.6 million in 2024 to USD 1,757.6 million by 2032, registering a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiber Reinforced Plastic (FRP) Panels and Sheets Market Size 2024 |

USD 1,136.6 million |

| Fiber Reinforced Plastic (FRP) Panels and Sheets Market, CAGR |

5.6% |

| Fiber Reinforced Plastic (FRP) Panels and Sheets Market Size 2032 |

USD 1,757.6 million |

The fiber reinforced plastic (FRP) panels and sheets market is expanding due to growing demand for lightweight, corrosion-resistant, and durable materials across construction, transportation, and industrial sectors. Rising infrastructure development, especially in emerging markets, and the preference for low-maintenance, long-lasting building solutions are driving adoption. Technological advancements in resin and fiber compositions, along with the introduction of fire-retardant and UV-resistant products, are enhancing performance. Additionally, the increasing integration of FRP materials in green building projects, supported by stringent energy efficiency regulations and the need for extended service life, is shaping market trends and fostering sustained growth in the coming years.

The fiber reinforced plastic (FRP) panels and sheets market spans North America, Europe, Asia-Pacific, and the Rest of the World, with North America leading through advanced manufacturing and strong demand in construction and transportation. Europe follows with emphasis on sustainability and marine applications, while Asia-Pacific shows rapid growth driven by urbanization and infrastructure expansion. The Rest of the World sees rising adoption in industrial and marine sectors. Key players include Gurit Holding AG, Owens Corning, Teijin Limited, SGL Carbon SE, Exel Composites, Strongwell Corporation, Mitsubishi Chemical Corporation, Cytec Solvay Group, AOC Resins, Toray Industries, Inc., Hexcel Corporation, and Plasan Carbon Composites.

Market Insights

- The fiber reinforced plastic (FRP) panels and sheets market is projected to grow from USD 1,136.6 million in 2024 to USD 1,757.6 million by 2032, at a CAGR of 5.6%, driven by demand for lightweight, durable, and corrosion-resistant materials.

- Construction remains the largest application segment, supported by urbanization, infrastructure expansion, and preference for low-maintenance building solutions in emerging and developed markets.

- Transportation and automotive sectors adopt FRP to achieve weight reduction, improve fuel efficiency, and meet stringent environmental and safety standards.

- Technological advancements in resin and fiber formulations enable enhanced strength, fire resistance, UV protection, and antimicrobial properties, broadening usage in specialized industries.

- High production costs and raw material price fluctuations challenge market growth, particularly for smaller manufacturers in price-sensitive regions.

- North America leads with 32% share, followed by Asia-Pacific at 31%, Europe at 27%, and the Rest of the World at 10%, each driven by distinct industrial and regulatory factors.

- Key players include Gurit Holding AG, Owens Corning, Teijin Limited, SGL Carbon SE, Exel Composites, Strongwell Corporation, Mitsubishi Chemical Corporation, Cytec Solvay Group, AOC Resins, Toray Industries, Inc., Hexcel Corporation, and Plasan Carbon Composites.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand Across Construction and Infrastructure

The fiber reinforced plastic (FRP) panels and sheets market benefits from the growing use of lightweight, corrosion-resistant materials in commercial, industrial, and residential projects. It supports faster installation, reduced maintenance, and extended durability in building structures. Expanding urbanization and large-scale infrastructure projects in emerging economies are boosting adoption. Builders value its high strength-to-weight ratio and resistance to moisture, chemicals, and extreme weather. Government-backed modernization programs further enhance market penetration.

- For instance, Fibergrate Composite Structures Inc. supplied FRP molded grating and structural shapes for elevated walkways and safety ladders at major infrastructure sites such as the LA chemical plant and Canadian chemical facilities, demonstrating FRP’s durability and corrosion resistance in demanding industrial environments.

Expansion in Transportation and Automotive Applications

The fiber reinforced plastic (FRP) panels and sheets market is driven by the need for weight reduction and durability in transportation. It helps manufacturers improve fuel efficiency, reduce emissions, and extend service life for buses, trucks, railcars, and marine vessels. The material’s resistance to impact and environmental degradation ensures lower lifecycle costs. Increasing regulatory pressure for sustainable materials in vehicles accelerates demand. OEMs adopt FRP to meet evolving performance and safety standards.

- For instance, BMW’s i8 sports car uses fiber reinforced polymer (FRP) for its chassis and body panels, reducing weight significantly which improves fuel efficiency and handling performance.

Technological Advancements in Material Composition

The fiber reinforced plastic (FRP) panels and sheets market gains momentum through innovations in resin formulations and fiber reinforcement techniques. It delivers improved mechanical strength, thermal stability, and fire resistance for critical applications. The introduction of UV-resistant and antimicrobial variants supports broader use in healthcare, clean rooms, and outdoor structures. Manufacturers focus on customization to meet diverse industry requirements. Strategic R&D investments by key players enhance product competitiveness in global markets.

Growing Adoption in Green and Sustainable Building Projects

The fiber reinforced plastic (FRP) panels and sheets market benefits from increasing integration into environmentally responsible construction practices. It supports LEED certifications and other green building standards due to recyclability and energy efficiency benefits. Reduced need for frequent replacement lowers environmental impact. Architects and engineers prefer FRP for design flexibility and aesthetic appeal. Supportive regulations promoting energy-efficient materials encourage long-term adoption in residential, commercial, and public infrastructure projects worldwide.

Market Trends

Advancements in Manufacturing and Material Technology

The fiber reinforced plastic (FRP) panels and sheets market is witnessing significant progress in manufacturing processes and material engineering. It benefits from improved resin chemistry, automated production lines, and precision molding techniques that enhance strength, consistency, and finish quality. The development of fire-retardant, UV-resistant, and antimicrobial variants broadens application potential. Manufacturers are focusing on cost-effective solutions without compromising performance. These innovations enable FRP products to meet evolving industry standards and demanding environmental conditions.

- For instance, Owens Corning utilizes automated production lines and precision molding techniques to manufacture FRP panels with consistent quality and superior finish, widely used in building construction and insulation.

Rising Use in Prefabricated and Modular Construction

The fiber reinforced plastic (FRP) panels and sheets market is experiencing strong demand from the growing prefabricated and modular construction sector. It offers lightweight, easy-to-install panels that accelerate project timelines and reduce labor requirements. The material’s durability and low maintenance make it ideal for long-term use in modular buildings. Architects prefer FRP for its design flexibility and range of finishes. The trend aligns with global efforts to improve construction efficiency and sustainability.

- For instance, Altif Foams Pvt Ltd., a leading FRP panel manufacturer in India, offers high-quality FRP panels that are lightweight, durable, and easy to install. Their panels are used in industrial and construction projects, providing customization options to meet specific design and functional requirements.

Integration with Sustainable Building Practices

The fiber reinforced plastic (FRP) panels and sheets market is aligning with the global shift toward environmentally responsible construction. It supports green building certifications through recyclability, long service life, and energy efficiency. Reduced replacement frequency lowers overall carbon footprint. Developers adopt FRP to meet regulatory requirements for eco-friendly materials. Enhanced performance in thermal insulation and weather resistance contributes to energy conservation goals. This alignment strengthens its position in future-focused building strategies.

Expansion into Specialized Industrial Applications

The fiber reinforced plastic (FRP) panels and sheets market is expanding its footprint in specialized sectors such as healthcare, food processing, and chemical industries. It offers hygienic, non-porous surfaces resistant to bacteria, corrosion, and chemical exposure. These qualities make it suitable for clean rooms, laboratories, and storage facilities. Industries value its compliance with safety and sanitation standards. Growing demand in niche, high-performance environments reinforces its role beyond traditional construction and transportation applications.

Market Challenges Analysis

High Production Costs and Raw Material Price Volatility

The fiber reinforced plastic (FRP) panels and sheets market faces the challenge of high manufacturing costs driven by advanced resin systems, specialized fibers, and precision molding processes. It remains sensitive to fluctuations in raw material prices, particularly fiberglass, resins, and additives, which can impact profitability. Limited domestic production in some regions increases reliance on imports, raising costs further. Smaller manufacturers often struggle to compete with larger players on pricing. This cost pressure can slow adoption in price-sensitive markets and limit penetration into certain sectors.

Limited Recycling Infrastructure and Environmental Concerns

The fiber reinforced plastic (FRP) panels and sheets market encounters sustainability challenges due to the complexity of recycling composite materials. It requires specialized processes to separate fibers from resins, which are not widely available in many regions. Inadequate recycling infrastructure can lead to disposal in landfills, raising environmental concerns. Regulatory pressure to reduce non-biodegradable waste may increase compliance costs. End-users seeking fully circular material solutions may opt for alternatives, potentially affecting future market growth.

Market Opportunities

Growing Demand in Emerging Construction and Infrastructure Markets

The fiber reinforced plastic (FRP) panels and sheets market holds strong potential in rapidly developing economies with expanding construction and infrastructure needs. It offers lightweight, durable, and corrosion-resistant solutions ideal for large-scale residential, commercial, and public projects. Urbanization, government-funded infrastructure upgrades, and smart city initiatives create sustained demand. Builders seek materials that reduce maintenance and extend service life. Expanding transportation networks, stadiums, and industrial facilities present significant growth avenues for FRP adoption.

Rising Adoption in High-Performance and Specialized Applications

The fiber reinforced plastic (FRP) panels and sheets market can benefit from increasing use in sectors requiring high performance under extreme conditions. It meets the needs of industries such as marine, aerospace, food processing, and healthcare, where hygiene, chemical resistance, and strength are critical. Growth in renewable energy infrastructure and offshore projects offers further opportunities. Manufacturers focusing on customization and compliance with stringent standards can capture niche markets with high-margin potential.

Market Segmentation Analysis:

By Fiber Type

The fiber reinforced plastic (FRP) panels and sheets market is segmented into glass fiber, carbon fiber, aramid fiber, and others. Glass fiber dominates due to its cost-effectiveness, high strength, and broad application range in construction and transportation. Carbon fiber offers superior strength-to-weight ratio, driving demand in aerospace, automotive, and high-performance sectors. Aramid fiber provides exceptional impact and heat resistance, making it suitable for defense and protective applications. Niche fibers address specialized industrial requirements.

- For instance, Fiber-Tech’s glass fiber FRP panels have been used extensively in truck bodies and trailers, increasing cargo space by up to 24 cubic feet without adding structural weight, boosting efficiency in transportation.

By Resin Type

The fiber reinforced plastic (FRP) panels and sheets market includes polyester, epoxy, polyurethane, and other resin systems. Polyester resin leads due to its affordability, versatility, and compatibility with various fibers. Epoxy resin offers superior adhesion, chemical resistance, and structural performance, making it ideal for aerospace and marine uses. Polyurethane provides flexibility and impact resistance for demanding environments. Other resins cater to applications requiring specific thermal or mechanical properties, expanding the market’s customization potential.

- For instance, TOPOLO manufactures gelcoat FRP sheets primarily using unsaturated polyester resin, offering high tensile strength and impact resistance suitable for applications like RV roof panels and yacht construction.

By Application

The fiber reinforced plastic (FRP) panels and sheets market serves construction, automotive, aerospace, marine, and other industries. Construction remains the largest segment due to high demand for durable, low-maintenance materials. Automotive applications focus on weight reduction and fuel efficiency, while aerospace prioritizes strength and performance. Marine usage benefits from corrosion resistance in harsh saltwater conditions. Other sectors, including industrial equipment and renewable energy, adopt FRP for its adaptability to diverse operational requirements.

Segments:

Based on Fiber Type

- Glass Fiber

- Carbon Fiber

- Aramid Fiber

- Others

Based on Resin Type

- Polyester

- Epoxy

- Polyurethane

- Others

Based on Application

- Construction

- Automotive

- Aerospace

- Marine

- Others

Based on End-User Industry

- Building & Construction

- Transportation

- Electrical & Electronics

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 32% of the fiber reinforced plastic (FRP) panels and sheets market, driven by strong demand from construction, transportation, and industrial sectors. It benefits from advanced manufacturing capabilities and a mature infrastructure network that supports large-scale adoption. High emphasis on energy-efficient and low-maintenance materials encourages integration into residential, commercial, and public projects. The region’s automotive and aerospace industries leverage FRP for lightweight and high-strength applications. Stringent building codes and sustainability standards further stimulate demand. Investment in renovation and infrastructure modernization projects strengthens market growth.

Europe

Europe accounts for 27% of the fiber reinforced plastic (FRP) panels and sheets market, supported by a well-established construction industry and stringent environmental regulations. It sees growing adoption in green building projects due to the material’s recyclability and energy efficiency. The transportation sector uses FRP extensively for reducing vehicle weight and emissions. Marine applications remain strong in coastal nations, where corrosion resistance is critical. Technological innovation in composite materials boosts competitiveness. Government incentives for sustainable materials reinforce long-term demand.

Asia-Pacific

Asia-Pacific represents 31% of the fiber reinforced plastic (FRP) panels and sheets market, fueled by rapid urbanization, industrial expansion, and infrastructure development in China, India, and Southeast Asia. It benefits from low-cost manufacturing and high availability of raw materials. Construction remains the dominant application, with rising use in commercial complexes, transportation hubs, and industrial facilities. Automotive production hubs adopt FRP for performance and compliance with global standards. Strong government investment in public infrastructure accelerates market penetration. Export-oriented manufacturing enhances regional growth potential.

Rest of the World

The Rest of the World holds 10% of the fiber reinforced plastic (FRP) panels and sheets market, with adoption growing steadily in Latin America, the Middle East, and Africa. It gains traction through construction of commercial and industrial facilities in emerging urban centers. Harsh environmental conditions in certain regions drive demand for corrosion-resistant materials. Marine and oil & gas sectors integrate FRP for structural and protective applications. Expanding transportation networks create further opportunities. Local partnerships with global manufacturers strengthen supply and distribution channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gurit Holding AG

- Owens Corning

- Teijin Limited

- SGL Carbon SE

- Exel Composites

- Strongwell Corporation

- Mitsubishi Chemical Corporation

- Cytec Solvay Group

- AOC Resins

- Toray Industries, Inc.

- Hexcel Corporation

- Plasan Carbon Composites

Competitive Analysis

The fiber reinforced plastic (FRP) panels and sheets market is characterized by intense competition among global and regional manufacturers focusing on innovation, product quality, and cost efficiency. It sees leading players such as Gurit Holding AG, Owens Corning, Teijin Limited, SGL Carbon SE, Exel Composites, Strongwell Corporation, Mitsubishi Chemical Corporation, Cytec Solvay Group, AOC Resins, Toray Industries, Inc., Hexcel Corporation, and Plasan Carbon Composites competing through advanced material technologies, expanded application portfolios, and strategic partnerships. Companies invest in research and development to enhance performance attributes, including strength, fire resistance, and environmental sustainability. Market leaders strengthen distribution networks and expand manufacturing capabilities to serve growing demand in construction, automotive, aerospace, and marine sectors. Competitive strategies also include mergers, acquisitions, and collaborations aimed at increasing market reach and technological capabilities. Focus on meeting evolving regulatory standards and delivering customized solutions helps maintain market position. Players with diversified product offerings and strong brand recognition are better positioned to capture long-term growth opportunities across both developed and emerging economies.

Recent Developments

- In July 2025, Crane Composites launched GLASBOND™, a next-generation adhesive-backed FRP panel system that enables quick peel-and-stick installation, enhancing efficiency in construction and renovation projects.

- In March 2023, Creative Composites Group acquired Enduro Composites, a Houston-based FRP product manufacturer, to diversify manufacturing capabilities and improve operational efficiency.

- In May 2023, Avient Corporation expanded its Asia Pacific production line for OnForce and Complēt long fiber reinforced thermoplastic composites to meet rising demand for advanced composite materials.

- In July 2023, SABIC introduced PP compound H1090 and Stamax 30YH611 resins, engineered for extrusion and thermoforming of large, compounded EV battery pack components for automotive applications.

Market Concentration & Characteristics

The fiber reinforced plastic (FRP) panels and sheets market demonstrates moderate to high concentration, with a mix of global leaders and specialized regional players competing on technology, product performance, and cost efficiency. It is characterized by strong focus on innovation in resin systems, fiber reinforcements, and surface treatments to meet evolving application requirements. Key manufacturers leverage economies of scale, established distribution networks, and advanced manufacturing capabilities to maintain market share. The industry serves diverse sectors, including construction, transportation, aerospace, marine, and industrial applications, each with distinct performance demands. It faces barriers to entry due to high capital investment, technical expertise requirements, and established customer relationships. Competitive differentiation often depends on customization capabilities, compliance with stringent safety and environmental standards, and the ability to deliver long-term durability under challenging conditions. Ongoing demand for lightweight, corrosion-resistant, and sustainable materials reinforces the market’s growth potential while sustaining competitive intensity.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Resin Type, Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for FRP panels and sheets will rise in construction due to the need for durable and low-maintenance building materials.

- Adoption in transportation will grow as manufacturers seek weight reduction and improved fuel efficiency.

- Aerospace and marine sectors will increase usage for high-strength and corrosion-resistant applications.

- Technological advancements will enhance performance with improved resin and fiber compositions.

- Sustainable and recyclable FRP solutions will gain preference in green building projects.

- Emerging economies will offer significant growth opportunities through rapid infrastructure expansion.

- Customization for niche industrial applications will drive competitive differentiation.

- Strategic partnerships and mergers will strengthen supply chains and global market presence.

- Enhanced fire, UV, and impact resistance will expand use in specialized environments.

- Regulatory support for energy-efficient materials will accelerate adoption across multiple sectors